Professional Documents

Culture Documents

Business Combination 2

Business Combination 2

Uploaded by

Jamie RamosOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Business Combination 2

Business Combination 2

Uploaded by

Jamie RamosCopyright:

Available Formats

BUSINESS COMBINATION (2)

01. Fay acquires assets and liabilities of May Company on January 1, 2022. To obtain these

shares, Fay pays P400,000 and issues 10,000 shares of P20 par value ordinary shares on

this date. Fay’s shares had a fair value of P36 per share on that date. Fay also pays

P15,000 to a local investment firm for arranging the transaction. An additional P10,000

was paid by Fay in stock issuance costs.

The book values of Fay’s accounts and the book and fair values of May’s accounts as of

January 1 follow:

May Company

Fay, Inc. Book Value Fair Value

Cash P 900,000 P 80,000 P 80,000

Receivables 480,000 180,000 160,000

Inventory 660,000 260,000 300,000

Land 300,000 120,000 130,000

Building (net) 1,200,000 220,000 280,000

Equipment (net) 360,000 100,000 75,000

Trademarks - - 40,000

Accounts payable 480,000 60,000 60,000

Long-term liabilities 1,140,000 340,000 300,000

Ordinary shares 1,200,000 80,000

Retained earnings 1,080,000 480,000

Assuming the combination is accounted for as acquisition, immediately after the acquisition,

in the statement of financial position of Fay, what amount will be reported for goodwill?

a. P55,000 b. P65,000 c. P70,000 d. P135,000

02. Using the same information in no. 1, what amount will be reported for receivables?

a. P660,000 b. P640,000 c. P500,000 d. P460,000

03. Using the same information in no. 1, what amount will be reported for long-term liabilities?

a. P1,480,000 b. P1,440,000 c. P1,180,000 d. P1,100,000

04. Using the same information in no. 1, what amount will be reported for ordinary shares?

a. P1,200,000 b. P1,280,000 c. P1,400,000 d. P1,480,000

05. Using the same information in no. 1, what amount will be reported for retained earnings?

a. P1,065,000 b. P1,080,000 c. P1,525,000 d. P1,560,000

06. Using the same information in no.1, what amount will be reported for share premium?

a. P165,000 b. P150,000 c. P160,000 d. P175,000

07. Using the same information in no.1, what amount will be reported for cash after the purchase

transaction?

a. P980,000 b. P900,000 c. P875,000 d. P555,000

08. Zyxel Corporation acquired all the assets and liabilities of Globe Tattoo Corporation by issuing its

ordinary shares on January 1, 2022. The statement of financial position data for the companies

prior to the business combination and immediately following the combination is provided:

Zyxel Globe After

Book Value Book Value Combination

Cash P 65,000 P 25,000 P 90,000

Accounts receivable 72,000 20,000 94,000

Inventory 33,000 45,000 88,000

Building/Equipment (net) 400,000 150,000 650,000

Goodwill - - ?

Total Assets P570,000 P240,000 P ?

======= ======= =======

Accounts payable P 50,000 P 25,000 P 75,000

Bonds payable 250,000 100,000 350,000

Ordinary share, P2 par 100,000 25,000 160,000

Share premium 65,000 20,000 245,000

Retained earnings 105,000 70,000 ?

Total liabilities and equities P570,000 P240,000 P ?

======= ======= ======

How many number of shares did Zyxel issue for the acquisition of Globe?

a. 80,000 b. 50,000 c. 30,000 d. 17,500

09. What was the fair value of Zyxel’s stock when these were issued for acquisition of Globe?

a. P2.00 b. P5.63 c. P6.00 d. P8.00

10. What was the fair value of the net assets held by Globe at the time of combination?

a. P115,000 b. P227,000 c. P270,000 d. P497,000

11. What amount of goodwill will be reported by the combined entity immediately following the

combination?

a. P13,000 b. P125,000 c. P173,000 d. P413,000

12. What balance in retained earnings will the combined entity report immediately following the

combination?

