Professional Documents

Culture Documents

Module 2 Question Bank

Module 2 Question Bank

Uploaded by

sukeshCopyright:

Available Formats

You might also like

- Feasibility Study For Memorial ParkDocument3 pagesFeasibility Study For Memorial ParkAtnapaz Jod100% (1)

- Tata Nano Case StudyDocument21 pagesTata Nano Case StudyLaura LandiNo ratings yet

- Cost AccountingDocument43 pagesCost AccountingAmina QamarNo ratings yet

- BCOM 22031 Practice Question-Varaince AnalysisDocument4 pagesBCOM 22031 Practice Question-Varaince Analysisajanthahn0% (1)

- OVERHEAD COSTING APPLIED Lecture 4Document15 pagesOVERHEAD COSTING APPLIED Lecture 4pritish chadhaNo ratings yet

- 1) May 2005 Cost ManagementDocument60 pages1) May 2005 Cost Managementshyammy foruNo ratings yet

- 8408 Cost Accounting Past Paper 2019Document23 pages8408 Cost Accounting Past Paper 2019Fazila FaheemNo ratings yet

- 3 Model Q. Set A BBS 2nd Year Cost and Management - AccountingDocument5 pages3 Model Q. Set A BBS 2nd Year Cost and Management - Accountingprabeshchaudhary3No ratings yet

- T I C A P: HE Nstitute of Hartered Ccountants of AkistanDocument3 pagesT I C A P: HE Nstitute of Hartered Ccountants of AkistanShehrozSTNo ratings yet

- BU5504BU5501Document4 pagesBU5504BU5501abinaya590455No ratings yet

- Standard CostingDocument7 pagesStandard CostingAnupam BaliNo ratings yet

- Tutorial - FMA - Activity 4Document5 pagesTutorial - FMA - Activity 4Anonymous cdbGe8bFJoNo ratings yet

- Cost Accounting Test 2024Document4 pagesCost Accounting Test 2024Chloe HendricksNo ratings yet

- AMA Terminal Fall 20Document3 pagesAMA Terminal Fall 20Ibrahim IbrahimchNo ratings yet

- Cost Accounting: T I C A PDocument5 pagesCost Accounting: T I C A PShehrozSTNo ratings yet

- Cost Sheet: Particulars Job 101 Job 102Document12 pagesCost Sheet: Particulars Job 101 Job 102vishal soniNo ratings yet

- Cost Accounting and Financial Management: All Questions Are CompulsoryDocument4 pagesCost Accounting and Financial Management: All Questions Are CompulsorySudist JhaNo ratings yet

- 68957Document9 pages68957Mehar WaliaNo ratings yet

- Cost Accounitng - Core PaperDocument4 pagesCost Accounitng - Core PaperharshdeepNo ratings yet

- Model Question For Account409792809472943360Document8 pagesModel Question For Account409792809472943360yugeshNo ratings yet

- Chapter 1-Job and Batch Costing: Ref: Cost & Management Accounting by K.S.AdigaDocument14 pagesChapter 1-Job and Batch Costing: Ref: Cost & Management Accounting by K.S.AdigaAR Ananth Rohith BhatNo ratings yet

- Ankitastic Exams Solutions MCQ and Long AnswerDocument29 pagesAnkitastic Exams Solutions MCQ and Long AnswerAnkitastic tutoring ServicesNo ratings yet

- Mcom NotesDocument10 pagesMcom Notesvkharish21No ratings yet

- Topic 2 Introduction To Costing: DBS Management AccountingDocument9 pagesTopic 2 Introduction To Costing: DBS Management AccountingziehuiNo ratings yet

- Cost SheetDocument6 pagesCost SheetAishwary Sakalle100% (1)

- Learning Unit 4Document70 pagesLearning Unit 4Ndivho MavhethaNo ratings yet

- Question Bank Paper: Cost Accounting McqsDocument8 pagesQuestion Bank Paper: Cost Accounting McqsDarmin Kaye PalayNo ratings yet

- Cost Acc Nov06Document27 pagesCost Acc Nov06api-3825774100% (1)

- Question Bank Paper: Cost Accounting McqsDocument8 pagesQuestion Bank Paper: Cost Accounting McqsNikhilNo ratings yet

- Cost Sheet - ProblemsDocument3 pagesCost Sheet - Problemssasirekha02758No ratings yet

- Cost & Management AccountingDocument5 pagesCost & Management AccountingRupal Rohan DalalNo ratings yet

