Professional Documents

Culture Documents

Q1: Why DBK Company Is Sensing That The Current Trend Might Affect Their Business? (Max Words: 100)

Q1: Why DBK Company Is Sensing That The Current Trend Might Affect Their Business? (Max Words: 100)

Uploaded by

VishalCopyright:

Available Formats

You might also like

- Stryker Corporation - Assignment 22 March 17Document4 pagesStryker Corporation - Assignment 22 March 17Venkatesh K67% (6)

- ExxonMobil Internal and External Environment AnalysisDocument27 pagesExxonMobil Internal and External Environment AnalysisAlya Khaira Nazhifa100% (1)

- FIN 3512 Fall 2019 Quiz #1 9.18.2019 To UploadDocument3 pagesFIN 3512 Fall 2019 Quiz #1 9.18.2019 To UploadgNo ratings yet

- Cepuros Foods Malaysia: Finding The Secret Sauce For Growth Student Spreadsheet SupplementDocument7 pagesCepuros Foods Malaysia: Finding The Secret Sauce For Growth Student Spreadsheet SupplementSaurabh MahajanNo ratings yet

- Business Analysis Plan - TemplateDocument5 pagesBusiness Analysis Plan - TemplateAlia DiabNo ratings yet

- DPC Case SolutionDocument11 pagesDPC Case Solutionburiticas992No ratings yet

- Word Note The Body Shop International PLC 2001: An Introduction To Financial ModelingDocument9 pagesWord Note The Body Shop International PLC 2001: An Introduction To Financial Modelingalka murarka100% (2)

- JAZZ Sellside MA PitchbookDocument47 pagesJAZZ Sellside MA PitchbookSamarth MarwahaNo ratings yet

- Laura Eps Business GameDocument1 pageLaura Eps Business GameLaura Camila Cristancho FernandezNo ratings yet

- Design by Kate: The Power of Direct SalesDocument8 pagesDesign by Kate: The Power of Direct SalesSaurabh PalNo ratings yet

- AFM Mini Exam - SolutionDocument6 pagesAFM Mini Exam - SolutionHamid KhanNo ratings yet

- M4 Dividend Paying CapacityDocument2 pagesM4 Dividend Paying CapacityReginald ValenciaNo ratings yet

- Park - 12011328 - BSBFIM601 - Ass 2 - Aaron - 280217Document6 pagesPark - 12011328 - BSBFIM601 - Ass 2 - Aaron - 280217EricKang67% (3)

- BF 07arDocument86 pagesBF 07arAlexander HertzbergNo ratings yet

- Extra Questions For Mid Term Test 2 MA2 ACCA ANSWERDocument20 pagesExtra Questions For Mid Term Test 2 MA2 ACCA ANSWERNguyễn Minh ĐứcNo ratings yet

- DCF Tutorial - Part IIDocument18 pagesDCF Tutorial - Part IISanket AdvilkarNo ratings yet

- NVDA F3Q23 Investor Presentation FINALDocument62 pagesNVDA F3Q23 Investor Presentation FINALandre.torresNo ratings yet

- Sapphire Fibres LimitedDocument37 pagesSapphire Fibres Limitedappkamubashar7364No ratings yet

- Nvda 28092022132137-0001 PDFDocument47 pagesNvda 28092022132137-0001 PDFTey Boon KiatNo ratings yet

- Ford Case Study (LT 11) - Jerry's Edit v2Document31 pagesFord Case Study (LT 11) - Jerry's Edit v2JerryJoshuaDiazNo ratings yet

- Krakatau Steel A CaseDocument9 pagesKrakatau Steel A CaseFarhan SoepraptoNo ratings yet

- STJ Write UpDocument5 pagesSTJ Write Upmunger649No ratings yet

- (CL Logistics) 3Q23IR - ENG - VFDocument20 pages(CL Logistics) 3Q23IR - ENG - VFAyee 217No ratings yet

