Professional Documents

Culture Documents

Yes No: Vat-On Business Services-In General VB010 2,108,277.52 252,993.30 2,108,277.52 252,993.30

Yes No: Vat-On Business Services-In General VB010 2,108,277.52 252,993.30 2,108,277.52 252,993.30

Uploaded by

MJ TuliaoCopyright:

Available Formats

You might also like

- 2550Q - 4thQ 2021Document3 pages2550Q - 4thQ 2021rdecendario.upturnNo ratings yet

- AaaaDocument3 pagesAaaaFranz GaldonesNo ratings yet

- 12 December 2550Q'19Document3 pages12 December 2550Q'19RóndoNo ratings yet

- 0622 - 2550Q - Lola Tina NewDocument3 pages0622 - 2550Q - Lola Tina NewKaren RodriguezNo ratings yet

- DoneDocument3 pagesDoneJam DiolazoNo ratings yet

- Yes NoDocument3 pagesYes NoNia AtalinNo ratings yet

- CARELIFT - BIR Form 2550Q VAT RETURN - 4Q 2021Document1 pageCARELIFT - BIR Form 2550Q VAT RETURN - 4Q 2021Jay Mark DimaanoNo ratings yet

- Marife 2550q Dec2022Document2 pagesMarife 2550q Dec2022cathzNo ratings yet

- Yes NoDocument3 pagesYes Noyrrej tadgolNo ratings yet

- Year Ended Calendar Fiscal (MM/YYYY) Quarter 1st 2nd 3rd 4th Return Period (MM/DD/YYYY) From: To: Yes NoDocument5 pagesYear Ended Calendar Fiscal (MM/YYYY) Quarter 1st 2nd 3rd 4th Return Period (MM/DD/YYYY) From: To: Yes Noarchell gabicaNo ratings yet

- VAT 3rd Quarter (September) 2550QDocument3 pagesVAT 3rd Quarter (September) 2550QVan Joshua NunezNo ratings yet

- (A715df5e 0954 4777 A1Document1 page(A715df5e 0954 4777 A1John Aries Paz SarteNo ratings yet

- Quarterly Value Added Tax Declaration - 1st QuarterDocument3 pagesQuarterly Value Added Tax Declaration - 1st QuarterJo HernandezNo ratings yet

- Quarterly Value-Added Tax Declaration: Kawanihan NG Rentas InternasDocument1 pageQuarterly Value-Added Tax Declaration: Kawanihan NG Rentas Internaschiahwalousette100% (1)

- Feb 2550MDocument3 pagesFeb 2550MNia AtalinNo ratings yet

- May 2550MDocument3 pagesMay 2550MNia AtalinNo ratings yet

- Value Added Tax (Quarterly)Document6 pagesValue Added Tax (Quarterly)Kaisha CastroNo ratings yet

- 10 255om October 2022Document1 page10 255om October 2022Patricia NoroñaNo ratings yet

- Problem 5-1 QuarterDocument6 pagesProblem 5-1 QuarterAlexis KingNo ratings yet

- Ambot Ani Oy Gusto Rko Mag Basa Sa PDFDocument4 pagesAmbot Ani Oy Gusto Rko Mag Basa Sa PDFJahziel Rosh V. AroaNo ratings yet

- Tax ReturnDocument4 pagesTax ReturncykablyatNo ratings yet

- Schedule 1 Schedule of Sales/Receipts and Output Tax (Attach Additional Sheet, If Necessary)Document1 pageSchedule 1 Schedule of Sales/Receipts and Output Tax (Attach Additional Sheet, If Necessary)Clarine BautistaNo ratings yet

- Schedule 1 Schedule of Sales/Receipts and Output Tax (Attach Additional Sheet, If Necessary)Document3 pagesSchedule 1 Schedule of Sales/Receipts and Output Tax (Attach Additional Sheet, If Necessary)Carlsberg AndresNo ratings yet

- (Cumulative For 3 Months) : Kawanihan NG Rentas InternasDocument6 pages(Cumulative For 3 Months) : Kawanihan NG Rentas InternasAllaine Vera MercadoNo ratings yet

