Professional Documents

Culture Documents

Investment Behaviour of College Teachers

Investment Behaviour of College Teachers

Uploaded by

Alok MonayOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Investment Behaviour of College Teachers

Investment Behaviour of College Teachers

Uploaded by

Alok MonayCopyright:

Available Formats

INVESTMENT BEHAVIOUR OF COLLEGE TEACHERS

CHAPTER 1

INTRODUCTION

SULLAMUSSALAM SCIENCE COLLEGE AREEKODE Page 1

INVESTMENT BEHAVIOUR OF COLLEGE TEACHERS

1.1 INTRODUCTION

Teaching is the one of the most popular profession across the globe.

Teachers are an important force in our society, not only because of their sheer numbers but

much more because they are guarantors of the education of future generations, especially in

the developing countries like India. A teacher enjoys the privileged position of unleashing the

human potential of students within the formal education system and thereby transforming the

individuals, families, communities and society-at-large. The competency of the teacher is a

major determinant of the quality of the education. Teacher‟s professional advancement is

decided by many factors. One of the main factors which strongly influence the efficiency of

teacher is his quality of life. The quality of one‟s life is closely tied to the level or standard of

living maintained by that person. The presence or absence of certain material items, such as

home, cars, jewelry is commonly associated with standard of life. The ability to spend money

for entertainment, health, education, variety in life, art, music and travel also contribute to the

standard of life. Large expensive or fancy items are viewed as evidence of high standard of

living (Lawrence J Gitman, 1981). Thus management of personal finance i.e. income,

consumption saving and investment has a great impact on standard of living. So attitude of

teachers towards consumption, savings and investment would reflect their economic

behaviour, which would influence quality of life and in turn influence their profession and the

education system. Research in this aspect of important stakeholder in education system

assumes significance in the field of educational reform.

Although a few research studies are available which have examined this

phenomenon, most of them are conceptual, descriptive and theoretical in nature. Moreover,

most of the research articles appearing in the popular press are based on anecdotal evidences

rather than rigorous empirical research with diagnostic evaluation. From this analysis, it

follows that the domain of savings and investment behaviour of teaching community belongs

to the under researched area, and as such, it calls for a comprehensive, authoritative and well

integrated empirical examination of the attitude and behaviour of teachers towards their

savings and investment activities. In this context the present research study titled “Investment

behaviour of college teachers with special reference to malappuram district” is undertaken.

SULLAMUSSALAM SCIENCE COLLEGE AREEKODE Page 2

INVESTMENT BEHAVIOUR OF COLLEGE TEACHERS

1.2 STATEMENT OF PROBLEM

The ultimate objective of the investor is to derive a variety of investments that meet his

preference for risk and expected return. The investor will select the portfolio which will

maximize his utility. The temperament and psychology of the investor is the another

important consideration in making an investment decision by the investors. College Teachers

minimum qualification is Postgraduate and National Eligibility Test in India. So literacy level

of the college teachers is very high and their job is permanent. This study is an attempt to

study investment pattern of college teachers and influencing factor for investment. So the

research problem is to identify the investment pattern of college teachers in malappuram

district

1.3 OBJECTIVES OF THE STUDY

To identify the major investment avenues currently used by college teachers

To identify the factors that influences the investment decision.

To know the awareness of teachers on investment avenues

1.4 SIGNIFICANCE OF THE STUDY

The competency of a teacher is a major determinant of the quality of the education. Teacher‟s

professional advancement is decided by many factors. One of the main factors which strongly

influence the efficiency of teacher is his quality of life. The quality of one‟s life is closely

related to the level consumption, savings and investment. The attitude of teachers toward

consumption, saving and investment would reflect their economic behaviour, which would

influence quality of life and in turn influence their profession and the education system.

Today, the living standard of the people increasing day by day so teacher community has

started realizing the importance of savings and proper investment of their savings. They avoid

spending money on heavy luxurious life style and preferring the normal living standard. The

study is conducted to know the saving & investment patterns of college teachers & to know

SULLAMUSSALAM SCIENCE COLLEGE AREEKODE Page 3

INVESTMENT BEHAVIOUR OF COLLEGE TEACHERS

whether college teachers are making use of modern and attractive investment schemes

available to them

1.5 SCOPE OF THE STUDY

This study covers the college teachers working in government and unaided colleges in

Malappuram district on their savings and investment behavior. The study seeks to analyze

investment avenues used by them, factors influences the investment decision, and their

investment awareness. The study significant because of no study is conducted earlier in

Malappuram district.

1.6 HYPOTHESIS

H0: There is no significance difference between investment avenues used by Government

College and unaided college teachers

1.7 RESEARCH METHODOLOGY

The research methodology used in this study is mainly designed as an empirical work based on

both secondary data and primary data, obtained through pre-tested questionnaire, internet

browsing, direct personal interviews of selected persons involved in this sector as well as

1.7.1 SOURCE OF PRIMARY DATA

The study makes use of primary data. The primary data collected through the questionnaire

from the 60 college teachers

1.7.2 SOURCE OF SECONDARY DATA

The secondary data has been mainly collected for creating theoretical background for this

study. Main sources of secondary data are websites, books, magazines etc.

1.7.3 SAMPLE SIZE

The study is conducted on the basis of 60 selected sample (30 each from government \

aided teachers and unaided college teachers) and findings are drawn based on their

response.

SULLAMUSSALAM SCIENCE COLLEGE AREEKODE Page 4

INVESTMENT BEHAVIOUR OF COLLEGE TEACHERS

1.7.4 SAMPLING METHOD

Simple Random Sampling Method is used for selecting the sampling unit

1.7.5 TOOLS AND TECHNIQUES

1.7.5.1 TOOLS FOR DATA COLLECTION

The required data for the study has been collected through questionnaire

1.7.5.2 TOOLS USED FOR DATA REPRESENTATION

Tables, graphs and charts used to present data

1.7.5.3 TOOLS USED FOR DATA ANALYSIS

Percentage analysis, chi square analysis used for data analysis

1.8 LIMITATION OF STUDY

1. There are many investment opportunities are available in the financial market. But

the study incorporates the only limited number of investment avenues in market.

2. The data for the purpose of the study is collected from respondents in malappuram

district only. The study concentrates only on selected factors relating to teachers

investment Behaviour. There may be other influencing factors too, which have not been

considered due to time and data constraints

3. The primary data for the study is collected through questionnaires and the results of the

study may suffer from the inherent drawbacks of such instrument

4. The study compares the perceptions and expectations of the teachers‟ attitude and

Perceptions towards investment are subjective in nature and are likely to Change with the

changing times and market conditions

5. Reliability of data depends on respondent‟s response

SULLAMUSSALAM SCIENCE COLLEGE AREEKODE Page 5

INVESTMENT BEHAVIOUR OF COLLEGE TEACHERS

1.9 CHAPTER PLAN

The study contains five chapters .The first chapter deals introduction, statement of problem,

objectives, scope and methodology and limitations .The second chapter explains the past studies

relating to this study.

The third chapter explains theoretical background of investment. The fourth chapter contains

the analysis and interpretation of data collected from sample units. The fifth chapter includes

findings, suggestion and conclusion.

SULLAMUSSALAM SCIENCE COLLEGE AREEKODE Page 6

INVESTMENT BEHAVIOUR OF COLLEGE TEACHERS

CHAPTER 2

REVIEW OF LITERATURE

SULLAMUSSALAM SCIENCE COLLEGE AREEKODE Page 7

INVESTMENT BEHAVIOUR OF COLLEGE TEACHERS

Richard A. Duschl and Emmett Wright (1989) investigated the manner and the degree to

which science teachers considered the nature of the subject matter in their decision making

addressing the planning and the delivery of instructional tasks. The goal of the study was the

development of grounded hypotheses about science teacher„s pedagogical decision making.

R. Goymda and Y. Josephine (2005) provided an overview of Para-teacher in India. It traced its

origins of para-teacher schemes in the country and analyses the changing policy context where-in

poorly paid and trained Para-teachers on contract were increasingly being recruited in place of

regular teachers in government schools. Drawing upon available research studies, the authors

drew attention to the detrimental implications that para-teacher programed had for

professionalization of teachers, the quality of schooling and equity concerns in education.

Archna v. Hegde and Deborah j. Cassidy (2009) interviewed twelve kindergarten teachers in

their study, and a constant comparative method was used to analyze the interviews. This study

included a focus on academics vs. play, the importance of worksheets, the importance of groups

for socialization, and the difficulties of implementing a play-based curriculum.

Bhardwaj Rajesh, RahejaRekh and Priyanka (2011), examine Analysis of Income and

Savings Pattern of Government and Private Senior Secondary School Teachers.The study

concluded that the major source of income of Government teachers is salary while tuition fee for

private teachers. Mostly Government & Private teachers both used Bank Deposits and Life

Insurance for investing their savings. Government school teachers received more perks in

comparison to private teachers. The main objective of savings of Government teachers is an

emergency and security while for private teachers is children education and purchase of

consumer durable.

