Professional Documents

Culture Documents

Consumer Health in Vietnam - Analysis: Country Report - Sep 2021

Consumer Health in Vietnam - Analysis: Country Report - Sep 2021

Uploaded by

BUI THI THANH HANGOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Consumer Health in Vietnam - Analysis: Country Report - Sep 2021

Consumer Health in Vietnam - Analysis: Country Report - Sep 2021

Uploaded by

BUI THI THANH HANGCopyright:

Available Formats

CONSUMER HEALTH IN VIETNAM - ANALYSIS

Country Report | Sep 2021

EXECUTIVE SUMMARY Market Sizes

Consumer health in 2021: The big picture Sales of Consumer Health

Retail Value RSP - VND billion - Current - 2007-2026

In 2021, as several cities and provinces continue to be subject to lockdown and social

distancing measures, large numbers of people are buying medicines for storage

purposes due to ongoing fears of further long periods of home seclusion. Vitamin and 45,319 Forecast

dietary supplements, analgesics and cough, cold, and allergy (hay fever) remedies are 80,000

categories that are seeing particularly strong growth rates in both value and volume

sales. However, products such as wound care and digestive remedies are continuing to

see lower demand in 2021 as people are limiting the time they spend outside.

Nonetheless, overall, the consumer health market is experiencing a stronger growth 60,000

pace in value sales compared to the previous year mainly thanks to a brighter economic

performance and the ageing population.

40,000

COVID-19 pandemic lifts demand for vitamin and dietary supplements,

analgesics and cough remedies

In 2021, the demand for consumer health products such as vitamins and dietary 20,000

supplements, analgesics and cough remedies remained high due to the ongoing

presence of COVID-19 in the country. The Ministry of Healthcare also encouraged

people to exercise regularly and take vitamins daily in order to strengthen their

immune system and fend off the virus. All of these factors helped to boost value sales 0

2007 2021 2026

in these categories in 2021.

International players characterise the consumer health market in 2021

Sales Performance of Consumer Health

In 2021, international players such as Abbott Vietnam Co Ltd, Herbalife Vietnam Ltd, % Y-O-Y Retail Value RSP Growth 2007-2026

New Image Vietnam Co Ltd, GSK Consumer Healthcare and Sanofi-Aventis Vietnam Co

Ltd continued to dominate the consumer health market due to their high brand

reputation, wide distribution networks and strong financial capability. In order to

10.0% Forecast

compete with those foreign players and gain attention from Vietnamese consumers, 25%

many local pharmaceutical companies such as Duoc Hau Giang, Nam Ha, Traphaco and

OPC focused on upgrading their factories to achieve higher quality standards such as

EU-GMP, PIC/S and JAPAN - GMP while simultaneously launching new more highly 20%

sophisticated products. Moreover, these local companies are also increasingly focusing

on improving their distribution chains through the implementation of new technology

as a sustainable strategy for longer term development. 15%

Chemists/pharmacies remains a significant channel for consumer

10%

health, while e-commerce achieves strong growth

During the review period, there was a significant expansion of chemists/pharmacies

5%

such as Pharmacity and Long Chau within the Vietnamese market. These players

focused on expanding their networks in both rural and urban areas. By the end of 2021,

Pharmacity and Long Chau are expected to open 1,000 and 500 stores respectively and

0%

aim to become the leading players in the chemists/pharmacies channel in the future. 2007 2021 2026

Hence, as chemists/pharmacies have been allowed to remain open during the

pandemic, this channel has become an even more important distributor in helping

companies reach a wider audience. Moreover, as people continue to limit the time

they spend outdoors due to the outbreak, Pharmacity’s online sales have also recorded

an impressive growth rate, with this trend expected to grow gradually as Vietnamese

consumers become accustomed to shopping online during the pandemic. This is set to

encourage more retailers to adopt an omnichannel approach in consumer health.

Consumer health achieves healthy growth over the forecast period

According to the General Statistics Office in 2020, Vietnam's population is ageing at an

unprecedented rate. This combined with a low birth rate will lead to a high proportion

of elderly people over the age of 65 by 2055. However, government statistics also

predict that the Vietnamese economy is expected to achieve strong GDP growth of 6%

in 2021 and 2022. This economic improvement is expected to be higher than in most

other countries within the ASEAN region and globally. This will also be a good

springboard to maintain economic growth throughout the rest of the forecast period.

