Professional Documents

Culture Documents

SIE Class Summary: Please Review Them Multiple Times Before Your Actual Test. They Are Not Intended

SIE Class Summary: Please Review Them Multiple Times Before Your Actual Test. They Are Not Intended

Uploaded by

Shuchana HadyCopyright:

Available Formats

You might also like

- Sie 3rd Edition Textbook 1600 PDFDocument480 pagesSie 3rd Edition Textbook 1600 PDFWill Mason90% (20)

- SIE QuickSheet, 2E PDF (Secured)Document4 pagesSIE QuickSheet, 2E PDF (Secured)Henry Jose Codallo Siso91% (11)

- Series 7 NotesDocument38 pagesSeries 7 Notesybigalow100% (3)

- Series 63 NotesDocument12 pagesSeries 63 Notesnk7350100% (5)

- Series 79 - Study NotesDocument31 pagesSeries 79 - Study NotesAdio Foster80% (5)

- SIE Exam Prep 2021-2022: SIE Study Guide with 300 Questions and Detailed Answer Explanations for the FINRA Securities Industry Essentials Exam (Includes 4 Full-Length Practice Tests)From EverandSIE Exam Prep 2021-2022: SIE Study Guide with 300 Questions and Detailed Answer Explanations for the FINRA Securities Industry Essentials Exam (Includes 4 Full-Length Practice Tests)Rating: 5 out of 5 stars5/5 (1)

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2024 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2024 Edition)Rating: 5 out of 5 stars5/5 (1)

- Series 7 Options QuicksheetDocument3 pagesSeries 7 Options QuicksheetAli ShafiqueNo ratings yet

- SECURITIES INDUSTRY ESSENTIALS EXAM STUDY GUIDE 2022 + TEST BANKFrom EverandSECURITIES INDUSTRY ESSENTIALS EXAM STUDY GUIDE 2022 + TEST BANKRating: 5 out of 5 stars5/5 (4)

- Series 63 NotesDocument8 pagesSeries 63 Notesleo2331100% (2)

- Series 65 Exam Study Guide 2022 + Test BankFrom EverandSeries 65 Exam Study Guide 2022 + Test BankRating: 5 out of 5 stars5/5 (1)

- Series 65 Practice Exam For Available Courses PageDocument8 pagesSeries 65 Practice Exam For Available Courses PagePatrick Crutcher100% (3)

- SECURITIES INDUSTRY ESSENTIALS EXAM STUDY GUIDE 2021 + TEST BANKFrom EverandSECURITIES INDUSTRY ESSENTIALS EXAM STUDY GUIDE 2021 + TEST BANKRating: 5 out of 5 stars5/5 (1)

- Securities Industry Essentials Exam For Dummies with Online Practice TestsFrom EverandSecurities Industry Essentials Exam For Dummies with Online Practice TestsRating: 5 out of 5 stars5/5 (1)

- Series 7 Qualification Exam: General Securities Representative Study Manual - 42nd EditionDocument499 pagesSeries 7 Qualification Exam: General Securities Representative Study Manual - 42nd EditionGiovanni100% (5)

- Series 6 Study GuideDocument8 pagesSeries 6 Study GuideelNo ratings yet

- Series 63 ReviewDocument12 pagesSeries 63 ReviewDavid D100% (1)

- SIE Learning Guide v08Document153 pagesSIE Learning Guide v08Nredfneei riefh100% (9)

- Series 7 OutlineDocument95 pagesSeries 7 OutlineIZABELLAE9100% (3)

- Business AccountingDocument47 pagesBusiness AccountingXiao PoNo ratings yet

- Series 7 Study Guide 2022 + Test BankFrom EverandSeries 7 Study Guide 2022 + Test BankRating: 5 out of 5 stars5/5 (1)

- Series 7 EquationsDocument1 pageSeries 7 Equationsbradovich4760No ratings yet

- Series 7 Study GuideDocument5 pagesSeries 7 Study GuideDaniel GV100% (2)

- NASD Series 7 Prep ManualDocument692 pagesNASD Series 7 Prep ManualKaty Coulthane100% (3)

- Series 7 Suitability Exercise SecuredDocument28 pagesSeries 7 Suitability Exercise SecuredAnthony Mcnichols100% (1)

- Series 79 CL 1Document68 pagesSeries 79 CL 1barlie3824100% (1)

- NASD Series 7 Cheat Sheet - Monica Haven - 01Document1 pageNASD Series 7 Cheat Sheet - Monica Haven - 01HappyGhost0% (3)

- Series 63 BinderDocument77 pagesSeries 63 BinderDon Don100% (4)

- Series 7 NotesDocument13 pagesSeries 7 NotesColin Ford100% (3)

- Series 7 Study Guide OutlineDocument26 pagesSeries 7 Study Guide Outlinescribdguru9No ratings yet

- Series 7 Notes Part1Document17 pagesSeries 7 Notes Part1ybigalow100% (1)

- Series 65 101Document52 pagesSeries 65 101Cameron Killeen100% (3)

- Series 65 Test SpecsDocument8 pagesSeries 65 Test SpecsAd100% (1)

- NASD Series 7Document692 pagesNASD Series 7Bart JamesNo ratings yet

- Series 79 Outline 0Document28 pagesSeries 79 Outline 0Michael Luna100% (1)

- Setting Up A Business EntityDocument9 pagesSetting Up A Business EntityUsman WaheedNo ratings yet

- Equity Investment for CFA level 1: CFA level 1, #2From EverandEquity Investment for CFA level 1: CFA level 1, #2Rating: 5 out of 5 stars5/5 (1)

- Securities Industry Essentials (SIE) Examination: Content OutlineDocument15 pagesSecurities Industry Essentials (SIE) Examination: Content OutlinejayNo ratings yet

- SIE ReviewerDocument5 pagesSIE ReviewerMina G.No ratings yet

- SIE NotesDocument85 pagesSIE NotesJohn Lee100% (1)

- FINRA SIE Exam NotesDocument2 pagesFINRA SIE Exam NotesPayal100% (1)

- Passing Score Series 7Document23 pagesPassing Score Series 7Rakib Sikder100% (5)

- SIE Classroom Two-Day v18 Handout (Print - Cover)Document74 pagesSIE Classroom Two-Day v18 Handout (Print - Cover)studdyForExamsNo ratings yet

- Series 7 Numbers: 0 0 .001 1/32nds 1/32nds 1/8ths 1/8ths 1 1 1 1 2 2 2 2 2 3 3 3 3 3 3 3Document2 pagesSeries 7 Numbers: 0 0 .001 1/32nds 1/32nds 1/8ths 1/8ths 1 1 1 1 2 2 2 2 2 3 3 3 3 3 3 3Mohit VermaNo ratings yet

- Series 6 Study SheetDocument14 pagesSeries 6 Study SheetJoseph BarozNo ratings yet

- Technical English Exam Read The Following Text Carefully and Repeatedly Then Answer The Ensuing ExercisesDocument3 pagesTechnical English Exam Read The Following Text Carefully and Repeatedly Then Answer The Ensuing ExercisessabriNo ratings yet

- Quick FactsDocument30 pagesQuick FactsWilliam James100% (2)

- Series 7 - Class 1 HandoutDocument54 pagesSeries 7 - Class 1 HandoutEvelyn Chua-FongNo ratings yet

- Series 7 - Study LiteratureDocument27 pagesSeries 7 - Study LiteratureAli Shafique100% (2)

- Scribd NotesDocument14 pagesScribd NotesLeeAnn MarieNo ratings yet

- Pass The 66 Study SheetDocument4 pagesPass The 66 Study SheetEmmanuelDasiNo ratings yet

- Complete Series 6 License Exam Training and DocumentationDocument449 pagesComplete Series 6 License Exam Training and DocumentationChad Artiaga100% (1)

- Series 66 Test SpecsDocument6 pagesSeries 66 Test SpecsSnow BurritoNo ratings yet

- Quizlet Series 63Document13 pagesQuizlet Series 63ahmaky100% (1)

- Series 6 ReviewDocument202 pagesSeries 6 ReviewAnthony McnicholsNo ratings yet

- Pass The 6 Study SheetDocument14 pagesPass The 6 Study SheetEmmanuelDasi100% (1)

