Professional Documents

Culture Documents

Date of Issue 07/03/2022: Address of Property To Which Tax Relates 16 Southey Road Rugby

Date of Issue 07/03/2022: Address of Property To Which Tax Relates 16 Southey Road Rugby

Uploaded by

Daniel HollandsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Date of Issue 07/03/2022: Address of Property To Which Tax Relates 16 Southey Road Rugby

Date of Issue 07/03/2022: Address of Property To Which Tax Relates 16 Southey Road Rugby

Uploaded by

Daniel HollandsCopyright:

Available Formats

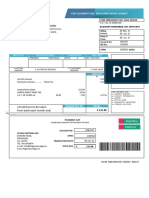

10067036 COUNCIL TAX BILL

2022/2023

For enquiries regarding this bill, please write to

Revenues Service, Town Hall, Rugby CV21 2RR or email

council.tax@rugby.gov.uk

www.rugby.gov.uk/counciltax Date of Issue 07/03/2022

Mr D Hollands and Miss L A Thomas

«¤:#6)-^-52lF4®

16 Southey Road

Rugby

CV22 6HF

9826 0322 0900 6200 2118 7638

Reference Number 2002118763

Address of property to which tax relates Property Valuation Band D

16 Southey Road % change from

Rugby previous year

Warwickshire County Council 1.7 £1,414.86

*Warwickshire County Council Adult Social Care 2.0 £176.07

CV22 6HF Office of the Police & Crime Commissioner for Warwickshire 3.9 £262.71

Rugby Borough Council 2.3 £158.80

*The council tax attributable to

Warwickshire County Council includes Rugby Town Area 4.1 £78.02

a precept to fund adult social care Total 3.7% £2,090.46

Charge period 01/04/22 to 31/03/23 £2,090.46

The Government is providing a £150 one-off

Energy Bills Rebate for most households in

council tax bands A-D. Amount payable by you £2,090.46

To receive your bill electronically, sign up online at www.rugby.gov.uk/counciltax

Reason for producing: New Year Billing

PAYMENT INSTRUCTIONS PAYMENT METHOD See overleaf for how and where to pay

01/04/2022 £176.46 01/08/2022 £174.00 01/12/2022 £174.00

01/05/2022 £174.00 01/09/2022 £174.00 01/01/2023 £174.00

01/06/2022 £174.00 01/10/2022 £174.00 01/02/2023 £174.00

01/07/2022 £174.00 01/11/2022 £174.00 01/03/2023 £174.00

10067036 WAYS TO PAY

It is important that all payments are made on or before the due date. Failure to do so may result

in cancellation of the instalment arrangement, and further recovery action being taken for recovery of the total

amount outstanding.

1. DIRECT DEBIT We have 4 different payment dates with something to suit everyone. You can choose from 1st,

12th, 19th or 26th of each month. Alternatively we also offer weekly, fortnightly or 4 weekly payments.

There are now over 33,000 Rugby residents paying their council tax by direct debit, so if you want to join them call the office

on 01788 533488.

If you already pay by this method it will state Direct Debit overleaf.

2. ONLINE by visiting our secure website www.rugby.gov.uk/counciltax where you can pay using your debit/credit card

3. BANK transfers can be sent direct to our bank account. Please always quote the reference number stated overleaf starting

with 20. Our bank account details are Sort code 30-00-02 Account Number 00830939 Account Name Rugby Borough Council.

4. DEBIT or CREDIT CARD payments can be made using our 24/7 automated payment line on 01788 533463.

5. CASH can be paid free of charge at any Post Office or retail outlet displaying the PayPoint sign, providing you take a

bill showing a barcode on the front.

You may request in writing to pay your council tax over 12 months from April to March.

You can now manage your council tax account online. Sign up at www.rugby.gov.uk/counciltax

If you want to receive your bill electronically email us at council.tax@rugby.gov.uk

INFORMATION ABOUT YOUR BILL

VALUATION. Council Tax is based on the value of your property as at 1 April 1991. The corresponding Council

Tax band is shown on the front of your bill.

COUNCIL TAX DISCOUNTS. The basic Council Tax covers 2 or more adults aged 18 or over living in

the property. If you are the only person living in the property you will get a 25% discount.

EXEMPTIONS. These are applicable to some unoccupied properties and to some occupied properties where all

of the occupiers fall into a qualifying category such as full time students.

EMPTY PROPERTIES. 100% charge is payable on all empty properties.

LONG TERM EMPTY PREMIUM. If your property is empty and unfurnished for more than 2 years a 100%

premium may be imposed.

DISABLED REDUCTION. If you need extra room to meet the needs of a disabled person in your household you

may be able to pay on a lower band than shown on your bill.

