Professional Documents

Culture Documents

Screenshot 2022-03-16 at 11.23.42 PM

Screenshot 2022-03-16 at 11.23.42 PM

Uploaded by

Venkatesh WOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Screenshot 2022-03-16 at 11.23.42 PM

Screenshot 2022-03-16 at 11.23.42 PM

Uploaded by

Venkatesh WCopyright:

Available Formats

Whereas, the Vendor purchased the Schedule B and Schedule C Property

from the developer in title by way of Registered Sale Deed bearing No.

011111:128001-02, dated 22.02.2020, in Book-I, in the Office of the Sub-

Registrar, Shivaji Nagar, Bangalore.

AND WHEREAS VENDOR also applied and obtained the transfer of revenue

documents and the BBMP Authority has also assigned with new Khatha

No. 72-8-314/8-'to the Schedule C Property. The VENDOR have also

paid up to date property tax to the said authority in respect of the

Schedule C Property.

WHEREAS the VENDOR and PURCHASER hereto discussed the terms and

conditions relating to sale and purchase of the Schedule Property as

hereunder and are entering into this Sale Agreement.

And whereas, the parties hereto are desirous of reducing into writing all

the orally agreed to the terms and conditions.

NOW THIS INDENTURE OF AGREEMENT OF SALE WITNESSETH AS

FOLLOWS:

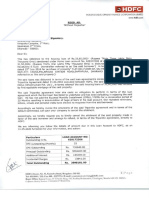

1. That the total consideration for the transfer of Schedule "B" & "C" Property is

agreed at Rs. 44,00,000/-(Rupees forty four Lakhs Only)out of which

the PURCHASER will pays mentioned below to the VENDOR, before the

under mentioned witnesses for which sums the VENDOR do hereby

acknowledges the receipt of the same in the presence of the witnesses

signing this agreement.

a. Rs.5,00,000/-(Rupees Five lakh Only) by online account

transfer, transaction reference No:RRR0O7421101, Dated:

15/02/2020, Drawn on HDFC Bank, Panchshila park branch in

favour of Mr. VKG NAIR

b. Rs.5,00,000/- (Rupees Five Lakhs Only) by online account

transfer within a month, from the day of this Agreement of sale

execution, Drawn on HDFC Bank, Panchshila park branch in favour

of Mr. VKG NAIR.

c. The TDS as per Section 194 IA of IT Act,1961 deducted on the

payment of towards sale consideration and shall be deductible

from settlement of total sale consideration. In need of enabling the

Vendor to claim the said TDS amount in their discharge of the

income tax obligation on sale of the said property, the

PURCHASER or PURCHASER's Bank is obligated to deposit the TDS

amount d provide the necessary certificate.

You might also like

- Tripartite Agreement1Document8 pagesTripartite Agreement1saniyasenNo ratings yet

- Tripartite Agreement FormatDocument7 pagesTripartite Agreement Formataquaankit67% (3)

- 20-Bank Guarantee FormatDocument3 pages20-Bank Guarantee Formatskantaraj100% (3)

- Aged About 91 Years, S/o. Late Vackayil KrishnaDocument5 pagesAged About 91 Years, S/o. Late Vackayil KrishnaVenkatesh WNo ratings yet

- Capital GainDocument10 pagesCapital GainSunny MittalNo ratings yet

- Alberto Series Comic Pack by Jack T ChickDocument11 pagesAlberto Series Comic Pack by Jack T ChickAustineNo ratings yet

- UntitledDocument6 pagesUntitledvarun singhNo ratings yet

- 1 DigiSign Contract To Purchase CABR October 2021 Star OneDocument11 pages1 DigiSign Contract To Purchase CABR October 2021 Star OneLeyah YisraelNo ratings yet

- Jhakan Jhora-23Document108 pagesJhakan Jhora-23nitish JhaNo ratings yet

- Bid DocumentDocument108 pagesBid Documentnitish JhaNo ratings yet

- Ats Final 394-8Document5 pagesAts Final 394-8Girish SharmaNo ratings yet

- Concord Real Estate & Development LTD.Document9 pagesConcord Real Estate & Development LTD.Atique hasan AnikNo ratings yet

