Professional Documents

Culture Documents

Quiz Vat

Quiz Vat

Uploaded by

Heidi OpadaCopyright:

Available Formats

You might also like

- Lala Trading DEC2018 - SOPL & SOFP DEC2018 AFTER ADJUSTMENTDocument3 pagesLala Trading DEC2018 - SOPL & SOFP DEC2018 AFTER ADJUSTMENTAFIQ RAFIQIN RAHMADNo ratings yet

- VATDocument3 pagesVATVixen Aaron EnriquezNo ratings yet

- Assignment-2 2Document11 pagesAssignment-2 2CPAREVIEWNo ratings yet

- Tax Lecture VAT Answer KeyDocument2 pagesTax Lecture VAT Answer KeyKathreen Aya ExcondeNo ratings yet

- Illustrative Problems On VAT On ImportationDocument6 pagesIllustrative Problems On VAT On ImportationShamae Duma-anNo ratings yet

- Session 5Document19 pagesSession 5youssef.oubenaliNo ratings yet

- Tax Endterm Business Taxes: ExampleDocument4 pagesTax Endterm Business Taxes: ExampleCharmaine ChuaNo ratings yet

- P112,000 Vat PayableDocument3 pagesP112,000 Vat PayableMichael CayabyabNo ratings yet

- Vat Part 2Document5 pagesVat Part 2CPAREVIEWNo ratings yet

- Ayuste BusinesstaxationDocument140 pagesAyuste BusinesstaxationJayaAntolinAyusteNo ratings yet

- Business TaxDocument9 pagesBusiness TaxChristian Dela PenaNo ratings yet

- Gwapa Ko Chapter 3 Tax 1Document10 pagesGwapa Ko Chapter 3 Tax 1adarose romaresNo ratings yet

- Assignment E & L Env 4 BusiDocument9 pagesAssignment E & L Env 4 BusiSyed Hamza RasheedNo ratings yet

- Chapter 9 - Input VAT True or False 1Document7 pagesChapter 9 - Input VAT True or False 1Angelo BagabaldoNo ratings yet

- Chapter 5 Value Added Tax Importation of GoodsDocument3 pagesChapter 5 Value Added Tax Importation of GoodsMary Grace BaquiranNo ratings yet

- TAX ANSWER-R4Tanyag KeyDocument5 pagesTAX ANSWER-R4Tanyag KeyCheska JaplosNo ratings yet

- Tax 8 9 12Document5 pagesTax 8 9 12Maix19No ratings yet

- Final Examination TaxDocument2 pagesFinal Examination Taxjeffersam31No ratings yet

- TM 314C Topic 1 BF and BCDocument25 pagesTM 314C Topic 1 BF and BCLicardo, Marc PauloNo ratings yet

- Name: Jean Rose T. Bustamante Bsma-3 Set B Income TaxationDocument5 pagesName: Jean Rose T. Bustamante Bsma-3 Set B Income TaxationJean Rose Tabagay BustamanteNo ratings yet

- Solutions To Quiz 2 - VAT PAYABLEDocument4 pagesSolutions To Quiz 2 - VAT PAYABLEMark Emil BaritNo ratings yet

- Tax 2Document8 pagesTax 2Genel Christian DeypalubosNo ratings yet

- Chapter 9 - Input VAT True or False 1Document55 pagesChapter 9 - Input VAT True or False 1Angelo Bagabaldo100% (1)

- Quiz No. 8Document2 pagesQuiz No. 8Grecian DiazNo ratings yet

- Chapter 5Document5 pagesChapter 5Kristine Jhoy Nolasco SecopitoNo ratings yet

- CHAPTER 12-InPUT VAT2013 - Valencia T&BT6thed - Docx Version 1Document8 pagesCHAPTER 12-InPUT VAT2013 - Valencia T&BT6thed - Docx Version 1kathNo ratings yet

- BUSITAX (Final Output)Document5 pagesBUSITAX (Final Output)Ivan AnaboNo ratings yet

- May 15 Input VATDocument15 pagesMay 15 Input VATA cNo ratings yet

- Chapter 12 - Input Vat2013Document8 pagesChapter 12 - Input Vat2013libraolrack0% (3)

- Chapter 2 AssignmentDocument8 pagesChapter 2 AssignmentRoss John JimenezNo ratings yet

