Professional Documents

Culture Documents

ICICI Bank Limited Regd. Office: "Landmark", Race Course Circle, Vadodara 390007, India

ICICI Bank Limited Regd. Office: "Landmark", Race Course Circle, Vadodara 390007, India

Uploaded by

Dr.kailas Gaikwad , MO UPHC Turbhe NMMCOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ICICI Bank Limited Regd. Office: "Landmark", Race Course Circle, Vadodara 390007, India

ICICI Bank Limited Regd. Office: "Landmark", Race Course Circle, Vadodara 390007, India

Uploaded by

Dr.kailas Gaikwad , MO UPHC Turbhe NMMCCopyright:

Available Formats

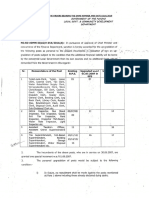

PROVISIONAL STATEMENT FOR CLAIMING DEDUCTIONS UNDER SECTIONS 24 (b) & 80C (2) (xviii) OF

THE INCOME TAX ACT, 1961

To,

Whomsoever It May Concern,

This is to state that KAILASH SOMNATH GAIKWAD & SUJATA KAILAS GAIKWAD with Loan Account no

LBMUM00001067556 / Application Form No.7774636010 has/have been granted a Housing Loan for purchase

/ construction of house property of Rs 700000.00/- @ 07.75% p.a in respect of the following property:

FLAT NO 202

2ND FLOOR SHIV TEJ PLAZA

PLOT NO B 71 SECTOR NO 20

NERUL NAVI MUMBAI

-

The above loan is repayable in Equated Monthly Installments (EMIs) comprising of Principal and interest. The

break-up of the EMI amount for the above loan into Principal and Interest is as follows:

Payable from April 2021 to March 2022

EMI Amount / Prepayment if any

Rs.11760.00 /-

Rs.144888.00 /-

The EMI interest payable from April 2021 to March 2022 is Rs.0.00/-. Please

Note -

* Interest and Principal figures are subject to change in case of prepayments and/or change in repayment

schedule.

* Deduction under Section 24(b) of the Income-tax Act, 1961, in respect of interest payable on borrowed

capital can be claimed in accordance with and subject to fulfillment of conditions prescribed under the

income-tax laws. Interest payable for the pre-acquisition or pre-construction period can also be claimed as

deduction in five equal instalments beginning with the year the house property is purchased or constructed

in accordance with and subject to fulfillment of conditions prescribed in section 24(b) of the Income-tax Act,

1961.

* Deduction under Section 80C (2) (xviii) of the Income-tax Act, 1961, in respect of payment towards

repayment of principal can be claimed in accordance with and subject to fulfillment of conditions prescribed

under the income-tax laws.

* The utilisation/end use of the loan is as per the Borrowers' discretion, and is required to be in accordance

with the details provided in the loan application and the undertakings given, if any, in the Loan Agreement,

which, where such details have been provided, has solely been relied upon.

For ICICI Bank Ltd.,

(acting for itself and / or as duly constituted attorney in this behalf of ICICI Home Finance Co. Limited)

Address of borrower -

KAILASH SOMNATH GAIKWAD

243 V M MAHTRE CHAWL

SECTOR 20 NERUL GAON

NAVI MUMBAI-400706, NAVI MUMBAI

Sd/- NAVI MUMBAI 400705 -

Authorised Signatory

Statement Generated on : December 28, 2021

This is a Computer generated Certificate, not requiring signature.

ICICI Bank Limited Ahmedabad: 6630 9890 Andhra Pradesh: 98495 78000 Assam: 9954108000 Bangalore: 41131877 Bhubaneshwar:

Regd. Office : "Landmark", 9938488000 Bihar: 9934008000 Chandigarh: 5055700 Chattisgarh: 9893208000 Chennai: 42088000 Coimbatore: 4358000

Race Course Circle, Cuttack: 9938488000 Delhi: 41718000 Delhi (Mobile): 9818178000 Darjeeling: 9933008000 Goa: 9890478000 Gujarat:

9898278000 Guwahati: 9954108000 Haryana: 9896178000 Himachal Pradesh: 9816608000 Hyderabad: 23128000 Indore:

Vadodara 390007, India. 4022005 Jamshedpur: 9934008000 Jharkand: 9934008000 Karnataka : 9845578000 Kerala : 9895478000 Kochi:

9895478000 Kolkata: 9831378000 Lucknow: 9936218000 Madhya Pradesh: 9893208000 Maharashtra: 9890478000

You might also like

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal DetailsRITIKANo ratings yet