- AGR The Forest 002 Sec-92 NewDocument4 pagesAGR The Forest 002 Sec-92 NewSatveer kashyapNo ratings yet

- Tendernotice_1 (5)Document4 pagesTendernotice_1 (5)meghaNo ratings yet

- Indian Overseas Bank KRIBHCO Branch Sector-1, NOIDA, U P-201 301Document3 pagesIndian Overseas Bank KRIBHCO Branch Sector-1, NOIDA, U P-201 301Jayaprakash M PNo ratings yet

- Tutorial III Agreement of Sale: Submitted byDocument6 pagesTutorial III Agreement of Sale: Submitted byManasi DicholkarNo ratings yet

- Shilpa PDFDocument4 pagesShilpa PDFRavi MoneNo ratings yet

- Versus: Efore Apadnis Ember AND Djudicating FficerDocument3 pagesVersus: Efore Apadnis Ember AND Djudicating Fficerrohit jadhavNo ratings yet

- Memorandum of Sale Agreement RamakrishnaDocument7 pagesMemorandum of Sale Agreement RamakrishnaGomathi NarayananNo ratings yet

- Addendum Additional ConditionDocument2 pagesAddendum Additional ConditionwmujeketwaNo ratings yet

- UBINBHUBHP5658Document4 pagesUBINBHUBHP5658vishwanath286699No ratings yet

- No. B.V-1/2012-13-122-Q Dated, The 21 February'2013Document11 pagesNo. B.V-1/2012-13-122-Q Dated, The 21 February'2013Suraj ChaturvediNo ratings yet

- Judgment - RAJ-RERA-C-2021-4046Document18 pagesJudgment - RAJ-RERA-C-2021-4046kevin.johnsonNo ratings yet

- Bid Document Works SQ 01 RDBRT 3371653 2076 77-001Document54 pagesBid Document Works SQ 01 RDBRT 3371653 2076 77-001nitish JhaNo ratings yet

- Vehicle Sales Agreement Cum Memorandum of UnderstandingDocument11 pagesVehicle Sales Agreement Cum Memorandum of UnderstandingAltamash PathanNo ratings yet

- Ofltr 4311063 181103114418718 1 3Document3 pagesOfltr 4311063 181103114418718 1 3폴로 쥰 차No ratings yet

- Bid DocumentDocument50 pagesBid DocumentcivilNo ratings yet

- Bid DocumentDocument108 pagesBid Documentnitish JhaNo ratings yet

- Yogesh Cubix New 2Document3 pagesYogesh Cubix New 2parbatarvindNo ratings yet

- Caroline AgreementDocument10 pagesCaroline Agreementnixon abiraNo ratings yet

- Versus: Efore Apadnis Ember AND Djudicating FficerDocument3 pagesVersus: Efore Apadnis Ember AND Djudicating FficerArham RezaNo ratings yet

- Fleet ManagementDocument14 pagesFleet Managementsarbaz0003No ratings yet

- 1.2 Sale AgreementDocument6 pages1.2 Sale AgreementlilianNo ratings yet

- AGREEMENT Untuk KeretaDocument10 pagesAGREEMENT Untuk Keretawelcome prowinsNo ratings yet

- UBI TenderDocument6 pagesUBI TenderAngat RaiNo ratings yet

- Tendernotice 1Document14 pagesTendernotice 1QASWA ENGINEERING PVT LTDNo ratings yet

- Aratt Royal Citadel Apt Flat No 405 Vishal - Doc FinalDocument8 pagesAratt Royal Citadel Apt Flat No 405 Vishal - Doc FinalNithya LakshmanNo ratings yet

- PDFDocument9 pagesPDFyogesh shingareNo ratings yet

- Bid DocumentDocument108 pagesBid DocumentbibekNo ratings yet

- Pankaj Vs Sandeep Legal Notice Specific Performance From Buyer-2Document4 pagesPankaj Vs Sandeep Legal Notice Specific Performance From Buyer-2rajNo ratings yet