- (Cumulative For 3 Months) : Kawanihan NG Rentas InternasDocument6 pages(Cumulative For 3 Months) : Kawanihan NG Rentas InternasAllaine Vera MercadoNo ratings yet

- Monthly Value-Added Tax DeclarationDocument2 pagesMonthly Value-Added Tax DeclarationJa'maine ManguerraNo ratings yet

- Quarterly Value-Added Tax Return: (Cumulative For 3 Months)Document1 pageQuarterly Value-Added Tax Return: (Cumulative For 3 Months)Games NathanNo ratings yet

- BIR Form No. 2551MDocument1 pageBIR Form No. 2551MLorraine Steffany BanguisNo ratings yet

- eFPS Home - Efiling and Payment System PDFDocument2 pageseFPS Home - Efiling and Payment System PDFRegs AccountingTaxNo ratings yet

- Quarterly Income Tax Return: Schedule 1Document3 pagesQuarterly Income Tax Return: Schedule 1Ja'maine ManguerraNo ratings yet

- Easterbloom 2550M - 082022Document2 pagesEasterbloom 2550M - 082022Reyes Accounting Law OfficeNo ratings yet

- Group 7 - Project No. 3 - BIR Form No. 1801Document2 pagesGroup 7 - Project No. 3 - BIR Form No. 1801Shane Nicole PepitoNo ratings yet

- Monthly Value-Added Tax Declaration: Kawanihan NG Rentas InternasDocument1 pageMonthly Value-Added Tax Declaration: Kawanihan NG Rentas InternaschiahwalousetteNo ratings yet

- 2550-M February-2022Document2 pages2550-M February-2022Jing ReyesNo ratings yet

- Quarterly Value-Added Tax Return: DLN: PsicDocument2 pagesQuarterly Value-Added Tax Return: DLN: PsicKaila Mae Tan DuNo ratings yet

- 1601C Sept 2019Document2 pages1601C Sept 2019Virnadette Lopez0% (1)

- Improperly Accumulated Earnings Tax Return: Mac Arthur Highway, Brgy. Dolores, City of San Fernando, PampangaDocument3 pagesImproperly Accumulated Earnings Tax Return: Mac Arthur Highway, Brgy. Dolores, City of San Fernando, PampangaTrisha Mae Mendoza MacalinoNo ratings yet

- Sales Tax Return Sept 10Document6 pagesSales Tax Return Sept 10Raheel BaigNo ratings yet

- Quarterly Income Tax Return: 12 - December 056Document2 pagesQuarterly Income Tax Return: 12 - December 056Cha GomezNo ratings yet

- VL Yap 1601-c August 2019 FormDocument1 pageVL Yap 1601-c August 2019 FormAnimeMusicCollectionBacolod0% (1)

- Tal 1601 Eq Front OnlyDocument1 pageTal 1601 Eq Front OnlyKatherine Anne SantosNo ratings yet

- 1601C JanuaryDocument3 pages1601C JanuaryJoshua Honra0% (1)

- 1601-C Monthly Remittance Return: of Income Taxes Withheld On CompensationDocument1 page1601-C Monthly Remittance Return: of Income Taxes Withheld On CompensationEljoe Vinluan0% (1)

- 1601-C Monthly Remittance Return: of Income Taxes Withheld On CompensationDocument1 page1601-C Monthly Remittance Return: of Income Taxes Withheld On CompensationNards SVNo ratings yet

- Monthly Percentage Tax ReturnDocument4 pagesMonthly Percentage Tax ReturnromarcambriNo ratings yet

- 1601C 082019 ItemsiDocument1 page1601C 082019 Itemsi___wenaNo ratings yet

- Page 4Document1 pagePage 4Carol MNo ratings yet

- Submitted Status:: Sales Tax Credit Gross Value Taxable Value Sales TaxDocument4 pagesSubmitted Status:: Sales Tax Credit Gross Value Taxable Value Sales TaxaizazbarkiNo ratings yet

- 2550-M November-2022Document2 pages2550-M November-2022Jing ReyesNo ratings yet

- 2550m April 2019 - LGSLDocument3 pages2550m April 2019 - LGSLexergyNo ratings yet

