Professional Documents

Culture Documents

A3 9M10 TV Radio Market Share Media

A3 9M10 TV Radio Market Share Media

Uploaded by

Oscar GutiérrezOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A3 9M10 TV Radio Market Share Media

A3 9M10 TV Radio Market Share Media

Uploaded by

Oscar GutiérrezCopyright:

Available Formats

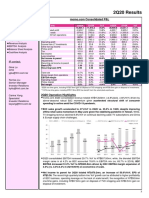

GRUPO ANTENA 3

9M10 RESULTS

October 28th, 2010

Highlights

Spanish TV Ad market increased by +7.1% in 9M10, outperforming

Conventional Ad market (+2.7%)

Antena 3 Group’s net revenues grew by +15% in first nine months

Savings in 3Q10 (-3.1%) resulted in a 9M10 OPEX increase of 2.8%

Antena 3 holds a solid position in total audience share and leads

among the complementary channels

NITRO, Antena 3`s new complementary channel, the best

newcomer

Antena 3 Group 9M10 EBITDA reached €96 mill, x2.7 vs 9M09

Net profit of €63 mill, x3.3 vs 9M09

2 Antena 3 – 9M10 Results

9M10 FINANCIAL SUMMARY

3 Antena 3 – 9M10 Results

Advertising market in Spain

Strong growth in 3Q10 TV Ad market, in line with 9M10

TV market share accounted for 47% of the Total Ad market (+2 pc vs

9M09)

Media 3Q10 yoy 9M10 yoy Market share by media

TV +6.2% +7.1% €3,666 mill €3,766 mill

Radio -4.6% -1.1% OTHERS 7.3% +0.1 pc 7.4%

INTERNET 4.7% +0.5 pc 5.2%

Newspapers -9.1% -4.8%

PRESS -2.1pc 30.2%

32.3%

Magazines +8.8% -2.5%

Sunday suppl. +12.5% +6.1% RADIO 10.6% -0.4pc 10.2%

Outdoor +4.3% +2.3%

Internet +10.5% +12.8% 45.0% +1.9pc 46.9%

TV

Cinema -14.8% +49.4%

9M 09 9M 10

Total +0.8% +2.7%

Source: Infoadex Source: Infoadex

4 Antena 3 – 9M10 Results

Consolidated Group

9M10 Results in € mill: P&L

9M10 9M09 YoY

Net Revenues 570.2 496.3 +14.9%

OPEX 473.6 460.7 +2.8%

EBITDA 96.5 35.5 +171.6%

EBITDA Margin 16.9% 7.2%

Net profit 62.6 18.9 +231.8%

Net profit Margin 11.0% 3.8%

Source: Antena 3

5 Antena 3 – 9M10 Results

Antena 3 Group: Net revenues by segment

Double-digit growth in TV revenues (+15%)

Radio (+2.5%) continued to outperform its market (-1.1%)

“Others” division doubled its revenues (2.0x)

+14.9%

Net Revenues 85% 487

TV 424

(€ mill)

9M09 9M10

+14.9%

+2.5%

12% 64 66

570 Radio

496

9M09 9M10

9M09 9M10

2.0x 18

3% 9

Others

9M09 9M10

Source: Antena 3

6 Antena 3 – 9M10 Results

Antena 3 Group: OPEX

Discipline in costs reduced 3Q10 OPEX by -3%

9M10 OPEX up +2.8% to €474 mill (including non recurring items)

3Q10 OPEX yoy (€ mill) 9M10 OPEX breakdown yoy (€ mill)

461 +2.8% 474

120 +18.0% 142

Other

Costs

141 -3.1% 137 102 +0.8% 103

Personnel

Costs

Programming 238 -4.0% 228

costs & Others

3Q09 3Q10 9M09 9M10

Source: Antena 3

7 Antena 3 – 9M10 Results

Antena 3 Group: Cash flow

FFO rose to €174 mill

Net debt stood at €72 mill, €109 mill less than in 2009

Cash flow (€ mill)