Dr. S. Mathivannan and Dr. M. Selvakumar (2011) studied on saving and investment pattern

of school teaches – A study with reference to Sivakasi Taluk, Tamil Nadu. The study concludes

that today, the teaching community has stated realizing the importance of money and money„s

worth. They are initiated to prepare a budget for the proposed expenses and compare it with the

actual expenses met by them, so that they are not influence by other tempting and fashionable

expenses.

SULLAMUSSALAM SCIENCE COLLEGE AREEKODE Page 8

INVESTMENT BEHAVIOUR OF COLLEGE TEACHERS

Dr. Dhiraj Jain and Parul Jain (2012) examine savings and investment pattern of school

teachers - a study with reference to Udaipur District, Rajasthan. The study concluded that in

today„s world money play vital role in one„s life and that the importance of money has been

started being recognized by the school teacher„s community. They know the importance of

money so they are initiated themselves to prepare the budget and lessen down their expenses to

meet the future consequences. It has been evident from the study that most of the school teachers

are saving their money for the purpose of their children„s education, marriage and as security

after retirement.

Dr. AnanthapadhmanabhaAchar (2012) studied on saving and Investment Behaviour of

Teachers - An empirical study. In the ultimate analysis individual characteristics of teachers such

as age, gender, marital status, and lifestyle determined the savings and investment behaviour of

teaching community in the study region. In a more or less similar manner, their family

characteristics such as monthly family income, stage of family life cycle, and upbringing status

emerged as determinants of their savings and investment behaviour.

Mooij (2005) studied that since the early 1990s, significant progress was made with regard to

education in India. This positive development stands, however, in sharp contrast with the way in

which government teachers themselves think and talk about education. Instead of feeling pride

and satisfaction, many teachers were unhappy, and often self-critical. Based on focused group

discussions and interviews with teachers in Andhra Pradesh, south India, the study analyses the

reasons behind motivations and demotivation of government schoolteachers and concludes that

there was a need for a new professional ethos and culture.

Dr. AnanthapadhmanabhaAchar (2012) studied on saving and Investment Behaviour of

Teachers - An empirical study. In the ultimate analysis individual characteristics of teachers such

as age, gender, marital status, and lifestyle determined the savings and investment behaviour of

teaching community in the study region. In a more or less similar manner, their family

characteristics such as monthly family income, stage of family life cycle, and upbringing status

emerged as determinants of their savings and investment behaviour.

SULLAMUSSALAM SCIENCE COLLEGE AREEKODE Page 9

INVESTMENT BEHAVIOUR OF COLLEGE TEACHERS

Archna v. Hegde, Deborah j. Cassidy (2009) interviewed twelve kindergarten teachers in their

study, and a constant comparative method was used to analyze the interviews. This study

included a focus on academics vs. play, the importance of worksheets, the importance of groups

for socialization, and the difficulties of implementing a play-based curriculum

Michael Kremer, Nazmul Chaudhury, F.Halsey,Rogers,Karthik Muralidharan and

Hammer (2005) found that twenty-five percent of teachers were absent from school, and only

about half were teaching during unannounced visits to a nationally representative sample

of government primary schools in India. The researchers found little evidence that attempting

to strengthen local community ties reduced absence. Teachers from the local area had similar

absence rates as teachers from outside the community. Locally controlled non-formal schools

have slightly higher absence rates than schools run by the state government. The existence of a

PTA was not correlated with lower absence. Private-school teachers were only slightly less likely

to be absent than public-school teachers in general, but were 8 percentage points less likely to be

absent than public-school teachers in the same village.

Bindu (2017) examines Investment pattern of college teachers the variables liquidity, high

returns, tax benefit and capital appreciation have significant influence on influencing factor for

investment. But the variables, safety, children‟s education, social norms and marriage have no

significant influence on influencing factor for investment

Krishnamoorthi (2009) in his research paper, “Changing Pattern of Indian Households: Savings

in Financial Assets”, published in RVS Journal of management, concluded that irrespective of

the developments in the capital market and economic conditions, investors like to invest

regularly and this investment behaviour is highly related to educational background.

Sultana and Pardhasaradhi (2012).examine Factor Analysis Individual Eccentric, Wealth

Maximization, Risk Minimization, Brand Perception, Social Responsibility, Financial

Expectation, Accounting information, Government and Media, Economic Expectation and

Advocate recommendation are factors influencing the behaviour of Indian individual equity

investors.

SULLAMUSSALAM SCIENCE COLLEGE AREEKODE Page 10

INVESTMENT BEHAVIOUR OF COLLEGE TEACHERS

Murithi, Narayanan and Arivazhagan (2012) examine the individual investors still prefer to

invest in financial products which give risk free returns 32

Palaniveluand Chandrakumar (2013) examine Certain factors like education level, awareness

about the current financial system, age of investors make significant impact while deciding the

investment avenues. Awareness program has to be conducted by Stock Broking firms, because

most of the respondents unaware about new services

SULLAMUSSALAM SCIENCE COLLEGE AREEKODE Page 11

INVESTMENT BEHAVIOUR OF COLLEGE TEACHERS

CHAPTER 3

CONCEPTUAL FRAMEWORK

SULLAMUSSALAM SCIENCE COLLEGE AREEKODE Page 12

INVESTMENT BEHAVIOUR OF COLLEGE TEACHERS

SAVING BEHAVIOUR

Savings means the act of refraining from spending one‟s income on consumption. The part of the

income, which is unspent, is called savings. From the economist‟s perspective people allocate

disposable income between consumption and savings and at various levels of income, there will

be corresponding level of consumption and savings. According to classical definition, saving is

income minus consumption and is residual in character. Savings can also be defined as stock,

wherein savings stands for change in wealth over a period of time. In this sense it is regarded as

the sacrifice in the present consumption for the future

As an accounting concept, saving may be defined as the residual that is left from income after the

consumption choice has been made as part of the household's utility maximization process.

Substantially, saving is future consumption, and it is an important example of an inter-temporal

decision. Division of income between consumption and savings is driven by preferences between

present and future consumption and the utility derived from consumption.

Every individual has a psychological preference for present consumption to equally certain

future consumption. Saving means going against this preference and hence involves sacrifices of

the preference. Thus, saving is an activity that involves both pain of foregoing consumption and

pleasure at a particular moment in time for an anticipated future.

VARIABLES INFLUENCING SAVING BEHAVIOUR

Saving behaviour is influenced by several factors, important among them are: income, wealth,

education, employment status, stages in life cycle, dependency ratio, fiscal policy, pension,

insurance and banking infrastructure.

Income: is considered as the most important explanatory variable of the household savings. The

influence of various concepts of income such as absolute income, permanent income, relative

income, transitory income (life cycle income), on saving behaviour have been explained

variously.

Wealth: When a household experiences an increase in wealth, it is expected to consume both the

added interest income and some portion of the increase in principal. If attractive rates of return

encourage savings, then those with greater wealth have stronger incentives to defer consumption.

SULLAMUSSALAM SCIENCE COLLEGE AREEKODE Page 13

INVESTMENT BEHAVIOUR OF COLLEGE TEACHERS

Education: Several studies indicate that saving rates increase with education, even after

considering a variety of control variables. Solomon also found that motives for saving varied

with education. Less educated individuals were more likely to save providing for emergencies as

their primary savings goal, while those with more education cited the desire to provide for

children‟s education and to help them set up households. Since educated individuals appear to

have longer time horizons, Solmon suggests that education may alter individual preferences.

Although it is likely that education affects willingness to save, more research is needed to

confirm this hypothesis and to identify the mechanisms through which this process occurs.

Age distribution: age and stage of the population will also affect the fraction of aggregate

income spent. Both ends of the age distribution, the old and the young tend to spend a higher

proportion of their incomes than those in the middle do. The savings-income ratio is small for

younger groups, high for middle age groups, and again low among old age groups.

Employment status: is likely to have important indirect effects on saving rates. Full-time, year

round employees are more likely to have access to institutionalized saving mechanisms (e.g.,

employer-sponsored pension plans); financial information and education; saving subsidies (e.g.,

employer contributions to pension plans); and payroll deduction. Employment status may help

explain saving in low-income households).

Fiscal policies: also would influence savings behaviour. Governments generally provide tax

shelters for private savings. Willingness to save is influenced by taxation. In order to avoid or

reduce the tax burden, people may prefer to save their money in various forms of financial assets.

However, it is not clear, whether the tax incentives really rise the aggregate savings

Availability of public pensions and social security benefits reduces the saving rate by reducing

the need of saving for retirement and contingencies.. The presence of wide spread banking

infrastructure also has a positive impact on savings

Inflation: It has been argued that inflation has negative impact on savings particularly in a

country like India, with low consumption levels where consumers are likely to resist cuts into

real consumption. Empirical evidence on the impact of savings has been mixed.