- Series 6 Licensing Exam Manual PDFDocument432 pagesSeries 6 Licensing Exam Manual PDFRichard Fields100% (2)

- Series 63 GlossaryDocument9 pagesSeries 63 GlossaryGiovanniNo ratings yet

- Series 7 Key FactsDocument2 pagesSeries 7 Key FactsMohit VermaNo ratings yet

- SERIES 7 Exam Dumps - Reduce Your Chances of Failure: Finra Series 7 Sample QuestionsDocument1 pageSERIES 7 Exam Dumps - Reduce Your Chances of Failure: Finra Series 7 Sample QuestionsMuhammad UmairNo ratings yet

- SIE Learning Guide v08Document153 pagesSIE Learning Guide v08Angelo ImmacolatoNo ratings yet

- SAP SD Sales and Distribution Accounting EntriesDocument2 pagesSAP SD Sales and Distribution Accounting EntriesRaghuchandran RevanurNo ratings yet

- Question and AnswerDocument8 pagesQuestion and Answerashish panwarNo ratings yet

- 2023 CFA Level 1 Curriculum Changes Summary (300hours)Document2 pages2023 CFA Level 1 Curriculum Changes Summary (300hours)johnNo ratings yet

- Chapter 1 - Question 1Document4 pagesChapter 1 - Question 1Sophie ChopraNo ratings yet

- Partnership Operation: Acp 311 - UlobDocument49 pagesPartnership Operation: Acp 311 - UlobMeleen TadenaNo ratings yet

- Fin 370 Final Exam - New 2016 VersionDocument7 pagesFin 370 Final Exam - New 2016 Versionheaton073bradfordNo ratings yet

- Chapter 4, CostJoint Cost AllocationDocument25 pagesChapter 4, CostJoint Cost AllocationDEREJENo ratings yet

- Solution Manual FIM 7sem TU-1Document32 pagesSolution Manual FIM 7sem TU-1rabin neupaneNo ratings yet

- Ro81bacx0000001363339000 Ron 092023Document2 pagesRo81bacx0000001363339000 Ron 092023adrianabirceanuNo ratings yet

- ZS13 G L Account Hierarchy 29072022Document24 pagesZS13 G L Account Hierarchy 29072022nawairishfaqNo ratings yet

- Finalchapter 23Document7 pagesFinalchapter 23Jud Rossette ArcebesNo ratings yet

- Balawrex Reviewer 2Document7 pagesBalawrex Reviewer 2Princess GomezNo ratings yet

- International Accounting Standards in French Companies in The 1990s: An Institutionalization Contested by Us GaapDocument25 pagesInternational Accounting Standards in French Companies in The 1990s: An Institutionalization Contested by Us GaapShirley FebliciaNo ratings yet

- KiTTC - Audit Evidence & TriangulationDocument47 pagesKiTTC - Audit Evidence & TriangulationDung HàNo ratings yet

- Investment in Equity Securities - Problem 16-2, 16-3, 16-10. and 16-11Document6 pagesInvestment in Equity Securities - Problem 16-2, 16-3, 16-10. and 16-11Jessie Dela CruzNo ratings yet

- Short-Term Financial Planning: Mcgraw-Hill/IrwinDocument23 pagesShort-Term Financial Planning: Mcgraw-Hill/IrwinUmair Latif KhanNo ratings yet

- Satish: Mobile: +91-7829764822Document1 pageSatish: Mobile: +91-7829764822Anonymous xMYE0TiNBcNo ratings yet

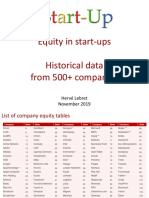

- Equity List in About 525 Startups - Lebret - October 2019Document543 pagesEquity List in About 525 Startups - Lebret - October 2019Herve Lebret100% (2)

- Lesson 2 Business LawDocument3 pagesLesson 2 Business LawAshok ReddyNo ratings yet

- 0efd540ca24e3b7470a3673d1307d5adDocument93 pages0efd540ca24e3b7470a3673d1307d5adAtiaTahiraNo ratings yet

- Burger King India: SubscribeDocument13 pagesBurger King India: SubscribeLalit VashistaNo ratings yet

- Quiz Bomb FDDocument12 pagesQuiz Bomb FDTshering Pasang SherpaNo ratings yet

- Income Taxation CHAPTER 6Document14 pagesIncome Taxation CHAPTER 6Mark67% (3)

- CH 8 Abs-Var Costing & Inv MNGTDocument21 pagesCH 8 Abs-Var Costing & Inv MNGTArnalistan EkaNo ratings yet

- Lesson 1 - The Nature of BusinessDocument67 pagesLesson 1 - The Nature of BusinessIvan Cryolle AbuyuanNo ratings yet

- Alfalah Bank PDFDocument334 pagesAlfalah Bank PDFrahim Abbas aliNo ratings yet

- Depreciation Practice in BangladeshDocument11 pagesDepreciation Practice in BangladeshSadharon CheleNo ratings yet

- Cluster A Far LVL 1 - TosDocument2 pagesCluster A Far LVL 1 - TosEunice VillacacanNo ratings yet

SIE Class Summary: Please Review Them Multiple Times Before Your Actual Test. They Are Not Intended

SIE Class Summary: Please Review Them Multiple Times Before Your Actual Test. They Are Not Intended

Uploaded by

Shuchana HadyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SIE Class Summary: Please Review Them Multiple Times Before Your Actual Test. They Are Not Intended

SIE Class Summary: Please Review Them Multiple Times Before Your Actual Test. They Are Not Intended

Uploaded by

Shuchana HadyCopyright:

Available Formats

SIE Class Summary

This summary highlights important and heavily tested concepts on the SIE exam.

Please review them multiple times before your actual test. They are not intended

as a substitute for the textbook, class attendance, or practice examinations but

instead will help you focus your study efforts as the exam approaches.

Contents

Chapter 1 – Equity Securities ................................................................................................................ 2

Chapter 2 – Debt Securities .................................................................................................................. 5

Chapter 3 – Types of Bonds .................................................................................................................. 7

Chapter 4 – Investment Company Securities ................................................................................ 10

Chapter 5 – Other Managed Products ........................................................................................... 13

Chapter 6 – Options .............................................................................................................................. 15

Chapter 7 – Suitability and Investment Risks .................................................................................. 17

Chapter 8 – Issuing Securities ............................................................................................................. 18

Chapter 9 – The Secondary Market and Equity Trading ............................................................ 20

Chapter 10 – Economics and Monetary Policy ............................................................................ 22

Chapter 11 – Customer Accounts .................................................................................................... 24

Chapter 12 – Tax-Advantaged Accounts and Products ........................................................... 29

Chapter 13 – FINRA Registration ........................................................................................................ 33

Chapter 14 – Business Conduct Rules .............................................................................................. 35

Version: 2021 V9 Confidential—For Knopman Marks Students Only Page 1 of 39

SIE Class Summary

Chapter 1 – Equity Securities

1. Treasury Stock: Treasury stock is authorized stock that was previously sold to

the public but was repurchased by the issuer. Because it is no longer

outstanding, the company’s share count will fall, and the shares no longer

receive dividends or have voting rights. Treasury shares may be held by the

company, reissued to the public, or cancelled.

2. Company Repurchases: A company that believes its stock is undervalued

may repurchase shares in the open market (creating treasury stock).

3. Voting Rights: Holders of common stock have voting rights, which allow

them to exercise control by electing the board of directors and voting on

corporate policy. This contrasts with holders of preferred stock, who

typically do not have voting rights.

4. Statutory Versus Cumulative Voting: Voting by common stockholders can

be carried out by one of two methods.

• Statutory voting allows a shareholder to vote one time per share for

each seat on the board of directors. For example, if an investor

owns 100 shares of common stock and there are three board seats

to be filled, they can cast up to 100 votes for each of the three

seats.

• Cumulative voting allows the shareholder to pool their votes

together and allocate them as desired. For example, the

shareholder above can aggregate all of their votes – 300 total (100

votes x 3 seats) and allocate them however they choose (e.g. they

could cast all 300 votes for one candidate or cast 200 for one

candidate and the remaining 100 votes for another).

5. Form 10-K: Public companies must file annual financial reports (which

includes financial statements) called 10-ks with the SEC within 90 days of

year-end.

