Professional Documents

Culture Documents

1.H82 07APHSSRArticle

1.H82 07APHSSRArticle

Uploaded by

Ashraful AlamOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1.H82 07APHSSRArticle

1.H82 07APHSSRArticle

Uploaded by

Ashraful AlamCopyright:

Available Formats

See discussions, stats, and author profiles for this publication at: https://www.researchgate.

net/publication/340597845

DETERMINANTS OF NON-PERFORMING LOANS: EVIDENCE FROM

CONVENTIONAL BANKS IN MALAYSIA

Article in Humanities & Social Sciences Reviews · April 2020

DOI: 10.18510/hssr.2020.8248

CITATIONS READS

3 1,229

3 authors, including:

Eni Noreni Mohamad Zain Puspa Liza Ghazali

University of Malaysia, Kelantan Universiti Sultan Zainal Abidin

12 PUBLICATIONS 9 CITATIONS 123 PUBLICATIONS 529 CITATIONS

SEE PROFILE SEE PROFILE

Some of the authors of this publication are also working on these related projects:

developing a framework of micro takaful medical and health for poor people in malaysia View project

KAJIAN PERBANDINGAN UNDANG-UNDANG TAKAFUL DI MALAYSIA DENGAN INDONESIA View project

All content following this page was uploaded by Eni Noreni Mohamad Zain on 10 August 2020.

The user has requested enhancement of the downloaded file.

Humanities & Social Sciences Reviews

eISSN: 2395-6518, Vol 8, No 2, 2020, pp 423-430

https://doi.org/10.18510/hssr.2020.8248

DETERMINANTS OF NON-PERFORMING LOANS: EVIDENCE FROM

CONVENTIONAL BANKS IN MALAYSIA

Eni Noreni Mohamad Zain1, Puspa Liza Ghazali2*, Wan Mohd Nazri Wan Daud3

1

Faculty of Entrepreneurship and Business, Universiti Malaysia Kelantan, Kelantan, Malaysia, 2,3Faculty of Business,

Universiti Sultan Zainal Abidin, Terengganu, Malaysia.

Email: 1noreni@umk.edu.my, 2*puspaliza@unisza.edu.my, 3wanmnazri@unisza.edu.my

th th th

Article History: Received on 28 January 2020, Revised on 26 March 2020, Published on 04 April 2020

Abstract

Purpose of the study: This paper attempts to determine the determinants of non-performing loans in commercial banks

in Malaysia. This study attempts to explore the specific bank factors as well as macroeconomics factors that are

contributing to the non-performing loans.

Methodology: This paper analyzes the data using eight local commercial banks in Malaysia. The data collected from the

annual report and Data Streams database for the year 2009 to 2018. A panel data approach has been used to analyze the

data. All the determinants regressed against non-performing loans by using STATA 14 as a tool.

Main Findings: The results of this study present that capitalization had a significant negative relationship with non-

performing loans, while the real effective exchange rate had a significant positive correlation with non-performing loans.

Applications of this study: This study highlights the crucial factors of the non-performing loans that can be used by the

bank or financial institutions.

Novelty/Originality of this study: This study includes one new variable for the macroeconomics factors, which is the

real effective exchange rate, and the result shows it is significant towards non-performing loans. Therefore, this study

enhances the existing model with the new variable that can be used to find what is affecting the non-performing loans.

Keywords: Non-performing Loans, Conventional Banking, Bank-specific, Macroeconomics, Panel Regression Model,

Random Effect Model.

INTRODUCTION

A financial intermediary is a foundation that handles the financial transaction. Investments, deposits, and loans are

examples of a financial transaction. According to Chinweoke, Onydikachi, and Elizabeth (2014), one of the exercises of

financial institutions (banks) includes intermediating between the surplus and shortage parts of the economy. The

financial intermediary will become a middleman who collects deposits from the surplus units (savers) and look for a

suitable deficit unit (borrower) to lend for it on behalf of the institutions and receive the interest payment.

Typically, the commercial bank will get the profits from the deposit when the customers keep or save their money in the

bank. Customers save their money into the bank account and earn the interest rates according to the bank they referred to

(Saini and Sindhu, 2014). When they save more money, they can make more through the interest rates offered by the

bank. At this time, the commercial bank will use the money in the bank for some lending activities and earn the profits

from the interest rate. The commercial bank will also take the deposits and lend it out to those who request to the bank to

borrow money. These customers are known as the borrower, and the lender will be a commercial bank. There are many

types of loans, some loans are long term, and some are short term.

Non-performing loans or non-performing financing is the most crucial issue in banking systems. Sometimes, the

borrower may not be able to repay the amount they borrowed in the period given that agreed with the bank; these types

of loans grouped under the non-performing loan (NPL). Regarding International Monetary Fund (IMF), NPL exists

when the borrower has an outstanding payment for more than 90 days; or when the interest has been renegotiated,

deferred or promoted for more than 90 days; or on the other hand, instalments are under 90 days past due yet are never

again foreseen (Chavan and Gambacorta, 2016). It will cause the commercial bank to be in trouble if the cases of NPL

are getting more because it affects the performances of the bank if the bank has lots of NPL cases, which means lots of

debtors are unable to pay back the debts. Besides, the bank will have a lower cost efficiency if the bank has severe NPL

problems (Karim, Chan and Hassan, 2010). As a result, a commercial bank shall reserve a specific amount of the profits

for loan loss provision to ensure and defend their different kinds of situations. It will minimize the bank's volatility and

reduce the probability of getting bad performances to maintain its reputation. This study focuses and concentrates on the

determinants that may influence NPL in the commercial banks.

LITERATURE REVIEW

DEFINITION OF NON-PERFORMING LOAN

Non-performing loans occurred when it cannot be recovered within the specified time that is ruled by some respective

laws (Islam, Shil and Mannan, 2005). The most familiar interpretation of non-performing loans is where the debtor has

fallen more than a defined number of days behind the scheduled payments on the loans. According to the Bank for

423 |www.hssr.in © Zain et al.

Humanities & Social Sciences Reviews

eISSN: 2395-6518, Vol 8, No 2, 2020, pp 423-430

https://doi.org/10.18510/hssr.2020.8248

International Settlement (BIS), there are five classifications of the non-performing loans. Table 1 shows the rating of

non-performing loans.

Table 1: Five-Tiers of Non-performing loans

Tier Descriptions

Passed Solvent credits

Special Mention Loans to enterprises, which may represent a variety of challenges, for

instance, considering continuing with business loss.

