Professional Documents

Culture Documents

BSAIS 304 Syllabus

BSAIS 304 Syllabus

Uploaded by

Adrian Perolino DelosoCopyright:

Available Formats

You might also like

- Questions AnswerDocument11 pagesQuestions AnswerShaziaAnees100% (2)

- Letter of CancellationDocument2 pagesLetter of CancellationClark Lim79% (14)

- Statistical Analysis With Software ApplicationDocument126 pagesStatistical Analysis With Software ApplicationKryzzel Anne Jon100% (1)

- Investments Analysis and Management 12th Edition Charles P Jones Test BankDocument10 pagesInvestments Analysis and Management 12th Edition Charles P Jones Test BankMohmed GodaNo ratings yet

- Lesson 1 Introduction To Xero: Cloud ComputingDocument17 pagesLesson 1 Introduction To Xero: Cloud ComputingLeah ManalangNo ratings yet

- 09 Additional NotesDocument4 pages09 Additional NotesMelody GumbaNo ratings yet

- Syllabus - Intermediate Accounting 3Document20 pagesSyllabus - Intermediate Accounting 3Ellen BuenafeNo ratings yet

- Cfas Pas 41 AgricultureDocument4 pagesCfas Pas 41 AgricultureMeg sharkNo ratings yet

- Specialized IndustryDocument9 pagesSpecialized IndustryPhilip Jhon BayoNo ratings yet

- 1.1 Audit of Cash and Cash EquivalentsDocument2 pages1.1 Audit of Cash and Cash EquivalentsANGELU RANE BAGARES INTOLNo ratings yet

- Effective School Year 2018-2019/: Busman 104Document4 pagesEffective School Year 2018-2019/: Busman 104Super Man of SteelNo ratings yet

- Kinney 8e - CH 05Document16 pagesKinney 8e - CH 05Ashik Uz ZamanNo ratings yet

- Chapter 4 Information Technology ItDocument63 pagesChapter 4 Information Technology It黄勇添No ratings yet

- Next-X Inc - FinalDocument9 pagesNext-X Inc - FinalJam Xabryl AquinoNo ratings yet

- THESIS ACCOUNTANCY - FinalDocument69 pagesTHESIS ACCOUNTANCY - Finalgelma furing lizalizaNo ratings yet

- Problems and Internal Control Issues in AIS From The View Point of Jordanian Certified Public AccountantsDocument4 pagesProblems and Internal Control Issues in AIS From The View Point of Jordanian Certified Public AccountantsAlbert Carl Baltazar IINo ratings yet

- Fundamentals of AccountingDocument11 pagesFundamentals of AccountingJacob DiazNo ratings yet

- Far Reviewer - Bale (Millan)Document27 pagesFar Reviewer - Bale (Millan)Chiee Takahashi100% (1)

- Auditing in CIS Environment - Auditing Operating Systems and Networks (Final)Document44 pagesAuditing in CIS Environment - Auditing Operating Systems and Networks (Final)Luisito100% (2)

- BSMA PrE 417 PERFORMANCE MANAGEMENT SYSTEMDocument8 pagesBSMA PrE 417 PERFORMANCE MANAGEMENT SYSTEMDonna ZanduetaNo ratings yet

- Statistical Analysis With Software Application PDFDocument145 pagesStatistical Analysis With Software Application PDF2B MASIGLAT, CRIZEL JOY Y.No ratings yet

- Fundamentals OF Accounting I: By: Jason P. GregorioDocument14 pagesFundamentals OF Accounting I: By: Jason P. GregorioJason GregorioNo ratings yet

- Income Based ValuationDocument25 pagesIncome Based ValuationApril Joy ObedozaNo ratings yet

- SYLLAB - 00accounting Information SystemDocument6 pagesSYLLAB - 00accounting Information SystemEfren100% (1)

- (M2S2-POWERPOINT) Control Self-Assessment (CSA) and Evaluating The Internal Audit ActivityDocument18 pages(M2S2-POWERPOINT) Control Self-Assessment (CSA) and Evaluating The Internal Audit ActivityJayson J. ManlangitNo ratings yet

- 20201st Sem Syllabus Auditing Assurance PrinciplesDocument10 pages20201st Sem Syllabus Auditing Assurance PrinciplesJamie Rose AragonesNo ratings yet

- OpAudCh03 CBET 01 501E Toralde, Ma - Kristine E.Document5 pagesOpAudCh03 CBET 01 501E Toralde, Ma - Kristine E.Kristine Esplana ToraldeNo ratings yet