a. P35,000 b. P70,000 c. P105,000 d. P175,000

13. On January 2, 2022, Power, Inc. acquired 80% of the outstanding shares of Sigh Company

for P1,952,000 cash. At the time of acquisition, the shareholders’ equity section of the two

companies is shows below:

Power, Inc Sigh Company

Ordinary shares P 4,000,000 P1,600,000

Share premium 3,000,000 480,000

Retained earnings 6,840,000 420,000

Total P13,840,000 P2,500,000

========= ========

Assuming NCI is measured at its implied value, what is the shareholders’ equity on the

consolidated statements of financial position on January 2, 2022?

a. P13,840,000 b. P14,328,000 c. P17,260,000 d. P15,440,000

14. Pull Company acquires a controlling interest in Solar Corporation in the open market for

P120,000. The P100 par value stock of Solar Corporation at the date of acquisition is

P125,000 and its retained earnings amounts to P50,000. The market value of Solar

Corporation is P120 per share. In the consolidated statement of financial position on the

date of acquisition, non-controlling interest would show a balance of:

a. P40,000 b. P35,000 c. P17,500 d. P30,000

15. On December 31, 2021, Pyrex Corporation purchased 80% of the outstanding ordinary shares

of Simplex Company for P395,000 cash. The condensed statement of financial position of

Simplex Company as of the date of the purchase is shown below:

Assets Liabilities & Equity

Cash P150,000 Liabilities P400,000

Inventories 250,000 Ordinary shares, P1 par value 50,000

Property and equipment (net) 450,000 Share premium 100,000

Retained Earnings 300,000

Total P850,000 Total P850,000

======= =======

On December 31, 2021, the inventories and property and equipment of Simplex had a fair

values

of P275,000 and P500,000 respectively. The fair value of NCI on December 31, 2021 was

P100,000. How much goodwill (gain on acquisition) must be shown in the consolidated

statement of financial position of Pyrex and its subsidiary on December 31, 2021?

a. (P30,000) b. P30,000 c. (P25,000) d. P25,000

You might also like

- Canvass Ia QuizDocument32 pagesCanvass Ia QuizLhowellaAquinoNo ratings yet

- Terms and Conditions For Prospective Taught Postgraduate StudentsDocument2 pagesTerms and Conditions For Prospective Taught Postgraduate StudentsBirungi NelsonNo ratings yet

- Net Asset AcquisitionDocument2 pagesNet Asset AcquisitionRafael BarbinNo ratings yet

- 6938 - Operating, Investisng and Financing ActivitiesDocument2 pages6938 - Operating, Investisng and Financing ActivitiesAljur SalamedaNo ratings yet

- Acquisition of Stocks Date of AcquisitionDocument9 pagesAcquisition of Stocks Date of Acquisitiondom baldemorNo ratings yet

- Hyperinflation and Current CostDocument2 pagesHyperinflation and Current CostAna Marie IllutNo ratings yet

- Problem 1 (Branch Was Billed at Cost)Document16 pagesProblem 1 (Branch Was Billed at Cost)James AguilarNo ratings yet

- MQC - Quiz On Segment, Cash To Accrual, Single and CorrectionDocument10 pagesMQC - Quiz On Segment, Cash To Accrual, Single and CorrectionLenie Lyn Pasion Torres0% (1)

- Cash Base VS Accrual BaseDocument8 pagesCash Base VS Accrual BaseCheryl FuentesNo ratings yet

- Accounting For Decentralized Operations: Inventory at Cost of P40,000Document6 pagesAccounting For Decentralized Operations: Inventory at Cost of P40,000Nicole Allyson AguantaNo ratings yet

- Consolidated Financial Statement Part 2 and Separate Financial Statements 1Document9 pagesConsolidated Financial Statement Part 2 and Separate Financial Statements 1PaupauNo ratings yet

- Practical Accounting 2Document4 pagesPractical Accounting 2Steph BorinagaNo ratings yet

- Hedging InstrumentDocument4 pagesHedging InstrumentErwin MagallanesNo ratings yet