Substandard Loans whose interest or principal payment are longer than a quarter of a year

overdue debts of loaning conditions are facilitated

Doubtful Full liquidation of outstanding debts seems faulty, and the record proposes

that there will be a loss, the specific amount of which can't be resolved yet.

Banks make a 50% provision for doubtful loans.

Loss Virtual Loss and Loss (Unrecoverable). Outstanding debts viewed as not

collectible typically loans to firms, which applied for legitimate goals and

assurance under liquidation laws. Banks make 100% provision for loss loans.

Source: Bank for International Settlement

Bank Negara Malaysia published the Guideline of Impaired Loans/Financing and Provisioning for Bad and Doubtful

Debts in 2005 to classify the general rule of impaired loans and credit facilities. Table 2 below shows the classifications

of problem loans.

Table 2: Classifications of Problem Loans

Period of Default Classification

Six months* however, undermine months Substandard, except there, is verification a worse-

off classification

Nine months however under12 months Doubtful, except for there, is verification a worse-

off classification

A year and above Bad

*3 months in the case of credit cards and trade financing instruments

Source: Bank Negara Malaysia (2005)

EFFECT OF BANK SPECIFIC FACTORS

Several studies have proved the association between bank-specific variables and problem loans. As stated in the survey

by Hue (2015), the study found that the growth rate of the loan, the total assets of the banks, and the previous NPLs have

a positive effect on NPLs for the recent year. A study from Hu, Yang, and Yung-Ho (2006) analyzed the association

between the ownership structure of the banks and NPLs, and it ratified that the banks with higher government ownership

would have the lower NPLs. There are numerous factors (bank-specific) that will affect the NPLs; however, this study

will employ three significant factors that researchers found that would influence NPLs most.

Bank Size

Previous studies have discovered information on variation in NPLs. Most of the studies found that the higher or larger

the bank size, the higher the probability of defaulting (such as Sheefeni, 2015; Geletta, 2012; Misra and Dhal, 2010;

Delis and Papanikolaou, 2009; Khemraj and Pasha, 2009). While other studies found a negative relationship between

bank size and NPLs. Their study argued that the bigger size of the banks seems to have fewer loan defaults (Hu, Yang,

and Yung-Ho, 2006; Rajan and Dhal, 2003; Salas and Saurina, 2002). The negative sign of the bank size might be

because of the less concentrated portfolio since the bigger size of the banks allows for diversification opportunities.

Capitalization

Most of the previous studies found that capitalization is one of the factors that influencing NPLs. Numerous research has

discovered that when the capitalization of the bank is decreasing, therefore NPLs are increasing. Hence, there is a

negative relationship between capitalization and NPLs (Chaibi, 2016; Salas and Saurina, 2002; Berger and DeYoung,

1997). However, some studies show the opposite findings, which means that highly capitalized banks are likely to have

high NPLs compared to their fellow with lower capitalization (Laryea, Ntow-Gyamfi, and Alu, 2016; Agoraki, 2011;

Boudriga, 2009). Meanwhile, the finding from Fajar and Umanto (2017) stated that there is no significant relationship

between capitalization and NPLs, and it supported by the study from Louzis (2012) and Khemraj and Pasha (2009).

Net Interest Margin

Empirical evidence proposed that there is a positive association between interest margin and NPLs. Several studies from

Angbazo (1997), Demirguc-Kunt and Huizinga (1999), Mendes and Abree (2003) and Carbo and Rodriquez (2007)

424 |www.hssr.in © Zain et al.

Humanities & Social Sciences Reviews

eISSN: 2395-6518, Vol 8, No 2, 2020, pp 423-430

https://doi.org/10.18510/hssr.2020.8248

found a positive association between interest margin and NPLs since a high proportion of problem loans may cause

banks to increase their margin to compensate for possible default risk.

EFFECT OF MACROECONOMICS FACTORS

Most of the studies that investigated the relationship between macroeconomic factors and NPLs revealed that there were

significant relationships between the macroeconomics variables. There are several numbers of macroeconomics

variables affecting NPLs; however, this study will focus on three significant factors that we considered.

Gross Domestic Product

There is a large number of published studies on the relationship between the GDP growth rate and NPLs. Several

numbers of empirical studies have found that there is a negative relationship between real GDP growth rate and NPLs

(Mwega, 2011; Khemraj and Pasha, 2009; Jimenez and Saurina, 2006; Fofack, 2005; Salas and Saurina, 2002). They had

mentioned that the higher positive level of real GDP growth typically requires a higher income. Therefore, the borrowers

had their capacity to pay their debts. Consequently, it will reduce the possibility of the loan default. However, there is an

inconsistency with this argument when Beck, Jakubik, and Piloiu (2013) found that the GDP growth rate has a

significant positive effect on NPLs. This finding was supported by the previous studies that have been done by

Thiagarajan, Ayyapan, and Ramachandran (2011), Derbali (2011), Ali and Daly (2010).

Inflation Rate

Several authors have considered the effect of the inflation rate on NPLs. Previous studies from Mileris (2012) stated that

increases in the inflation rate had a positive impact on NPLs, which means, when the inflation rate is increasing, NPLs

also increase. This finding supported by Badar and Javid (2013), Moinescu and Codirlasu (2012), Kochetkov (2012),

Derbali (2011), Greenidge and Grosvenor (2010). On the other study by Warue (2013), the findings show that the

inflation rate was negatively related to NPLs. The study employs both pooled (unbalanced and fixed effect panel

methods to investigate the effect of inflation rate on NPLs. It supported by the previous research from Khemraj and

Pasha (2009) and Kasselaki and Tagkalakis (2014).

Real Effective Exchange Rate

An adjustment in the effective exchange rate likewise can influence borrowers' obligation overhauling limits through

different channels, and its effects on NPLs can be certain or the other way around. As referenced in Khemraj and Pasha

(2009), deterioration of the exchange rate can have assorted signs on borrowers' debt-servicing limit. In any case, it can

improve the seriousness of fare situated firms. To the extent the estimation of local cash deteriorated (lower), trade

arranged firms can control the worldwide market at a lower cost since their creation cost canvassed in neighborhood

money which has a lower an incentive than outside money and their income gathered in remote cash which has a higher

incentive when contrasted with the household money. Henceforth, the deterioration of the swapping scale can upgrade

the obligation adjusting limit of fare situated borrowers since this examination is concern progressively about the impact

of the real effective exchange rate towards NPLs for both the financial framework.

Although most of the factors have been studied in previous researches, this exploration was directed as extra writing in

the financial division particularly in Malaysia. This research is required to create better conclusions and help the

regulators in understanding the present circumstance in Malaysia. Hence, this investigation additionally expected to

contribute recommendations for policy-makers by analyzing various macroeconomics indicators including real effective

exchange rate that influenced non-performing loans.

