Professional Documents

Culture Documents

Cash Bank Reconciliation

Cash Bank Reconciliation

Uploaded by

Khai Ed PabelicoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cash Bank Reconciliation

Cash Bank Reconciliation

Uploaded by

Khai Ed PabelicoCopyright:

Available Formats

INTERMEDIATE ACCOUNTING 1

BANK RECONCILIATION

Reminders in preparing bank reconciliation statement:

1. Always write the name/header of the report you are preparing.

2. Look for the unadjusted balances (books and bank) from the given data. There will be

times when you would have to compute for them, so you should know how to distinguish

one from the other; which among the data will give or lead you to the book and bank

unadjusted balances.

3. Recall the reconciling items, and where you should properly extend them, whether to

the books or to the bank.

4. Deposit in Transit - compare the book receipts (Dr side of the ledger or t-account) with

the bank credits (Cr side of the bank statement; sometimes the column heading used is

"Deposits"). If they are recorded or reflected in the ledger or t-account but they cannot be

located or traced in the bank statement, then they are Deposit in Transit.

5. Outstanding Checks - compare the book disbursements (Cr side of the ledger or t-

account) with the bank debits (Dr side of the bank statement; sometimes the column

heading used is "Withdrawals"). If they are recorded or reflected in the ledger or t-account

but they cannot be located or traced in the bank statement, then they are Outstanding

Checks. Make sure to write the check number as reference.

6. Errors - analyze carefully who committed the error, whether the company (books) or the

bank. Analyze further the effect of the error, whether the error understates or overstates

the book or bank balance.

7. Bank CM - compare the bank credits (Cr side of the bank statement; sometimes the

column heading is "Deposits") with the book receipts (Dr side of the ledger or t-account). If

they are recorded or reflected in the bank statement but cannot be located or traced in the

ledger or t-account, then they are Bank CM.

8. Bank DM - compare the bank debits (Dr side of the bank statement, sometimes the

column heading is "Withdrawals") with the cash disbursements (Cr side of the ledger or

the t-account). If they are recorded or reflected in the bank statement but cannot be

located or traced in the ledger or t-account, then they are Bank DM.

9. Adjusting Entries - only reconciling items of the books are adjusted. If the reconciling

item is an addition to the unadjusted balance, then your adjusting entry should have a

debit to Cash in Bank and a credit to an appropriate account title. If the reconciling item is

a deduction from the unadjusted balance, then your adjusting entry should have a credit to

Cash in Bank and a debit to an appropriate account title. Remember, "NSF Check(s)” is

not an account title.

You might also like

- 211158705-Miguel Baza FcoDocument4 pages211158705-Miguel Baza FcoJaram JohnsonNo ratings yet

- Ub 0630 09 30 2022Document2 pagesUb 0630 09 30 2022Kc CapacioNo ratings yet

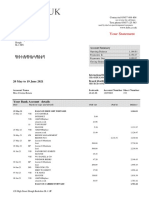

- Your Statement: 20 May To 19 June 2021Document3 pagesYour Statement: 20 May To 19 June 2021Cristina Rotaru100% (1)

- Basic Banking Account As of Feburary 14, 2020: Checking Opening Balance Closing BalanceDocument2 pagesBasic Banking Account As of Feburary 14, 2020: Checking Opening Balance Closing BalanceKellogg Delia100% (1)

- wet wipe 海关数据Document12 pageswet wipe 海关数据yuntian shenNo ratings yet

- Statement April 2022Document2 pagesStatement April 2022Taim JadidNo ratings yet

- Curtin College - Agent ListDocument106 pagesCurtin College - Agent ListMidhun Babu NTNo ratings yet

- Chapter 2 - Basic Documents and TransactionsDocument33 pagesChapter 2 - Basic Documents and Transactionsmarissa casareno almuete100% (1)

- Accounting Notes PDFDocument129 pagesAccounting Notes PDFLeeroy Gift100% (2)

- Bank Statement Apr 14 To Mar 15Document7 pagesBank Statement Apr 14 To Mar 15Vivek PatilNo ratings yet

- Reminders in Preparing Bank Reconciliation StatementDocument2 pagesReminders in Preparing Bank Reconciliation Statementfeitheart_rukaNo ratings yet

- Rekonsiliasi Bank 1718764831Document11 pagesRekonsiliasi Bank 1718764831dqk2tqvpnhNo ratings yet

- Cash Book PDFDocument24 pagesCash Book PDFsavinay agrawalNo ratings yet

- Bank Reconciliation StatementDocument5 pagesBank Reconciliation StatementakankaroraNo ratings yet

