Professional Documents

Culture Documents

PROBLEM 1: Goodwill and Barain Purchase Option Requirement 1

PROBLEM 1: Goodwill and Barain Purchase Option Requirement 1

Uploaded by

PrincessOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PROBLEM 1: Goodwill and Barain Purchase Option Requirement 1

PROBLEM 1: Goodwill and Barain Purchase Option Requirement 1

Uploaded by

PrincessCopyright:

Available Formats

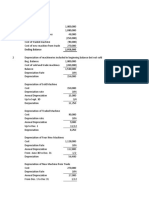

PROBLEM 1: Goodwill and Barain Purchase Option

Requirement 1

Accounts Receivable 180,000

Inventory 400,000

Land 50,000

Building 60,000

Equipment 70,000

Patent 20,000

Goodwill 10,000

Current Liabilities 70,000

Long-term debt 160,000

Cash 560,000

Acquisition Expense 20,000

Cash 20,000

Requirement 2

Accounts Receivable 180,000

Inventory 400,000

Land 50,000

Building 60,000

Equipment 70,000

Patent 20,000

Current Liabilities 70,000

Long-term debt 160,000

Cash 500,000

Gain on Bargain Purchase 50,000

Acquisition Expense 20,000

Cash 20,000

PROBLEM 2: Cash and Stock plus Contingent Consideration

Requirement 1

Goodwill 500,000

Paid-in capital for Contingent Consideration 500,000

Requirement 2

Paid-in capital for Contingent Consideration 500,000

Common Stock 100,000 (10,000 shares X 10par value)

Paid-in capital in excess of par 400,000

Problem 3: Acquisition with Balance Sheet

NT Company

Statement of Financial Position

As of January 1, 20x4

Assets Liabilities and Shareholder's Equity

Cash 64,000 Accounts Payable 144,000

Receivables 213,000 Notes Payable 415,000

Trademarks 625,000 Total Liabilities 559,000

Record Music Catalog 1,020,000

Equipment 425,000 Common Stock 460,000

In-process research and developm 200,000 Additional paid in capital 695,000

Goodwill 27,000 Retained Earnings 860,000

Total Equities 2,015,000

Total Assets 2,574,000 Total Liabilities and Shareholder's E 2,574,000

Cash

NT Beginning cash 60,000 Goodwill

Acquired from OTG 29,000 Cash 29,000

Stock Registration and issuance co (25,000) Receivables 63,000

NT Cash after acquisition 64,000 Trademarks 225,000

Record Music Catalog 180,000

Receivables Equipment 105,000

NT Recceivables 150,000 In-process research and developme 200,000

Acquired from OTG 63,000 Accounts Payable (34,000)

NT Receivables after Acquisition 213,000 Notes Payable (45,000)

Net identifiable assets 723,000

Trademarks Consideration transferred 750,000

NT Trademarks 400,000 Goodwill 27,000

Acquired from OTG 225,000

NT Trademarks after Acquisition 625,000 Accounts Payable

NT Accounts Payable 110,000

Record Music Catalog Acquired from OTG 34,000

NT Record Music Catalog 840,000 NT Accounts Payable from Acquisiti 144,000

Acquired from OTG 180,000

NT Trademarks after Acquisition 1,020,000 Notes Payable

NT Notes Payable 370,000

Equipment Acquired from OTG 45,000

NT Equipments 320,000 NT Notes Payable from Acquisition 415,000

Acquired from OTG 105,000

NT Equipments after acquisition 425,000 Common Stock

Beginning 400,000

Common Stock exchanged 60,000*

Total 460,000

*(15,000 shares X par value of 4=60,000)

Share Premium

Paid in capital of NT 30,000

Paid in capital from the merger 690,000

Stock issue cost (25,000)

695,000

You might also like

- ProblemDocument30 pagesProblemJenika AtanacioNo ratings yet

- Advac 2 Prelims 1 - PALACIODocument4 pagesAdvac 2 Prelims 1 - PALACIOPinky DaisiesNo ratings yet