- Quiz On Income TaxationDocument4 pagesQuiz On Income TaxationLenard Josh Ingalla100% (1)

- Chapter 2 Problems and SolutionsDocument4 pagesChapter 2 Problems and SolutionsEstonilo, Monica BenesaNo ratings yet

- Answer: The Company Remitted P 22,400 VAT To The BIR. SolutionDocument3 pagesAnswer: The Company Remitted P 22,400 VAT To The BIR. SolutionGreyzon AbdonNo ratings yet

- Problem FS - SOLUTIONDocument6 pagesProblem FS - SOLUTIONhuyenvtk.tfacNo ratings yet

- IAS12 - Examples - SolutionDocument9 pagesIAS12 - Examples - SolutionTrần Nguyễn Tuệ MinhNo ratings yet

- P6 3Document5 pagesP6 3Neil RyanNo ratings yet

- TAX SOLUTIONS (2) Corrected 2aaDocument12 pagesTAX SOLUTIONS (2) Corrected 2aaketty sambaNo ratings yet

- Custom Duty CalculationDocument3 pagesCustom Duty CalculationSneha AroraNo ratings yet

- Chapter 11 - Vat On Services 2013Document10 pagesChapter 11 - Vat On Services 2013Jean Chel Perez Javier100% (3)

- 2806-Individuals PPT PDFDocument35 pages2806-Individuals PPT PDFMay Grethel Joy PeranteNo ratings yet

- Vat Math 2021Document83 pagesVat Math 2021Fakharuddin Ahmed ShahNo ratings yet

- Chapter 10 - Vat On Goods2013Document8 pagesChapter 10 - Vat On Goods2013libraolrack100% (4)

- S5FIN563 ExamDocument5 pagesS5FIN563 ExamVera DobrinaNo ratings yet

- Post-Closing Trial BalanceDocument8 pagesPost-Closing Trial BalanceNicole Andrea TuazonNo ratings yet

- Group 5Document8 pagesGroup 5Doreen OngNo ratings yet

- Answers TaxDocument6 pagesAnswers TaxDANICA DIVINANo ratings yet

- Problem Fs - SolutionDocument5 pagesProblem Fs - SolutionÁnh NguyễnNo ratings yet

- Quiz Btaxxx 1Document3 pagesQuiz Btaxxx 1John LucaNo ratings yet

- ACTIVITY 1 Excise TaxDocument2 pagesACTIVITY 1 Excise Tax케이No ratings yet

- Value Added TaxDocument17 pagesValue Added TaxkirigofortunateNo ratings yet

- Vergara, Gian Bianca F. BSAT-4A Recitation: Compensation IncomeDocument4 pagesVergara, Gian Bianca F. BSAT-4A Recitation: Compensation Incomelena cpaNo ratings yet

- Answer Key On Comprehensive ExerciseDocument13 pagesAnswer Key On Comprehensive ExerciseErickaNo ratings yet

- FUNDALES BTAX MidtermsDocument4 pagesFUNDALES BTAX MidtermsE. RobertNo ratings yet

- Value-Added Tax: Business and Transfer Taxation 5Th Edition (By: Valencia & Roxas) Suggested AnswersDocument7 pagesValue-Added Tax: Business and Transfer Taxation 5Th Edition (By: Valencia & Roxas) Suggested AnswersCha DumpyNo ratings yet

- Illustration: The Following Data Were Reported For 200A Business Activities of Western UniversitiesDocument3 pagesIllustration: The Following Data Were Reported For 200A Business Activities of Western UniversitiesCarlo QuiambaoNo ratings yet

- C5 - To - C6 - Suggested - Answers - PDF Filename UTF-8''C5 To C6 - Suggested AnswersDocument11 pagesC5 - To - C6 - Suggested - Answers - PDF Filename UTF-8''C5 To C6 - Suggested AnswersJessa De GuzmanNo ratings yet

- Discussion From MiriamDocument68 pagesDiscussion From MiriamHeidi OpadaNo ratings yet

- E-Learning Portfolio in Strategic Management: Heidi P. Opada T31 Mely S. Tabucol, DBADocument7 pagesE-Learning Portfolio in Strategic Management: Heidi P. Opada T31 Mely S. Tabucol, DBAHeidi OpadaNo ratings yet

- Installment SalesDocument65 pagesInstallment SalesHeidi OpadaNo ratings yet

- CHAPTER I-IntroductionDocument2 pagesCHAPTER I-IntroductionHeidi OpadaNo ratings yet

