Professional Documents

Culture Documents

Proposal For Acquisition of Oberoi Group by Reliance Industries LTD

Proposal For Acquisition of Oberoi Group by Reliance Industries LTD

Uploaded by

jasdeepgp11Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Proposal For Acquisition of Oberoi Group by Reliance Industries LTD

Proposal For Acquisition of Oberoi Group by Reliance Industries LTD

Uploaded by

jasdeepgp11Copyright:

Available Formats

Proposal for Acquisition of Oberoi Group

by Reliance industries Ltd

Submitted To- Submitted By-

Ms. Ridhi Bhatia Harneet Singh

Karan Arora

Nitin Bansal

Vineet Gupta

Yash Jain

Proposal for Acquisition of Oberoi Hotels by Reliance Industries Ltd Page 1

ACKNOWLEDGEMENT

We are extremely thankful to our teachers Ms. Ridhi Bhatia for

giving us the opportunity to undertake this project for making a

“Acquisition plan for Reliance industries ltd to acquire Oberoi hotels

ltd” and for their overall support, valuable guidance, astute judgment,

constructive criticism and an eye for perfection without which this project

would not have been in its present shape.

Proposal for Acquisition of Oberoi Hotels by Reliance Industries Ltd Page 2

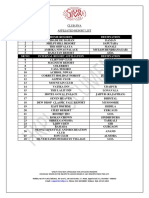

Table of Contents

S.No Head Page No

1 Overview of Reliance Industries ltd 4

2 Reliance and Its interventions in service sector 5

3 Reliance : Swot Analysis 6-8

4 Industry attractiveness: Hotel Industry 9-11

5 Environmental Analysis – Pest Analysis 12-15

6 External Environment: Current Competition through 16-19

Porter 5 Forces Model

7 Overview of Oberoi Hotels 19

8 Internal Analysis through Value chain analysis 19-23

9 Current situation of Oberoi hotels through SWOT 23-25

Analysis

10 Valuation model for Oberoi Hotels 26-28

11 Mode of Payments 28

12 Post Merger Financial Ratios 29

13 Post Merger Issues 30

14 Post Merger Solutions 31

15 Post Merger Benefits 32

Proposal for Acquisition of Oberoi Hotels by Reliance Industries Ltd Page 3

Overview of Reliance Industries

The Reliance Group, founded by Dhirubhai H. Ambani (1932-2002), is India's

largest private sector enterprise, with businesses in the energy and materials

value chain. Group's annual revenues are in excess of US$ 44 billion. The flagship

company, Reliance Industries Limited, is a Fortune Global 500 company and is

the largest private sector company in India.

Backward vertical integration has been the cornerstone of the evolution and

growth of Reliance. Starting with textiles in the late seventies, Reliance pursued a

strategy of backward vertical integration - in polyester, fibre intermediates,

plastics, petrochemicals, petroleum refining and oil and gas exploration and

production - to be fully integrated along the materials and energy value chain.

The Group's activities span exploration and production of oil and gas, petroleum

refining and marketing, petrochemicals (polyester, fibre intermediates, plastics

and chemicals), textiles, retail and special economic zones.

Reliance enjoys global leadership in its businesses, being the largest polyester

yarn and fibre producer in the world and among the top five to ten producers in

the world in major petrochemical products.

Major Group Companies are Reliance Industries Limited (including main

subsidiary Reliance Retail Limited) and Reliance Industrial Infrastructure

Limited

Reliance and its service sector interventions:

Proposal for Acquisition of Oberoi Hotels by Reliance Industries Ltd Page 4

In 2010, Reliance buys 14.12 % stake of Oberoi’ Hotels

• ITC Ltd had increased its stake to 14.98 per cent in EIH.

• Speculations were there that ITC could go for an open offer once it crossed

the 15 per cent mark.

• EIH Chairman PRS Oberoi' wanted strong associations for defeating ITC's

possible hostile takeover.

• Reliance Industries Ltd paid Rs10.2bn ($217m) for the 14.12 per cent stake

in EIH

Reliance move towards Service Sector:

• Indian Economy is becoming more of a Service oriented economy: 56% of

the total is contributed by the service sector in entire GDP.

• Government is promoting tourism through Incredible India

• Hospitality industry set to grow at 15 % for next 5-8 years

• Availability of huge reserves for investment in service sector

• Emotional quotient of Indian people for Reliance would help Reliance gain

market confidence and consumers would have faith in Reliance services.

• Reliance is close to signing an agreement with DE Shaw & Co. to start an

$800 million infrastructure fund

• Recent establishments in pharma and retail sector, $1.2 billion in a

broadband.

• Plans to make Investments in Hospitals, farmhouses and universities,

sports marketing in future.

• This would be another business for Ms Nita Ambani,

• Like cricket team, the Mumbai Indians, as well as its school and healthcare

initiatives.

SWOT OF RELIANCE INDUSTRIES LIMITED

Proposal for Acquisition of Oberoi Hotels by Reliance Industries Ltd Page 5

Strengths

Technological Skills- Reliance has a very good technological team. Since it is in

a manufacturing process their cost of manufacturing should not be so high that is

possible because of the good technology they have.

Distribution channels- I n the manufacturing sector distribution channel is one

of the important factor. Without having a good distribution channel it is very

difficult to sustain in the manufacturing industry.

Production Quality- The final output comes out from the complete process is

very good. This is possible because of the good technological skills they have. So

their strengths are inter-related in terms of supporting each other.

Presence in many sectors- Their strength is that its presence as a group is in

many sector. So if there is any loss in one particular sector then it may undue that

loss with any other sector.

Proposal for Acquisition of Oberoi Hotels by Reliance Industries Ltd Page 6

High resource & surplus- In India in terms of market capitalization it is the

largest industry. They have a huge resource and surplus kept aside which needs

to be used in other areas where they can get some return out of it.

Strong financial performance- They have a very strong financial performance in

terms of profit as well as net worth. Their profits were increased from year and

year which becomes one of the reasons of increase in share price.

Fortune 500 companies- It is included in the Fortune 500 company which itself is

a global acknowledgment for any company. Because of its presence in Fortune

500 the reliability in the company increases because of which investment comes

from the public in large. They have a huge Brand equity in the country where

they have been able to form an emotional quotient with people.

Weakness

No Direct Contact with the consumers- Their one of the biggest weakness is that

they don’t have direct contact with the customer because they are in the

manufacturing sector. Though peoples have an emotional quotient with RIL but

to increase that they have to do more like going into the ventures where people

can connect with RIL.

Un-utilized high resource & surplus. Since they have a huge resource and

surplus but they were not being utilized properly. So if the resources and surplus

can be utilized then the company can generate extra income from it.