- ACCO 20053 - Intermediate Accounting 1Document5 pagesACCO 20053 - Intermediate Accounting 1Darryl LabradorNo ratings yet

- Activity 1 - Fundamentals To Auditing and Assurance ServicesDocument14 pagesActivity 1 - Fundamentals To Auditing and Assurance ServicesRen100% (1)

- Finacc 3 Question Set BDocument9 pagesFinacc 3 Question Set BEza Joy ClaveriasNo ratings yet

- Chapter 7 Audit Planning: Assessment of Control RiskDocument21 pagesChapter 7 Audit Planning: Assessment of Control RiskLalaine JadeNo ratings yet

- PrE 4 - AUDIT OF THE GAS, PETROLEUM, AND OIL SECTORS (Outline)Document12 pagesPrE 4 - AUDIT OF THE GAS, PETROLEUM, AND OIL SECTORS (Outline)nefael lanciolaNo ratings yet

- Working Capital Management of Construction Supplies in District I of BatangasDocument68 pagesWorking Capital Management of Construction Supplies in District I of BatangasPatricia Mae BendañaNo ratings yet

- First Preboard ExamsDocument4 pagesFirst Preboard ExamsRandy PaderesNo ratings yet

- Operations Auditing: Audi26Document19 pagesOperations Auditing: Audi26Pricia AbellaNo ratings yet

- MGMT 322 - Management ScienceDocument8 pagesMGMT 322 - Management ScienceMARITONI MEDALLANo ratings yet

- SAMPLE OBE SYLLABUS - GOVT ACCTG & ACCTG FOR NPOsDocument10 pagesSAMPLE OBE SYLLABUS - GOVT ACCTG & ACCTG FOR NPOsHarry Rejuso Chua100% (1)

- Prelim ExamDocument4 pagesPrelim ExamAngeloNo ratings yet

- Pas 20, 23Document32 pagesPas 20, 23Angela WaganNo ratings yet

- Arellano - Final RequirementDocument76 pagesArellano - Final RequirementLuigi Enderez BalucanNo ratings yet

- Gelinas-Dull 8e Chapter 11 Billing & ReceivableDocument30 pagesGelinas-Dull 8e Chapter 11 Billing & Receivableleen mercado100% (1)

- MASDocument6 pagesMASIyang LopezNo ratings yet

- FAR-01 Trade & Other PayableDocument3 pagesFAR-01 Trade & Other PayablehIgh QuaLIty SVT100% (1)

- Camarines Norte State College: College of Business and Public AdministrationDocument15 pagesCamarines Norte State College: College of Business and Public AdministrationDominic E. BoticarioNo ratings yet

- Issai 1315 PNDocument8 pagesIssai 1315 PNMohammad Jasim UddinNo ratings yet

- Ae 123 Management ScienceDocument7 pagesAe 123 Management ScienceMa MaNo ratings yet

- 12 AdmissionDocument14 pages12 Admissionhussain balochNo ratings yet

- Post-First-Preboards-Fb-Live (8.23.2020)Document3 pagesPost-First-Preboards-Fb-Live (8.23.2020)Princess SalvadorNo ratings yet

- BSTX Reviewer (Midterm)Document7 pagesBSTX Reviewer (Midterm)alaine daphneNo ratings yet

- 3-1. Discussion Questions / ProblemsDocument4 pages3-1. Discussion Questions / Problemscoleen paraynoNo ratings yet

- (Final) Acco 20113 - Strategic Cost ManagementDocument18 pages(Final) Acco 20113 - Strategic Cost ManagementJona kelssNo ratings yet

- Module 2 - Introduction To BusinessDocument4 pagesModule 2 - Introduction To BusinessMarjorie Rose GuarinoNo ratings yet

- Worksheet On Cash Flow Statement (Board Exam Questions)Document14 pagesWorksheet On Cash Flow Statement (Board Exam Questions)Cfa Deepti BindalNo ratings yet

- Audit of General Insurance CompaniesDocument16 pagesAudit of General Insurance CompaniesTACS & CO.No ratings yet

- Ra 9298Document10 pagesRa 9298Abraham Mayo MakakuaNo ratings yet

- Philippine Standard On Auditing 300Document6 pagesPhilippine Standard On Auditing 300HavanaNo ratings yet