Thus, the bright economic performance will be a significant factor contributing to the

growth of consumer health, as consumers will be increasingly willing to spend more on

healthcare. Hence, due to the ageing population and higher living standards, consumer

health is expected to witness a healthy growth rate over the forecast period which will

make Vietnam an attractive market for new entrants, in a continuation of the trend

© Euromonitor Interna onal 2022 Page 1 of 5

seen in the last few years of the review period. The market is therefore expected to

become more competitive for both existing and new players as consumer health starts

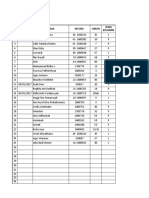

Sales of Consumer Health by Category

Retail Value RSP - VND billion - Current - 2021 Growth Performance

to witness a more mature growth rate across most categories.

Despite the expected continued slowdown in the birth rate, parents have already OTC

8,916.7

proven more willing to spend on caring for their children, with this trend set to

accelerate due to the predicted strong economy and rising disposable incomes in the Sports Nutrition

387.6

wake of the pandemic. This is expected to maintain strong growth for paediatric

consumer health, despite the lower number of children in the country in the forecast Vitamins and Dietary Supplements

20,775.2

period. Vitamins is expected to be one of the highest growing categories over the

forecast period. In addition to the ageing population, this will also be a lasting impact Weight Management and Wellbeing

15,239.7

of the COVID-19 pandemic in the country. Consumers are expected to be more

proactive and look after their health and boost their immunity, rather than waiting to Herbal/Traditional Products

12,680.3

treat symptoms when they appear. The rising number of health-conscious consumers is

also expected to lead sports nutrition to see a strong increase in sales, although this Allergy Care

364.6

will be from a low base. Most OTC categories are not expected to see such strong

growth rates, due to greater maturity and the impact of better healthcare. Paediatric Consumer Health

912.1

0% 10% 20%

APPENDIX

CONSUMER HEALTH 45,319.2 CURRENT % CAGR % CAGR

YEAR % 2016-2021 2021-2026

OTC registration and classification GROWTH

A Ministry of Health circular from May 2003 addressed the categorisation of OTC and

Rx products. The circular listed seven Rx groups: addictive, psychoactive, toxic class A

and B, antibiotics, harmonic (except for contraceptive), cardiac and medical fluid

transfer. The circular also stated that drug sellers are only allowed to sell OTC drugs

Competitive Landscape

and are not permitted to sell Rx products without a doctor’s prescription. However,

in reality, Rx products are often sold without a prescription in Vietnam, due to the Company Shares of Consumer Health

habit of consumers purchasing medicinal products based on personal experience or % Share (NBO) - Retail Value RSP - 2021

following guidance from pharmacists. As a result, some common Rx products such as

antibiotics can easily be purchased in pharmacies throughout the country. Herbalife Vietnam Ltd 16.3%

Abbott Vietnam Co Ltd 13.2%

Only consumers with healthcare insurance are entitled to the reimbursement of

healthcare costs. On 1 January 2010, an amended health insurance law came into New Image Vietnam Co Ltd 3.9%

effect, with those who have subscribed to the insurance programme now having to Haugiang Pharmaceutical ... 3.9%

pay as much as one and a half times more than what they contributed in 2009. The

new rate is 5% of monthly salary, whilst students have to pay 3% of the basic salary GSK Consumer Healthcare 3.0%

rate assigned by the government. Products purchased for children under the age of Traphaco JSC 3.0%

six are subject to 100% reimbursement. Retired people, ethnic minorities, people in

poverty and those who are unable to work are entitled to a 95% reimbursement, Bayer Vietnam Ltd 2.8%

with all others being entitled to 80%. Nu Skin Vietnam Co Ltd 2.5%

According to the World Health Organization, generic products can be used in place of Amway Vietnam Ltd 2.3%

original products after the patent of the original product has expired (patents last for UPSA, Laboratoires 2.2%

20 years on average). In Vietnam, domestic manufacturers wishing to produce

Sanofi-Aventis Vietnam C... 1.5%

generic drugs only need comply with a number of requirements set by the Ministry

of Health and do not need to perform clinical tests on people. In general, the Rohto-Mentholatum Vietna... 1.3%

majority of domestically produced drugs are generic. The price of generic drugs is

