Professional Documents

Culture Documents

Individual Investors Doing Business During Pandemic

Individual Investors Doing Business During Pandemic

Uploaded by

Kevin Jeason PerdidoCopyright:

Available Formats

You might also like

- G.R. No. 181455-56 Case DigestDocument2 pagesG.R. No. 181455-56 Case DigestKevin Jeason PerdidoNo ratings yet

- Transfer Pricing, Thin Capitalization, Financial Distress, Earning Management, Dan Capital Intensity GrowthDocument26 pagesTransfer Pricing, Thin Capitalization, Financial Distress, Earning Management, Dan Capital Intensity GrowthLukmanul HakimNo ratings yet

- The Effect of Liquidity, Leverage and Determined Tax Load On Profitability With Profit Management As Moderating VariablesDocument13 pagesThe Effect of Liquidity, Leverage and Determined Tax Load On Profitability With Profit Management As Moderating VariablesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- ABM TextDocument6 pagesABM TextPauline TayabanNo ratings yet

- Has COVID-19 Hindered Small Business Activities - The Role of FintechDocument12 pagesHas COVID-19 Hindered Small Business Activities - The Role of FintechFaizan KhanNo ratings yet

- The Effect of Political Factors On FDI AttractionDocument6 pagesThe Effect of Political Factors On FDI AttractionTrần Minh ĐạtNo ratings yet

- Lesson 4 EBBADocument108 pagesLesson 4 EBBAHuyền LinhNo ratings yet

- The Effect of Institutional Ownership, Sales Growth and Profitability On Tax AvoidanceDocument9 pagesThe Effect of Institutional Ownership, Sales Growth and Profitability On Tax AvoidanceAJHSSR JournalNo ratings yet

- Corporate Income Tax Rate and Foreign Direct Investment - A CrossDocument23 pagesCorporate Income Tax Rate and Foreign Direct Investment - A CrossnigusNo ratings yet

- Help For EconoDocument15 pagesHelp For EcononigusNo ratings yet

- Sumaiya Selim Sushme - 20104071 - BUS203 - 04 - FINALDocument7 pagesSumaiya Selim Sushme - 20104071 - BUS203 - 04 - FINALSumaiya Selim SushmeNo ratings yet

- Taxationasa Significant Toolfor Economic DevelopmentDocument12 pagesTaxationasa Significant Toolfor Economic DevelopmentRohan 70KNo ratings yet

- Imposition of Tax Penalties and Interest and Its IDocument11 pagesImposition of Tax Penalties and Interest and Its IJhonalyn MaraonNo ratings yet

- Effect of Economic and Non-Economic Factors On Tax Compliance With Trust As A Moderating Variable in SME (Case Study SME in Bekasi, Indonesia)Document7 pagesEffect of Economic and Non-Economic Factors On Tax Compliance With Trust As A Moderating Variable in SME (Case Study SME in Bekasi, Indonesia)International Journal of Innovative Science and Research TechnologyNo ratings yet

- Position Paper DraftDocument4 pagesPosition Paper DraftsephNo ratings yet

- Financial Distress, Earnings Management, and Tax Avoidance: Evidence From IndonesiaDocument8 pagesFinancial Distress, Earnings Management, and Tax Avoidance: Evidence From IndonesiaAJHSSR JournalNo ratings yet

- Effect of Taxation Amendment in Corporate Arena ReportDocument4 pagesEffect of Taxation Amendment in Corporate Arena Reportsidharth A.JNo ratings yet

- Will Anti-Tax-Avoidance Provisions Reduce The InveDocument24 pagesWill Anti-Tax-Avoidance Provisions Reduce The InveKiruthigaah KanadasanNo ratings yet

- An Extensive Examination of Taxation As An Accelerator For Economic Growth in NigeriaDocument6 pagesAn Extensive Examination of Taxation As An Accelerator For Economic Growth in NigeriaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Bbe A2.2Document17 pagesBbe A2.2Minh PhíNo ratings yet

- 135-Article Text-875-1-10-20220509Document14 pages135-Article Text-875-1-10-20220509Samelyn SabadoNo ratings yet

- Discussion Unit 3Document3 pagesDiscussion Unit 3Monica KamalNo ratings yet

- Lesson 4 EBBADocument105 pagesLesson 4 EBBADo Huyen TrangNo ratings yet

- Chapter 1 - IntroductionDocument9 pagesChapter 1 - IntroductionObed OppongNo ratings yet