6. Pre-Emptive Rights: Pre-emptive rights allow a current shareholder to

maintain their proportionate ownership interest and avoid dilution when a

company issues additional shares.

7. Warrants: Warrants are typically issued by a company in conjunction with

another security to make that other security more attractive to investors.

For example, a company might use a warrant as a sweetener for investors

as part of a debt deal. Unlike pre-emptive rights, warrants do not prevent

dilution.

8. Warrants As Equity Securities: Warrants are considered equity securities

(not debt securities) because if the warrant is exercised, the investor will

Version: 2021 V9 Confidential—For Knopman Marks Students Only Page 2 of 39

SIE Class Summary

receive shares in the underlying company. Importantly, warrants do not

make interest payments to investors.

9. Value of Warrants: A warrant provides an investor the ability to purchase a

company’s stock at a specified exercise price for a set time period. For

example, the investor is given the right to purchase the stock at $100 per

share. The investor would want to exercise this right if the price increases

above the exercise price (e.g. an investor wants to pay $100 for stock

worth $150 not for stock only worth $50) and therefore the market value of

a warrant is tied to the value of the underlying stock.

10. Issuance Price of Warrants: Warrants are generally not issued with intrinsic

value, meaning they are issued with an exercise price above the current

market value of the stock. For example, if the current stock price is $50,

the exercise price given to the warrants might be $80. For the warrants to

be exercised by an investor, the price would have to increase above the

exercise price.

11. Define Penny Stock: Penny stocks are defined as OTC equity securities

(i.e. unlisted) worth less than $5.00 per share.

12. Blue Chip Versus Penny Stocks: Stocks of well-established, stable

companies with a long history of steady earnings and dividends are

known as blue chip stocks. Blue chip stocks typically trade on the major

exchanges such as the NYSE or Nasdaq. Penny stocks are riskier, more

volatile, and less liquid than blue chip stocks.

13. Wilshire 5000: The Wilshire 5000 is an index which measures the value of

U.S. companies with actively traded stock.

14. Business Risk: Non-systematic risk is business risk, which is the risk that a

specific company may not be profitable.

15. Risk of ADRs: American depositary receipts (ADRs) help to facilitate the

trading of a foreign corporation’s stock in the US. Investors in ADRs face

political risk, which is the risk that political instability and uncertainty in that

foreign country might negatively impact their investment. Importantly,

because ADRs are common stock and not debt securities, they do not

have call risk or interest rate risk.

16. Withholding Taxes: When a foreign corporation pays a dividend, a bank

will take the foreign dividend payment (e.g. Euro or Japanese Yen) and

convert it into US dollars for the ADR holder. It is possible that the ADR

holder might receive a lower dividend than was actually declared

because the foreign government might withhold a percentage of the

dividend for taxes.

17. Cumulative Preferred Stock: Cumulative preferred stock allows investors to

receive dividends in arrears. This means that if a dividend is skipped for

Version: 2021 V9 Confidential—For Knopman Marks Students Only Page 3 of 39

SIE Class Summary

cumulative preferred shareholders, they must receive both current and

skipped dividend payments before any dividend payment can be made

to common shareholders. This is a benefit for the investor as it entitles them

to receive missed dividend payments.

18. Transfer Agent Versus Custodian: A transfer agent of an issuer is

responsible for issuing and cancelling certificates and processing investor

mailings (e.g. proxies). A custodian, on the other hand, is responsible for

holding investor assets or securities for protections. A custodian may also

maintain certain investor records.

19. Cash Dividend Taxation: Cash dividends on stock received by an investor

are taxable as ordinary income and do not increase the investor’s cost

basis.

20. Ex-Dividend Date: The ex-date is the first day purchasers of the stock will

not receive a dividend. This is because the trade will not settle on or

before the record date. For a regular way trade, which settles T + 2 (two

business days after the trade date), the ex-date is the business day before

the record date.

21. Order of Dividend Process: Make sure to know the order of dates in the

dividend payment process. 1) Declaration Date, 2) Ex-Dividend Date, 3)

Record Date, 4) Payment Date.

22. Stock Splits: A stock split is an artificial adjustment in the issuer’s

outstanding share count and stock price. Importantly, because the

number of shares and price change in proportion with one another, the

overall value of the company as well as the investor’s ownership position

in the company remain unchanged. For example, if an investor owned

$1,000 of stock before a stock split, they will still own $1,000 of stock after.

23. Forward Stock Split: In a forward stock split, the number of outstanding

shares increases, and the share price is reduced proportionally. For

example, after a 2-for-1 split an investor owning 100 shares of stock at $30

per share will now own 200 shares at $15 per share. Both before and after

the split, the value of the investor’s position remains $3,000.

24. Reverse Stock Split: In a reverse stock split, the number of outstanding

shares is reduced, and the share price is increased proportionally.

Generally, a reverse split is used by a company to inflate their stock price

and avoid falling below the minimum price required for exchange listing.

For example, after a 1-for-10 split an investor owning 100 shares of stock at

$1 per share will now own 10 shares at $10 per share. Both before and

after the split, the value of the investor’s position remains $100.

Version: 2021 V9 Confidential—For Knopman Marks Students Only Page 4 of 39

SIE Class Summary

25. Stock Dividend Taxation: Stock dividends are not taxed when received by

a shareholder. However, the basis of the investor’s position is adjusted

downward to reflect the new number of shares.

• Example: Assume an investor holds 100 shares of stock valued at $50

per share and receives a 10% stock dividend. The $5,000 value ($50

x 100 shares) of the total position does not change, so the investor

now has 110 shares with an adjusted basis of $45.45 (calculated as

$5,000 total value/110 shares).

26. Short Sale: Selling short is when an investor, believing the price of the

security will decline, sells borrowed shares in the market, hoping to

repurchase and replace the shares at a lower price than what they were

initially sold for. Theoretically, because the price of the shares can rise

indefinitely (rather than fall as the investor wants), short sellers have

unlimited risk potential.

Chapter 2 – Debt Securities

1. Discount Versus Premium Bond: When the market value of a bond is

greater than the par value, the bond is trading at a premium. If the

market value of the bond is below par value, the bond is trading at a

discount.

2. Nominal Yield: Also referred to as the coupon, the nominal yield is the

annual interest rate paid to the investor. Unlike other bond yields, the

nominal yield is fixed and does not change over the life of the bond. For

example, a bond that pays a 5% coupon, pays the same 5% of $1,000

(par value) or $50 of interest per year throughout the life of the bond.

3. Current Yield: The current yield of a bond is calculated as the annual

interest divided by the market price. If the semiannual coupon is

provided, make sure to multiply by two to annualize.

• Example: A bond is trading at $960 and pays a $15 semiannual

coupon. Current yield is calculated as the annual interest of $30

($15 x 2) divided by the market price of $960. Therefore, current

yield is 3.1%.

4. Interest Rate Risk: The risk that if interest rates increase, the price of

outstanding bonds will fall. Long-term, low-coupon bonds (including zero-

coupon bonds) have the greatest interest rate risk, meaning they are most

sensitive to changing rates. Although a Treasury bond has no credit risk, as

they are guaranteed by the full faith and credit of the US government,

they still are very susceptible to interest rate risk given their long-term (e.g.

30 year) maturity.

Version: 2021 V9 Confidential—For Knopman Marks Students Only Page 5 of 39

SIE Class Summary

5. Reinvestment Rate Risk: The risk that as interest rates fall, that the semi-

annual coupon payments that an investor receives will be reinvested

back into the market at a lower rate of return. Note that zero coupon

bonds do not have reinvestment rate risk as there are no cash flows to

reinvest.

6. Duration: Duration is a measure of a bond’s sensitivity to changing interest

rates. Bonds with a longer duration are more sensitive to changing rates.

7. Bond Pricing: The price of a bond is affected most by interest rates.

Factors like credit rating, market demand, and earnings potential of the

company are not as impactful.

8. Serial Bonds: In a serial bond issue, the outstanding bonds mature at

different intervals with a portion of the issue maturing each year.

9. Call Feature: If a bond is callable, the issuer has the right to buy it back

from the investor prior to maturity. Typically, the issuer will redeem a bond

if interest rates decline, allowing the company to issue new bonds at a

lower interest rate. A call feature benefits the issuer, not the investor.

