Professional Documents

Culture Documents

Chapter 5 Answers Key Millan Financial Accounting and Reporting (3rd Edition)

Chapter 5 Answers Key Millan Financial Accounting and Reporting (3rd Edition)

Uploaded by

Terese PingolCopyright:

Available Formats

You might also like

- Quiz 9 FinacrDocument9 pagesQuiz 9 FinacrJen Ner100% (5)

- Sol. Man. - Chapter 11 - Partnership FormationDocument12 pagesSol. Man. - Chapter 11 - Partnership Formationpehik100% (2)

- Module 6 - Worksheet and Financial Statements Part IIDocument4 pagesModule 6 - Worksheet and Financial Statements Part IIMJ San Pedro100% (2)

- Quizzes - Chapter 7 - Posting To The LedgerDocument9 pagesQuizzes - Chapter 7 - Posting To The LedgerAmie Jane Miranda100% (3)

- Activity 6Document12 pagesActivity 6danica gomezNo ratings yet

- First Grading Examination Key AnswersDocument5 pagesFirst Grading Examination Key AnswersJames CastañedaNo ratings yet

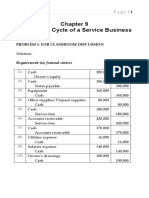

- Sol. Man. - Chapter 9 - Acctg Cycle of A Service BusinessDocument52 pagesSol. Man. - Chapter 9 - Acctg Cycle of A Service Businesscan't yujout80% (5)

- Task 5Document9 pagesTask 5Honey TolentinoNo ratings yet

- Quizzes Chapter 3 Acccounting EquationDocument7 pagesQuizzes Chapter 3 Acccounting EquationAmie Jane Miranda100% (2)

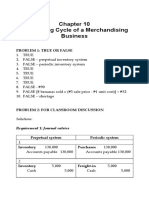

- Sol. Man. - Chapter 10 - Acctg Cycle of A Merchandising BusinessDocument65 pagesSol. Man. - Chapter 10 - Acctg Cycle of A Merchandising BusinessPeter Piper67% (3)

- Chapter 6 Answers Key Millan Financial Accounting and Reporting (3rd Edition)Document16 pagesChapter 6 Answers Key Millan Financial Accounting and Reporting (3rd Edition)Terese PingolNo ratings yet

- Chapter 1 Answers Key Millan Financial Accounting and Reporting (3rd Edition)Document3 pagesChapter 1 Answers Key Millan Financial Accounting and Reporting (3rd Edition)Terese Pingol50% (2)

- Chapter 6 Answers Key Millan Financial Accounting and Reporting (3rd Edition)Document16 pagesChapter 6 Answers Key Millan Financial Accounting and Reporting (3rd Edition)Terese PingolNo ratings yet

- Chapter 1 Answers Key Millan Financial Accounting and Reporting (3rd Edition)Document3 pagesChapter 1 Answers Key Millan Financial Accounting and Reporting (3rd Edition)Terese Pingol50% (2)

- Chapter 10 - Problem 9Document13 pagesChapter 10 - Problem 9Christy HabelNo ratings yet

- Answer Rak N Koll-Converted Answer Rak N KollDocument32 pagesAnswer Rak N Koll-Converted Answer Rak N KollAlyssah Grace EllosoNo ratings yet

- CHAP2Document2 pagesCHAP2Uyen Tran100% (1)

- Lerner The Concept of Monopoly and The Measurement of Monopoly Power (1934) PDFDocument20 pagesLerner The Concept of Monopoly and The Measurement of Monopoly Power (1934) PDFEstefani PeñaNo ratings yet

- Chapter 6 - Business Transactions & Their AnalysisDocument10 pagesChapter 6 - Business Transactions & Their AnalysisJaycel Yam-Yam VerancesNo ratings yet

- Ans Quiz 1Document13 pagesAns Quiz 1Jazzy Mercado100% (2)

- Answer InventoryDocument7 pagesAnswer InventoryAllen Carl60% (5)

- OutsourcingDocument34 pagesOutsourcingRahul R Naik100% (4)

- Sol. Man. - Chapter 4 - Types of Major AccountsDocument6 pagesSol. Man. - Chapter 4 - Types of Major AccountsAmie Jane MirandaNo ratings yet

- Sol. Man. - Chapter 6 - Business Transactions and Their Analysis 1Document17 pagesSol. Man. - Chapter 6 - Business Transactions and Their Analysis 1Lableh Arpyah100% (3)

- Sol. Man. - Chapter 5 - Books of Accounts and Double-Entry SystemDocument7 pagesSol. Man. - Chapter 5 - Books of Accounts and Double-Entry SystemTali0% (1)