- Opada-Quiz - 2-27-21Document1 pageOpada-Quiz - 2-27-21Heidi OpadaNo ratings yet

- Midterm Topics 1&2Document40 pagesMidterm Topics 1&2Heidi OpadaNo ratings yet

- GED101Document1 pageGED101Heidi OpadaNo ratings yet

- Opada, Heidi P. Corporation #0631 Purok 4 Sitio Sapinit Brgy. San Juan, Antipolo City, Rizal Number Product Code Description Delivery DateDocument3 pagesOpada, Heidi P. Corporation #0631 Purok 4 Sitio Sapinit Brgy. San Juan, Antipolo City, Rizal Number Product Code Description Delivery DateHeidi OpadaNo ratings yet

- Schedule in ResearchDocument3 pagesSchedule in ResearchHeidi OpadaNo ratings yet

- Product ProposalDocument9 pagesProduct ProposalHeidi OpadaNo ratings yet

- GED101Document1 pageGED101Heidi OpadaNo ratings yet

- Accounting Information System: Midterm ExamDocument37 pagesAccounting Information System: Midterm ExamHeidi OpadaNo ratings yet

- Guidelines For E-Learning Portfolio 1. FormatDocument2 pagesGuidelines For E-Learning Portfolio 1. FormatHeidi OpadaNo ratings yet

Quiz Vat

Quiz Vat

Uploaded by

Heidi OpadaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Quiz Vat

Quiz Vat

Uploaded by

Heidi OpadaCopyright:

Available Formats

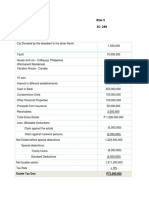

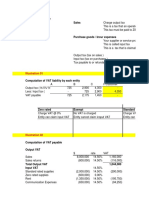

OPADA, HEIDI P.

TAXATION- 2 12/07/2021

RCA CORPORATION

OUTPUT TAX

Net sales (25,000,000- 2,500,000) = (22,500,000 x 12%) /112% ₱2,410,714

Services rendered to clients (6,250,000x 12%) /112% 669,643

Deemed Sale:

Value goods in payment of debt, exclusive of VAT (4,200,000 x 12%) 504,000

Car as property dividends, exclusive of VAT (1,500,000 x 12%) 180,000

TOTAL ₱3,764,357

Less: INPUT TAX

Purchase of raw materials from

VAT registered person (16,800,000x12%) /112% 1,800,000

Purchase of Supplies (1,400,000x12%) /112% 150,000

Utilities inclusive of VAT (750,000x12%) /112% 80,357

Purchase of Capital Goods (5,300,000x12%) /112% 567,857

VAT on Importation 702,000

TOTAL ₱ (3,300,214)

VAT Payable ₱464,143

VAT ON IMPORTATION

Invoice price ₱4,200,000

Customs duties 800,000

Freight 200,000

Other charges- BOC 150,000

Facilitation fee 500,000

Landed Cost ₱5,850,000

X12%

VAT on Importation ₱702,000

You might also like

- Lala Trading DEC2018 - SOPL & SOFP DEC2018 AFTER ADJUSTMENTDocument3 pagesLala Trading DEC2018 - SOPL & SOFP DEC2018 AFTER ADJUSTMENTAFIQ RAFIQIN RAHMADNo ratings yet

- VATDocument3 pagesVATVixen Aaron EnriquezNo ratings yet

- Assignment-2 2Document11 pagesAssignment-2 2CPAREVIEWNo ratings yet

- Tax Lecture VAT Answer KeyDocument2 pagesTax Lecture VAT Answer KeyKathreen Aya ExcondeNo ratings yet

- Illustrative Problems On VAT On ImportationDocument6 pagesIllustrative Problems On VAT On ImportationShamae Duma-anNo ratings yet

- Session 5Document19 pagesSession 5youssef.oubenaliNo ratings yet

- Tax Endterm Business Taxes: ExampleDocument4 pagesTax Endterm Business Taxes: ExampleCharmaine ChuaNo ratings yet

- P112,000 Vat PayableDocument3 pagesP112,000 Vat PayableMichael CayabyabNo ratings yet

- Vat Part 2Document5 pagesVat Part 2CPAREVIEWNo ratings yet

- Ayuste BusinesstaxationDocument140 pagesAyuste BusinesstaxationJayaAntolinAyusteNo ratings yet