Tradewind Asia Ltd 1.2%

lower than that of original products. The amount spent on research, development

and production of a new drug can reach as high as USD800 million and it may take United Pharma (Vietnam) ... 1.1%

decades before the product is approved for distribution. However, after a product’s Imexpharm Pharmaceutical... 1.1%

patent has expired, other manufacturers only need to pay USD1 million to buy the

rights to produce the drug themselves. Tiens Vietnam Co Ltd 0.9%

Korea Ginseng Corp 0.9%

A circular jointly issued by the Ministry of Health and the Ministry of Culture and

Information in January 2004 covers regulations regarding the advertising of medical Boehringer Ingelheim Pha... 0.8%

products. All advertisements must include certain information, such as usage International Medical Co... 0.8%

instructions, possible side effects, the name and address of the manufacturer and

distributor, etc. Consumer health products approved by the Ministry of Health and Others 37.2%

which have a valid registration number can be advertised on television and radio,

through newspapers, magazines, flyers, electronic newspapers, company websites,

banners, transportation vehicles, mobile objects, luminescent objects and other

advertising means.

Vietnam’s Drug Administration is mainly responsible for the control and monitoring

of the packaging and labelling of medicines. Rx drugs must have Rx printed on the

bottom left-hand side of the label and must clearly state “prescribed product”.

“Keep away from children” should also be indicated on the label if applicable. Based

on article 24 of the circular 15/2018/TT-BYT, there are some requirements for

labelling contents. Organisations and individuals producing and/or trading products

in Vietnam, apart from complying with the regulation on goods labelling, must also

comply with the following regulations:

Medical nutrition food must contain the following phrases: “Medical nutrition food”

and “Use for patients with the supervision of medical personnel”.

Foods for special diets must include the phrase: “Nutritional products (for specific

subjects)” on the main face of the label to distinguish them from ordinary foods.

Particularly for imported products, names of organisations and individuals that are

responsible for inscribing on product labels must show: names and addresses of

production organisations and individuals and names and addresses of organisations

and individuals.

© Euromonitor Interna onal 2022 Page 2 of 5

The distribution network for consumer health in Vietnam is very wide and extends Brand Shares of Consumer Health

throughout the country. Chemists/pharmacies dominate sales in large cities. Now % Share (LBN) - Retail Value RSP - 2021

that Vietnam is a member of the World Trade Organization, there is the possibility

that the country’s medicinal product distribution network will be taken over by Herbalife Nutrition 16.3%

foreign players. In order to compete with them, the government requires all Ensure 12.1%

drugstores in the country to meet GPP (Good Pharmacy Practice) criteria. GPP aims to

ensure the quality of medicinal products and protect the health of consumers. In Alpha Lipid 3.7%

order to become GPP-certified, chemists/pharmacies must only sell Rx drugs on Panadol 2.6%

prescription. In addition, only certified pharmacists are allowed to sell medicinal

Traphaco 2.6%

products to consumers and all products offered by approved stores must have

documentation of origin and transaction receipts. Moreover, chemists/pharmacies Pharmanex 2.5%

have to meet several requirements, such as having a minimum area of 10 sq m, and Berocca 2.4%

separate display and preservation areas. Stores must also meet several storage

condition regulations, such as maintaining a temperature of below 30°C and Nutrilite 2.0%

humidity of less than 75%. Efferalgan 1.5%

Rohto 1.2%

Vitamins and dietary supplements registration and classification

Hapacol 1.2%

Local and international players are increasingly attracted to Vietnam’s vitamins and

Glucerna 1.1%

dietary supplements landscape, due to Vietnam’s huge population. However, this

market remains fragile because a large number of counterfeit and poor-quality Bocalex 1.1%

goods are advertised and sold in many channels, especially by e-commerce retailers. DHG products 1.1%

In 2018, the Ministry of Health decided to apply stricter regulations, such as the

circular 15/2018/TT-BYT on vitamins and dietary supplements, not only to protect Tiens 0.9%

consumers’ health but also to limit counterfeits and poor-quality goods. Cheong-Kwan-Jang 0.9%

Based on article 32 of the circular 15/2018/TT-BYT, there is a new regulation on IMC 0.8%

combination products with new uses: pms-Mexcold 0.7%

New combination ingredients must be registered for the Ministry of Health’s Plusssz 0.7%

product publication. Others 44.6%

New combination ingredients must be listed with quantitative ingredients for each 5-Year Trend

one in the composition or formula. Increasing share Decreasing share No change

Vitamins and dietary supplements must register advertising content before launch

in the market. Dietary supplements include protective health foods, medical

nutrition foods, special diet foods and nutrition products. Amongst them, there is no

ban of advertising nutrition products used for children up to 36 months old,

following article 7 of the Advertising Law.