- Sol. Man. - Chapter 4 - Types of Major AccountsDocument5 pagesSol. Man. - Chapter 4 - Types of Major AccountsMae Ann Tomimbang MaglinteNo ratings yet

- Sol. Man. - Chapter 6 - Business Transactions and Their AnalysisDocument18 pagesSol. Man. - Chapter 6 - Business Transactions and Their AnalysisAmie Jane MirandaNo ratings yet

- Chapter 3 Answers Key Millan Financial Accounting and Reporting (3rd Edition)Document8 pagesChapter 3 Answers Key Millan Financial Accounting and Reporting (3rd Edition)Terese PingolNo ratings yet

- Sol. Man. - Chapter 2 - Accounting Concepts and PrinciplesDocument3 pagesSol. Man. - Chapter 2 - Accounting Concepts and PrinciplesAmie Jane MirandaNo ratings yet

- Sol. Man. - Chapter 3 - The Accounting EquationDocument9 pagesSol. Man. - Chapter 3 - The Accounting EquationAmie Jane Miranda100% (2)

- Sol. Man. - Chapter 8 - Adjusting Entries PDFDocument11 pagesSol. Man. - Chapter 8 - Adjusting Entries PDFPerdito John VinNo ratings yet

- Sol. Man. - Chapter 7 - Posting To The LedgerDocument7 pagesSol. Man. - Chapter 7 - Posting To The LedgerMae Ann Tomimbang MaglinteNo ratings yet

- Sol. Man. - Chapter 12 - Partnership OperationsDocument10 pagesSol. Man. - Chapter 12 - Partnership OperationsMikhaela Torres50% (2)

- Sol. Man. - Chapter 8 - Adjusting EntriesDocument11 pagesSol. Man. - Chapter 8 - Adjusting EntriesPerdito John Vin100% (3)

- Sol. Man. - Chapter 7 - Posting To The LedgerDocument28 pagesSol. Man. - Chapter 7 - Posting To The LedgerPeter PiperNo ratings yet

- Sol. Man. - Chapter 13 - Partnership DissolutionDocument7 pagesSol. Man. - Chapter 13 - Partnership DissolutioncpawannabeNo ratings yet

- Sol. Man. - Chapter 16 - Accounting For DividendsDocument16 pagesSol. Man. - Chapter 16 - Accounting For DividendspehikNo ratings yet

- Sol Man - Chap13 - Partnership Dissolution - PDFDocument8 pagesSol Man - Chap13 - Partnership Dissolution - PDFsabyNo ratings yet

- Chapter 12 FAR Millan Chapter 12 FAR MillanDocument4 pagesChapter 12 FAR Millan Chapter 12 FAR MillanJoanah AquinoNo ratings yet

- 1a Millan Solution Manual 2021 1Document259 pages1a Millan Solution Manual 2021 1avilastephjaneNo ratings yet

- To Record The Purchase of EquipmentDocument13 pagesTo Record The Purchase of EquipmentShane Nayah100% (1)

- Pas 2 Inventories Ans KeyDocument3 pagesPas 2 Inventories Ans KeyTeree ZuNo ratings yet

- Problems Problem 1: True or FalseDocument4 pagesProblems Problem 1: True or Falsejessamae gundanNo ratings yet

- Quizzes - Chapter 8 - Adjusting EntriesDocument3 pagesQuizzes - Chapter 8 - Adjusting EntriesJhonric Aquino0% (2)

- Module 3 - Business Transaction and Their Analysis Part 3Document16 pagesModule 3 - Business Transaction and Their Analysis Part 31BSA5-ABM Espiritu, Charles100% (1)

- Partnership LiquidationDocument17 pagesPartnership LiquidationPam IntruzoNo ratings yet

- Problem 1: PostingDocument7 pagesProblem 1: Postingbunny bunnyNo ratings yet

- Sol. Man. - Chapter 15 - Accounting For CorporationsDocument15 pagesSol. Man. - Chapter 15 - Accounting For Corporationspehik100% (1)

- Chapter 9 Problem 1 SolutionDocument8 pagesChapter 9 Problem 1 SolutionAustin Coles83% (6)

- ACCTNG Answers of Chapter 3Document5 pagesACCTNG Answers of Chapter 3Hayes MedranoNo ratings yet

- Wellness Massage General Journal For The Period Ended December 31, 20x1Document26 pagesWellness Massage General Journal For The Period Ended December 31, 20x1John Paul TomasNo ratings yet

- Sol. Man. - Chapter 12 - Partnership OperationsDocument11 pagesSol. Man. - Chapter 12 - Partnership OperationspehikNo ratings yet