- Contoh Soal Pelaporan KorporatDocument4 pagesContoh Soal Pelaporan Korporatirma cahyani kawi0% (1)

- Financial Accounting 2 BBA 212 Instructions: 1 Answer One (1) Question Only Q. 1Document4 pagesFinancial Accounting 2 BBA 212 Instructions: 1 Answer One (1) Question Only Q. 1Mwilah Joshua ChalobaNo ratings yet

- Assignment 1Document25 pagesAssignment 1Judy ZhangNo ratings yet

- Little Black Book of Investment SecretsDocument113 pagesLittle Black Book of Investment SecretsUzair Umair100% (3)

- Accounting For Business Combi SolutionDocument4 pagesAccounting For Business Combi SolutionSophia Anne Margarette NicolasNo ratings yet

- Business Combination MergerDocument108 pagesBusiness Combination Mergergojo satoruNo ratings yet

- AFA Tut 2Document16 pagesAFA Tut 2Đỗ Kim ChiNo ratings yet

- Balance SheetDocument8 pagesBalance SheetCaryl Joyce OmboyNo ratings yet

- Buscom Problems 2 4Document5 pagesBuscom Problems 2 4De Jesus, Tracy Marie L.No ratings yet

- Solution Chapter 14Document26 pagesSolution Chapter 14grace guiuanNo ratings yet

- Bus. Combi Probs and SolnDocument3 pagesBus. Combi Probs and SolnRyan Prado AndayaNo ratings yet

- Acquisition of Assets and Liabilities:: Problem IDocument17 pagesAcquisition of Assets and Liabilities:: Problem IklairvaughnNo ratings yet

- Advanced Accounting Part 2 Dayag 2015 Chapter 14Document29 pagesAdvanced Accounting Part 2 Dayag 2015 Chapter 14jayson100% (2)

- Problem 2 1. Goodwill: Books of AcquirerDocument2 pagesProblem 2 1. Goodwill: Books of AcquirerNikki Coleen SantinNo ratings yet

- Statement of Financial PositionDocument2 pagesStatement of Financial PositionAnnabeth BrionNo ratings yet

- Problem 2.3.Document4 pagesProblem 2.3.ArtisanNo ratings yet

- Corp. BankruptcyDocument7 pagesCorp. BankruptcyLorifel Antonette Laoreno TejeroNo ratings yet

- P1-43 Comprehensive Business Combination ProblemDocument3 pagesP1-43 Comprehensive Business Combination ProblemkathNo ratings yet

- P1-43 Comprehensive Business Combination ProblemDocument3 pagesP1-43 Comprehensive Business Combination ProblemkathNo ratings yet

- Business CombinationDocument3 pagesBusiness CombinationkathNo ratings yet

- Soal Akuntansi LanjutanDocument2 pagesSoal Akuntansi LanjutanDion Bonaventura ManaluNo ratings yet

- Special Transaction ACtivityDocument4 pagesSpecial Transaction ACtivityPrincessNo ratings yet

- Andrew's Sa... Service - SARAY 2Document2 pagesAndrew's Sa... Service - SARAY 2Laiza Cristella SarayNo ratings yet

- Asdos Jawaban 3Document4 pagesAsdos Jawaban 3mutiaoooNo ratings yet

- Corporate Liquidation (Integration) PDFDocument5 pagesCorporate Liquidation (Integration) PDFCatherine Simeon100% (1)

- Question 2 CashFlowDocument6 pagesQuestion 2 CashFlowsuraj lamaNo ratings yet

- Chapter 1Document14 pagesChapter 1Monica WulanNo ratings yet

- Assignment in Financial Accounting: Jane B. Evangelista Bsba-2BDocument4 pagesAssignment in Financial Accounting: Jane B. Evangelista Bsba-2BJane Barcelona Evangelista0% (1)