- (PPT) Investment Property, Exploration For and Evaluation of Mineral Resources Assets, and NCA HFSDocument21 pages(PPT) Investment Property, Exploration For and Evaluation of Mineral Resources Assets, and NCA HFS수지100% (1)

- Smith's Market Case StudyDocument9 pagesSmith's Market Case StudyDhanylane Phole Librea SeraficaNo ratings yet

- Aud 7 8 HakdogDocument21 pagesAud 7 8 HakdogPerla ManalangNo ratings yet

- CE On Book Value Per ShareDocument3 pagesCE On Book Value Per SharealyssaNo ratings yet

- Fundamentals of Assurance ServicesDocument32 pagesFundamentals of Assurance ServicesDavid alfonsoNo ratings yet

- Assurance and Non Assurance ServicesDocument4 pagesAssurance and Non Assurance ServicesAnne Waban100% (1)

- Basic Accounting 1Document74 pagesBasic Accounting 1Rohann James Abrogueña ReañoNo ratings yet

- BISAIS 203 SyllabusDocument4 pagesBISAIS 203 SyllabusAdrian Perolino DelosoNo ratings yet

- Agusan Colleges, Inc: - Butuan City SyllabusDocument3 pagesAgusan Colleges, Inc: - Butuan City SyllabusAdrian Perolino DelosoNo ratings yet

- TAXA 301 SyllabusDocument12 pagesTAXA 301 SyllabusAdrian Perolino DelosoNo ratings yet

- Agusan Colleges, Inc: SyllabusDocument3 pagesAgusan Colleges, Inc: SyllabusAdrian Perolino DelosoNo ratings yet

- BSBA Self Assessment MonitoringDocument16 pagesBSBA Self Assessment MonitoringAdrian Perolino DelosoNo ratings yet

- Drian ThesisDocument42 pagesDrian ThesisAdrian Perolino DelosoNo ratings yet

- BISAIS 203 SyllabusDocument4 pagesBISAIS 203 SyllabusAdrian Perolino DelosoNo ratings yet

- BSBA Self Assessment MonitoringDocument16 pagesBSBA Self Assessment MonitoringAdrian Perolino DelosoNo ratings yet

- Agusan Colleges Inc. Butuan City: College of Arts and Sciences and Teacher Education Course SyllabusDocument10 pagesAgusan Colleges Inc. Butuan City: College of Arts and Sciences and Teacher Education Course SyllabusAdrian Perolino DelosoNo ratings yet

- G5-T6 How To Use RSIDocument4 pagesG5-T6 How To Use RSIThe ShitNo ratings yet

- Afm 101 Review NotesDocument9 pagesAfm 101 Review NotesNicolle YhapNo ratings yet

- Solved Calculate The Arc Elasticity of Demand Coefficient Between Point ADocument1 pageSolved Calculate The Arc Elasticity of Demand Coefficient Between Point AM Bilal SaleemNo ratings yet

- Foreign Direct Investment Inflows and Financial Development in Central and Eastern European Union Countries: A Panel Cointegration and CausalityDocument13 pagesForeign Direct Investment Inflows and Financial Development in Central and Eastern European Union Countries: A Panel Cointegration and CausalitymuthiaNo ratings yet

- AisDocument7 pagesAisAnnaNo ratings yet

- Economics For 2nd PUC - ToPIC 6Document22 pagesEconomics For 2nd PUC - ToPIC 6Vipin Mandyam KadubiNo ratings yet

- Gen Math Module 32 Fair Market ValueDocument25 pagesGen Math Module 32 Fair Market Valueivanjade627No ratings yet

- Nike Inc Basic Valuation TemplateDocument70 pagesNike Inc Basic Valuation Templatetranejones763No ratings yet

- Worksheet 1 Financial MathDocument8 pagesWorksheet 1 Financial Mathcaroline_amideast8101No ratings yet

- This Project Takes Place in South AustraliaDocument2 pagesThis Project Takes Place in South AustraliaKavitha DhasNo ratings yet

- Unlock-NISM XV - RESEARCH ANALYST EXAM - PRACTICE TEST 2 PDFDocument17 pagesUnlock-NISM XV - RESEARCH ANALYST EXAM - PRACTICE TEST 2 PDFAbhishek100% (2)

- Annexure C3: Format of Declaration From Distributor / Registered Investment Advisor (Ria) (Us Persons)Document2 pagesAnnexure C3: Format of Declaration From Distributor / Registered Investment Advisor (Ria) (Us Persons)Ayushi ShahNo ratings yet