- 4+Amelia+Sandra+114 125Document12 pages4+Amelia+Sandra+114 125yunita heraNo ratings yet

- Tax Risk AssessmentDocument22 pagesTax Risk Assessmentmalik874No ratings yet

- The Role of Political Connection in The Influences of Transfer Pricing, Thin Capitalization, Return On Assets Toward Tax AvoidanceDocument9 pagesThe Role of Political Connection in The Influences of Transfer Pricing, Thin Capitalization, Return On Assets Toward Tax AvoidanceInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Assignment Cover Sheet: Student DetailsDocument15 pagesAssignment Cover Sheet: Student DetailsNguyen Long HuynhNo ratings yet

- Jurnal Sinta 3, 1Document9 pagesJurnal Sinta 3, 1Andre R Mandala PSNo ratings yet

- Financial Review and Financial Distress On Covid 19 Pandemic A Comparison of Two South East Asia Countries in The Real Estate and Property Sub SectorsDocument8 pagesFinancial Review and Financial Distress On Covid 19 Pandemic A Comparison of Two South East Asia Countries in The Real Estate and Property Sub SectorsInternational Journal of Innovative Science and Research Technology100% (1)

- Seminar Indirect TaxDocument17 pagesSeminar Indirect TaxMilan BhallaNo ratings yet

- Financial Innovation, Financial Patents and Business Performance: An Empirical Study On The Banking Industry in TaiwanDocument15 pagesFinancial Innovation, Financial Patents and Business Performance: An Empirical Study On The Banking Industry in TaiwanMayank ShekharNo ratings yet

- The Effect of Environmental UncertaintyDocument9 pagesThe Effect of Environmental Uncertaintyabdillah.akhsanNo ratings yet

- 57121-Article Text-177864-1-10-20221011Document10 pages57121-Article Text-177864-1-10-20221011EstefaniaNo ratings yet

- Economic Freedom, FDI, Inflation, and Economic GrowthDocument10 pagesEconomic Freedom, FDI, Inflation, and Economic GrowthPutu SulasniNo ratings yet

- 206-Article Text-1116-3-10-20220718Document15 pages206-Article Text-1116-3-10-20220718fay hiNo ratings yet

- Ethical Concerns Associatedwith Corporate Financeand Their ManagementDocument9 pagesEthical Concerns Associatedwith Corporate Financeand Their ManagementVed JainNo ratings yet

- Global in ContextDocument9 pagesGlobal in ContextOluwadunsin OlajideNo ratings yet

- Jokowi Fiscal Evaluation CELIOSDocument39 pagesJokowi Fiscal Evaluation CELIOSAis AisyahNo ratings yet

- Nextrans Startup Industry Report 2022Document65 pagesNextrans Startup Industry Report 2022Phương Thùy Nguyễn ThịNo ratings yet

- Domestic Economy Outlook For 2023Document5 pagesDomestic Economy Outlook For 2023Mukoya OdedeNo ratings yet

- The Effect of Liquidity and Capital Intensity On Tax Aggressive Through Intellectual CapitalDocument9 pagesThe Effect of Liquidity and Capital Intensity On Tax Aggressive Through Intellectual CapitalInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Jurnal EkonomiDocument9 pagesJurnal EkonomiRichard MhojeNo ratings yet

- UAE Salary Guide 2020 Cooper FitchDocument34 pagesUAE Salary Guide 2020 Cooper FitchEr Jyotirmaya DalaiNo ratings yet

- B. AristyatamaDocument19 pagesB. AristyatamasyifasaidaNo ratings yet

- CH0507 1135Document11 pagesCH0507 1135aris munandarNo ratings yet

- Macro Environment AnalysisDocument7 pagesMacro Environment AnalysisSEAN DANIEL AGUARESNo ratings yet

- The Impact of Thin Capitalization and Profitability On Tax Avoidance With Institutional Ownership As A Moderation VariableDocument9 pagesThe Impact of Thin Capitalization and Profitability On Tax Avoidance With Institutional Ownership As A Moderation VariableInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Principle - of - Economics - Alternate AssessmentDocument17 pagesPrinciple - of - Economics - Alternate AssessmentVINCENT CHUANo ratings yet

- Affect of Lockdown On Business EnvironmentDocument7 pagesAffect of Lockdown On Business EnvironmentSudipta RanjanNo ratings yet