- Cost Accounting RTP CAP-II June 2016Document31 pagesCost Accounting RTP CAP-II June 2016Artha sarokarNo ratings yet

- Cost and Management Accounting April 2024Document4 pagesCost and Management Accounting April 2024golechapreksha12No ratings yet

- Ankitastic Exams SolutionsDocument30 pagesAnkitastic Exams SolutionsAnkitastic tutoring ServicesNo ratings yet

- Cost Mock Test Paper 2Document7 pagesCost Mock Test Paper 2Soul of honeyNo ratings yet

- BBS 2nd Year QuestionDocument1 pageBBS 2nd Year Questionsatya25% (4)

- Test Series: March, 2022 Mock Test Paper - 1 Intermediate: Group - I Paper - 3: Cost and Management AccountingDocument7 pagesTest Series: March, 2022 Mock Test Paper - 1 Intermediate: Group - I Paper - 3: Cost and Management AccountingMusic WorldNo ratings yet

- Chap 1 Problems Cost SheetDocument5 pagesChap 1 Problems Cost SheetRositaNo ratings yet

- Topic 2 Cost Concepts and Analysis HandoutsDocument5 pagesTopic 2 Cost Concepts and Analysis HandoutsJohn Kenneth ColarinaNo ratings yet

- Intern's Dilemma Solution Data Given Required To CalculateDocument3 pagesIntern's Dilemma Solution Data Given Required To CalculateMuskan ManchandaNo ratings yet

- Cost Accounting. ActivityDocument6 pagesCost Accounting. ActivityReida DelmasNo ratings yet

- Paper - 3: Cost and Management Accounting Questions Material CostDocument33 pagesPaper - 3: Cost and Management Accounting Questions Material CostEFRETNo ratings yet

- ABC Costing 2Document4 pagesABC Costing 2محمد شہبازNo ratings yet

- Activity Based Costing SystemDocument18 pagesActivity Based Costing SystemMAXA FASHIONNo ratings yet

- Unit IVDocument14 pagesUnit IVkuselvNo ratings yet

- CAMA Assignment Group 6Document8 pagesCAMA Assignment Group 6Dinkar SuranglikarNo ratings yet

- Chapters 1 To 3 (Answers)Document8 pagesChapters 1 To 3 (Answers)Cho AndreaNo ratings yet

- Job and Batch CostingDocument3 pagesJob and Batch CostingbhngbjNo ratings yet

- Question Bank - B.COM (H) Semester - IV (2022-25)Document19 pagesQuestion Bank - B.COM (H) Semester - IV (2022-25)antarjot69No ratings yet

- BBA-VI 562 Subjective Dec 2016Document2 pagesBBA-VI 562 Subjective Dec 2016Saif ali KhanNo ratings yet

- Cost and Management Accounting-I - Honours First Paper (CC 2.1 CH) Full Marks: 80Document12 pagesCost and Management Accounting-I - Honours First Paper (CC 2.1 CH) Full Marks: 80Anshul BajajNo ratings yet

- Standard CostingDocument3 pagesStandard CostingElijah MontefalcoNo ratings yet

- Cost and Management AccountingDocument6 pagesCost and Management AccountingN. Karthik UdupaNo ratings yet

- FinanceDocument8 pagesFinanceJøÿå BhardwajNo ratings yet

- Management Accounting 9mrQc9m4HBDocument3 pagesManagement Accounting 9mrQc9m4HBMadhuram SharmaNo ratings yet

- Accounting Assignment CardiffDocument12 pagesAccounting Assignment CardiffpavanihirushaNo ratings yet

- Activity Based Costing: Presented By: Anurag Garg Himanshu Sumit Garg AnjliDocument17 pagesActivity Based Costing: Presented By: Anurag Garg Himanshu Sumit Garg AnjliSumit GargNo ratings yet

- Variance SolDocument42 pagesVariance SolsafaNo ratings yet

- Quiz Finals CostDocument3 pagesQuiz Finals CostALLYSON BURAGANo ratings yet

- Title01 - Job Costing and Batch CostingDocument72 pagesTitle01 - Job Costing and Batch CostingPoonamNo ratings yet

- Corporate Finance V2Document80 pagesCorporate Finance V2sukeshNo ratings yet

- IDirect Glenmark Q3FY22Document9 pagesIDirect Glenmark Q3FY22sukeshNo ratings yet

- 1 Basic Concepts Quiz-MergedDocument50 pages1 Basic Concepts Quiz-MergedsukeshNo ratings yet