- Vbook - Pub Business Combination QuizDocument3 pagesVbook - Pub Business Combination QuizRialeeNo ratings yet

- Problem 1: CAT LEVEL 3 - SET 4 QuestionsDocument4 pagesProblem 1: CAT LEVEL 3 - SET 4 QuestionsEliza BethNo ratings yet

- BANGAN ReceivablesDocument6 pagesBANGAN ReceivablesJenna BanganNo ratings yet

- Chapter 35Document7 pagesChapter 35loiseNo ratings yet

- Sec 2. Par. 2 of The 1987 ConstitutionDocument15 pagesSec 2. Par. 2 of The 1987 ConstitutionTroisNo ratings yet

- Name: Score: Prof. Mark Lester T. Balasa, Cpa, Mba Date:: Standard CostingDocument3 pagesName: Score: Prof. Mark Lester T. Balasa, Cpa, Mba Date:: Standard CostingCherrylane EdicaNo ratings yet

- ReportsDocument5 pagesReportsLeanne FaustinoNo ratings yet

- Requirements:: Intermediate Accounting 3Document7 pagesRequirements:: Intermediate Accounting 3happy240823No ratings yet

- (Cpar2016) AP-8008 (Audit of Cash)Document10 pages(Cpar2016) AP-8008 (Audit of Cash)Dawson Dela CruzNo ratings yet

- Retained EarningsDocument2 pagesRetained EarningsJeanycanycs CongayoNo ratings yet

- AT.3403 - Risk-Based FS Audit ProcessDocument5 pagesAT.3403 - Risk-Based FS Audit ProcessMonica GarciaNo ratings yet

- Consolidations - Subsequent To The Date of Acquisition: Multiple Choice QuestionsDocument290 pagesConsolidations - Subsequent To The Date of Acquisition: Multiple Choice QuestionsKim FloresNo ratings yet

- Audit of Error Correction and Cash and AccrualsDocument4 pagesAudit of Error Correction and Cash and AccrualsRafael BarbinNo ratings yet

- Fixed Assets and Intangible Assets Test BankDocument24 pagesFixed Assets and Intangible Assets Test BankJessie jorgeNo ratings yet

- GP Variance SmartsDocument6 pagesGP Variance SmartsKarlo D. ReclaNo ratings yet

- Chapter 19 Accounting For Income Tax Problem 19-1Document5 pagesChapter 19 Accounting For Income Tax Problem 19-1nicole bancoroNo ratings yet

- Global CompanyDocument1 pageGlobal Companydagohoy kennethNo ratings yet

- National Federation of Junior Philippine Institute of Accountants Financial AccountingDocument8 pagesNational Federation of Junior Philippine Institute of Accountants Financial AccountingWeaFernandezNo ratings yet

- Quiz Chapter 5 Consol. Fs Part 2Document7 pagesQuiz Chapter 5 Consol. Fs Part 2Meagan AndesNo ratings yet

- Franchise Accounting ProblemsDocument8 pagesFranchise Accounting ProblemsCiarwena PangcogaNo ratings yet

- 1617 1stS MX NBergonia RevDocument11 pages1617 1stS MX NBergonia RevJames Louis BarcenasNo ratings yet

- Accounting For Business Combination - Quiz 2Document1 pageAccounting For Business Combination - Quiz 2Hey BuddyNo ratings yet

- IA2 02 - Handout - 1 PDFDocument10 pagesIA2 02 - Handout - 1 PDFMelchie RepospoloNo ratings yet

- Cost AcctgDocument6 pagesCost AcctgMarynelle Labrador SevillaNo ratings yet

- AFAR ReviewDocument11 pagesAFAR ReviewPaupauNo ratings yet

- Afar 106 - Home Office and Branch Accounting PDFDocument3 pagesAfar 106 - Home Office and Branch Accounting PDFReyn Saplad PeralesNo ratings yet