- Michele Sjolander - LinkedInDocument4 pagesMichele Sjolander - LinkedInNye LavalleNo ratings yet

- Tutorial 3 FMIDocument5 pagesTutorial 3 FMIJing HangNo ratings yet

- Cryo-Asia SF6 Quotation - AsiaphilDocument2 pagesCryo-Asia SF6 Quotation - AsiaphilAldrin SorianoNo ratings yet

- Introduction To Alternative Investments: Weekly Test - AIDocument96 pagesIntroduction To Alternative Investments: Weekly Test - AIRuchira GoleNo ratings yet

- ACT 1124 - Financial ManagementDocument13 pagesACT 1124 - Financial ManagementRonald LeabresNo ratings yet

- 2049 上銀 NMR 20240228Document12 pages2049 上銀 NMR 20240228Kuo Szu-WeiNo ratings yet

- #01 Accounting ProcessDocument3 pages#01 Accounting ProcessZaaavnn VannnnnNo ratings yet

- Fema f2Document2 pagesFema f2santoshkumar86No ratings yet

- India Completing Inv UniverseDocument16 pagesIndia Completing Inv UniverseKushal ManupatiNo ratings yet

- Research Insight: Powered by Compustat DataDocument4 pagesResearch Insight: Powered by Compustat DataaadolfsmtNo ratings yet

- Wipro LTD: Profitable Growth Focus of New CEODocument11 pagesWipro LTD: Profitable Growth Focus of New CEOPramod KulkarniNo ratings yet

- Capital AccountDocument38 pagesCapital AccountSheetal IyerNo ratings yet

- Chapter-I Financial Statement Analysis of Jaya Lakshmi TextilesDocument56 pagesChapter-I Financial Statement Analysis of Jaya Lakshmi TextilesSurendra SkNo ratings yet

- IBA - Syllabus - Financial Management Summer Semester 2022Document5 pagesIBA - Syllabus - Financial Management Summer Semester 2022susheel kumarNo ratings yet

BSAIS 304 Syllabus

BSAIS 304 Syllabus

Uploaded by

Adrian Perolino DelosoCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BSAIS 304 Syllabus

BSAIS 304 Syllabus

Uploaded by

Adrian Perolino DelosoCopyright:

Available Formats

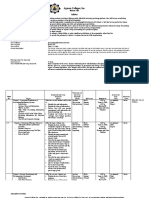

Agusan Colleges, Inc.

Butuan City

Syllabus

Institutional Vision A leading academic institution offering quality affordable education producing graduates who will become contributing

and responsive members of the global community.

Institutional Mission To provide high quality, comprehensive and meaningful education for all students so that they become productive citizens

Empowered with knowledge and skills and untainted personal attributes.

Institutional Goals As envisioned by the Founder, ACI’s goals are based not only on a liberal learning education which encourages the molding

and growth of productive professionals but also on the provision of opportunities.

1. To enable students to acquire a body of knowledge in a specific discipline.

2. To think critically

3. To enhance student abilities to make significant contributions to the communities where they live.

4. To provide the pathway for students to continue the pursuit of life-long learning.

Program Vision, Mission, and Goals

Institutional Intended Learning Outcomes

Course Name Intermediate Accounting 3

Course Code BSAIS 304

Course Unit Three ( 3 ) units

Course Description This is the culmination of Financial Accounting Theory and Practice lot. It includes financial statements, statements of

Financial position, notes to financial statements, statement of comprehensive income, noncurrent asset held for sale,

discontinued operations, accounting changes, interim financial reporting, operating segment, cash and accrual basis,

single entry, error correction, statement of cash flows, hyperinflation, current cost accounting, SMEs-part one, SMEs - part two,

and SMEs- part three.

Pre-requisites/ Co-requisites Intermediate Accounting 2

Contact hours 54 hours

Course Intended Learning Outcomes upon completion of this course, the students will be able to evaluate contemporary issues in accounting and related disciplines.

They will be able to analyze and interpret effectively transactions for Small and Medium sized entities and achieved fair presentation

of the financial statements prepared in accordance with PFRS which represent the GAAP in the Philippines.