Over reliant on manufacturing sector- They are over reliant on manufacturing

sector which can cause problem for the company because if in case

manufacturing sector will face any recession time then the company as a whole

will have to suffer, so to overcome that they have to diversify themselves.

Opportunities-

Low per capita consumption-Currently, domestic per capita polymer

consumption is nearly 4 kgs while the global average is nearly 20 kgs. This

underlines the fact that there is immense scope of capacity expansion in the

country as the market to be tapped is huge.

Proposal for Acquisition of Oberoi Hotels by Reliance Industries Ltd Page 7

Spending on R&D- Spending on R&D activities is around 2% of sales as

compared to an international average of 18%. This leaves enough room for

product development. Also, currently, India has a chemicals trade deficit of

about US$ 1.5 bn a year, which leaves enough investment opportunities in the

industry.

Growing Opportunities in Service Sector: Service sector contributes 56% of

GDP, and reports growth rate of approx 15-18 %,

Threats-

Customs duties- Historically, the domestic industry has been protected from

overseas competition by high import duties imposed by the government.

However, of late, Import duty on polymers has been steadily reduced and is

currently at 20%.As part of its commitment to various multilateral and bilateral

trade agreements, the government is likely to reduce duties going forward and

this is likely to reduce the cushion enjoyed by the domestic players as against the

landed cost of imported products.

Growing competition- The domestic industry is likely to witness immense

competition going forward with IOC Further. If there are any huge changes in

the petrochemical sector then reliance may have to suffer huge losses because

there contribution of profit from petroleum products is huge.

Manufacturing sector grows at 7-8 % every year as compared to service industry

which reports 15-18 % every year, so there over reliance on manufacturing sector

may back fire.

Only major intervention in service sector is retail, which itself is faced by the

threat of 100 % FDI, which could open the gates for players like Wal-Mart.

INDIAN HOTEL INDUSTRY:

India's hotel industry is experiencing a boom, which is determined by increasing

Proposal for Acquisition of Oberoi Hotels by Reliance Industries Ltd Page 8

numbers of business and tourist arrivals in India after RECESSION.

The hospitality industry is one of the fastest growing industries today with more and

more people travelling for business as well as vacation.

So keeping this in mind India, today, offers hotel facilities at par with world standards

and has the capability to provide all the hotel infrastructural needs of the inbound

tourist as well the business visitor.

Indian tourism and hospitality sector is recovering again from its bad times of business

slowdown. Travellers are taking new interests in our country which leads to the

improvement of the hospitality sector.

Foreigners are visiting India at a frequent rate and have reached a record of 3.92 million;

this is leading to a boost up in hospitality sector.

Hospitality Industry is closely linked with travel and tourism industries because the

more tourists visit our country the more business hotels could receive from them which

lead to increase in occupancy level of rooms in hotels.

Overall Industry Attractiveness

Environmental Analysis:

INDUSTRY ATTRCTIVENESS

Strength

Natural and cultural diversity: - India has cultural heritage. It is ranked the 14th best

tourist destination for its natural resources and 24th for its cultural resources, with many

World heritage sites, both natural and cultural, rich fauna, and strong creative industry

in the country.

Demand-Supply gap: - Indian hotel industry is a facing a mismatch between the

demand and supply of rooms leading to higher room rates and occupancy levels. With

the privilege of hosting commonwealth Games 2010 there is more demand of rooms in

five star hotels. This has led to the rapid growth of the sector.

Proposal for Acquisition of Oberoi Hotels by Reliance Industries Ltd Page 9

Government support: - the Government has realized the importance of tourism and has

proposed a budget of Rs, 540 crore the development of the industry. The priority is

being given to the development of the infrastructure and of new tourist destination and

circuits. The Department of Tourism (DOT) has already started the “Incredible India”

and “Athithi Devo Bhava” campaign for the promotion of tourism in India. The

ministry promoted India as a safe tourist destination and has undertaken various

measures, such as stepping up vigilance in key cities and at historically important

tourist sites. It has also deployed increased manpower and resources for improving

security checks at key airports and railway stations.

Increase in the market share: - India's share in international tourism and hospitality

market is expected to increase over the long-term. New budget and star hotels are being

established. Moreover, foreign hospitality players are heading towards Indian markets.

Weakness:-

Poor support infrastructure: Though the government is taking necessary steps, many

more things need to be done to improve the infrastructure. In 2003, the total

expenditure made in this regard was US $150 billion in china compared to US$ 21

billion in India. Lack of support from the law and order for providing security to the

tourist and tourist places

Slow implementation: - The lack of adequate recognition for the tourism industry has

been hampering its growth prospects. Whatever steps are being taken by the

government are implemented at a slower pace.

OPPORTUNITIES:-

Rising income: - Owing to the rise in income levels, Indians have spare money to

spend, which is expected to enhance leisure tourism

Open sky benefits: - With the open sky policy, the tourism industry has seen as

increase in business. Increased airline activity has stimulated demand and has helped

improve the infrastructure. It has benefited both international and domestic travels.

Destination for tourism: - Hotels in India has a shortage of 150,000 rooms fuelling hotel

Proposal for Acquisition of Oberoi Hotels by Reliance Industries Ltd Page 10

room rates across India. With tremendous pull of opportunity, India is a destination for

hotels chains looking for growth. The World Travel and Tourism Council, India, data

says India ranks 18th in business travel and will be among top 5 in the next decade.

Sources estimate, demand is going to exceed supply by at least 100% over the next 2

years. Indian hotel room’s rates are most likely to rise 25% annually and occupancy to

rise by 80%, over the next two years. ‘Hotel Industry in India’ is eroding its

competiveness as a cost effective destination.

Threats

Fluctuation in international tourist arrivals: - The Total dependency on foreign tourists

can be risky, as there are wide fluctuations in international tourism. Domestic tourism

needs to be given equal importance and measures should be taken to promote it.

Increasing competition: - Several international majors like the Fore Season, Shangri-La

and Aman Resorts are entering the Indian markets. Two other groups- the Carlson

Group and the Marriott chain are also looking forward to join this race. This will

increase the competition for the existing Indian hotel majors.

Overall if we look at the Industry attractiveness , Hotel Industry is one of the fastest

growing sector in the Indian Economy and entering this industry although requires

huge investments but the return and growth from business still makes this industry

as an attractive sector.

PEST Analysis for hotel industry

Since hotel industry is attractive enough but for entering in this sector, Analysis of the

Environment has to be done from the point of view of all the macroeconomic factors.

POLITICAL FACTORS

Proposal for Acquisition of Oberoi Hotels by Reliance Industries Ltd Page 11

Environment Laws:

An analysis of the hotel industry has revealed that there are environmental, labour, and

food & safety regulations as well as regulations for merging, which must be looked at

before entering into the industry. Environment is one aspect the government will

always have their eye on, and they will introduce laws that will protect the

environment. Such laws will need to be looked at as a player in the hotel industry.