- Offer To Purchase 65 WaDocument6 pagesOffer To Purchase 65 WaedNo ratings yet

- Rani Bagan ReraaaDocument1 pageRani Bagan ReraaaJunaid AzmiNo ratings yet

- Sample TenderDocument45 pagesSample Tendershyam karkiNo ratings yet

- Ganpati-IRP-agreementDocument12 pagesGanpati-IRP-agreementVaibhav KharbandaNo ratings yet

- Case of Tds On RefundDocument7 pagesCase of Tds On Refundsujeessince2001No ratings yet

- Tender Guarantee in The Form of Bank GuaranteeDocument4 pagesTender Guarantee in The Form of Bank GuaranteeHello WorldNo ratings yet

- BIR Ruling No. 1397-18Document4 pagesBIR Ruling No. 1397-18SGNo ratings yet

- Booking Form ATP103776 - 4 JLN Anggerik 6Document1 pageBooking Form ATP103776 - 4 JLN Anggerik 6Suffiyan RahmanNo ratings yet

- The Ark Vehicle Trading & General Merchandise Inc.: Payment ContractDocument3 pagesThe Ark Vehicle Trading & General Merchandise Inc.: Payment ContractkeouhNo ratings yet

- Ayushi Bode Money SuitDocument7 pagesAyushi Bode Money SuitAyushi BodeNo ratings yet

- Presentation 1Document16 pagesPresentation 1ar.priyasingh07No ratings yet

- Form 30Document2 pagesForm 30mundhenitalNo ratings yet

- Fortaliza - Evora 103Document13 pagesFortaliza - Evora 103Chandrashekhar SohoniNo ratings yet

- Chiron Projects B.V Deed of Agreement PurchaseDocument24 pagesChiron Projects B.V Deed of Agreement PurchaseroyaleliontradingaccNo ratings yet

- As Is Where Is, As Is What Is and Whatever There Is"Document5 pagesAs Is Where Is, As Is What Is and Whatever There Is"100abhayNo ratings yet

- Bid Document PDFDocument107 pagesBid Document PDFMainali IshuNo ratings yet

- Bai Mujjal of Sukuk 31.3.2014Document11 pagesBai Mujjal of Sukuk 31.3.2014Shaikh GMNo ratings yet

- Bid DocumentDocument86 pagesBid DocumentGaming NepalNo ratings yet

- CP 2501 of 2019 Jain Sales Vs MSWIPE TECHNOLOGIES PVT LTDDocument9 pagesCP 2501 of 2019 Jain Sales Vs MSWIPE TECHNOLOGIES PVT LTDAshhab KhanNo ratings yet

- 1 QC KFHQLToPASxawmUPWLQDocument2 pages1 QC KFHQLToPASxawmUPWLQVenkatesh WNo ratings yet

- En Public Opinion On The War Against Ukraine 20230511Document2 pagesEn Public Opinion On The War Against Ukraine 20230511Venkatesh WNo ratings yet

- En Public Opinion On The War Against Ukraine 20230330Document2 pagesEn Public Opinion On The War Against Ukraine 20230330Venkatesh WNo ratings yet

- PredictDocument3 pagesPredictVenkatesh WNo ratings yet

- Most Important Terms and Conditions (Mitc) (For Individual Housing/ Non-Housing Loan)Document2 pagesMost Important Terms and Conditions (Mitc) (For Individual Housing/ Non-Housing Loan)Venkatesh W0% (1)

- Aged About 91 Years, S/o. Late Vackayil KrishnaDocument5 pagesAged About 91 Years, S/o. Late Vackayil KrishnaVenkatesh WNo ratings yet

- Schedule A' Property: Lobbies, Lifts, Staircases Andoth9y Rpe of Common Use With One CoveredDocument1 pageSchedule A' Property: Lobbies, Lifts, Staircases Andoth9y Rpe of Common Use With One CoveredVenkatesh WNo ratings yet

- Log Train None ResNet None CTCDocument21 pagesLog Train None ResNet None CTCVenkatesh WNo ratings yet

- Main QimgDocument1 pageMain QimgVenkatesh WNo ratings yet

- Incidental Charges - Rs. 13841.00Document1 pageIncidental Charges - Rs. 13841.00Venkatesh WNo ratings yet