- Test PDFDocument2 pagesTest PDFLulu Adaro VillanuevaNo ratings yet

- Sample ITR Page 4Document1 pageSample ITR Page 4Eduardo BallesterNo ratings yet

- 2550-M October-2022Document2 pages2550-M October-2022Jing ReyesNo ratings yet

- 1801 SilvozaDocument1 page1801 SilvozaKate Hazzle JandaNo ratings yet

- Page 1 BirDocument1 pagePage 1 BirAce AbeciaNo ratings yet

- Return of Percentage Tax Payable Under Special Laws: Maria Belinda Nitura/ Coleen Duran TTH 9:30-11:00Document2 pagesReturn of Percentage Tax Payable Under Special Laws: Maria Belinda Nitura/ Coleen Duran TTH 9:30-11:00Anonymous 5wXJMHCNo ratings yet

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDocument1 page1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and Trustsjoel razNo ratings yet

- Thermo Scientific KR4i Centrifuge: Multi-Use, Low-Speed, High-Capacity CentrifugeDocument6 pagesThermo Scientific KR4i Centrifuge: Multi-Use, Low-Speed, High-Capacity CentrifugeYURHI GONZALESNo ratings yet

- A New Day For SustainabilityDocument9 pagesA New Day For SustainabilityswaraNo ratings yet

- Chap 04 Customer Perceptions of ServiceDocument26 pagesChap 04 Customer Perceptions of Servicelann.yenNo ratings yet

- DOH Manual AcronymsDocument14 pagesDOH Manual AcronymsJohn Oliver GuiangNo ratings yet

- Exercises Chapter 04Document23 pagesExercises Chapter 04vintcs181892No ratings yet

- Session 4 of CSDocument8 pagesSession 4 of CSHaji HalviNo ratings yet

- FR QB Part 2Document12 pagesFR QB Part 2AkhilNo ratings yet

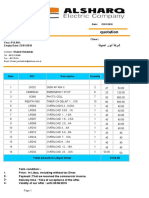

- Alsharq Electric CompanyDocument2 pagesAlsharq Electric CompanymuslimhammedNo ratings yet

- 2023 True and Full ValuesDocument1 page2023 True and Full ValuesinforumdocsNo ratings yet

- Functional Areas of Management: Search..Document10 pagesFunctional Areas of Management: Search..Sheryll PascobilloNo ratings yet

- Nolasco VDocument2 pagesNolasco VCherNo ratings yet

- Soa VS MomDocument8 pagesSoa VS MomCharbel TawkNo ratings yet

- Microeconomics Quiz IDocument6 pagesMicroeconomics Quiz IRohit MukherjeeNo ratings yet

- 1 Agrawal Packers and Movers Group 1.1Document20 pages1 Agrawal Packers and Movers Group 1.1Ajinkya LadNo ratings yet

- money: Revealed: Gupta's Circular Money TrailDocument14 pagesmoney: Revealed: Gupta's Circular Money TrailAna LourençoNo ratings yet

- Structure of The Indian EconomyDocument16 pagesStructure of The Indian EconomyAmbalika Smiti100% (9)

- FilterDocument2 pagesFilterNguyen PhatNo ratings yet

- Proposed Roadmap Model For Developing A Corporate Risk Awareness Culture (Case Study at PT. PNM)Document6 pagesProposed Roadmap Model For Developing A Corporate Risk Awareness Culture (Case Study at PT. PNM)International Journal of Innovative Science and Research TechnologyNo ratings yet

- JD Account Associate DTV Mobility PDFDocument1 pageJD Account Associate DTV Mobility PDFWelson TeNo ratings yet

- CBSE Sample Paper For Class 2 Maths ErDocument8 pagesCBSE Sample Paper For Class 2 Maths Errwf0606No ratings yet

- Income Based Valuation Discounted Cash Flows Group 2Document90 pagesIncome Based Valuation Discounted Cash Flows Group 2natalie clyde mates100% (1)

- Dubai GCC Lighting Strategy To Q2 2014 PDFDocument57 pagesDubai GCC Lighting Strategy To Q2 2014 PDFgilbertomjcNo ratings yet

- Summer Internship Project (Pharma)Document8 pagesSummer Internship Project (Pharma)Sadiya ZaveriNo ratings yet