Teaching and

Integrated Learning Learning Assessment

Week Outcomes Activities Task Allocation

No. Topics (ILO) (TLA) Resources References (AT) Time

1-2 1. Financial Statements After this session, the students can: Lecture Journals Financial Assignments 6 hours

General Purpose of financial statements describe the importance of Recitation Books Accounting Group

Components and objectives of financial the information provided by the. Discussion Exercises Volume Three,by Discussion

statements financial statements Research Conrado T.Valix, Quizzes

Financial Reporting-objectives explain the primary responsibility Jose F.Peralta and Detailed Course

Responsibility for financial statements for financial statements Christian Aris Syllabus

Accountability of management assess the effectiveness of the M.Valix

General features of financial statements entity's management

Identification of financial statements account for entity's resources

Elements of Financial statements for their proper, efficient and

Recognition of elements profitable use

Asset recognition principle identify the primary users and

Liability recognition principle other users of financial

Income recognition principle information

Expense recognition principle

Measurement of elements

Users for financial statements

2.Statement of Financial Position After this unit, the students can: Lecture Journals Financial Assignments 6 hours

Statement of financial position defined describe the principles of Recitation Books Accounting Group

Definition of assets statement presentation Discussion Exercises Volume Three,by Discussion

Current assets classify assets as current Research Conrado T.Valix, Quizzes

Presentation of current assets and noncurrent based on the Jose F.Peralta and

Noncurrent assets criteria provided Christian Aris

Presentation of noncurrent assets classify liabilities as current M.Valix

Definition of liabilities and noncurrent based on the

Current liabilities criteria provided

Long-term debt currently maturing explain the effect of breach of

Covenants covenants on the balance sheet

Presentation of current liabilities classification of a liability

Noncurrent liabilities classify estimated liabilities

Estimated liabilities whether current on noncurrent

Contingent liability explain the effect of recognizing

Contingent asset a contingent asset

Elements of shareholders' equity with

list the elements constituting

equivalent IAS term

the stockholders' equity

Line items in the statement of financial

describe the treatment of

position

contingent assets in the financial

Forms of statement of financial position

statements

illustrate the report form and

account form of statement of

financial position

3-4 3.Notes to Financial Statements After this unit, the students can: Lecture Journals Financial Assignments 6 hours

GRADING SYSTEM

Agusan Colleges Inc., modified its grading system into two sets, Online and Modular Learning, to accommodate students with their learning modality.

PARAMETERS GRADING AND MARKING

Attendance 10%

Project 10%

Quizzes/Assignments 30%

Examination 40%

Active Participation 10%

Total 100%

Computation of the Overall or Final Grade shall be the average of the students Midterm and Final grade.

MIDTERM 40%

FINAL 60%

TOTAL 100%

Date Revised:

Effectivity :

Prepared: Reviewed: Approved:

FE C. ORTIZ, CPA JOANNA B. CUENCA, Ph.D. CESO III HANNIBAL FRITZ V. CHANJUECO, D.M.

Dean, BSAIS Executive Vice President/VPAARE School President

You might also like

- Questions AnswerDocument11 pagesQuestions AnswerShaziaAnees100% (2)

- Letter of CancellationDocument2 pagesLetter of CancellationClark Lim79% (14)

- Statistical Analysis With Software ApplicationDocument126 pagesStatistical Analysis With Software ApplicationKryzzel Anne Jon100% (1)

- Investments Analysis and Management 12th Edition Charles P Jones Test BankDocument10 pagesInvestments Analysis and Management 12th Edition Charles P Jones Test BankMohmed GodaNo ratings yet

- Lesson 1 Introduction To Xero: Cloud ComputingDocument17 pagesLesson 1 Introduction To Xero: Cloud ComputingLeah ManalangNo ratings yet

- 09 Additional NotesDocument4 pages09 Additional NotesMelody GumbaNo ratings yet

- Syllabus - Intermediate Accounting 3Document20 pagesSyllabus - Intermediate Accounting 3Ellen BuenafeNo ratings yet

- Cfas Pas 41 AgricultureDocument4 pagesCfas Pas 41 AgricultureMeg sharkNo ratings yet

- Specialized IndustryDocument9 pagesSpecialized IndustryPhilip Jhon BayoNo ratings yet

- 1.1 Audit of Cash and Cash EquivalentsDocument2 pages1.1 Audit of Cash and Cash EquivalentsANGELU RANE BAGARES INTOLNo ratings yet

- Effective School Year 2018-2019/: Busman 104Document4 pagesEffective School Year 2018-2019/: Busman 104Super Man of SteelNo ratings yet

- Kinney 8e - CH 05Document16 pagesKinney 8e - CH 05Ashik Uz ZamanNo ratings yet

- Chapter 4 Information Technology ItDocument63 pagesChapter 4 Information Technology It黄勇添No ratings yet