10. Call Protection: Issuers can call callable bonds at any time unless the

bond has a call protection period. If there is call protection, the issuer

must wait until the period expires. Callable bonds with call protection are

safer for investors.

• Example: A 20-year bond with a 10-year call protection period

could be called any time after year 10 through maturity.

11. Call Price: When an issuer calls bonds, it must pay the investor par value +

any call premium (if applicable) + interest accrued to that date. Investors

receive no interest after the bond is called.

12. Default: If an interest payment is missed on an outstanding debt

obligation, the bond will default.

13. Credit Ratings: Bond rating services publish credit ratings to inform

investors of a bond’s credit quality. A bonds credit rating may change

periodically while it is outstanding. Credit ratings are typically a big factor

in the liquidity of bonds (even more so than the coupon or maturity).

14. Adjusting Premium Bonds by Amortization: Bonds purchased at a premium

(> $1,000 par) must be amortized over the life of the bond. Amortization

means that the cost basis will be adjusted downwards each year so that

at maturity an investor’s cost basis is $1,000 par. What will amortization

effect? Amortization effects a bond’s cost basis (downwards) and should

the investor sell the bond prior to maturity, the profit or loss on the

transaction. Amortization does not affect sale proceeds (what a

purchaser is willing to pay).

Version: 2021 V9 Confidential—For Knopman Marks Students Only Page 6 of 39

SIE Class Summary

• Example: When an investor purchases a bond at a premium, the

cost basis will be adjusted downward towards par on a straight-line

basis. This is referred to as amortization. For example, a 10-year

bond bought at 110 would be adjusted by one point per year,

calculated as: 10-point premium / 10 years to maturity = 1 point per

year.

15. Accretion of Discount Bonds: Discount bonds will be accreted, which is

similar to amortization, but the cost basis is adjusted upwards (towards

par) each year.

16. Accrued Interest: Accrued interest is the interest paid by the buyer of the

bond to the seller of the bond when the bond is trading between coupon

dates. A bond the trades with accrued interest is said to trade “and” or

“with” interest. The accrued interest is taxable for the recipient as ordinary

income, though it does not impact the cost basis of the bond. A bond

that trades without accrued interest (e.g. a bond in default, or a zero

coupon instrument) is said to trade flat.

17. Dated Date: The dated date is the date when interest begins to accrue on

fixed income securities. The dated date is only relevant for new issuances

and once regular semi-annual coupon payments begin, it is no longer

relevant.

Chapter 3 – Types of Bonds

1. Unsecured Corporate Debt: Unsecured corporate debt is not backed by

collateral or a specific asset of the corporation. Instead, it is backed by

the good faith and credit quality of the company. It is also referred to as a

debenture bond.

2. Convertible Bonds: Convertible bonds are a type of corporate bond

where the investor has the right to convert the bond into the company’s

underlying common stock. Because of this conversion benefit for the

investor, convertible bonds pay a lower rate of interest compared to

similar non-convertible bonds.

3. Convertible Bond Pricing: The value of a convertible bond is based on the

value of the underlying common stock, since the investor can exchange

the bond for the shares. The parity price is the value at which the investor

is mathematically indifferent between owning the bond or converting into

the underlying shares.

Version: 2021 V9 Confidential—For Knopman Marks Students Only Page 7 of 39

SIE Class Summary

4. Non-Marketable US Government Securities: The US government issues

both marketable and non-marketable debt securities. Marketable

securities can be freely traded by investors and include US Treasury

securities, such as Treasury bills, Treasury notes, and Treasury bonds. Non-

marketable securities, for example US savings bonds, cannot be resold by

investors and therefore have no secondary market.

5. Series I Bond: A Series I bond is a non-marketable US Treasury savings

bond. It pays a combination of fixed and variable interest (linked to the

rate of inflation).

6. Risk of Treasury Securities: Treasury securities do not have credit risk but

are subject to interest rate risk, purchasing power risk and political risk. An

investor purchasing treasury securities would be more concerned with

interest rate risk than political or credit risk.

7. Taxation of Treasury Securities: The interest income from Treasury bonds is

taxed at the federal level, but not at the state or local levels.

8. Treasury Receipts: Treasury receipts are zero-coupon bonds that are

structured by broker-dealers but backed by cash flows from Treasury

securities.

9. STRIPS: STRIPS are zero coupon bonds that are issued and backed by the

US Government. They are issued at a discount and mature to face value.

10. General Obligation Bonds: GO bonds are municipal securities used to

finance non-revenue facilities, such as public parks, public schools, and

public libraries. The interest and principal is backed by the full taxing

power of the issuing municipality.

11. Industrial Development Revenue Bonds: Industrial development revenue

bonds are a type of taxable municipal security that is issued by a

municipality on behalf of a corporation. Specifically, the municipality will

issue to debt to build a facility on behalf of a corporation and then lease

that facility to the corporation. Because the bonds are backed by lease

payments made by the corporation, the debt is the responsibility and

credit quality of the corporation.

12. Official Statement: The official statement is the primary disclosure

document used in connection with a municipal security offering. It

includes all relevant information for investors, such as the risks of the

bonds.

13. Ginnie Mae: Along with Fannie Mae and Freddie Mac, Ginnie Mae is an

issuer of mortgage-backed securities (MBS). However, Ginnie is the only

one of the three that is backed by the full faith and credit of the US

government. Because Fannie and Freddie are government sponsored

Version: 2021 V9 Confidential—For Knopman Marks Students Only Page 8 of 39

SIE Class Summary

enterprises, they only have an implied, but not an explicit backing of the

US government.

14. Agency Securities: Securities issued by Ginnie Mae, Fannie Mae, and

Freddie Mac – sometimes collectively referred to as “Agency Securities” –

are taxable at the federal, state, and local levels.

15. Money Market Instruments: Money market securities are short-term debt

instruments with maturities of one year or less. Because of their short-term

nature, they tend to be relatively liquid and low risk compared to longer-

term bonds. Examples include Treasury bills, commercial paper,

negotiable CDs, and banker’s acceptances. Additionally, once a Treasury

bond has only one year or less remaining until maturity, it can trade in the

money market.

16. Commercial Paper: Commercial paper is an unsecured promissory note,

issued by corporations at a discount. It typically has a maximum maturity

of 270 days.

17. Banker’s Acceptances: A banker’s acceptance is a money market

instrument that is used to finance and facilitate international trade.

18. Eurodollar Deposit: Eurodollars are U.S. Dollars held in a depository (bank)

abroad. E.g. A swiss bank account denominated in U.S. dollars would

hold Eurodollar deposits. These are used by foreign corporations (or

individuals) who have US currency abroad.

19. Eurodollar Bonds: Eurodollar bonds are bonds issued outside the United

States (e.g. Argentina) but denominated in U.S. dollars. Par is $1,000 USD;

coupon payments are made in USD. These are issued and trade outside

the U.S. and are not registered with the SEC. Issuers use Eurodollar bonds

to make their securities more marketable (e.g. the issuer’s home currency

is unstable).

20. Tax-Equivalent Yield: To determine the interest an investor must earn on a

taxable corporate bond to equal the tax-free yield of a municipal bond,

an investor can calculate the tax-equivalent yield, which is the tax-free

yield of the municipal bond divided by (100% - Tax Rate).

• Example: For an investor in the 35% tax bracket who owns a 5% tax-

free municipal bond, the tax-equivalent yield is 7.69%, calculated as

5%/(100% - 35%). This means that a taxable bond yielding 7.69%

produces equal after-tax income to a tax-free municipal bond

yielding 5% for this investor in the 35% tax bracket.

Version: 2021 V9 Confidential—For Knopman Marks Students Only Page 9 of 39

SIE Class Summary

Chapter 4 – Investment Company Securities

1. Summary Prospectus: The SEC allows a mutual fund to deliver a summary

prospectus to shareholders, which is a compilation of highlights from the

longer prospectus. A summary prospectus includes the fund’s investment

objectives, fee structure, and other pertinent information. It must be

provided to investors prior to or at the time of sale.

2. Mutual Fund Shareholder Reports: Mutual funds are required to send

financial reports to shareholders which include financial statements (e.g. a

balance sheet and income statement) and detail the holdings of the

fund’s portfolio. These reports must be sent semiannually.