- Principles of Marketing Term Project Module 2Document16 pagesPrinciples of Marketing Term Project Module 2Palize QaziNo ratings yet

- Meta EarningsDocument10 pagesMeta EarningsThao NguyenNo ratings yet

- Shapovalova Et AlDocument19 pagesShapovalova Et AlLeyte Zarate EleasNo ratings yet

- PITRELa Case Analysis No.1Document2 pagesPITRELa Case Analysis No.1alyannaleeNo ratings yet

- ImpactsofVAT AhmedAlHamadiDocument45 pagesImpactsofVAT AhmedAlHamadikevinNo ratings yet

- FinalDocument20 pagesFinalSonam Peldon (Business) [Cohort2020 RTC]No ratings yet

- Probable RRLDocument3 pagesProbable RRLCharrey Leigh T. FORMARANNo ratings yet

- BM Individual AssignmentDocument15 pagesBM Individual AssignmentPei Qi ErNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2020: Volume II: COVID-19 Impact on Micro, Small, and Medium-Sized Enterprises in Developing AsiaFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2020: Volume II: COVID-19 Impact on Micro, Small, and Medium-Sized Enterprises in Developing AsiaNo ratings yet

- Effects of Rescue PlanDocument12 pagesEffects of Rescue Planmuhammad.nm.abidNo ratings yet

- Strengthening Fiscal Decentralization in Nepal’s Transition to FederalismFrom EverandStrengthening Fiscal Decentralization in Nepal’s Transition to FederalismNo ratings yet

- Number 1: Kevin Jeason Perdido X & Y PartnershipDocument2 pagesNumber 1: Kevin Jeason Perdido X & Y PartnershipKevin Jeason PerdidoNo ratings yet

- 01 Task Performance 1Document2 pages01 Task Performance 1Kevin Jeason PerdidoNo ratings yet

- Answer:: Kevin Jeason Perdido Bsa 301 03 Quiz 1Document1 pageAnswer:: Kevin Jeason Perdido Bsa 301 03 Quiz 1Kevin Jeason PerdidoNo ratings yet

- 04 ELMS Quiz 1Document1 page04 ELMS Quiz 1Kevin Jeason PerdidoNo ratings yet

- 05 Elms Quiz 1Document1 page05 Elms Quiz 1Kevin Jeason PerdidoNo ratings yet

- 06 Activity 2Document1 page06 Activity 2Kevin Jeason PerdidoNo ratings yet

- G.R. No. 119002Document5 pagesG.R. No. 119002Kevin Jeason PerdidoNo ratings yet

- G.R. No. 181455-56Document28 pagesG.R. No. 181455-56Kevin Jeason PerdidoNo ratings yet

- BA3 M KIT Chapter 10Document4 pagesBA3 M KIT Chapter 10Sanjeev JayaratnaNo ratings yet

- Europe's Best Kept Secret: Individual TaxationDocument8 pagesEurope's Best Kept Secret: Individual TaxationAbai AmanatNo ratings yet

- 301 Public ExpenditureDocument72 pages301 Public ExpenditureZannath HabibNo ratings yet

- Nigeria Withholding Tax GAZETTE 2015Document4 pagesNigeria Withholding Tax GAZETTE 2015ahmad bNo ratings yet

- Efu Life Assurance LTD.: Total 20,480 Provisional Sales Tax 0.0 0Document1 pageEfu Life Assurance LTD.: Total 20,480 Provisional Sales Tax 0.0 0ASAD RAHMANNo ratings yet

- Taxation Activity1Document2 pagesTaxation Activity1Creativexie ResinNo ratings yet

- GST and Its Impact 3 PDFDocument3 pagesGST and Its Impact 3 PDFanushka kashyapNo ratings yet

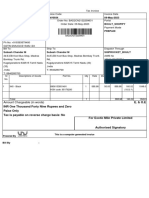

- Exotic Mile Private Limited BINV0934 09-May-2023 Boult - ShopifyDocument1 pageExotic Mile Private Limited BINV0934 09-May-2023 Boult - ShopifyMellodie GamingNo ratings yet

- Hedcor Sibulan, Inc. Vs Commissioner of Internal RevenueDocument10 pagesHedcor Sibulan, Inc. Vs Commissioner of Internal RevenueRudnar Jay Bañares BarbaraNo ratings yet