- Next-X Inc - FinalDocument9 pagesNext-X Inc - FinalJam Xabryl AquinoNo ratings yet

- THESIS ACCOUNTANCY - FinalDocument69 pagesTHESIS ACCOUNTANCY - Finalgelma furing lizalizaNo ratings yet

- Problems and Internal Control Issues in AIS From The View Point of Jordanian Certified Public AccountantsDocument4 pagesProblems and Internal Control Issues in AIS From The View Point of Jordanian Certified Public AccountantsAlbert Carl Baltazar IINo ratings yet

- Fundamentals of AccountingDocument11 pagesFundamentals of AccountingJacob DiazNo ratings yet

- Far Reviewer - Bale (Millan)Document27 pagesFar Reviewer - Bale (Millan)Chiee Takahashi100% (1)

- Auditing in CIS Environment - Auditing Operating Systems and Networks (Final)Document44 pagesAuditing in CIS Environment - Auditing Operating Systems and Networks (Final)Luisito100% (2)

- BSMA PrE 417 PERFORMANCE MANAGEMENT SYSTEMDocument8 pagesBSMA PrE 417 PERFORMANCE MANAGEMENT SYSTEMDonna ZanduetaNo ratings yet

- Statistical Analysis With Software Application PDFDocument145 pagesStatistical Analysis With Software Application PDF2B MASIGLAT, CRIZEL JOY Y.No ratings yet

- Fundamentals OF Accounting I: By: Jason P. GregorioDocument14 pagesFundamentals OF Accounting I: By: Jason P. GregorioJason GregorioNo ratings yet

- Income Based ValuationDocument25 pagesIncome Based ValuationApril Joy ObedozaNo ratings yet

- SYLLAB - 00accounting Information SystemDocument6 pagesSYLLAB - 00accounting Information SystemEfren100% (1)

- (M2S2-POWERPOINT) Control Self-Assessment (CSA) and Evaluating The Internal Audit ActivityDocument18 pages(M2S2-POWERPOINT) Control Self-Assessment (CSA) and Evaluating The Internal Audit ActivityJayson J. ManlangitNo ratings yet

- 20201st Sem Syllabus Auditing Assurance PrinciplesDocument10 pages20201st Sem Syllabus Auditing Assurance PrinciplesJamie Rose AragonesNo ratings yet

- OpAudCh03 CBET 01 501E Toralde, Ma - Kristine E.Document5 pagesOpAudCh03 CBET 01 501E Toralde, Ma - Kristine E.Kristine Esplana ToraldeNo ratings yet

- ACCO 20053 - Intermediate Accounting 1Document5 pagesACCO 20053 - Intermediate Accounting 1Darryl LabradorNo ratings yet

- Activity 1 - Fundamentals To Auditing and Assurance ServicesDocument14 pagesActivity 1 - Fundamentals To Auditing and Assurance ServicesRen100% (1)

- Finacc 3 Question Set BDocument9 pagesFinacc 3 Question Set BEza Joy ClaveriasNo ratings yet

- Chapter 7 Audit Planning: Assessment of Control RiskDocument21 pagesChapter 7 Audit Planning: Assessment of Control RiskLalaine JadeNo ratings yet

- PrE 4 - AUDIT OF THE GAS, PETROLEUM, AND OIL SECTORS (Outline)Document12 pagesPrE 4 - AUDIT OF THE GAS, PETROLEUM, AND OIL SECTORS (Outline)nefael lanciolaNo ratings yet

- Working Capital Management of Construction Supplies in District I of BatangasDocument68 pagesWorking Capital Management of Construction Supplies in District I of BatangasPatricia Mae BendañaNo ratings yet

- First Preboard ExamsDocument4 pagesFirst Preboard ExamsRandy PaderesNo ratings yet

- Operations Auditing: Audi26Document19 pagesOperations Auditing: Audi26Pricia AbellaNo ratings yet

- MGMT 322 - Management ScienceDocument8 pagesMGMT 322 - Management ScienceMARITONI MEDALLANo ratings yet

- SAMPLE OBE SYLLABUS - GOVT ACCTG & ACCTG FOR NPOsDocument10 pagesSAMPLE OBE SYLLABUS - GOVT ACCTG & ACCTG FOR NPOsHarry Rejuso Chua100% (1)