- To Whomsoever It May Concern Statement For Claiming Deductions Under Sections 24 (B) & 80C (2) (Xviii) of The Income Tax ACT, 1961Document2 pagesTo Whomsoever It May Concern Statement For Claiming Deductions Under Sections 24 (B) & 80C (2) (Xviii) of The Income Tax ACT, 1961RitvikLalithNo ratings yet

- PremiumReceipt 02457968 1684397311Document1 pagePremiumReceipt 02457968 1684397311Deebie RoyNo ratings yet

- Renewal Premium Receipt: Benefit Opted For Tax Benefit Available Under The Income Tax Act, Premium PayableDocument1 pageRenewal Premium Receipt: Benefit Opted For Tax Benefit Available Under The Income Tax Act, Premium PayableAmit MishraNo ratings yet

- Serco Ratio AnalysisDocument4 pagesSerco Ratio Analysisfcfroic0% (1)

- HL IT - Certificate - 621058739 FY 23-24 SampleDocument1 pageHL IT - Certificate - 621058739 FY 23-24 SampleGouravpurvi100% (1)

- Policy 417815024Document5 pagesPolicy 417815024MuraliMohanNo ratings yet

- LHXXXXXXXXXXXX24Document2 pagesLHXXXXXXXXXXXX24Dhananjay RambhatlaNo ratings yet

- Provisional Letter CommDocument1 pageProvisional Letter CommShekharNo ratings yet

- PolicySoftCopy 156477674Document7 pagesPolicySoftCopy 156477674aniket goyalNo ratings yet

- Suman Jade Policy 21-22Document5 pagesSuman Jade Policy 21-22Vipasha SanghaviNo ratings yet

- My: Optima SecureDocument4 pagesMy: Optima SecureAshok KumarNo ratings yet

- JeevanBeema8 17 2022Document1 pageJeevanBeema8 17 2022Mani VasanNo ratings yet

- EnDocument378 pagesEnMahesh100% (2)

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument1 pageStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceMangilal MoondNo ratings yet

- Broadband Clime July Sep-2021Document6 pagesBroadband Clime July Sep-2021VENKATESH NVSNo ratings yet

- Tax CertificateDocument3 pagesTax CertificateSharpReXNo ratings yet

- Account Statement: Folio No.: 11325320 / 36Document2 pagesAccount Statement: Folio No.: 11325320 / 36Inderpaal SinghNo ratings yet

- Dear Munish SharmaDocument2 pagesDear Munish SharmaMunish SharmaNo ratings yet

- To Whomsoever It May Concern Statement For Claiming Deductions Under Sections 24 (B) & 80C (2) (Xviii) of The Income Tax ACT, 1961Document1 pageTo Whomsoever It May Concern Statement For Claiming Deductions Under Sections 24 (B) & 80C (2) (Xviii) of The Income Tax ACT, 1961Ameya SudameNo ratings yet

- HDFC ERGO General Insurance Company Limited: Date: 25/06/2018Document5 pagesHDFC ERGO General Insurance Company Limited: Date: 25/06/2018nilesh sawantNo ratings yet

- End of StatementDocument1 pageEnd of StatementSoumyadeep MahapatraNo ratings yet

- Sanction LetterDocument1 pageSanction LetterManohar NMNo ratings yet

- Agent Name: Insured Persons DetailsDocument14 pagesAgent Name: Insured Persons Detailsravi yadavNo ratings yet

- Registered O Ce: @: Aegon Life InsuranceDocument16 pagesRegistered O Ce: @: Aegon Life Insuranceabhinov saikiaNo ratings yet

- 1643730083633Document1 page1643730083633Saurabh ChoudharyNo ratings yet

- HDFC Insurance PolicyDocument2 pagesHDFC Insurance PolicyPushpendra SinghNo ratings yet

- 31 2020 1571 PDFDocument2 pages31 2020 1571 PDFNandakishor AjNo ratings yet

- Account StatementDocument3 pagesAccount StatementKoushik MukherjeeNo ratings yet

- UdyogAadharRegistrationCertificate PDFDocument1 pageUdyogAadharRegistrationCertificate PDFRajit KumarNo ratings yet

- Co Mprehens Ive Po Licy Co Mprehens Ive Po Licy: Acko AdvantageDocument6 pagesCo Mprehens Ive Po Licy Co Mprehens Ive Po Licy: Acko AdvantageRajesh NatarajanNo ratings yet

- Zprmrnot - 22253699 - 17202314 2Document1 pageZprmrnot - 22253699 - 17202314 2Inder Raj GuptaNo ratings yet