- Remuneration Statement: For The Month of October 2020Document1 pageRemuneration Statement: For The Month of October 2020AZIZ REHMANNo ratings yet

- WHT CertificateDocument1 pageWHT CertificateMichael OdiemboNo ratings yet

- Zaib - Altaf - Naik - Payslip - July - 2022 (1) NewDocument2 pagesZaib - Altaf - Naik - Payslip - July - 2022 (1) Newzuber shaikhNo ratings yet

- 2016 Pulong PulongDocument22 pages2016 Pulong PulongJeromy VillarbaNo ratings yet

- Implementasi Insentif Pajak Menurut Model G Edward IiiDocument13 pagesImplementasi Insentif Pajak Menurut Model G Edward Iii03Ni Putu Widya AntariNo ratings yet

- Steps Involved in Filing GST ReturnsDocument9 pagesSteps Involved in Filing GST ReturnssaranistudyNo ratings yet

- Aapt Outsourcing Solutions Pvt. LTD.: Payslip For The Month of April 2022Document1 pageAapt Outsourcing Solutions Pvt. LTD.: Payslip For The Month of April 2022ayush bhatnagarNo ratings yet

- Accounting Neri & LoiDocument120 pagesAccounting Neri & Loinerissa lopeNo ratings yet

- Corporate Tax Law PDFDocument20 pagesCorporate Tax Law PDFshikah sidarNo ratings yet

- Nigerian PAYE Calculator 4.0Document2 pagesNigerian PAYE Calculator 4.0obumuyaemesi100% (1)

- NEPAL Tax Reform Strategic PlanDocument44 pagesNEPAL Tax Reform Strategic PlanPaxton Walung LamaNo ratings yet

- CanonsDocument5 pagesCanonssyeda ayeshaNo ratings yet

- Questionnaire On Fringe BenefitsDocument5 pagesQuestionnaire On Fringe BenefitsMeera Jasmiin0% (1)

- Example of Balanced Budget MultiplierDocument1 pageExample of Balanced Budget MultiplierAjeet SinghNo ratings yet

- Chartered ClubDocument3 pagesChartered ClubkajshdiNo ratings yet

- Taxation & Economics PresentationDocument21 pagesTaxation & Economics PresentationDanica Mae SerranoNo ratings yet

- E-Way Bill SystemDocument2 pagesE-Way Bill SystemKuldeep PatidarNo ratings yet

- Key Points in Creation of Huf and Format of Deed For Creation of HufDocument5 pagesKey Points in Creation of Huf and Format of Deed For Creation of HufGopalakrishna SrinivasanNo ratings yet

- New Jersey Amended Resident Income Tax Return: A / / B / / C / / DDocument3 pagesNew Jersey Amended Resident Income Tax Return: A / / B / / C / / DЛена КиселеваNo ratings yet

- LEGJLE23IN004474Document3 pagesLEGJLE23IN004474nishant.jadhavlnteccNo ratings yet

- Bir - Train Tot - Transfer TaxesDocument2 pagesBir - Train Tot - Transfer TaxesGlo GanzonNo ratings yet

Individual Investors Doing Business During Pandemic

Individual Investors Doing Business During Pandemic

Uploaded by

Kevin Jeason PerdidoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Individual Investors Doing Business During Pandemic

Individual Investors Doing Business During Pandemic

Uploaded by

Kevin Jeason PerdidoCopyright:

Available Formats

Members: DATE: March 21, 2022

Score:

Clarito, Ma. Shoebie L.

Perdido, Keavin Jeason A.

Saja, Mariel E.

Tamboong, Mark Paolo C.

TITLE: The Effect of the Corporate Income Tax (CIT) under CREATE Law for

Individual Investors Doing Business During Pandemic

Area of Research:

Corporate Income Tax (CIT) under CREATE LAW.

Research Question:

1. How CIT will influence the decision-making of individual to do business

during pandemic?

2. Does the new CIT rate during pandemic will be the right time to create

business?

3. Is there a benefit for the development of economic stability under CREATE

law?