- Xdabf 037 ADocument34 pagesXdabf 037 APatricia Mae Santos MañalacNo ratings yet

- Gamification in MarketingDocument8 pagesGamification in MarketingAcademic JournalNo ratings yet

- Faa Ac 120-79Document81 pagesFaa Ac 120-79Jhobana UreñaNo ratings yet

- Definition, Scope, Importance and Limitations of StatisticsDocument8 pagesDefinition, Scope, Importance and Limitations of StatisticsVNo ratings yet

- Tax Invoice: Description of Goods Amount Disc. % Per Rate Quantity GST Hsn/SacDocument1 pageTax Invoice: Description of Goods Amount Disc. % Per Rate Quantity GST Hsn/SacSanket BorkuteNo ratings yet

- Fortnite Event License Terms: 1. Background and AcceptanceDocument7 pagesFortnite Event License Terms: 1. Background and AcceptanceAdolfo RamirezNo ratings yet

- Ia3 - Chapter 1Document8 pagesIa3 - Chapter 1chesca marie penarandaNo ratings yet

Yes No: Vat-On Business Services-In General VB010 2,108,277.52 252,993.30 2,108,277.52 252,993.30

Yes No: Vat-On Business Services-In General VB010 2,108,277.52 252,993.30 2,108,277.52 252,993.30

Uploaded by

MJ TuliaoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Yes No: Vat-On Business Services-In General VB010 2,108,277.52 252,993.30 2,108,277.52 252,993.30

Yes No: Vat-On Business Services-In General VB010 2,108,277.52 252,993.30 2,108,277.52 252,993.30

Uploaded by

MJ TuliaoCopyright:

Available Formats

BIR Form No.

2550-Q Page 2 of 4

Year Ended Calendar Fiscal 2 Quarter 3 Return Period(MM/DD/YYYY) 4 Amended Return? 5 Short Period Return?

(MM/YYYY) December 2021 1st 2nd 3rd 4th From: 04/01/2021 To: 06/30/2021 Yes No Yes No

6 TIN 760 372 620 000 7 RDO Code 052 8 No. of Sheets Attached 0 9 Line of Business OTHER RELATED ACTIVITIES

10 Taxpayer's Name TILINK PHILS INC. 11 Telephone No. 5874367

12Registered Address 44 TOMAS ST. MULTINATIONAL VILL. BRGY. MOONWALK PARANAQUE CITY 13 Zip Code 000

14 Are you availing of tax relief under Special Law / International Tax Treaty? Yes No If yes, specify

Sales/Receipts for the Quarter (Exclusive of VAT) Output Tax Due for the Quarter

15 Vatable Sales/Receipt - Private ( Sch. 1 ) 15A 2,108,277.52 15B 252,993.30

16 Sales to Government 16A 0.00 16B 0.00

17 Zero Rated Sales/Receipts 17 0.00

18 Exempt Sales/Receipts 18 0.00

19 Total Sales/Receipts and Output Tax Due 19A 2,108,277.52 19B 252,993.30

20 Less: Allowable Input Tax

20A Input Tax Carried Over from Previous Period 20A 432,341.71

20B Input Tax Deferred on Capital Goods Exceeding P1Million from Previous Period 20B 0.00

20C Transitional Input Tax 20C 0.00

20D Presumptive Input Tax 20D 0.00

20E Others 20E 0.00

20F Total (Sum of Item 20A, 20B, 20C, 20D & 20E) 20F 432,341.71

21 Current Transactions Purchases

21A/B Purchase of Capital Goods not exceeding P1Million ( Sch. 2 )21A 0.00 21B 0.00

21C/D Purchase of Capital Goods exceeding P1Million ( Sch. 3 ) 21C 0.00 21D 0.00

21E/F Domestic Purchases of Goods Other than Capital Goods 21E 1,961,846.32 21F 235,421.56

21G/H Importation of Goods Other than Capital Goods 21G 1,468,478.83 21H 176,217.46