Hotels are liable for clean up of contamination and other corrective action under

various laws, ordinances and regulations relating to environmental matters. Such laws

referring to keeping the environment in good shape can be quite costly to hotels in the

industry.

Employment Legislations:

Another political factor that can impose a concern for a member in the hotel industry is

the laws regarding labour. For instance, there are laws that govern minimum wage.

Although this might not seem to be a concern, but anytime you are forced to pay a

wage not in plans, which are taking away bottom line. Another law that can be quite

costly is treatment of employees. For example, there are laws that prevent

discrimination, and sexual harassment. If a hotel company violates these laws, it can

lead to severe lawsuits, and at the same time the hotel will be slicing their revenues. The

labour laws are pretty strait forward, but must be obeyed in order to keep on going

profits.

Level of Terrorism

Level of terrorism affects the number of tourists that are attracted towards the country.

There was a steep fall in the tourism percentage received in the country after the

Mumbai Attack

Economic factors

The Government’s major policy initiatives include:

• Liberalization in aviation sector

• Rationalization in tax rates in the hospitality sector

• Tourist friendly visa regime

• Immigration services

Proposal for Acquisition of Oberoi Hotels by Reliance Industries Ltd Page 12

• Procedural changes in making available land for construction of hotels

• Allowing setting up of Guest Houses

All these provisions make the setting up hotels in Delhi a favourable place for setting

up a hotel.

Foreign Trade Policy

The Foreign Trade Policy announced in April, 2006, offered following incentives to the

hospitality industry:

Hotels and Restaurants are allowed to import duty free equipment and other items

including liquor, against their foreign exchange earnings under the Served from India

Scheme. As in previous years, this entitlement is 5per cent of previous year’s foreign

exchange earnings for hotels of one-star and above (including managed hotels and

heritage hotels) approved by the Department of Tourism and other service providers in

the tourism sector registered with it.

FDI in Hotel and Tourism Sector

100 per cent FDI is permissible in the sector on the automatic route. The term

Hotels include restaurants, beach resorts, and other tourist complexes providing

accommodation and/or catering and food facilities to tourists. Tourism related industry

include travel agencies, tour operating agencies and tourist transport operating

agencies, units providing facilities for cultural, adventure and wild life experience to

tourists, surface, air and water transport facilities to tourists, leisure, entertainment,

amusement, sports, and health units for tourists and Convention/Seminar units and

organization.

Social Cultural Factors

Hospitality industry has the socio-cultural impact. This means that social structures, the

culture and traditions can be influenced, changed or even completely substituted due to

hospitality industry. Social cultural factors are a big issue to look into for hotel industry

because it deals with a lot of consumers who have different demographic, ethnic,

cultural backgrounds. By satisfying each consumers or generalizing the way to

hospitalize, hotel industry can have chance to expand more.

Proposal for Acquisition of Oberoi Hotels by Reliance Industries Ltd Page 13

Demographics

India as a country is continuously growing, and its trade with foreign countries is

increasing, Indian Urban sector .People‘s eating out habits are changing. So now the

People‘s attitude towards the Five star hotels has changed. Public’s attitude has

changed from wastage or excessive Spending to Luxury and as a matter of pride.

Technological factors

Use of Hi-Tech Soft wares

In order for a hotel to prevent obsolescence and remain technologically advanced, the

hotel must be up to date with all the latest technological changes that are taking place

that might have an impact on the industry. Today, the Internet is increasingly being

used. For the hotel industry, Consumers need to take this into consideration. So, in

order for a hotel to have a competitive advantage, they need to have a very high tech

information system.

In the hospitality industry, as in all arenas of commerce, technology represents one of

the strongest forces for change, while having had a significant impact on brand

marketing. Hotel reservations systems have been shifting from voice to electronic

Global Distribution Systems are now on the verge of consumer access via the Internet.

The increasing role played by the Internet should slowly affect booking patterns in the

future as inexpensive consumer access to hotel product becomes available. This, of

course, has potential implications for the benefits associated with the branding of

hospitality products.

Online Reservation system

Similarly hotel room booking and various other travel-tourism related services could be

booked by a customer on-line at the best available rate. Advance IT software and

systems make it possible for many agents and operators to provide a bouquet of

complete services- i.e. from Airline ticket booking, airport pick and drop to Hotel room

booking along with sightseeing at very nominal rates due to consolidation and

integration of all travel and tourism related services using various software’s and

booking engines interface. Due to this integration, booking engines are empowered to

Proposal for Acquisition of Oberoi Hotels by Reliance Industries Ltd Page 14

great deals to customers online.

Conclusion from Environmental Analysis (Macroeconomic events):

So overall the Pest analysis shows there is as such no big major force that stops the start

up or running of a five star Hotel.

Now after analysis of environment factors, Oberoi has discovered over the years, the

next important factor that affects is the Competition and problems that it could face in

serving Customers .But on analysis it was identified that these forces of suppliers and

competitors over the period have varied from destination to destination. Like in one

place Taj could be the biggest competition, in other it could be ITC.

Also threat of new entrant is more than the other, so porter analysis for the hotel chain

is done individually for each and every hotel. Broad areas remain the same but some

sub heads are varied as per the location of the Hotel.

Porter 5 forces For ITC Welcome Group

Proposal for Acquisition of Oberoi Hotels by Reliance Industries Ltd Page 15

Market Share(Approx)

0.6

0.5

2.5

Taj Hotels

Oberoi Hotels

ITC Welcomgroup

1.1

Hotel Leela

Others

1.7

Current Competitors: High

Oberoi’s Group is basically a Business Hotel group so its biggest competitor is ITC

Proposal for Acquisition of Oberoi Hotels by Reliance Industries Ltd Page 16

Ltd

With its Presence close to the Taj Hotel, makes it other competitor for Oberoi even

though it is a Luxury i.e. a Leisure Hotel.

These two players are very big players in the Indian Hotel industry, so a small mistake

from Oberoi could cause huge business losses.

Like wise in Delhi, apart from these big chains: other big players are Hyatt Regency, Le

Meridian, Radisson and Ashok Hotel.

Threat of the new entrants: Moderate

Hotel Industry requires huge sum of initial investment, so threat of a new player to

enter the Hotel Business in India is very difficult.

Threat from Foreign Hotel chains: These chains have started to come to the Indian

Market, Like the Hilton's have come to Delhi, and Hiltons enjoys a very good

reputation among the Foreign Travellers. It is highly likely that when Foreigners on

visit to India, they would prefer a Known Brand over the Indian Hotel.

So Overall Threat of new Entrants is Medium to Moderately High.