Articles: (APA Format)

Oden, C. (2022), Impact of Taxation on Business Decision,

https://www.projecttopics.org/impact-taxation-business-decision.html

Villanueva J. (2020, May 26). “CREATE bill to attract more investments, save

and create jobs’’. Gov.ph. https://www.pna.gov.ph/articles/1104017

Villanueva, J. (2021, July 12). “CREATE law, opening of economy boost PH's

net FDI’s”. PNA Gov.ph, https://www.pna.gov.ph/articles/1146823#:~:text=

%22Some%20foreign%20investors%20may%20have,tax%20rates%20in

%20other%20Asean%2F

Justification:

According to Roche 2015: 5), Corporate taxation is of great concern on

investors’ decisions and hence in economic growth and employment. Depending on

the nature of tax, taxation may have a positive or negative effect on business

decisions. A high marginal tax rate will be a disincentive for business while a lower

one will be an incentive to work. (Oden, 2022)

Economist Michael Rica fort said that “some foreign investors may have

started to come in view of the progress made on the CREATE law, which was finally

signed on March 26, 2021 and reduces corporate income tax rates to 25 percent for

large corporations (from 30 percent) retroactive July 1, 2020, thereby narrowing

the gap with the tax rates in other Asean/Asian countries, and also provides greater

certainty on investment incentives, thereby helping attract more FDIs and making

some foreign investors on the sidelines in recent months/years to become more

decisive and finally bring in more FDIs into the country. “(Villanueva, 2021, par. 4)

Economist Michael Rica fort said that “some foreign investors may have

started to come in view of the progress made on the CREATE law, which was finally

signed on March 26, 2021 and reduces corporate income tax rates to 25 percent for

large corporations (from 30 percent) retroactive July 1, 2020, thereby narrowing

the gap with the tax rates in other Asean/Asian countries, and also provides greater

certainty on investment incentives, thereby helping attract more FDIs and making

some foreign investors on the sidelines in recent months/years to become more

decisive and finally bring in more FDIs into the country. “(Villanueva, 2021, par. 4)

You might also like

- G.R. No. 181455-56 Case DigestDocument2 pagesG.R. No. 181455-56 Case DigestKevin Jeason PerdidoNo ratings yet

- Transfer Pricing, Thin Capitalization, Financial Distress, Earning Management, Dan Capital Intensity GrowthDocument26 pagesTransfer Pricing, Thin Capitalization, Financial Distress, Earning Management, Dan Capital Intensity GrowthLukmanul HakimNo ratings yet

- The Effect of Liquidity, Leverage and Determined Tax Load On Profitability With Profit Management As Moderating VariablesDocument13 pagesThe Effect of Liquidity, Leverage and Determined Tax Load On Profitability With Profit Management As Moderating VariablesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- ABM TextDocument6 pagesABM TextPauline TayabanNo ratings yet

- Has COVID-19 Hindered Small Business Activities - The Role of FintechDocument12 pagesHas COVID-19 Hindered Small Business Activities - The Role of FintechFaizan KhanNo ratings yet

- The Effect of Political Factors On FDI AttractionDocument6 pagesThe Effect of Political Factors On FDI AttractionTrần Minh ĐạtNo ratings yet

- Lesson 4 EBBADocument108 pagesLesson 4 EBBAHuyền LinhNo ratings yet

- The Effect of Institutional Ownership, Sales Growth and Profitability On Tax AvoidanceDocument9 pagesThe Effect of Institutional Ownership, Sales Growth and Profitability On Tax AvoidanceAJHSSR JournalNo ratings yet

- Corporate Income Tax Rate and Foreign Direct Investment - A CrossDocument23 pagesCorporate Income Tax Rate and Foreign Direct Investment - A CrossnigusNo ratings yet

- Help For EconoDocument15 pagesHelp For EcononigusNo ratings yet

- Sumaiya Selim Sushme - 20104071 - BUS203 - 04 - FINALDocument7 pagesSumaiya Selim Sushme - 20104071 - BUS203 - 04 - FINALSumaiya Selim SushmeNo ratings yet

- Taxationasa Significant Toolfor Economic DevelopmentDocument12 pagesTaxationasa Significant Toolfor Economic DevelopmentRohan 70KNo ratings yet

- Imposition of Tax Penalties and Interest and Its IDocument11 pagesImposition of Tax Penalties and Interest and Its IJhonalyn MaraonNo ratings yet

- Effect of Economic and Non-Economic Factors On Tax Compliance With Trust As A Moderating Variable in SME (Case Study SME in Bekasi, Indonesia)Document7 pagesEffect of Economic and Non-Economic Factors On Tax Compliance With Trust As A Moderating Variable in SME (Case Study SME in Bekasi, Indonesia)International Journal of Innovative Science and Research TechnologyNo ratings yet