- Parag Milk Foods: CMP: INR207 TP: INR255 (+23%) BuyDocument10 pagesParag Milk Foods: CMP: INR207 TP: INR255 (+23%) BuyNiravAcharyaNo ratings yet

- Sol3ch6 RevDocument49 pagesSol3ch6 RevSonyaTanSiYing100% (1)

- Performance RecordDocument11 pagesPerformance RecordJonathan PolandNo ratings yet

- Bootstrapping: Tenor Benchmark Coupon Benchmark Price Discount Factor Cumulative Sum of DfsDocument19 pagesBootstrapping: Tenor Benchmark Coupon Benchmark Price Discount Factor Cumulative Sum of DfsOUSSAMA NASRNo ratings yet

- 3GL Marketing PlanDocument11 pages3GL Marketing Planzerlake4213No ratings yet

- Advanced Accounting 6th Edition Jeter Solutions ManualDocument25 pagesAdvanced Accounting 6th Edition Jeter Solutions Manualjasonbarberkeiogymztd100% (54)

- NVIDIA Announces Financial Results For Fourth Quarter and Fiscal 2023Document10 pagesNVIDIA Announces Financial Results For Fourth Quarter and Fiscal 2023Andrei SeimanNo ratings yet

- Assignment Brief Mn2415 2023 24Document7 pagesAssignment Brief Mn2415 2023 24Haseeb DarNo ratings yet

- Supersonic Stereo, Inc.: Lahore School of Economics Sales Force ManagementDocument5 pagesSupersonic Stereo, Inc.: Lahore School of Economics Sales Force Managementxahrah100% (1)

- Word Write Soln - Newell Design Manufacturing Valuation Decision MakingDocument7 pagesWord Write Soln - Newell Design Manufacturing Valuation Decision Makingalka murarkaNo ratings yet

- Abbvie Inc. $148.47 Rating: NeutralDocument3 pagesAbbvie Inc. $148.47 Rating: Neutralphysicallen1791No ratings yet

- Ambuja Cements LTD (ACEM IN) - AdjustedDocument8 pagesAmbuja Cements LTD (ACEM IN) - AdjustedAswini Kumar BhuyanNo ratings yet

- Building A Compensation Plan Part 3: Implementing The Total Rewards PlanDocument17 pagesBuilding A Compensation Plan Part 3: Implementing The Total Rewards PlanIva NedeljkovicNo ratings yet

- Quarterly Update Q3FY21: Century Plyboards (India) LTDDocument10 pagesQuarterly Update Q3FY21: Century Plyboards (India) LTDMalolanRNo ratings yet

- Synergy Valuation WorksheetDocument6 pagesSynergy Valuation WorksheetRishav AgarwalNo ratings yet

- Synergy Calculator For Mergers and AcquisitionsDocument6 pagesSynergy Calculator For Mergers and AcquisitionsRoopika PalukurthiNo ratings yet

- Full Download Advanced Accounting 6th Edition Jeter Solutions Manual PDF Full ChapterDocument36 pagesFull Download Advanced Accounting 6th Edition Jeter Solutions Manual PDF Full Chapterbeatencadiemha94100% (16)

- Supersonic Stereo CaseDocument12 pagesSupersonic Stereo CaseelliceNo ratings yet

- Research Insight Sector: Pharmaceuticals Company: Astrazeneca Pharma India LTDDocument6 pagesResearch Insight Sector: Pharmaceuticals Company: Astrazeneca Pharma India LTDakanksha morghadeNo ratings yet

- The Discounted Free Cash Flow Model For A Complete BusinessDocument5 pagesThe Discounted Free Cash Flow Model For A Complete BusinessSanket DubeyNo ratings yet

- Dividend Policy DecisionDocument37 pagesDividend Policy DecisionGaurav KumarNo ratings yet

- PFE Financials As On 08-09-2023Document38 pagesPFE Financials As On 08-09-2023Asim MalikNo ratings yet