- Accounting CycleDocument5 pagesAccounting Cycleruth san jose100% (1)

- Sol. Man. - Chapter 13 - Partnership DissolutionDocument16 pagesSol. Man. - Chapter 13 - Partnership DissolutionJaymark Ruelo100% (1)

- Conceptual Framework and Acctg Standards 1.9: SolutionDocument4 pagesConceptual Framework and Acctg Standards 1.9: SolutionKrissa Mae LongosNo ratings yet

- MILLAN SOL. MAN. Chapter 20 Agriculture IA PART 1BDocument5 pagesMILLAN SOL. MAN. Chapter 20 Agriculture IA PART 1BZhaira Kim CantosNo ratings yet

- Chapter 5 Books of Accounts and Double Entry SystemDocument8 pagesChapter 5 Books of Accounts and Double Entry Systemnana weeNo ratings yet

- Books of Accounts and Double Entry Sytem BSAIS 1A Group 2Document27 pagesBooks of Accounts and Double Entry Sytem BSAIS 1A Group 2Marydelle De Austria-De GuiaNo ratings yet

- Practice Exam Answer KeyDocument4 pagesPractice Exam Answer KeyDavid Marion CatindinNo ratings yet

- Bo120 - Disquitado Ivy T. - Activity For Chap 4Document4 pagesBo120 - Disquitado Ivy T. - Activity For Chap 4Ivy DisquitadoNo ratings yet

- FAR Assignment 2Document2 pagesFAR Assignment 2Andrea Monique AlejagaNo ratings yet

- FAR Module 4,5,6 - Assignment ActivityDocument5 pagesFAR Module 4,5,6 - Assignment ActivityairamaecsibbalucaNo ratings yet

- Quiz 2Document2 pagesQuiz 2Bervette HansNo ratings yet

- Type of AccountsDocument4 pagesType of AccountsIgnacio De LunaNo ratings yet

- Activity 4 Quiz FABMDocument1 pageActivity 4 Quiz FABMJake SabilloNo ratings yet

- Sol. Man. - Chapter 4 - Types of Major AccountsDocument6 pagesSol. Man. - Chapter 4 - Types of Major AccountsAmie Jane MirandaNo ratings yet

- Chapter 3 Answers Key Millan Financial Accounting and Reporting (3rd Edition)Document8 pagesChapter 3 Answers Key Millan Financial Accounting and Reporting (3rd Edition)Terese PingolNo ratings yet

- United Company For FoodDocument2 pagesUnited Company For FoodmshawkycnNo ratings yet

- Government of Andhra Pradesh: Finance (Fmu-He-Skills-Dev-Trng) DepartmentDocument2 pagesGovernment of Andhra Pradesh: Finance (Fmu-He-Skills-Dev-Trng) Departmentrbharat87100% (1)

- University of Luzon College of Accountnacy Acc 412 - NCL Part 2 NAME: - Problem 1Document3 pagesUniversity of Luzon College of Accountnacy Acc 412 - NCL Part 2 NAME: - Problem 1fghhnnnjmlNo ratings yet

- British Columbia Box Limited: Case AnalysisDocument8 pagesBritish Columbia Box Limited: Case AnalysisAbhishek MishraNo ratings yet

- SAP ABAP BasicDocument6 pagesSAP ABAP BasicSatheessh KonthalaNo ratings yet

- City Bank Statement - CompressDocument1 pageCity Bank Statement - CompressBhim Sher0% (2)

- Lesson 2 Research SynthesisDocument11 pagesLesson 2 Research SynthesisJhason CastroNo ratings yet

- Management Theory and Practice Assignment: American College of Technology Master of Business AdministrationDocument10 pagesManagement Theory and Practice Assignment: American College of Technology Master of Business AdministrationKaleab AlemayehuNo ratings yet

- HRM549 Reflectiv EssayDocument3 pagesHRM549 Reflectiv EssaySITINo ratings yet

- Cost Sheet ExercisesDocument2 pagesCost Sheet ExercisessivapriyakamatNo ratings yet

- More Than 4.84 Million Persons Are in Housing Shortage in Central American RegionDocument15 pagesMore Than 4.84 Million Persons Are in Housing Shortage in Central American RegionRicardo Arturo Gallopp JohnsonNo ratings yet

- International Migrations To Brazil in The 21st CenturyDocument35 pagesInternational Migrations To Brazil in The 21st CenturyMarie DupontNo ratings yet

- Agreement For Sale of PropertyDocument2 pagesAgreement For Sale of PropertyDikshagoyal123No ratings yet

- RM - Group 3 - TESCO PLCDocument11 pagesRM - Group 3 - TESCO PLCRishabh SanghaviNo ratings yet