SULLAMUSSALAM SCIENCE COLLEGE AREEKODE Page 14

INVESTMENT BEHAVIOUR OF COLLEGE TEACHERS

Rate of interest exerts influence on the way in which any given level of aggregate disposable

income is allocated between consumption and savings. People save money and try to get good

profit in future. This is because they prefer a larger real consumption at a later date than a

smaller immediate consumption.

Size of the family: Propensity to save and propensity to consume are also influenced by the size

of the family. With an increase in family size, the propensity to consume increases due to

increased demand for food, clothing and other necessaries of life. Every aspect of household

economic behaviour is significantly correlated with the presence of children in the household.

Children affect the allocation of a given family budget; they affect the household demand

patterns in a well-defined way.

The saving behaviour and propensity to consume differ between government employee

households and private employee households. It is well known that self-employed people

generally save more than others probably because of their definite interest in expanding their

business or profession

The various studies reviewed above reveal that dividing household income between consumption

and saving is a complex process. Several factors influencing them vary over region, time and

community. In this context, it would be interesting to analyse the consumption and saving

behaviour among teachers and to diagnose the economic and socio- cultural dimensions of such

behavioural patterns.

INVESTMENT BEHAVIOUR

Personal disposable income of the household is divided between consumption and savings.

Savings may be idle or active. Savings becomes active, when it is canalized into return bearing

avenues. The act of canalizing savings into return bearing avenues is investment. In this sense,

investment refers to the increase in real capital, which leads to the generation of income. It is the

addition to the existing stock of capital assets and leads to capital formation. Investment is a

wider concept, and household investment reflects the microform of it. Household investment

mainly, refers to channelizing household savings into return giving options.

SULLAMUSSALAM SCIENCE COLLEGE AREEKODE Page 15

INVESTMENT BEHAVIOUR OF COLLEGE TEACHERS

Here, decisions are very much based on risks involved and risk- bearing capacity of the

investors. Every investment is exposed to one or another type of risk. There are five major risks

in investment, which may be present in varying degrees, in different sorts of investment: non-

payment risk, business risk, inflation risk, political risk, and social risk. Therefore, an investor,

while investing money would try to satisfy the three objectives- safety, profitability, and

liquidity.

The skill in management of investment does not lie in generating high returns alone. It lies in

achieving a sound balance between the three objectives viz – profitability – liquidity – safety.

Investment planning is not a game of maximizing returns, but a game of delicate balancing.

Every investment is a trade- off between risk and returns.

Apart from risk and return other factors that influence investment decision are: marketability,

initial investment, tax benefit, loan facility, institution, past experience, age and needs, social

conditions, and liquidity.

House hold investment may be in the form – financial investment and physical or real

investment. Financial investment comprises deposits in banks, shares, debentures, securities in

companies, contributions to provident fund/public provident fund, contributions to chit funds,

and insurance. While physical investments include land, buildings, vehicles and stock of raw

materials

DETERMINANTS OF INVESTMENT BEHAVIOUR

Investment avenues for an individual or family or household are many, generally known as

instruments. The preference shown by an investor in choosing a particular instrument is called

Investment behaviour. The process of investment commences with surplus income, which

includes operating and non- operating earnings.

The prime determinants of investment behaviour of an individual are: sociological factors, such

as culture or sub culture, social classes, reference group; and psychological factors like

personality, attitude, beliefs, values and perceived investment- related benefits.

Cultural surroundings and the various groups of people with whom an individual inter relates,

greatly influences his perception, thinking and belief about different forms of investment).

SULLAMUSSALAM SCIENCE COLLEGE AREEKODE Page 16

INVESTMENT BEHAVIOUR OF COLLEGE TEACHERS

People‟s investment behaviour is strongly influenced by the class to which they belong. Research

studies have shown that a class membership is a significant determinant of investment behaviour.

Investor behaviour is also influenced by the small group to which investors belong or aspire to

belong. This group may include family, fraternal organization, labour unions church or religious

groups or circle of close friends or neighbours (William D wells, 1975).

Attitudes and beliefs have strong and direct impact on the investor‟s perceptions in household

investment behaviour. Household investment attitudes are formed, generally speaking, by the

information investors acquire through their past learning experiences with the investment

opportunity, or through their relations with their reference groups such as family, social and

work groups, etc. The perception of this information is influenced by personality traits. It is

generally agreed that investor personality traits influence their perceptions and investment

behaviour

Studies have shown that informal personal advice in face- to- face groups is much more effective

as a behavioural determinant than advertising in newspapers, magazines, journals, Television or

other mass media. That is, when it comes to selecting investment avenues or changing

investment patterns, a prospective investor is more likely to be influenced by word of mouth

advertising from the satisfied investors in his or her reference group. This is true especially when

the speaker is considered to be knowledgeable regarding the particular investment opportunity.

SULLAMUSSALAM SCIENCE COLLEGE AREEKODE Page 17

INVESTMENT BEHAVIOUR OF COLLEGE TEACHERS

IMPORTANCE OF INVESTMENT

Investments are both important and useful in the context of present day conditions. Some factors

that made investment decisions increasingly important are:

Income

The growth and development of country leading to greater economic activity has lead to

introduction of a vast array of investment outlets. The investor in his choice of investment will

have to try and achieve a proper mix between high rate of return and stability of return to reap

the benefit of both.

Interest rates

Another aspect which is necessary for a sound investment plan is the level of interest rates. It

may vary between one investment and another. These may vary between risky and safe

investments; they may also differ due to different benefits schemes offered by the investments.

Inflation

Since the last decade inflation has become continue as problem. In these years of rising prices,

several problems are associated coupled with a falling standard of living. The investor will try

and search an outlet which will give him a high rate of returns in the form of interest to cover any

decrease due to inflation.

Increasing rate of taxation

Taxation is one of the crucial factors in any country which introduced an element of compulsion

in individual‟s savings. There are various forms of savings outlet in our country in the form of

investment which helps in bringing down the tax level by offering the deductions in personal

income.

And also some factors like

SULLAMUSSALAM SCIENCE COLLEGE AREEKODE Page 18

INVESTMENT BEHAVIOUR OF COLLEGE TEACHERS

Past market trends

Sometimes history repeats itself; sometimes markets learn from their mistakes. The investor

needs to understand how various asset classes have performed in the past before planning your

finances.

Risk appetite

The ability to tolerate risk differs from person to person. It depends on factors such as investor‟s

financial responsibilities, environment, basic personality, etc. Therefore, understanding an

investor‟s capacity to take on risk becomes a crucial factor in investment decision making.

Investment horizon

How long an investor can keep the money invested? The longer the time-horizon, the greater are

the returns that you should expect. Further, the risk element reduces with time.

Investible surplus

How much money an investor able to keep aside for investments? The investible surplus plays a

vital role in selecting from various asset classes as the minimum investment amounts differ and

so do the risks and returns.

Investment need

How much money an investor need at the time of maturity? This helps the investor determine

the amount of money need to invest every month or year to reach the magic figure.

Expected returns

The expected rate of returns is a crucial factor as it will guide the investor‟s choice of

investment. Based on investor‟s expectations, he can decide whether you want to invest heavily

into equities or debt or balance his portfolio.

Investment attributes:

For evaluating an investment avenue the following attributes are relevant.

SULLAMUSSALAM SCIENCE COLLEGE AREEKODE Page 19

INVESTMENT BEHAVIOUR OF COLLEGE TEACHERS

Rate of return

The rate of returns of an investment for a period is defined as follows:

Rate of return = Annual income + (Ending price- Beginning price)/Beginning price

Risk

The risk of an investment refers to the possibility of losing part or full of the invested amount.

The rate of return from investment likes equity share, real estate and gold can vary rather widely.

Rate of return from different investment options vary a lot. Remember the famous quote, More

the risk and more the profits. It is a general phenomenon that more return is expected out of a

high risk investment. Risk means uncertainty of returns. Statistically, the risk is judged based on

parameters like variance, standard deviation and beta. More a security deviate from its expected

outcomes, risk is considered to be high. Challenge for a finance manager while investing funds is

to achieve high returns on investments while keeping the risk at lowest possible levels.

Marketability

An investment is highly marketable or liquid if, it can be transacted quickly, The transaction cost

is low and the price change between two successive transactions is negligible.

Liquidity

Liquidity means marketability of an investment. For example, equity shares of a big company

can be easily liquidated in the stock markets. On the other hand, money invested in an asset

(machinery) cannot be liquidated as easily as the equity share. An investment is considered

highly marketable or liquid it can be easily transacted with low transaction cost and low price

variation. A finance manager looks for more liquid investments when the funds are available for

short period. Liquidity is always given a preference because it helps the managers remain

flexible.

SULLAMUSSALAM SCIENCE COLLEGE AREEKODE Page 20

INVESTMENT BEHAVIOUR OF COLLEGE TEACHERS

Convenience

The selected investment avenue should be under the legal and regularity framework. If it is not

under the framework, it is difficult to represent grievances, if any approval of the law itself adds

a flavor of safety.