3. Mutual Fund Custodian: A bank or trust company acts as custodian for

mutual fund sand is responsible for the holding and safekeeping of the

fund’s securities and cash.

4. Net Investment Income: Net investment income is the total profits that an

individual earns from their investments. For mutual fund investments, this

would include any dividends plus interest income plus net capital gains

(capital gains minus capital losses).

5. Forward Pricing: When an investor purchases shares of a mutual fund, the

price they pay is based on the next NAV (net asset value) calculation

after the order is received. The NAV is calculated daily based on the

closing price of the market. This is referred to as forward pricing. For

example, if on Monday a customer places an order to buy shares at

5:00pm, which is after the market close, the price they would pay for the

shares is based on Tuesday’s closing price. The share price is not

calculated based on the prior day’s closing price or the next day’s

opening price.

6. Expense Ratio: Every mutual fund has an expense ratio, which is the

percentage of the fund’s total assets that will be used to cover the

expenses of the fund. It is calculated as (management fees plus operating

expenses) divided by the average annual net assets of the fund. The

fund’s expense ratio would increase if the operating expenses of the fund

were rising faster than the value of the fund’s investments.

7. 12b-1 Fee: 12b-1 fees are annual fees paid by mutual funds shareholders

to cover the marketing and administrative expenses of the fund. 12b-1

fees do not cover management expenses or trading fees.

8. Fund Share Classes: Mutual funds can have different share classes. Class A

shares have an upfront sales charge. Class B shares have a back-end

load (aka contingent deferred sales charges or CDSCs), which investors

pay when they redeem their shares. Class C shares have level loads. All

share classes have 12b-1 fees, but Class B and C 12b-1 fees are usually

Version: 2021 V9 Confidential—For Knopman Marks Students Only Page 10 of 39

SIE Class Summary

higher than Class A shares. Class A shares are the only share class that can

benefit from breakpoints.

9. No-Load Fund: No-load funds are mutual funds that do not charge a sales

charge. They are purchased by investors at the NAV.

10. Mutual Fund Suitability: When deciding on a mutual fund investment, the

investor’s investment objectives are the primary consideration. Fees are of

secondary importance. Note that the size of the fund is typically the least

important factor.

11. Letter of Intent (LOI): A letter of intent allows a mutual fund shareholder to

invest in installments and receive breakpoints, which are discounts off of

the sales charge. A letter of intent can be used for up to 13 months and

can be backdated 90 days.

12. Breakpoint Sale: A breakpoint sale is a violation where a registered rep

suggests that an investor purchases a mutual fund just below the point at

which they would receive a discounted sales charge. For example, if

there is a breakpoint at $250,000, suggesting the customer only invest

$249,000 is a violation.

13. Municipal Bond Funds: A municipal bond fund, also referred to as a tax-

exempt bond fund, is a mutual fund consisting of tax-free municipal

bonds. These funds are most appropriate for high-net-worth investors in

high tax brackets who will most benefit from the tax-free nature of the

interest income. When the fund pays out its net investment income to

investors, the dividends are tax-free because they represent the tax-free

interest income, though any capital gains distributions are taxable.

14. Money Market Fund: Money market funds are mutual funds consisting of

money market securities, which are debt securities with maturities of one

year or less. Because of the nature of the securities they invest in, money

market funds are extremely safe and highly liquid. These funds generally

attempt to maintain a stable NAV of $1.00 per share, though the price

can fluctuate above or below that amount. Investments in a money

market fund are least exposed to currency risk as the investments are held

in US dollars. They would be subject to inflationary risk.

15. Mutual Fund Investment Strategies: Mutual funds can invest in equities,

corporate bonds and other registered securities. An investor who is

seeking a combination of interest income and growth potential can invest

in a diversified mutual fund that offers exposure to both debt and equity.

16. Prohibited Mutual Fund Strategies: Mutual funds cannot sell stock short or

borrow money.

Version: 2021 V9 Confidential—For Knopman Marks Students Only Page 11 of 39

SIE Class Summary

17. Cost Basis: Cost basis is the original value of an asset for tax purposes. If

the asset is later sold for a profit, the difference between the cost basis

and sales proceeds reflects the investor’s taxable capital gain.

Importantly, any dividends reinvested by an investor would increase their

cost basis as the investor will have already paid tax on that income. For

example, if an investor’s original cost basis in a mutual fund is $1,000 and

the investor receives $200 in dividends which they reinvest into the fund,

their cost basis would be adjusted upwards to $1,200.

18. Mutual Fund Dividends: Mutual fund cash dividends are taxable for

investors regardless of whether they are taken in cash or reinvested back

into the fund.

19. Impact of Dividends on NAV: The NAV of a mutual fund share will

decrease by the amount of the dividend on the ex-date. This is because

the fund is paying out cash so the fund’s assets will fall.

20. Index Fund Reconstitution: Index funds are mutual funds that seek to track

the performance of a specific index – i.e. the S&P 500. Because they

simply track an index and are not actively managed they have lower fees

and expenses than other types of mutual funds. Generally, the only time

the portfolio changes is when a company is added or subtracted from the

benchmark index. For example, when Facebook was added to the S&P

500, all of the index funds that tracked the S&P 500 purchased Facebook

stock. The process of updating the portfolio to continue to mirror the

underlying index is referred to as reconstitution.

21. Closed-End Fund Pricing: Similar to mutual funds, closed-end funds have a

net asset value, which is the total assets of the fund minus the total

liabilities. However, because closed-end funds are exchange-traded, they

can trade at a price either above or below their NAV based on the supply

and demand of the shares.

22. Unit Investment Trust (UIT): A UIT is an investment company security that

combines redeemable shares with a fixed portfolio. Specifically, the

portfolio is assembled by a sponsor, who does not actively trade the

portfolio.

23. Exchange-Traded Funds (ETFs): ETFs are investment company securities

that are designed to track a specific index or benchmark. Like closed-end

funds, ETFs are exchange-traded and thus investors pay commissions

when purchasing the shares.

24. ETFs Versus Mutual Funds: Mutual fund shares are redeemable, which

means they can only be bought from and sold back to the mutual fund.

There is no secondary market for mutual funds. In contrast, ETFs are

exchange-traded and can be bought and sold between investors

Version: 2021 V9 Confidential—For Knopman Marks Students Only Page 12 of 39

SIE Class Summary

throughout the day. Because ETFs have a secondary market, they are

considered more liquid than mutual funds.

25. ETF Versus Mutual Fund Expenses: Because mutual funds are actively

managed, they typically have higher fees for investors than ETFs.

Chapter 5 – Other Managed Products

1. REITs: A real estate investment trust (REIT) is a company that owns or

operates income-producing real estate or real estate-related assets. It is

not an investment company or direct participation program (DPP). REITs

are not subject to corporate tax (they pass through gains, though not

losses)) if they meet all three of the following criteria:

I. At least 75% of the assets must be invested in real estate

II. At least 75% of the REIT’s income must be derived from real estate,

and

III. 90% of the gains must be passed through to investors

2. REIT Investment Objective: The primary investment objective for a REIT

investor is current income in the form of dividends. This is because REITs are

required to pay out at least 90% of income to investors.

3. REIT Dividends: Dividends paid by a REIT are always taxed as ordinary

income, regardless of the holding period. This contrasts with dividends

paid by traditional corporations which are taxed at a lower rate as long

as the investor holds the stock for greater than 60 days.

4. Equity REITs: Equity REITs own and operate income-producing real estate.

They are professionally managed to generate income from rent received

as well as sales from the properties they hold.

5. Depletion: Depletion is a tax deduction that compensates a limited

partnership as they use up a natural resource such as oil or gas. Because

real estate is not a natural resource it cannot be depleted.

6. Passive Gains and Losses: Direct participation programs (DPPs) pass

through gains and losses to investors, which means there is no corporate

taxation, instead only the investors in the program pay tax. If there is a

passive loss, it can only be used to offset passive gains.

7. General Versus Limited Partners: In a limited partnership, the general

partner is the active partner in the business, managing the day-to-day,

whereas the limited partner contributes capital and from that point has a

passive involvement in the business. The general partner has unlimited

personal liability, whereas the limited partners have limited liability.

Version: 2021 V9 Confidential—For Knopman Marks Students Only Page 13 of 39

SIE Class Summary

8. Interest in a Limited Partnership: An interest in a limited partnership is an

equity security as it indicates the partner owns a piece of the partnership.