METHODOLOGY

Variables

This empirical study is to analyze the determinants of non-performing loans (NPL). Therefore, researchers have included

seven variables that consist of one variable for the dependent variable, and the others are as exploratory. The

independent variables divided into two categories, which are bank-specific and macroeconomic determinants of the non-

performing loans. As for the dependent variable, non-performing loans measured by using the ratio of gross non-

performing loans and total loans. For the dependent variables, bank-specific determinants are the internal factors of the

bank. For this empirical study, we are using three internal factors as bank-specific determinants of non-performing loans:

Bank size: In most finance literature, the natural logarithm of the total assets of the banks used as a proxy of the bank

size. The result of the most previous studies shows that the effect of the bank size generally gives a negative relationship

(Smirlock, 1985).

Capitalization: For capitalization, it measured by the ratio of equity of the bank to the total assets. This ratio considered

as the primary ratio for capital strength. This ratio expected to have a negative relationship with non-performing loans.

In another word, well-capitalized banks will reduce the default loans.

Net interest margin: Net interest margin is measured using the ratio of net interest income to total assets. It measures a

bank's net interest spread, and it focused on the profit earned on interest activities.

425 |www.hssr.in © Zain et al.

Humanities & Social Sciences Reviews

eISSN: 2395-6518, Vol 8, No 2, 2020, pp 423-430

https://doi.org/10.18510/hssr.2020.8248

Moreover, for the macroeconomics factors, three variables are used as the external factors for the non-performing loans:

Real GDP growth rate: Real GDP is a measurement of economic output that accounts for the effects of inflation or

deflation. According to the literature on the association between economic growth and loan defaults, it expected to have

a negative relationship on the non-performing loans (Mwega, 2011; Khemraj and Pasha, 2009; Jimenez and Saurina,

2006).

Inflation rate: Annual inflation refers to the percentage change of the Consumer Price Index (CPI). Inflation may have a

positive effect on non-performing loans. Most of the studies observe increasing in non-performing loans caused by

higher inflation (Badar and Javid, 2013; Moinescu and Codirlasu, 2012; Babihuga; 2007).

Real effective exchange rate: It is a measure of the value of a currency against a weighted average of several foreign

currencies divided by a price deflator or index of costs.

Data and Method

The sample of the study is an unbalanced panel dataset of eight local commercial banks in Malaysia observed over the

period 2009 – 2018 consisting of 80 observations. Most of the bank-specific variables derived from income statements

and balance sheets of the banks through their annual reports and FitchConnect database. As for the macroeconomic

variables, the data of growth rate and inflation rate obtained from the data stream database. While for the data for real

effective exchange rates are derived from the United Nations Conference on Trade and Development (UNCTAC).

To examine the determinants of non-performing loans, we utilize a panel data approach. A data set that comprises both

time series and cross-sectional elements is known as a panel of data or longitudinal data. In panel data models, the data

set consists of n cross-sectional units (banks), denoted by i = 1,2,…, N; (N=8 commercial banks), observed at each of T

periods, t = 1,2,…,T; (T=10). Therefore, in this study, the total observations are n x T (8 x10 = 80 observations). The

basic framework for the panel data defined according to the following regression model (Brook, 2019):

Where:

= dependent variable

= intercept term

= parameters to be estimated on the exploratory variables

= observations on the exploratory variables

The estimation models of the panel data are estimated using a fixed-effects or random-effects model. The Hausman test

conducted to find out which models are most appropriate. Based on the result of the Hausman test, a random-effects

model has been selected.

FINDINGS

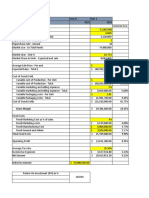

Descriptive Statistics

The basic descriptive statistics of the variables presented in Table 3. It shows mean, standard deviation, minimum, and

maximum value. On average, non-performing loans (dependent variable) for the local commercial banks in Malaysia is

0.72% over the whole period from 2009 to 2018. Mean for bank size varies greatly across banks and periods; the

standard deviation of bank size is 1.78. The average for the capitalization is 0.35%, the standard deviation 0.32, the

minimum and maximum value of 0.05, and 0.99%, respectively. The mean and standard deviation of other variables

along with their number of observations shown in Table 3.

Table 3: Descriptive Statistics for Variables

Mean Std. Dev. Min Max

NPL 0.7205 0.7693 -0.8195 3.9204

BNKSZ 24.5193 1.7824 21.1777 26.9570

CAP 0.3549 0.3271 0.0504 0.9983

NIM 1.0840 1.0981 -1.3075 2.5848

GDP 3.2641 2.2016 -3.2856 5.6235

INF 2.1505 0.9795 0.5833 3.8712

REER 4.5417 0.0621 4.4441 4.6052

Table 4 presented the correlation matrix between independent variables. As shown in Table 3, most of the independent

variables represent low data correlations among them, except capitalization (CAP) and bank size (BNKSZ), net interest

margin (NIM) and bank size (BNKSZ) and also capitalization (CAP) and net interest margin (NIM). Therefore, we can

assume that there is no multicollinearity problem exists.

426 |www.hssr.in © Zain et al.

Humanities & Social Sciences Reviews

eISSN: 2395-6518, Vol 8, No 2, 2020, pp 423-430

https://doi.org/10.18510/hssr.2020.8248

Table 4: Correlations between Independent Variables

BNKSZ CAP NIM GDP INF REER

BNKSZ 1.0000

CAP -0.7022 1.0000

NIM 0.5239 -0.8849 1.0000

GDP 0.0188 -0.0223 -0.0175 1.0000

INF 0.0110 -0.0344 -0.0432 0.5442 1.0000

REER -0.1027 0.0737 -0.0035 0.0634 -0.1016 1.0000

Empirical Results from Panel Data Analysis

Table 5 shows the estimated parameters and t-statistics obtained from the application of a random-effects model using

NPLs as the dependent variable. Based on the result, for the bank-specifics determinants, capitalization (CAP) found to

be negatively related to non-performing loans at a 5% level of significance. This negative relationship shows that when

the ratio of capital strength is low, therefore it will harm loan defaults. The other bank-specific determinants, bank size,

and net interest margin shows that they are not giving an effect toward NPLs. For the macroeconomic variables, the real

effective exchange rate is highly significant and positively related to NPLs at a 1% level of significance. While the other

variables for macroeconomic are not substantial.