INVESTMENT AVENUES

Investment refers to the sacrificing of certain present value for some uncertain future value. It

also means the conversion of money into claims on money and use of funds for productive and

income earned assets.

The investment options available to an investor fall in to 3 broad categories viz financial

investment, real investment and non-securitized investment. Financial investment are contracts

written on pieces of paper like equity shares, govt. securities etc. Real investments are represent

by tangible assets like residential house, agricultural farm, gold, precious stones and art objects.

Non securitized investments include deposits in banks. The investment avenues available are

described here.

EQUITY SHARES

Equity capital represents ownership capital. Equity share holder collectively owned the

company. They bear the risk and enjoys the rewards of ownership. Potential rewards and

penalties associated with the equity shares make them interesting, even exiting proposition. The

shareholders get voting right.

PREFERENCE SHARES

Preference shares represent a hybrid security that takes some characteristics of equity shares and

some attributes of debentures. Preference shares carry a fixed rate of dividend and it is

redeemable. Preference shareholders enjoys restricted voting right also.

SULLAMUSSALAM SCIENCE COLLEGE AREEKODE Page 21

INVESTMENT BEHAVIOUR OF COLLEGE TEACHERS

COMMERCIAL BANKS/BANK DEPOSITS

Bank deposit is the simple investment avenue open for the investors. Commercial banks provide

to the investor both deposits which are liquid in nature, which has stability and which also given

an element of security. The following kind of deposits is provided by the bank.

1. Savings bank deposit

The most liquid form of investment is the maintenance of a saving bank account. The deposits

may be made at any time through the introduction of a person already having a bank account or

through the manager of the bank on completion of the formalities of filling a form and having it

certified, the investor can begin to operate association.

2. Current account

An investigator is also given the option of having a current account in the bank for maintaining

liquidity. A current account is usually open a business house of this current account, the account

holder is permitted to draw according to a fixed limited provided by the bankers in agreement

with the account opening association.

3. Recurring deposit

Recurring deposit is a made by which an investor may at regular intervals deposit a fixed sum of

money in bank.

4. Fixed deposit schemes

Each bank has certain special schemes. These schemes vary from bank to bank but the maturity

value is normally the same and the interest at a fixed deposit is specified from time to time by the

RBI.

5. Mutual fund schemes

Commercial banks in India have also started mutual fund schemes. The first bank take this step

was in 1987.

SULLAMUSSALAM SCIENCE COLLEGE AREEKODE Page 22

INVESTMENT BEHAVIOUR OF COLLEGE TEACHERS

POST OFFICE SCHEMES

Post office schemes are generally like the commercial bank schemes. They have a saving

account, a recurring account, and a ten-year Cumulative Time Deposit (CTD) account which are

also recurring in nature. The savings account operates in the same way as commercial banks

through Cheque and there is no restriction on withdrawals.

NATIONAL SAVING SCHEMES

National saving schemes have been started by the government of India mainly to finance its

economic development plans through the mobilization of savings of smaller income groups this

scheme is operated mainly through the post offices. Because of the tax free nature of the scheme,

its main purpose is to attract higher income group of people also. The investor has an exact

picture of the amount that he will receive at the time of encashment of security. The rate of

interest on NSS is usually higher than the commercial banks. The certificates have an advantage

that they can be used as collateral at the time of taking a loan from the bank.

LAND AND HOUSE PROPERTY/ REAL ESTATE

Land and house property is also called real estate. This investment is taken by a large number of

people for hedging the inflation rates. The real estate market offers a high return to investors.

People invest in real estate because of High capital appreciation particularly in the urban area.

Availability of loans for the constructions of houses

GOLD & SILVER

Gold is one of the most valuable assert in the economy. It has been used in India primarily as the

form of saving by the house vice although it is said to appreciate many times yet in India it is

more of a sense of security and fixed assets rather than for the use of sale or for the purchase of

making profit or income on this investment. Gold may be invested into either in the form of gold

shares, gold coins, gold bars and gold jewelries.

Silver is sold in the form of weight by kilograms in India. Silver may be owned in the form of

coin, utensils, glasses, bowels, plates, trays and jewellery. This like gold has been a hedge during

inflation. The price of silver although less than gold, also keeps on rising in the same way as gold

SULLAMUSSALAM SCIENCE COLLEGE AREEKODE Page 23

INVESTMENT BEHAVIOUR OF COLLEGE TEACHERS

CHIT FUND

Chit fund means a transaction whether called chit, chit fund, chitty, kuri or by any other name

by or under which a person enters into an agreement with a specified number of persons that

every one of them shall subscribe a certain sum of money (or a certain quantity of grain instead)

by way of periodical installments over a definite period and that each such subscriber shall, in his

turn, as determined by lot or by auction of by tender or in such other manner as may be specified

in the chit agreement, be entitled to the prize amount.

PUBLIC PROVIDENT FUND

The Public Provident Fund (PPF) is a savings-cum-tax-saving instrument in India, introduced by

the National Savings Institute of the Ministry of Finance in 1968. The aim of the scheme is to

mobilize small savings by offering an investment with reasonable returns combined with income

tax benefits.

SULLAMUSSALAM SCIENCE COLLEGE AREEKODE Page 24

INVESTMENT BEHAVIOUR OF COLLEGE TEACHERS

CHAPTER 4

ANALYSIS

AND

INTERPRETATION OF DATA

SULLAMUSSALAM SCIENCE COLLEGE AREEKODE Page 25

INVESTMENT BEHAVIOUR OF COLLEGE TEACHERS

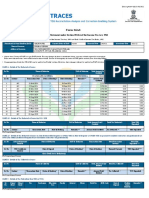

CLASSIFICATION OF DEMOGRAPHIC FACTORS OF RESPONDENTS

TABLE 4.1

CRITERIA PARTICULERS NO OF PERCENTAGE

RESPONDENTS

Below 30 25 41%

30-40 14 24%

Age 40-50 11 19%

50-60 8 13%

Above 60 2 3%

Total 60 100%

Male 37 62%

Gender Female 23 38%

Total 60 100%

Government/Aided 30 50%

Types of institution Unaided 30 50%

Total 60 100%

Married 42 70%

Marital status Unmarried 18 30%

Total 60 100%

Below 25000 30 50%

25000-50000 1 2%

Monthly income 50000-75000 16 27%

75000-100000 5 8%

Above 100000 8 13%

Total 60 100%

Source: Primary data

INTERPRETATION:

The above table shows that majority of respondents are belong to age group below 30

(41%).Gender wise classification shows that out of 60 respondents,62% are male. Respondents

are 30 each from government / aided sector.

Out of 60 respondents, 70% are married and 30% are unmarried.

As to monthly income, 50% of respondents fall under below 25000 and 27% are receiving

income between 50000-75000

SULLAMUSSALAM SCIENCE COLLEGE AREEKODE Page 26

INVESTMENT BEHAVIOUR OF COLLEGE TEACHERS

CLASSIFICATION ON THE BASIS OF AWARENESS

TABLE 4.2

VERY HIGH AVERAGE LOW VERY

INVESTMENT

HIGH LOW

AVENUES

(5) (4) (3) (2) (1)

Savings account 53 6 1 0 0

Fixed deposit 11 29 18 2 0

Gold and silver 22 30 8 0 0

Real estate 11 24 11 10 4

Life insurance 9 19 21 10 1

Post office deposit 8 21 11 14 6

PPF 9 21 9 9 12

Share and debentures 5 10 18 21 6

Mutual fund 3 6 14 21 10

Treasury bill 1 5 11 22 21

Chitties and kurries 18 29 7 3 4

Source: Primary data

CHART 4.1

120%

97%

100%

85%

76% 79%

80% 69% 68%

64% 62%

60% 56%

44% 41%

40%

20%

0%

SULLAMUSSALAM SCIENCE COLLEGE AREEKODE Page 27

INVESTMENT BEHAVIOUR OF COLLEGE TEACHERS

ANALYSIS OF AWARENESS LEVEL

TABLE 4.3

VERY VERY

INVESTMENT HIGH AVERAGE LOW

HIGH LOW TOTAL PERCENTAGE

AVENUES (4) (3) (2)

(5) (1)

Savings account 265 24 3 0 0 292 97%

Fixed deposit 55 116 54 4 0 229 76%

Gold and silver 110 120 24 0 0 254 85%

Real estate 55 96 33 20 4 208 69%

Life insurance 45 76 63 20 1 205 68%

Post office

40 84 33 28 6 191 64%

deposit

PPF 45 84 27 18 12 186 62%

Share and

25 40 54 42 6 167 56%

debentures

Mutual fund 15 24 42 42 10 133 44%

Treasury bill 5 20 33 44 21 123 41%

Chitties and

90 116 21 6 4 237 79%

kurries

Source: primary data

INTERPRETATION:

The above table shows 97% of respondents have well knowledge on savings bank account and

85% ,79% had awareness on gold & silver and Chitties and kurries respectively . Whereas 41%

of respondents only have awareness on Treasury bill

SULLAMUSSALAM SCIENCE COLLEGE AREEKODE Page 28

INVESTMENT BEHAVIOUR OF COLLEGE TEACHERS

CLASSIFICATION ON THE BASIS OF INVESTMENT AVENUES

TABLE 4.4

INVESTMENT AVENUES NO.OF RESPONDANTS PERCENTAGE

Savings account 59 36%

Fixed deposit 17 10%

Gold and silver 20 12%

Real estate 12 7%

Life insurance 7 4%

Post office deposit 11 7%

PPF 16 10%

Share and debentures 6 4%

Mutual fund 2 1%

Treasury bill 0 0%

Chitties and kurries 14 9%

Total 164 100%

Source: Primary data

CHART 4.2

40% 36%

35%

30%

25%

20%

15% 12%

10% 10%

10% 7% 9%

7%

4% 4%

5% 1% 0%

0%

INTERPRETATION:

The above table shows that out of 60 respondents 36 % of investors prefer to invest their money

in savings account, 12% of the investors invest their gold and silver and 10% investors invest

their money in fixed deposit.