- Faro AR 2008Document76 pagesFaro AR 2008Rudi HasibuanNo ratings yet

- DCF TemplateDocument21 pagesDCF TemplateShrikant ShelkeNo ratings yet

- Godrej Consumer Products Result Update - Q1FY23Document4 pagesGodrej Consumer Products Result Update - Q1FY23Prity KumariNo ratings yet

- Gordon&Shapiro ModelDocument5 pagesGordon&Shapiro ModelsarahNo ratings yet

- Pepsico, Inc.: RecommendationDocument2 pagesPepsico, Inc.: Recommendationsasaki16No ratings yet

- Ultimate Financial ModelDocument33 pagesUltimate Financial ModelTulay Farra100% (1)

- Abhishek FRA Quiz 2Document17 pagesAbhishek FRA Quiz 2Fun LearningNo ratings yet

- Itc Limited: Equity AnalysisDocument15 pagesItc Limited: Equity AnalysisrskatochNo ratings yet

- Case 8 Finance CPK - Syndicate 2 YP56BDocument13 pagesCase 8 Finance CPK - Syndicate 2 YP56BBerni RahmanNo ratings yet

- NBA Happy Hour Co - DCF Model - Task 4 - Revised TemplateDocument10 pagesNBA Happy Hour Co - DCF Model - Task 4 - Revised Templateww weNo ratings yet

- Horizontal and Vertical Analysis: D.UlziiragchaaDocument29 pagesHorizontal and Vertical Analysis: D.UlziiragchaaMisheel MishkaNo ratings yet

- 100 Tips for Consulting Firms to Accelerate Profit and Value GrowthFrom Everand100 Tips for Consulting Firms to Accelerate Profit and Value GrowthRating: 4 out of 5 stars4/5 (1)

- Profit Building: Cutting Costs Without Cutting PeopleFrom EverandProfit Building: Cutting Costs Without Cutting PeopleRating: 4 out of 5 stars4/5 (1)

- Business Restructuring: An Action Template for Reducing Cost and Growing ProfitFrom EverandBusiness Restructuring: An Action Template for Reducing Cost and Growing ProfitNo ratings yet

- Account-Based Marketing: How to Target and Engage the Companies That Will Grow Your RevenueFrom EverandAccount-Based Marketing: How to Target and Engage the Companies That Will Grow Your RevenueRating: 1 out of 5 stars1/5 (1)

- The Key to Higher Profits: Pricing PowerFrom EverandThe Key to Higher Profits: Pricing PowerRating: 5 out of 5 stars5/5 (1)

- The High-Impact Sales Manager: A No-Nonsense, Practical Guide to Improve Your Team's Sales PerformanceFrom EverandThe High-Impact Sales Manager: A No-Nonsense, Practical Guide to Improve Your Team's Sales PerformanceRating: 5 out of 5 stars5/5 (1)

- GautamiDocument1 pageGautamigaidhanemrudul12345No ratings yet

- World Class ManufacturingDocument78 pagesWorld Class ManufacturingRAJASREE SNo ratings yet

- Capital Market PDFDocument12 pagesCapital Market PDFAyush BhadauriaNo ratings yet

- Bmec 003 Week 1 ModuleDocument9 pagesBmec 003 Week 1 ModuleJohn Andrei ValenzuelaNo ratings yet

- Purchasing Process Pt. 2: Laboratory ExerciseDocument6 pagesPurchasing Process Pt. 2: Laboratory ExercisebeverlybandojoNo ratings yet

- Related Party Transactions Under Companies ActDocument8 pagesRelated Party Transactions Under Companies ActSoumitra ChawatheNo ratings yet

- 2 FS Analysis USTDocument22 pages2 FS Analysis USTFk TnccNo ratings yet

- Staffing Policy and ProcedureDocument9 pagesStaffing Policy and ProcedureAbdijabbar Ismail NorNo ratings yet

- 2023 Lazard Secondary MarketDocument26 pages2023 Lazard Secondary MarketAlexandre Da costaNo ratings yet

- Retail Banking and Wealth ManagementDocument36 pagesRetail Banking and Wealth Managementamanjotkaur10saini100% (1)