Bargaining power of the Customers: High

Customers are of utmost importance in the hotel industry, every policy is framed

keeping on mind the customers needs, desires and preferences.

Customers of Oberoi is basically the Business Travellers , Foreign travellers, Delegates

and sports persons, HNI's and all the Head of states, CEO's , MD's of Big Companies.etc

These Customers are very choosy and very sensitive in brand choice and Services that

are offered to them.

A small mistake from the Hotel staff can make them angry, and they switches over to

the other Brand i.e. the other Hotel.

So as Customers are of very High Profile, so they have in general a very High

Proposal for Acquisition of Oberoi Hotels by Reliance Industries Ltd Page 17

Bargaining Power.

Bargaining Power of the Suppliers: Low

Oberoi purchases are:

FMCG and Consumer durables

Fruits and Vegetables ,all the requirements of Food and Beverages Departments ,

Regular requirements of the Housekeeping Departments, room requirements in the

form of blankets , mattresses, and many more.

Most of these Purchases are done as an Institutional Buyers, so most often suppliers go

to any extent and provide with various discounts and Low prices and schemes to win a

client like EIH Group who has a well off financial position in the market.

If one of the Suppliers fails to provide the inventory in time they usually keeps a

backup by having 2-3 supplies for the same goods. So they can easily switch over to the

other supplier very easily.

So Bargaining power of the Suppliers is Low.

Threat of the Substitutes: Low

The type of its Customers and their high Profile would not allow them to shift to any

Leisure Hotel or to any resorts or to any of the Budget Hotel.

The Customers who stays at the five stars would not like to shift over to any other Hotel

which doesn't provide the kind of ambience they enjoy in the Hotel like Taj and Oberoi.

Threat of the Substitutes is very Low.

The above porter analysis of Oberoi group shows two major areas where it needs to

concentrate on is to do better than the competitors and still keeping the customers

happy.

In order to do that Oberoi should have a Competitive edge over its competitors in

terms of providing better service to its customers. In order to achieve that its value

chain should be built on the parameters that can outplay its competitors and provide

the best facility to its employees and customers.

From the above, it is visible After Taj and ITC WelcomGroup, Oberoi’s is the largest

Proposal for Acquisition of Oberoi Hotels by Reliance Industries Ltd Page 18

Hotel chain in India, which makes it a lucrative offer for Acquisition.

Overview of Oberoi Group

The Oberoi Group, founded in 1934, operates 28 hotels and three cruisers in five

countries under the luxury ‘Oberoi’ and five-star ‘Trident’ brands. The Group is also

engaged in flight catering, airport restaurants, travel and tour services, car rentals,

project management and corporate air charters.

Oberoi Hotels & Resorts is synonymous the world over with providing the right blend

of service, luxury and quiet efficiency. Internationally acclaimed for all-round

excellence and unparalleled levels of service, Oberoi hotels and resorts have received

innumerable awards and accolades. A distinctive feature of The Group’s hotels is their

highly motivated and well trained staff that provides exceptionally attentive,

personalized and warm service. The Group’s new luxury hotels have established a

reputation for redefining the paradigm of luxury and excellence in service amongst

leisure hotels around the world. The Oberoi Group is committed to employing the best

environmental and ecological practices in technology, equipment and operational

processes. The Group also supports philanthropic activities that range from education

to assistance for the mentally and physically challenged. The Group is also a keen

contributor to the conservation of nature and of cultural heritage.

EIH Ltd posted revenue of Rs. 907.27 crore for FY09-10 wit a PAT of Rs.57.23 crore. EIH

is planning to invest Rs.150 crore over the next two years on new projects. It is looking

at locations like London, Paris, New York, Shanghai, Beijing and Bangkok, mostly for

management control of existing and upcoming properties .

Internal Analysis of OBEROI’S Welcome Group:

Value chain Analysis at OBEROI’S Welcome Group:

• Carried out to find or take stock of:

– OBEROI’S’s resources - assets, intellectual property, and people

– What OBEROI’S can do best – its competitive strength

This analysis will help us discover that OBEROI’S can gain advantage in which areas

and improve on others so as to gain the Competitive advantage in the market.

Analysis would also help us in gaining the insight of OBEROI’S group and can help in

achievement of the Strategic fit with corporate strategies built at OBEROI’S.

Proposal for Acquisition of Oberoi Hotels by Reliance Industries Ltd Page 19

Value Chain Analysis: Understanding Client’s Business

Firm Infrastructure

Human Resource Management

Support

Activities

Technological Development

Procurement

Inbound Operations Outbound Marketing Service

Activities

Primary

Logistics Logistics & Sales

Relationship with Suppliers Relationship with Buyers

Support Activities

Infrastructure

This activity includes and is driven by corporate or strategic planning. It includes the

Management Information System (MIS) and other mechanisms for planning and control

such as the accounting department, Housekeeping trolley, Maintenance of hotel,

furniture and other ambience. OBEROI’S over the years have maintained world class

infrastructure that has always offered Contemporary Facilities to provide the unrivalled

Luxury experience.

Technology Development

Technology is an important source of competitive advantage. Companies need to

innovate to reduce costs and to protect and sustain competitive advantage. OBEROI’S

used Opera softwares. Central Lock in System (CLS) & Central Registration System

(CRS) for customers, Point of Sale (POS) for inventory control & store, Customer

Relationship Management (CRM) and GFS guest feedback system that helps OBEROI’S

in doing its work more efficiently than it would have been able to do without them. It

Proposal for Acquisition of Oberoi Hotels by Reliance Industries Ltd Page 20

helps them in making Databases of Customers that helps them in providing better

services to their customers.

Human Resource Management (HRM)

Employees are an expensive and vital resource. OBEROI’S gives training to their all

employees irrespective of their designation and work span through Welcome

Management Institute, On-Job-Training., workshops, guest Lectures, job rotation.

People in hospitality industry plays a huge role in providing services to their customers,

Attrition rate at OBEROI’S is lowest among its competitors and according to the last

report employees were highly satisfied with the job.

Procurement

This function is responsible for all purchasing of goods, services and materials. The aim

is to secure the lowest possible price for purchases of the highest possible quality.

OBEROI’S believes in doing most of its work on its own as a little mistake at ant step

can affect the satisfaction of the Guests.

Apart from the Security Department everything is managed by OBEROI’S’s own teams.

Security is managed by an outsourced agency as it is a specialized function and is

always done by specialized agencies.

Primary Activities

Inbound Logistics.

Here goods are received from OBEROI’S suppliers. They are stored until they are

needed on the production/consumption department. Goods are moved around the

Hotel.

They have their permanent supplier who supply on the request of Store Department

Manager within 24hrs. Fresh fruits and vegetables are received and prepared every day.