21I/J Domestic Purchase of Services 21I 0.00 21J 0.00

21K/L Services rendered by Non-residents 21K 0.00 21L 0.00

21M Purchases Not Qualified for Input Tax 21M 0.00

21N/O Others 21N 0.00 21O 0.00

21P Total Current Purchases (Sum of Item 21A, 21C, 21E, 21G,

21P 3,430,325.15

21I, 21K, 21M & 21N)

22 Total Available Input Tax (Sum of Item 20F, 21B, 21D, 21F, 21H, 21J, 21L & 21O) 22 843,980.73

23 Less: Deductions from Input Tax

23A Input Tax on Purchases of Capital Goods exceeding P1Million deferred for the succeeding period ( Sch. 3 ) 23A 0.00

23B Input Tax on Sale to Gov't. closed to expense ( Sch. 4 ) 23B 0.00

23C Input Tax allocable to Exempt Sales ( Sch. 5 ) 23C 0.00

23D VAT Refund/TCC claimed 23D 0.00

23E Others 23E 0.00

23F Total (Sum of Item 23A, 23B, 23C, 23D & 23E) 23F 0.00

24 Total Allowable Input Tax (Item 22 less Item 23F) 24 843,980.73

25 Net VAT Payable (item 19B less Item 24) 25 -590,987.43

26 Less: Tax Credits/Payments

26A Monthly VAT Payments - previous two months 26A 0.00

26B Creditable Value-Added Tax Withheld ( Sch. 6 ) 26B 0.00

26C Advance Payment for Sugar and Flour Industries( Sch. 7 ) 26C 0.00

26D VAT withheld on Sales to Government ( Sch. 8 ) 26D 0.00

26E VAT paid in return previously filed, if this is an amended return 26E 0.00

26F Advance Payments made (please attach proof of payments - BIR Form No. 0605) 26F 0.00

26G Others 26G 0.00

26H Total Tax Credits/Payments(Sum of Item 26A, 26B, 26C, 26D, 26E, 26F, & 26G) 26H 0.00

27 Tax Still Payable/ (Overpayment) (Item 25 less Item 26H) 27 -590,987.43

28 Add Penalties Surcharge Interest Compromise

28A 0.00 28B 0.00 28C 0.00 28D 0.00

29 Total Amount Payable (Overpayment) (Sum of Item 27& 28D) 29 -590,987.43

I declare, under the penalties of perjury, that this return has been made in good faith, verified by me, and to the best of my knowledge, and

belief, is true and correct, pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof.

30______________________________________________________________________________ 31_____________________________

President/Vice President/Principal Officer/Accredited Tax Agent/ Treasurer/Assistant Treasurer

Authorized Representative/Taxpayer (Signature Over Printed Name)

(Signature Over Printed Name)

_______________________________________ ______________________________________ ______________________________

Title/Position of Signatory TIN of Signatory Title/Position of Signatory

_______________________________________ _______________ _______________ ______________________________

Tax Agent Acc. No./Atty's Roll No.(if applicable) Date of Issuance Date of Expiry TIN of Signatory

Machine Validation/Revenue Official Receipt Details (If not filed with an Authorized Agent Bank)

Schedule 1 Schedule of Sales/Receipts and Output Tax (Attach additional sheet, if necessary)

Amount of Sales/Receipts For

Industry Covered by VAT Output Tax for the Period

the Period

VAT-ON BUSINESS SERVICES-IN GENERAL VB010 2,108,277.52 252,993.30

To Item 15A/B 2,108,277.52 252,993.30

file:///C:/Users/InteL/AppData/Local/Temp/%7BACA73A24-12E9-4142-92EC-41DEA5B... 9/27/2021

You might also like

- 2550Q - 4thQ 2021Document3 pages2550Q - 4thQ 2021rdecendario.upturnNo ratings yet

- AaaaDocument3 pagesAaaaFranz GaldonesNo ratings yet

- 12 December 2550Q'19Document3 pages12 December 2550Q'19RóndoNo ratings yet

- 0622 - 2550Q - Lola Tina NewDocument3 pages0622 - 2550Q - Lola Tina NewKaren RodriguezNo ratings yet