- Position Paper DraftDocument4 pagesPosition Paper DraftsephNo ratings yet

- Financial Distress, Earnings Management, and Tax Avoidance: Evidence From IndonesiaDocument8 pagesFinancial Distress, Earnings Management, and Tax Avoidance: Evidence From IndonesiaAJHSSR JournalNo ratings yet

- Effect of Taxation Amendment in Corporate Arena ReportDocument4 pagesEffect of Taxation Amendment in Corporate Arena Reportsidharth A.JNo ratings yet

- Will Anti-Tax-Avoidance Provisions Reduce The InveDocument24 pagesWill Anti-Tax-Avoidance Provisions Reduce The InveKiruthigaah KanadasanNo ratings yet

- An Extensive Examination of Taxation As An Accelerator For Economic Growth in NigeriaDocument6 pagesAn Extensive Examination of Taxation As An Accelerator For Economic Growth in NigeriaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Bbe A2.2Document17 pagesBbe A2.2Minh PhíNo ratings yet

- 135-Article Text-875-1-10-20220509Document14 pages135-Article Text-875-1-10-20220509Samelyn SabadoNo ratings yet

- Discussion Unit 3Document3 pagesDiscussion Unit 3Monica KamalNo ratings yet

- Lesson 4 EBBADocument105 pagesLesson 4 EBBADo Huyen TrangNo ratings yet

- Chapter 1 - IntroductionDocument9 pagesChapter 1 - IntroductionObed OppongNo ratings yet

- 4+Amelia+Sandra+114 125Document12 pages4+Amelia+Sandra+114 125yunita heraNo ratings yet

- Tax Risk AssessmentDocument22 pagesTax Risk Assessmentmalik874No ratings yet

- The Role of Political Connection in The Influences of Transfer Pricing, Thin Capitalization, Return On Assets Toward Tax AvoidanceDocument9 pagesThe Role of Political Connection in The Influences of Transfer Pricing, Thin Capitalization, Return On Assets Toward Tax AvoidanceInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Assignment Cover Sheet: Student DetailsDocument15 pagesAssignment Cover Sheet: Student DetailsNguyen Long HuynhNo ratings yet

- Jurnal Sinta 3, 1Document9 pagesJurnal Sinta 3, 1Andre R Mandala PSNo ratings yet

- Financial Review and Financial Distress On Covid 19 Pandemic A Comparison of Two South East Asia Countries in The Real Estate and Property Sub SectorsDocument8 pagesFinancial Review and Financial Distress On Covid 19 Pandemic A Comparison of Two South East Asia Countries in The Real Estate and Property Sub SectorsInternational Journal of Innovative Science and Research Technology100% (1)

- Seminar Indirect TaxDocument17 pagesSeminar Indirect TaxMilan BhallaNo ratings yet

- Financial Innovation, Financial Patents and Business Performance: An Empirical Study On The Banking Industry in TaiwanDocument15 pagesFinancial Innovation, Financial Patents and Business Performance: An Empirical Study On The Banking Industry in TaiwanMayank ShekharNo ratings yet

- The Effect of Environmental UncertaintyDocument9 pagesThe Effect of Environmental Uncertaintyabdillah.akhsanNo ratings yet

- 57121-Article Text-177864-1-10-20221011Document10 pages57121-Article Text-177864-1-10-20221011EstefaniaNo ratings yet

- Economic Freedom, FDI, Inflation, and Economic GrowthDocument10 pagesEconomic Freedom, FDI, Inflation, and Economic GrowthPutu SulasniNo ratings yet

- 206-Article Text-1116-3-10-20220718Document15 pages206-Article Text-1116-3-10-20220718fay hiNo ratings yet

- Ethical Concerns Associatedwith Corporate Financeand Their ManagementDocument9 pagesEthical Concerns Associatedwith Corporate Financeand Their ManagementVed JainNo ratings yet

- Global in ContextDocument9 pagesGlobal in ContextOluwadunsin OlajideNo ratings yet

- Jokowi Fiscal Evaluation CELIOSDocument39 pagesJokowi Fiscal Evaluation CELIOSAis AisyahNo ratings yet

- Nextrans Startup Industry Report 2022Document65 pagesNextrans Startup Industry Report 2022Phương Thùy Nguyễn ThịNo ratings yet