- Audit of CashDocument6 pagesAudit of CashVan MateoNo ratings yet

- What Is ReconciliationDocument7 pagesWhat Is ReconciliationRamesh GarikapatiNo ratings yet

- Intermediate Acc NotesDocument2 pagesIntermediate Acc NotesKrystelle JalemNo ratings yet

- Bank Reconciliation Statement NOTESDocument3 pagesBank Reconciliation Statement NOTESvarun rajNo ratings yet

- 206bank Reconcilliation StatementDocument3 pages206bank Reconcilliation StatementRAKESH VARMANo ratings yet

- Bank Reconciliation Statement - Why & How To Prepare The - Statement PDFDocument2 pagesBank Reconciliation Statement - Why & How To Prepare The - Statement PDFAman KodwaniNo ratings yet

- Bank Reconciliation Statement - Why & How To Prepare The - StatementDocument2 pagesBank Reconciliation Statement - Why & How To Prepare The - StatementAman KodwaniNo ratings yet

- Accounting 0452 Notes-Ch4&5Document3 pagesAccounting 0452 Notes-Ch4&5Huma PeeranNo ratings yet

- Question SheetDocument7 pagesQuestion Sheetscientistmonster0001No ratings yet

- Chapter Eight Bank Reconciliation-2Document67 pagesChapter Eight Bank Reconciliation-2Kingsley MweembaNo ratings yet

- What Are Bank Recon StatementsDocument8 pagesWhat Are Bank Recon Statementsedwardsdavian26No ratings yet

- Accountancy Unit 4 Questions:-: 5 Marks QuestionDocument11 pagesAccountancy Unit 4 Questions:-: 5 Marks QuestionHari HaranNo ratings yet

- Accountancy Unit 4 Questions:-: 5 Marks QuestionDocument11 pagesAccountancy Unit 4 Questions:-: 5 Marks QuestionHari HaranNo ratings yet

- Finals FABM2 Lesson 1 Accounting For Cash in BankDocument4 pagesFinals FABM2 Lesson 1 Accounting For Cash in BankFrancine Joy AvenidoNo ratings yet

- CBSE Class 11 ACCOUNTANCY Chapter 6 Ledger and Trial Balance Revision NotesDocument5 pagesCBSE Class 11 ACCOUNTANCY Chapter 6 Ledger and Trial Balance Revision NotesBinoy TrevadiaNo ratings yet

- Bank Reconciliation StatementDocument6 pagesBank Reconciliation StatementamnatariqshahNo ratings yet

- Bank Reconciliation Theory & ProblemsDocument9 pagesBank Reconciliation Theory & ProblemsSalvador DapatNo ratings yet

- KRM Public School Balancing of Ledger Balancing of Different AccountsDocument3 pagesKRM Public School Balancing of Ledger Balancing of Different AccountsTheerthuNo ratings yet

- Graphic Representation of The AccountDocument6 pagesGraphic Representation of The AccountJorge JuniorNo ratings yet

- Financial Accounting M - 2 N - 1Document10 pagesFinancial Accounting M - 2 N - 1Abhijith ANo ratings yet

- BRS Bank Reconcilation StatementDocument15 pagesBRS Bank Reconcilation Statementbabluon22No ratings yet

- Accountancy Notes PDF Class 11 Chapter 5Document4 pagesAccountancy Notes PDF Class 11 Chapter 5Rishi ShibdatNo ratings yet

- 7Document14 pages7Anupam GyawaliNo ratings yet

- ACTBAS 1 Lecture 6 Notes Accounting Cycle of A Service Business Part I: Journalizing, Posting and Trial BalanceDocument22 pagesACTBAS 1 Lecture 6 Notes Accounting Cycle of A Service Business Part I: Journalizing, Posting and Trial BalanceAA Del Rosario AlipioNo ratings yet

- Accounting For CashDocument9 pagesAccounting For CashNatty STAN100% (1)

- Chapter 6 CashDocument15 pagesChapter 6 CashTesfamlak MulatuNo ratings yet

- Bank ReconciliationDocument13 pagesBank ReconciliationMichael AsieduNo ratings yet

- INFORMATION SHEET 1 Entrep 4thDocument22 pagesINFORMATION SHEET 1 Entrep 4thAndrea Mae CenizalNo ratings yet

- Bank Reconciliation Statement: Names of Sub-UnitsDocument6 pagesBank Reconciliation Statement: Names of Sub-UnitsHermann Schmidt EbengaNo ratings yet