Based on the article 27 of the circular 15/2018/TT-BYT, in addition to complying with

the provisions of the advertising law, the registration of food advertising content

must also comply with the following provisions:

Before advertising, organisations and individuals having products to advertise must

register the advertisement content with the agencies granting the paper of receipt

of the product registration according to current regulations.

The content of the advertisement must be consistent with the use and effect of the

product published in the product announcement. The content may not use images,

equipment, costumes, names, medical facilities, doctors, pharmacists, medical staff,

thank you letters of patients, doctor's’ articles, pharmacists or health workers to

advertise foods.

Requirements for health protection dietary supplements’ advertising content

include:

There must be a statement that reads “This food is not a medicine and has no effect

to replace medicine”; the writing must be clear and contrast with the background

colour.

Advertisements on spoken and visual newspapers must clearly read their

recommendations according to the provisions mentioned above.

Advertisements in newspapers and on spoken media with a duration of fewer than

15 seconds are not required to read, “This food is not a medicine and does not have

the effect of replacing medicine”, but the statement must be shown in the written

advertisement.

Self-medication/self-care and preventive medicine

Over the review period most Vietnamese consumers chose to self-medicate when

suffering from mild symptoms of illnesses such as colds and flu, including coughs

and headaches, instead of seeking advice from a doctor or other healthcare

professional. The reason for this is that going to see a doctor for something deemed

a relatively minor issue takes time, and often involves queuing and sitting in a very

crowded and unpleasant waiting room. Consumers generally only go to the doctor if

their symptoms do not improve. However, the practice of self-medication appears to

be less popular in major cities and urban areas, as consumers have become

increasingly aware of the possible health hazards of misusing medicinal products

which they do not know much about. Nevertheless, self-medication continued to be

quite common in rural areas.

In 2021, Vietnamese consumers have increasingly been relying on alternative

© Euromonitor Interna onal 2022 Page 3 of 5

channels to self-diagnose and to identify their health needs instead of receiving

advice directly from sellers at chemists/pharmacies or from a doctor, as they did

prior to the pandemic. Consumers have been using the internet to gather health

information throughout all parts of the health journey, such as pre-diagnosis,

diagnosis and treatment, before purchasing products. This trend has brought more

sales for consumer health companies, as many purchases are the result of consumers

taking their health into their own hands, not a result of direct advice from a doctor.

Following this trend, e-commerce sales are also gradually rising, as has been the

case over the last few years, mainly thanks to huge efforts by manufacturers to

improve the online shopping experience through better online education and

targeted marketing. In addition, customers feel more comfortable buying consumer

health products online. Therefore, e-commerce is playing an increasingly significant

role, contributing to the growth of this distribution channel.

Switches

There were no switches seen in consumer health in Vietnam over 2020/2021.

DISCLAIMER

Forecast and scenario closing date: 6 September 2021

Report closing date: 17 September 2021

Analysis and data in this report give full consideration to consumer behaviour and

market performance in 2021 and beyond as of the dates above. For the very latest

insight on this industry and consumer behaviour, at both global and national level,

readers can access strategic analysis and updates on www.euromonitor.com and via the

Passport system, where new content is being added on a systematic basis.

DEFINITIONS

The total market size given for consumer health is the sum of OTC, sports nutrition,

vitamins and dietary supplements and weight management and wellbeing.

The sum of these categories is greater than actual market size because allergy care is

a duplicate of categories found in cough, cold and allergy (hay fever) remedies,

dermatologicals and eye care; paediatric consumer health is an aggregate of

paediatric categories in OTC and vitamins and dietary supplements; and

herbal/traditional products is an aggregate of herbal/traditional categories in OTC

and vitamins and dietary supplements.

2021 data are provisional and based on part-year estimates.