- Ilovepdf MergedDocument212 pagesIlovepdf MergedsukeshNo ratings yet

- Project Management NotesDocument5 pagesProject Management NotessukeshNo ratings yet

- Financing of Projects: Prof - Ashalatha Jkshim, NitteDocument27 pagesFinancing of Projects: Prof - Ashalatha Jkshim, NittesukeshNo ratings yet

- Investment Criteria: Prof - Ashalatha J.K.S.H I M, NitteDocument13 pagesInvestment Criteria: Prof - Ashalatha J.K.S.H I M, NittesukeshNo ratings yet

- 2nd Case StudyDocument2 pages2nd Case StudysukeshNo ratings yet

- Project Cash Flows: Prof - Ashalatha Jkshim, NitteDocument24 pagesProject Cash Flows: Prof - Ashalatha Jkshim, NittesukeshNo ratings yet

- Lesson Plan: 20MBA42: Enterprise Systems Course Instructor - MR Raghupathi PaiDocument5 pagesLesson Plan: 20MBA42: Enterprise Systems Course Instructor - MR Raghupathi PaisukeshNo ratings yet

- Supporting Facility: Creating The Right EnvironmentDocument63 pagesSupporting Facility: Creating The Right EnvironmentsukeshNo ratings yet

- Build Customer RelationshipsDocument50 pagesBuild Customer RelationshipssukeshNo ratings yet

- Modified LESSON PLAN Mergers and Acquisitions 19 FinalDocument7 pagesModified LESSON PLAN Mergers and Acquisitions 19 FinalsukeshNo ratings yet

- 05 Fixed Income SecuritiesDocument55 pages05 Fixed Income SecuritiessukeshNo ratings yet

- Module 1 Part 2Document21 pagesModule 1 Part 2sukeshNo ratings yet

- International Takeovers and RestructuringDocument18 pagesInternational Takeovers and RestructuringsukeshNo ratings yet

- Fundamental Analysis Checklist, SUN PHARMA, CIPLA, GLENMARK (Final)Document116 pagesFundamental Analysis Checklist, SUN PHARMA, CIPLA, GLENMARK (Final)sukeshNo ratings yet

- CH 05Document33 pagesCH 05sukeshNo ratings yet

- Employee Stock Ownership and MlpsDocument20 pagesEmployee Stock Ownership and MlpssukeshNo ratings yet

- Case Study of ERP ImplementationDocument29 pagesCase Study of ERP ImplementationsukeshNo ratings yet

- Alliances and Joint VenturesDocument18 pagesAlliances and Joint VenturessukeshNo ratings yet

- Hersheys ERP ProjectDocument3 pagesHersheys ERP ProjectsukeshNo ratings yet

- What Are The Main Objectives of Establishing NARCL (Bad Bank) ?Document3 pagesWhat Are The Main Objectives of Establishing NARCL (Bad Bank) ?sukeshNo ratings yet

- Modern Portfolio ManagementDocument74 pagesModern Portfolio ManagementsukeshNo ratings yet

- Prime Cost Factory OHD VariableDocument7 pagesPrime Cost Factory OHD VariablesukeshNo ratings yet

- Chapter 07: Pricing Strategies: Muhammad Umar FarooqDocument14 pagesChapter 07: Pricing Strategies: Muhammad Umar FarooqUmar ChacharNo ratings yet

- F 8 BCDCDocument10 pagesF 8 BCDCyenNo ratings yet

- Davangere University: Exam Application FormDocument1 pageDavangere University: Exam Application FormMadhu RakshaNo ratings yet

- Launching A Kids ToothpasteDocument7 pagesLaunching A Kids Toothpastemufthi25% (4)

- 2020 08 08 16 54 23 843 - Aaecb8489p - 2019Document83 pages2020 08 08 16 54 23 843 - Aaecb8489p - 2019Jyoti MeenaNo ratings yet

- Solved Use Your Answers To Problems 26a and 28 To ExplainDocument1 pageSolved Use Your Answers To Problems 26a and 28 To ExplainM Bilal SaleemNo ratings yet

- Acc 206 Week 1 AssignmentDocument4 pagesAcc 206 Week 1 AssignmentLynna ElliottNo ratings yet

- Levitt - Marketing MyopiaDocument54 pagesLevitt - Marketing MyopiaSamarth Sharma100% (1)

- Chapter 2-NPD and PLCDocument23 pagesChapter 2-NPD and PLCKaleab TessemaNo ratings yet