- Individual Development PlanDocument64 pagesIndividual Development Plandeepthishaji100% (3)

- Equity SharesDocument18 pagesEquity Sharessan291076No ratings yet

- Fundraising PresentationDocument18 pagesFundraising Presentationpushkar royNo ratings yet

- Final Report: Internal Audit On Purchasing and Payments ATDocument18 pagesFinal Report: Internal Audit On Purchasing and Payments ATwiseguy4uNo ratings yet

- Management of Commercial BankingDocument11 pagesManagement of Commercial BankingadtyshkhrNo ratings yet

- Erp Keda Sap ImplementationDocument28 pagesErp Keda Sap ImplementationAksa DindeNo ratings yet

- Michael Burry Case StudiesDocument47 pagesMichael Burry Case StudiesMichael James Cestas100% (1)

- Financial Performance Icici Life InsuranceDocument39 pagesFinancial Performance Icici Life InsuranceMamilla BabuNo ratings yet

- ACCA F2 Sample Study NoteDocument21 pagesACCA F2 Sample Study Notebillyryan10% (1)

- MEDINA - Homework 2 Nos. 8 & 9Document7 pagesMEDINA - Homework 2 Nos. 8 & 9Von Andrei MedinaNo ratings yet

- Meagan LoftisDocument2 pagesMeagan LoftisMeagan LoftisNo ratings yet

- How Precision Revenue Growth Management Transforms CPG PromotionsDocument5 pagesHow Precision Revenue Growth Management Transforms CPG PromotionsMichael GiovaniNo ratings yet

- ExpleoDocument13 pagesExpleog_sivakumarNo ratings yet

- Kukatpally, Hyderabad - 500 085, Andhra Pradesh, India Grams: 'Technology' Phones: +91-040-2315 8661 To 2315 8664Document29 pagesKukatpally, Hyderabad - 500 085, Andhra Pradesh, India Grams: 'Technology' Phones: +91-040-2315 8661 To 2315 8664Helol PracheNo ratings yet

- Selected SCM McqsDocument6 pagesSelected SCM Mcqsabdul mueedNo ratings yet

- Fake Tata LetterDocument1 pageFake Tata Letterpriyadarshini212007No ratings yet

- GRU UiTMDocument51 pagesGRU UiTMKhai MNo ratings yet

- Impact of Foreign Exchange Risk and Its Management at Wipro LTDDocument6 pagesImpact of Foreign Exchange Risk and Its Management at Wipro LTDMayur MakwanaNo ratings yet

Q1: Why DBK Company Is Sensing That The Current Trend Might Affect Their Business? (Max Words: 100)

Q1: Why DBK Company Is Sensing That The Current Trend Might Affect Their Business? (Max Words: 100)

Uploaded by

VishalOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Q1: Why DBK Company Is Sensing That The Current Trend Might Affect Their Business? (Max Words: 100)

Q1: Why DBK Company Is Sensing That The Current Trend Might Affect Their Business? (Max Words: 100)

Uploaded by

VishalCopyright:

Available Formats

Q1: Why DBK company is sensing that the current trend might affect their business?

(Max Words:

100)

The current trend: Slowdown in sales representatives transitioning to leadership roles.

Under the current business model of DBK, sales growth is the function of number of sales reps and

the productivity of each. The sales leadership program hits two targets with one arrow. It makes

sure that the leader increases the sales rep pool on one hand, and on other addresses the falling

productivity (which stagnates after 5 years) by adding more and more new people - having fresh

networks.

Thus, the above trend means the sales reps will be added at a lower pace and on top of that once

after exhausting their network in a few years their individual ability to drive more sales, will fall too.

All this will cause the revenue growth to stagnate.

Q2: What should DBK do? (Max Words: 150)

Recommendation: Commission Increase (26% + 6%) ; Price Increase: 5%

We recommend increasing the compensation from being a leader to (26%+6%) instead of (25%+5%).

