Professional Documents

Culture Documents

Description: S&P Bse Teck

Description: S&P Bse Teck

Uploaded by

Neelkanth DaveOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Description: S&P Bse Teck

Description: S&P Bse Teck

Uploaded by

Neelkanth DaveCopyright:

Available Formats

Equity

S&P BSE TECK

Description

The S&P BSE TECk index comprises constituents of the S&P BSE 500 that are classified as members of the media &

publishing, information technology & telecommunications sectors as defined by the BSE industry classification system.

Index Attributes

The S&P BSE TECk index is designed to measure the performance of companies in the media & publishing, information

technology & telecommunications sectors. Calculated using a float-adjusted market-cap-weighted methodology, the

index has more than 10 years of history.

Quick Facts

WEIGHTING METHOD Float-adjusted market cap weighted

REBALANCING FREQUENCY Semiannually in June and December

CALCULATION FREQUENCY Real time

CALCULATION CURRENCIES INR, USD

LAUNCH DATE July 11, 2001

FIRST VALUE DATE January 31, 2000

For more information, view the methodology document at https://www.spglobal.com/spdji/en/documents/methodologies/methodology-sp-bse-

indices.pdf.

All information for an index prior to its Launch Date is back-tested, based on the methodology that was in effect on the Launch Date. Back-tested

performance, which is hypothetical and not actual performance, is subject to inherent limitations because it reflects application of an Index

methodology and selection of index constituents in hindsight. No theoretical approach can take into account all of the factors in the markets in general

and the impact of decisions that might have been made during the actual operation of an index. Actual returns may differ from, and be lower than,

back-tested returns.

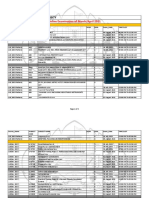

Historical Performance

* Data has been re-based at 100

S&P BSE TECK (TR) S&P BSE 500 (TR)

www.asiaindex.co.in index_services@spbse.com AS OF JANUARY 31, 2022

Equity

S&P BSE TECK

Performance

INDEX LEVEL RETURNS ANNUALIZED RETURNS

1 MO 3 MOS YTD 1 YR 3 YRS 5 YRS 10 YRS

TOTAL RETURNS

19,480.67 -6.74% 3.58% -6.74% 37.88% 29.33% 25.93% 18.11%

PRICE RETURNS

15,478.8 -6.84% 3.46% -6.84% 36.01% 27.2% 23.73% 16.11%

BENCHMARK* TOTAL RETURNS

29,069.01 -0.38% -0.99% -0.38% 33.47% 19.87% 16.69% 15.26%

BENCHMARK* PRICE RETURNS

23,715.29 -0.4% -1.15% -0.4% 31.93% 18.41% 15.26% 13.73%

* The index benchmark is the S&P BSE 500

Calendar Year Performance

2021 2020 2019 2018 2017 2016 2015 2014 2013 2012

TOTAL RETURNS

51.7% 46.54% 11.12% 12.42% 18.82% -7.58% 5.4% 17.97% 49.3% 3%

PRICE RETURNS

49.68% 43.84% 9.22% 10.27% 16.55% -9.16% 3.61% 15.65% 47.36% 1.41%

BENCHMARK* TOTAL RETURNS

31.63% 18.41% 8.98% -1.81% 37.6% 5.15% 0.45% 38.93% 4.93% 33.41%

BENCHMARK* PRICE RETURNS

30.11% 16.8% 7.75% -3.08% 35.94% 3.78% -0.82% 36.96% 3.25% 31.2%

* The index benchmark is the S&P BSE 500

Risk

ANNUALIZED RISK ANNUALIZED RISK-ADJUSTED RETURNS

3 YRS 5 YRS 10 YRS 3 YRS 5 YRS 10 YRS

STD DEV

19.86% 18.26% 17.84% 1.48 1.42 1.02

BENCHMARK* STD DEV

21.86% 18.88% 16.97% 0.91 0.88 0.9

Risk is defined as standard deviation calculated based on total returns using monthly values.

* The index benchmark is the S&P BSE 500

www.asiaindex.co.in index_services@spbse.com AS OF JANUARY 31, 2022

Equity

S&P BSE TECK

Fundamentals

P/E [TRAILING] P/E [PROJECTED] P/B INDICATED DIV YIELD P/SALES P/CASH FLOW

48.76 39.01 9.15 1.28% 6.76 20.88

As of January 31, 2022. Fundamentals are updated on approximately the fifth business day of each month.