- Key AnswerDocument27 pagesKey AnswerMelvin Lee Felipe GarbinNo ratings yet

- Commercial Bank Management AssignmentDocument3 pagesCommercial Bank Management AssignmentAtiaTahiraNo ratings yet

- Economics of Money Banking and Financial Markets The Business School Edition 3rd Edition Mishkin Test BankDocument11 pagesEconomics of Money Banking and Financial Markets The Business School Edition 3rd Edition Mishkin Test Banklasherdiedral.7cqo100% (28)

- Finman4e Quiz Mod18 040615Document3 pagesFinman4e Quiz Mod18 040615Brian KangNo ratings yet

- The Rise of Global CorporationDocument33 pagesThe Rise of Global CorporationPhilip John1 Gargar'sNo ratings yet

- Entrepreneurship ModuleDocument83 pagesEntrepreneurship Modulebritonkariuki97No ratings yet

- 05 Bbfa1103 T1Document24 pages05 Bbfa1103 T1djaljdNo ratings yet

- IV. Marketing Plan V. Production PlanDocument51 pagesIV. Marketing Plan V. Production PlanKelly ReyesNo ratings yet

- CMS Info SystemsDocument29 pagesCMS Info Systemskrishna_buntyNo ratings yet

- Sip PresentationDocument13 pagesSip Presentationvivekvmathew87No ratings yet

- Coca Cola Strategic PlanDocument38 pagesCoca Cola Strategic PlanJudith AinembabaziNo ratings yet

- TradeMark SquattingDocument3 pagesTradeMark Squattingnidhishah182003No ratings yet

- Feasibility Report Parts and FunctionDocument12 pagesFeasibility Report Parts and FunctionAldrian Ala75% (4)

- Roofing Contracting Market Update May 2022Document7 pagesRoofing Contracting Market Update May 2022p4rfmdxpndNo ratings yet

- Information Systems ManagementDocument19 pagesInformation Systems Managementv9pratapNo ratings yet

- Sem-3 Hotel Accountancy NotesDocument3 pagesSem-3 Hotel Accountancy NotesPriyanka NehraNo ratings yet

- The Factor Make Mcdonalds Popular Among College Student in MalaysiaDocument11 pagesThe Factor Make Mcdonalds Popular Among College Student in MalaysiaZulLC InfoTechNo ratings yet

- Bachelor of Procurement and Suplly Chain ManagementDocument1 pageBachelor of Procurement and Suplly Chain ManagementBiong Alor DengNo ratings yet

- Marketing Term Paper DraftDocument2 pagesMarketing Term Paper DraftAhnaf Tahmid ProttoyNo ratings yet

Module 2 Question Bank

Module 2 Question Bank

Uploaded by

sukeshOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Module 2 Question Bank

Module 2 Question Bank

Uploaded by

sukeshCopyright:

Available Formats

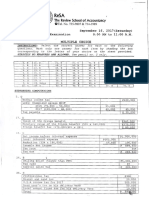

Process Costing

A product passes through three process., P1, P2 and P3, the expenses for the month of June are

as follow

P1 P2 P3

Rs. Rs. Rs.

Material 1,500 2,250 750

Labour 7,500 12,000 9,750

Expenses 1,575 1,425 3,015

Other information:

Normal wastage 3% 6% 10%

Scrap value (per unit) Re.0.25 0.50 1.00

Output (units) 14,250 13,650 12,012

15,000 units of materials were introduced in process PI at Re.0.10 per unit. Prepare process

amounts and other necessary accounts.

Questions on Over & Under Absorption

1. The budgeted working conditions for a cost centre are as follows:

Normal working hours per week 42 hours

Number of machines 14

Normal weekly loss of hours on maintenance 5 hours per machine

No.of weeks worked per year 48

Estimated annual overheads Rs.1,24,320

Estimated direct wage rate Rs.4 per hour

Actual results in respect of 4 weeks period are:

Wages incurred Rs. 9,000

Overheads incurred Rs.10,200

Machine hours produced 2000

You are required to calculate:

a) The overhead rate per machine hour

b) The amount of under or over absorption of wages and overheads.

SOLUTION:

Normal working hours for the year = 48 weeks * 42 hours * 14 machines =28224 hours

Less: Loss of hours due to maintenance=48 weeks * 5 hours* 14 machines = 3360 hours

Effective working hours = 24864 hours

Estimated overheads per year Rs. 124320

a) Machine Hour rate (Rs.124320/24864 hrs) Rs.5

Overhead absorbed = 2000 hrs @Rs.5/hr Rs.10000

Less: Overhead incurred Rs.10200

Under absorbed Overhead Rs.200

b) Wages absorbed = 4 weeks * 42 hours * 14 machines * Rs.4 Rs.9408

Less: waged incurred Rs.9000

Over-absorbed wages Rs.408

2. XYZ Ltd. uses a historical cost system and applies overhead on the basis of pre-

determined rates. The following are available from the records of the company for the

year ended 31st March, 2014.