+174

-36 -30

-72

-109

-180

2009 Debt FFO Inv & Others Divid. 9M10 Debt

Source: Antena 3

8 Antena 3 – 9M10 Results

Antena 3 Group: 3Q10 results

EBITDA at €11mill vs € -10mill in 3Q09

Net income of €5mill vs € -4mill in 3Q09

Net Revenues

(€ mill) EBITDA (€ mill)

+21 11

-10

+12.7% 148

131

Net Income (€ mill)

+9

5

-4

3Q09 3Q10

3Q09 3Q10

Source: Antena 3

9 Antena 3 – 9M10 Results

TV Advertising market in Spain

TV Ad market increased by 6% in 3Q10, maintaining 9M10 growth at 7%

TV Advertising by quarter yoy

12%

6%

2%

1Q08 2Q08 3Q08 4Q08 1Q09 2Q09 3Q09 4Q09 1Q10 2Q10 3Q10

-3%

-6%

9M10=+7%

-11%

-17%

-19%

-23%

-26%

FY08= -11%

-34%

9M09= -28%

FY09= -23%

Source: Infoadex and Internal estimates A3

10 Antena 3 – 9M10 Results

TV Advertising market in Spain

Market growth was mainly driven by Beauty, Food & Autos

TV Ad market by sector TV Ad market by sector yoy

9M10 9M10

Beauty Beauty 6%

Others

21% 18% Food 11%

Automotive 15%

Telecom -2%

Beverages Food

8% 14% Distribution -9%

Finance Finance 2%

7% 22%

Beverages

Automotive

Distribution

Telecom 13% Others 1%

9%

10%

Source: Internal Estimates A3

11 Antena 3 – 9M10 Results

Television division

9M10 Results in € mill: P&L

9M10 9M09 YoY

Total Net Revenues 486.6 423.5 +14.9%

OPEX 399.1 392.5 +1.7%

EBITDA 87.6 31.0 +182.0%

EBITDA Margin 18.0% 7.3%

EBIT 79.1 21.9 +261.1%

EBIT Margin 16.2% 5.2%

Source: Antena 3

12 Antena 3 – 9M10 Results

Television division

9M10 Results in € mill: Revenues breakdown

9M10 9M09 YoY

Gross Ad. sales 487.3 402.0 +21.2%

Net Ad. sales 464.3 384.5 +20.8%

Other net revenues 22.3 39.0 -42.8%

Total Net Revenues 486.6 423.5 +14.9%

Source: Antena 3

13 Antena 3 – 9M10 Results

Television division

9M10 Results in € mill: OPEX breakdown

9M10 9M09 YoY

Programming Costs 212.5 226.3 -6.1%

Personnel Costs 65.5 65.0 +0.9%

Other Costs 121.0 101.2 +19.6%

Total OPEX 399.1 392.5 +1.7%

Source: Antena 3

14 Antena 3 – 9M10 Results

Antena 3: Market share & power ratio

Antena 3 accounted for 28% of the total TV market share

Antena 3’s market share Power ratio by player

9M10 9M10

27.6%

1.87x

24.4%

+3.2pc 1.78x

1.64x

1.53x

1.02x

9M09 9M10

Source: Infoadex

15 Antena 3 – 9M10 Results

Antena 3 Television: Advertising revenues breakdown

9M10 Key factors

GRPs

Audience Inventory Consumption

GRPs Prices

3.4% 3.5%

22.7%

-7.7%

-1.3%

Gross Ad. Revenues

+21.2%

Source: Antena 3

16 Antena 3 – 9M10 Results

Antena 3 Television: 3Q10 results

Gross ad revenues increased by 18% to €124 mill

EBITDA stood at €14 mill vs € -7 mill in 3Q09

Gross Ad revenues (€ mill) EBITDA (€ mill)

+18.0% 14

124

105

+21

-7

3Q09 3Q10

3Q09 3Q10

Source: Antena 3

17 Antena 3 – 9M10 Results

Radio division

9M10 Results in € mill: P&L

9M10 9M09 YoY

Net Revenues 65.5 63.9 +2.5%

OPEX 50.6 50.8 -0.2%

EBITDA 14.9 13.2 +12.8%

EBITDA Margin 22.7% 20.6%

EBIT 12.6 10.7 +17.6%

EBIT Margin 19.2% 16.7%

Source: Antena 3

18 Antena 3 – 9M10 Results

Other Subsidiaries contribution + Adjustments

Financials

Net revenues split

€ mill 9M10 9M09

A3 films

A3A

32%

36%

Net Revenues 18.0 8.8

A3

Movier.