Table 5: Determinants of Non-performing Loans (NPLs)

Coef. Std. Err. t P>|t|

BNKSZ -0.2216 0.1635 -1.36 0.175

CAP -1.7709 0.8295 -2.13 0.033**

NIM -0.2403 0.2009 -1.20 0.0232**

GDP -0.0421 0.3064 -1.37 0.170

INF 0.0205 0.0688 0.30 0.766

REER 4.1021 1.001 4.10 0.000***

Constant -11.4937 7.2987 -1.57 0.115

Note: ***,**, and * indicate significance level of 1*, 5% and 10% respectively.

DISCUSSION

Table 5 summarizes the results of our regression model which is estimated using a random effect estimator. The variable

BNKSZ (size of the bank) is negative and insignificant. This evidence is inconsistent with previous studies by Sheefeni

(2015), Geletta (2012), Misra and Dhal(2010), Delis and Papanikolaou(2009) and Khemraj and Pasha (2009). Therefore,

in this study, it could be summarized that the larger the size of the bank, the fewer loan defaults. It also can be

interpreted that the larger banks are not necessarily more effective in screening loan customers.

Similar to previous studies, the result shows a negative significant association between capitalization (CAP) and non-

performing loans (Chaibi, 2016; Salas and Saurina, 2002; Berger and DeYoung, 1997). This study shows that non-

performing loans will be increased when the capitalization of the bank is decreasing. As for the net interest margin

(NIM) shows the results are negative and significant. This evidence is not consistent with Angbazo (1997), Demirguc-

Kunt and Huizinga (1999), Mendes and Abree (2003) and Carbo and Rodriquez (2007).

Based on Table 5, the gross domestic product (GDP) is negatively and insignificantly related to non-performing loans.

This result is supported by the previous study by Beck, Jakubik, and Piloiu (2013). Our variable on inflation rate (INF)

shows negatively insignificant results toward this study which is inconsistent with Badar and Javid (2013), Moinescu

and Codirlasu (2012), Kochetkov (2012), Derbali (2011), Greenidge and Grosvenor (2010). On the other variable, a real

effective exchange rate (REER) shows a consistent result with Khemraj and Pasha (2009) and Fofack (2005) which

positively and significantly related to non-performing loans.

CONCLUSION

In this study, we attempted to identify variables that can affect non-performing loans of the local commercial banks in

Malaysia. In order to fulfill the research objective, the panel data approach (random-effects model) applied to estimate

the data, which contains eight banks' financial statements from 2009 – 2018. We found that capitalization (CAP) has a

significantly negative effect on non-performing loans. In other words, when the value of capitalization is higher, it

means the banks are well-capitalized, and hence it will reduce loan defaults furthermore will reduce the rate of non-

performing loans. On the macroeconomics variables, only the real effective exchange rate (REER) found having a

significant positive relationship with non-performing loans. This result means, when the real effective exchange rate

higher, therefore NPls also getting higher. Meanwhile, the other bank-specific determinants (bank size and net interest

margin) and macroeconomics determinants (GDP and inflation) seem not giving a vital effect on NPLs.

427 |www.hssr.in © Zain et al.

Humanities & Social Sciences Reviews

eISSN: 2395-6518, Vol 8, No 2, 2020, pp 423-430

https://doi.org/10.18510/hssr.2020.8248

LIMITATION AND STUDY FORWARD

There were limitations during the preparation of this study. This study focused solely on Malaysia. Therefore, it is an

insufficient journal about this study published by Malaysia. However, some information was obtained from a foreign

country's article or journals, which can cover the lack of information in Malaysia studies. The availability of the data also

one of the limitations of this study because there is an insufficient platform to obtain the data. Since most of the banks

must follow the regulations and restrictions in keeping customers' information confidentiality, therefore some of the data

released by banks were inconsistent and not completed. The data gathered from annual reports from each bank and the

database from Fitchconnect, and it is slightly different between both of them. Therefore, the authors need to handle the

data carefully to make sure the data collected is consistent. The availability of the report mostly from 2009 until 2018.

Therefore, this study range is only for ten years.

In order to extend this study, future studies can be done on the other internal variables of the banks that have significant

factors in non-performing loans and also the insurance or takaful in business for NPLs to avoid bankruptcy (Ghazali,

P.L., 2012a, 2012b, 2015, 2017 and 2019). The future researcher also may lengthen the period of the study. Due to the

time constraint, only a yearly data basis was used. The result might vary and more accurate if semi-annually data or

monthly data was used in this study. On the other hand, this paper only focused on one country and only on the

conventional banking system. Therefore, for future studies, the researcher may involve the Islamic banking system or

take more countries as a subject of the research.

ACKNOWLEDGMENT

The authors would like to thank Universiti Malaysia Kelantan, Malaysia, and the Ministry of Higher Education in

Malaysia for the support and fund in completing this study. The first author is a lecturer in the Faculty of

Entrepreneurship and Business at Universiti Malaysia Kelantan. This article was written while she was on study leave

for her Ph.D. at Universiti Sultan Zainal Abidin under the supervision of Associate Professor, Dr. Puspa Liza Ghazali,

and Dr. Wan Mohd Nazri Wan Daud.

AUTHORS CONTRIBUTION

Puspa Liza Ghazali is a corresponding author for this article who was checking all the flow for this paper especially for

the literature review and the parts of the reference and Wan Mohd Nazri Wan Daud was contributed to this article by

guiding the first author in the analysis part.

REFERENCES

1. Agoraki, M. E. K., Delis, M. D., & Pasiouras, F. (2011). Regulations, competition and bank risk-taking in

transition countries. Journal of Financial Stability, 7(1), 38–48. https://doi.org/10.1016/j.jfs.2009.08.002

2. Angbazo, L. (1997). Commercial bank net interest margins, default risk, interest rate risk, and off-balance sheet

banking. Journal of Banking and Finance, 21, pp. 55-87. https://doi.org/10.1016/S0378-4266(96)00025-8

3. Ali, A., & Daly, K. (2010). Macroeconomic determinants of credit risk: Recent evidence from a cross country

study. International Review of Financial Analysis, 19(3), 165–171. https://doi.org/10.1016/j.irfa.2010.03.001

4. Babihuga, R. (2007). Macroeconomic and financial soundness indicators: An empirical investigation. IMF

Working Paper, 07/115. https://doi.org/10.5089/9781451866797.001

5. Badar, M., & Yasmin Javid, A. (2013). Impact of macroeconomic forces on nonperforming loans: An empirical

study of commercial banks in Pakistan. WSEAS Transactions on Business and Economics, 10(1), 40–48.