COUNCIL TAX REDUCTION (SUPPORT). If you are on a low income or claiming a state benefit such as

Universal Credit, you may be entitled to some help with your Council Tax.

CHANGE OF CIRCUMSTANCES. If you have a change of circumstances that may affect your entitlement to

any of the reductions above such as a change of income or status, a partner moving in, a child becoming 18

or an empty property becoming occupied you must let us know within 21 days of the change. You can phone us on 01788

533488. If you fail to tell us you may incur a financial penalty or even be prosecuted. If in doubt let us know.

FINANCIAL INFORMATION on Warwickshire County Council (including Adult Social Care), Police

and Rugby Borough Council expenditure plans can be found at www.rugby.gov.uk

A paper copy may be obtained by contacting us (see front of the bill.)

APPEALS. If you think your property is in the wrong band you may be able to appeal against it to the Listing Officer.

Go to gov.uk/contact-voa or ring 03000 501501 for more details. If you wish to appeal against

a financial penalty, being made liable for this bill or not being allowed the correct reduction please contact us

(see the front of the bill for how to do this).

ADULT SOCIAL CARE. For adult social care authorities, council tax bills show two percentage changes:

one for the part of the overall change attributable to the adult social care precept, and one for the part attributable to

general expenditure.

You might also like

- Statement 2024 1Document1 pageStatement 2024 1xfzm99mr8rNo ratings yet

- Bill 10296080Document1 pageBill 10296080luminitamihai775No ratings yet

- Business Account Statement: MR John Doe 20 Sherwood ST, London W1F 7edDocument4 pagesBusiness Account Statement: MR John Doe 20 Sherwood ST, London W1F 7edarianit100% (1)

- ElectricDocument2 pagesElectrickasmarproNo ratings yet

- So Energy BillDocument1 pageSo Energy BillPhill LivesleyNo ratings yet

- HSBC Bank StatemeDocument1 pageHSBC Bank StatemeHamad Falah100% (1)

- 5 6217778743729982038 PDFDocument3 pages5 6217778743729982038 PDFdyadik24No ratings yet

- Statement 21-APR-23 AC 73219674 23081839Document3 pagesStatement 21-APR-23 AC 73219674 23081839g6psbtnb87No ratings yet

- James BillDocument3 pagesJames BillJohn Bean100% (2)

- United Kingdom Scottish HydroDocument1 pageUnited Kingdom Scottish HydroNikita TishchenkoNo ratings yet

- Council Tax Demand Notice 2020/2021: :-U-Can) 82®Document2 pagesCouncil Tax Demand Notice 2020/2021: :-U-Can) 82®Amruta Lambat Daulatkar100% (1)

- Classic 15 December 2020 To 14 January 2021: Your Account Arranged Overdraft Limit 250Document4 pagesClassic 15 December 2020 To 14 January 2021: Your Account Arranged Overdraft Limit 250Deva LinaNo ratings yet

- Standard Chartered 360 Rewards Catalog PDFDocument50 pagesStandard Chartered 360 Rewards Catalog PDFPiyal Hossain60% (5)

- Nilson Report May 16 Part 2 PDFDocument11 pagesNilson Report May 16 Part 2 PDFiguzinaNo ratings yet

- Council Tax Bill 2021/22Document2 pagesCouncil Tax Bill 2021/22Lucas Victor VargasNo ratings yet

- My Islington Council Tax DocumentDocument4 pagesMy Islington Council Tax Documentjohnsonwto15No ratings yet

- Dent Eimear LindaDocument4 pagesDent Eimear LindaITNo ratings yet

- PreviewDocument4 pagesPreviewandrealhepburnNo ratings yet

- Extct Bill 905431x 677697Document2 pagesExtct Bill 905431x 677697clinica.sante.resultsNo ratings yet

- Account Reference: 3305530341: Amount Payable 120.31Document2 pagesAccount Reference: 3305530341: Amount Payable 120.31jeffreyhaswell219No ratings yet

- Statement 517014 78338832 22 Dec 2023Document5 pagesStatement 517014 78338832 22 Dec 2023cressidafunkeadedareNo ratings yet

- Council Tax Bill 2023/24Document2 pagesCouncil Tax Bill 2023/24shahin.imani69No ratings yet

- Utility BillDocument2 pagesUtility BillHadi GhamarzadehNo ratings yet

- Scottishpower - Co.uk/ Getintouch 0345 270 0700: Account NumberDocument6 pagesScottishpower - Co.uk/ Getintouch 0345 270 0700: Account NumberIlluminated By LightNo ratings yet

- Classic 01 August 2019 To 08 August 2019: Your AccountDocument5 pagesClassic 01 August 2019 To 08 August 2019: Your AccountHuszár PicsaNo ratings yet

- A 2d87ed76 175382523 1Document3 pagesA 2d87ed76 175382523 1Danut NechitaNo ratings yet