- P2-22, 28, 32Document8 pagesP2-22, 28, 32jyraEB9390No ratings yet

- Business Combinations - Net Asset AcquisitionDocument15 pagesBusiness Combinations - Net Asset AcquisitionLyca Mae CubangbangNo ratings yet

- Chapter 1 - Multiple Choice Problem Answers AfarDocument13 pagesChapter 1 - Multiple Choice Problem Answers AfarChincel G. ANINo ratings yet

- Yohannes Wibowo - Akuntansi Keuangan Lanjutan I - Akuntansi (E) - Tugas Minggu 5Document5 pagesYohannes Wibowo - Akuntansi Keuangan Lanjutan I - Akuntansi (E) - Tugas Minggu 5YOHANNES WIBOWONo ratings yet

- ACCTG 14 Lesson 1 Introduction To Business Combination ExercisesDocument4 pagesACCTG 14 Lesson 1 Introduction To Business Combination ExercisesRUBIO FHEA J.No ratings yet

- Assets Book Value Estimated Realizable ValuesDocument3 pagesAssets Book Value Estimated Realizable ValuesEllyza SerranoNo ratings yet

- Chapter 15Document9 pagesChapter 15Coleen Joy Sebastian PagalingNo ratings yet

- Kunci Jawaban Soal Latihan Pertemuan 6Document6 pagesKunci Jawaban Soal Latihan Pertemuan 6aprian caesarioNo ratings yet

- Output No. 2 - PAS 1 Instruction: Write Your Answers On Long Bond PapersDocument2 pagesOutput No. 2 - PAS 1 Instruction: Write Your Answers On Long Bond Papersnmdl123No ratings yet

- Equity Method VS Cost MethodDocument14 pagesEquity Method VS Cost MethodMerliza JusayanNo ratings yet

- Asawa Ko Aking Mahal Book Value Fair Value Book Value Fair ValueDocument22 pagesAsawa Ko Aking Mahal Book Value Fair Value Book Value Fair ValueLyka RoguelNo ratings yet

- Example Problems W Solutions in SFP & SCFDocument7 pagesExample Problems W Solutions in SFP & SCFQueen Valle100% (1)

- Problem #1: Adjusting EntriesDocument5 pagesProblem #1: Adjusting EntriesShahzad AsifNo ratings yet

- Financial StatementsDocument1 pageFinancial StatementsjaphethadadNo ratings yet

- Problem 1: Total Assets 937,500 Total Liab &she 937,500Document14 pagesProblem 1: Total Assets 937,500 Total Liab &she 937,500Kez MaxNo ratings yet

- Chapter 25Document19 pagesChapter 25shivanthi nisansalaNo ratings yet

- BusCom Exercises AnswerDocument4 pagesBusCom Exercises AnswerVidgezxc LoriaNo ratings yet

- Prob 9Document1 pageProb 9Angelia TNo ratings yet

- 150.curren and Non Current Assets and Liabilities 2Document3 pages150.curren and Non Current Assets and Liabilities 2Melanie SamsonaNo ratings yet

- Ch1 HW SolutionsDocument6 pagesCh1 HW SolutionsNuzul Hafidz Yaslin0% (1)

- Question 2: Ias 7 Statements of Cash Flows: The Following Information Is RelevantDocument3 pagesQuestion 2: Ias 7 Statements of Cash Flows: The Following Information Is RelevantamitsinghslideshareNo ratings yet

- Module 1 Comprehensive - MergerDocument5 pagesModule 1 Comprehensive - MergerGenevieve Manalo100% (6)

- Chapter 1 Afar (Bus Com)Document24 pagesChapter 1 Afar (Bus Com)jajajaredredNo ratings yet

- Assets: Assets To Be Realized: Assets RealizedDocument10 pagesAssets: Assets To Be Realized: Assets RealizedKylabsssNo ratings yet