- Vendor CompaniesDocument28 pagesVendor CompaniesWilfred DsouzaNo ratings yet

- Super Care Pharma Bank Statement-July-2021Document4 pagesSuper Care Pharma Bank Statement-July-2021AKM Anwar SadatNo ratings yet

- Catherine Morris - Demystifying SustainabilityDocument34 pagesCatherine Morris - Demystifying SustainabilityshivalikaNo ratings yet

- Dubai Economic Report 2018 Full Report PDFDocument220 pagesDubai Economic Report 2018 Full Report PDFHugo RidaoNo ratings yet

- Worksheet For A Course Industrial Management and Engineering EconomyDocument2 pagesWorksheet For A Course Industrial Management and Engineering Economysolomonlemma14No ratings yet

- Year Ended (Audited) Quarter Ended (Unaudited) Nine Months Ended (Unaudited)Document1 pageYear Ended (Audited) Quarter Ended (Unaudited) Nine Months Ended (Unaudited)Jatin GuptaNo ratings yet

- SWOT ANALYSIS - Docx PearlDocument6 pagesSWOT ANALYSIS - Docx PearlPamela Joyce RiambonNo ratings yet

- Financial Statement Analysis: K R Subramanyam John J WildDocument40 pagesFinancial Statement Analysis: K R Subramanyam John J WildEmma SuryaniNo ratings yet

- Business Economics Ca Foundation - Paper 4 (Part 1) - Business EconomicsDocument5 pagesBusiness Economics Ca Foundation - Paper 4 (Part 1) - Business EconomicsbnanduriNo ratings yet

- SUBJECTIVE FINAL QUESTION Paper 2021Document2 pagesSUBJECTIVE FINAL QUESTION Paper 2021Madiha Baqai EntertainmentNo ratings yet

- Health Insurance Architecture in IndiaDocument4 pagesHealth Insurance Architecture in IndiaShantanuNo ratings yet

- Lecture 5Document49 pagesLecture 5premsuwaatiiNo ratings yet

- Employee Engagement: The Key To Realizing Competitive AdvantageDocument33 pagesEmployee Engagement: The Key To Realizing Competitive Advantageshivi_kashtiNo ratings yet

Chapter 5 Answers Key Millan Financial Accounting and Reporting (3rd Edition)

Chapter 5 Answers Key Millan Financial Accounting and Reporting (3rd Edition)

Uploaded by

Terese PingolOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 5 Answers Key Millan Financial Accounting and Reporting (3rd Edition)

Chapter 5 Answers Key Millan Financial Accounting and Reporting (3rd Edition)

Uploaded by

Terese PingolCopyright:

Available Formats

Chapter 5

Books of Accounts and Double-entry System

PROBLEM 1: TRUE OR FALSE

1. FALSE

2. FALSE

3. TRUE

4. FALSE – General ledger

5. FALSE – Subsidiary ledger

6. TRUE

7. TRUE

8. TRUE

9. FALSE – double-entry system

10. FALSE – concept of duality

PROBLEM 2: TRUE OR FALSE

1. TRUE

2. TRUE

3. FALSE – credit

4. FALSE

5. FALSE – ₱6M (10M – 4M)

6. TRUE

7. FALSE – (100 + 20 – 70) = ₱50

8. FALSE – debit

9. FALSE – decrease

10. TRUE

PROBLEM 3: FOR CLASSROOM DISCUSSION

1. Purchases journal

2. Cash receipts journal

3. General journal

4. Cash disbursements journal

5. General ledger

6. Subsidiary ledger

ACCOUNTS COLUMN A COLUMN B

7. Cash ASSET DEBIT

8. Owner’s equity EQUITY CREDIT

9. Accounts receivable ASSET DEBIT

10. Prepaid supplies ASSET DEBIT

11. Accounts payable LIABILITY CREDIT

12. Salaries payable LIABILITY CREDIT

13. Accumulated depreciation CONTRA-ASSET CREDIT

14. Sales INCOME CREDIT

15. Cost of sales EXPENSE DEBIT

16. Depreciation EXPENSE DEBIT

17. DEBIT

18. CREDIT

19. CREDIT

20. CREDIT

21. C

Solution:

Cash

beg. 20,000

Collection of accounts Payment of notes

receivable 11,000 8,000 payable

Issuance of notes

payable 5,000

28,000 end.

Notes payable

15,00

0 beg.

