Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

6 viewsA FINAL REV WMISummary - FINAL-2

A FINAL REV WMISummary - FINAL-2

Uploaded by

Tamiru TesfayeWMI is a microfinance program that provides loans, business training, and support groups to rural women in East Africa to start businesses. Borrowers are organized into village groups to guarantee each other's loans. Successful borrowers can later access bank loans. The program aims to fund 3 existing pilot loan hubs in Tanzania, Uganda, and Kenya to benefit 960 women directly and 9,600 villagers total. The project will improve women's lives by providing access to capital and skills training, increasing their confidence, incomes, and standards of living. WMI is a 501(c)(3) nonprofit run by a US-based staff and local hubs. It aims to fund the remaining $162,000 needed for the

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Contracting Meeting - Peter Block, Flawless ConsultingDocument16 pagesThe Contracting Meeting - Peter Block, Flawless ConsultingJonathan H West100% (1)

- Establishment and Expansion of Islamic Microfinance Instituitions (Mfis) in Africa by Farz FoundationDocument56 pagesEstablishment and Expansion of Islamic Microfinance Instituitions (Mfis) in Africa by Farz FoundationTamiru TesfayeNo ratings yet

- Communities, Ngos & Other Civil Society OrganizationsDocument12 pagesCommunities, Ngos & Other Civil Society OrganizationsTamiru TesfayeNo ratings yet

- Lean Production Systems in Practice: March 2012Document7 pagesLean Production Systems in Practice: March 2012Tamiru TesfayeNo ratings yet

- Licensing and Supervision of Micro Financing Institutions Proclamation No. 40-1996Document8 pagesLicensing and Supervision of Micro Financing Institutions Proclamation No. 40-1996Tamiru TesfayeNo ratings yet

- 3 - Burt County AppendixDocument77 pages3 - Burt County AppendixTamiru TesfayeNo ratings yet

- Braeside Primary School - Strategic PlanDocument10 pagesBraeside Primary School - Strategic PlanTamiru TesfayeNo ratings yet

- 1T6-220 Switched Ethernet Network Analysis and TroubleshootingDocument36 pages1T6-220 Switched Ethernet Network Analysis and TroubleshootingcertvistaNo ratings yet

- FEM Analysis and Mxy Moments in Concrete DesignDocument4 pagesFEM Analysis and Mxy Moments in Concrete DesignMarekNo ratings yet

- ISCN 2015 Abstract Summary PDFDocument26 pagesISCN 2015 Abstract Summary PDFJen LinaresNo ratings yet

- Indo-Pacific StrategyDocument24 pagesIndo-Pacific Strategy李修瑩No ratings yet

- B031910499 - Students Who Study Abroad Achieve Greater SuccessDocument9 pagesB031910499 - Students Who Study Abroad Achieve Greater SuccessIsrat DibaNo ratings yet

- Preliminary Full KrisDocument59 pagesPreliminary Full KrisKris Antonnete DaleonNo ratings yet

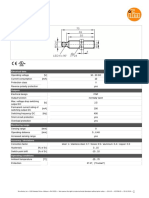

- Ig5788 03 - en UsDocument3 pagesIg5788 03 - en UsRachid SmailiNo ratings yet

- Analysis of Uti Mutual Fund With Reliance Mutual FundDocument64 pagesAnalysis of Uti Mutual Fund With Reliance Mutual FundSanjayNo ratings yet

- Ariesogeo BR Nse Ae - 0Document2 pagesAriesogeo BR Nse Ae - 0Martine OneNo ratings yet

- Mercedes Benz Brocure Mb900Document16 pagesMercedes Benz Brocure Mb900ramsi17No ratings yet

- Embedded Systems Design Flow Using Altera's FPGA Development Board (DE2-115 T-Pad)Document107 pagesEmbedded Systems Design Flow Using Altera's FPGA Development Board (DE2-115 T-Pad)john smithNo ratings yet

- Genzeb 2 On TaxDocument15 pagesGenzeb 2 On TaxAbu DadiNo ratings yet

- P Servo-EDocument64 pagesP Servo-EÉder Camargo100% (1)

- MAD Lab ManualDocument60 pagesMAD Lab Manualarun kumarNo ratings yet

- Limpiador de Serpetin Alkifoam Parker Virgina - MsdsDocument2 pagesLimpiador de Serpetin Alkifoam Parker Virgina - MsdsJessikAraceltyNo ratings yet

- Bank Soal MJK PDFDocument47 pagesBank Soal MJK PDFNabila Aulia RamadhaniNo ratings yet

- BP B2P WB Answer KeyDocument15 pagesBP B2P WB Answer KeyKim Nhung NguyễnNo ratings yet