Others Eventos

EBITDA -5.9 -8.7 7%

12% 13%

Source: Antena 3

Contribution to consolidated group

Mainly represents the business lines: A3Advertising, Movierecord, Antena 3 Films, Antena 3 Editorial (Música Aparte), Antena 3 Eventos

19 Antena 3 – 9M10 Results

9M10 BUSINESS SUMMARY

20 Antena 3 – 9M10 Results

Audience share: 24h

Antena 3, solid second position among commercial FTA players

Total individuals 9M10 Commercial Target 9M10

Complementary Channels Complementary Channels

Core channel Core channel

24.7

20.8

18.1

17.4 16.5

15.5

11.0

10.3

8.6 8.7

8.1

8.0

7.1

6.7 5.7

5.4

3.2

2.3

1.0 0.9

PAY PAY

OTHER OTHER

TV TV

Source: Kantar Media

Audience share 24h; Total Individuals: 4+ & Commercial Target:16-54 yr

21 Antena 3 – 9M10 Results

FTA commercial players’ audience share: 24h

Antena 3’s audience share bounced back to 3Q09 levels

Total individuals by quarter Commercial Target by quarter

In % In %

17.9 17.7 18.4

16.9

17.7

16.2

16.1 16.7

12.3

9.9

8.1 10.1 10.6

8.3 9.3

7.1

6.5 9.1 8.1

7.3

3Q09 4Q09 1Q10 2Q10 3Q10 3Q09 4Q09 1Q10 2Q10 3Q10

-0.7 +1.8 -2.4 +0.2 -0.6 +0.0 +1.7 -2.0 +0.5 -1.0

Source: Kantar Media

Total individuals: 4+

Commercial Target: 16-54 yrs. Up to 10,000 inhabitants

22 Antena 3 – 9M10 Results

Complementary channels: Audience share (I)

Antena 3’s complementary channels rocketed since the analogue switch off

Complementary channel audiences-Total Individuals

New Complementary

channels

In %

5.7 +3.3

Analogue switch off 5.6 +1.9

final phase

3.9 +1.4

3.7

3.8 +2.2

2.5

2.4

1.6 * +0.2

1.0 1.2

0.6 0.6 * +0.0

Jan-10 Feb-10 Mar-10 Apr-10 May-10 Jun-10 Jul-10 Aug-10 Sep-10

Source: Kantar Media 24h

Total individuals: 4+

* Sony en Veo no longer FTA channel as of May 10 and 40 Latino as of Sep 10

23 Antena 3 – 9M10 Results

Complementary channels: Audience share (II)

Antena 3’s complementary channels, clear leaders in commercial target

Complementary channel audiences-Commercial Target

New Complementary

channels

In %

7.2 +4.4

Analogue switch off

final phase

5.0 +1.6

4.2 +2.3

3.4

2.8 2.8 +1.0

1.9

1.8 1.0 * +0.5

0.7 0.6 *

0.5 -0.1

Jan-10 Feb-10 Mar-10 Apr-10 May-10 Jun-10 Jul-10 Aug-10 Sep-10

Source: Kantar Media 24h

Commercial Target 16-54 yr

* Sony en Veo no longer FTA channel as of May 10 and 40 Latino as of Sep 10

24 Antena 3 – 9M10 Results

Complementary channels: Audience share (III)

Nitro, Antena’s new channel, the best channel among those launched in

September 10

Audience Share new channels. Audience Share new channels.