SOURCES

Sources used during the research included the following:

Summary 1 Research Sources

Official Sources Central Institute for Medical Science Information (CIMSI)

Depa rtment of Drug Adminis tra tion

Drug Adminis tra tion of Vietna m

Korea Tra de Inves tment Promotion Agency (KOTRA)

Minis try of Hea lth

Trade Associations Vietna m As s ocia tion of Functiona l Foods

Vietna m Pha rma ceutica l Cos As s ocia tion

World Self-Medica tion Indus try (WSMI)

Trade Press a ngi.com.vn

ba omoi.com

Da n Tri Online

Da n Viet

Doa nh Nha n Sa igon Online

Kinh Doa nh & Pha p Lua t

Phu Nu Online

Sa igon Gia i Phong Online

Sa igon Times

Ta p Chi Cong Sa n

Ta p Chi Dinh Duong

Tha nh Nien Online

Thu Vien Pha p Lua t Online

Vietna m Economic Times

Vietna m Inves tment Review

Vietna m News

Vietna m Plus

Vietna mnet

© Euromonitor Interna onal 2022 Page 4 of 5

Official Sources Central Institute for Medical Science Information (CIMSI)

Vietna mShipper

Vina net

Source: Euromonitor Interna tiona l

© Euromonitor Interna onal 2022 Page 5 of 5

You might also like

- Vietnam Skincare Products Market - Growth, Trends, COVID-19 Impact, and Forecasts (2023 - 2028)Document133 pagesVietnam Skincare Products Market - Growth, Trends, COVID-19 Impact, and Forecasts (2023 - 2028)shashankchatblrNo ratings yet

- Consumer Appliances in VietnamDocument29 pagesConsumer Appliances in VietnamLinh HoàngNo ratings yet

- Sweet Biscuits, Snack Bars and Fruit Snacks in VietnamDocument15 pagesSweet Biscuits, Snack Bars and Fruit Snacks in Vietnamvuong100% (1)

- Health and Wellness in VietnamDocument21 pagesHealth and Wellness in VietnamvuongNo ratings yet

- British Pharmacopoeia Free Download PDFDocument1 pageBritish Pharmacopoeia Free Download PDFDea PermataNo ratings yet

- Men's Grooming in VietnamDocument10 pagesMen's Grooming in VietnamMẫn NgôNo ratings yet

- Vietnam Consumer Outlook 2023 ENG - Summary Deck 1Document17 pagesVietnam Consumer Outlook 2023 ENG - Summary Deck 1Tăng Chí QuyềnNo ratings yet

- Consumer Electronics in VietnamDocument11 pagesConsumer Electronics in VietnamNgơTiênSinhNo ratings yet

- Drinking Milk Products in Vietnam - Analysis: Country Report - Aug 2019Document3 pagesDrinking Milk Products in Vietnam - Analysis: Country Report - Aug 2019Tiger HồNo ratings yet

- Consumer Lifestyles in VietnamDocument45 pagesConsumer Lifestyles in VietnamLe Thiet Bao100% (1)

- ABC Calc DDDDocument83 pagesABC Calc DDDDewi PratiwiNo ratings yet

- Clinical PharmacyDocument38 pagesClinical PharmacyBalakrishna Thalamanchi100% (2)

- Health and Wellness in VietnamDocument25 pagesHealth and Wellness in Vietnamvinhpp0308No ratings yet

- Consumer Health in VietnamDocument17 pagesConsumer Health in VietnamNguyễn Bảo NgọcNo ratings yet

- Better For You Packaged Food in Vietnam: Euromonitor International February 2022Document9 pagesBetter For You Packaged Food in Vietnam: Euromonitor International February 2022Linh HoàngNo ratings yet

- Drinking Milk Products in Vietnam - Analysis: Country Report - Aug 2019Document2 pagesDrinking Milk Products in Vietnam - Analysis: Country Report - Aug 2019thanhNo ratings yet

- Sports Drinks in Vietnam AnalysisDocument2 pagesSports Drinks in Vietnam AnalysisBÌNH NGUYỄN THỊNo ratings yet

- Consumer Trends in VietnamDocument3 pagesConsumer Trends in VietnamNa Lê CaoNo ratings yet

- Health and Beauty Specialist Retailers in Vietnam AnalysisDocument2 pagesHealth and Beauty Specialist Retailers in Vietnam AnalysisÂn THiên100% (1)

- Yoghurt and Sour Milk Products in VietnamDocument9 pagesYoghurt and Sour Milk Products in VietnamHuy Nguyễn Hoàng NhậtNo ratings yet