Issuance of

Payment of notes payable 8,000 5,000 notes payable

12,00

end. 0

PROBLEM 4: IDENTIFICATION (BOOKS OF ACCOUNTS)

1. Sales journal

2. Purchases journal

3. Cash receipts journal

4. Cash disbursements journal

5. Cash disbursements journal

6. Cash receipts journal

7. Cash disbursements journal

8. General ledger

9. Subsidiary ledger

10. Journal

PROBLEM 5: IDENTIFICATION (TYPES OF ACCOUNTS)

ACCOUNTS COLUMN A COLUMN B

1. Notes receivable ASSET DEBIT

2. Salaries expense EXPENSE DEBIT

3. Owner’s drawings CONTRA-EQUITY DEBIT

4. Building ASSET DEBIT

5. Service fees INCOME CREDIT

6. Advances from customers LIABILITY CREDIT

7. Gains INCOME CREDIT

EXPENSE DEBIT

8. Interest expense

LIABILITY CREDIT

9. Unearned income

ASSET DEBIT

10. Equipment

ASSET DEBIT

11. Interest receivable

EQUITY CREDIT

12. Owner’s capital ASSET DEBIT

13. Equipment EXPENSE DEBIT

14. Freight-out EXPENSE DEBIT

15. Losses INCOME CREDIT

16. Service fees CONTRA-ASSET CREDIT

17. Allowance for bad debts ASSET DEBIT

18. Inventory EXPENSE DEBIT

19. Depreciation LIABILITY CREDIT

20. Utilities payable

PROBLEM 6: IDENTIFICATION (RULES OF DEBIT/CREDIT)

Account Titles INCREASED BY A

1. Cash DEBIT

2. Sales CREDIT

3. Accumulated depreciation CREDIT

4. Depreciation DEBIT

5. Inventory DEBIT

6. Owner’s capital CREDIT

7. Rent expense DEBIT

8. Rent income CREDIT

9. Interest receivable DEBIT

10. Interest expense DEBIT

11. Prepaid rent DEBIT

12. Owner’s drawings DEBIT

13. Accounts payable CREDIT

14. Unearned income CREDIT

15. Cost of sales DEBIT

16. Equipment DEBIT

17. Notes payable CREDIT

18. Insurance expense DEBIT

19. Prepaid insurance DEBIT

20. Gains CREDIT

21. Notes receivable DEBIT

22. Land DEBIT

23. Building DEBIT

24. Furniture & fixture DEBIT

25. Freight out DEBIT

PROBLEM 7: MULTIPLE CHOICE

1. D

2. B

3. B

4. A

5. D

6. D

7. A

8. D

9. A

10. D

PROBLEM 8: MULTIPLE CHOICE

1. D

2. D

3. A

4. A

5. A

6. A

7. B

8. A

9. C

10. D

PROBLEM 9: MULTIPLE CHOICE

1. A

2. A

3. C

4. D

5. D

6. B

7. C

8. B

9. A

10. B

PROBLEM 10: MULTIPLE CHOICE

1. C

2. C

3. B

4. B

5. A

6. D

7. A

8. C

9. C

10. C

You might also like

- Quiz 9 FinacrDocument9 pagesQuiz 9 FinacrJen Ner100% (5)

- Sol. Man. - Chapter 11 - Partnership FormationDocument12 pagesSol. Man. - Chapter 11 - Partnership Formationpehik100% (2)

- Module 6 - Worksheet and Financial Statements Part IIDocument4 pagesModule 6 - Worksheet and Financial Statements Part IIMJ San Pedro100% (2)

- Quizzes - Chapter 7 - Posting To The LedgerDocument9 pagesQuizzes - Chapter 7 - Posting To The LedgerAmie Jane Miranda100% (3)

- Activity 6Document12 pagesActivity 6danica gomezNo ratings yet

- First Grading Examination Key AnswersDocument5 pagesFirst Grading Examination Key AnswersJames CastañedaNo ratings yet

- Sol. Man. - Chapter 9 - Acctg Cycle of A Service BusinessDocument52 pagesSol. Man. - Chapter 9 - Acctg Cycle of A Service Businesscan't yujout80% (5)

- Task 5Document9 pagesTask 5Honey TolentinoNo ratings yet

- Quizzes Chapter 3 Acccounting EquationDocument7 pagesQuizzes Chapter 3 Acccounting EquationAmie Jane Miranda100% (2)

- Sol. Man. - Chapter 10 - Acctg Cycle of A Merchandising BusinessDocument65 pagesSol. Man. - Chapter 10 - Acctg Cycle of A Merchandising BusinessPeter Piper67% (3)

- Chapter 6 Answers Key Millan Financial Accounting and Reporting (3rd Edition)Document16 pagesChapter 6 Answers Key Millan Financial Accounting and Reporting (3rd Edition)Terese PingolNo ratings yet