- Problem 14 10Document2 pagesProblem 14 10indri retnoningtyasNo ratings yet

- Catálogo X1 PDFDocument60 pagesCatálogo X1 PDFAnderson OliveiraNo ratings yet

- Module 7 - Biggest Issues It Faces TodayDocument8 pagesModule 7 - Biggest Issues It Faces TodayErichelle EspineliNo ratings yet

- Self Declaration CertificateDocument1 pageSelf Declaration CertificatePuran SinghNo ratings yet

- Application To Pay Filing Fee in InstallmentsDocument2 pagesApplication To Pay Filing Fee in InstallmentsNatalie RowlandNo ratings yet

- Port Security Plan Establishment, Approval and UpdatingDocument16 pagesPort Security Plan Establishment, Approval and UpdatingromazNo ratings yet

- AHR 2016previewDocument29 pagesAHR 2016previewAnonymous XhkjXCxxsTNo ratings yet

- Ce1403 - Basics of Dynamics and Aseismic Design (For Vii - Semester)Document7 pagesCe1403 - Basics of Dynamics and Aseismic Design (For Vii - Semester)KarnalPreethNo ratings yet

- Kings - Indicator BibleDocument13 pagesKings - Indicator BibleAkelly47sNo ratings yet

- Management of Cybersecurity in Medical Devices - Diec 2020Document13 pagesManagement of Cybersecurity in Medical Devices - Diec 2020Haris Hamidovic100% (1)

- MicroProcessor Interview Questions and Answers 2Document1 pageMicroProcessor Interview Questions and Answers 2YESHUDAS MUTTUNo ratings yet

- Surface Defects in Steel ProductsDocument41 pagesSurface Defects in Steel ProductsShilaj PNo ratings yet

A FINAL REV WMISummary - FINAL-2

A FINAL REV WMISummary - FINAL-2

Uploaded by

Tamiru Tesfaye0 ratings0% found this document useful (0 votes)

6 views1 pageWMI is a microfinance program that provides loans, business training, and support groups to rural women in East Africa to start businesses. Borrowers are organized into village groups to guarantee each other's loans. Successful borrowers can later access bank loans. The program aims to fund 3 existing pilot loan hubs in Tanzania, Uganda, and Kenya to benefit 960 women directly and 9,600 villagers total. The project will improve women's lives by providing access to capital and skills training, increasing their confidence, incomes, and standards of living. WMI is a 501(c)(3) nonprofit run by a US-based staff and local hubs. It aims to fund the remaining $162,000 needed for the

Original Description:

Original Title

A_FINAL_REV_WMISummary_-_FINAL-2

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentWMI is a microfinance program that provides loans, business training, and support groups to rural women in East Africa to start businesses. Borrowers are organized into village groups to guarantee each other's loans. Successful borrowers can later access bank loans. The program aims to fund 3 existing pilot loan hubs in Tanzania, Uganda, and Kenya to benefit 960 women directly and 9,600 villagers total. The project will improve women's lives by providing access to capital and skills training, increasing their confidence, incomes, and standards of living. WMI is a 501(c)(3) nonprofit run by a US-based staff and local hubs. It aims to fund the remaining $162,000 needed for the

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

6 views1 pageA FINAL REV WMISummary - FINAL-2

A FINAL REV WMISummary - FINAL-2

Uploaded by

Tamiru TesfayeWMI is a microfinance program that provides loans, business training, and support groups to rural women in East Africa to start businesses. Borrowers are organized into village groups to guarantee each other's loans. Successful borrowers can later access bank loans. The program aims to fund 3 existing pilot loan hubs in Tanzania, Uganda, and Kenya to benefit 960 women directly and 9,600 villagers total. The project will improve women's lives by providing access to capital and skills training, increasing their confidence, incomes, and standards of living. WMI is a 501(c)(3) nonprofit run by a US-based staff and local hubs. It aims to fund the remaining $162,000 needed for the

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

Proposed Target Project: Women’s

Microfinance Initiative (WMI)

Brief Project Description:

WMI is a village level microfinance program that offers loans and business training to rural women in East Africa to start income generating

businesses. The borrowers are organized by village in solidarity groups of 20, and cross guarantee each other’s loans, creating a responsible

atmosphere with a high payment rate. After 24 months (4 loan cycles) successful WMI borrowers graduate to commercial bank loans with favorable

terms in a unique program offered by WMI’s partner banks. Loan groups are organized under a loan hub serving a geographical area and a hub is

“full” with 16 groups. A full loan hub becomes self-sustaining after two years as loan income & repayment is sufficient to support all future loans and

all program operations. By providing training/financial education, peer support and credit in areas with limited to no banking services, WMI promotes

women’s economic participation which produces a ripple effect on women and their communities. Ownership of the loan program is vested in the

community from Day One and WMI has a waiting list of women’s village groups that have requested assistance in starting a loan program in their

community. WMI also partners with local activists to provide supporting programs such as cervical cancer screening, domestic violence awareness,

teen-age girl empowerment to break the cycle of oppression, tree planting and clean water. WMI’s five year track record of substantive positive

impact on the villages has been documented by annual and longitudinal surveys of the 4,000 women in the program.