OBEROI’S has always used a software POS that takes care of the stock of stores and

updates the Purchase department about the store requirement.

It purchases its each requirement from more than one supplier so as to keep the inflow

Proposal for Acquisition of Oberoi Hotels by Reliance Industries Ltd Page 21

of stores running even in the case of Default from any one supplier.

This policy also helps them in maintaining stiff competition between the competitors

and helps it getting the most discounted prices.

Operations

Individual operations could include making of dishes, room service, cleaning &

decoration of rooms, placing soap, tissue in a hotel, and wake up calls to customer,

producing cash memos, security checks at various places, cleaning of pool & lawn,

advance reservation through CLS & CRS.

Process begins with Guest making a call or walking in to the Hotel.

Operation includes bringing the guest from the airport, making the arrangements in the

room as per the specifications, check in arrangements, providing room service for food,

wake up call, managing Health club, spas, swimming pools, Business Centre etc,

making proper arrangements for the checking out of the guests.

All these processes involve many moments of truth and providing excellent service at

every step includes well defined operational steps that include pre written dialogue

points, discovering Fail and problem points. OBEROI’S has realized the importance of

people in the process so it holds regular Area effective teams, regular feedback sessions

and is currently working on Six Sigma training to make the whole process Fault proof.

Outbound Logistics

As such there is no tangible outbound logistic involved in hotel service, but they

consider the Satisfaction that guest carries with them while checking out from the hotel

is very much important for the Hotel as future business depends on the satisfaction he

has got during the stay in the Hotel.

Marketing and Sales

This area focuses strongly upon marketing communications and the promotions. Oberoi

target premium class of customer and for that they prepare the offering to meet the

needs of targeted customers.

They have their own sales team for bulk booking of rooms for corporate and

institutional clients. They have the best marketing and sales team.

Proposal for Acquisition of Oberoi Hotels by Reliance Industries Ltd Page 22

SWOT ANALYSIS OF OBEROI HOTELS.

Strengths

• Strong MIS system- They have a strong Management Information System in

which they were maintaining the database of their customers because of which

they got to know about the tastes and preference of their customers due to which

the brand value of Oberoi increases.

• Strong Marketing Teams- They have a strong marketing team due to which the

awareness of Oberoi Hotel is widely spread. Since it has a second largest market

share in the hospitality sector so it has to always market themselves as one of the

premier hotels in the country.

• Asset leverage- Another important factor for Oberoi’s is that they have no

blocked their money in purchasing the hotels, they had taken on the lease due to

which they got certain tax benefits and they were able to use that money in some

other activity.

• Strong brand equity- Since the awareness of Oberoi’s is worldwide and brand

equity is something which is an outcome of marketing efforts done by the

company. So the brand equity of Oberoi’s is quite high in terms of sales.

Proposal for Acquisition of Oberoi Hotels by Reliance Industries Ltd Page 23

• Loyal Customers- In the service oriented sector customer don’t often change

their service provider unless until they saw any major changes in the service. So

Oberoi’s also has their set of loyal customer which is increasing year on year.

Weakness

Recent Diseconomies of scale- In the recent times because of the recession

hospitality sector has been hurt majorly. There was so much fluctuation in the

economy because of which the hotel industry affected so much.

Room size – As compares to their competitors the room size of Oberoi’s is

comparatively small because of which customer may feel of switching. Although

it’s not easy to increase the room size but they can provide some extra service to

their customers so that they will not think of switching.

Security system- The security system of Oberoi’s is not up to the mark. They are

using same old technology which they have installed initially. So there was no

up gradation in the security system because of which customers does not feel a

sense of security especially after the Mumbai attacks.

Not diversified- Although the group in which Oberoi’s hotel come (East India

Hotel) is itself a very large group but they all are in the hotel business, so they

are not diversified in terms of different business because of which they suffered

huge losses when recession hits the hotel industry.

Opportunities

Low debt to equity ratio financial markets (raise money through debt, etc.)-

They have a very low debt to equity ratio of .82 as compared to the industry

average of 1.5 so if needed they can easily raise the money from the market and

invest into the business.

Proposal for Acquisition of Oberoi Hotels by Reliance Industries Ltd Page 24

Emerging markets and expansion abroad-There is a huge potential not only in

India but all over the world. So there is a huge opportunity for them to invest not

only in India but all over the world.

Innovation- Nowadays customers want something new and to give that new

company has to come up with innovative strategy like eco-friendly room because

it attracts attention of the customer and it creates a need of trying that particular

thing.

Product and services expansion-Here product and services expansion means

adding a product line into your existing one. Oberoi’s is in the premier class of

hotels but since the market is huge for budgeted hotels as well so they can extend

their product line to budgeted hotel too.

High growth rate in hospitality sector- According to the government data there

is a huge growth in the hospitality sector. It is estimated about 14% growth till

2018 which itself is a huge growth rate in any sector.

Threats

• Competition- There is so much competition among the hotels because most of

the premier class hotels are in the prime location and these hotels are close to

each other.

• External changes (government, politics, taxes)-There may be changes in the tax

structure like in recent budget there was a tax imposed with certain conditions

like hotel accommodation, in excess of declared tariff of `1,000 per day with an

abatement of 50 per cent so that the effective burden is only 5 per cent of the

amount charged.

• Price wars-Price wars between the hotels are another threat for the Oberoi’s. As

mentioned earlier these are located nearby so they can’t afford a big price

difference and also there are some regulating authorities (Indian Hotel

Association) according to whom they have to set the tariffs.

Proposal for Acquisition of Oberoi Hotels by Reliance Industries Ltd Page 25

• Threat of acquisition by ITC-The major threat for Oberoi’s is that there may be

an open offer for their hotel because ITC has purchased 14.12% stake in Oberoi’s

and if it crossed 15% then it will be the end for the Oberoi’s.

Valuation for Oberoi Hotels

Sales Revenue: Till 2008, Sales grew in double digits for Hotel industry, but in 2009

Sales growth rate came down to 5 %, and in 2010 it went up to 7%.

For Oberoi’s Sales grew in double digits till 208, but unlike other hotels, Oberoi’s

reported negative growth rate in 2009 and 2010.

Two major reasons being: Recession caused the fall for every Hotel and the further

impact was caused by turmoil in management caused by threat of hostile takeover by

ITC ltd in 2010, which made Oberoi to enter into a deal of sale of stake of 14.12 % to

Reliance.

After Acquisition, Reliance expects to grow by 8% in first year and aims for 15 %

growth by year 2014 and aims at a growth of 15 % till 2018 as industry expects to grow

at 14 % till late part of this decade.