- Chapter 1 Answers Key Millan Financial Accounting and Reporting (3rd Edition)Document3 pagesChapter 1 Answers Key Millan Financial Accounting and Reporting (3rd Edition)Terese Pingol50% (2)

- Chapter 6 Answers Key Millan Financial Accounting and Reporting (3rd Edition)Document16 pagesChapter 6 Answers Key Millan Financial Accounting and Reporting (3rd Edition)Terese PingolNo ratings yet

- Chapter 1 Answers Key Millan Financial Accounting and Reporting (3rd Edition)Document3 pagesChapter 1 Answers Key Millan Financial Accounting and Reporting (3rd Edition)Terese Pingol50% (2)

- Chapter 10 - Problem 9Document13 pagesChapter 10 - Problem 9Christy HabelNo ratings yet

- Answer Rak N Koll-Converted Answer Rak N KollDocument32 pagesAnswer Rak N Koll-Converted Answer Rak N KollAlyssah Grace EllosoNo ratings yet

- CHAP2Document2 pagesCHAP2Uyen Tran100% (1)

- Lerner The Concept of Monopoly and The Measurement of Monopoly Power (1934) PDFDocument20 pagesLerner The Concept of Monopoly and The Measurement of Monopoly Power (1934) PDFEstefani PeñaNo ratings yet

- Chapter 6 - Business Transactions & Their AnalysisDocument10 pagesChapter 6 - Business Transactions & Their AnalysisJaycel Yam-Yam VerancesNo ratings yet

- Ans Quiz 1Document13 pagesAns Quiz 1Jazzy Mercado100% (2)

- Answer InventoryDocument7 pagesAnswer InventoryAllen Carl60% (5)

- OutsourcingDocument34 pagesOutsourcingRahul R Naik100% (4)

- Sol. Man. - Chapter 4 - Types of Major AccountsDocument6 pagesSol. Man. - Chapter 4 - Types of Major AccountsAmie Jane MirandaNo ratings yet

- Sol. Man. - Chapter 6 - Business Transactions and Their Analysis 1Document17 pagesSol. Man. - Chapter 6 - Business Transactions and Their Analysis 1Lableh Arpyah100% (3)

- Sol. Man. - Chapter 5 - Books of Accounts and Double-Entry SystemDocument7 pagesSol. Man. - Chapter 5 - Books of Accounts and Double-Entry SystemTali0% (1)

- Sol. Man. - Chapter 4 - Types of Major AccountsDocument5 pagesSol. Man. - Chapter 4 - Types of Major AccountsMae Ann Tomimbang MaglinteNo ratings yet

- Sol. Man. - Chapter 6 - Business Transactions and Their AnalysisDocument18 pagesSol. Man. - Chapter 6 - Business Transactions and Their AnalysisAmie Jane MirandaNo ratings yet

- Chapter 3 Answers Key Millan Financial Accounting and Reporting (3rd Edition)Document8 pagesChapter 3 Answers Key Millan Financial Accounting and Reporting (3rd Edition)Terese PingolNo ratings yet

- Sol. Man. - Chapter 2 - Accounting Concepts and PrinciplesDocument3 pagesSol. Man. - Chapter 2 - Accounting Concepts and PrinciplesAmie Jane MirandaNo ratings yet

- Sol. Man. - Chapter 3 - The Accounting EquationDocument9 pagesSol. Man. - Chapter 3 - The Accounting EquationAmie Jane Miranda100% (2)

- Sol. Man. - Chapter 8 - Adjusting Entries PDFDocument11 pagesSol. Man. - Chapter 8 - Adjusting Entries PDFPerdito John VinNo ratings yet

- Sol. Man. - Chapter 7 - Posting To The LedgerDocument7 pagesSol. Man. - Chapter 7 - Posting To The LedgerMae Ann Tomimbang MaglinteNo ratings yet

- Sol. Man. - Chapter 12 - Partnership OperationsDocument10 pagesSol. Man. - Chapter 12 - Partnership OperationsMikhaela Torres50% (2)

- Sol. Man. - Chapter 8 - Adjusting EntriesDocument11 pagesSol. Man. - Chapter 8 - Adjusting EntriesPerdito John Vin100% (3)

- Sol. Man. - Chapter 7 - Posting To The LedgerDocument28 pagesSol. Man. - Chapter 7 - Posting To The LedgerPeter PiperNo ratings yet

- Sol. Man. - Chapter 13 - Partnership DissolutionDocument7 pagesSol. Man. - Chapter 13 - Partnership DissolutioncpawannabeNo ratings yet

