Professional Documents

Culture Documents

Home Loan Certificate

Home Loan Certificate

Uploaded by

Neha YadavOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Home Loan Certificate

Home Loan Certificate

Uploaded by

Neha YadavCopyright:

Available Formats

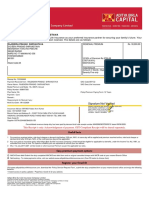

MS.

NEHA YADAV 19-1-2021

PLOT 29/A

AMBIENCE ISLAND

DLF PHASE 1

GURGAON

Pin Code:- 122011

Phone No:- 918888880678

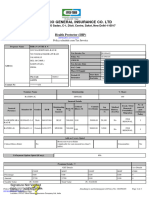

Ref: A/c no:- 983 / 0264675900002239

A/C No:- 0264675900002239

Customer ID:- 79420049

TO WHOMSOEVER IT MAY CONCERN

PROVISIONAL CERTIFICATE FOR THE FINANCIAL YEAR 2020-2021

This is to certify that MS. NEHA YADAV was sanctioned housing loan from IDBI Bank Ltd. in respect of the following

property

B-501 5TH FLR B BLK, SUPREME RESIDENCY, MATHURA NAGAR

BEHIND PUNJAB DAIRY, NALLASOPRA EAST, 29

THANE, 401209

The provisional details of Interest and Principal for claiming deduction under Section 24(b) & 80 C of Income Tax Act, 1961

for the period - 01-04-2020 to 31-03-2021 are as under:

Notes:

1.Interest is calculated on daily balances at monthly rests. Repayments due Above are exclusive of arrears if any.

2.Interest and Principal figures are subject to change in case of prepayment/ And/or change in repayment schedule.

3.Principal repayments through EMI's and/or Prepayments qualify for deduction Under Section 80 C if the amounts are

actually paid by 31-03-2021

4.Deduction under Section 80 C can be claimed only if:

1. The repayment of the loan is made out of income chargeable to tax and

2. The property for which the loan is taken is not transferred before expiry of 5 years from the end of the financial

year in which the possession of such property is obtained.

THESE CONDITIONS HAVE NOT BEEN VERIFIED BY IDBI BANK LTD.

5.Interest payable on the loan (including Pre EMI Interest, if any) is allowed as a deduction under Section 24 (b)

The onus of establishing eligibility vests with the subject client.

This Certificate Being Provisional in nature requires no authorization from IDBI BANK LTD.

You might also like

- MR Parmar Krishnarajsinh 554/1, Satyam Society, Sector-22, Gandhinagar, GANDHINAGAR-382021Document1 pageMR Parmar Krishnarajsinh 554/1, Satyam Society, Sector-22, Gandhinagar, GANDHINAGAR-382021parmarkrishnarajsinh100% (1)

- Principal Amount Payable: Interest Amount Payable: Rs. 19,684.19 Rs. 1,435.81Document1 pagePrincipal Amount Payable: Interest Amount Payable: Rs. 19,684.19 Rs. 1,435.81Sarath KumarNo ratings yet

- LIC Housing Finance LTDDocument1 pageLIC Housing Finance LTDanand7602No ratings yet

- Manish Negi A1412020004 Interest Certificate 2015 16Document3 pagesManish Negi A1412020004 Interest Certificate 2015 16Ajinkya Bagade0% (1)

- Reg No: Dl8Cav0116: Registration Certificate For VehicleDocument1 pageReg No: Dl8Cav0116: Registration Certificate For Vehicleh4ckerNo ratings yet

- Branch Code:02186 Bank's PAN: Branch Name:: To Whomsoever It May Concern Provisional Home Loan Interest CertificateDocument1 pageBranch Code:02186 Bank's PAN: Branch Name:: To Whomsoever It May Concern Provisional Home Loan Interest Certificatesudarsan kingNo ratings yet

- HHLHYE00424239 Provisional (2019-2020)Document1 pageHHLHYE00424239 Provisional (2019-2020)sanjeevNo ratings yet