- DoneDocument3 pagesDoneJam DiolazoNo ratings yet

- Yes NoDocument3 pagesYes NoNia AtalinNo ratings yet

- CARELIFT - BIR Form 2550Q VAT RETURN - 4Q 2021Document1 pageCARELIFT - BIR Form 2550Q VAT RETURN - 4Q 2021Jay Mark DimaanoNo ratings yet

- Marife 2550q Dec2022Document2 pagesMarife 2550q Dec2022cathzNo ratings yet

- Yes NoDocument3 pagesYes Noyrrej tadgolNo ratings yet

- Year Ended Calendar Fiscal (MM/YYYY) Quarter 1st 2nd 3rd 4th Return Period (MM/DD/YYYY) From: To: Yes NoDocument5 pagesYear Ended Calendar Fiscal (MM/YYYY) Quarter 1st 2nd 3rd 4th Return Period (MM/DD/YYYY) From: To: Yes Noarchell gabicaNo ratings yet

- VAT 3rd Quarter (September) 2550QDocument3 pagesVAT 3rd Quarter (September) 2550QVan Joshua NunezNo ratings yet

- (A715df5e 0954 4777 A1Document1 page(A715df5e 0954 4777 A1John Aries Paz SarteNo ratings yet

- Quarterly Value Added Tax Declaration - 1st QuarterDocument3 pagesQuarterly Value Added Tax Declaration - 1st QuarterJo HernandezNo ratings yet

- Quarterly Value-Added Tax Declaration: Kawanihan NG Rentas InternasDocument1 pageQuarterly Value-Added Tax Declaration: Kawanihan NG Rentas Internaschiahwalousette100% (1)

- Feb 2550MDocument3 pagesFeb 2550MNia AtalinNo ratings yet

- May 2550MDocument3 pagesMay 2550MNia AtalinNo ratings yet

- Value Added Tax (Quarterly)Document6 pagesValue Added Tax (Quarterly)Kaisha CastroNo ratings yet

- 10 255om October 2022Document1 page10 255om October 2022Patricia NoroñaNo ratings yet

- Problem 5-1 QuarterDocument6 pagesProblem 5-1 QuarterAlexis KingNo ratings yet

- Ambot Ani Oy Gusto Rko Mag Basa Sa PDFDocument4 pagesAmbot Ani Oy Gusto Rko Mag Basa Sa PDFJahziel Rosh V. AroaNo ratings yet

- Tax ReturnDocument4 pagesTax ReturncykablyatNo ratings yet

- Schedule 1 Schedule of Sales/Receipts and Output Tax (Attach Additional Sheet, If Necessary)Document1 pageSchedule 1 Schedule of Sales/Receipts and Output Tax (Attach Additional Sheet, If Necessary)Clarine BautistaNo ratings yet

- Schedule 1 Schedule of Sales/Receipts and Output Tax (Attach Additional Sheet, If Necessary)Document3 pagesSchedule 1 Schedule of Sales/Receipts and Output Tax (Attach Additional Sheet, If Necessary)Carlsberg AndresNo ratings yet

- (Cumulative For 3 Months) : Kawanihan NG Rentas InternasDocument6 pages(Cumulative For 3 Months) : Kawanihan NG Rentas InternasAllaine Vera MercadoNo ratings yet

- (Cumulative For 3 Months) : Kawanihan NG Rentas InternasDocument6 pages(Cumulative For 3 Months) : Kawanihan NG Rentas InternasAllaine Vera MercadoNo ratings yet

- Monthly Value-Added Tax DeclarationDocument2 pagesMonthly Value-Added Tax DeclarationJa'maine ManguerraNo ratings yet

- Quarterly Value-Added Tax Return: (Cumulative For 3 Months)Document1 pageQuarterly Value-Added Tax Return: (Cumulative For 3 Months)Games NathanNo ratings yet

- BIR Form No. 2551MDocument1 pageBIR Form No. 2551MLorraine Steffany BanguisNo ratings yet

- eFPS Home - Efiling and Payment System PDFDocument2 pageseFPS Home - Efiling and Payment System PDFRegs AccountingTaxNo ratings yet

- Quarterly Income Tax Return: Schedule 1Document3 pagesQuarterly Income Tax Return: Schedule 1Ja'maine ManguerraNo ratings yet