9. S-Corp Versus C-Corp: An S corporation is a type of DPP. Shareholders

receive a pass-through of income and losses, and the S-Corp entity is not

taxed. A C corporation is a taxable entity and shareholders receive

dividends that were taxed at the entity level and will be taxed again at

the shareholder level. Double taxation applies to dividends from C-Corps.

10. Raw Land Limited Partnership: Raw land LPs invest in a piece of land

hoping that it increases in value over time and that it can eventually be

sold for a profit. Because the land is not developed, there is no income or

depreciation from the ownership interest.

11. Dissolution of a Limited Partnership: When a limited partnership is dissolved,

the priority of claims against the partnership is:

I. Secured lenders

II. General creditors

III. Limited partners

IV. General partners

12. Hedge Funds: Hedge funds are typically only suitable investments for

institutional and sophisticated investors. This is because they often pursue

aggressive trading strategies, such as the use of derivatives as well as

purchasing stocks of distressed companies or those of public companies

looking to go private.

13. Hedge Fund Managers: Hedge fund managers receive management and

performance fees which are typically higher than fees charged for other

fund investments.

14. Fund of Hedge Funds: An investment in a “fund of hedge funds” offers the

liquidity of a mutual fund, but with risk more associated with a hedge

fund.

15. Prime Brokerage Accounts: Prime brokerage is a suite of bundled services

offered to hedge funds and other large institutional investors by banks

and wealth management firms.

16. Exchange-Traded Notes (ETNs): ETNs are of unsecured corporate debt

issued by a broker-dealer that combines principal protection with equity

market upside exposure. Because they are unsecured, although their

return is based on an underlying equity, they do not actually own that

security. This contrasts with ETFs, which own the securities in their portfolio.

The credit quality of an ETN is based on that of the issuing broker-dealer.

Version: 2021 V9 Confidential—For Knopman Marks Students Only Page 14 of 39

SIE Class Summary

Chapter 6 – Options

1. Options Clearing Corporation (OCC): The OCC issues and guarantees all

listed options contracts. Therefore, if an investor wants to exercise an

options position, their broker-dealer would notify the OCC who would

then assign their contract to an appropriate counterparty.

2. Listed Options: A listed option is issued by the OCC and not by the

underlying corporation (e.g. Apple or Facebook). Therefore, listed options

have no impact on the capital structure of a corporation as the company

itself is not raising money. A stock or bond issuance by a corporation

would impact its capital structure.

3. American-Style Options: American-style options can be exercised at the

strike price any time up to and including the expiration date. This contrasts

with European-style options which can only be exercised on the expiration

date.

4. LEAPS: A LEAP is a long-term option contract with a maturity of up to three

years. Operating like a conventional short-term option contract, a LEAP

provides an investor with longer exposure to the price movement of the

underlying security.

5. At-the-Money: Options are at-the-money when the market value is equal

to the strike price. When the option is at-the-money, the owner of the

option would let is expire and lose their premium.

6. Liquidate an Option: If an investor owns a call option which is in-the-

money (e.g. they own a 50 call with the stock trading at $60), the investor

will not necessarily exercise the option. Instead, they may opt to liquidate

their position (sell the option contract to another investor).

7. Maximum Gain on Long Call: When an investor buys a call option, they

have the right to buy the underlying stock at the strike price. Because

there is no limit on how high the stock price can rise, the maximum gain is

unlimited.

8. Obligation of Call Writer: If a call writer receives an assignment notice,

they will have an obligation to sell the stock at the strike price. In return for

this obligation, they receive the premium. Options are always written to

generate income in the form of the premium.

9. Risk of Uncovered Call: When an investor sells an uncovered call, they are

writing a call option without owning the underlying stock. This position has

unlimited risk because no matter how high the price of the stock

increases, the writer is obligated to purchase the shares in the market and

then sell the stock at the strike price. Because of this risk profile, uncovered

calls are typically inappropriate for retail investors.

Version: 2021 V9 Confidential—For Knopman Marks Students Only Page 15 of 39

SIE Class Summary

10. Covered Call Breakeven: A covered call is a strategy where an investor

sells a call option on a stock, while also owning that stock. To calculate

the breakeven of a covered call, which is the market value where there is

no profit or loss on the position, subtract the premium received from the

purchase price of the stock.

• Example: Investor owns 100 shares of XYZ stock @50 and sells 1 XYZ

Nov Call @5. The breakeven is $45 ($50 - $5). Put differently, the $5

premium received for writing the option provides investor with $5 of

downside protection on their stock.

11. Long Put Breakeven: The breakeven of a put option is calculated as the

strike price minus the premium. Take note, that purchasing multiple

contracts would not impact the breakeven point.

• Example: Investor buys 3 ABC Nov 60 Puts @5. The breakeven is $55

($60 - $5). The fact that the customer purchased three contracts

does not change breakeven.

12. Protecting a Short Put: If an investor sells (shorts) a put option, they have an

obligation to purchase the stock at the strike price regardless of how far

the price has fallen if they option is exercised against them. If the investor

wants to hedge against some of the downside risk, they can buy a put

option with a lower strike price in order to lock in a sale price for the

shares.

13. Volatility Market Index (VIX): The VIX, often referred to as the “fear index”,

measures the volatility of S&P 500 index options.

14. Index Options: Stock index options allow investors to speculate on the

performance of an index (e.g. S&P 500 or Nasdaq 100) or hedge their

existing stock portfolio. If an investor has a diversified portfolio of stocks

and they are concerned about market risk, they can purchase puts on

that an index to protect their portfolio. Index options are settled in cash;

there is no stock transaction.

15. Option Contract Adjustment: Options contracts are adjusted for stock

dividends. Specifically, the number of shares the contract represents will

increase, while the strike price will decrease proportionately. The total

value of the contract does not change.

• Example: An ABC 60 call is subject to a 6% stock dividend. The total

value of the contract is $60 strike price x 100 shares per contract =

$6,000. After the stock dividend, the investor will now have 106

shares (6% more). To find the new strike price: $6,000 total value

divided by 106 shares equals $56.60.

Version: 2021 V9 Confidential—For Knopman Marks Students Only Page 16 of 39

SIE Class Summary

16. Option Series: Options series are all call or put contracts in the same class

(call or put) with identical strike prices and expiration dates. For example,

a March 80 call and a March 80 put are of the same series

Chapter 7 – Suitability and Investment Risks

1. Institutional Threshold: Under FINRA suitability rules, an individual with

assets of at least $50 million is considered an institutional investor.

2. Preferred Stock Investment Objective: Preferred stock pays a fix quarterly

dividend and is therefore appropriate for an investor seeking current

income. However, because of the fixed dividend, preferred stock does

not have as much potential for appreciation and capital gains. For an

investor seeking growth, common stock would be more suitable.

3. Liquidity Risk: A security that cannot easily be sold is said to have liquidity

risk. Examples of illiquid investments include direct participation programs

and thinly traded stocks, such as penny stocks.

4. Safety and Preservation of Capital: An investment objective in which an

investor seeks no decline in the value of their investments. Suitable

investments for this strategy would include highly rated instruments such as

Treasury and money market securities. Investments where there is a risk of

loss of principal, such as common stock, penny stocks, direct participation

programs, and high-yield bonds, are inappropriate.

5. Fund Investing: If the manager of a fund believes there might be a short-

term drop in the market, they could keep excess cash in cash and cash

equivalents and then buy the dip.

6. Total Return on Equity: The total return on a stock investment is calculated

as (dividends plus capital gains) divided by the initial purchase price of

the shares.

• Example: Jane purchased ABC stock for $100 and sold it one year

later for $110. She also received $5 in dividends. Total return = ($5

dividend + $10 capital gain)/$100 purchase price = 15%

7. Current Yield of Common Stock: Another way to evaluate the return on

common stock is by calculating its current yield, which is the annual

dividend divided by the current market price. Make sure that if a quarterly

dividend is provided that you annualize it by multiplying by four.