6. Bank Negara Malaysia (2005). Guideline on the classification of impaired loans/financing and provisioning for

bad and doubtful debts. Development Finance and Enterprise Department.

7. Beck, R., Jakubik, P., & Piloiu, A. (2013). Non-performing loans: What matters in addition to the economic

cycle? European Central Bank Working Paper Series, (1515), 34.

8. Berger, A. N., & DeYoung, R. (1997). Problem loans and cost efficiency in commercial banks. Journal of

Banking and Finance, 21(6), 849–870. https://doi.org/10.1016/S0378-4266(97)00003-4

9. Boudriga, A., Boulila, N., & Jellouli, S. (2009). Does Bank Supervision Impact Nonperforming Loans : Cross-

Country Determinants using Agregate Data. Munich Personal RePEc Archive, (18068), 1–28.

https://doi.org/10.1108/17576380911050043

10. Brooks, C. (2019). Introductory Econometrics for Finance. 4th Edition. Cambridge University.

https://doi.org/10.1017/9781108524872

11. Carbo, S. & Rodriguez, F. (2007). The determinants of bank margins in European banking. Journal of Banking

& Finance, 31, pp. 2043-2063. https://doi.org/10.1016/j.jbankfin.2006.06.017

12. Chaibi, H. (2016). Determinants of Problem Loans: Non-performing Loans vs. Loan Quality Deterioration.

International Business Research, 9(10), 86. https://doi.org/10.5539/ibr.v9n10p86

13. Chinweoke, N., Onydikachi, M., and Elizabeth, N. (2014). Financial intermediation and economic growth in

Nigeria (1992 – 2011). The Macrotheme Review 3(6), Summer 2014.

14. Chavan, P., and Gambacorta, L. (2016). Bank Lending and Loan Quality: The Case of India. BIS Working

Paper No. 595.

428 |www.hssr.in © Zain et al.

Humanities & Social Sciences Reviews

eISSN: 2395-6518, Vol 8, No 2, 2020, pp 423-430

https://doi.org/10.18510/hssr.2020.8248

15. Delis, M. D., & Papanikolaou, N. I. (2009). Determinants of bank efficiency: evidence from a semi‐parametric

methodology. Managerial Finance, 35(3), 260–275. https://doi.org/10.1108/03074350910931771

16. Demirguc-Kunt, A., & Huizinga, H. (1999). Determinants of Commercial Bank Interest Margins and

Profitability: Some International Evidence. World Economic Review, 13(2), 379-408.

https://doi.org/10.1093/wber/13.2.379

17. Derbali, A. (2011). Determinants of Banking Profitability Before and During the Financial Crisis of 2007: The

Case of Tunisian Banks. Interdisciplinary Journal of Contemporary Research in Business, Vol. 3, No. 3.

18. Fofack, Hippolyte L. (2005). Non-performing loans in Sub-Saharan Africa : causal analysis and

macroeconomic implications. Policy, Research working paper ; no. WPS 3769. Washington, DC: World

Bank. https://doi.org/10.1596/1813-9450-3769

19. Geletta, W. N. (2012). Determinants of non-performing loans: The case of Ethiopian banks (Doctoral

dissertation).

20. Ghazali, P.L., Foziah, H., Mamat, M., Razak, R.A., Omar, L., Afthanorhan, A., Wan Daud, W.M.N. (2019).

Mathematical concept in integration model of education plan Takaful. International Journal of Recent

Technology and Engineering, 7(5),594-599.

21. Ghazali, P.L.B., Mamat, M., Omar, L.B., Foziah, N.H.M., Guci, D.A., Abdullah, Y.B., & Sazali, N.E.S.B.

(2017). Medical integration model of family takaful for blue collar. Far East Journal of Mathematical Sciences,

101(6), 1197–1205. https://doi.org/10.17654/MS101061197

22. Ghazali, P.L.B, Mazlina, A.N., Izah, M.T., Maslina, M., Zulqurnain, W.I., & Mustafa, M. (2015). Optimization

of integration model in family takaful. Applied Mathematical Sciences, 9(39), 1899–1909.

https://doi.org/10.12988/ams.2015.411930

23. Ghazali, P.L.B, Mohd, I., Ahmad, W.M.A.W., & Mamat, M. (2012a). Implementation of integration model for

all. Journal of Applied Sciences Research, 8(3), 1802–1812.

24. Ghazali, P.L.B, Mohd, I., Ahmad, W.M.A.W., & Mamat, M. (2012b). Integration model of Education Plan

Takaful: A Case Study for Terengganu, Kelantan and Perlis, States in Malaysia. Journal of Applied Sciences

Research, 65(1), Page 97-117.

25. Greenidge, K., & Grosvenor, T. (2010). Forecasting Non-Performing Loans in Barbados. Journal of Business,

Finance & Economics in Emerging Economies, 5(1).

26. Fajar, H. & Umanto (2017). The impact of macroeconomic and bank-specific factors toward non-performing

loan: evidence from Indonesian public banks. Banks and Bank Systems (open-access), 12(1), 67-74.

https://doi.org/10.21511/bbs.12(1).2017.08

27. Hu, J., Yang, L. & Yung-Ho, C. (2006). Ownership and Non-performing Loans: Evidence from Taiwan's

Banks. Developing Economies. Vol. 42, no. 3, pp. 405-420. https://doi.org/10.1111/j.1746-1049.2004.tb00945.x

28. Islam, Mohammad & Shil, Nikhil & Mannan, Md. (2005). Non performing loans - its causes, consequences and

some learning. University Library of Munich, Germany, MPRA Paper.

29. Jiménez, G., & Saurina, J. (2006). Credit Cycles, Credit Risk, and Prudential Regulation. International Journal

of Central Banking, 2(January), 65–98.

30. Karim, M. Z. A., Chan, S. G., & Hassan, S. (2010). Bank efficiency and non-performing loans: Evidence from

Malaysia and Singapore. Prague Economic Papers, 2(2010), 118-132. https://doi.org/10.18267/j.pep.367

31. Kasselaki, M. T., & Tagkalakis, A. O. (2014). Financial soundness indicators and financial crisis

episodes. Annals of Finance, 10(4), 623-669. https://doi.org/10.1007/s10436-013-0233-6

32. Khemraj, T., & Pasha, S. (2009). The determinants of non-performing loans: an econometric case study of

Guyana. MPRA Paper 53128, University Library of Munich, Germany.