- E-Commerce in VietnamDocument8 pagesE-Commerce in VietnamThanh BuiNo ratings yet

- Vietnamese Confectionery MarketDocument1 pageVietnamese Confectionery MarketMinh VuNo ratings yet

- Consumer Lifestyles in Vietnam - Euromonitor International - August 2014Document60 pagesConsumer Lifestyles in Vietnam - Euromonitor International - August 2014Cassandra NguyenNo ratings yet

- Beer in Vietnam - Datagraphics: Country Report - May 2021Document4 pagesBeer in Vietnam - Datagraphics: Country Report - May 2021Linh HoàngNo ratings yet

- Skin Care in Vietnam: Euromonitor International July 2020Document17 pagesSkin Care in Vietnam: Euromonitor International July 2020Nguyễn TrangNo ratings yet

- Sauces Dips and Condiments in VietnamDocument14 pagesSauces Dips and Condiments in VietnamQuyền VũNo ratings yet

- Baked Goods in VietnamDocument10 pagesBaked Goods in VietnamLinh HoàngNo ratings yet

- Soft Drinks in Vietnam AnalysisDocument4 pagesSoft Drinks in Vietnam AnalysisChâu Vương100% (1)

- Baby Food in Vietnam AnalysisDocument3 pagesBaby Food in Vietnam AnalysisLinh HoàngNo ratings yet

- Beer in Vietnam 1Document14 pagesBeer in Vietnam 1nhatvy2929No ratings yet

- Helping Brands Tap Into Vietnams Changing Eating Habits PDFDocument68 pagesHelping Brands Tap Into Vietnams Changing Eating Habits PDFHoang Nguyen MinhNo ratings yet

- Beauty and Personal Care in Vietnam: Euromonitor International July 2020Document15 pagesBeauty and Personal Care in Vietnam: Euromonitor International July 2020Nguyễn TrangNo ratings yet

- Premium Beauty and Personal Care in VietnamDocument10 pagesPremium Beauty and Personal Care in VietnamTuyến Đặng ThịNo ratings yet

- Shopee X Local Brands Collaboration ProposalDocument18 pagesShopee X Local Brands Collaboration ProposalMeyliana TaslimNo ratings yet

- Consumer Health in Vietnam DatagraphicsDocument4 pagesConsumer Health in Vietnam DatagraphicsDoan MinhquanNo ratings yet

- Mass Beauty and Personal Care in VietnamDocument10 pagesMass Beauty and Personal Care in VietnamYenNo ratings yet

- Kantar Vietnam Insight Ebook2021Document57 pagesKantar Vietnam Insight Ebook2021Nguyen Khang TranNo ratings yet

- Euromonitor Hot Drinks in Vietnam (Full Market Report)Document35 pagesEuromonitor Hot Drinks in Vietnam (Full Market Report)Wendy PumpkiniclNo ratings yet

- Internet Retailing in VietnamDocument8 pagesInternet Retailing in VietnamLe Thiet BaoNo ratings yet

- Vietnam Health Supplements: Prepared by Britcham VietnamDocument11 pagesVietnam Health Supplements: Prepared by Britcham VietnamChiNo ratings yet

- Cooking Ingredients and Meals in BangladeshDocument36 pagesCooking Ingredients and Meals in BangladeshDeep VashiNo ratings yet

- Financial Cards and Payments in VietnamDocument17 pagesFinancial Cards and Payments in VietnamAnn NguyenNo ratings yet

- Apparel and Footwear in VietnamFull Market ReportDocument87 pagesApparel and Footwear in VietnamFull Market ReportĐức Độ BùiNo ratings yet

- Vietnam 2019 - DrinksDocument10 pagesVietnam 2019 - DrinksMinh ThuậnNo ratings yet

- Mobile Phones in Vietnam: Euromonitor International October 2020Document9 pagesMobile Phones in Vietnam: Euromonitor International October 2020Nhi ThuầnNo ratings yet

- Retailing in VietnamDocument29 pagesRetailing in VietnamHa Thu-NguyenNo ratings yet

- Pharmaceutical Bao Cao - 14-00976Document18 pagesPharmaceutical Bao Cao - 14-00976technology Ionnet100% (1)

- CafésBars in VietnamDocument11 pagesCafésBars in VietnamLong Pham /Director of Market Development/MVillageNo ratings yet