Rs.

Manufacturing overhead incurred 8,50,000

Manufacturing overhead applied 7,50,000

Work-in-progress 2,40,000

Finished goods 4,80,000

Cost of goods sold 16,80,000

Apply two methods for disposal of under absorbed overhead showing the implications

of

each method on the profit of the company.

SOLUTION:

Manufacturing overhead – actual Rs.8,50,000

Manufacturing overhead – applied Rs.7,50,000

Under absorbed overhead Rs.1,00,000

Methods of disposal:

Method I – Supplementary rate method: under absorbed amount of OH of Rs.1,00,000 is added

to cost of sales, WIP and finished goods in the ratio calculated as follows:

Unabsorbed Overhead * 100 =100000/240000+480000+1680000=(100000/2400000)*100=

4.16667%

Total cost

Particulars Amount Under absorbed OH Total

WIP 2,40,000 (240000*4.16667%)10000 2,50,000

Finished goods 4,80,000 (480000*4.16667%)20000 5,00,000

Cost of goods sold 16,80,000 (1680000*4.1667%)70000 17,50,000

Total Cost 25,00,000

Effect on profit: the profit will reduce by Rs.70,000 because of increase in the cost of sales

which is debited to Profit & Loss A/c on the other hand, Rs.30,000 will be credited to P&L A/c

on account of increase in the value of closing stock of WIP & PG. Thus, the net effect of using

this method is that profit for the year will be reduced by Rs.40,000..

Method II – the entire amount of under-absorbed manufacturing OH may be carried forward to

the next year if it is presumed that such under-absorption has arisen due to cyclical or seasonal

fluctuations. In such case, the profit of the current year will then be based on pre-determined OH

and remain unaffected.

You might also like

- Feasibility Study For Memorial ParkDocument3 pagesFeasibility Study For Memorial ParkAtnapaz Jod100% (1)

- Tata Nano Case StudyDocument21 pagesTata Nano Case StudyLaura LandiNo ratings yet

- Cost AccountingDocument43 pagesCost AccountingAmina QamarNo ratings yet

- BCOM 22031 Practice Question-Varaince AnalysisDocument4 pagesBCOM 22031 Practice Question-Varaince Analysisajanthahn0% (1)

- OVERHEAD COSTING APPLIED Lecture 4Document15 pagesOVERHEAD COSTING APPLIED Lecture 4pritish chadhaNo ratings yet

- 1) May 2005 Cost ManagementDocument60 pages1) May 2005 Cost Managementshyammy foruNo ratings yet

- 8408 Cost Accounting Past Paper 2019Document23 pages8408 Cost Accounting Past Paper 2019Fazila FaheemNo ratings yet

- 3 Model Q. Set A BBS 2nd Year Cost and Management - AccountingDocument5 pages3 Model Q. Set A BBS 2nd Year Cost and Management - Accountingprabeshchaudhary3No ratings yet

- T I C A P: HE Nstitute of Hartered Ccountants of AkistanDocument3 pagesT I C A P: HE Nstitute of Hartered Ccountants of AkistanShehrozSTNo ratings yet

- BU5504BU5501Document4 pagesBU5504BU5501abinaya590455No ratings yet

- Standard CostingDocument7 pagesStandard CostingAnupam BaliNo ratings yet

- Tutorial - FMA - Activity 4Document5 pagesTutorial - FMA - Activity 4Anonymous cdbGe8bFJoNo ratings yet

- Cost Accounting Test 2024Document4 pagesCost Accounting Test 2024Chloe HendricksNo ratings yet

- AMA Terminal Fall 20Document3 pagesAMA Terminal Fall 20Ibrahim IbrahimchNo ratings yet

- Cost Accounting: T I C A PDocument5 pagesCost Accounting: T I C A PShehrozSTNo ratings yet

- Cost Sheet: Particulars Job 101 Job 102Document12 pagesCost Sheet: Particulars Job 101 Job 102vishal soniNo ratings yet

- Cost Accounting and Financial Management: All Questions Are CompulsoryDocument4 pagesCost Accounting and Financial Management: All Questions Are CompulsorySudist JhaNo ratings yet