• Example: XYZ stock is trading at $15 and pays a quarterly dividend

of $0.30. Current yield = ($0.30 x 4)/$15 = 8%

Version: 2021 V9 Confidential—For Knopman Marks Students Only Page 17 of 39

SIE Class Summary

Chapter 8 – Issuing Securities

1. Preliminary Prospectus: A preliminary prospectus can be used to market

to investors during the cooling-off period. The preliminary prospectus will

generally not include the timely details of the transaction, such as the

offer price or number of shares being registered. Instead, buyers must still

receive a final prospectus no later than the settlement date of the

transaction, which includes this information.

2. SEC Effectiveness: When the SEC declares a new issue effective, it clears

the securities for public sale. At this time a registered rep could say the

issue has been deemed effective, but could not say that it has been

approved by the SEC.

3. Prospectus Delivery: A prospectus or notice of its availability must be

delivered to investors for any sales for the first 25 days following an IPO.

4. Rule 147: Rule 147 allows an in-state business to raise capital in their home

state and avoid SEC registration. Under 147, 100% of the securities must be

sold to state residents who cannot resell outside the state for six months.

5. Regulation D: Regulation D is an exemption from SEC registration for

private placements. In a Reg D transaction, there are two types of

investors – accredited and non-accredited. Accredited investors include

1) officers and directors of the issuer, 2) institutions with at least $5 million in

assets, and 3) individuals with a net worth of at least $1 million, excluding

the value of their primary residence or individuals who earned at least

$200,000 in each of the past two years ($300,000 for married couples).

Anyone who is not defined as accredited is considered a non-accredited

investor. Although different types of private placement transactions exist,

generally there can be an unlimited number of accredited investors and

a maximum of 35 non-accredited participating in the deal.

6. Retired Individuals Accredited Status: An individual who consistently made

at least $200,000 during his or her career but has since retired would not

be accredited because once he or she retires there is not a reasonable

expectation for a similar income to continue.

7. Private Investment in Public Equity (PIPE): A PIPE deal is when a public

company raises capital through a private placement. A company might

do this in order to raise capital quickly and avoid the SEC registration

process.

8. Offering Memorandum: An offering memorandum is provided to investors

for disclosure like a prospectus, except it is used for offerings that are

exempt from SEC registration like private placements. Audited financial

statements are not required in an offering memorandum.

Version: 2021 V9 Confidential—For Knopman Marks Students Only Page 18 of 39

SIE Class Summary

9. Regulation S: Reg S is an exempt transaction which allows an issuer to raise

money outside the U.S. and avoid SEC registration.

10. Qualified Institutional Buyer (QIB): Rule 144A allows QIBs to freely trade

unregistered securities (e.g. private placements) among themselves. A

QIB is defined as an institution that manages at least $100 million of

discretionary assets.

11. Tender Offer Minimum Threshold: A tender offer is an offer by a company

or an outside investor to purchase at least 5% of the company’s shares

directly from the company’s shareholders. The purchaser making the offer

might qualify a tender with a minimum number of acceptable shares. This

means that unless shareholders agree to sell a certain number of shares,

the investor making the offer will not go through with any purchases.

• Example: InvestorCo is looking to purchase up to 10 million shares of

Company ABC at a price of $25 per share. InvestorCo sets a

minimum threshold of 8 million shares. If the shareholders of

Company ABC only agree to tender 6 million shares collectively,

InvestorCo will not go through with any purchases since the

minimum threshold was not met.

12. All Holders Best Price: All shareholders receive the exact same price in a

tender offer. This is sometimes referred to as “all holders best price”.

13. Oversubscribed Tender Offers: If a tender offer is oversubscribed, the

shares are accepted proportionally from those shareholders who

tendered.

• Example: If an investor seeks to purchase 10 million shares in a

tender offer, but shareholders collectively tender 100 million shares,

only 10% of each shareholders’ shares will be accepted. Therefore,

if a shareholder tendered 1,000 shares, only 100 of their shares (10%)

will actually be accepted.

14. Follow-On Offering: A follow-on is a public offering by an existing public

company that has already had its IPO.

15. Secondary Offering: A secondary offering is a new issue (could be an IPO

or follow-on) where shares are being sold by existing investors, not the

company. For example, if a private equity firm liquidates a position in a

company, this is a secondary offering.

16. Shelf Registration: A shelf registration allows an issuer to preregister

securities today and sell them at a later date when market conditions are

favorable. A shelf is good for up to three years and can be used for both

debt and equity follow-on offerings, but never for an IPO.

Version: 2021 V9 Confidential—For Knopman Marks Students Only Page 19 of 39

SIE Class Summary

17. Best Efforts: A best efforts is a type of underwriting where the underwriters

act as agents and have no financial responsibility for any unsold securities.

18. Restricted Persons: FINRA rules prohibit restricted persons from investing in

an IPO of common stock. Restricted persons include broker-dealers,

portfolio managers for their own personal accounts, employees of broker-

dealers, as well as their immediate family members. Under this rule

immediate family members include the spouse, parents, siblings, children,

and in-laws of the employee of a broker-dealer. Note who is not

immediate family and therefore not restricted: grandparents, aunts and

uncles, cousins, nieces and nephews, and ex-spouses.

19. Regulation M: Reg M is an SEC rule that aims to prevent market

manipulation of IPOs and follow-on offerings by broker-dealers.

20. Stabilization: Stabilization allows an underwriter to bid on securities in the

open market to prevent the price from declining following an IPO. The

underwriters are allowed to stabilize at or below the POP (public offering

price). For example, if XYZ stock went public at $30 per share, the

underwriters could stabilize at or below $30.

Chapter 9 – The Secondary Market and Equity Trading

1. Settlement: Settlement is the legal transfer of securities to a buyer’s

account and cash to seller’s account. The standard settlement cycle

varies for different securities:

• T+1 Treasures and listed options contracts

• T+2 Equities, corporate bonds and municipal bonds

Note: Customers have a two-day grace period to pay for their

securities under Regulation T, i.e. payment must be made by T+4.

2. Dealer Capacity: When a firm acts as a principal or dealer they are a

counterparty to the customer, trading from its own inventory. When the

firm sells to the customer they charge them a mark-up and when they buy

from the customer they charge them a mark-down.

3. Backing Away: Backing away is a violation that occurs if a market maker

fails to honor firm quotes.

4. OTC Quotes: Quotes on the OTC Bulletin Board (OTCBB) and OTC Pink

may be one-sided, meaning both a bid and ask are NOT required. Quotes

on national exchanges such as the NYSE, NASDAQ, and BATS are required

to be two-sided.

5. OTCBB Requirements: Companies that want to have their securities

quoted on the OTCBB must file current financial reports with the SEC.

Version: 2021 V9 Confidential—For Knopman Marks Students Only Page 20 of 39

SIE Class Summary

6. Market Orders: Market orders are executed immediately at the best

available price.

7. Market-On-Close: A market-on-close order is a market order that is held

and executed near the end of trading hours as close to the closing price

as possible.

8. Partial Execution of Customer Orders: Limit orders can be partially filled if

the trader cannot get the entirety of the order executed. However,

because stop orders become a market order once the order is activated,

there is no partial execution.

9. Adjustment of Orders: On the morning of the ex-dividend date any orders

that are entered at or below the market are adjusted downwards by the

amount of the dividend. This includes buy limit, sell stop, and sell stop limit

orders. Note that orders entered at or above the market, including sell

limit, buy stop, and buy stop limit orders, are not adjusted.

10. Order Splitting: Breaking a large customer order into smaller parts is

allowed if it will help achieve best execution for a customer. It is not

permitted if the sole purpose is to generate higher commissions.

11. Front-Running: Front-running is a prohibited activity whereby a registered

rep or a firm becomes aware of a large customer order and trade for his

personal account beforehand in the hopes the large order will increase

the stock price.

• Example: A firm receives an order from a customer to purchase

20,000 shares of XYZ stock. If the firm buys XYZ stock for itself before

executing the client’s order, that would be a front-running violation.

12. Trading Ahead of Research Reports: Trading ahead is a violation where a

broker-dealer or registered representative trades a security based on

nonpublic information contained in a research report prior to that report

being released to the public.

13. Arbitrage: Arbitrage occurs when an investor takes advantage of a

temporary price disparity in a security. An example is buying a stock on

one exchange for a low price and then reselling it on another exchange

for a higher price.