SULLAMUSSALAM SCIENCE COLLEGE AREEKODE Page 29

INVESTMENT BEHAVIOUR OF COLLEGE TEACHERS

CLASSIFICATION OF FACTORS INFLUENCING INVESTMENT

DECISION

TABLE 4.5

SCORE

FACTOR 10 9 8 7 6 5 4 3 2 1

Safety 27 21 11 3 0 0 0 0 0 0

Return 2 17 16 10 5 3 0 0 0 0

Liquidity 2 2 1 10 25 15 0 2 0 0

Risk 3 8 8 11 11 13 4 0 0 0

Maturity period 0 0 1 1 5 5 30 15 2 2

Tax benefit 9 11 4 5 3 3 3 2 16 4

Convenience 2 2 1 2 2 10 6 29 5 0

Availability of

13 12 16 6 0 2 3 3 2 2

income

Reliability 0 0 0 4 2 6 2 7 31 2

Customer service 1 0 1 1 1 1 0 0 5 46

Source: Primary data

CHART 4.3

568

445

416

390

347 343

241 243

163

92

SULLAMUSSALAM SCIENCE COLLEGE AREEKODE Page 30

INVESTMENT BEHAVIOUR OF COLLEGE TEACHERS

ANALYSIS OF FACTORS INFLUENCING INVESTMENT DECISION

TABLE 4.6

SCORE

FACTORS TOTAL RANK

10 9 8 7 6 5 4 3 2 1

Safety 270 189 88 21 0 0 0 0 0 0 568 1

Return 20 153 128 70 30 15 0 0 0 0 416 3

Liquidity 20 18 8 70 150 75 0 6 0 0 347 5

Risk 30 72 64 77 66 65 16 0 0 0 390 4

Maturity

0 0 8 7 30 25 120 45 4 2 241 8

period

Tax benefit 90 99 32 35 18 15 12 6 32 4 343 6

Convenience 20 18 8 14 12 50 24 87 10 0 243 7

Availability

130 108 128 42 0 10 12 9 4 2 445 2

of income

Reliability 0 0 0 28 12 30 8 21 62 2 163 9

Customer

10 0 8 7 6 5 0 0 10 46 92 10

service

Source: Primary data

INTERPRETATION:

This is done to know the importance of each factor while choosing investment option. we

identify that safety get the first rank. The second influencing factor is availability of income and

third is return. Least influencing factor is customer service

SULLAMUSSALAM SCIENCE COLLEGE AREEKODE Page 31

INVESTMENT BEHAVIOUR OF COLLEGE TEACHERS

CLASSIFICATION ON THE BASIS OF INVESTMENT OBJECTIVES

TABLE 4.4

OBJECTIVES NO.OF RESPONDANTS PERCENTAGE

Retirement plan 13 19%

Tax benefit 10 14%

Construction& acquisition of asset 16 23%

Children‟s marriage 9 13%

Children‟s education 11 16%

Others 11 16%

Total 70 100%

Source: Primary data

CHART 4.4

25% 23%

20% 19%

16% 16%

14%

15% 13%

10%

5%

0%

Retirement Tax benefit Construction& Children’s Children’s Others

plan acquisition of marriage education

asset

INTERPRETATION:

Most of the investors invest their saving for the objective of construction & acquisition of asset

(23%) and retirement plan(19%).16% of respondents are preferred children`s education and

others.

SULLAMUSSALAM SCIENCE COLLEGE AREEKODE Page 32

INVESTMENT BEHAVIOUR OF COLLEGE TEACHERS

CLASSIFICATION ON THE BASIS OF FREQUENCY

TABLE 4.8

FREQUENCY NO.OF RESPONDANTS PERCENTAGE

Regularly 11 18%

Often 16 27%

Occasionally 19 32%

Sometimes 9 15%

Rarely 5 8%

Total 60 100%

Source: Primary data

CHART 4.5

32%

27%

18%

15%

8%

Regularly Often Occasionally Sometimes Rarely

INTERPRETATION:

The above table shows that out of 60 respondents 32% of investors occasionally make their

investment, 27% of respondents make their investment often & 18% of respondents make their

investment regularly.

SULLAMUSSALAM SCIENCE COLLEGE AREEKODE Page 33

INVESTMENT BEHAVIOUR OF COLLEGE TEACHERS

CLASSIFCATION ON THE BASIS OF SOURCE OF

INFORMATION

TABLE 4.9

Score

SOURCES

5 4 3 2 1

friends & Relatives 32 18 6 2 0

co-workers 20 22 17 0 0

Advertisements 5 14 30 7 2

journals & magazine 3 5 3 49 1

Others 0 0 3 0 55

Source: Primary data

CHART 4.6

7%

29%

16%

friends & Relatives

co-workers

advertisements

journals & magazine

others

21%

27%

SULLAMUSSALAM SCIENCE COLLEGE AREEKODE Page 34

INVESTMENT BEHAVIOUR OF COLLEGE TEACHERS

ANALYSIS ON THE BASIS OF SOURCE OF INFORMATION

TABLE 4.10

SCORE

SOURCES TOTAL RANK

5 4 3 2 1

friends & Relatives 160 72 18 4 0 254 1

co-workers 100 88 51 0 0 239 2

advertisements 25 56 90 14 2 187 3

journals & magazine 15 20 9 98 1 143 4

others 0 0 9 0 55 64 5

Source: Primary data

INTERPRETATION:

This is done to know where they get information about investment. Most of respondent depend

on the information obtained from friends & relatives and got first rank.co- workers got second

rank.

SULLAMUSSALAM SCIENCE COLLEGE AREEKODE Page 35

INVESTMENT BEHAVIOUR OF COLLEGE TEACHERS

CLASSIFICATION ON THE BASIS OF PROBLEMS

TABLE 4.11

1. Problems in banking investment

SCORE

STRONGLY STRONGLY

PROBLEMS AGREE NEUTRAL DISAGREE

AGREE DISAGREE

Low return 44 13 1 1 0

High risk 0 1 20 29 9

poor services 1 21 24 8 5

Liquidity 1 11 12 15 20

Source: Primary data

CHART4.7

300

250

200

150

100

50

0

Low return High risk poor services Liquidity

SULLAMUSSALAM SCIENCE COLLEGE AREEKODE Page 36

INVESTMENT BEHAVIOUR OF COLLEGE TEACHERS

ANALYSIS OF PROBLEMS REGARDING BANKING

INVESTMENT

TABLE 4.12

SCORE

PROBLEMS STRONGLY AGREE NEUTRAL DISAGREE STRONGLY TOTAL RANK

AGREE DISAGREE

(5) (4) (3) (2) (1)

Low return 220 52 3 2 0 277 1

High risk 0 4 60 58 9 131 4

poor services 5 84 72 16 5 182 2

Liquidity 5 44 36 30 20 135 3

Source: Primary data

INTERPRETATION:

This is done to know the problems faced by investors regarding banking investments. From this

we can identify that the low return gets 1st rank. Poor services, liquidity and high risk got 2nd ,

3rd and 4th rank respectively

SULLAMUSSALAM SCIENCE COLLEGE AREEKODE Page 37

INVESTMENT BEHAVIOUR OF COLLEGE TEACHERS

CLASSIFICATION ON THE BASIS OF PROBLEMS

TABLE 4.13

2. Problems in share and debenture investment

score

PROBLEMS STRONGLY STRONGLY

AGREE NEUTRAL DISAGREE

AGREE DISAGREE

Low return 0 1 2 3 1

High risk 7 0 0 0 0

poor services 2 3 0 2 0

Liquidity 2 1 2 0 1

Source: Primary data

CHART 4.8

40

35

35

30

26

25

21

20

17

15

10

0

Low return High risk poor services Liquidity

SULLAMUSSALAM SCIENCE COLLEGE AREEKODE Page 38

INVESTMENT BEHAVIOUR OF COLLEGE TEACHERS

ANALYSIS OF PROBLEMS REGARDING SHARES AND

DEBENTURES INVESTMENT

TABLE 4.14

SCORE

PROBLEMS TOTAL RANK

STRONGLY STRONGLY

AGREE NEUTRAL DISAGREE

AGREE DISAGREE

Low return 0 4 6 6 1 17 4

High risk 35 0 0 0 0 35 1

poor services 10 12 0 4 0 26 2

Liquidity 10 4 6 0 1 21 3

Source: Primary data

INTERPRETATION:

This is done to know the problems faced by investors regarding shares and debentures

investments. From this we can identify that the high risk gets 1st rank. Poor services, liquidity and

low return got e 2nd, 3rd and 4th rank respectively

SULLAMUSSALAM SCIENCE COLLEGE AREEKODE Page 39

INVESTMENT BEHAVIOUR OF COLLEGE TEACHERS

CLASSIFICATION ON THE BASIS OF PROBLEMS

TABLE 4.15

3. Problems in gold and silver investment

Score

PROBLEMS STRONGLY STRONGLY

AGREE NEUTRAL DISAGREE

AGREE DISAGREE

Low return 17 6 0 0 0

High risk 0 5 11 7 0

poor services 1 6 8 7 2

Liquidity 0 4 3 10 7

Source: Primary data

CHART 4.9

120

100

80

60

40

20

0

Low return High risk poor services Liquidity

SULLAMUSSALAM SCIENCE COLLEGE AREEKODE Page 40

INVESTMENT BEHAVIOUR OF COLLEGE TEACHERS

ANALYSIS OF PROBLEMS REGARDING GOLD AND SILVER

INVESTMENT

TABLE 4.16

Score

PROBLEMS TOTAL RANK

STRONGLY STRONGLY

AGREE NEUTRAL DISAGREE

AGREE DISAGREE

Low return 85 24 0 0 0 109 1

High risk 0 20 33 14 0 67 3

poor services 5 24 24 14 2 69 2

Liquidity 0 16 9 20 7 52 4

Source: Primary data

INTERPRETATION:

This is done to know the problems faced by investors regarding banking investments. From this

we can identify that the low return gets 1st rank. Poor services, high risk and liquidity got 2nd, 3rd

and 4th rank respectively

SULLAMUSSALAM SCIENCE COLLEGE AREEKODE Page 41

INVESTMENT BEHAVIOUR OF COLLEGE TEACHERS

CLASSIFICATION ON THE BASIS OF PROBLEMS

TABLE 4.17

4. Problems in Chitties & kurries investment

Score

PROBLEMS STRONGLY STRONGLY

AGREE NEUTRAL DISAGREE

AGREE DISAGREE

Low return 11 1 1 0 0

High risk 1 2 5 3 3

poor services 1 8 2 1 1

Liquidity 2 3 2 5 1

Source: Primary data

CHART 4.10

70

60

50

40

30

20

10

0

Low return High risk poor services Liquidity

SULLAMUSSALAM SCIENCE COLLEGE AREEKODE Page 42

INVESTMENT BEHAVIOUR OF COLLEGE TEACHERS

ANALYSIS OF PROBLEMS REGARDING CHITTIES &

KURRIES INVESTMENT

TABLE 4.18

SCORE

PROBLEMS TOTAL RANK

STRONGLY STRONGLY

AGREE NEUTRAL DISAGREE

AGREE DISAGREE

Low return

55 4 3 0 0 62 1

High risk 5 8 15 6 3 37 4

poor services 5 32 6 2 1 46 2

Liquidity 10 12 6 10 1 39 3

Source: Primary data

INTERPRETATION:

This is done to know the problems faced by investors regarding Chitties and kurries investments.

From this we can identify that the low return gets 1st rank. Poor services, liquidity and high risk

got 2nd, 3rd and 4th rank respectively

SULLAMUSSALAM SCIENCE COLLEGE AREEKODE Page 43

INVESTMENT BEHAVIOUR OF COLLEGE TEACHERS

CLASSIFICATION ON THE BASIS OF PROBLEMS

TABLE 4.19

5. Problems in life insurance investments

SCORE

PROBLEMS STRONGLY STRONGLY

AGREE NEUTRAL DISAGREE

AGREE DISAGREE

Low return 6 3 0 0

0

High risk 0 3 5 1 0

poor

0 4 1 4

services 0

Liquidity 3 0 1 3 2

Source: Primary data

CHART 4.11

45

40

35

30

25

20

15

10

0

Low return High risk poor services Liquidity

SULLAMUSSALAM SCIENCE COLLEGE AREEKODE Page 44

INVESTMENT BEHAVIOUR OF COLLEGE TEACHERS

ANALYSIS OF PROBLEMS REGARDING LIFE INSURANCE

TABLE 4.20

SCORE

PROBLE TOT RAN

MS STRONGLY AGR NEUTR DISAG STRONGLY AL K

AGREE EE AL REE DISAGREE

Low

return

30 12 0 0 0 42 1

High risk 0 12 15 2 0 29 2

poor

services

0 16 3 8 0 27 3

Liquidity 15 0 3 6 2 26 4

Source: Primary data

INTERPRETATION:

This is done to know the problems faced by investors regarding life insurance investments. From

this we can identify that the low return gets 1st rank. High risk, Poor services and liquidity got

2nd , 3rd and 4th rank

SULLAMUSSALAM SCIENCE COLLEGE AREEKODE Page 45

INVESTMENT BEHAVIOUR OF COLLEGE TEACHERS

CLASSIFICATION ON THE BASIS OF RATE OF RETURN

TABLE 4.21

RATE OF RETURN NO.OF RESPONDANTS PERCENTAGE

Below 8% 38 63%

8% -12% 15 25%

12%-16% 3 5%

16%-20% 2 3%

above 20% 2 3%

Total 60 100%

Source: Primary data

CHART 4.12

Below 8% 8% -12% 12%-16% 16%-20% above 20%

4% 3%

5%

25%

63%

INTERPRETATION:

From the above table, 63% of respondents expect rate of return is below 8 % and 3 % expect

rate of return above 20%

SULLAMUSSALAM SCIENCE COLLEGE AREEKODE Page 46

INVESTMENT BEHAVIOUR OF COLLEGE TEACHERS

CLASSIFICATION ON THE BASIS OF MATURITY PERIOD

TABLE 4.22

MATURITY PERIOD NO OF RESPONDENT PERCENTAGE

Short term (1 year) 26 43%

Mid-term (1-5 year) 23 38%

Long term (above 5 year) 11 18%

Total 60 100%

Source: Primary data

CHART 4.13

18%

43% Short term(1 yr)

Mid term(1-5 yr)

Long term(above 5 yr)

38%

INTERPRETATION:

The above charts shows that the majority of respondents (43%) are short term investors. 38%

and 18% are mid-term and long term investors respectively.

SULLAMUSSALAM SCIENCE COLLEGE AREEKODE Page 47

INVESTMENT BEHAVIOUR OF COLLEGE TEACHERS

CLASSIFICATION ON THE BASIS OF REASONS OF

WITHDRAWAL

TABLE 4.23

REASONS NO.OF RESPONDANTS PERCENTAGE

Huge risk 2 8%

Low return 3 12%

Difficult to maintain 6 23%

Non-performance of asset 2 8%

Life situation 12 46%

others 1 4%

Total 26 100%

Source: Primary data

CHART 4.14

46%

23%

12%

8% 8%

4%

INTERPRETATION:

46% of respondents says that life situation is the reason for their withdrawal and difficult to

maintain is the reason for 23%.

SULLAMUSSALAM SCIENCE COLLEGE AREEKODE Page 48

INVESTMENT BEHAVIOUR OF COLLEGE TEACHERS

ANALYSIS OF HYPOTHESIS

H0: There is no significance difference between investment avenues of government/aided

college and aided college teachers

TABLE 4.24

Government / aided Unaided

Investment avenues Total

teachers teachers

Savings account 30 29 59

Fixed deposit 15 2 17

Gold and silver 12 8 20

Real estate 10 2 12

Life insurance 4 3 7

Post office deposit 8 3 11

PPF 14 2 16

Share and debentures 5 1 6

Mutual fund 2 0 2

Treasury bill 0 0 0

Chitties and kurries 6 8 14

Total 106 58 164

Source: Primary data

CHI-SQUARE TEST

OBSERVED (O) EXPECTED (E) (O-E)2/E

30 38.1 1.7

29 20.9 3.2

15 11.0 1.5

14 18.9 1.3

8 7.1 0.1

10 7.8 0.6

9 11.2 0.4

8 7.1 0.1

17 14.2 0.5

7 9.5 0.7

9 13.2 1.3

8 5.0 1.9

Total 13.4

SULLAMUSSALAM SCIENCE COLLEGE AREEKODE Page 49

INVESTMENT BEHAVIOUR OF COLLEGE TEACHERS

Degree of freedom = (r-1) (c-1)

(11-1) (2-1)

10*1 = 10

Level of significance = 0.05

The calculated value (13.4) is less than the table value (18.30). So hypothesis is accepted.