Total Individuals - Sept 10 Commercial Target – Sept 10

In % In %

1.40

1.27

0.55

0.50

0.37 0.42

0.32

0.20

0.12 0.12

Source: Kantar Media 24h

Commercial Target 16-54 yr

Nitro: Antena 3 Group

Boing: Telecinco Group

MTV and La 10: Net TV Group

Marca TV: Veo Group

25 Antena 3 – 9M10 Results

Radio audience share

Radio business increased listeners by 10% vs. same period 2009

Radio division accounted for 18% of Total Radio market (+1 pc vs 9M09)

Listeners evolution Market share

+9.7%

3,513

3,201 62

50

+0.9pc 18.0%

1,157 17.1%

1,000

2,151 2294

2nd 09 2nd 10

9M09 9M10

Source: EGM Surveys Monday to Friday (.000) (2nd. Wave, 2010. Moving average)

26 Antena 3 – 9M10 Results

Antena 3.0: Internet

Strong performance in every business indicator

Unique Users (mill) Viewed Pages (mill) Video Streams (mill)

+59% +99%

+43% 788 30.1

4.6

496

3.2

15.1

9M09 9M10 9M09 9M10 9M09 9M10

Monthly average Monthly average Monthly average

Source: OJD/Nielsen Market Intelligence Source: OJD/Nielsen Market Intelligence Source: Smartadserver

27 Antena 3 – 9M10 Results

Additional information

Investor Relations Department

Phone: +34 91 623 46 14

E-mail: ir@antena3tv.es

Web: www.grupoantena3.com

Legal Notice

The information contained in this presentation has not been independently verified and is, in any case, subject to

negotiation, changes and modifications.

None of the Company, its shareholders or any of their respective affiliates shall be liable for the accuracy or completeness

of the information or statements included in this presentation, and in no event may its content be construed as any type of

explicit or implicit representation or warranty made by the Company, its shareholders or any other such person. Likewise,

none of the Company, its shareholders or any of their respective affiliates shall be liable in any respect whatsoever

(whether in negligence or otherwise) for any loss or damage that may arise from the use of this presentation or of any

content therein or otherwise arising in connection with the information contained in this presentation. You may not copy or

distribute this presentation to any person.

The Company does not undertake to publish any possible modifications or revisions of the information, data or statements

contained herein should there be any change in the strategy or intentions of the Company, or occurrence of unforeseeable

facts or events that affect the Company’s strategy or intentions.

This presentation may contain forward-looking statements with respect to the business, investments, financial condition,

results of operations, dividends, strategy, plans and objectives of the Company. By their nature, forward-looking

statements involve risk and uncertainty because they reflect the Company’s current expectations and assumptions as to

future events and circumstances that may not prove accurate. A number of factors, including political, economic and

regulatory developments in Spain and the European Union, could cause actual results and developments to differ materially

from those expressed or implied in any forward-looking statements contained herein.

The information contained in this presentation does not constitute an offer or invitation to purchase or subscribe for any

ordinary shares, and neither it nor any part of it shall form the basis of or be relied upon in connection with any contract or

commitment whatsoever.

28 Antena 3 – 9M10 Results

BACK UP SLIDES

29 Antena 3 – 9M10 Results

Consolidated Group

3Q10 Results in € mill: P&L

3Q10 3Q09 YoY

Net Revenues 147.5 130.8 12.7%

OPEX 136.8 141.2 -3.1%

EBITDA 10.7 -10.4 n.a.

EBITDA Margin 7.2% -7.9%

Net profit 4.9 -3.9 n.a.

Net profit Margin 3.4% -3.0%

Source: Antena 3

30 Antena 3 – 9M10 Results

Television

3Q10 Results in € mill: P&L

3Q10 3Q09 YoY

Net Revenues 125.2 110.8 13.0%

OPEX 111.6 117.6 -5.1%

EBITDA 13.6 -6.8 n.a.

EBITDA Margin 10.8% -6.1%

EBIT 10.7 -9.8 n.a.

EBIT Margin 8.5% -8.9%

Source: Antena 3

31 Antena 3 – 9M10 Results

Radio

3Q10 Results in € mill: P&L

3Q10 3Q09 YoY

Net Revenues 16.7 16.7 0.0%

OPEX 15.8 15.9 -0.7%

EBITDA 1.0 0.9 11.7%

EBITDA Margin 5.8% 5.2%

EBIT 0.2 0.0 n.a

Net profit Margin 1.3% n.a.