- Prelim ExamDocument4 pagesPrelim ExamAngeloNo ratings yet

- Pas 20, 23Document32 pagesPas 20, 23Angela WaganNo ratings yet

- Arellano - Final RequirementDocument76 pagesArellano - Final RequirementLuigi Enderez BalucanNo ratings yet

- Gelinas-Dull 8e Chapter 11 Billing & ReceivableDocument30 pagesGelinas-Dull 8e Chapter 11 Billing & Receivableleen mercado100% (1)

- MASDocument6 pagesMASIyang LopezNo ratings yet

- FAR-01 Trade & Other PayableDocument3 pagesFAR-01 Trade & Other PayablehIgh QuaLIty SVT100% (1)

- Camarines Norte State College: College of Business and Public AdministrationDocument15 pagesCamarines Norte State College: College of Business and Public AdministrationDominic E. BoticarioNo ratings yet

- Issai 1315 PNDocument8 pagesIssai 1315 PNMohammad Jasim UddinNo ratings yet

- Ae 123 Management ScienceDocument7 pagesAe 123 Management ScienceMa MaNo ratings yet

- 12 AdmissionDocument14 pages12 Admissionhussain balochNo ratings yet

- Post-First-Preboards-Fb-Live (8.23.2020)Document3 pagesPost-First-Preboards-Fb-Live (8.23.2020)Princess SalvadorNo ratings yet

- BSTX Reviewer (Midterm)Document7 pagesBSTX Reviewer (Midterm)alaine daphneNo ratings yet

- 3-1. Discussion Questions / ProblemsDocument4 pages3-1. Discussion Questions / Problemscoleen paraynoNo ratings yet

- (Final) Acco 20113 - Strategic Cost ManagementDocument18 pages(Final) Acco 20113 - Strategic Cost ManagementJona kelssNo ratings yet

- Module 2 - Introduction To BusinessDocument4 pagesModule 2 - Introduction To BusinessMarjorie Rose GuarinoNo ratings yet

- Worksheet On Cash Flow Statement (Board Exam Questions)Document14 pagesWorksheet On Cash Flow Statement (Board Exam Questions)Cfa Deepti BindalNo ratings yet

- Audit of General Insurance CompaniesDocument16 pagesAudit of General Insurance CompaniesTACS & CO.No ratings yet

- Ra 9298Document10 pagesRa 9298Abraham Mayo MakakuaNo ratings yet

- Philippine Standard On Auditing 300Document6 pagesPhilippine Standard On Auditing 300HavanaNo ratings yet

- (PPT) Investment Property, Exploration For and Evaluation of Mineral Resources Assets, and NCA HFSDocument21 pages(PPT) Investment Property, Exploration For and Evaluation of Mineral Resources Assets, and NCA HFS수지100% (1)

- Smith's Market Case StudyDocument9 pagesSmith's Market Case StudyDhanylane Phole Librea SeraficaNo ratings yet

- Aud 7 8 HakdogDocument21 pagesAud 7 8 HakdogPerla ManalangNo ratings yet

- CE On Book Value Per ShareDocument3 pagesCE On Book Value Per SharealyssaNo ratings yet

- Fundamentals of Assurance ServicesDocument32 pagesFundamentals of Assurance ServicesDavid alfonsoNo ratings yet

- Assurance and Non Assurance ServicesDocument4 pagesAssurance and Non Assurance ServicesAnne Waban100% (1)

- Basic Accounting 1Document74 pagesBasic Accounting 1Rohann James Abrogueña ReañoNo ratings yet

- BISAIS 203 SyllabusDocument4 pagesBISAIS 203 SyllabusAdrian Perolino DelosoNo ratings yet

- Agusan Colleges, Inc: - Butuan City SyllabusDocument3 pagesAgusan Colleges, Inc: - Butuan City SyllabusAdrian Perolino DelosoNo ratings yet

- TAXA 301 SyllabusDocument12 pagesTAXA 301 SyllabusAdrian Perolino DelosoNo ratings yet

- Agusan Colleges, Inc: SyllabusDocument3 pagesAgusan Colleges, Inc: SyllabusAdrian Perolino DelosoNo ratings yet

- BSBA Self Assessment MonitoringDocument16 pagesBSBA Self Assessment MonitoringAdrian Perolino DelosoNo ratings yet

- Drian ThesisDocument42 pagesDrian ThesisAdrian Perolino DelosoNo ratings yet

- BISAIS 203 SyllabusDocument4 pagesBISAIS 203 SyllabusAdrian Perolino DelosoNo ratings yet