Hence it is concluded that, “There is no significant difference between type of organization and

investment avenues”.

SULLAMUSSALAM SCIENCE COLLEGE AREEKODE Page 50

INVESTMENT BEHAVIOUR OF COLLEGE TEACHERS

CHAPTER 5

FINDINGS, SUGGESTIONS

AND

CONCLUSIONS

SULLAMUSSALAM SCIENCE COLLEGE AREEKODE Page 51

INVESTMENT BEHAVIOUR OF COLLEGE TEACHERS

5.1 SUMMARY

The project entitled “Investment behaviour of college teachers with special reference to

malappuram district”. The main objective of the study was to find out the saving and investment

behaviour of college teachers

This project was successfully completed through five chapters. The first chapter of the project

contains introduction. It also includes objective and importance of the study. This chapter also

includes research methodology used, period of study, and limitation of the study and chapter

plan.

The second chapter includes theoretical background. The study was conducted with the

objectives of looking in to the level of saving and the manner of its disposition and in depth

analysis of factors underlying. From the study it was found that a high proportion of saving was

absorbed in unproductive assets leading to a vicious of low income and low saving

The study is conducted through direct personal interview of 60 college teachers with the help of

well-structured questionnaire Respondent of selected samples are duly tabulated, analyzed and

interpreted by using various statistical tools are included in the fourth chapter.

The researcher while conducting the study comes across many findings suggestions and

conclusions. All these includes in fifth chapter.

SULLAMUSSALAM SCIENCE COLLEGE AREEKODE Page 52

INVESTMENT BEHAVIOUR OF COLLEGE TEACHERS

5.1 FINDINGS

The following are the findings that appeared while analyzing the study

1. Most of the respondents (36%) have made their investment in savings account. Whereas

not even one invested in Treasury bill

2. Safety and availability of income are the most attractive factors while selecting an

investment avenue. Then after return and risk are the attractive factors. The reliability and

customer service are least attractive factors.

3. Savings bank account, gold and silver and kurries and Chitties investment avenues are

having higher awareness level. Whereas treasury bills having least awareness.

4. Most of the investors depend on the friends and relatives and coworkers for getting

investment information.

5. Low return and poor services are main Problems regarding banking investment, Chitties

& kurries and gold & silver

6. High risk and poor services are main Problems regarding share and debenture investment.

whereas Low return and high risk are main Problems regarding life insurance investment

7. Construction& acquisition of asset (23%) and retirement plan(19%) are the prime motive

of the investment.

8. Most of respondents (32% )would like to invest occasionally

9. Majority of investors (63%) gets rate of return below 8% .

10. Most of respondents (43%) would like to invest in short term investment.

11. Main reason for withdrawal of investment are life situation and low return

SULLAMUSSALAM SCIENCE COLLEGE AREEKODE Page 53

INVESTMENT BEHAVIOUR OF COLLEGE TEACHERS

5.2 SUGGESTIONS

The following are the suggestions that appeared while analyzing the study

1. As the score obtained for the level of awareness of the Respondents about shares &

Debentures, Mutual Fund, Treasury Bill etc. is less. It reveals that the teachers

„knowledge about various innovative and new generation investment avenues are very

low. so they should update their knowledge about new investments

2. Investments like mutual fund, share and debentures are not well preferred so,

Companies or agencies related to investments like mutual fund, share and debentures

etc. should reduce complexities and give awareness class to enhance knowledge level

3. Introduce new innovation schemes with low risk

SULLAMUSSALAM SCIENCE COLLEGE AREEKODE Page 54

INVESTMENT BEHAVIOUR OF COLLEGE TEACHERS

5.3 CONCLUSION

The investment pattern of college teachers follows the traditional pattern of

investments which have been used by them for years. Bank deposit is the favorite

investment avenue of almost all respondents. Most of the teachers is make investment of

the influence by self and by family and relatives. The only drawback of the teachers is

that they are reluctant to invest in modern investment schemes. And majority of them

are afraid to take risk.

Accordingly, the study was confined to different categories of teachers working in

various educational institutions in malappuram district with a special emphasis on their

attitude and behaviour towards consumption, savings and investments. Hence it is micro

study, the findings, discussions and conclusions cannot be generalized so as to make

them applicable to all sections of the society in all States in India due to differing social-

economic and cultural circumstances.

SULLAMUSSALAM SCIENCE COLLEGE AREEKODE Page 55

INVESTMENT BEHAVIOUR OF COLLEGE TEACHERS

BIBLIOGRAPHY

SULLAMUSSALAM SCIENCE COLLEGE AREEKODE Page 56

INVESTMENT BEHAVIOUR OF COLLEGE TEACHERS

BIBLIOGRAPHY

Books

1. H.R MACHIRAJU. Indian Financial system, Vikas publishing House Pvt. Ltd.

Second edition.

2. VASANT B DESAI, Financial markets and financial services, Himalaya

Publishing house.

Websites

1. www.shodhganga.inflibnet.ac.in

2. www.scribd.com

3. www.wikipedia.com

SULLAMUSSALAM SCIENCE COLLEGE AREEKODE Page 57

INVESTMENT BEHAVIOUR OF COLLEGE TEACHERS

APPENDIX

SULLAMUSSALAM SCIENCE COLLEGE AREEKODE Page 58

INVESTMENT BEHAVIOUR OF COLLEGE TEACHERS

QUESTIONNAIRE

INVESTMENT BEHAVIOUR OF COLLEGE TEACHERS

IN MALAPPURAM DISTRICT

Dear Respondent,

We are students from MEASS College, Areekode currently pursuing for M.COM course as a

part of curriculum. We are required to do a project work. We will be pleased if you kindly spare

few minutes for filling up the questionnaire. Whatever Information provided by you will be kept

confidential used only for the purpose of our study.

1. Name :

2. Age : below 30 30-40 40-50

50-60 above 60

3. Gender : male female

4. Marital status : married unmarried

5. Types of institution : government/aided unaided

6. Monthly income : less than 250000 25000-50000 50000-75000

75000-100000 above 100000

7. state your level of awareness about investment avenues

Very

Investment avenues High Average Low Very low

high

1. Savings bank account

2. Fixed deposits

3. Gold/ silver

4. Real estate

5. Life Insurance

6. Post office deposits

7. Provident fund

8. Shares or debentures

9. Mutual funds

10. Treasury bill

11 Chitties and kurries

SULLAMUSSALAM SCIENCE COLLEGE AREEKODE Page 59

INVESTMENT BEHAVIOUR OF COLLEGE TEACHERS

8. Where do you invest? ( please put tick applicable to you)

1. Savings bank account

2. Fixed deposits

3. Gold/ silver

4. Real estate

5. Life Insurance

6. Post office deposits

7. Provident fund

8. Shares or debentures

9. Mutual funds

10. Treasury bill

11. Chitties and kurries

12. Others (specify)

9. Which factor do you consider before investing (rank the following)

Safety

Return

Liquidity

Risk

Maturity period

Tax benefits

Convenience

availability of income

Reliability

Customer service

10. what is your investment objective?(please put tick applicable to you)

Retirement benefits

Tax benefits

Construction and acquisition of asset

Children‟s marriage

Children‟s education

Others

SULLAMUSSALAM SCIENCE COLLEGE AREEKODE Page 60

INVESTMENT BEHAVIOUR OF COLLEGE TEACHERS

11. How frequently do you invest?

Regularly often occasionally sometimes rarely

12. Source of getting information about investment? (rank the following)

1. Friends and Relatives

2. co workers

3. Advertisement

4. journals and magazine

5. Others

13. What are the problems faced by you in investments?

Strongly Strongly

Problems Agree Neutral Disagree

agree Disagree

Low return

1.Banking

Risk

investment

Poor services

Liquidity

Strongly Strongly

Problems Agree Neutral Disagree

agree Disagree

2.Share Low return

and Risk

debenture Poor services

Liquidity

Strongly Strongly

Problems Agree Neutral Disagree

agree Disagree

Low return

3.Gold Risk

and silver Poor services

Liquidity

SULLAMUSSALAM SCIENCE COLLEGE AREEKODE Page 61

INVESTMENT BEHAVIOUR OF COLLEGE TEACHERS

Strongly Strongly

4. Problems Agree Neutral Disagree

agree Disagree

Chitties Low return

and Risk

kurries Poor services

Liquidity

Strongly Strongly

5. Problems Agree Neutral Disagree

agree Disagree

Life Low return

insurance

Risk

Poor services

Liquidity

14. your expected rate of return

Below 8% 8%- 12% 12%-16% 16%-20% above 20%

15. what is the maturity date you prefer

1 year 1-5 year above 5 year

16. Have you withdrawn your investment before maturity date?

Yes No

17. If yes, what are reasons to withdraw your investment? (tick applicable to you)

Huge risk

Low return

Difficult to maintain

Non-performance of asset

Life situation

Others ( specify)