Index Characteristics

NUMBER OF CONSTITUENTS 27

CONSTITUENT MARKET CAP [INR CRORE]

MEAN TOTAL MARKET CAP 144,494.88

LARGEST TOTAL MARKET CAP 1,382,668.27

SMALLEST TOTAL MARKET CAP 5,108.88

MEDIAN TOTAL MARKET CAP 30,745.39

WEIGHT LARGEST CONSTITUENT [%] 36.3

WEIGHT TOP 10 CONSTITUENTS [%] 91.5

ESG Carbon Characteristics

CARBON TO VALUE INVESTED (METRIC TONS CO2e/$1M INVESTED)* 5

WEIGHTED AVERAGE CARBON INTENSITY (METRIC TONS CO2e/$1M REVENUES)* 31

*Operational and first-tier supply chain greenhouse gas emissions.

For more information, please visit: www.spdji.com/esg-carbon-metrics.

Top 10 Constituents By Index Weight

CONSTITUENT SYMBOL SECTOR*

Infosys Ltd 500209 NA

Tata Consultancy Services Ltd 532540 NA

Bharti Airtel Ltd 532454 NA

HCL Technologies Ltd 532281 NA

Tech Mahindra Ltd 532755 NA

Wipro Ltd 507685 NA

Larsen & Toubro Infotech Ltd 540005 NA

Zee Entertainment Enterprises Ltd 505537 NA

Tata Elxsi Ltd 500408 NA

MphasiS Ltd 526299 NA

*Based on GICS® sectors

www.asiaindex.co.in index_services@spbse.com AS OF JANUARY 31, 2022

Equity

S&P BSE TECK

Tickers

TICKER REUTERS

PRICE RETURNS BSETECK .BSETECK

TOTAL RETURNS SPBSETET N/A

www.asiaindex.co.in index_services@spbse.com AS OF JANUARY 31, 2022

Equity

S&P BSE TECK

Disclaimer

Source: Asia Index Private Limited.

The launch date of the S&P BSE TECK was July 11, 2001. The launch date of the S&P BSE 500 was August 9, 1999.

All information presented prior to the index launch date is back-tested. Back-tested performance is not actual performance, but is hypothetical. The

back-test calculations are based on the same methodology that was in effect when the index was officially launched. Past performance is not a

guarantee of future results. Please see the Performance Disclosure at http://www.asiaindex.co.in/regulatory-affairs-disclaimers/ for more information

regarding the inherent limitations associated with back-tested performance.

© Asia Index Private Limited 2022. All rights reserved. Redistribution, reproduction and/or photocopying in whole or in part are prohibited without

written permission. The S&P BSE Indices (the “Indices”) are published by Asia Index Private Limited (“AIPL”), which is a joint venture among affiliates of

S&P Dow Jones Indices LLC (“SPDJI”) and BSE Limited (“BSE”). Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s

Financial Services LLC (“S&P”) and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”). BSE® and SENSEX®

are registered trademarks of BSE. These trademarks have been licensed to AIPL. AIPL, BSE, S&P Dow Jones Indices LLC or their respective affiliates

(collectively “AIPL Companies”) make no representation or warranty, express or implied, as to the ability of any index to accurately represent the asset

class or market sector that it purports to represent and AIPL Companies shall have no liability for any errors, omissions, or interruptions of any index or

the data included therein. Past performance of an index is not an indication of future results. This document does not constitute an offer of any

services. All information provided by AIPL Companies is general in nature and not tailored to the needs of any person, entity or group of persons. It is not

possible to invest directly in an index. AIPL Companies may receive compensation in connection with licensing its indices to third parties. Exposure to

an asset class represented by an index is available through investable instruments offered by third parties that are based on that index. AIPL

Companies do not sponsor, endorse, sell, promote or manage any investment fund or other investment vehicle that seeks to provide an investment

return based on the performance of any Index. AIPL and S&P Dow Jones Indices LLC are not an investment advisor, and the AIPL Companies make no

representation regarding the advisability of investing in any such investment fund or other investment vehicle. For more information on any of our

indices please visit www.spdji.com and www.asiaindex.co.in.