- Easterbloom 2550M - 082022Document2 pagesEasterbloom 2550M - 082022Reyes Accounting Law OfficeNo ratings yet

- Group 7 - Project No. 3 - BIR Form No. 1801Document2 pagesGroup 7 - Project No. 3 - BIR Form No. 1801Shane Nicole PepitoNo ratings yet

- Monthly Value-Added Tax Declaration: Kawanihan NG Rentas InternasDocument1 pageMonthly Value-Added Tax Declaration: Kawanihan NG Rentas InternaschiahwalousetteNo ratings yet

- 2550-M February-2022Document2 pages2550-M February-2022Jing ReyesNo ratings yet

- Quarterly Value-Added Tax Return: DLN: PsicDocument2 pagesQuarterly Value-Added Tax Return: DLN: PsicKaila Mae Tan DuNo ratings yet

- 1601C Sept 2019Document2 pages1601C Sept 2019Virnadette Lopez0% (1)

- Improperly Accumulated Earnings Tax Return: Mac Arthur Highway, Brgy. Dolores, City of San Fernando, PampangaDocument3 pagesImproperly Accumulated Earnings Tax Return: Mac Arthur Highway, Brgy. Dolores, City of San Fernando, PampangaTrisha Mae Mendoza MacalinoNo ratings yet

- Sales Tax Return Sept 10Document6 pagesSales Tax Return Sept 10Raheel BaigNo ratings yet

- Quarterly Income Tax Return: 12 - December 056Document2 pagesQuarterly Income Tax Return: 12 - December 056Cha GomezNo ratings yet

- VL Yap 1601-c August 2019 FormDocument1 pageVL Yap 1601-c August 2019 FormAnimeMusicCollectionBacolod0% (1)

- Tal 1601 Eq Front OnlyDocument1 pageTal 1601 Eq Front OnlyKatherine Anne SantosNo ratings yet

- 1601C JanuaryDocument3 pages1601C JanuaryJoshua Honra0% (1)

- 1601-C Monthly Remittance Return: of Income Taxes Withheld On CompensationDocument1 page1601-C Monthly Remittance Return: of Income Taxes Withheld On CompensationEljoe Vinluan0% (1)

- 1601-C Monthly Remittance Return: of Income Taxes Withheld On CompensationDocument1 page1601-C Monthly Remittance Return: of Income Taxes Withheld On CompensationNards SVNo ratings yet

- Monthly Percentage Tax ReturnDocument4 pagesMonthly Percentage Tax ReturnromarcambriNo ratings yet

- 1601C 082019 ItemsiDocument1 page1601C 082019 Itemsi___wenaNo ratings yet

- Page 4Document1 pagePage 4Carol MNo ratings yet

- Submitted Status:: Sales Tax Credit Gross Value Taxable Value Sales TaxDocument4 pagesSubmitted Status:: Sales Tax Credit Gross Value Taxable Value Sales TaxaizazbarkiNo ratings yet

- 2550-M November-2022Document2 pages2550-M November-2022Jing ReyesNo ratings yet

- 2550m April 2019 - LGSLDocument3 pages2550m April 2019 - LGSLexergyNo ratings yet

- Test PDFDocument2 pagesTest PDFLulu Adaro VillanuevaNo ratings yet

- Sample ITR Page 4Document1 pageSample ITR Page 4Eduardo BallesterNo ratings yet

- 2550-M October-2022Document2 pages2550-M October-2022Jing ReyesNo ratings yet

- 1801 SilvozaDocument1 page1801 SilvozaKate Hazzle JandaNo ratings yet

- Page 1 BirDocument1 pagePage 1 BirAce AbeciaNo ratings yet

- Return of Percentage Tax Payable Under Special Laws: Maria Belinda Nitura/ Coleen Duran TTH 9:30-11:00Document2 pagesReturn of Percentage Tax Payable Under Special Laws: Maria Belinda Nitura/ Coleen Duran TTH 9:30-11:00Anonymous 5wXJMHCNo ratings yet

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDocument1 page1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and Trustsjoel razNo ratings yet