- BSBA Self Assessment MonitoringDocument16 pagesBSBA Self Assessment MonitoringAdrian Perolino DelosoNo ratings yet

- Agusan Colleges Inc. Butuan City: College of Arts and Sciences and Teacher Education Course SyllabusDocument10 pagesAgusan Colleges Inc. Butuan City: College of Arts and Sciences and Teacher Education Course SyllabusAdrian Perolino DelosoNo ratings yet

- G5-T6 How To Use RSIDocument4 pagesG5-T6 How To Use RSIThe ShitNo ratings yet

- Afm 101 Review NotesDocument9 pagesAfm 101 Review NotesNicolle YhapNo ratings yet

- Solved Calculate The Arc Elasticity of Demand Coefficient Between Point ADocument1 pageSolved Calculate The Arc Elasticity of Demand Coefficient Between Point AM Bilal SaleemNo ratings yet

- Foreign Direct Investment Inflows and Financial Development in Central and Eastern European Union Countries: A Panel Cointegration and CausalityDocument13 pagesForeign Direct Investment Inflows and Financial Development in Central and Eastern European Union Countries: A Panel Cointegration and CausalitymuthiaNo ratings yet

- AisDocument7 pagesAisAnnaNo ratings yet

- Economics For 2nd PUC - ToPIC 6Document22 pagesEconomics For 2nd PUC - ToPIC 6Vipin Mandyam KadubiNo ratings yet

- Gen Math Module 32 Fair Market ValueDocument25 pagesGen Math Module 32 Fair Market Valueivanjade627No ratings yet

- Nike Inc Basic Valuation TemplateDocument70 pagesNike Inc Basic Valuation Templatetranejones763No ratings yet

- Worksheet 1 Financial MathDocument8 pagesWorksheet 1 Financial Mathcaroline_amideast8101No ratings yet

- This Project Takes Place in South AustraliaDocument2 pagesThis Project Takes Place in South AustraliaKavitha DhasNo ratings yet

- Unlock-NISM XV - RESEARCH ANALYST EXAM - PRACTICE TEST 2 PDFDocument17 pagesUnlock-NISM XV - RESEARCH ANALYST EXAM - PRACTICE TEST 2 PDFAbhishek100% (2)

- Annexure C3: Format of Declaration From Distributor / Registered Investment Advisor (Ria) (Us Persons)Document2 pagesAnnexure C3: Format of Declaration From Distributor / Registered Investment Advisor (Ria) (Us Persons)Ayushi ShahNo ratings yet

- Michele Sjolander - LinkedInDocument4 pagesMichele Sjolander - LinkedInNye LavalleNo ratings yet

- Tutorial 3 FMIDocument5 pagesTutorial 3 FMIJing HangNo ratings yet

- Cryo-Asia SF6 Quotation - AsiaphilDocument2 pagesCryo-Asia SF6 Quotation - AsiaphilAldrin SorianoNo ratings yet

- Introduction To Alternative Investments: Weekly Test - AIDocument96 pagesIntroduction To Alternative Investments: Weekly Test - AIRuchira GoleNo ratings yet

- ACT 1124 - Financial ManagementDocument13 pagesACT 1124 - Financial ManagementRonald LeabresNo ratings yet

- 2049 上銀 NMR 20240228Document12 pages2049 上銀 NMR 20240228Kuo Szu-WeiNo ratings yet

- #01 Accounting ProcessDocument3 pages#01 Accounting ProcessZaaavnn VannnnnNo ratings yet

- Fema f2Document2 pagesFema f2santoshkumar86No ratings yet

- India Completing Inv UniverseDocument16 pagesIndia Completing Inv UniverseKushal ManupatiNo ratings yet

- Research Insight: Powered by Compustat DataDocument4 pagesResearch Insight: Powered by Compustat DataaadolfsmtNo ratings yet

- Wipro LTD: Profitable Growth Focus of New CEODocument11 pagesWipro LTD: Profitable Growth Focus of New CEOPramod KulkarniNo ratings yet

- Capital AccountDocument38 pagesCapital AccountSheetal IyerNo ratings yet

- Chapter-I Financial Statement Analysis of Jaya Lakshmi TextilesDocument56 pagesChapter-I Financial Statement Analysis of Jaya Lakshmi TextilesSurendra SkNo ratings yet

- IBA - Syllabus - Financial Management Summer Semester 2022Document5 pagesIBA - Syllabus - Financial Management Summer Semester 2022susheel kumarNo ratings yet