- Business TaxDocument9 pagesBusiness TaxChristian Dela PenaNo ratings yet

- Gwapa Ko Chapter 3 Tax 1Document10 pagesGwapa Ko Chapter 3 Tax 1adarose romaresNo ratings yet

- Assignment E & L Env 4 BusiDocument9 pagesAssignment E & L Env 4 BusiSyed Hamza RasheedNo ratings yet

- Chapter 9 - Input VAT True or False 1Document7 pagesChapter 9 - Input VAT True or False 1Angelo BagabaldoNo ratings yet

- Chapter 5 Value Added Tax Importation of GoodsDocument3 pagesChapter 5 Value Added Tax Importation of GoodsMary Grace BaquiranNo ratings yet

- TAX ANSWER-R4Tanyag KeyDocument5 pagesTAX ANSWER-R4Tanyag KeyCheska JaplosNo ratings yet

- Tax 8 9 12Document5 pagesTax 8 9 12Maix19No ratings yet

- Final Examination TaxDocument2 pagesFinal Examination Taxjeffersam31No ratings yet

- TM 314C Topic 1 BF and BCDocument25 pagesTM 314C Topic 1 BF and BCLicardo, Marc PauloNo ratings yet

- Name: Jean Rose T. Bustamante Bsma-3 Set B Income TaxationDocument5 pagesName: Jean Rose T. Bustamante Bsma-3 Set B Income TaxationJean Rose Tabagay BustamanteNo ratings yet

- Solutions To Quiz 2 - VAT PAYABLEDocument4 pagesSolutions To Quiz 2 - VAT PAYABLEMark Emil BaritNo ratings yet

- Tax 2Document8 pagesTax 2Genel Christian DeypalubosNo ratings yet

- Chapter 9 - Input VAT True or False 1Document55 pagesChapter 9 - Input VAT True or False 1Angelo Bagabaldo100% (1)

- Quiz No. 8Document2 pagesQuiz No. 8Grecian DiazNo ratings yet

- Chapter 5Document5 pagesChapter 5Kristine Jhoy Nolasco SecopitoNo ratings yet

- CHAPTER 12-InPUT VAT2013 - Valencia T&BT6thed - Docx Version 1Document8 pagesCHAPTER 12-InPUT VAT2013 - Valencia T&BT6thed - Docx Version 1kathNo ratings yet

- BUSITAX (Final Output)Document5 pagesBUSITAX (Final Output)Ivan AnaboNo ratings yet

- May 15 Input VATDocument15 pagesMay 15 Input VATA cNo ratings yet

- Chapter 12 - Input Vat2013Document8 pagesChapter 12 - Input Vat2013libraolrack0% (3)

- Chapter 2 AssignmentDocument8 pagesChapter 2 AssignmentRoss John JimenezNo ratings yet

- Quiz On Income TaxationDocument4 pagesQuiz On Income TaxationLenard Josh Ingalla100% (1)

- Chapter 2 Problems and SolutionsDocument4 pagesChapter 2 Problems and SolutionsEstonilo, Monica BenesaNo ratings yet

- Answer: The Company Remitted P 22,400 VAT To The BIR. SolutionDocument3 pagesAnswer: The Company Remitted P 22,400 VAT To The BIR. SolutionGreyzon AbdonNo ratings yet

- Problem FS - SOLUTIONDocument6 pagesProblem FS - SOLUTIONhuyenvtk.tfacNo ratings yet

- IAS12 - Examples - SolutionDocument9 pagesIAS12 - Examples - SolutionTrần Nguyễn Tuệ MinhNo ratings yet

- P6 3Document5 pagesP6 3Neil RyanNo ratings yet

- TAX SOLUTIONS (2) Corrected 2aaDocument12 pagesTAX SOLUTIONS (2) Corrected 2aaketty sambaNo ratings yet

- Custom Duty CalculationDocument3 pagesCustom Duty CalculationSneha AroraNo ratings yet

- Chapter 11 - Vat On Services 2013Document10 pagesChapter 11 - Vat On Services 2013Jean Chel Perez Javier100% (3)

- 2806-Individuals PPT PDFDocument35 pages2806-Individuals PPT PDFMay Grethel Joy PeranteNo ratings yet