- Bank Reconciliation StatementDocument20 pagesBank Reconciliation Statement1t4No ratings yet

- Week 1: Basic Documents and Transactions Related To Bank DepositsDocument6 pagesWeek 1: Basic Documents and Transactions Related To Bank Depositsgregorio gualdadNo ratings yet

- What Is A Cash Book?: Double/two Column Cash Book Triple/three Column Cash BookDocument7 pagesWhat Is A Cash Book?: Double/two Column Cash Book Triple/three Column Cash BookAiman KhanNo ratings yet

- FA ASM2 HuuKhaiDocument32 pagesFA ASM2 HuuKhaiHữu KhảiNo ratings yet

- Bank Reconciliation StatementDocument14 pagesBank Reconciliation StatementMarvie MendozaNo ratings yet

- W5 L15 Bank Reconciliation Statment Part 1 Part-1Document8 pagesW5 L15 Bank Reconciliation Statment Part 1 Part-1moqimNo ratings yet

- UCSB Campus Information & Procedure Manual Reviewing & Reconciling TheDocument6 pagesUCSB Campus Information & Procedure Manual Reviewing & Reconciling Themansoor2685No ratings yet

- Chapter 4Document6 pagesChapter 4Ashwani yadavNo ratings yet

- General Ledger Debits and Credits Normal Account Balances Journal Entries The Income StatementDocument11 pagesGeneral Ledger Debits and Credits Normal Account Balances Journal Entries The Income Statementpri_dulkar4679No ratings yet

- First Off, What Is A Bank Reconciliation?: Bookkeeping RecordsDocument11 pagesFirst Off, What Is A Bank Reconciliation?: Bookkeeping RecordsYassi CurtisNo ratings yet

- Bank Reconciliation and Steps in Bank ReconciliationDocument15 pagesBank Reconciliation and Steps in Bank ReconciliationGrace AncajasNo ratings yet

- VJ Mini ProjectDocument10 pagesVJ Mini ProjectRAKESH VARMA100% (1)

- AbmDocument10 pagesAbmMark AndrewNo ratings yet

- Principles of Book-Keeping: Accounting EntriesDocument42 pagesPrinciples of Book-Keeping: Accounting EntriesJanine padronesNo ratings yet

- Poa Notes For CsecDocument3 pagesPoa Notes For CsecVida Betances-Reyes100% (1)

- Accounting Project: Bank Reconciliation StatementDocument2 pagesAccounting Project: Bank Reconciliation StatementshabanNo ratings yet

- Unit 5Document6 pagesUnit 5deepshrmNo ratings yet

- Bank Reconciliation (Theories and Concept) : Bank Reconciliation, According To Williams, Haka, Et - Al. (2008)Document3 pagesBank Reconciliation (Theories and Concept) : Bank Reconciliation, According To Williams, Haka, Et - Al. (2008)Princess MagpatocNo ratings yet

- 5 Simple Steps To Write and Prepare Ledger AccountDocument4 pages5 Simple Steps To Write and Prepare Ledger AccountNik ZulaimiNo ratings yet

- Reading Material BRSDocument12 pagesReading Material BRSDrake100% (1)

- Accounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCFrom EverandAccounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCRating: 5 out of 5 stars5/5 (1)

- The Barrington Guide to Property Management Accounting: The Definitive Guide for Property Owners, Managers, Accountants, and Bookkeepers to ThriveFrom EverandThe Barrington Guide to Property Management Accounting: The Definitive Guide for Property Owners, Managers, Accountants, and Bookkeepers to ThriveNo ratings yet

- Teeter-Totter Accounting: Your Visual Guide to Understanding Debits and Credits!From EverandTeeter-Totter Accounting: Your Visual Guide to Understanding Debits and Credits!Rating: 2 out of 5 stars2/5 (1)

- Cost of Production Report - FIFO Costing (Module On Cost Accounting)Document10 pagesCost of Production Report - FIFO Costing (Module On Cost Accounting)Khai Ed PabelicoNo ratings yet

- Cost of Production Report - Average CostingDocument12 pagesCost of Production Report - Average CostingKhai Ed PabelicoNo ratings yet

- Completing The Cost Cycle and Accounting For Production LossesDocument10 pagesCompleting The Cost Cycle and Accounting For Production LossesKhai Ed PabelicoNo ratings yet

- Chapter 5 - Labor Accounting - Control and Costing Timekeeping ProceduresDocument6 pagesChapter 5 - Labor Accounting - Control and Costing Timekeeping ProceduresKhai Ed PabelicoNo ratings yet