SULLAMUSSALAM SCIENCE COLLEGE AREEKODE Page 62

You might also like

- English HKSI LE Paper 2 Pass Paper Question Bank (QB)Document10 pagesEnglish HKSI LE Paper 2 Pass Paper Question Bank (QB)Tsz Ngong Ko0% (1)

- Cash ManagementDocument82 pagesCash ManagementAjiLalNo ratings yet

- Saving and Investment Pattern of College Teachers'Document6 pagesSaving and Investment Pattern of College Teachers'Rishav SinglaNo ratings yet

- Desk Project On Financial Risk ManagementDocument28 pagesDesk Project On Financial Risk ManagementAamirNo ratings yet

- Objective: Fundamental Analysis of Real Estate Sector in IndiaDocument44 pagesObjective: Fundamental Analysis of Real Estate Sector in IndiaDnyaneshwar DaundNo ratings yet

- Scope of Marketing Management 1Document9 pagesScope of Marketing Management 1hysbeslem02No ratings yet

- SV Naan MudhalvanDocument37 pagesSV Naan Mudhalvansakthivelr20bba446No ratings yet

- Project Work QuestionnairesDocument9 pagesProject Work QuestionnairesFran100% (1)

- An Analysis of Investors Behaviour On Various Investment Avenues in IndiaDocument74 pagesAn Analysis of Investors Behaviour On Various Investment Avenues in IndiaDivya Chawhan100% (1)

- RamanDocument50 pagesRamanAlisha SharmaNo ratings yet

- INTERNATIONAL FINANCE-Factors Affecting International InvestmentsDocument3 pagesINTERNATIONAL FINANCE-Factors Affecting International InvestmentsRahul R Naik100% (1)

- The Impact of Behavioral Finance On Stock Markets - Sangeeta ThakurDocument5 pagesThe Impact of Behavioral Finance On Stock Markets - Sangeeta ThakurRajyaLakshmiNo ratings yet

- 6 - Research MethodologyDocument6 pages6 - Research Methodologytrushna19No ratings yet

- Project CertificateDocument79 pagesProject CertificatemahenderNo ratings yet

- Investment and Trading Pattern of Individuals Dealing in Stock MarketDocument8 pagesInvestment and Trading Pattern of Individuals Dealing in Stock MarketthesijNo ratings yet

- Case Study On The IDR of Standard Chartered PLCDocument1 pageCase Study On The IDR of Standard Chartered PLCFalguni MathewsNo ratings yet

- A Comparision Between Bse and Nasdaq (Kshitij Thakur)Document35 pagesA Comparision Between Bse and Nasdaq (Kshitij Thakur)Kshitij Thakur0% (1)

- Lgeil YashDocument3 pagesLgeil YashYash RoxsNo ratings yet

- Financial RiskDocument68 pagesFinancial RiskGouravNo ratings yet

- A Summer Internship Project Report On A Study of Online Trading in Indian Stock Market at Mudrabiz LTDDocument15 pagesA Summer Internship Project Report On A Study of Online Trading in Indian Stock Market at Mudrabiz LTDRupali BoradeNo ratings yet

- A Study On Investment Behaviour of Teachers With Special ReferenceDocument58 pagesA Study On Investment Behaviour of Teachers With Special ReferenceShoaib100% (1)

- Investors-Investment BehaviourDocument19 pagesInvestors-Investment Behaviourkarteek reddyNo ratings yet

- MCom Project Topics Finances PDFDocument2 pagesMCom Project Topics Finances PDFCsNo ratings yet

- Mahindra Bolero - RM FinalDocument38 pagesMahindra Bolero - RM FinalanuragkamNo ratings yet

- HyundaiDocument6 pagesHyundaiRahul KumarNo ratings yet

- SYNOPSIS Last PDFDocument14 pagesSYNOPSIS Last PDFzaidkhanNo ratings yet

- Sip ChandniDocument45 pagesSip ChandniRajveer singh PariharNo ratings yet

- Investors Perception Towards Stock MarketDocument2 pagesInvestors Perception Towards Stock MarketAkhil Anilkumar0% (1)

- A Study On Awareness of Financial Literacy Among College Students in ChennaiDocument83 pagesA Study On Awareness of Financial Literacy Among College Students in ChennaiGunavathi.S 016100% (1)

- Fanancial Analysis F Icici BankDocument78 pagesFanancial Analysis F Icici BankPaul DiazNo ratings yet

- Mcom Research PaperDocument63 pagesMcom Research PaperKhushbu MishraNo ratings yet

- Legal and Procedural Aspects of MergerDocument8 pagesLegal and Procedural Aspects of MergerAnkit Kumar (B.A. LLB 16)No ratings yet

- Investors' Perception Towards Commodity MarketsDocument9 pagesInvestors' Perception Towards Commodity MarketsJotpal SinghNo ratings yet

- Evolution of E-CommerceDocument16 pagesEvolution of E-CommerceDarshan PatilNo ratings yet

- Project Report (T.y Bcom H)Document47 pagesProject Report (T.y Bcom H)Dhruv GandhiNo ratings yet

- Portfolio Management Banking SectorDocument133 pagesPortfolio Management Banking SectorNitinAgnihotri100% (1)

- SYNOPSIS Project SbiDocument3 pagesSYNOPSIS Project SbiRakshitha NanayakkaraNo ratings yet

- Nature and Scope of Investment ManagementDocument5 pagesNature and Scope of Investment ManagementRavi GuptaNo ratings yet

- Infrastructure Internship ReportDocument56 pagesInfrastructure Internship Reporthimanshu97240% (1)

- 03 - Review of LitretureDocument9 pages03 - Review of LitretureHarsh AgarwalNo ratings yet

- "A Study On Comparative Analysis of Consumer Reviews Between Nykaa and PurplleDocument95 pages"A Study On Comparative Analysis of Consumer Reviews Between Nykaa and PurpllePranav PasteNo ratings yet

- Investors Perception Towards Stock MarketDocument64 pagesInvestors Perception Towards Stock MarketsonuNo ratings yet

- Indian Telecommunication ProjectDocument63 pagesIndian Telecommunication Projectjdahiya_1No ratings yet

- An Analysis of Various Investment Avenues With Special Reference To Mutual FundsDocument42 pagesAn Analysis of Various Investment Avenues With Special Reference To Mutual FundsAYUSH SAWANTNo ratings yet

- Project For SharekhanDocument55 pagesProject For Sharekhantushar vatsNo ratings yet

- LG TV FinalDocument75 pagesLG TV FinalSubramanya DgNo ratings yet

- Research Methodology: Analytical in NatureDocument3 pagesResearch Methodology: Analytical in NaturePrasad PhawadeNo ratings yet

- Working Capital Management-OpyclDocument82 pagesWorking Capital Management-Opyclganguly_ajayNo ratings yet

- Comparative Analysis of Investment Options AvailableDocument63 pagesComparative Analysis of Investment Options AvailableMausam MishraNo ratings yet

- MRP TopicsDocument3 pagesMRP TopicsJill RoseNo ratings yet

- Analysis of Risk Involved in Portfolio Management of IPLIC - FinalDocument72 pagesAnalysis of Risk Involved in Portfolio Management of IPLIC - FinalTbihva Aviirsa100% (1)

- Fdi and Its Impact On Indian EconomyDocument22 pagesFdi and Its Impact On Indian EconomyYash AgarwalNo ratings yet

- BoP, CAD and Fiscal DeficitDocument10 pagesBoP, CAD and Fiscal DeficitPalak MehtaNo ratings yet

- To Study The Students Buying Behaviour Towards Laptops: Harshit Gupta Harshit - Gupta@lbsim - Ac.inDocument39 pagesTo Study The Students Buying Behaviour Towards Laptops: Harshit Gupta Harshit - Gupta@lbsim - Ac.inMegha MattaNo ratings yet

- Mutual Fund Project OutlineDocument6 pagesMutual Fund Project OutlineAnto PremNo ratings yet

- Emerging Trends in Rural MarketingDocument21 pagesEmerging Trends in Rural MarketingChirag GoyaniNo ratings yet

- Mutual Fund Marketing in IndiaDocument85 pagesMutual Fund Marketing in Indiamohneeshbajpai100% (3)

- Colleage ProjectDocument29 pagesColleage ProjectBusiness ManNo ratings yet

- Effective Learning Style For The Student of Asian Institute of Science and TechnologyDocument7 pagesEffective Learning Style For The Student of Asian Institute of Science and Technologycarl seseNo ratings yet

- ProjectDocument3 pagesProject929 John MathewNo ratings yet

- Journal-Revised-Finished-3 (Repository) Bab 1&5Document12 pagesJournal-Revised-Finished-3 (Repository) Bab 1&5barbekyu RoastedNo ratings yet