- Domestic Economy Outlook For 2023Document5 pagesDomestic Economy Outlook For 2023Mukoya OdedeNo ratings yet

- The Effect of Liquidity and Capital Intensity On Tax Aggressive Through Intellectual CapitalDocument9 pagesThe Effect of Liquidity and Capital Intensity On Tax Aggressive Through Intellectual CapitalInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Jurnal EkonomiDocument9 pagesJurnal EkonomiRichard MhojeNo ratings yet

- UAE Salary Guide 2020 Cooper FitchDocument34 pagesUAE Salary Guide 2020 Cooper FitchEr Jyotirmaya DalaiNo ratings yet

- B. AristyatamaDocument19 pagesB. AristyatamasyifasaidaNo ratings yet

- CH0507 1135Document11 pagesCH0507 1135aris munandarNo ratings yet

- Macro Environment AnalysisDocument7 pagesMacro Environment AnalysisSEAN DANIEL AGUARESNo ratings yet

- The Impact of Thin Capitalization and Profitability On Tax Avoidance With Institutional Ownership As A Moderation VariableDocument9 pagesThe Impact of Thin Capitalization and Profitability On Tax Avoidance With Institutional Ownership As A Moderation VariableInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Principle - of - Economics - Alternate AssessmentDocument17 pagesPrinciple - of - Economics - Alternate AssessmentVINCENT CHUANo ratings yet

- Affect of Lockdown On Business EnvironmentDocument7 pagesAffect of Lockdown On Business EnvironmentSudipta RanjanNo ratings yet

- Principles of Marketing Term Project Module 2Document16 pagesPrinciples of Marketing Term Project Module 2Palize QaziNo ratings yet

- Meta EarningsDocument10 pagesMeta EarningsThao NguyenNo ratings yet

- Shapovalova Et AlDocument19 pagesShapovalova Et AlLeyte Zarate EleasNo ratings yet

- PITRELa Case Analysis No.1Document2 pagesPITRELa Case Analysis No.1alyannaleeNo ratings yet

- ImpactsofVAT AhmedAlHamadiDocument45 pagesImpactsofVAT AhmedAlHamadikevinNo ratings yet

- FinalDocument20 pagesFinalSonam Peldon (Business) [Cohort2020 RTC]No ratings yet

- Probable RRLDocument3 pagesProbable RRLCharrey Leigh T. FORMARANNo ratings yet

- BM Individual AssignmentDocument15 pagesBM Individual AssignmentPei Qi ErNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2020: Volume II: COVID-19 Impact on Micro, Small, and Medium-Sized Enterprises in Developing AsiaFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2020: Volume II: COVID-19 Impact on Micro, Small, and Medium-Sized Enterprises in Developing AsiaNo ratings yet

- Effects of Rescue PlanDocument12 pagesEffects of Rescue Planmuhammad.nm.abidNo ratings yet

- Strengthening Fiscal Decentralization in Nepal’s Transition to FederalismFrom EverandStrengthening Fiscal Decentralization in Nepal’s Transition to FederalismNo ratings yet

- Number 1: Kevin Jeason Perdido X & Y PartnershipDocument2 pagesNumber 1: Kevin Jeason Perdido X & Y PartnershipKevin Jeason PerdidoNo ratings yet

- 01 Task Performance 1Document2 pages01 Task Performance 1Kevin Jeason PerdidoNo ratings yet

- Answer:: Kevin Jeason Perdido Bsa 301 03 Quiz 1Document1 pageAnswer:: Kevin Jeason Perdido Bsa 301 03 Quiz 1Kevin Jeason PerdidoNo ratings yet

- 04 ELMS Quiz 1Document1 page04 ELMS Quiz 1Kevin Jeason PerdidoNo ratings yet

- 05 Elms Quiz 1Document1 page05 Elms Quiz 1Kevin Jeason PerdidoNo ratings yet

- 06 Activity 2Document1 page06 Activity 2Kevin Jeason PerdidoNo ratings yet

- G.R. No. 119002Document5 pagesG.R. No. 119002Kevin Jeason PerdidoNo ratings yet

- G.R. No. 181455-56Document28 pagesG.R. No. 181455-56Kevin Jeason PerdidoNo ratings yet

- BA3 M KIT Chapter 10Document4 pagesBA3 M KIT Chapter 10Sanjeev JayaratnaNo ratings yet