After 2018, industry expects to grow at 8.8% till perpetuity and Reliance expects Oberoi

to grow by 9 %

Cost of Revenue to fall to 40 % from 46% by means of 1% loss every year till 2016 and

then to stabilize at 40%, industry average being 42%

Selling and Admin expenses to fall to 15 % as compared to industry average of 16%,

currently its 18% for Oberoi.

Depreciation rate is fixed at 5%, Working capital is fixed at 12 % of Sales and Capital

expenditure incurred remains 20 %till 2019 and to come down to 15 % after 2019 and to

remain the same forever.

Tax rate to be fixed at 36%

Calculations of Cost of Capital

Proposal for Acquisition of Oberoi Hotels by Reliance Industries Ltd Page 26

Particulars Values

Cost of debt after tax 5.8%

Debt Component 1260 crores

Interest 101 Crores

Retention Ratio 56.28

Return on Equity 20.03

Dividends Paid Re 1.2

Growth Rate 11.27

Current Market Price 80

Weight of Debt 20%

Weight of Equity 80%

Cost of Equity 11.7%

Cost of Capital 10.5%

Calculation of Enterprise value

Particulars Values

Terminal Value Rs.34494 Crores

Discounting Rate 10.5%

Enterprise Value Rs.12617 Crores

Free Cash flow to Equity Rs. 11,368 Crores

Intrinsic Value of 1 share Rs 199.27

Current Value of Share Rs 80

Negotiation Price per share Rs.155

Total Payments to be made:

Particulars Values

Negotiated Price for equity Rs 8842 crores

Debt on books of Oberoi RS 1260 crores

Total deal price Rs 10,102 Crores

Current Stake in EIH 14.12%

Total Price to be made for 85.88 % stake Rs 8675 crores

Price to be paid to shareholders is Rs 7416 crores

Proposal for Acquisition of Oberoi Hotels by Reliance Industries Ltd Page 27

Current Debt to equity ratio of Oberoi is 0.85, where as it can be raised to 1.5 on account

of industry average of 1.5

So debt that can be raised through debts on Oberoi’s books of accounts being Rs 962

Crores

So rest amount of Rs 6453 Crores to be made out as cash from Reserves of Reliance

industries ltd

So the deal amount stands at Rs 7416 crores as equity and Rs 1260 crores of debt on

books of Oberoi books of accounts to be borne by Reliance industries.

Particulars Values

Deal amount : Equity amount Rs 7416 Crores

Debt Rs 1260 Crores

Total amount Rs 8675 Crores

In billions Rs 86.75 billion

Exchange Rate Rs 45/US dollar

Deal amount US $ 1.93 billion

So Reliance would go for a cash buyout of Oberoi Hotels.

This amount stands equals to 41% of RIL Profits in year 2010 or equivalent to 5% of the

entire Reliance reserves and surplus.

Post Merger Financial Ratios:

Debt to equity ratio for Reliance stood at 0.46 before the deal

Post merger DE ratio For Reliance Industries Ltd:

• DE ratio for Reliance pre merger is 0.46 and post merger it would show a partial

increase of 0.015

• DE Ratio post merger would be 0.475

This increase in DE ratio comes on account of increase of debt raised on Oberoi books.

Pre Merger: Earnings per share:

Proposal for Acquisition of Oberoi Hotels by Reliance Industries Ltd Page 28

EPS for Oberoi’s is Rs 4.11

EPS for Reliance is Rs 49.7

Post merger EPS shows synergy as Reliance would be able to bring growth in Oberoi’s

Post merger ratio stands at Rs 49.23and would go on to increase to Rs 70* till 2019

The value for 2019 is calculated on accounts that Reliance industries grow by 5% every

year and Hotel business would increase at the rate as taken in discount cash flow

method.

Assumption being the number of shares of Reliance remains the same till 2019.

Change in Price Earnings Ratio

Small changes in PE ratio from 20.28.4 to 20.29 given the assumption that Reliance does

not increase the number of shares

PRE MERGER AND POST MERGER RATIO SHEDULE

Ratios Pre Merger Post Merger

D/E 0.46 0.475

EPS 49.7 49.3 in 2011

To Rs 70 in 2019

PE 20.28 20.29

POST MERGER ISSUES

Reliance has no knowledge of hospitality sector as their major presence is in

the manufacturing sector.- Reliance has a major presence in the manufacturing

sector so if they come into the service sector they may have to face problem of

Proposal for Acquisition of Oberoi Hotels by Reliance Industries Ltd Page 29

direct dealing with the customers. Since service sector is so sensitive so they have

to deal it with very prudently.

Adaptation of management may become problem.-In any merger adaption of

management is very critical because the ego problem between the employees

arises and creates conflict. The top management people feel like they were on

such top positions and after the merger they may not get that positions.

Competition with the competitor like Tata group that controls the bigger but

less suave Taj hotel group.-Although the Oberoi’s has second largest market

share after Tata group but still Tata as a group has a large potential to invest into

the sector. So there is a huge competition between the Tata and the Reliance

&Oberoi’s.

May affect the other business of Reliance Industries because RIL share price

went down by 0.21 percent to Rs. 947.75 a share- The day when Reliance

acquires Oberoi’s 14.12% stake the share price of RIL fall down by .21% to Rs

947.75. So once RIL took over rest of the stake their share price may fall down by

much.

RIL has no in-house professional expertise in the service sector- Since the

service sector is so sensitive they need a professional expertise which they don’t

have so this is another post merger issues which company sees as whole.

Post – Merger solution

Provide visible leadership from top management

As Reliance is going to enter into Hospitality industry, they should retain some top

level management people and some important people from the Oberoi group so that it

will be beneficial for the new organization as a whole. Other than this they should hire

some experienced people from this industry so that they can bring this new

organization to some other level by implementing good practices by talking it into

consideration that the right person fit the right position.

Ensure that goals are clearly defined and progress is tracked

A special term should be prepared to ensure that first the goals to be prepared well and

than these goals are to be clearly defined and communicated by proper planning and

Proposal for Acquisition of Oberoi Hotels by Reliance Industries Ltd Page 30

coordination so that each individual should know what is his/ her job. They should

also ensure that the each process or work is integrated and can be easily tracked so

check the authenticity of the process at different level.

Ensure that the culture of new organisation matches with the culture of both

organizations

Reliance should ensure that the culture of new organisation is such that the employs of

both organisations can easily adapt the change in the culture and easily cope up with

the change. The "cultural migration" to the desired organizational behaviour is best

achieved by visible example along with continuous reinforcement

And check that the right person fit the right position (e.g. a person from Bengal should

be transfer to Oberoi Kolkata branch if the person is not willing to work in other

branch). Cultural events should be conducted so that the employees retain from Oberoi

group got the chance to know the other employees in the new organization.

Concentrate on key employee retention

Some people may not have the same roles as before, but their value should be

recognized and their egos nurtured.