- ReceiptDocument1 pageReceiptkushalNo ratings yet

- AGEAS FEDERAL LIFE INSURANCE COMPANY LIMITED (Formerly Known As IDBI Federal Life Insurance Co. LTD.)Document1 pageAGEAS FEDERAL LIFE INSURANCE COMPANY LIMITED (Formerly Known As IDBI Federal Life Insurance Co. LTD.)hareesh shettyNo ratings yet

- Ac Ko Ac Ko Advant Ag e Advant Ag eDocument6 pagesAc Ko Ac Ko Advant Ag e Advant Ag eJeet TrivediNo ratings yet

- Policy Document 10621599Document28 pagesPolicy Document 10621599Ved VyasNo ratings yet

- Plazzo Mall Rental AgreementDocument3 pagesPlazzo Mall Rental AgreementATGS GNo ratings yet

- Account Statement (From 12-JAN-2023 To 12-JAN-2023)Document2 pagesAccount Statement (From 12-JAN-2023 To 12-JAN-2023)shekhy123No ratings yet

- For HDFC ERGO General Insurance Company LTDDocument2 pagesFor HDFC ERGO General Insurance Company LTDMuhammed shamil HameedNo ratings yet

- HDFC PolicyDocument30 pagesHDFC PolicyXen Operation DPHNo ratings yet

- Insurance PDFDocument2 pagesInsurance PDFJohn AjishNo ratings yet

- RenewalNotice 0000000030189652 PDFDocument2 pagesRenewalNotice 0000000030189652 PDFVikas YadavNo ratings yet

- PDF 13778483 1550746368063Document7 pagesPDF 13778483 1550746368063Shivendra SinghNo ratings yet

- Policy No. Plan Name Frequency Installment PremiumDocument1 pagePolicy No. Plan Name Frequency Installment PremiumMotilal HembramNo ratings yet

- HDFC ERGO General Insurance Company LimitedDocument4 pagesHDFC ERGO General Insurance Company LimitedMandar JadhavNo ratings yet

- ICICI Health Policy 2022Document6 pagesICICI Health Policy 2022HuddarNo ratings yet

- PolicyDocument7 pagesPolicysachin savantNo ratings yet

- Max Bupa Health Insurance Company LimitedDocument1 pageMax Bupa Health Insurance Company LimitedTarunNo ratings yet

- AEGON RELIGARE Premium Payment Receipt PDFDocument1 pageAEGON RELIGARE Premium Payment Receipt PDFe2arvindNo ratings yet

- Motorised Two Wheeler Certificate Cum Policy Schedule - Package PolicyDocument2 pagesMotorised Two Wheeler Certificate Cum Policy Schedule - Package Policy18BIT001 ABISHEKNo ratings yet

- SBI Life Cerificate PDFDocument1 pageSBI Life Cerificate PDFsachin sawantNo ratings yet

- IPPB Recruitment 2022Document14 pagesIPPB Recruitment 2022NDTVNo ratings yet

- Formerly Known As Max Bupa Health Insurance Co. Ltd.Document42 pagesFormerly Known As Max Bupa Health Insurance Co. Ltd.NamanNo ratings yet

- (Cin) L65190mh2004goi148838Document2 pages(Cin) L65190mh2004goi148838Kantesh KudapaliNo ratings yet

- Gmail - Manipal Hospitals Healthcheck - New Order # 100043604Document2 pagesGmail - Manipal Hospitals Healthcheck - New Order # 100043604gururaj96No ratings yet

- The New India Assurance Co. LTDDocument3 pagesThe New India Assurance Co. LTDsarath potnuriNo ratings yet

- 21 18 0064382 02 00 - 20210326Document9 pages21 18 0064382 02 00 - 20210326RahulNo ratings yet

- Welcome To Transport Department Government of Telangana - IndiaDocument1 pageWelcome To Transport Department Government of Telangana - Indiashiva kumarNo ratings yet

- Renewal Premium Receipt: Invoice Number: A150048237100041Document1 pageRenewal Premium Receipt: Invoice Number: A150048237100041Aasiya shadab KhanNo ratings yet

- Premium Paid AcknowledgementDocument1 pagePremium Paid AcknowledgementArpit SinghalNo ratings yet

- Customer GT2 ProDocument1 pageCustomer GT2 Proyunuskhan558800No ratings yet

- SUSNEHADocument2 pagesSUSNEHAsusnehanalam47No ratings yet

- Medical Surgical Nursing-I June 2009Document4 pagesMedical Surgical Nursing-I June 2009Dr.kailas Gaikwad , MO UPHC Turbhe NMMCNo ratings yet