- AFAR - 10-Foreign Currency - Transaction and TranslationDocument5 pagesAFAR - 10-Foreign Currency - Transaction and TranslationDaniela AubreyNo ratings yet

- MAS Responsibility Acctg.Document6 pagesMAS Responsibility Acctg.Rosalie Solomon BocalaNo ratings yet

- CPA Review School of The Philippines ManilaDocument4 pagesCPA Review School of The Philippines ManilaSophia PerezNo ratings yet

- Activity #1Document5 pagesActivity #1Lyka Nicole DoradoNo ratings yet

- 03 ACCTNG-FOR-BUSINESS-COMBINATION-MERGER-AND-CONSOLIDATION-Problems-Part-1Document5 pages03 ACCTNG-FOR-BUSINESS-COMBINATION-MERGER-AND-CONSOLIDATION-Problems-Part-1Ma Jessa Kathryl Alar IINo ratings yet

- ROMERO BSMA1E Standard Costing ExerciseDocument4 pagesROMERO BSMA1E Standard Costing ExerciseAliah Romero100% (1)

- Module 1 InventoryDocument57 pagesModule 1 InventoryA. MagnoNo ratings yet

- AFAR 2306 - Home Office, Branch & Agency AcctgDocument5 pagesAFAR 2306 - Home Office, Branch & Agency AcctgDzulija TalipanNo ratings yet

- Chapter 16 Dissolution and Liquidation of PartnershipDocument14 pagesChapter 16 Dissolution and Liquidation of Partnershipkp_popinjNo ratings yet

- Home Office and Branch Acccounting 2020Document3 pagesHome Office and Branch Acccounting 2020ReilpeterNo ratings yet

- Accounting For Joint ArrangementsDocument4 pagesAccounting For Joint ArrangementsQuinn Samaon100% (1)

- Assignment No. 2 Business Combination Stock Acquisition Part 1.2Document4 pagesAssignment No. 2 Business Combination Stock Acquisition Part 1.2Aivan De LeonNo ratings yet

- P2 BautistaDocument8 pagesP2 BautistaMedalla NikkoNo ratings yet

- Intercompany Sale of PPE ActivityDocument2 pagesIntercompany Sale of PPE Activitybea kullin0% (1)

- Home Office and Branch AccountingDocument6 pagesHome Office and Branch AccountingJasmine LimNo ratings yet

- Quantity Schedule: Cost Accounted For As FollowsDocument5 pagesQuantity Schedule: Cost Accounted For As FollowsJoshua CabinasNo ratings yet

- Drill 5 - Business Com, Consolidted FS, Forex - For Print FSUU AccountingDocument5 pagesDrill 5 - Business Com, Consolidted FS, Forex - For Print FSUU AccountingRobert CastilloNo ratings yet

- Advac2 MidtermDocument5 pagesAdvac2 MidtermgeminailnaNo ratings yet

- Business CombinationDocument3 pagesBusiness Combinationlov3m3No ratings yet

- Cpareviewschoolofthephilippines ChanchanDocument8 pagesCpareviewschoolofthephilippines ChanchanDavid David100% (1)

- Business CombinationDocument6 pagesBusiness CombinationJalieha Mahmod0% (1)

- Acc113 P1 QuizDocument5 pagesAcc113 P1 QuizEDELYN PoblacionNo ratings yet

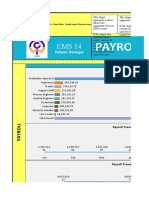

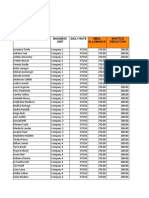

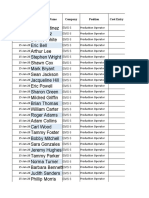

- Ems 4 Semi Annual PayrollDocument250 pagesEms 4 Semi Annual PayrollJamie RamosNo ratings yet

- EMS3 Payroll File - NewDocument166 pagesEMS3 Payroll File - NewJamie RamosNo ratings yet

- EMS 14 Payroll File ACCOMPLISHEDDocument216 pagesEMS 14 Payroll File ACCOMPLISHEDJamie RamosNo ratings yet