- Chocolate Confectionery in VietnamDocument11 pagesChocolate Confectionery in VietnamPeanut Vũ100% (2)

- Covid-19 On FMCG In-Home Purchase Share by WorldLine Technology PDFDocument10 pagesCovid-19 On FMCG In-Home Purchase Share by WorldLine Technology PDFviện_nguyễn_67No ratings yet

- Men's Grooming in VietnamDocument10 pagesMen's Grooming in VietnamĐỗ Minh NgọcNo ratings yet

- A Look at Vietnam Foodservice Industry in 2017Document61 pagesA Look at Vietnam Foodservice Industry in 2017Cao Cam HoangNo ratings yet

- Mass Beauty and Personal Care in VietnamDocument4 pagesMass Beauty and Personal Care in VietnamshashankchatblrNo ratings yet

- Alcoholic Drinks in Vietnam (Full Market Report)Document66 pagesAlcoholic Drinks in Vietnam (Full Market Report)Janie RêNo ratings yet

- BMI Vietnam Consumer Electronics Report Q3 2013Document52 pagesBMI Vietnam Consumer Electronics Report Q3 2013chip12384No ratings yet

- FMCG Monitor: An Integrated Update of Vietnam FMCG MarketDocument13 pagesFMCG Monitor: An Integrated Update of Vietnam FMCG MarketHoàng Bảo Quốc - IMCNo ratings yet

- Healthy Food and Beverage Vietnam Report EieqrrDocument17 pagesHealthy Food and Beverage Vietnam Report Eieqrrduenphen sinothokNo ratings yet

- Ready Meals in CanadaDocument11 pagesReady Meals in CanadaMaxime Bertrand GilbertNo ratings yet

- Vietnam Dairy Products JSC (Vinamilk) in Packaged Food (Vietnam)Document5 pagesVietnam Dairy Products JSC (Vinamilk) in Packaged Food (Vietnam)Nisrina AuliaNo ratings yet

- Vietnam Cosmetic Market Overview 2016Document10 pagesVietnam Cosmetic Market Overview 2016Hồ KhoaNo ratings yet

- Kantar - Asia Brand Footprint 2021 - VietnamDocument115 pagesKantar - Asia Brand Footprint 2021 - VietnamH&N StoreNo ratings yet

- Paediatric Consumer Health in ColombiaDocument9 pagesPaediatric Consumer Health in ColombiaPepe PerezNo ratings yet

- Sample - World Market For Consumer HealthDocument54 pagesSample - World Market For Consumer Healthمحمود عليمىNo ratings yet

- Psychosocial and Health Behavioural Covariates of Cosmetic Surgery: Women's Health Australia StudyDocument8 pagesPsychosocial and Health Behavioural Covariates of Cosmetic Surgery: Women's Health Australia StudyBUI THI THANH HANGNo ratings yet

- Motivation Factor To Undergo Cosmetic Surgery Among Thai Working Officer in Private EnterpriseDocument20 pagesMotivation Factor To Undergo Cosmetic Surgery Among Thai Working Officer in Private EnterpriseBUI THI THANH HANGNo ratings yet

- Motivational Factors and Psychological Processes in Cosmetic Breast Augmentation Surgery - 2010 - Journal of Plastic Reconstructive Aesthetic SurgeryDocument9 pagesMotivational Factors and Psychological Processes in Cosmetic Breast Augmentation Surgery - 2010 - Journal of Plastic Reconstructive Aesthetic SurgeryBUI THI THANH HANGNo ratings yet

- Spa Market Segmentation According To Customer Preference: Basak Denizci Guillet and Deniz KucukustaDocument17 pagesSpa Market Segmentation According To Customer Preference: Basak Denizci Guillet and Deniz KucukustaBUI THI THANH HANGNo ratings yet

- UEH Source 1Document8 pagesUEH Source 1BUI THI THANH HANGNo ratings yet

- Food Supplement Asanew Luxury: Beauty Consumption Inside, Out!Document29 pagesFood Supplement Asanew Luxury: Beauty Consumption Inside, Out!BUI THI THANH HANGNo ratings yet

- 2018 Hi SEA Market Review Final 2Document25 pages2018 Hi SEA Market Review Final 2BUI THI THANH HANGNo ratings yet

- Bailey Children Motivations PRDocument6 pagesBailey Children Motivations PRBUI THI THANH HANGNo ratings yet