Specific Project Objectives:

In 2013, loans were issued to three pilot women's groups in Tanzania, Uganda and Kenya as ‘sisters’ of existing loan hubs. Due to their success,

WMI would use the FAWCO funds to turn the pilots into full-service loan hubs. Each full hub supports 16 groups of 20 women, so 3 new fully

functioning and independent loan hubs will initially benefit 960 women - each loan impacts at least 10 people (including family, employees, suppliers

and customers) meaning 9,600 villagers will benefit in just the first 2 years. Plus, the self-sustaining loan hub operations can continue indefinitely.

How does this project improve the lives of women?

Access to financial services is critical for rural women and their families to achieve long-lasting economic gains, but loans from formal financial

institutions are not available. By providing access to collateral free loans, training and education, WMI offers women immediate benefits of launching

microenterprises, increasing their skills, improving their ability to access traditional financing. They have increased self-confidence and become

better advocates for themselves and their families, as well as leaders in their communities. WMI's programs disrupt the economic gender inequality

that can lead to domestic violence. Other impacts: reduced financial dependence on men, increased incomes, improved household savings and

standards of living, building a permanent home with a cement floor, and savings for emergency needs.

Who will carry out the project?

Founded in 2007 by seven Washington, DC area women to address economic disenfranchisement of women in rural East Africa, WMI is a registered

501(c)(3), is governed by a pro bono board, which oversees program direction and oversight. Operational support is provided by a small US-based,

part time staff and numerous volunteers. All loan program operations and training functions are staffed (on a part-time paid basis by the borrowers)

at in-country hub offices. All Head Administrators in WMI loan hubs are local leaders in their communities, elected to their position by the women in

their community organization. Program operations are paid from income generated from interest on funds lent through the loan program.

Project Budget

The full cost to fund a loan hub is $75,000 ($64k permanent loan fund, plus business training and start-up costs). The three pilot programs have

already received partial funding; the remainder required to fund them is $162,000 ($54,000 x 3) over the next 2 years. With the FAWCO grant

providing the majority funding, WMI can commit to raising any shortfall from other sources to complete this project, so that FAWCO is assured its

investment in WMI is used effectively and efficiently and has maximum impact.

Which UN Millennium Development Goals will the project address?

1. Eradicate Extreme Poverty and Hunger – by 24 months, all borrowers earn over US$2,000/yr.- an increase of about 10,000% in 2 years.

2. Achieve Universal Primary Education – borrowers cite saving for school fees their highest priority.

3. Promote Gender Equality and Empower Women – by providing economic tools necessary to give women an opportunity to compete in the formal

economy, they are being recognized as motivated and strategic. Two borrowers have become local government representatives.

4. Reduce Child Mortality – increase income and savings enable women to improve living standards thus reducing child mortality.

5. Improved Maternal Health –access to nutrition and healthcare due to income earned in her business leads to improved maternal care.

6. Combat HIV/AIDS, Malaria, other Diseases – sponsors HIV/AIDS/ cervical cancer testing. Borrower + family members must have mosquito nets.

7. Ensure Environmental Sustainability – two specific programs: 1) Reducing wood as fuel: partnership for borrowers to purchase fuel efficient

stove; 2) Agro forestry training: protecting tree cover, environmental care. Borrowers are taught how to build nursery beds and provided seedlings.

8. Global Partnership for Development – support of sub goals: 1) an open, rule based predictable nondiscriminatory financial system; 2) making new

technologies available: WMI provides laptops and software to each loan hub location.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Contracting Meeting - Peter Block, Flawless ConsultingDocument16 pagesThe Contracting Meeting - Peter Block, Flawless ConsultingJonathan H West100% (1)

- Establishment and Expansion of Islamic Microfinance Instituitions (Mfis) in Africa by Farz FoundationDocument56 pagesEstablishment and Expansion of Islamic Microfinance Instituitions (Mfis) in Africa by Farz FoundationTamiru TesfayeNo ratings yet

- Communities, Ngos & Other Civil Society OrganizationsDocument12 pagesCommunities, Ngos & Other Civil Society OrganizationsTamiru TesfayeNo ratings yet

- Lean Production Systems in Practice: March 2012Document7 pagesLean Production Systems in Practice: March 2012Tamiru TesfayeNo ratings yet