- Homework Presentation of Financial StatementsDocument1 pageHomework Presentation of Financial StatementsAmy SpencerNo ratings yet

- Advacc Buscom Prob IVDocument2 pagesAdvacc Buscom Prob IVEdward James SantiagoNo ratings yet

- Problem Relates To A Chapter AppendixDocument15 pagesProblem Relates To A Chapter AppendixsameerNo ratings yet

- Business Combination Asset Acquisition: Third YearDocument6 pagesBusiness Combination Asset Acquisition: Third YearRosalie Colarte LangbayNo ratings yet

- Acc For Business CombinationDocument4 pagesAcc For Business CombinationBabyann BallaNo ratings yet

- BDO Unibank 2020 Annual ReportDocument96 pagesBDO Unibank 2020 Annual ReportPrincessNo ratings yet

- Sustainability Report 2018Document68 pagesSustainability Report 2018PrincessNo ratings yet

- Policy Outline SuggestionDocument5 pagesPolicy Outline SuggestionPrincessNo ratings yet

- UB SR 2019 Digital 0521Document61 pagesUB SR 2019 Digital 0521PrincessNo ratings yet

- AT Quizzer (CPAR) - Audit SamplingDocument2 pagesAT Quizzer (CPAR) - Audit SamplingPrincessNo ratings yet

- Firm Infrastructure Risk Management Human Resources Technologic Al Developme NTDocument3 pagesFirm Infrastructure Risk Management Human Resources Technologic Al Developme NTPrincessNo ratings yet

- Annual Report 2020 - 06-04-2021Document342 pagesAnnual Report 2020 - 06-04-2021PrincessNo ratings yet

- Annual Report 2017 - 01-01-2018Document329 pagesAnnual Report 2017 - 01-01-2018PrincessNo ratings yet

- Annual Report 2019 - 07-31-2020Document336 pagesAnnual Report 2019 - 07-31-2020PrincessNo ratings yet

- Annual Report 2018 - 01-01-2019Document325 pagesAnnual Report 2018 - 01-01-2019PrincessNo ratings yet

- Annual Report 2016 - 01-01-2017Document277 pagesAnnual Report 2016 - 01-01-2017PrincessNo ratings yet

- Auditing ActivityDocument4 pagesAuditing ActivityPrincessNo ratings yet

- Labor LawDocument58 pagesLabor LawPrincessNo ratings yet

- Special TransactionDocument2 pagesSpecial TransactionPrincessNo ratings yet

- AuditingDocument1 pageAuditingPrincessNo ratings yet

- Ra 10142 Financial Rehabilitaion and Insolvency ActDocument41 pagesRa 10142 Financial Rehabilitaion and Insolvency ActPrincessNo ratings yet

- Labor LawDocument58 pagesLabor LawPrincessNo ratings yet

- Cash Fraud Schemes: The FraudsterDocument2 pagesCash Fraud Schemes: The FraudsterPrincessNo ratings yet

- Special Transaction ACtivityDocument4 pagesSpecial Transaction ACtivityPrincessNo ratings yet

- Business Combinations: Advantages Disadvantages T Y E PDocument1 pageBusiness Combinations: Advantages Disadvantages T Y E PPrincessNo ratings yet

- Pakistan Company Requirement 1: Journal EntryDocument4 pagesPakistan Company Requirement 1: Journal EntryPrincessNo ratings yet

- Rigidifying Global Financial Conditions and Inequality Brought Upon by Enduring PovertyDocument2 pagesRigidifying Global Financial Conditions and Inequality Brought Upon by Enduring PovertyPrincessNo ratings yet

- Shareholder's WealthDocument1 pageShareholder's WealthPrincessNo ratings yet

- Law On PatentDocument30 pagesLaw On PatentPrincessNo ratings yet

- Banking Law: PrimerDocument21 pagesBanking Law: PrimerAnonymous XuOGlMiNo ratings yet