CONTACT US

www.asiaindex.co.in MUMBAI TOKYO MEXICO CITY

index_services@spbse.com +91-22-2272-5312 81 3 4550 8564 52 (55) 1037 5290

BEIJING SYDNEY LONDON

86.10.6569.2770 61 2 9255 9802 44 207 176 8888

HONG KONG NEW YORK DUBAI

852 2532 8000 1 212 438 7354 971 (0)4 371 7131

1 877 325 5415

You might also like

- PDF DocumentDocument6 pagesPDF DocumentGregory RodriguezNo ratings yet

- Sample of An Actual Legal OpinionDocument2 pagesSample of An Actual Legal OpinionindaiclerrNo ratings yet

- Description: S&P BSE 100Document5 pagesDescription: S&P BSE 100deepak sadanandanNo ratings yet

- Fs SP Bric 40 IndexDocument7 pagesFs SP Bric 40 IndexHARSH KATARE MA ECO KOL 2021-23No ratings yet

- Fs SP Bse Capital GoodsDocument5 pagesFs SP Bse Capital GoodsyaarthNo ratings yet

- Description: S&P Biotechnology Select Industry IndexDocument7 pagesDescription: S&P Biotechnology Select Industry IndexRandom LifeNo ratings yet

- Fs SP Bse MidcapDocument7 pagesFs SP Bse MidcapRavishankarNo ratings yet

- Fs SP Bse Momentum IndexDocument5 pagesFs SP Bse Momentum IndexRajneeshNo ratings yet

- Description: S&P/BMV Mining & Agriculture IndexDocument5 pagesDescription: S&P/BMV Mining & Agriculture Indextmayur21No ratings yet

- Description: S&P Bse Financials Ex-Banks 30 IndexDocument6 pagesDescription: S&P Bse Financials Ex-Banks 30 IndexKamal joshiNo ratings yet

- Fs-Sp-Bse-200 Factsheet Apr 2024Document9 pagesFs-Sp-Bse-200 Factsheet Apr 2024Fabio ZenNo ratings yet

- Fs SP TSX Composite IndexDocument6 pagesFs SP TSX Composite Indexalt.sa-33bwuogNo ratings yet

- Description: S&P/BMV Commercial Services IndexDocument5 pagesDescription: S&P/BMV Commercial Services Indextmayur21No ratings yet

- Fs Energy Select Sector IndexDocument7 pagesFs Energy Select Sector IndexdanieldebestNo ratings yet

- Description: S&P/Asx All Technology IndexDocument6 pagesDescription: S&P/Asx All Technology IndexSuhasNo ratings yet

- Fs-Sp-Bse-Sensex Apr 2024Document9 pagesFs-Sp-Bse-Sensex Apr 2024Fabio ZenNo ratings yet

- Description: S&P/BMV Mexico-Brazil IndexDocument6 pagesDescription: S&P/BMV Mexico-Brazil Indextmayur21No ratings yet

- Fs SP Bse Momentum IndexDocument5 pagesFs SP Bse Momentum Indexpriya.sunderNo ratings yet

- Description: S&P 500 Dividend AristocratsDocument7 pagesDescription: S&P 500 Dividend AristocratsCalvin YeohNo ratings yet

- Fs SP 500 GrowthDocument7 pagesFs SP 500 GrowthDynand PLNNo ratings yet

- Fs SP Bse Sensex 50Document5 pagesFs SP Bse Sensex 50Samriddh DhareshwarNo ratings yet

- Fs SP Bse Low Volatility IndexDocument5 pagesFs SP Bse Low Volatility Indexd.a.m.ari.onjua.re.z5.98No ratings yet

- Fs SP Epac Largemidcap UsdDocument7 pagesFs SP Epac Largemidcap UsdNguoi KoNo ratings yet

- Fs SP BMV Construction IndexDocument6 pagesFs SP BMV Construction Indextmayur21No ratings yet

- Fs SP 500 Industrials SectorDocument6 pagesFs SP 500 Industrials SectorLuella LukenNo ratings yet

- Fs SP 500 Financials SectorDocument7 pagesFs SP 500 Financials SectorJeffrey NguyenNo ratings yet

- Fs SP Global Luxury IndexDocument7 pagesFs SP Global Luxury Indexxexane5787No ratings yet