- Europe's Best Kept Secret: Individual TaxationDocument8 pagesEurope's Best Kept Secret: Individual TaxationAbai AmanatNo ratings yet

- 301 Public ExpenditureDocument72 pages301 Public ExpenditureZannath HabibNo ratings yet

- Nigeria Withholding Tax GAZETTE 2015Document4 pagesNigeria Withholding Tax GAZETTE 2015ahmad bNo ratings yet

- Efu Life Assurance LTD.: Total 20,480 Provisional Sales Tax 0.0 0Document1 pageEfu Life Assurance LTD.: Total 20,480 Provisional Sales Tax 0.0 0ASAD RAHMANNo ratings yet

- Taxation Activity1Document2 pagesTaxation Activity1Creativexie ResinNo ratings yet

- GST and Its Impact 3 PDFDocument3 pagesGST and Its Impact 3 PDFanushka kashyapNo ratings yet

- Exotic Mile Private Limited BINV0934 09-May-2023 Boult - ShopifyDocument1 pageExotic Mile Private Limited BINV0934 09-May-2023 Boult - ShopifyMellodie GamingNo ratings yet

- Hedcor Sibulan, Inc. Vs Commissioner of Internal RevenueDocument10 pagesHedcor Sibulan, Inc. Vs Commissioner of Internal RevenueRudnar Jay Bañares BarbaraNo ratings yet

- Remuneration Statement: For The Month of October 2020Document1 pageRemuneration Statement: For The Month of October 2020AZIZ REHMANNo ratings yet

- WHT CertificateDocument1 pageWHT CertificateMichael OdiemboNo ratings yet

- Zaib - Altaf - Naik - Payslip - July - 2022 (1) NewDocument2 pagesZaib - Altaf - Naik - Payslip - July - 2022 (1) Newzuber shaikhNo ratings yet

- 2016 Pulong PulongDocument22 pages2016 Pulong PulongJeromy VillarbaNo ratings yet

- Implementasi Insentif Pajak Menurut Model G Edward IiiDocument13 pagesImplementasi Insentif Pajak Menurut Model G Edward Iii03Ni Putu Widya AntariNo ratings yet

- Steps Involved in Filing GST ReturnsDocument9 pagesSteps Involved in Filing GST ReturnssaranistudyNo ratings yet

- Aapt Outsourcing Solutions Pvt. LTD.: Payslip For The Month of April 2022Document1 pageAapt Outsourcing Solutions Pvt. LTD.: Payslip For The Month of April 2022ayush bhatnagarNo ratings yet

- Accounting Neri & LoiDocument120 pagesAccounting Neri & Loinerissa lopeNo ratings yet

- Corporate Tax Law PDFDocument20 pagesCorporate Tax Law PDFshikah sidarNo ratings yet

- Nigerian PAYE Calculator 4.0Document2 pagesNigerian PAYE Calculator 4.0obumuyaemesi100% (1)

- NEPAL Tax Reform Strategic PlanDocument44 pagesNEPAL Tax Reform Strategic PlanPaxton Walung LamaNo ratings yet

- CanonsDocument5 pagesCanonssyeda ayeshaNo ratings yet

- Questionnaire On Fringe BenefitsDocument5 pagesQuestionnaire On Fringe BenefitsMeera Jasmiin0% (1)

- Example of Balanced Budget MultiplierDocument1 pageExample of Balanced Budget MultiplierAjeet SinghNo ratings yet

- Chartered ClubDocument3 pagesChartered ClubkajshdiNo ratings yet

- Taxation & Economics PresentationDocument21 pagesTaxation & Economics PresentationDanica Mae SerranoNo ratings yet

- E-Way Bill SystemDocument2 pagesE-Way Bill SystemKuldeep PatidarNo ratings yet

- Key Points in Creation of Huf and Format of Deed For Creation of HufDocument5 pagesKey Points in Creation of Huf and Format of Deed For Creation of HufGopalakrishna SrinivasanNo ratings yet

- New Jersey Amended Resident Income Tax Return: A / / B / / C / / DDocument3 pagesNew Jersey Amended Resident Income Tax Return: A / / B / / C / / DЛена КиселеваNo ratings yet

- LEGJLE23IN004474Document3 pagesLEGJLE23IN004474nishant.jadhavlnteccNo ratings yet

- Bir - Train Tot - Transfer TaxesDocument2 pagesBir - Train Tot - Transfer TaxesGlo GanzonNo ratings yet