- 68957Document9 pages68957Mehar WaliaNo ratings yet

- Cost Accounitng - Core PaperDocument4 pagesCost Accounitng - Core PaperharshdeepNo ratings yet

- Model Question For Account409792809472943360Document8 pagesModel Question For Account409792809472943360yugeshNo ratings yet

- Chapter 1-Job and Batch Costing: Ref: Cost & Management Accounting by K.S.AdigaDocument14 pagesChapter 1-Job and Batch Costing: Ref: Cost & Management Accounting by K.S.AdigaAR Ananth Rohith BhatNo ratings yet

- Ankitastic Exams Solutions MCQ and Long AnswerDocument29 pagesAnkitastic Exams Solutions MCQ and Long AnswerAnkitastic tutoring ServicesNo ratings yet

- Mcom NotesDocument10 pagesMcom Notesvkharish21No ratings yet

- Topic 2 Introduction To Costing: DBS Management AccountingDocument9 pagesTopic 2 Introduction To Costing: DBS Management AccountingziehuiNo ratings yet

- Cost SheetDocument6 pagesCost SheetAishwary Sakalle100% (1)

- Learning Unit 4Document70 pagesLearning Unit 4Ndivho MavhethaNo ratings yet

- Question Bank Paper: Cost Accounting McqsDocument8 pagesQuestion Bank Paper: Cost Accounting McqsDarmin Kaye PalayNo ratings yet

- Cost Acc Nov06Document27 pagesCost Acc Nov06api-3825774100% (1)

- Question Bank Paper: Cost Accounting McqsDocument8 pagesQuestion Bank Paper: Cost Accounting McqsNikhilNo ratings yet

- Cost Sheet - ProblemsDocument3 pagesCost Sheet - Problemssasirekha02758No ratings yet

- Cost & Management AccountingDocument5 pagesCost & Management AccountingRupal Rohan DalalNo ratings yet

- Cost Accounting RTP CAP-II June 2016Document31 pagesCost Accounting RTP CAP-II June 2016Artha sarokarNo ratings yet

- Cost and Management Accounting April 2024Document4 pagesCost and Management Accounting April 2024golechapreksha12No ratings yet

- Ankitastic Exams SolutionsDocument30 pagesAnkitastic Exams SolutionsAnkitastic tutoring ServicesNo ratings yet

- Cost Mock Test Paper 2Document7 pagesCost Mock Test Paper 2Soul of honeyNo ratings yet

- BBS 2nd Year QuestionDocument1 pageBBS 2nd Year Questionsatya25% (4)

- Test Series: March, 2022 Mock Test Paper - 1 Intermediate: Group - I Paper - 3: Cost and Management AccountingDocument7 pagesTest Series: March, 2022 Mock Test Paper - 1 Intermediate: Group - I Paper - 3: Cost and Management AccountingMusic WorldNo ratings yet

- Chap 1 Problems Cost SheetDocument5 pagesChap 1 Problems Cost SheetRositaNo ratings yet

- Topic 2 Cost Concepts and Analysis HandoutsDocument5 pagesTopic 2 Cost Concepts and Analysis HandoutsJohn Kenneth ColarinaNo ratings yet

- Intern's Dilemma Solution Data Given Required To CalculateDocument3 pagesIntern's Dilemma Solution Data Given Required To CalculateMuskan ManchandaNo ratings yet

- Cost Accounting. ActivityDocument6 pagesCost Accounting. ActivityReida DelmasNo ratings yet

- Paper - 3: Cost and Management Accounting Questions Material CostDocument33 pagesPaper - 3: Cost and Management Accounting Questions Material CostEFRETNo ratings yet

- ABC Costing 2Document4 pagesABC Costing 2محمد شہبازNo ratings yet

- Activity Based Costing SystemDocument18 pagesActivity Based Costing SystemMAXA FASHIONNo ratings yet

- Unit IVDocument14 pagesUnit IVkuselvNo ratings yet

- CAMA Assignment Group 6Document8 pagesCAMA Assignment Group 6Dinkar SuranglikarNo ratings yet

- Chapters 1 To 3 (Answers)Document8 pagesChapters 1 To 3 (Answers)Cho AndreaNo ratings yet

- Job and Batch CostingDocument3 pagesJob and Batch CostingbhngbjNo ratings yet

- Question Bank - B.COM (H) Semester - IV (2022-25)Document19 pagesQuestion Bank - B.COM (H) Semester - IV (2022-25)antarjot69No ratings yet