- United States Court of Appeals, Third CircuitDocument7 pagesUnited States Court of Appeals, Third CircuitScribd Government DocsNo ratings yet

- JD & MainDocument2 pagesJD & MainSourabh Sharma100% (1)

- q1 and 2Document12 pagesq1 and 2Dawood Mehab 037No ratings yet

- Romanian Equity: NN (L) InternationalDocument3 pagesRomanian Equity: NN (L) InternationalDaniel MacoveiNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Ca Final Idt RtpsDocument31 pagesCa Final Idt Rtpschandrakantchainani606No ratings yet

- Certificate of Internal Guide: Udayveer SinghDocument4 pagesCertificate of Internal Guide: Udayveer SinghUdayveerSinghNo ratings yet

- Negative ExternalitiesDocument11 pagesNegative ExternalitiesGeronimo StiltonNo ratings yet

- Accounting Concepts and PrinciplesDocument18 pagesAccounting Concepts and PrinciplesCharissa Jamis ChingwaNo ratings yet

- Study On Merger and Acquisition in Banking Sector of IndiaDocument78 pagesStudy On Merger and Acquisition in Banking Sector of IndiaPawanDubeyNo ratings yet

- Bhutan National Urbanization Strategy 2008Document155 pagesBhutan National Urbanization Strategy 2008Sonam Dorji100% (1)

- Budgeting Quiz Answer KeyDocument5 pagesBudgeting Quiz Answer KeyDeniseNo ratings yet

- QTLT (Year 2019-20)Document4 pagesQTLT (Year 2019-20)Mazharul Ali AbbaasNo ratings yet

- Accounting Fundamentals in Society ACCY111: DR Sanja PupovacDocument21 pagesAccounting Fundamentals in Society ACCY111: DR Sanja PupovacStephanie BuiNo ratings yet

- Negotiable Instruments ActDocument38 pagesNegotiable Instruments ActSonali Namdeo DaineNo ratings yet

- SebiDocument26 pagesSebiHitesh MendirattaNo ratings yet

- Chapter Three How Financial Statements Are Used in ValuationDocument35 pagesChapter Three How Financial Statements Are Used in ValuationSilvia WongNo ratings yet

- Simple Interest Worksheet 2Document2 pagesSimple Interest Worksheet 2A.BensonNo ratings yet

- Accounting Chapter 2Document56 pagesAccounting Chapter 2hnhNo ratings yet

- Anna MariaDocument12 pagesAnna MariasinomicsjournalNo ratings yet

- Finman Reviewer - Finals Current Assets: Fixed Assets:: Net Working CapitalDocument15 pagesFinman Reviewer - Finals Current Assets: Fixed Assets:: Net Working CapitalHoney MuliNo ratings yet

- (Ust-Jpia) Ca51016 Ia3 Mock Preliminary Examination ReviewerDocument12 pages(Ust-Jpia) Ca51016 Ia3 Mock Preliminary Examination Reviewerhpp academicmaterialsNo ratings yet

- SFC Fund Manager Code of Conduct Workshop (Clifford Chance - Jan 2018)Document37 pagesSFC Fund Manager Code of Conduct Workshop (Clifford Chance - Jan 2018)Chris W ChanNo ratings yet

- Ep Mar Apr1979 Part3 Mote PDFDocument7 pagesEp Mar Apr1979 Part3 Mote PDFMuhammad TohamyNo ratings yet

- Cost II Assignment IIDocument2 pagesCost II Assignment IIAmanuel GenetNo ratings yet

- Handling Objections:: Client ResponseDocument3 pagesHandling Objections:: Client ResponseAndrew AdlawonNo ratings yet

- UNIT 5 - Company AuditDocument12 pagesUNIT 5 - Company AuditHrishikesh R BhatNo ratings yet

- INVENTORIESDocument28 pagesINVENTORIESLourdios EdullantesNo ratings yet