- Fs SP 500 PDFDocument8 pagesFs SP 500 PDFAndrés EscobarNo ratings yet

- Description: S&P/BMV Retail & Distributors IndexDocument6 pagesDescription: S&P/BMV Retail & Distributors Indextmayur21No ratings yet

- Fs SP 2Document13 pagesFs SP 2FuboNo ratings yet

- Description: S&P Retail Select Industry IndexDocument7 pagesDescription: S&P Retail Select Industry IndexAndrew KimNo ratings yet

- S&P 500 FactsheetDocument8 pagesS&P 500 FactsheetSurre BankéNo ratings yet

- Fs SP Asx 200 Utilities SectorDocument5 pagesFs SP Asx 200 Utilities SectorRaymond LauNo ratings yet

- Fs SP Pan Arab CompositeDocument6 pagesFs SP Pan Arab CompositeMarNo ratings yet

- Fs SP Asx All Technology IndexDocument7 pagesFs SP Asx All Technology IndexTim RileyNo ratings yet

- Fs SP 500 PDFDocument9 pagesFs SP 500 PDFSajad AhmadNo ratings yet

- Fs SP 500 Top 50Document5 pagesFs SP 500 Top 50Terence La100% (1)

- Description: S&P 500 Dividend and Free Cash Flow Yield IndexDocument6 pagesDescription: S&P 500 Dividend and Free Cash Flow Yield IndexKOMATSU SHOVELNo ratings yet

- Description: S&P/BMV Total Mexico Esg Index (MXN)Document7 pagesDescription: S&P/BMV Total Mexico Esg Index (MXN)tmayur21No ratings yet

- Fs SP Asx 200Document7 pagesFs SP Asx 200Oliver LeeNo ratings yet

- Fs SP Byma Cedear Index ArsDocument7 pagesFs SP Byma Cedear Index ArsmartinezivanlNo ratings yet

- Fs SP 500 Information Technology SectorDocument8 pagesFs SP 500 Information Technology SectorAbudNo ratings yet

- Fs SP TSX Composite Index UsdDocument6 pagesFs SP TSX Composite Index Usdjaya148kurupNo ratings yet

- Fs SP Kensho Smart Factories Index UsdDocument6 pagesFs SP Kensho Smart Factories Index UsdCarlos Rodriguez TebarNo ratings yet

- Fs SP Global 1200Document8 pagesFs SP Global 1200prathap.hcuNo ratings yet

- Description: S&P Gsci SGD TRDocument5 pagesDescription: S&P Gsci SGD TRCalvin YeohNo ratings yet

- Fs SP 500 CadDocument7 pagesFs SP 500 Cadalt.sa-33bwuogNo ratings yet

- Fs SP Uk Investment Grade Corporate Bond IndexDocument4 pagesFs SP Uk Investment Grade Corporate Bond IndexAlokNo ratings yet

- Fs Dow Jones Us Basic Materials IndexDocument5 pagesFs Dow Jones Us Basic Materials Indexsilva.mathew29No ratings yet

- Fs SP Korea Corporate Bond IndexDocument5 pagesFs SP Korea Corporate Bond Indexj.dohNo ratings yet

- Fs SP 500Document7 pagesFs SP 500sohbifayrouzNo ratings yet

- Fs Dow Jones Us Completion Total Stock Market IndexDocument6 pagesFs Dow Jones Us Completion Total Stock Market IndexparaoaltoeavanteNo ratings yet

- Fs Dow Jones Us Semiconductors IndexDocument5 pagesFs Dow Jones Us Semiconductors IndexRakesh SNo ratings yet

- Fs SP TSX 60 IndexDocument7 pagesFs SP TSX 60 Indexjaya148kurupNo ratings yet

- Fs SP Equity Commodity Energy IndexDocument4 pagesFs SP Equity Commodity Energy Indexinezpt29No ratings yet

- Fs SP 500 Shariah IndexDocument8 pagesFs SP 500 Shariah IndexJimot DLangapaNo ratings yet

- Fs SP 500Document13 pagesFs SP 500alt.sa-33bwuogNo ratings yet

- Description: S&P Latin America Ex-Mexico Bmi Materials (Sector)Document6 pagesDescription: S&P Latin America Ex-Mexico Bmi Materials (Sector)tmayur21No ratings yet