- EMS 14 Semi Annual Payroll DashboardDocument226 pagesEMS 14 Semi Annual Payroll DashboardJamie RamosNo ratings yet

- EMS3 Payroll FileDocument256 pagesEMS3 Payroll FileJamie RamosNo ratings yet

- EMS5 Payroll File - NewDocument166 pagesEMS5 Payroll File - NewJamie RamosNo ratings yet

- Employees Payroll (Blue-Collared, White-Collared, Annual Report & Status Reports)Document33 pagesEmployees Payroll (Blue-Collared, White-Collared, Annual Report & Status Reports)Jamie RamosNo ratings yet

- EMS4 Payroll (Editing... )Document206 pagesEMS4 Payroll (Editing... )Jamie RamosNo ratings yet

- EMS9 Payroll File - NewDocument131 pagesEMS9 Payroll File - NewJamie RamosNo ratings yet

- EMS2 Payroll File - NewDocument129 pagesEMS2 Payroll File - NewJamie RamosNo ratings yet

- EMS4 Payroll File - NewDocument139 pagesEMS4 Payroll File - NewJamie RamosNo ratings yet

- Share-Based Compensation-Share OptionDocument16 pagesShare-Based Compensation-Share OptionJamie RamosNo ratings yet

- EMS6 Payroll File - NewDocument234 pagesEMS6 Payroll File - NewJamie RamosNo ratings yet

- Red Ocean Strategy: Alaras, Chariz Bobadilla, Arlene Inocencio, Baby RoseDocument21 pagesRed Ocean Strategy: Alaras, Chariz Bobadilla, Arlene Inocencio, Baby RoseJamie RamosNo ratings yet

- Retained Earnings Appropriation and Quasi-Reorganization Retained Earnings Appropriation and Quasi-ReorganizationDocument10 pagesRetained Earnings Appropriation and Quasi-Reorganization Retained Earnings Appropriation and Quasi-ReorganizationJamie RamosNo ratings yet

- The Challenges of Distance Learning Modality To The Bachelor of Science in Accountancy Students in Immaculate Conception College Balayan Inc. SCHOOL YEAR 2021-2022Document13 pagesThe Challenges of Distance Learning Modality To The Bachelor of Science in Accountancy Students in Immaculate Conception College Balayan Inc. SCHOOL YEAR 2021-2022Jamie RamosNo ratings yet

- Provisions & Contingent Liabilities: John Bo S. Cayetano, CPA, MBADocument80 pagesProvisions & Contingent Liabilities: John Bo S. Cayetano, CPA, MBAJamie RamosNo ratings yet

- FT Specialized IndustryDocument4 pagesFT Specialized IndustryJamie RamosNo ratings yet

- LTCC 1Document3 pagesLTCC 1Jamie RamosNo ratings yet

- Business Model Canvas (BMC) : Just Coconut IncorporationDocument16 pagesBusiness Model Canvas (BMC) : Just Coconut IncorporationJamie RamosNo ratings yet

- A. C. Fair Value After Reconditioning CostDocument3 pagesA. C. Fair Value After Reconditioning CostJamie RamosNo ratings yet

- Business Combination 4Document2 pagesBusiness Combination 4Jamie RamosNo ratings yet

- Aa BcprelimsDocument4 pagesAa BcprelimsJamie RamosNo ratings yet

- Audit in Cis Basic ConceptsDocument9 pagesAudit in Cis Basic ConceptsJamie RamosNo ratings yet

- Installment Liquidation 2Document3 pagesInstallment Liquidation 2Jamie RamosNo ratings yet

- Installment Sales 2Document2 pagesInstallment Sales 2Jamie RamosNo ratings yet

- Installment Sales 1Document2 pagesInstallment Sales 1Jamie Ramos0% (1)

- Econnect GuideDocument23 pagesEconnect GuideParthi GovinNo ratings yet

- Accounting Fact SheetDocument1 pageAccounting Fact SheetSergio OlarteNo ratings yet