33. Kochetkov, Y. (2012). Modern model of interconnection of inflation and unemployment in Latvia. Engineering

Economics, 23(2), 117-124. https://doi.org/10.5755/j01.ee.23.2.1543

34. Laryea, E., Ntow-Gyamfi, M., & Alu, A. A. (2016). Non-performing loans and bank profitability: evidence

from an emerging market. African Journal of Economic and Management Studies, 7(4), 462–481.

https://doi.org/10.1108/AJEMS-07-2015-0088

35. Louzis, D. P., Vouldis, A. T., & Metaxas, V. L. (2012). Macroeconomic and bank-specific determinants of non-

performing loans in Greece: A comparative study of mortgage, business and consumer loan portfolios. Journal

of Banking & Finance, 36(4), 1012-1027. https://doi.org/10.1016/j.jbankfin.2011.10.012

36. Mendes, V., & Abree, M. (2003). Do Macro-Financial Variables Matter for European Bank Interest Margins

and Profitability?. In EcoMod2003-International Conference on Policy Modeling. Global Economic Modeling

Network.

37. Mileris, R. (2012). Macroeconomic determinants of loan portfolio credit risk in banks. Engineering

Economics, 23(5), 496-504. https://doi.org/10.5755/j01.ee.23.5.1890

38. Hue, Minh. (2015). Non-Performing Loans: Affecting Factor for the Sustainability of Vietnam Commercial

Banks. Journal of Economics and Development. 93-106. https://doi.org/10.33301/2015.17.01.06

39. Misra, B. M., & Dhal, S. (2010). Pro-cyclical management of banks’ non-performing loans by the Indian public

sector banks. BIS Asian Research Papers.

40. Moinescu, B., & Codirlasu, A. (2012). Assessing the Sectoral Dynamics of Non-performing Loans: Signs from

Financial and Real Economy. Theoretical & Applied Economics, 19(2).

429 |www.hssr.in © Zain et al.

Humanities & Social Sciences Reviews

eISSN: 2395-6518, Vol 8, No 2, 2020, pp 423-430

https://doi.org/10.18510/hssr.2020.8248

41. Mwega, F. (2011). The Competitiveness and Efficiency of the Financial Services Sector in Africa: A Case

Study of Kenya. African Development Review, 23: 44–59. https://doi.org/10.1111/j.1467-8268.2010.00271.x

42. Rajan, R. & Dhal, S.C. (2003). Non-performing loans and terms of credit of public sector banks in India: An

empirical assessment. Reserve Bank of India Occasional Papers, 24(3), pp 81-121.

43. Saini, P., and Sindhu. J. (2014). Role of Commercial Bank in the Economic Development of India.

International Journal of Engineering and Management Research 4: 27–31.

44. Salas, V., & Saurina, J. (2002). Credit risk in two institutional regimes: Spanish commercial and savings banks.

Journal of Financial Services Research, 22(3), 203-224. https://doi.org/10.1023/A:1019781109676

45. Sheefeni, J. P. (2015). Evaluating the Impact of Bank Specific Determinants of Non-performing Loans in

Namibia. Journal of Emerging Issues in Economics, Finance and Banking , Vol.4 (No.2), PP.1525-1541.

46. Smirlock, M. (1985). Evidence on the (Non) Relationship between Concentration and Profitability in

Banking, Journal of Money, Credit and Banking, 17, issue 1, p. 69-83. https://doi.org/10.2307/1992507

47. Thiagarajan, S., Ayyappan, S., & Ramachandran, A. (2011). Credit Risk Determinants of Public and Private

Sector Banks in India. European Journal of Economics, Finance and Administrative Sciences, 34(34), 147–153.

48. Warue, B. N. (2013). The effects of bank specific and macroeconomic factors on non-performing loans in

commercial banks in Kenya: A comparative panel data analysis. Advances in Management and Applied

Economics, 3(2), 135.

430 |www.hssr.in © Zain et al.

View publication stats

You might also like

- Guidelines On Foreigners Property Ownership in IndonesiaDocument76 pagesGuidelines On Foreigners Property Ownership in IndonesiaRazvan Julian PetrescuNo ratings yet

- A Study On South Indain Bank LTDDocument67 pagesA Study On South Indain Bank LTDKarthik Ravi67% (3)

- Bankers' Perspective On Challenges of Bad Debt Recovery: Empirical Evidence From Commercial Banks of NepalDocument23 pagesBankers' Perspective On Challenges of Bad Debt Recovery: Empirical Evidence From Commercial Banks of NepalNiranjan Devkota, PhDNo ratings yet

- 5580-Source Texts-23748-1-10-20211124Document14 pages5580-Source Texts-23748-1-10-20211124Abhi DNo ratings yet

- Causes of Non-Performing Loan: A Study On Bangladesh Public Sector BanksDocument8 pagesCauses of Non-Performing Loan: A Study On Bangladesh Public Sector BanksMohaiminul Islam MominNo ratings yet

- Thesis Proposal MBSDocument23 pagesThesis Proposal MBSluciferparajuleeNo ratings yet

- Munna Tamang ProposalDocument10 pagesMunna Tamang Proposalmunna tamangNo ratings yet

- New Report-1Document15 pagesNew Report-1Ahmed BaigNo ratings yet

- Negi-2 Npa Sip ProjectDocument56 pagesNegi-2 Npa Sip ProjectSooRaj AliNo ratings yet

- Credit Risk Analysis of Canara Bank - A Case StudyDocument11 pagesCredit Risk Analysis of Canara Bank - A Case Studysharon0% (1)

- Proposal A 2222151049 ABSDocument6 pagesProposal A 2222151049 ABSmehrin mostofa addritaNo ratings yet

- 1 Background To The StudyDocument4 pages1 Background To The StudyNagabhushanaNo ratings yet

- Research Proposal: Topic: Loan Delinquency: Causes, Effects and Exemption SchemesDocument4 pagesResearch Proposal: Topic: Loan Delinquency: Causes, Effects and Exemption SchemesNandini AlyaniNo ratings yet

- A Case Study Dissertation OnDocument44 pagesA Case Study Dissertation Onsachin mohanNo ratings yet

- Synopsis 01Document8 pagesSynopsis 01Alok SmgNo ratings yet

- 10 1108 - Ijbm 03 2021 0088Document18 pages10 1108 - Ijbm 03 2021 0088Shweta ChaudharyNo ratings yet

- Ijrbm - Effect of Macro-Economic and Banks Specific Determinants of Credit Risk of Select Public Sector Banks in The Post Financial Crisis Period Evidence From IndiaDocument11 pagesIjrbm - Effect of Macro-Economic and Banks Specific Determinants of Credit Risk of Select Public Sector Banks in The Post Financial Crisis Period Evidence From IndiaImpact JournalsNo ratings yet