Upgrade your self with the best IT practises

As Reliance have lot of cash surplus available with them, so they should upgrade its

processes with best IT practices so to integrate its also processes along the world which

can be beneficial to both internal users as well as external users. As Oberoi security

system is not up to date as compare to other 5 star hotels under this category. After 26-

11 security becomes the main concern for the visitors, so Reliance should bring the best

security system available with them.

Post merger benefits

• After the merger the company’s overall efficiency will increase which add

value to the firm.

Better management, better staff, and new recruitment from this industry, better

security, and Reliance as a brand name in its self will overall increase the

efficiency of the merged organization as a whole.

• Reliance Industries market value will increase.

Proposal for Acquisition of Oberoi Hotels by Reliance Industries Ltd Page 31

After merger Reliance industries market value will definitely increase as it can be

seen that from the valuation analysis. It will give Reliance another way of

entering into hospitality sector. Reliance as a group is almost in every sector but

not in hospitality sector. It is a way of diversification for Reliance.

Reliance will get a high level entry by acquiring a well settled

group.

Proposal for Acquisition of Oberoi Hotels by Reliance Industries Ltd Page 32

You might also like

- Ril Swot AnalysisDocument5 pagesRil Swot Analysistulasi nandamuriNo ratings yet

- Singkawang Cultural Centre Case StudyDocument19 pagesSingkawang Cultural Centre Case Studylijith cb100% (3)

- Reliance Industries - Porter's Five Forces ModelDocument15 pagesReliance Industries - Porter's Five Forces ModelSophie Kakker100% (1)

- Financial Analysis of Reliance IndustriesDocument32 pagesFinancial Analysis of Reliance IndustriesManik SinghNo ratings yet

- Bharti - Strong: MarketDocument3 pagesBharti - Strong: MarketMrinmoy PoddarNo ratings yet

- Ril Competitive AdvantageDocument7 pagesRil Competitive AdvantageMohitNo ratings yet

- Reliance Industries Prices Soaring High!: Corporate Financial Management & Decision ProcessDocument12 pagesReliance Industries Prices Soaring High!: Corporate Financial Management & Decision ProcesssammitNo ratings yet

- SWOT Analysis 6.1. StrengthDocument10 pagesSWOT Analysis 6.1. StrengthAkshara AkzNo ratings yet

- Capstone - E9Document7 pagesCapstone - E9HarshavardhanNo ratings yet

- Vanshika Ka AssignmentsDocument17 pagesVanshika Ka AssignmentsAniket SharmaNo ratings yet

- Presentation Case Based Intervention Project - Copy 1599479961 396373Document17 pagesPresentation Case Based Intervention Project - Copy 1599479961 396373Aniket SharmaNo ratings yet

- Moh. HushenDocument19 pagesMoh. HushenhaiderhusainNo ratings yet

- Reliance Industries Limited (RIL) Is An Indian MultinationalDocument7 pagesReliance Industries Limited (RIL) Is An Indian MultinationalPankaj MahantaNo ratings yet

- A Project Report On Reliance Industures RepairedDocument73 pagesA Project Report On Reliance Industures RepairedVivek KumarNo ratings yet

- Reliance IndustriesDocument13 pagesReliance IndustriesPlacement CellNo ratings yet

- Lovely Professional University: Mittal School of Business Academic Task - 3Document16 pagesLovely Professional University: Mittal School of Business Academic Task - 3Shashank Rana100% (1)

- Business & Society Project - CA2Document10 pagesBusiness & Society Project - CA2Bhushan ToraskarNo ratings yet

- Reliance IndustriesDocument11 pagesReliance IndustriesJerryNo ratings yet

- S9 Retail Consumer BehaviourDocument11 pagesS9 Retail Consumer Behaviourmohammed shabeerNo ratings yet

- Reliance ReportDocument40 pagesReliance ReportKareena GuptaNo ratings yet

- BE AssignmentDocument7 pagesBE AssignmentDileep C KumarNo ratings yet

- Reliance Case StudyDocument2 pagesReliance Case StudydrishtiNo ratings yet

- Summer Internship Project ReportDocument32 pagesSummer Internship Project ReportSupratik Das60% (5)

- Reliance Industries Limited: A Brief Overview of Its StrategiesDocument21 pagesReliance Industries Limited: A Brief Overview of Its Strategiesnutan korhaleNo ratings yet

- Reliance Industries Limited: Founder Key People Headquarters Revenue Subsidiaries Roles OfferedDocument5 pagesReliance Industries Limited: Founder Key People Headquarters Revenue Subsidiaries Roles OfferedSeshagiri VempatiNo ratings yet

- Best 4 Specialty Chemicals Stocks To Buy NowDocument60 pagesBest 4 Specialty Chemicals Stocks To Buy Nowmasta kalandarNo ratings yet

- MOAT Analysis of Pidilite: CH. Udaysai Shanmukha II MBA 20458Document7 pagesMOAT Analysis of Pidilite: CH. Udaysai Shanmukha II MBA 20458udaysai shanmukhaNo ratings yet

- SM ProjectDocument12 pagesSM ProjectSaloni GargNo ratings yet

- Reliance Industries LTDDocument13 pagesReliance Industries LTDFashion InfluencersNo ratings yet

- Sl. Roll No. NameDocument13 pagesSl. Roll No. NameMedha BhattacharjeeNo ratings yet

- Reliance India LimitedDocument27 pagesReliance India Limitedkunal_vk100% (3)

- Reliance Industries Ltd.Document9 pagesReliance Industries Ltd.Hrithik SaxenaNo ratings yet

- Reliance IndustriesDocument7 pagesReliance IndustriesSanidhay SindhwaniNo ratings yet

- Assigment On Reliance Industry: Master of Business Administration (Talentedge)Document14 pagesAssigment On Reliance Industry: Master of Business Administration (Talentedge)Mayank MalhotraNo ratings yet

- Abhishek Ghosh PGD18035 Management and Organizational Beahviour AssignmentDocument7 pagesAbhishek Ghosh PGD18035 Management and Organizational Beahviour AssignmentAbhishek GhoshNo ratings yet

- Reliance Industries: Aim: To Analyse The Competition Amongst Firms & The Pricing Strategies Being Adopted by ThemDocument12 pagesReliance Industries: Aim: To Analyse The Competition Amongst Firms & The Pricing Strategies Being Adopted by Themsehar Ishrat SiddiquiNo ratings yet

- Economics SWOTDocument25 pagesEconomics SWOTAchintiya DharNo ratings yet

- Reliance Industrial Plots - Reliance Met Industrial Plots - Reliance Industrial Plots JhajjarDocument26 pagesReliance Industrial Plots - Reliance Met Industrial Plots - Reliance Industrial Plots JhajjarNURealty GroupNo ratings yet