- Medical Surgical Nursing-I June 2008Document4 pagesMedical Surgical Nursing-I June 2008Dr.kailas Gaikwad , MO UPHC Turbhe NMMCNo ratings yet

- Mental Health Nursing August 2017Document4 pagesMental Health Nursing August 2017Dr.kailas Gaikwad , MO UPHC Turbhe NMMCNo ratings yet

- NHM Thane Recruitment 2022 For 280 PostsDocument9 pagesNHM Thane Recruitment 2022 For 280 PostsDr.kailas Gaikwad , MO UPHC Turbhe NMMCNo ratings yet

- Family SurveyDocument5 pagesFamily SurveyDr.kailas Gaikwad , MO UPHC Turbhe NMMCNo ratings yet

- Sales Tax Collection MatrixDocument2 pagesSales Tax Collection MatrixbeckerjeNo ratings yet

- Literature Review On Personal Income Tax in NigeriaDocument7 pagesLiterature Review On Personal Income Tax in NigeriabeemwvrfgNo ratings yet

- CA Inter DT Revision LecturesDocument119 pagesCA Inter DT Revision LecturesJerrin JoseNo ratings yet

- Cir vs. CA and Anscor, G.R. No. 108576, January 20. 1999Document2 pagesCir vs. CA and Anscor, G.R. No. 108576, January 20. 1999Ayra CadigalNo ratings yet

- Form 47Document1 pageForm 47hunjan82No ratings yet

- Case Analysis 2Document2 pagesCase Analysis 2Gie MaeNo ratings yet

- Khyber City Fee ScheduleDocument2 pagesKhyber City Fee ScheduleMohsin KhanNo ratings yet

- W4 - SW1 - Statement of Financial PositionDocument2 pagesW4 - SW1 - Statement of Financial PositionJere Mae MarananNo ratings yet

- TCP-V1 2024Document244 pagesTCP-V1 2024Roshan SNo ratings yet

- Upgradation of PostsDocument2 pagesUpgradation of PostsihtishamulhussanNo ratings yet

- Income Tax 2020-21 SolvedDocument61 pagesIncome Tax 2020-21 SolvedSyed QasimNo ratings yet

- Corporate Break-Up CalculationDocument5 pagesCorporate Break-Up CalculationNachiketaNo ratings yet

- Annex A.1.1 - Taxpayers AttestationsDocument3 pagesAnnex A.1.1 - Taxpayers AttestationssheilaNo ratings yet

- PBCOM v. CIR Case DigestDocument4 pagesPBCOM v. CIR Case DigestCareenNo ratings yet

- Final Term, Quiz 1Document2 pagesFinal Term, Quiz 1jhell de la cruzNo ratings yet

- Service Tax Certificate Centralized NewDocument3 pagesService Tax Certificate Centralized NewSuresh SharmaNo ratings yet

- Barangay Financial Report SREDocument2 pagesBarangay Financial Report SREIzabela RodriguezNo ratings yet

- Buang PayslipDocument1 pageBuang Payslipnokwandadlamini2010No ratings yet

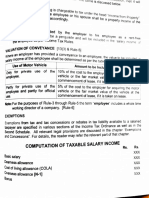

- Calculation of Salary IncomeDocument3 pagesCalculation of Salary IncomeIqra HayatNo ratings yet

- Sumia To Kagua Claim O3Document2 pagesSumia To Kagua Claim O3Justin KubulNo ratings yet

- CIR v. BOAC DigestedDocument2 pagesCIR v. BOAC DigestedChari100% (1)

- UntitledDocument1 pageUntitledAbirami AdhiNo ratings yet

- Bitumen - Emulsion Rates 01.01.2017Document8 pagesBitumen - Emulsion Rates 01.01.2017karunamoorthi_p2209No ratings yet

- CIR Vs Interpublic Group of Companies (2019)Document19 pagesCIR Vs Interpublic Group of Companies (2019)Joshua DulceNo ratings yet

- Assignment Week 4 Hal 205Document1 pageAssignment Week 4 Hal 205Pinarasrayan HaqueNo ratings yet

- Pirovano v. CIR Case SummaryDocument4 pagesPirovano v. CIR Case SummaryDiwata de LeonNo ratings yet

- KANJAKDocument1 pageKANJAKgajari gulNo ratings yet

- GST Invoice Format For Goods in ExcelDocument57 pagesGST Invoice Format For Goods in ExcelJugaadi BahmanNo ratings yet