The increase in direct compensation to 26% will help arrest to a certain extent, reduction in income

from overlap in sales. Increasing commission from Level 1 sales to 6% from 5% will help improve the

rewards to efforts ratio on being a leader which is the cause of the current problems faced by the

company.

2006 2007 2008 2009 2010E

Monthly Sales per Rep $648 $701 $705 $753 $781

Avg Pcs Sold 139 162 159 171 177

Avg Price $56 $52 $53 $53 $53

Since the increase in commission will have a stress on the company margins, we recommend

increasing the prices by roughly 5%. (Average Selling Price from $53 to $56 as was the case in 2006).

We do not forecast a reduction in demand due to this marginal price increase. The demand for

Women’s Jewellery is price inelastic, a, mere increase of $2.5 for women’s jewellery will not reduce

demand. The following table highlights the financial aspects of this change.

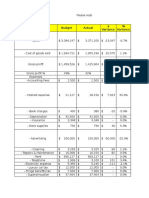

Old Structure Proposed New Structure

% Avg Sales Earnings % Avg Sales Earnings

Income Without Leader Status 25% 753.00 188.25 25% 795.62 198.91

On Recruiting 3 Leads 25% 414.15 103.54 26% 437.59 113.77

Income From Leads 5% 1944.00 97.20 6% 2054.04 123.24

Income With Leader Status 200.74 237.02

Additional Income from Old to New 36.28

Additional Income per Year 435.35

Assumptions

Market is inelastic to a certain extent (Women's Jewellery), a 5% price increase will have no impact

The women representative value absolute rather than the percentage return (since the average amount is small)

We are assuming a mere $12 increase in case of old structure was not worthy of the added burden of becoming a

leader and to other incentives were necessary

You might also like

- Stryker Corporation - Assignment 22 March 17Document4 pagesStryker Corporation - Assignment 22 March 17Venkatesh K67% (6)

- ExxonMobil Internal and External Environment AnalysisDocument27 pagesExxonMobil Internal and External Environment AnalysisAlya Khaira Nazhifa100% (1)

- FIN 3512 Fall 2019 Quiz #1 9.18.2019 To UploadDocument3 pagesFIN 3512 Fall 2019 Quiz #1 9.18.2019 To UploadgNo ratings yet

- Cepuros Foods Malaysia: Finding The Secret Sauce For Growth Student Spreadsheet SupplementDocument7 pagesCepuros Foods Malaysia: Finding The Secret Sauce For Growth Student Spreadsheet SupplementSaurabh MahajanNo ratings yet

- Business Analysis Plan - TemplateDocument5 pagesBusiness Analysis Plan - TemplateAlia DiabNo ratings yet

- DPC Case SolutionDocument11 pagesDPC Case Solutionburiticas992No ratings yet

- Word Note The Body Shop International PLC 2001: An Introduction To Financial ModelingDocument9 pagesWord Note The Body Shop International PLC 2001: An Introduction To Financial Modelingalka murarka100% (2)

- JAZZ Sellside MA PitchbookDocument47 pagesJAZZ Sellside MA PitchbookSamarth MarwahaNo ratings yet

- Laura Eps Business GameDocument1 pageLaura Eps Business GameLaura Camila Cristancho FernandezNo ratings yet

- Design by Kate: The Power of Direct SalesDocument8 pagesDesign by Kate: The Power of Direct SalesSaurabh PalNo ratings yet

- AFM Mini Exam - SolutionDocument6 pagesAFM Mini Exam - SolutionHamid KhanNo ratings yet

- M4 Dividend Paying CapacityDocument2 pagesM4 Dividend Paying CapacityReginald ValenciaNo ratings yet

- Park - 12011328 - BSBFIM601 - Ass 2 - Aaron - 280217Document6 pagesPark - 12011328 - BSBFIM601 - Ass 2 - Aaron - 280217EricKang67% (3)