- Star HealthDocument1 pageStar HealthpalanivelNo ratings yet

- Provisional Certificate 2018-2019Document1 pageProvisional Certificate 2018-2019RohanNo ratings yet

- Provisional Fy 20-21Document1 pageProvisional Fy 20-21Kedar YadavNo ratings yet

- Lony3004 00000037809338867 HDocument1 pageLony3004 00000037809338867 HlimcysebastinNo ratings yet

- MR Javed Mohammad Monis B295, Chattarpur Enclave, PHASE 2, NEW DELHI-110074Document1 pageMR Javed Mohammad Monis B295, Chattarpur Enclave, PHASE 2, NEW DELHI-110074javedmonis07No ratings yet

- Ravi Education Loan Interest-2023Document1 pageRavi Education Loan Interest-2023Cut Copy PateNo ratings yet

- Exide OctoberDocument1 pageExide OctoberSasidharKalidindiNo ratings yet

- Sridhar Medical Policy SelfDocument5 pagesSridhar Medical Policy SelfSurya GoudNo ratings yet

- Policy Doc PDFDocument4 pagesPolicy Doc PDFGajen SinghNo ratings yet

- Homeloancertificate - 38180652 DBFDBDocument1 pageHomeloancertificate - 38180652 DBFDBKRIS BARSAGADE100% (1)

- Education Loan - Interest Certificate FY23Document1 pageEducation Loan - Interest Certificate FY23Marzook SuhailNo ratings yet

- 1865362Document1 page1865362Bhavesh ParekhNo ratings yet

- InterestDocument1 pageInterestsatya.undapalliNo ratings yet

- Policy CertificateDocument5 pagesPolicy CertificateRahulpatel25No ratings yet

- Lic HFL PDFDocument1 pageLic HFL PDFSrinivasulu SambaNo ratings yet

- View CertificateDocument1 pageView CertificateSatyanarayana NandulaNo ratings yet

- 10789103Document7 pages10789103Sachit MalikNo ratings yet

- Interest Certificate: Shivam Garg and Ramkrishna GargDocument1 pageInterest Certificate: Shivam Garg and Ramkrishna GargShivamNo ratings yet

- View Certificate PDFDocument1 pageView Certificate PDFRama RaoNo ratings yet

- Homeloan IT Lcertificate Mithun 2023Document1 pageHomeloan IT Lcertificate Mithun 2023yaligartechNo ratings yet

- 9473667098713233264Document1 page9473667098713233264Parth NayakNo ratings yet

- Renewal NoticeDocument2 pagesRenewal NoticeJerry LamaNo ratings yet

- Tax Declaration Form 2021 22Document4 pagesTax Declaration Form 2021 22Kasiviswanathan ChinnathambiNo ratings yet

- Aditya Life InsuranceDocument2 pagesAditya Life InsuranceMirzaNo ratings yet

- Mediclaim Policy Parents - H1096407Document3 pagesMediclaim Policy Parents - H1096407Lokesh AnandNo ratings yet

- HL IT - Certificate - 621058739 FY 23-24 SampleDocument1 pageHL IT - Certificate - 621058739 FY 23-24 SampleGouravpurvi100% (1)

- Tax Certificate - 008927742 - 131310Document2 pagesTax Certificate - 008927742 - 131310Vignesh MahadevanNo ratings yet

- PremiumRept FamilyDocument2 pagesPremiumRept Familynavengg521No ratings yet

- Branch Code:03257 Branch Name: Bank's PAN:: To Whomsoever It May Concern Provisional Home Loan Interest CertificateDocument1 pageBranch Code:03257 Branch Name: Bank's PAN:: To Whomsoever It May Concern Provisional Home Loan Interest CertificateRishaan Ranjan100% (1)

- House ReceiptDocument1 pageHouse ReceiptArunNo ratings yet

- IntCertEduLoanProvisional10 01 2022Document1 pageIntCertEduLoanProvisional10 01 2022ajay chaudharyNo ratings yet