Source: Antena 3

32 Antena 3 – 9M10 Results

You might also like

- New Mail (30) 2 PDFDocument6 pagesNew Mail (30) 2 PDFWilliam SimonNo ratings yet

- Case 9-2 Innovative Engineering CoDocument4 pagesCase 9-2 Innovative Engineering CoFaizal PradhanaNo ratings yet

- Q3 2017 Press ReleaseDocument18 pagesQ3 2017 Press ReleaseGrace StylesNo ratings yet

- Kingspan FY ResultsDocument33 pagesKingspan FY Resultsdaveholohan8868No ratings yet

- Orange - Equity Research ReportDocument6 pagesOrange - Equity Research Reportosama aboualamNo ratings yet

- Mediaset (MS - MI) : 3Q03 Results On TuesdayDocument8 pagesMediaset (MS - MI) : 3Q03 Results On Tuesdaypoutsos1984No ratings yet

- Of A400M and Ticketing ProgrammesDocument11 pagesOf A400M and Ticketing ProgrammesIngegneria Aerospaziale PadovaNo ratings yet

- ¡Ú2010 4Q Results English 20110125Document11 pages¡Ú2010 4Q Results English 20110125maximebayenNo ratings yet

- France Telecom: Morgan Stanley TMT ConferenceDocument13 pagesFrance Telecom: Morgan Stanley TMT Conferenceshahid10No ratings yet

- CP Resultats FY2019 GB - DocxDocument30 pagesCP Resultats FY2019 GB - DocxPaula Andrea GarciaNo ratings yet

- BPort 100830 RN2Q10Document2 pagesBPort 100830 RN2Q10limml63No ratings yet

- Screst 100930 RN2QFY11Document2 pagesScrest 100930 RN2QFY11limml63No ratings yet

- France Telecom Orange France Telecom Orange 3q12 Results Outlook October 25Document55 pagesFrance Telecom Orange France Telecom Orange 3q12 Results Outlook October 25SanjinStuparNo ratings yet

- Vietnam's Mobile Phone MarketDocument15 pagesVietnam's Mobile Phone Markettrolai100% (3)

- 2011.10 Turbo+ Progress ReportDocument5 pages2011.10 Turbo+ Progress Reportosama anterNo ratings yet

- SapCrest 20100625 KenangaDocument3 pagesSapCrest 20100625 Kenangalimml63No ratings yet

- Irish Communications Market: Summary: Quarterly Key Data ReportDocument10 pagesIrish Communications Market: Summary: Quarterly Key Data ReportElizabeth OdomNo ratings yet

- 02 Company AnnouncementDocument6 pages02 Company AnnouncementThanh-Phu TranNo ratings yet

- Indra Press ReleaseDocument13 pagesIndra Press ReleaseTwobirds Flying PublicationsNo ratings yet

- 2017 Vinci Annual Report ShortDocument60 pages2017 Vinci Annual Report ShortMoutonNo ratings yet

- Telefónica - Presentation Jan-Sep 23Document19 pagesTelefónica - Presentation Jan-Sep 23meditationinstitute.netNo ratings yet

- 2010 Second Quarter N Half Yr ResultsDocument33 pages2010 Second Quarter N Half Yr ResultsmandikiniNo ratings yet

- BinaPuri 100824 RN2Q10Document2 pagesBinaPuri 100824 RN2Q10limml63No ratings yet

- De000kbx1006 Ja 2019 Eq e 00Document214 pagesDe000kbx1006 Ja 2019 Eq e 00Aditi DasNo ratings yet

- Q3 2023 Presentation - 240227 - 140404Document13 pagesQ3 2023 Presentation - 240227 - 140404jbilyasseNo ratings yet

- Press Release Vallourec Reports Third Quarter and First Nine Months 2020 ResultsDocument16 pagesPress Release Vallourec Reports Third Quarter and First Nine Months 2020 ResultsShambavaNo ratings yet

- VITO Learning Activity 4Document3 pagesVITO Learning Activity 4Steph AnieNo ratings yet

- En - Obel S1 2022-60496424Document31 pagesEn - Obel S1 2022-60496424paulgsozaNo ratings yet

- Shriram TechnoElectricQ3 11feb10Document2 pagesShriram TechnoElectricQ3 11feb10krishna615No ratings yet

- TEFÓNICA ResultadosDocument27 pagesTEFÓNICA ResultadosFilipe LuisNo ratings yet