- ViewEpsiiaEStatementDetail PDFDocument6 pagesViewEpsiiaEStatementDetail PDFsjeyarajah21No ratings yet

- YourBTbill 15042024Document3 pagesYourBTbill 15042024tranejones763No ratings yet

- Virgin Media Bill UKDocument2 pagesVirgin Media Bill UKwarrenad977No ratings yet

- Ireland Flogas Natural GasDocument1 pageIreland Flogas Natural GasMyt WovenNo ratings yet

- Bank StatementDocument3 pagesBank Statementrk7vzkvh9jNo ratings yet

- File PDFDocument1 pageFile PDFScumpyk VioNo ratings yet

- Assured Shorthold Tenancy AgreementDocument1 pageAssured Shorthold Tenancy Agreementfuddy luziNo ratings yet

- SimiomDocument4 pagesSimiombrananton070No ratings yet

- Basic Pay Income Tax National Insurance: 8344788 Carlos Ariza 16-FEB-2020 ZR 57 69 94 UDocument3 pagesBasic Pay Income Tax National Insurance: 8344788 Carlos Ariza 16-FEB-2020 ZR 57 69 94 UCamilo NietoNo ratings yet

- Council TaxDocument1 pageCouncil Taxsteve.hartNo ratings yet

- Norway Clean Energy Invest ASDocument1 pageNorway Clean Energy Invest ASAserNo ratings yet

- NEW Higginbotham-Jonespreview +++ - HALIFAXDocument4 pagesNEW Higginbotham-Jonespreview +++ - HALIFAX13KARATNo ratings yet

- Invoice 2024 02 02Document2 pagesInvoice 2024 02 02Vitalii PrisacariNo ratings yet

- customs: CorporationDocument2 pagescustoms: Corporationbilal sarfrazNo ratings yet

- Wiac - Info PDF Thames Water BillDocument3 pagesWiac - Info PDF Thames Water BillShiraz MushtaqNo ratings yet

- RevolutDocument6 pagesRevolutAndré SilvaNo ratings yet

- Your Bill For Water Services: Graeme Robert James Dunlop 128 Front Street Knotting MK44 1AE United KingdomDocument1 pageYour Bill For Water Services: Graeme Robert James Dunlop 128 Front Street Knotting MK44 1AE United KingdomTeam Pritom100% (1)

- Mortimer +++ 467786300-Utility-Bil-Svetlana-Koturova-1-1 PDFDocument4 pagesMortimer +++ 467786300-Utility-Bil-Svetlana-Koturova-1-1 PDF13KARATNo ratings yet

- Monthly Bank StatementDocument3 pagesMonthly Bank StatementHK UploadNo ratings yet

- 29th July 2022Document2 pages29th July 2022Morena hartnettNo ratings yet

- Total: Tax Invoice For..Document3 pagesTotal: Tax Invoice For..rcbpd.rNo ratings yet

- Statement 2023 OctDocument2 pagesStatement 2023 Octbabyshark9030No ratings yet

- Council Tax BenifitDocument5 pagesCouncil Tax BenifitPaula Starling100% (1)

- Preview 2Document3 pagesPreview 2g6psbtnb87No ratings yet

- Octopus Energy Statement 2022 06 19Document5 pagesOctopus Energy Statement 2022 06 19Jean-Charles CotteverteNo ratings yet

- SS033790C 52 Ionela Claudia Insuratelu 30-03-2023Document1 pageSS033790C 52 Ionela Claudia Insuratelu 30-03-2023Ionela InsurateluNo ratings yet

- Bill 1708790581Document2 pagesBill 1708790581NikNo ratings yet

- Statement 2023 3Document1 pageStatement 2023 3Pakinan ZeidNo ratings yet

- View BillDocument4 pagesView BillcristicrissltdNo ratings yet

- CorrespondenceDocument4 pagesCorrespondenceBec HindleNo ratings yet

- Statement Emilija BarclaysDocument4 pagesStatement Emilija BarclaysKris TheVillainNo ratings yet

- Renata Balogh - Payslip For 12.04.21Document1 pageRenata Balogh - Payslip For 12.04.21Renáta BaloghNo ratings yet

- Silver Account 06 December 2021 To 06 June 2022: Abuzeid Huda AliDocument2 pagesSilver Account 06 December 2021 To 06 June 2022: Abuzeid Huda Alimohamed elmakhzniNo ratings yet

- Statement 25-MAY-22 AC 43388212 28153934Document7 pagesStatement 25-MAY-22 AC 43388212 28153934cecilia mwangiNo ratings yet

- Monzo Bank Statement 2024 01 01 2024 03 31 40 1Document10 pagesMonzo Bank Statement 2024 01 01 2024 03 31 40 1tsundereadamsNo ratings yet