- Chapter 7 - Manufacturing Overhead - Departmentalization Need For DepartmentalizationDocument11 pagesChapter 7 - Manufacturing Overhead - Departmentalization Need For DepartmentalizationKhai Ed PabelicoNo ratings yet

- Financial Accounting QuizDocument11 pagesFinancial Accounting QuizKhai Ed PabelicoNo ratings yet

- Doubtful Accounts DemonstrationDocument25 pagesDoubtful Accounts DemonstrationKhai Ed PabelicoNo ratings yet

- (03A) AR NR Quiz ANSWER KEYDocument8 pages(03A) AR NR Quiz ANSWER KEYKhai Ed PabelicoNo ratings yet

- SUMMARY OF ACCOUNTS HELD UNDER CUST ID: 545338554 As On October 28, 2017Document1 pageSUMMARY OF ACCOUNTS HELD UNDER CUST ID: 545338554 As On October 28, 2017sagar amrutiyaNo ratings yet

- Deletion of Account HoldersDocument1 pageDeletion of Account HoldersSophia ShafiNo ratings yet

- Chase Bank Statement BankStatements - Net SepDocument4 pagesChase Bank Statement BankStatements - Net SepJoe SFNo ratings yet

- IDFCFIRSTBankstatement 10070894160 005449576Document4 pagesIDFCFIRSTBankstatement 10070894160 005449576manishasurywanshi91No ratings yet

- Statement 24-AUG-20 AC 10176192-разблокированDocument9 pagesStatement 24-AUG-20 AC 10176192-разблокирован13KARATNo ratings yet

- Schedule of Charges - Indus Online Savings Account VariantsDocument6 pagesSchedule of Charges - Indus Online Savings Account VariantsMyco StreptoNo ratings yet

- Annexure 6 - List of LocationsDocument26 pagesAnnexure 6 - List of LocationskrlalitNo ratings yet

- Payment FacilitiesDocument1 pagePayment FacilitiesKobe Lawrence VeneracionNo ratings yet

- RezzDocument131 pagesRezzSreenivaas SurathuNo ratings yet

- Utah Unemployment 103583581 Disclosure Client.V3Document6 pagesUtah Unemployment 103583581 Disclosure Client.V3Tracee GoffNo ratings yet

- Learning Activity Sheet Abm 12 Fundamentals of Abm 2 (Q2-Wk1-2) Bank Reconciliation IDocument14 pagesLearning Activity Sheet Abm 12 Fundamentals of Abm 2 (Q2-Wk1-2) Bank Reconciliation IKimverlee Anne GarciaNo ratings yet

- Union - Sandesh August 2021Document5 pagesUnion - Sandesh August 2021Visnu SankarNo ratings yet

- Inherent Defects InsuranceDocument8 pagesInherent Defects InsuranceXitish MohantyNo ratings yet

- Hon'Ble Mr. Justice Shantanu S. Kemkar, President Hon'Ble Mr. Shyam Sunder Bansal, Member Hon'Ble Mr. Prabhat Parashar, MemberDocument9 pagesHon'Ble Mr. Justice Shantanu S. Kemkar, President Hon'Ble Mr. Shyam Sunder Bansal, Member Hon'Ble Mr. Prabhat Parashar, MemberAnand ShahaniNo ratings yet

- SSC, HSC Scholarship ReprtDocument198 pagesSSC, HSC Scholarship Reprtrayan akbarNo ratings yet

- Internship Report On General Banking Activities of Uttara Bank Limited. (A Study On Shamoly Branch)Document1 pageInternship Report On General Banking Activities of Uttara Bank Limited. (A Study On Shamoly Branch)Shams GalibNo ratings yet

- List of Licensed Commercial Banks in NepalDocument2 pagesList of Licensed Commercial Banks in Nepalnocadmin100% (1)

- SOC DCB Privilege Savings AccountDocument4 pagesSOC DCB Privilege Savings AccountBVS NAGABABUNo ratings yet

- Customers' Perception Towards Retail Banking of The Commercial Banks in Coimbatore District QuestionnaireDocument12 pagesCustomers' Perception Towards Retail Banking of The Commercial Banks in Coimbatore District Questionnairemanoj kumar DasNo ratings yet

- PreviewDocument4 pagesPreviewblessingfaladebamideleNo ratings yet

- Mobilink Bank Statement SampleDocument2 pagesMobilink Bank Statement SampleShahzad YounasNo ratings yet

- Collection EncodingDocument33 pagesCollection EncodingjasmindeidonatoNo ratings yet