- PVS 20240506 BuyDocument21 pagesPVS 20240506 BuytataxpNo ratings yet

- SCM 1q 2023 Investors ReleaseDocument10 pagesSCM 1q 2023 Investors ReleasetirtaseptiandikiNo ratings yet

- LondonMetric Investor PresentationDocument32 pagesLondonMetric Investor PresentationmatthewsmcleodNo ratings yet

- Momo Operating Report 2Q20Document5 pagesMomo Operating Report 2Q20Wong Kai WenNo ratings yet

- Sampa Video G3 - SecBDocument3 pagesSampa Video G3 - SecBEina GuptaNo ratings yet

- Khác Biệt Hay Là ChếtDocument27 pagesKhác Biệt Hay Là ChếtVietanh HoangNo ratings yet

- Vinci 2017Document358 pagesVinci 2017sandun suranjanNo ratings yet

- Digital TV Update: Chart Pack For Q1 2011 Published July 2011Document17 pagesDigital TV Update: Chart Pack For Q1 2011 Published July 2011Matthew ClaytonNo ratings yet

- Finning Q3 2023 Interim Report Nov 6 2023Document64 pagesFinning Q3 2023 Interim Report Nov 6 2023Allan ShepherdNo ratings yet

- Vodafone Bid HBS Case - ExhibitsDocument13 pagesVodafone Bid HBS Case - ExhibitsNaman PorwalNo ratings yet

- AKM Annualreport17Document28 pagesAKM Annualreport17The Music TribeNo ratings yet

- Financial Results - First Half 2021: Investors' and Analysts' PresentationDocument24 pagesFinancial Results - First Half 2021: Investors' and Analysts' PresentationMiguel Couto RamosNo ratings yet

- NPC 100908 RN2Q10Document2 pagesNPC 100908 RN2Q10limml63No ratings yet

- 09-11-23 # Q3 2023 - Business Review - UKDocument4 pages09-11-23 # Q3 2023 - Business Review - UKsaurabh nolakhaNo ratings yet

- 23KODocument3 pages23KOHatim BaraNo ratings yet

- CJ - Credit SuiseDocument24 pagesCJ - Credit Suisebackup tringuyenNo ratings yet

- China Mediaexpress Holdings, IncDocument4 pagesChina Mediaexpress Holdings, IncwctbillsNo ratings yet

- Dsonic - 1QFY24Document4 pagesDsonic - 1QFY24gee.yeap3959No ratings yet

- Interim Report: Nokia Q3 2009 Net Sales EUR 9.8 Billion, non-IFRS EPS EUR 0.17 (Reported EPS EUR - 0.15)Document25 pagesInterim Report: Nokia Q3 2009 Net Sales EUR 9.8 Billion, non-IFRS EPS EUR 0.17 (Reported EPS EUR - 0.15)amantechino534No ratings yet

- BetterInvesting Weekly Stock Screen 4-15-19Document1 pageBetterInvesting Weekly Stock Screen 4-15-19BetterInvestingNo ratings yet

- VietnamCaseStudiesforPrint ENDocument60 pagesVietnamCaseStudiesforPrint ENHoang TraNo ratings yet

- q3 2016 PresentationDocument42 pagesq3 2016 Presentationvmekhasyuk2001No ratings yet

- Q1FY23 - Result Update: Future Growth IntactDocument10 pagesQ1FY23 - Result Update: Future Growth IntactResearch ReportsNo ratings yet

- 2020 11 09 PH e Nikl PDFDocument7 pages2020 11 09 PH e Nikl PDFJNo ratings yet

- Teleperformance Slideshow h1 2021 Va Def RsDocument60 pagesTeleperformance Slideshow h1 2021 Va Def RsJanella Marie BautistaNo ratings yet

- Ericsson Financial Report 2023 Q3Document50 pagesEricsson Financial Report 2023 Q3Ahmed HussainNo ratings yet

- Maintain NEUTRAL: Acem in CMP Rs 219 Target Rs 191 ( 13%)Document7 pagesMaintain NEUTRAL: Acem in CMP Rs 219 Target Rs 191 ( 13%)9987303726No ratings yet