- Loan Delinquency in Microfinance Institutions (Mfis) : Ways To Overcome The Problem Basu Dev LamichhaneDocument7 pagesLoan Delinquency in Microfinance Institutions (Mfis) : Ways To Overcome The Problem Basu Dev LamichhaneHamza AhmedNo ratings yet

- 09 - Chapter Om Swami SamarthDocument16 pages09 - Chapter Om Swami Samartharatikute2014No ratings yet

- Analytical Study On The Merger of Bank of Baroda, Vijaya Bank and Dena Bank, On The Back Drop of Their NpasDocument7 pagesAnalytical Study On The Merger of Bank of Baroda, Vijaya Bank and Dena Bank, On The Back Drop of Their NpasIJAR JOURNALNo ratings yet

- Abubakar Ladan B & FDocument49 pagesAbubakar Ladan B & FMOHAMMED ABDULMALIKNo ratings yet

- Non Performing Loan ThesisDocument4 pagesNon Performing Loan ThesisPaperWritingServiceSuperiorpapersSpringfield100% (2)

- R N P A R F C B - A S S I C BDocument19 pagesR N P A R F C B - A S S I C BAyona AduNo ratings yet

- Article Review 323Document20 pagesArticle Review 323yaredNo ratings yet

- Madda Walabu University College of Business and Economics Department of Accounting and FinanceDocument5 pagesMadda Walabu University College of Business and Economics Department of Accounting and FinancehabtamuNo ratings yet

- Influence of Products Range On Sacco'S Credit Accessibility in Imenti North Sub-County, KenyaDocument13 pagesInfluence of Products Range On Sacco'S Credit Accessibility in Imenti North Sub-County, KenyaGILBERT KIRUINo ratings yet

- Bank Efficiency and Non-Performing Loans: Evidence From Malaysia and SingaporeDocument16 pagesBank Efficiency and Non-Performing Loans: Evidence From Malaysia and SingaporeAshraful AlamNo ratings yet

- Proje FileDocument76 pagesProje FileNitin kumarNo ratings yet

- Credit Management in Indian Overseas BankDocument60 pagesCredit Management in Indian Overseas BankAkash DixitNo ratings yet

- Study On Sbi LoansDocument8 pagesStudy On Sbi LoansNithya KarthikNo ratings yet

- Thesis Banking SectorDocument9 pagesThesis Banking Sectormeganespinozadallas100% (4)

- Chapter One 1.1 Background To The StudyDocument49 pagesChapter One 1.1 Background To The StudyMr. Lawal YusufNo ratings yet

- Tphuc,+Editor,+7+Full+Paper+7 Quoc+Trung+ (Edit)Document18 pagesTphuc,+Editor,+7+Full+Paper+7 Quoc+Trung+ (Edit)hhapanhNo ratings yet

- Project Report ON: "A Study of Comparative Analyis of Kotak Mahindra Bank With Its Competitor'S"Document63 pagesProject Report ON: "A Study of Comparative Analyis of Kotak Mahindra Bank With Its Competitor'S"Nitesh AgrawalNo ratings yet

- Winter Project Report: A Study On Non Performing Assets in BanksDocument47 pagesWinter Project Report: A Study On Non Performing Assets in BanksLindoJacobNo ratings yet

- A Study of Credit Risk ManagementDocument60 pagesA Study of Credit Risk ManagementPrince Satish Reddy100% (2)

- Comparative Analysis On NBFC & Banks NPADocument33 pagesComparative Analysis On NBFC & Banks NPABHAVESH KHOMNENo ratings yet

- Dissertation On Risk Management in Indian Banking IndustryDocument7 pagesDissertation On Risk Management in Indian Banking IndustryHelpPaperRochesterNo ratings yet

- The Causes and Consequences of Over-Indebtedness of Micro-Finance Client: Evidence From Khulna Division, BangladeshDocument12 pagesThe Causes and Consequences of Over-Indebtedness of Micro-Finance Client: Evidence From Khulna Division, BangladeshMotiram paudelNo ratings yet

- The Hallmark Corruption Supervisory Lapses of TheDocument5 pagesThe Hallmark Corruption Supervisory Lapses of TheFeruz Sha RakinNo ratings yet

- Mburu MwangiandMuathe2020Document14 pagesMburu MwangiandMuathe2020Jr SantiagoNo ratings yet

- Literature Review On Non Performing AssetsDocument7 pagesLiterature Review On Non Performing Assetsibcaahsif100% (1)

- 2015 - OctDocument20 pages2015 - OctDeepika ENo ratings yet

- Nitika Dissertation 210010301046 2023Document43 pagesNitika Dissertation 210010301046 2023jatin208raoNo ratings yet

- Literature Review Banking SectorDocument7 pagesLiterature Review Banking Sectoreubvhsvkg100% (1)

- A STUDY ON LOAN MANAGEMENT OF NEPAL BANK LIMITED AND AGRICULTURAL DEVELOPMENT BANK LIMITED1stDocument7 pagesA STUDY ON LOAN MANAGEMENT OF NEPAL BANK LIMITED AND AGRICULTURAL DEVELOPMENT BANK LIMITED1stOmisha KhatiwadaNo ratings yet

- ABCDDocument45 pagesABCDKartik GaurNo ratings yet

- Thesis Banking UnionDocument8 pagesThesis Banking UnionJanelle Martinez100% (2)

- Analytical Study of Capital Structure of Icici BankDocument22 pagesAnalytical Study of Capital Structure of Icici BankKuldeep Ban100% (2)

- 17 PDFDocument12 pages17 PDFmuqadam buttNo ratings yet

- Effects of Credit Appraisal Methods...Document12 pagesEffects of Credit Appraisal Methods...Nhật QuangNo ratings yet

- Practices of Corporate Governance in The Banking IndustryDocument14 pagesPractices of Corporate Governance in The Banking IndustryMd. Rubel AhmedNo ratings yet

- Research Journal of Finance and Accounting ISSN 2222-1697 (Paper) ISSN 2222-2847 (Online) DOI: 10.7176/RJFA Vol.10, No.3, 2019Document12 pagesResearch Journal of Finance and Accounting ISSN 2222-1697 (Paper) ISSN 2222-2847 (Online) DOI: 10.7176/RJFA Vol.10, No.3, 2019daniel nugusieNo ratings yet

- Determinants of Credit Default Risk of Microfinance InstitutionsDocument9 pagesDeterminants of Credit Default Risk of Microfinance InstitutionsgudataaNo ratings yet

- Merga S Proposal UpdatedDocument17 pagesMerga S Proposal UpdatedAbera AsefaNo ratings yet