- Sol. Man. - Chapter 16 - Accounting For DividendsDocument16 pagesSol. Man. - Chapter 16 - Accounting For DividendspehikNo ratings yet

- Sol Man - Chap13 - Partnership Dissolution - PDFDocument8 pagesSol Man - Chap13 - Partnership Dissolution - PDFsabyNo ratings yet

- Chapter 12 FAR Millan Chapter 12 FAR MillanDocument4 pagesChapter 12 FAR Millan Chapter 12 FAR MillanJoanah AquinoNo ratings yet

- 1a Millan Solution Manual 2021 1Document259 pages1a Millan Solution Manual 2021 1avilastephjaneNo ratings yet

- To Record The Purchase of EquipmentDocument13 pagesTo Record The Purchase of EquipmentShane Nayah100% (1)

- Pas 2 Inventories Ans KeyDocument3 pagesPas 2 Inventories Ans KeyTeree ZuNo ratings yet

- Problems Problem 1: True or FalseDocument4 pagesProblems Problem 1: True or Falsejessamae gundanNo ratings yet

- Quizzes - Chapter 8 - Adjusting EntriesDocument3 pagesQuizzes - Chapter 8 - Adjusting EntriesJhonric Aquino0% (2)

- Module 3 - Business Transaction and Their Analysis Part 3Document16 pagesModule 3 - Business Transaction and Their Analysis Part 31BSA5-ABM Espiritu, Charles100% (1)

- Partnership LiquidationDocument17 pagesPartnership LiquidationPam IntruzoNo ratings yet

- Problem 1: PostingDocument7 pagesProblem 1: Postingbunny bunnyNo ratings yet

- Sol. Man. - Chapter 15 - Accounting For CorporationsDocument15 pagesSol. Man. - Chapter 15 - Accounting For Corporationspehik100% (1)

- Chapter 9 Problem 1 SolutionDocument8 pagesChapter 9 Problem 1 SolutionAustin Coles83% (6)

- ACCTNG Answers of Chapter 3Document5 pagesACCTNG Answers of Chapter 3Hayes MedranoNo ratings yet

- Wellness Massage General Journal For The Period Ended December 31, 20x1Document26 pagesWellness Massage General Journal For The Period Ended December 31, 20x1John Paul TomasNo ratings yet

- Sol. Man. - Chapter 12 - Partnership OperationsDocument11 pagesSol. Man. - Chapter 12 - Partnership OperationspehikNo ratings yet

- Accounting CycleDocument5 pagesAccounting Cycleruth san jose100% (1)

- Sol. Man. - Chapter 13 - Partnership DissolutionDocument16 pagesSol. Man. - Chapter 13 - Partnership DissolutionJaymark Ruelo100% (1)

- Conceptual Framework and Acctg Standards 1.9: SolutionDocument4 pagesConceptual Framework and Acctg Standards 1.9: SolutionKrissa Mae LongosNo ratings yet

- MILLAN SOL. MAN. Chapter 20 Agriculture IA PART 1BDocument5 pagesMILLAN SOL. MAN. Chapter 20 Agriculture IA PART 1BZhaira Kim CantosNo ratings yet

- Chapter 5 Books of Accounts and Double Entry SystemDocument8 pagesChapter 5 Books of Accounts and Double Entry Systemnana weeNo ratings yet

- Books of Accounts and Double Entry Sytem BSAIS 1A Group 2Document27 pagesBooks of Accounts and Double Entry Sytem BSAIS 1A Group 2Marydelle De Austria-De GuiaNo ratings yet

- Practice Exam Answer KeyDocument4 pagesPractice Exam Answer KeyDavid Marion CatindinNo ratings yet

- Bo120 - Disquitado Ivy T. - Activity For Chap 4Document4 pagesBo120 - Disquitado Ivy T. - Activity For Chap 4Ivy DisquitadoNo ratings yet

- FAR Assignment 2Document2 pagesFAR Assignment 2Andrea Monique AlejagaNo ratings yet

- FAR Module 4,5,6 - Assignment ActivityDocument5 pagesFAR Module 4,5,6 - Assignment ActivityairamaecsibbalucaNo ratings yet

- Quiz 2Document2 pagesQuiz 2Bervette HansNo ratings yet

- Type of AccountsDocument4 pagesType of AccountsIgnacio De LunaNo ratings yet

- Activity 4 Quiz FABMDocument1 pageActivity 4 Quiz FABMJake SabilloNo ratings yet

- Sol. Man. - Chapter 4 - Types of Major AccountsDocument6 pagesSol. Man. - Chapter 4 - Types of Major AccountsAmie Jane MirandaNo ratings yet