- BF 07arDocument86 pagesBF 07arAlexander HertzbergNo ratings yet

- Extra Questions For Mid Term Test 2 MA2 ACCA ANSWERDocument20 pagesExtra Questions For Mid Term Test 2 MA2 ACCA ANSWERNguyễn Minh ĐứcNo ratings yet

- DCF Tutorial - Part IIDocument18 pagesDCF Tutorial - Part IISanket AdvilkarNo ratings yet

- NVDA F3Q23 Investor Presentation FINALDocument62 pagesNVDA F3Q23 Investor Presentation FINALandre.torresNo ratings yet

- Sapphire Fibres LimitedDocument37 pagesSapphire Fibres Limitedappkamubashar7364No ratings yet

- Nvda 28092022132137-0001 PDFDocument47 pagesNvda 28092022132137-0001 PDFTey Boon KiatNo ratings yet

- Ford Case Study (LT 11) - Jerry's Edit v2Document31 pagesFord Case Study (LT 11) - Jerry's Edit v2JerryJoshuaDiazNo ratings yet

- Krakatau Steel A CaseDocument9 pagesKrakatau Steel A CaseFarhan SoepraptoNo ratings yet

- STJ Write UpDocument5 pagesSTJ Write Upmunger649No ratings yet

- (CL Logistics) 3Q23IR - ENG - VFDocument20 pages(CL Logistics) 3Q23IR - ENG - VFAyee 217No ratings yet

- Parag Milk Foods: CMP: INR207 TP: INR255 (+23%) BuyDocument10 pagesParag Milk Foods: CMP: INR207 TP: INR255 (+23%) BuyNiravAcharyaNo ratings yet

- Sol3ch6 RevDocument49 pagesSol3ch6 RevSonyaTanSiYing100% (1)

- Performance RecordDocument11 pagesPerformance RecordJonathan PolandNo ratings yet

- Bootstrapping: Tenor Benchmark Coupon Benchmark Price Discount Factor Cumulative Sum of DfsDocument19 pagesBootstrapping: Tenor Benchmark Coupon Benchmark Price Discount Factor Cumulative Sum of DfsOUSSAMA NASRNo ratings yet

- 3GL Marketing PlanDocument11 pages3GL Marketing Planzerlake4213No ratings yet

- Advanced Accounting 6th Edition Jeter Solutions ManualDocument25 pagesAdvanced Accounting 6th Edition Jeter Solutions Manualjasonbarberkeiogymztd100% (54)

- NVIDIA Announces Financial Results For Fourth Quarter and Fiscal 2023Document10 pagesNVIDIA Announces Financial Results For Fourth Quarter and Fiscal 2023Andrei SeimanNo ratings yet

- Assignment Brief Mn2415 2023 24Document7 pagesAssignment Brief Mn2415 2023 24Haseeb DarNo ratings yet

- Supersonic Stereo, Inc.: Lahore School of Economics Sales Force ManagementDocument5 pagesSupersonic Stereo, Inc.: Lahore School of Economics Sales Force Managementxahrah100% (1)

- Word Write Soln - Newell Design Manufacturing Valuation Decision MakingDocument7 pagesWord Write Soln - Newell Design Manufacturing Valuation Decision Makingalka murarkaNo ratings yet

- Abbvie Inc. $148.47 Rating: NeutralDocument3 pagesAbbvie Inc. $148.47 Rating: Neutralphysicallen1791No ratings yet

- Ambuja Cements LTD (ACEM IN) - AdjustedDocument8 pagesAmbuja Cements LTD (ACEM IN) - AdjustedAswini Kumar BhuyanNo ratings yet

- Building A Compensation Plan Part 3: Implementing The Total Rewards PlanDocument17 pagesBuilding A Compensation Plan Part 3: Implementing The Total Rewards PlanIva NedeljkovicNo ratings yet

- Quarterly Update Q3FY21: Century Plyboards (India) LTDDocument10 pagesQuarterly Update Q3FY21: Century Plyboards (India) LTDMalolanRNo ratings yet