14. Spoofing: Spoofing is a form of market manipulation where a trader enters

an order to manipulate prices to be higher or lower, with no intent to

actually execute at the quoted price. In other words, spoofing refers to

entering orders to entice other participants to join on the same side of the

market, and then trading against the other market participants’ orders.

15. Pump and Dump: A pump and dump scheme is a form of securities fraud

where an investor uses false or misleading statements to artificially inflate

the price of an owned stock in order to resell the stock at a higher price.

Version: 2021 V9 Confidential—For Knopman Marks Students Only Page 21 of 39

SIE Class Summary

An example is when an investor is randomly solicited with positive

information over email or social media to purchase shares in a penny

stock or other risky investment.

16. Marking the Open or Close: Marking the open or marking the close is

when a trader attempts to manipulate the opening or closing price of a

security by entering a number of buy or sell orders just prior to the open or

close of trading.

17. Fourth Market: The fourth market refers to a market where securities trade

directly between institutions on a private, OTC computer network rather

than large exchanges such as the NYSE or NASDAQ.

Chapter 10 – Economics and Monetary Policy

1. Elasticity: Elasticity refers to the sensitivity of supply and demand of a

commodity to a change of price. If a commodity is demand elastic, that

means that as prices change, demand will change. For example, if prices

increase, demand will decrease, and vice versa. Alternatively, if a

commodity is demand inelastic, a change in price will have no impact on

demand for that product.

2. Recession: A recession is defined as a decline in gross domestic product

(GDP) for two or more consecutive quarters.

3. Gross Domestic Product (GDP): GDP is the total market value of good and

services produced within a country. It is a coincident indicator.

4. Economic Stabilizer: In a recession, the government would take steps to

increase GDP. This is sometimes referred to as an economic stabilizer.

5. Velocity of Money: The velocity of money is the rate of turnover of money,

or how fast it is being spent. It is usually measured as a ratio comparing

GDP to money supply. When money velocity is low, people are investing

and saving instead of spending.

6. Inverted Yield Curve: The yield curve graphs the relationship between

interest rates and time until maturity. An inverted yield curve occurs when

short-term rates are higher than long-term rates and can be a sign of a

recession.

7. Cyclical Stocks: Cyclical stocks are those that mirror the economy,

strengthening when the economy is growing and declining as the

economy contracts. Examples include auto and tech stocks.

8. Defensive Stocks: Defensive stocks are those that are resistant to

downturns in the economy because they supply consumers with basic

needs. Examples include utility and health care stocks.

Version: 2021 V9 Confidential—For Knopman Marks Students Only Page 22 of 39

SIE Class Summary

9. Impact of Inflation: Inflation describes rising prices for goods and services

over time. Typically, as inflation increases, interest rates will also increase.

Therefore, as inflation increases, bond prices will decrease (because of

the inverse relationship between interest rates and bond prices).

Conversely, in a deflationary environment, interest rates are falling, and

bonds will increase in value. Note that in an inflationary environment

bonds with longer maturities will have a greater price decrease than

those with shorter maturities.

10. Deflationary Environment: In a deflationary environment, outstanding

issues of corporate bonds are more attractive than new issues. This is

because the new issue would have a lower coupon, reflecting the

decline in interest rates that accompanies deflation.

11. Working Capital: Working capital is a metric that helps to measure how

much cash a company needs to finance its current operations. It can be

calculated from a company’s balance sheet as current assets minus

current liabilities.

12. Earnings Per Share (EPS): Earnings per share (EPS) is calculated as a

company’s net income divided by shares outstanding. Research analysts

commonly provide EPS estimates. Stock splits impact EPS, for instance,

when a company initiates a reverse stock split the company’s EPS would

increase due to same amount of earnings divided by a decreased

number of shares outstanding.

13. P/E Ratio: The price-to-earnings (P/E) ratio is calculated as a company’s

stock price divided by earnings per share.

14. PEG Ratio: In addition to the PEG ratio, the current yield (also called

dividend yield) and cash flow yield are methods to evaluate and

compare stocks.

15. Adam Smith: Adam Smith is considered the founder of classical economic

theory, which states that the economy best functions without government

interference.

16. Keynesian Economics: Keynesian economists believe that the economy is

best controlled through taxation and government spending.

17. Federal Reserve: The Federal Reserve is the central banking system of the

US. In its role of implementing monetary policy, the Fed has several tools

including conducting open market operations, setting the discount rate,

as well as reserve and margin requirements. To ensure compliance with

these requirements, the Federal Reserve Board will audit member banks.

18. Federal Reserve Stimulus: When the economy is slowing, the Fed cuts

interest rates to stimulate financial activity. This will lead to a fall in different

Version: 2021 V9 Confidential—For Knopman Marks Students Only Page 23 of 39

SIE Class Summary

interest rates such as the federal funds rate, mortgage rates, and savings

account rates.

19. Curb Inflation: When inflation is increasing, the Fed will tighten the money

supply by increasing interest rates. The Fed can tighten the money supply

by increasing the discount rate, selling government securities, or raising

the reserve requirement.

20. Discount Rate: The discount rate is the rate of interest that the Fed charges

banks for short term loans. To ease the money supply, the Fed would lower

the discount rate as this would allow banks to borrow at a cheaper rate.

To tighten the money supply, the Fed would raise the discount rate as this

would make it more expensive for banks to borrow money.

21. Order of Interest Rates: The order from highest to lowest is 1) prime rate, 2)

broker’s call rate, 3) discount rate, and 4) federal fund rate.

22. Trade Surplus Versus Trade Deficit: A trade surplus (exports are greater

than imports) will cause a company’s currency to appreciate. A trade

deficit will cause the currency to depreciate.

23. Purchasing Power Parity: Purchasing power parity compares the strength

of a country’s currency by determining how much it costs to buy the same

basket of goods. It is used to determine the exchange rate between the

currencies of different countries.

24. Producer Price Index: The Producer Price Index (PPI) measures inflation for

producers of products, such as manufacturers.

Chapter 11 – Customer Accounts

1. Telemarketing: FINRA and the MSRB have telemarketing rules that allow

firms to solicit new business by cold calling potential clients. Prior to

making a cold call, the caller must ensure the individual is not on the

national or firm’s do-not-call list. Cold calls are permitted between 8am

and 9pm in the time zone of the person being called.

2. Do-Not-Call List: Under the telemarketing rule, once an individual is added

to the firm’s internal do-not-call list, they remain there indefinitely.

3. Do-Not-Call List Exceptions: A registered rep can call an individual on the

do-not-call list if the individual is an existing customer of the firm, the

registered rep has a personal relationship with the individual, or if the

individual has provided prior written consent.

4. New Account Form: A new account form must be completed when a

customer opens a new brokerage account with a broker-dealer. Required

information includes the customer’s name, address, social security

Version: 2021 V9 Confidential—For Knopman Marks Students Only Page 24 of 39

SIE Class Summary

number, employment status, investment experience and objectives. The

firm is required to maintain a record of this form.

5. Numbered Account: A numbered account is a brokerage account that is

represented by a symbol or number, allowing the account holder (e.g. a

celebrity) to remain anonymous. The broker-dealer must still receive a

written statement of ownership and proof of identity from the client.

6. Free-Riding: Free-riding is a violation under Regulation T where an investor

sells their securities without ever paying for them. If this occurs, the

customer’s account will be frozen for 90 days and transactions in the

account will be limited to sell orders and purchases where the customer

fully pays upfront prior to trade.

7. Long Margin Account Initial Minimum Equity Requirement: Under FINRA

rules, if a customer wants to purchase less than $2,000 of stock in a margin

account, they must deposit 100% of the purchase price. For example, if a

customer wants to buy $1,000 of stock on margin, they must deposit the

full $1,000. If the customer wants to purchase between $2,000 and $4,000

in a margin account, they must deposit minimum initial equity of at least

$2,000. For example, if a customer wants to buy $3,000 of stock on margin,

they must deposit $2,000. For purchases above $4,000, the customer must

deposit 50% of the purchase price (Regulation T).

8. Short Sales in a Margin Account: All short sales must be executed in a

margin account. Additionally, Reg T requires the customer to deposit 50%

of the sale price. For example, if a customer sells short $100,000 of stock,

they are required deposit $50,000 in equity into the account.

9. Mark-to-Market: The value of a customer’s margin account is marked-to-

market daily to determine equity balances and margin calls.