- Chapter 3 Answers Key Millan Financial Accounting and Reporting (3rd Edition)Document8 pagesChapter 3 Answers Key Millan Financial Accounting and Reporting (3rd Edition)Terese PingolNo ratings yet

- United Company For FoodDocument2 pagesUnited Company For FoodmshawkycnNo ratings yet

- Government of Andhra Pradesh: Finance (Fmu-He-Skills-Dev-Trng) DepartmentDocument2 pagesGovernment of Andhra Pradesh: Finance (Fmu-He-Skills-Dev-Trng) Departmentrbharat87100% (1)

- University of Luzon College of Accountnacy Acc 412 - NCL Part 2 NAME: - Problem 1Document3 pagesUniversity of Luzon College of Accountnacy Acc 412 - NCL Part 2 NAME: - Problem 1fghhnnnjmlNo ratings yet

- British Columbia Box Limited: Case AnalysisDocument8 pagesBritish Columbia Box Limited: Case AnalysisAbhishek MishraNo ratings yet

- SAP ABAP BasicDocument6 pagesSAP ABAP BasicSatheessh KonthalaNo ratings yet

- City Bank Statement - CompressDocument1 pageCity Bank Statement - CompressBhim Sher0% (2)

- Lesson 2 Research SynthesisDocument11 pagesLesson 2 Research SynthesisJhason CastroNo ratings yet

- Management Theory and Practice Assignment: American College of Technology Master of Business AdministrationDocument10 pagesManagement Theory and Practice Assignment: American College of Technology Master of Business AdministrationKaleab AlemayehuNo ratings yet

- HRM549 Reflectiv EssayDocument3 pagesHRM549 Reflectiv EssaySITINo ratings yet

- Cost Sheet ExercisesDocument2 pagesCost Sheet ExercisessivapriyakamatNo ratings yet

- More Than 4.84 Million Persons Are in Housing Shortage in Central American RegionDocument15 pagesMore Than 4.84 Million Persons Are in Housing Shortage in Central American RegionRicardo Arturo Gallopp JohnsonNo ratings yet

- International Migrations To Brazil in The 21st CenturyDocument35 pagesInternational Migrations To Brazil in The 21st CenturyMarie DupontNo ratings yet

- Agreement For Sale of PropertyDocument2 pagesAgreement For Sale of PropertyDikshagoyal123No ratings yet

- RM - Group 3 - TESCO PLCDocument11 pagesRM - Group 3 - TESCO PLCRishabh SanghaviNo ratings yet

- Vendor CompaniesDocument28 pagesVendor CompaniesWilfred DsouzaNo ratings yet

- Super Care Pharma Bank Statement-July-2021Document4 pagesSuper Care Pharma Bank Statement-July-2021AKM Anwar SadatNo ratings yet

- Catherine Morris - Demystifying SustainabilityDocument34 pagesCatherine Morris - Demystifying SustainabilityshivalikaNo ratings yet

- Dubai Economic Report 2018 Full Report PDFDocument220 pagesDubai Economic Report 2018 Full Report PDFHugo RidaoNo ratings yet

- Worksheet For A Course Industrial Management and Engineering EconomyDocument2 pagesWorksheet For A Course Industrial Management and Engineering Economysolomonlemma14No ratings yet

- Year Ended (Audited) Quarter Ended (Unaudited) Nine Months Ended (Unaudited)Document1 pageYear Ended (Audited) Quarter Ended (Unaudited) Nine Months Ended (Unaudited)Jatin GuptaNo ratings yet

- SWOT ANALYSIS - Docx PearlDocument6 pagesSWOT ANALYSIS - Docx PearlPamela Joyce RiambonNo ratings yet

- Financial Statement Analysis: K R Subramanyam John J WildDocument40 pagesFinancial Statement Analysis: K R Subramanyam John J WildEmma SuryaniNo ratings yet

- Business Economics Ca Foundation - Paper 4 (Part 1) - Business EconomicsDocument5 pagesBusiness Economics Ca Foundation - Paper 4 (Part 1) - Business EconomicsbnanduriNo ratings yet

- SUBJECTIVE FINAL QUESTION Paper 2021Document2 pagesSUBJECTIVE FINAL QUESTION Paper 2021Madiha Baqai EntertainmentNo ratings yet

- Health Insurance Architecture in IndiaDocument4 pagesHealth Insurance Architecture in IndiaShantanuNo ratings yet

- Lecture 5Document49 pagesLecture 5premsuwaatiiNo ratings yet

- Employee Engagement: The Key To Realizing Competitive AdvantageDocument33 pagesEmployee Engagement: The Key To Realizing Competitive Advantageshivi_kashtiNo ratings yet