- Vat Math 2021Document83 pagesVat Math 2021Fakharuddin Ahmed ShahNo ratings yet

- Chapter 10 - Vat On Goods2013Document8 pagesChapter 10 - Vat On Goods2013libraolrack100% (4)

- S5FIN563 ExamDocument5 pagesS5FIN563 ExamVera DobrinaNo ratings yet

- Post-Closing Trial BalanceDocument8 pagesPost-Closing Trial BalanceNicole Andrea TuazonNo ratings yet

- Group 5Document8 pagesGroup 5Doreen OngNo ratings yet

- Answers TaxDocument6 pagesAnswers TaxDANICA DIVINANo ratings yet

- Problem Fs - SolutionDocument5 pagesProblem Fs - SolutionÁnh NguyễnNo ratings yet

- Quiz Btaxxx 1Document3 pagesQuiz Btaxxx 1John LucaNo ratings yet

- ACTIVITY 1 Excise TaxDocument2 pagesACTIVITY 1 Excise Tax케이No ratings yet

- Value Added TaxDocument17 pagesValue Added TaxkirigofortunateNo ratings yet

- Vergara, Gian Bianca F. BSAT-4A Recitation: Compensation IncomeDocument4 pagesVergara, Gian Bianca F. BSAT-4A Recitation: Compensation Incomelena cpaNo ratings yet

- Answer Key On Comprehensive ExerciseDocument13 pagesAnswer Key On Comprehensive ExerciseErickaNo ratings yet

- FUNDALES BTAX MidtermsDocument4 pagesFUNDALES BTAX MidtermsE. RobertNo ratings yet

- Value-Added Tax: Business and Transfer Taxation 5Th Edition (By: Valencia & Roxas) Suggested AnswersDocument7 pagesValue-Added Tax: Business and Transfer Taxation 5Th Edition (By: Valencia & Roxas) Suggested AnswersCha DumpyNo ratings yet

- Illustration: The Following Data Were Reported For 200A Business Activities of Western UniversitiesDocument3 pagesIllustration: The Following Data Were Reported For 200A Business Activities of Western UniversitiesCarlo QuiambaoNo ratings yet

- C5 - To - C6 - Suggested - Answers - PDF Filename UTF-8''C5 To C6 - Suggested AnswersDocument11 pagesC5 - To - C6 - Suggested - Answers - PDF Filename UTF-8''C5 To C6 - Suggested AnswersJessa De GuzmanNo ratings yet

- Discussion From MiriamDocument68 pagesDiscussion From MiriamHeidi OpadaNo ratings yet

- E-Learning Portfolio in Strategic Management: Heidi P. Opada T31 Mely S. Tabucol, DBADocument7 pagesE-Learning Portfolio in Strategic Management: Heidi P. Opada T31 Mely S. Tabucol, DBAHeidi OpadaNo ratings yet

- Installment SalesDocument65 pagesInstallment SalesHeidi OpadaNo ratings yet

- CHAPTER I-IntroductionDocument2 pagesCHAPTER I-IntroductionHeidi OpadaNo ratings yet

- Opada-Quiz - 2-27-21Document1 pageOpada-Quiz - 2-27-21Heidi OpadaNo ratings yet

- Midterm Topics 1&2Document40 pagesMidterm Topics 1&2Heidi OpadaNo ratings yet

- GED101Document1 pageGED101Heidi OpadaNo ratings yet

- Opada, Heidi P. Corporation #0631 Purok 4 Sitio Sapinit Brgy. San Juan, Antipolo City, Rizal Number Product Code Description Delivery DateDocument3 pagesOpada, Heidi P. Corporation #0631 Purok 4 Sitio Sapinit Brgy. San Juan, Antipolo City, Rizal Number Product Code Description Delivery DateHeidi OpadaNo ratings yet

- Schedule in ResearchDocument3 pagesSchedule in ResearchHeidi OpadaNo ratings yet

- Product ProposalDocument9 pagesProduct ProposalHeidi OpadaNo ratings yet

- GED101Document1 pageGED101Heidi OpadaNo ratings yet

- Accounting Information System: Midterm ExamDocument37 pagesAccounting Information System: Midterm ExamHeidi OpadaNo ratings yet

- Guidelines For E-Learning Portfolio 1. FormatDocument2 pagesGuidelines For E-Learning Portfolio 1. FormatHeidi OpadaNo ratings yet