- Synergy Valuation WorksheetDocument6 pagesSynergy Valuation WorksheetRishav AgarwalNo ratings yet

- Synergy Calculator For Mergers and AcquisitionsDocument6 pagesSynergy Calculator For Mergers and AcquisitionsRoopika PalukurthiNo ratings yet

- Full Download Advanced Accounting 6th Edition Jeter Solutions Manual PDF Full ChapterDocument36 pagesFull Download Advanced Accounting 6th Edition Jeter Solutions Manual PDF Full Chapterbeatencadiemha94100% (16)

- Supersonic Stereo CaseDocument12 pagesSupersonic Stereo CaseelliceNo ratings yet

- Research Insight Sector: Pharmaceuticals Company: Astrazeneca Pharma India LTDDocument6 pagesResearch Insight Sector: Pharmaceuticals Company: Astrazeneca Pharma India LTDakanksha morghadeNo ratings yet

- The Discounted Free Cash Flow Model For A Complete BusinessDocument5 pagesThe Discounted Free Cash Flow Model For A Complete BusinessSanket DubeyNo ratings yet

- Dividend Policy DecisionDocument37 pagesDividend Policy DecisionGaurav KumarNo ratings yet

- PFE Financials As On 08-09-2023Document38 pagesPFE Financials As On 08-09-2023Asim MalikNo ratings yet

- Faro AR 2008Document76 pagesFaro AR 2008Rudi HasibuanNo ratings yet

- DCF TemplateDocument21 pagesDCF TemplateShrikant ShelkeNo ratings yet

- Godrej Consumer Products Result Update - Q1FY23Document4 pagesGodrej Consumer Products Result Update - Q1FY23Prity KumariNo ratings yet

- Gordon&Shapiro ModelDocument5 pagesGordon&Shapiro ModelsarahNo ratings yet

- Pepsico, Inc.: RecommendationDocument2 pagesPepsico, Inc.: Recommendationsasaki16No ratings yet

- Ultimate Financial ModelDocument33 pagesUltimate Financial ModelTulay Farra100% (1)

- Abhishek FRA Quiz 2Document17 pagesAbhishek FRA Quiz 2Fun LearningNo ratings yet

- Itc Limited: Equity AnalysisDocument15 pagesItc Limited: Equity AnalysisrskatochNo ratings yet

- Case 8 Finance CPK - Syndicate 2 YP56BDocument13 pagesCase 8 Finance CPK - Syndicate 2 YP56BBerni RahmanNo ratings yet

- NBA Happy Hour Co - DCF Model - Task 4 - Revised TemplateDocument10 pagesNBA Happy Hour Co - DCF Model - Task 4 - Revised Templateww weNo ratings yet

- Horizontal and Vertical Analysis: D.UlziiragchaaDocument29 pagesHorizontal and Vertical Analysis: D.UlziiragchaaMisheel MishkaNo ratings yet

- 100 Tips for Consulting Firms to Accelerate Profit and Value GrowthFrom Everand100 Tips for Consulting Firms to Accelerate Profit and Value GrowthRating: 4 out of 5 stars4/5 (1)

- Profit Building: Cutting Costs Without Cutting PeopleFrom EverandProfit Building: Cutting Costs Without Cutting PeopleRating: 4 out of 5 stars4/5 (1)

- Business Restructuring: An Action Template for Reducing Cost and Growing ProfitFrom EverandBusiness Restructuring: An Action Template for Reducing Cost and Growing ProfitNo ratings yet

- Account-Based Marketing: How to Target and Engage the Companies That Will Grow Your RevenueFrom EverandAccount-Based Marketing: How to Target and Engage the Companies That Will Grow Your RevenueRating: 1 out of 5 stars1/5 (1)

- The Key to Higher Profits: Pricing PowerFrom EverandThe Key to Higher Profits: Pricing PowerRating: 5 out of 5 stars5/5 (1)