- Project ReportDocument25 pagesProject Report21ACO56 RAM PRANAV T PNo ratings yet

- Company Overview 3 1Document78 pagesCompany Overview 3 1Vivek Vikram SinghNo ratings yet

- Strategic Choice: Sujit Mundul Course FacilitatorDocument5 pagesStrategic Choice: Sujit Mundul Course FacilitatorAdityaNo ratings yet

- Reliance ReportDocument38 pagesReliance ReportoctysystemserviceNo ratings yet

- ReportDocument13 pagesReportjeet.researchquoNo ratings yet

- New Microsoft Office Word Document by Shilipi GautamDocument22 pagesNew Microsoft Office Word Document by Shilipi Gautamcreatorw7No ratings yet

- Reliance Comm - Sudhir Term PaperDocument28 pagesReliance Comm - Sudhir Term Papersudhir_86kumarNo ratings yet

- Netweb IPODocument21 pagesNetweb IPOShubhamShekharSinhaNo ratings yet

- Reliance Industries LTDDocument6 pagesReliance Industries LTDPrachi JainNo ratings yet

- Marketing Strategiesof Reliance Industries LimitedDocument14 pagesMarketing Strategiesof Reliance Industries Limitedantoprincia1723No ratings yet

- IndexDocument38 pagesIndexkumarinikita1825No ratings yet

- Banking & Financial Institutions - Aditya Birla FinanceDocument34 pagesBanking & Financial Institutions - Aditya Birla FinanceSAIMBAhelplineNo ratings yet

- Reliance Case StudyDocument3 pagesReliance Case StudyDipinder100% (1)

- Reliance Industries Limited by ChiragDocument31 pagesReliance Industries Limited by ChiragChirag SolankiNo ratings yet

- Impact of Lockdown Due To Coronavirus Pandemic On The Performance of Reliance Industries LTDDocument6 pagesImpact of Lockdown Due To Coronavirus Pandemic On The Performance of Reliance Industries LTDAishNo ratings yet

- Individual ProjectDocument30 pagesIndividual ProjectAkriti SharmaNo ratings yet

- Vce Final ReportDocument32 pagesVce Final ReportTushar GuptaNo ratings yet

- SSRN Id3557071Document9 pagesSSRN Id3557071Nikhil KumarNo ratings yet

- Leveraging on India: Best Practices Related to Manufacturing, Engineering, and ItFrom EverandLeveraging on India: Best Practices Related to Manufacturing, Engineering, and ItNo ratings yet

- Policies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportFrom EverandPolicies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportNo ratings yet

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- BA English Notes, PU, UoS, IUBDocument4 pagesBA English Notes, PU, UoS, IUBCH M Ahmed67% (3)

- 02 Task Performance 1 ARGDocument2 pages02 Task Performance 1 ARGshayne paduaNo ratings yet

- 25hours LangstrasseDocument22 pages25hours LangstrasseInés FBNo ratings yet

- Royalton Hotel Dubai Hotel VoucherDocument1 pageRoyalton Hotel Dubai Hotel VoucherGabriel OmoluruNo ratings yet

- Assignment #1 Tourism and Maritime.Document8 pagesAssignment #1 Tourism and Maritime.Yurithsel Yaremi Gòmez AvilaNo ratings yet

- Club Jiva Resort List FebruaryDocument3 pagesClub Jiva Resort List FebruaryAtish PawarNo ratings yet

- A Nature-Lover's VacationDocument6 pagesA Nature-Lover's VacationCarlos RedrovánNo ratings yet

- Letter Writing TrainerDocument4 pagesLetter Writing TrainerMaria SanzNo ratings yet

- Thanh Lanh Lake - Suoi Tien - Thac Ba Lake Eco-Tourism AreaDocument58 pagesThanh Lanh Lake - Suoi Tien - Thac Ba Lake Eco-Tourism AreaYe Phone HlaingNo ratings yet

- Green Olive Minimalis Modern Trip Promotion Trifold BrochureDocument2 pagesGreen Olive Minimalis Modern Trip Promotion Trifold BrochureAr LoNo ratings yet

- 5.2 Brief Analysis of Cox's Bazar: HistoryDocument11 pages5.2 Brief Analysis of Cox's Bazar: Historyafiq sergioNo ratings yet

- Major Projects in AzerbaijanDocument36 pagesMajor Projects in AzerbaijanaxeholeNo ratings yet

- Hot Springs in Hat Yai - Google SearchDocument1 pageHot Springs in Hat Yai - Google SearchashleyteokxNo ratings yet

- MTTM 2nd Year 2019-2 PDFDocument11 pagesMTTM 2nd Year 2019-2 PDFRajnish PathaniaNo ratings yet

- Actual Planning - SonargaonDocument24 pagesActual Planning - SonargaonAbdur RazzaqNo ratings yet

- Tourism Experience TheoryDocument9 pagesTourism Experience TheoryJefferson BernaldezNo ratings yet

- Thesis Chapter 1 and 2Document22 pagesThesis Chapter 1 and 2JanellaReanoReyes100% (1)

- Best of Mangalore Recommended by Indian TravellersDocument12 pagesBest of Mangalore Recommended by Indian TravellersSudha RaniNo ratings yet

- Portfolio Nikolay NikolaevDocument120 pagesPortfolio Nikolay NikolaevJames HensleyNo ratings yet

- Philippine Culture, Tourism REVIEWER PRELIMDocument4 pagesPhilippine Culture, Tourism REVIEWER PRELIMJohnson FernandezNo ratings yet

- Travel 109-118Document10 pagesTravel 109-118colorado2014No ratings yet

- Top 10 UNESCO World Heritage Sites in Poland: Historic Centre of KrakówDocument6 pagesTop 10 UNESCO World Heritage Sites in Poland: Historic Centre of KrakówJorge SierraNo ratings yet

- Public Institutions and Financing Media ReportDocument132 pagesPublic Institutions and Financing Media ReporttcNo ratings yet

- Manfredo Di Robilant + Gjergji IslamiDocument17 pagesManfredo Di Robilant + Gjergji IslamiAtelier AlbaniaNo ratings yet

- McDonald's Adventure in The Hotel IndustryDocument16 pagesMcDonald's Adventure in The Hotel IndustryFábio Rabinovitsch100% (1)

- Educational Tour CompletionDocument6 pagesEducational Tour CompletionsiahkyNo ratings yet

- 3rd QUARTER EXAM BPP and Ltgs 2nd 2020 UPDocument6 pages3rd QUARTER EXAM BPP and Ltgs 2nd 2020 UPdhafNo ratings yet

- PHD PPT Final - PPTX (Autosaved)Document19 pagesPHD PPT Final - PPTX (Autosaved)secondson timungNo ratings yet