- Thermo Scientific KR4i Centrifuge: Multi-Use, Low-Speed, High-Capacity CentrifugeDocument6 pagesThermo Scientific KR4i Centrifuge: Multi-Use, Low-Speed, High-Capacity CentrifugeYURHI GONZALESNo ratings yet

- A New Day For SustainabilityDocument9 pagesA New Day For SustainabilityswaraNo ratings yet

- Chap 04 Customer Perceptions of ServiceDocument26 pagesChap 04 Customer Perceptions of Servicelann.yenNo ratings yet

- DOH Manual AcronymsDocument14 pagesDOH Manual AcronymsJohn Oliver GuiangNo ratings yet

- Exercises Chapter 04Document23 pagesExercises Chapter 04vintcs181892No ratings yet

- Session 4 of CSDocument8 pagesSession 4 of CSHaji HalviNo ratings yet

- FR QB Part 2Document12 pagesFR QB Part 2AkhilNo ratings yet

- Alsharq Electric CompanyDocument2 pagesAlsharq Electric CompanymuslimhammedNo ratings yet

- 2023 True and Full ValuesDocument1 page2023 True and Full ValuesinforumdocsNo ratings yet

- Functional Areas of Management: Search..Document10 pagesFunctional Areas of Management: Search..Sheryll PascobilloNo ratings yet

- Nolasco VDocument2 pagesNolasco VCherNo ratings yet

- Soa VS MomDocument8 pagesSoa VS MomCharbel TawkNo ratings yet

- Microeconomics Quiz IDocument6 pagesMicroeconomics Quiz IRohit MukherjeeNo ratings yet

- 1 Agrawal Packers and Movers Group 1.1Document20 pages1 Agrawal Packers and Movers Group 1.1Ajinkya LadNo ratings yet

- money: Revealed: Gupta's Circular Money TrailDocument14 pagesmoney: Revealed: Gupta's Circular Money TrailAna LourençoNo ratings yet

- Structure of The Indian EconomyDocument16 pagesStructure of The Indian EconomyAmbalika Smiti100% (9)

- FilterDocument2 pagesFilterNguyen PhatNo ratings yet

- Proposed Roadmap Model For Developing A Corporate Risk Awareness Culture (Case Study at PT. PNM)Document6 pagesProposed Roadmap Model For Developing A Corporate Risk Awareness Culture (Case Study at PT. PNM)International Journal of Innovative Science and Research TechnologyNo ratings yet

- JD Account Associate DTV Mobility PDFDocument1 pageJD Account Associate DTV Mobility PDFWelson TeNo ratings yet

- CBSE Sample Paper For Class 2 Maths ErDocument8 pagesCBSE Sample Paper For Class 2 Maths Errwf0606No ratings yet

- Income Based Valuation Discounted Cash Flows Group 2Document90 pagesIncome Based Valuation Discounted Cash Flows Group 2natalie clyde mates100% (1)

- Dubai GCC Lighting Strategy To Q2 2014 PDFDocument57 pagesDubai GCC Lighting Strategy To Q2 2014 PDFgilbertomjcNo ratings yet

- Summer Internship Project (Pharma)Document8 pagesSummer Internship Project (Pharma)Sadiya ZaveriNo ratings yet

- Xdabf 037 ADocument34 pagesXdabf 037 APatricia Mae Santos MañalacNo ratings yet

- Gamification in MarketingDocument8 pagesGamification in MarketingAcademic JournalNo ratings yet

- Faa Ac 120-79Document81 pagesFaa Ac 120-79Jhobana UreñaNo ratings yet

- Definition, Scope, Importance and Limitations of StatisticsDocument8 pagesDefinition, Scope, Importance and Limitations of StatisticsVNo ratings yet

- Tax Invoice: Description of Goods Amount Disc. % Per Rate Quantity GST Hsn/SacDocument1 pageTax Invoice: Description of Goods Amount Disc. % Per Rate Quantity GST Hsn/SacSanket BorkuteNo ratings yet

- Fortnite Event License Terms: 1. Background and AcceptanceDocument7 pagesFortnite Event License Terms: 1. Background and AcceptanceAdolfo RamirezNo ratings yet

- Ia3 - Chapter 1Document8 pagesIa3 - Chapter 1chesca marie penarandaNo ratings yet