- Description: S&P Cryptocurrency Largecap IndexDocument5 pagesDescription: S&P Cryptocurrency Largecap IndexAJ MagtotoNo ratings yet

- S&P500 Factsheet As of May 31 2024Document15 pagesS&P500 Factsheet As of May 31 2024wakeboardmanNo ratings yet

- Fs Dow Jones Us High Beta IndexDocument6 pagesFs Dow Jones Us High Beta IndexishaanNo ratings yet

- To the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioFrom EverandTo the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioNo ratings yet

- Room ListDocument7 pagesRoom ListThe Hello World GuyNo ratings yet

- Issues Concerning SustainabilityDocument14 pagesIssues Concerning SustainabilityYzappleNo ratings yet

- Cyber DefamationDocument10 pagesCyber DefamationAvishi RajNo ratings yet

- India - Bhutan RelationsDocument19 pagesIndia - Bhutan RelationsAbhishekNo ratings yet

- Mesr 2003Document14 pagesMesr 2003SureshkumaryadavNo ratings yet

- Nfpa Codes & StandardsDocument9 pagesNfpa Codes & StandardsPradip SharmaNo ratings yet

- Vikram's English Academy (ICSE) : ENGLISH Paper-1 Set DDocument3 pagesVikram's English Academy (ICSE) : ENGLISH Paper-1 Set DPrachi KiranNo ratings yet

- Things Fall ApartDocument6 pagesThings Fall ApartUme laila100% (1)

- Laurs & Birdz: Human Resource Policies of Sales PersonalDocument14 pagesLaurs & Birdz: Human Resource Policies of Sales PersonalTanmayMurugkarNo ratings yet

- Philosophical PerspectiveDocument33 pagesPhilosophical PerspectiveClarice Awa-aoNo ratings yet

- Coa DBM Joint Circular No 1 S 2021Document11 pagesCoa DBM Joint Circular No 1 S 2021Jessilen Consorte Nidea DexisneNo ratings yet

- Ethics Narrative ReportDocument10 pagesEthics Narrative ReportJesena SalveNo ratings yet

- ASSIGNMENT KaizenDocument6 pagesASSIGNMENT KaizenZankhana BhosleNo ratings yet

- arogya विभागDocument3 pagesarogya विभागpratik sangaleNo ratings yet

- Condominium: Living SpacesDocument15 pagesCondominium: Living SpacesAditya JainNo ratings yet

- Savitribai Phule Pune University: Timetable For Fresh & Backlog Online Examination of March/April 2021Document3 pagesSavitribai Phule Pune University: Timetable For Fresh & Backlog Online Examination of March/April 2021Gayatri DandwateNo ratings yet

- Purposive Communication Lesson 3Document12 pagesPurposive Communication Lesson 3LineClar RealNo ratings yet

- CWBP - Summary - SUBEHA (NP)Document6 pagesCWBP - Summary - SUBEHA (NP)sanchayNo ratings yet

- What Is HivDocument8 pagesWhat Is HivDomingos Victor MoreiraNo ratings yet

- Bhiwandi Plu Report - 4!10!2023 - With Sign SealDocument315 pagesBhiwandi Plu Report - 4!10!2023 - With Sign SealRAVIKANT SINDHENo ratings yet

- Presentation of DR Srinivas Ramaka On World Heart Day 2016Document43 pagesPresentation of DR Srinivas Ramaka On World Heart Day 2016bobbyramakantNo ratings yet

- Donald TrumpDocument154 pagesDonald TrumpzinisaloNo ratings yet

- ISG 2020 BookDocument528 pagesISG 2020 BookKatya GeorgievaNo ratings yet

- Chapter 9Document16 pagesChapter 9Weny Fitriana50% (4)

- 1935 - The Concept of Organization PDFDocument9 pages1935 - The Concept of Organization PDFDias DzakyNo ratings yet

- Assignment1 For MBADocument6 pagesAssignment1 For MBARickson P Antony PulickalNo ratings yet

- City of Chicago ComplaintDocument40 pagesCity of Chicago ComplaintAnonymous 6f8RIS6No ratings yet

- Night of The RadishesDocument12 pagesNight of The RadishesДария ПаученкоNo ratings yet