- BBA-VI 562 Subjective Dec 2016Document2 pagesBBA-VI 562 Subjective Dec 2016Saif ali KhanNo ratings yet

- Cost and Management Accounting-I - Honours First Paper (CC 2.1 CH) Full Marks: 80Document12 pagesCost and Management Accounting-I - Honours First Paper (CC 2.1 CH) Full Marks: 80Anshul BajajNo ratings yet

- Standard CostingDocument3 pagesStandard CostingElijah MontefalcoNo ratings yet

- Cost and Management AccountingDocument6 pagesCost and Management AccountingN. Karthik UdupaNo ratings yet

- FinanceDocument8 pagesFinanceJøÿå BhardwajNo ratings yet

- Management Accounting 9mrQc9m4HBDocument3 pagesManagement Accounting 9mrQc9m4HBMadhuram SharmaNo ratings yet

- Accounting Assignment CardiffDocument12 pagesAccounting Assignment CardiffpavanihirushaNo ratings yet

- Activity Based Costing: Presented By: Anurag Garg Himanshu Sumit Garg AnjliDocument17 pagesActivity Based Costing: Presented By: Anurag Garg Himanshu Sumit Garg AnjliSumit GargNo ratings yet

- Variance SolDocument42 pagesVariance SolsafaNo ratings yet

- Quiz Finals CostDocument3 pagesQuiz Finals CostALLYSON BURAGANo ratings yet

- Title01 - Job Costing and Batch CostingDocument72 pagesTitle01 - Job Costing and Batch CostingPoonamNo ratings yet

- Corporate Finance V2Document80 pagesCorporate Finance V2sukeshNo ratings yet

- IDirect Glenmark Q3FY22Document9 pagesIDirect Glenmark Q3FY22sukeshNo ratings yet

- 1 Basic Concepts Quiz-MergedDocument50 pages1 Basic Concepts Quiz-MergedsukeshNo ratings yet

- Ilovepdf MergedDocument212 pagesIlovepdf MergedsukeshNo ratings yet

- Project Management NotesDocument5 pagesProject Management NotessukeshNo ratings yet

- Financing of Projects: Prof - Ashalatha Jkshim, NitteDocument27 pagesFinancing of Projects: Prof - Ashalatha Jkshim, NittesukeshNo ratings yet

- Investment Criteria: Prof - Ashalatha J.K.S.H I M, NitteDocument13 pagesInvestment Criteria: Prof - Ashalatha J.K.S.H I M, NittesukeshNo ratings yet

- 2nd Case StudyDocument2 pages2nd Case StudysukeshNo ratings yet

- Project Cash Flows: Prof - Ashalatha Jkshim, NitteDocument24 pagesProject Cash Flows: Prof - Ashalatha Jkshim, NittesukeshNo ratings yet

- Lesson Plan: 20MBA42: Enterprise Systems Course Instructor - MR Raghupathi PaiDocument5 pagesLesson Plan: 20MBA42: Enterprise Systems Course Instructor - MR Raghupathi PaisukeshNo ratings yet

- Supporting Facility: Creating The Right EnvironmentDocument63 pagesSupporting Facility: Creating The Right EnvironmentsukeshNo ratings yet

- Build Customer RelationshipsDocument50 pagesBuild Customer RelationshipssukeshNo ratings yet

- Modified LESSON PLAN Mergers and Acquisitions 19 FinalDocument7 pagesModified LESSON PLAN Mergers and Acquisitions 19 FinalsukeshNo ratings yet

- 05 Fixed Income SecuritiesDocument55 pages05 Fixed Income SecuritiessukeshNo ratings yet

- Module 1 Part 2Document21 pagesModule 1 Part 2sukeshNo ratings yet

- International Takeovers and RestructuringDocument18 pagesInternational Takeovers and RestructuringsukeshNo ratings yet

- Fundamental Analysis Checklist, SUN PHARMA, CIPLA, GLENMARK (Final)Document116 pagesFundamental Analysis Checklist, SUN PHARMA, CIPLA, GLENMARK (Final)sukeshNo ratings yet

- CH 05Document33 pagesCH 05sukeshNo ratings yet

- Employee Stock Ownership and MlpsDocument20 pagesEmployee Stock Ownership and MlpssukeshNo ratings yet

- Case Study of ERP ImplementationDocument29 pagesCase Study of ERP ImplementationsukeshNo ratings yet

- Alliances and Joint VenturesDocument18 pagesAlliances and Joint VenturessukeshNo ratings yet