- CDSC Webinar PDFDocument42 pagesCDSC Webinar PDFBUI THI THANH HANGNo ratings yet

- 2016 - MUFG Global Generic Pharma Industry ReviewDocument25 pages2016 - MUFG Global Generic Pharma Industry ReviewNat BanyatpiyaphodNo ratings yet

- Lawsuit - Tennessee AG Sues Food City For Unlawful Sale of OpioidsDocument209 pagesLawsuit - Tennessee AG Sues Food City For Unlawful Sale of OpioidsDan LehrNo ratings yet

- UaeDocument7 pagesUaemarketing lakshNo ratings yet

- DLL Mathematics 6 q2 w6Document8 pagesDLL Mathematics 6 q2 w6LYNDON BADILLONo ratings yet

- India The Emerging Hub For Biologics and BiosimilarsDocument22 pagesIndia The Emerging Hub For Biologics and BiosimilarssanjitlNo ratings yet

- KarnatakaDocument3 pagesKarnatakaUsman DarNo ratings yet

- ORION SPLE Pharmacist ExamDocument171 pagesORION SPLE Pharmacist Examtania100% (1)

- In-Patient Pharmacy Dispensing PersonnelDocument3 pagesIn-Patient Pharmacy Dispensing Personneljanr123456No ratings yet

- DUPHAT Report 2013Document4 pagesDUPHAT Report 2013pravinnayakNo ratings yet

- Catalogo Cotizar-29-08-2022 VallejoDocument175 pagesCatalogo Cotizar-29-08-2022 VallejoSergio GonzalezNo ratings yet

- B Pharmacy 2015Document114 pagesB Pharmacy 2015GalataNo ratings yet

- Lecture 1 Introduction To PharmacotherapeuticsDocument30 pagesLecture 1 Introduction To Pharmacotherapeuticssha rcNo ratings yet

- Prescription Completeness and Drug Use PatternDocument7 pagesPrescription Completeness and Drug Use Patternadane yehualawNo ratings yet

- Health Coaching in Pharmacy Practice: A Systematic ReviewDocument14 pagesHealth Coaching in Pharmacy Practice: A Systematic ReviewrujaklutisNo ratings yet

- Colegio de San Gabriel ArcangelDocument5 pagesColegio de San Gabriel ArcangelJonille EchevarriaNo ratings yet

- Review Article: Barbara Davit, April C. Braddy, Dale P. Conner, and Lawrence X. YuDocument17 pagesReview Article: Barbara Davit, April C. Braddy, Dale P. Conner, and Lawrence X. Yulhthang1990No ratings yet

- Unit 3 Notes DRADocument22 pagesUnit 3 Notes DRAOyshi RaoNo ratings yet

- Adipex 37.5MgDocument8 pagesAdipex 37.5MgPhentermineNo ratings yet

- Safeway SWOT AnalysisDocument9 pagesSafeway SWOT AnalysisAlbertWhatmoughNo ratings yet

- Promosi Kesehatan "Tanya Lima O" Di Desa Beruntung Jaya, Sungai Tiung, Cempaka, Banjarbaru, Kalimantan SelatanDocument5 pagesPromosi Kesehatan "Tanya Lima O" Di Desa Beruntung Jaya, Sungai Tiung, Cempaka, Banjarbaru, Kalimantan SelatanKhalisatun Ni'mahNo ratings yet

- Laporan Kunjungan Pasien 2017Document21 pagesLaporan Kunjungan Pasien 2017citra husadaNo ratings yet

- Journal Reflection in Immersion Pharmacy LaboratoryDocument4 pagesJournal Reflection in Immersion Pharmacy LaboratoryCiel GevenNo ratings yet

- Pharma Marketing Management-QBDocument10 pagesPharma Marketing Management-QBprateekshaNo ratings yet

- 1222 PDFDocument3 pages1222 PDFNurhanida AssyfaNo ratings yet

- Barrier To CommunicationDocument10 pagesBarrier To CommunicationDianaNo ratings yet

- Tax 3.1-Vat Exempt Transactions: Learning Advancement Review Center TAX 3.1Document27 pagesTax 3.1-Vat Exempt Transactions: Learning Advancement Review Center TAX 3.1Mark Gelo WinchesterNo ratings yet

- INTERN 1 DefinitionsDocument2 pagesINTERN 1 DefinitionsJovis MalasanNo ratings yet