- Bridging The "Missing Middle" Between Microfinance and Small and Medium-Sized Enterprise Finance in South AsiaDocument26 pagesBridging The "Missing Middle" Between Microfinance and Small and Medium-Sized Enterprise Finance in South AsiaADBI PublicationsNo ratings yet

- DissertationnDocument39 pagesDissertationnmanan sukhijaNo ratings yet

- The Icarus Paradox in The Indian Banking Sector: The Story of Yes BankDocument8 pagesThe Icarus Paradox in The Indian Banking Sector: The Story of Yes BankANUSHKA SHARMA 20111307No ratings yet

- Impact of Borrower Characteristic On Loan Repayment in TanzaniaDocument30 pagesImpact of Borrower Characteristic On Loan Repayment in TanzaniaGift GeorgeNo ratings yet

- General Information of The ArticleDocument4 pagesGeneral Information of The ArticlehabtamuNo ratings yet

- WP 193Document45 pagesWP 193Ashraful AlamNo ratings yet

- Part I Project Conception - Topic 2 Developing Project Management Plan and Defining Project Goals or Scope, Project Design and Logical FrameworkDocument63 pagesPart I Project Conception - Topic 2 Developing Project Management Plan and Defining Project Goals or Scope, Project Design and Logical FrameworkAshraful AlamNo ratings yet

- Bank Efficiency and Non-Performing Loans: Evidence From Malaysia and SingaporeDocument16 pagesBank Efficiency and Non-Performing Loans: Evidence From Malaysia and SingaporeAshraful AlamNo ratings yet

- Optimal Score Cutoffs and Pricing of Regulatory CaDocument22 pagesOptimal Score Cutoffs and Pricing of Regulatory CaAshraful AlamNo ratings yet

- Credit PlanningDocument11 pagesCredit PlanningAshraful AlamNo ratings yet

- ProjectDocument2 pagesProjectAshraful AlamNo ratings yet

- Concept ChecksDocument8 pagesConcept ChecksAshraful AlamNo ratings yet

- LC .Excellent FinalDocument23 pagesLC .Excellent FinalAshraful AlamNo ratings yet

- Executive Summary: How Do Face Masks Help Prevent The Spread of COVID-19?Document8 pagesExecutive Summary: How Do Face Masks Help Prevent The Spread of COVID-19?Ashraful AlamNo ratings yet

- Generalized PaySlip For EmployeeDocument1 pageGeneralized PaySlip For EmployeePalash NaskarNo ratings yet

- Iron & Steel Industry in IndiaDocument18 pagesIron & Steel Industry in IndiaRahul KolekarNo ratings yet

- Gross MarginDocument2 pagesGross MarginEDxColdBloodedNo ratings yet

- Resource AllocationDocument21 pagesResource AllocationKeneth Ornos100% (2)

- AX Computer ShopDocument1 pageAX Computer ShopCherry Jana RobianesNo ratings yet

- PT Cahaya Xii Akl SMK KartiniDocument40 pagesPT Cahaya Xii Akl SMK Kartiniwahyudi yudiNo ratings yet

- Account Statement 20230530 20230629 110547Document3 pagesAccount Statement 20230530 20230629 110547DARANo ratings yet

- Entrepreneurs: The Driving Force Behind Small Business: Inc. Publishing As Prentice Hall 1Document32 pagesEntrepreneurs: The Driving Force Behind Small Business: Inc. Publishing As Prentice Hall 1omar ahmedNo ratings yet

- SSLIDES - VATEL - LSLIDES - Chap 3Document30 pagesSSLIDES - VATEL - LSLIDES - Chap 3uyenthanhtran2312No ratings yet

- ASBI Grouted Post Tensioning SpecificationsDocument19 pagesASBI Grouted Post Tensioning Specificationselev lookNo ratings yet

- Globalize or Customize: Finding The Right Balance: Global Steel 2015-2016Document32 pagesGlobalize or Customize: Finding The Right Balance: Global Steel 2015-2016Aswin Lorenzo GultomNo ratings yet

- Cost Management & Low Rise High Rise PDFDocument36 pagesCost Management & Low Rise High Rise PDFHarleen SehgalNo ratings yet

- Development Economics AssignmentDocument2 pagesDevelopment Economics Assignmentyedinkachaw shferawNo ratings yet

- BBG DWG PTT 129 01 PDFDocument1 pageBBG DWG PTT 129 01 PDFRezky Dian SunartoNo ratings yet

- Think Like A FREAK (Abridgement)Document12 pagesThink Like A FREAK (Abridgement)Ron TurfordNo ratings yet

- Tender Ad SCMEDocument1 pageTender Ad SCMESyed Raza AliNo ratings yet

- The Origin of The Tourism in The PhilippinesDocument18 pagesThe Origin of The Tourism in The PhilippinesLove Joy Espinueva100% (1)

- B4568 Arun 3N4D Standard Andaman TourDocument6 pagesB4568 Arun 3N4D Standard Andaman Tourarun.nagarkarNo ratings yet

- Fahad Resume2327Document4 pagesFahad Resume2327Fahad khanNo ratings yet

- List of Lto Vdap ManufacturerDocument3 pagesList of Lto Vdap ManufacturerRcs CheNo ratings yet

- Unit 1: Used With The Present Perfect Used With The Past SimpleDocument6 pagesUnit 1: Used With The Present Perfect Used With The Past Simplejulieta loveraNo ratings yet

- International Working Capital ManagementDocument28 pagesInternational Working Capital ManagementAvayant Kumar Singh100% (2)

- SIAT - Datasheet NASTRO-SB M-Series - ENG - Rev1.2Document2 pagesSIAT - Datasheet NASTRO-SB M-Series - ENG - Rev1.2Szabolcs MártonNo ratings yet

- YPF 3Q23 Earnings Webcast PresentationDocument9 pagesYPF 3Q23 Earnings Webcast PresentationCronista.comNo ratings yet

- Rajiv Awas YojanaDocument8 pagesRajiv Awas YojanakausiniNo ratings yet

- Theories ForLQ3Document33 pagesTheories ForLQ3Erica HababagNo ratings yet

- Dashboard Ence602Document314 pagesDashboard Ence602api-707678106No ratings yet

- Modernization of Metal Electroplating With No Mask FixturesDocument20 pagesModernization of Metal Electroplating With No Mask FixturestonymailinatorNo ratings yet

- Chapter 7 - Consumers, Producers, and The Efficiency of MarketsDocument37 pagesChapter 7 - Consumers, Producers, and The Efficiency of MarketsDellon-Dale BennettNo ratings yet