- PDF BahramDocument3 pagesPDF Bahramxfzm99mr8rNo ratings yet

- Council Tax Bill - SampleXXXDocument4 pagesCouncil Tax Bill - SampleXXXs6286135No ratings yet

- My Islington Council Tax DocumentDocument4 pagesMy Islington Council Tax Documentjohnsonwto15No ratings yet

- 02 - Smartscreen Handout 27 - Water HeatingDocument3 pages02 - Smartscreen Handout 27 - Water HeatingDaniel HollandsNo ratings yet

- 02 - Smartscreen Handout 27 - Water Heating-1Document3 pages02 - Smartscreen Handout 27 - Water Heating-1Daniel HollandsNo ratings yet

- 02 - Smartscreen Handout 01 - Supplies & Earthing-1Document5 pages02 - Smartscreen Handout 01 - Supplies & Earthing-1Daniel HollandsNo ratings yet

- 02 - Smartscreen Handout 24 - DistributionDocument5 pages02 - Smartscreen Handout 24 - DistributionDaniel HollandsNo ratings yet

- EStatement - Jul 2023 - Jan 2024 2Document29 pagesEStatement - Jul 2023 - Jan 2024 2alexotp88No ratings yet

- Current Affairs Today - 28.08.2019Document13 pagesCurrent Affairs Today - 28.08.2019vineethNo ratings yet

- Ibs Wakaf Siku 1 31/03/22Document8 pagesIbs Wakaf Siku 1 31/03/22sorfina3009No ratings yet

- Data DictionaryDocument2 pagesData DictionarysailushaNo ratings yet

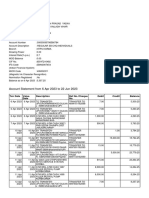

- Account Statement From 6 Apr 2023 To 22 Jun 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument11 pagesAccount Statement From 6 Apr 2023 To 22 Jun 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceNishant Sagar DewanganNo ratings yet

- Privy League - Client PresentationDocument24 pagesPrivy League - Client PresentationRaj Maisheri100% (1)

- Tax Invoice For: Your Telstra BillDocument3 pagesTax Invoice For: Your Telstra BillgeorgiaNo ratings yet

- Mercantile Bank Consolidated Pricing Guide - May2022Document5 pagesMercantile Bank Consolidated Pricing Guide - May2022IQaba DyosiNo ratings yet

- Senior High School: First Semester S.Y. 2020-2021Document9 pagesSenior High School: First Semester S.Y. 2020-2021sheilame nudaloNo ratings yet

- DisputeForm PDFDocument1 pageDisputeForm PDFAngelofnight LisaNo ratings yet

- Contract and Service Level AgreementDocument4 pagesContract and Service Level Agreementdavid ahiomeNo ratings yet

- Suncoast Bank Statement JulyDocument4 pagesSuncoast Bank Statement JulyamatobertrumNo ratings yet

- ATM Framework - Interface - User - GuideDocument85 pagesATM Framework - Interface - User - GuideArun KumarNo ratings yet

- Account Statement 13-08-2023T17 36 56Document1 pageAccount Statement 13-08-2023T17 36 56GretaNo ratings yet

- Chime Bank Statement 2020.Document4 pagesChime Bank Statement 2020.kutner8181No ratings yet

- 11 Appendix J B 1st-31st March 2020 - 2Document2 pages11 Appendix J B 1st-31st March 2020 - 2Adita DayNo ratings yet

- GOMO Mobile Plan TnCsDocument9 pagesGOMO Mobile Plan TnCspinkstars247No ratings yet

- PSBDocument16 pagesPSBXtorm TrooperNo ratings yet

- About Oriental Bank of CommerceDocument10 pagesAbout Oriental Bank of CommerceMandeep BatraNo ratings yet

- CompleteFreedom 0066 22oct2022Document5 pagesCompleteFreedom 0066 22oct2022bigman walthoNo ratings yet

- Navy StatementDocument4 pagesNavy StatementJonathan Seagull LivingstonNo ratings yet

- FASTag Application Form1Document10 pagesFASTag Application Form1Saurav AnandNo ratings yet

- EI Fund Transfer Intnl TT Form V5.1 VTDocument2 pagesEI Fund Transfer Intnl TT Form V5.1 VTpowellarryNo ratings yet

- Bpi 3Document6 pagesBpi 3fortune4u001No ratings yet

- Pradhan Mantri Shram-Yogi Maandhan - (PM-SYM)Document2 pagesPradhan Mantri Shram-Yogi Maandhan - (PM-SYM)Honey Ali33% (3)

- DigitalPaymentBook PDFDocument76 pagesDigitalPaymentBook PDFShachi RaiNo ratings yet