- Hersheys ERP ProjectDocument3 pagesHersheys ERP ProjectsukeshNo ratings yet

- What Are The Main Objectives of Establishing NARCL (Bad Bank) ?Document3 pagesWhat Are The Main Objectives of Establishing NARCL (Bad Bank) ?sukeshNo ratings yet

- Modern Portfolio ManagementDocument74 pagesModern Portfolio ManagementsukeshNo ratings yet

- Prime Cost Factory OHD VariableDocument7 pagesPrime Cost Factory OHD VariablesukeshNo ratings yet

- Chapter 07: Pricing Strategies: Muhammad Umar FarooqDocument14 pagesChapter 07: Pricing Strategies: Muhammad Umar FarooqUmar ChacharNo ratings yet

- F 8 BCDCDocument10 pagesF 8 BCDCyenNo ratings yet

- Davangere University: Exam Application FormDocument1 pageDavangere University: Exam Application FormMadhu RakshaNo ratings yet

- Launching A Kids ToothpasteDocument7 pagesLaunching A Kids Toothpastemufthi25% (4)

- 2020 08 08 16 54 23 843 - Aaecb8489p - 2019Document83 pages2020 08 08 16 54 23 843 - Aaecb8489p - 2019Jyoti MeenaNo ratings yet

- Solved Use Your Answers To Problems 26a and 28 To ExplainDocument1 pageSolved Use Your Answers To Problems 26a and 28 To ExplainM Bilal SaleemNo ratings yet

- Acc 206 Week 1 AssignmentDocument4 pagesAcc 206 Week 1 AssignmentLynna ElliottNo ratings yet

- Levitt - Marketing MyopiaDocument54 pagesLevitt - Marketing MyopiaSamarth Sharma100% (1)

- Chapter 2-NPD and PLCDocument23 pagesChapter 2-NPD and PLCKaleab TessemaNo ratings yet

- Key AnswerDocument27 pagesKey AnswerMelvin Lee Felipe GarbinNo ratings yet

- Commercial Bank Management AssignmentDocument3 pagesCommercial Bank Management AssignmentAtiaTahiraNo ratings yet

- Economics of Money Banking and Financial Markets The Business School Edition 3rd Edition Mishkin Test BankDocument11 pagesEconomics of Money Banking and Financial Markets The Business School Edition 3rd Edition Mishkin Test Banklasherdiedral.7cqo100% (28)

- Finman4e Quiz Mod18 040615Document3 pagesFinman4e Quiz Mod18 040615Brian KangNo ratings yet

- The Rise of Global CorporationDocument33 pagesThe Rise of Global CorporationPhilip John1 Gargar'sNo ratings yet

- Entrepreneurship ModuleDocument83 pagesEntrepreneurship Modulebritonkariuki97No ratings yet

- 05 Bbfa1103 T1Document24 pages05 Bbfa1103 T1djaljdNo ratings yet

- IV. Marketing Plan V. Production PlanDocument51 pagesIV. Marketing Plan V. Production PlanKelly ReyesNo ratings yet

- CMS Info SystemsDocument29 pagesCMS Info Systemskrishna_buntyNo ratings yet

- Sip PresentationDocument13 pagesSip Presentationvivekvmathew87No ratings yet

- Coca Cola Strategic PlanDocument38 pagesCoca Cola Strategic PlanJudith AinembabaziNo ratings yet

- TradeMark SquattingDocument3 pagesTradeMark Squattingnidhishah182003No ratings yet

- Feasibility Report Parts and FunctionDocument12 pagesFeasibility Report Parts and FunctionAldrian Ala75% (4)

- Roofing Contracting Market Update May 2022Document7 pagesRoofing Contracting Market Update May 2022p4rfmdxpndNo ratings yet

- Information Systems ManagementDocument19 pagesInformation Systems Managementv9pratapNo ratings yet

- Sem-3 Hotel Accountancy NotesDocument3 pagesSem-3 Hotel Accountancy NotesPriyanka NehraNo ratings yet

- The Factor Make Mcdonalds Popular Among College Student in MalaysiaDocument11 pagesThe Factor Make Mcdonalds Popular Among College Student in MalaysiaZulLC InfoTechNo ratings yet

- Bachelor of Procurement and Suplly Chain ManagementDocument1 pageBachelor of Procurement and Suplly Chain ManagementBiong Alor DengNo ratings yet

- Marketing Term Paper DraftDocument2 pagesMarketing Term Paper DraftAhnaf Tahmid ProttoyNo ratings yet