- Licensing and Supervision of Micro Financing Institutions Proclamation No. 40-1996Document8 pagesLicensing and Supervision of Micro Financing Institutions Proclamation No. 40-1996Tamiru TesfayeNo ratings yet

- 3 - Burt County AppendixDocument77 pages3 - Burt County AppendixTamiru TesfayeNo ratings yet

- Braeside Primary School - Strategic PlanDocument10 pagesBraeside Primary School - Strategic PlanTamiru TesfayeNo ratings yet

- 1T6-220 Switched Ethernet Network Analysis and TroubleshootingDocument36 pages1T6-220 Switched Ethernet Network Analysis and TroubleshootingcertvistaNo ratings yet

- FEM Analysis and Mxy Moments in Concrete DesignDocument4 pagesFEM Analysis and Mxy Moments in Concrete DesignMarekNo ratings yet

- ISCN 2015 Abstract Summary PDFDocument26 pagesISCN 2015 Abstract Summary PDFJen LinaresNo ratings yet

- Indo-Pacific StrategyDocument24 pagesIndo-Pacific Strategy李修瑩No ratings yet

- B031910499 - Students Who Study Abroad Achieve Greater SuccessDocument9 pagesB031910499 - Students Who Study Abroad Achieve Greater SuccessIsrat DibaNo ratings yet

- Preliminary Full KrisDocument59 pagesPreliminary Full KrisKris Antonnete DaleonNo ratings yet

- Ig5788 03 - en UsDocument3 pagesIg5788 03 - en UsRachid SmailiNo ratings yet

- Analysis of Uti Mutual Fund With Reliance Mutual FundDocument64 pagesAnalysis of Uti Mutual Fund With Reliance Mutual FundSanjayNo ratings yet

- Ariesogeo BR Nse Ae - 0Document2 pagesAriesogeo BR Nse Ae - 0Martine OneNo ratings yet

- Mercedes Benz Brocure Mb900Document16 pagesMercedes Benz Brocure Mb900ramsi17No ratings yet

- Embedded Systems Design Flow Using Altera's FPGA Development Board (DE2-115 T-Pad)Document107 pagesEmbedded Systems Design Flow Using Altera's FPGA Development Board (DE2-115 T-Pad)john smithNo ratings yet

- Genzeb 2 On TaxDocument15 pagesGenzeb 2 On TaxAbu DadiNo ratings yet

- P Servo-EDocument64 pagesP Servo-EÉder Camargo100% (1)

- MAD Lab ManualDocument60 pagesMAD Lab Manualarun kumarNo ratings yet

- Limpiador de Serpetin Alkifoam Parker Virgina - MsdsDocument2 pagesLimpiador de Serpetin Alkifoam Parker Virgina - MsdsJessikAraceltyNo ratings yet

- Bank Soal MJK PDFDocument47 pagesBank Soal MJK PDFNabila Aulia RamadhaniNo ratings yet

- BP B2P WB Answer KeyDocument15 pagesBP B2P WB Answer KeyKim Nhung NguyễnNo ratings yet

- Problem 14 10Document2 pagesProblem 14 10indri retnoningtyasNo ratings yet

- Catálogo X1 PDFDocument60 pagesCatálogo X1 PDFAnderson OliveiraNo ratings yet

- Module 7 - Biggest Issues It Faces TodayDocument8 pagesModule 7 - Biggest Issues It Faces TodayErichelle EspineliNo ratings yet

- Self Declaration CertificateDocument1 pageSelf Declaration CertificatePuran SinghNo ratings yet

- Application To Pay Filing Fee in InstallmentsDocument2 pagesApplication To Pay Filing Fee in InstallmentsNatalie RowlandNo ratings yet

- Port Security Plan Establishment, Approval and UpdatingDocument16 pagesPort Security Plan Establishment, Approval and UpdatingromazNo ratings yet

- AHR 2016previewDocument29 pagesAHR 2016previewAnonymous XhkjXCxxsTNo ratings yet

- Ce1403 - Basics of Dynamics and Aseismic Design (For Vii - Semester)Document7 pagesCe1403 - Basics of Dynamics and Aseismic Design (For Vii - Semester)KarnalPreethNo ratings yet

- Kings - Indicator BibleDocument13 pagesKings - Indicator BibleAkelly47sNo ratings yet

- Management of Cybersecurity in Medical Devices - Diec 2020Document13 pagesManagement of Cybersecurity in Medical Devices - Diec 2020Haris Hamidovic100% (1)

- MicroProcessor Interview Questions and Answers 2Document1 pageMicroProcessor Interview Questions and Answers 2YESHUDAS MUTTUNo ratings yet

- Surface Defects in Steel ProductsDocument41 pagesSurface Defects in Steel ProductsShilaj PNo ratings yet