- The High-Impact Sales Manager: A No-Nonsense, Practical Guide to Improve Your Team's Sales PerformanceFrom EverandThe High-Impact Sales Manager: A No-Nonsense, Practical Guide to Improve Your Team's Sales PerformanceRating: 5 out of 5 stars5/5 (1)

- GautamiDocument1 pageGautamigaidhanemrudul12345No ratings yet

- World Class ManufacturingDocument78 pagesWorld Class ManufacturingRAJASREE SNo ratings yet

- Capital Market PDFDocument12 pagesCapital Market PDFAyush BhadauriaNo ratings yet

- Bmec 003 Week 1 ModuleDocument9 pagesBmec 003 Week 1 ModuleJohn Andrei ValenzuelaNo ratings yet

- Purchasing Process Pt. 2: Laboratory ExerciseDocument6 pagesPurchasing Process Pt. 2: Laboratory ExercisebeverlybandojoNo ratings yet

- Related Party Transactions Under Companies ActDocument8 pagesRelated Party Transactions Under Companies ActSoumitra ChawatheNo ratings yet

- 2 FS Analysis USTDocument22 pages2 FS Analysis USTFk TnccNo ratings yet

- Staffing Policy and ProcedureDocument9 pagesStaffing Policy and ProcedureAbdijabbar Ismail NorNo ratings yet

- 2023 Lazard Secondary MarketDocument26 pages2023 Lazard Secondary MarketAlexandre Da costaNo ratings yet

- Retail Banking and Wealth ManagementDocument36 pagesRetail Banking and Wealth Managementamanjotkaur10saini100% (1)

- Individual Development PlanDocument64 pagesIndividual Development Plandeepthishaji100% (3)

- Equity SharesDocument18 pagesEquity Sharessan291076No ratings yet

- Fundraising PresentationDocument18 pagesFundraising Presentationpushkar royNo ratings yet

- Final Report: Internal Audit On Purchasing and Payments ATDocument18 pagesFinal Report: Internal Audit On Purchasing and Payments ATwiseguy4uNo ratings yet

- Management of Commercial BankingDocument11 pagesManagement of Commercial BankingadtyshkhrNo ratings yet

- Erp Keda Sap ImplementationDocument28 pagesErp Keda Sap ImplementationAksa DindeNo ratings yet

- Michael Burry Case StudiesDocument47 pagesMichael Burry Case StudiesMichael James Cestas100% (1)

- Financial Performance Icici Life InsuranceDocument39 pagesFinancial Performance Icici Life InsuranceMamilla BabuNo ratings yet

- ACCA F2 Sample Study NoteDocument21 pagesACCA F2 Sample Study Notebillyryan10% (1)

- MEDINA - Homework 2 Nos. 8 & 9Document7 pagesMEDINA - Homework 2 Nos. 8 & 9Von Andrei MedinaNo ratings yet

- Meagan LoftisDocument2 pagesMeagan LoftisMeagan LoftisNo ratings yet

- How Precision Revenue Growth Management Transforms CPG PromotionsDocument5 pagesHow Precision Revenue Growth Management Transforms CPG PromotionsMichael GiovaniNo ratings yet

- ExpleoDocument13 pagesExpleog_sivakumarNo ratings yet

- Kukatpally, Hyderabad - 500 085, Andhra Pradesh, India Grams: 'Technology' Phones: +91-040-2315 8661 To 2315 8664Document29 pagesKukatpally, Hyderabad - 500 085, Andhra Pradesh, India Grams: 'Technology' Phones: +91-040-2315 8661 To 2315 8664Helol PracheNo ratings yet

- Selected SCM McqsDocument6 pagesSelected SCM Mcqsabdul mueedNo ratings yet

- Fake Tata LetterDocument1 pageFake Tata Letterpriyadarshini212007No ratings yet

- GRU UiTMDocument51 pagesGRU UiTMKhai MNo ratings yet

- Impact of Foreign Exchange Risk and Its Management at Wipro LTDDocument6 pagesImpact of Foreign Exchange Risk and Its Management at Wipro LTDMayur MakwanaNo ratings yet