- 148) Reyes Vs TanDocument2 pages148) Reyes Vs TanChaNo ratings yet

- G.R. No. 217138Document2 pagesG.R. No. 217138cercadooharaNo ratings yet

- Case 1 2020Document16 pagesCase 1 2020Nympa VillanuevaNo ratings yet

- Safety and Health Protection On The JobDocument1 pageSafety and Health Protection On The JobCPSSTNo ratings yet

- Most Popular Newspapers and Magazines in MoldovaDocument2 pagesMost Popular Newspapers and Magazines in MoldovaAdriana AntoniNo ratings yet

- Tafari St. Aubyn Lewis, A210 109 301 (BIA Jan. 5, 2016)Document6 pagesTafari St. Aubyn Lewis, A210 109 301 (BIA Jan. 5, 2016)Immigrant & Refugee Appellate Center, LLCNo ratings yet

- The National Service Training ProgramDocument8 pagesThe National Service Training ProgramCiarra Kate PazNo ratings yet

- SOP For Handling of Rejected Raw MaterialDocument6 pagesSOP For Handling of Rejected Raw Materialanoushia alviNo ratings yet

- Dwnload Full Financial Accounting Asia Global 2nd Edition Williams Solutions Manual PDFDocument35 pagesDwnload Full Financial Accounting Asia Global 2nd Edition Williams Solutions Manual PDFkrossenflorrie355100% (14)

- 13-Fisher v. Trinidad G.R. No. L-17518 October 30, 1922Document13 pages13-Fisher v. Trinidad G.R. No. L-17518 October 30, 1922Jopan SJNo ratings yet

- Chapter 5Document65 pagesChapter 5Sena KahramanNo ratings yet

- Sec.21 To 26Document1 pageSec.21 To 26Laguna ProbationNo ratings yet

- Agot, HR-Law Assignment 4Document17 pagesAgot, HR-Law Assignment 4Crystal KateNo ratings yet

- Diao Vs MartinezDocument1 pageDiao Vs MartinezPatricia Ann Mae ArmendiNo ratings yet

- Ch. 3: Exploration & Colonization TestDocument2 pagesCh. 3: Exploration & Colonization TestJulie GerberNo ratings yet

- CREW: Environmental Protection Agency: Regarding Mary Gade: CREW Appeal Dow - List by Number Batch 1 - PDF-RDocument328 pagesCREW: Environmental Protection Agency: Regarding Mary Gade: CREW Appeal Dow - List by Number Batch 1 - PDF-RCREWNo ratings yet

- BCAS v11n04Document78 pagesBCAS v11n04Len HollowayNo ratings yet

- TB ch01 9eDocument12 pagesTB ch01 9eRadizaJisiNo ratings yet

- TOG Random GeneratorsDocument13 pagesTOG Random GeneratorsLaurgelon VigilNo ratings yet

- GRIHA Pre-Certification A5 HDDocument2 pagesGRIHA Pre-Certification A5 HDUp VickyNo ratings yet

- Graft CasesDocument37 pagesGraft CasesTuella RusselNo ratings yet

- Child Protection and Safeguarding Training 2018 2019Document46 pagesChild Protection and Safeguarding Training 2018 2019HITIMANA SylvestreNo ratings yet

- Biography of Abdul Hai HabibiDocument3 pagesBiography of Abdul Hai Habibisanakhan100% (1)

- Presentation. e ProcurementDocument14 pagesPresentation. e ProcurementTrifan_DumitruNo ratings yet

- Contract Law in Msia Brochure (MKTG)Document2 pagesContract Law in Msia Brochure (MKTG)Liaw Ee PinNo ratings yet

- Valeriano 2B Pat-Final-ExamDocument24 pagesValeriano 2B Pat-Final-ExamAira Rowena TalactacNo ratings yet

- Orrick's Technology Companies Group Start-Up Forms LibraryDocument24 pagesOrrick's Technology Companies Group Start-Up Forms LibraryScot BooksNo ratings yet