- ProvisionalInterestCertificate H403HHL0576456Document1 pageProvisionalInterestCertificate H403HHL0576456AyazNo ratings yet

- PVS Lakshmiprasad: IRDA Regn. No 129 Corporate Identity Number U66010TN2005PLC056649 Email ID: Info@starhealth - inDocument1 pagePVS Lakshmiprasad: IRDA Regn. No 129 Corporate Identity Number U66010TN2005PLC056649 Email ID: Info@starhealth - inSatvinder Singh ChandiNo ratings yet

- Dengue Ns1 Antigen Test (Elisa/Elfa) - 600.00 0.00: DuplicateDocument1 pageDengue Ns1 Antigen Test (Elisa/Elfa) - 600.00 0.00: DuplicateAbhishek GoelNo ratings yet

- Web It CertDocument1 pageWeb It CertSuppy PNo ratings yet

- Declaration 80D 80DDBDocument1 pageDeclaration 80D 80DDBShobit0% (1)

- Sanction LetterDocument3 pagesSanction Lettern5b859ryf6No ratings yet

- Rajendra Prasad ShrivastavaDocument2 pagesRajendra Prasad ShrivastavaSourabh ShrivastavaNo ratings yet

- Duplicate: 1 of Page No: File No: / 1 / 2Document2 pagesDuplicate: 1 of Page No: File No: / 1 / 2Anand AdkarNo ratings yet

- Interest Certificate: To Whomsoever It May ConcernDocument1 pageInterest Certificate: To Whomsoever It May ConcernfakeNo ratings yet

- Ofltr 4311063 181103114418718 1 3Document3 pagesOfltr 4311063 181103114418718 1 3폴로 쥰 차No ratings yet

- Policy DocDocument5 pagesPolicy DocAkshay ShajeevNo ratings yet

- IT CertificateDocument2 pagesIT CertificatePrashant TiwariNo ratings yet

- IT Certificate 608466263Document1 pageIT Certificate 608466263Selvakumaran GNo ratings yet

- In Gov swavlambancard-DPICR-BR2890020000065051Document1 pageIn Gov swavlambancard-DPICR-BR2890020000065051RajeevNo ratings yet

- View CertificateDocument1 pageView CertificateadiNo ratings yet

- Renewal of Your Ican Essential Advanced Insurance PolicyDocument3 pagesRenewal of Your Ican Essential Advanced Insurance PolicySuganthi ChandrasekaranNo ratings yet

- PolicyDocument1 pagePolicyaniket goyalNo ratings yet

- Interest Certificate Nov06 205111Document1 pageInterest Certificate Nov06 205111Sambasivarao ChindamNo ratings yet

- 524243536624287Document1 page524243536624287support marenNo ratings yet

- Subject: Risk Assumption Letter: LAN Number: 19020618531140 Policy Number: 4111/EPP/164559158/00/000Document2 pagesSubject: Risk Assumption Letter: LAN Number: 19020618531140 Policy Number: 4111/EPP/164559158/00/000shekarNo ratings yet

- Max Bupa Premium Reeipt Parents PDFDocument1 pageMax Bupa Premium Reeipt Parents PDFSatyaNo ratings yet

- 23rd Airport To HomeDocument1 page23rd Airport To HomeNeha YadavNo ratings yet

- Received With Thanks ' 9,784.00 Through Payment Gateway Over The Internet FromDocument1 pageReceived With Thanks ' 9,784.00 Through Payment Gateway Over The Internet FromNeha YadavNo ratings yet

- Received With Thanks ' 2,482.00 Through Payment Gateway Over The Internet FromDocument1 pageReceived With Thanks ' 2,482.00 Through Payment Gateway Over The Internet FromNeha YadavNo ratings yet

- Preventive Health CheckupDocument1 pagePreventive Health CheckupNeha YadavNo ratings yet