- Raising Estimates On Higher Earnings Contribution From Power BusinessDocument4 pagesRaising Estimates On Higher Earnings Contribution From Power BusinessJNo ratings yet

- Interim Financial Report As at September 30 2023Document15 pagesInterim Financial Report As at September 30 2023sofian aitNo ratings yet

- Airbus ValoDocument19 pagesAirbus ValobendidisalaheddineNo ratings yet

- IPTV Delivery Networks: Next Generation Architectures for Live and Video-on-Demand ServicesFrom EverandIPTV Delivery Networks: Next Generation Architectures for Live and Video-on-Demand ServicesSuliman Mohamed FatiNo ratings yet

- The Role of Financial Management The Role of Financial ManagementDocument20 pagesThe Role of Financial Management The Role of Financial ManagementAlimul RaziNo ratings yet

- Finance Theory - Robert C. MertonDocument327 pagesFinance Theory - Robert C. MertonSrujan ReddyNo ratings yet

- Qualitative FormatDocument45 pagesQualitative FormatRachellyn Limentang100% (1)

- Financial Accounting and Reporting Practice QuestionsDocument21 pagesFinancial Accounting and Reporting Practice QuestionsAnuar LoboNo ratings yet

- Le .15c3-3Document210 pagesLe .15c3-3RatónNo ratings yet

- Complaint - Sample - BP 22 - 05-16-19Document3 pagesComplaint - Sample - BP 22 - 05-16-19CJ MONo ratings yet

- Bank Statement-Malaysia CIMB Bank Account Statement PDFDocument2 pagesBank Statement-Malaysia CIMB Bank Account Statement PDF303355851No ratings yet

- Shashank Mhadnak: Regular Updating Technical KnowledgeDocument4 pagesShashank Mhadnak: Regular Updating Technical KnowledgeAmit KalsiNo ratings yet

- Module 3 Fabm2Document20 pagesModule 3 Fabm2Lorvin PalattaoNo ratings yet

- Importance of Highest and Best Use in AppraisalDocument5 pagesImportance of Highest and Best Use in AppraisalEnp Gus AgostoNo ratings yet

- MPIPDocument46 pagesMPIPJesus MarinoNo ratings yet

- Project On ICICI and BOR Merger and AcquistionsDocument32 pagesProject On ICICI and BOR Merger and Acquistionssourbh_brahma100% (1)

- Tax Invoice: de Guzman Randy Sison 64 PUNGGOL WALK #03-31 SINGAPORE 828782 Account No: 3924232952Document2 pagesTax Invoice: de Guzman Randy Sison 64 PUNGGOL WALK #03-31 SINGAPORE 828782 Account No: 3924232952Randy GusmanNo ratings yet

- V - 62 Caroni, Trinidad, Thursday 5th January, 2023-Price $1.00 N - 2Document8 pagesV - 62 Caroni, Trinidad, Thursday 5th January, 2023-Price $1.00 N - 2ERSKINE LONEYNo ratings yet

- Odisha FIntech Hackathon-ProposalDocument5 pagesOdisha FIntech Hackathon-Proposalsanjib paridaNo ratings yet

- SWIFT & SEPA - How International Money Transfers Actually Work ?Document21 pagesSWIFT & SEPA - How International Money Transfers Actually Work ?sandipghoshNo ratings yet

- AP Macroeconomics 2008 Free-Response Questions: The College Board: Connecting Students To College SuccessDocument3 pagesAP Macroeconomics 2008 Free-Response Questions: The College Board: Connecting Students To College SuccessJiacheng HuNo ratings yet

- MB101 Tutorial 1Document4 pagesMB101 Tutorial 1Hui Ru ChongNo ratings yet

- ITFG - Bulletin 9Document7 pagesITFG - Bulletin 9TanviNo ratings yet

- DocumentDocument2 pagesDocumentDelaNo ratings yet

- Accounts Project - Financial Statement Analysis of Steel Authority of India Limited - by Irfan Ahmad & Manisha YadavDocument18 pagesAccounts Project - Financial Statement Analysis of Steel Authority of India Limited - by Irfan Ahmad & Manisha YadavRavi Jaiswal0% (1)

- Managerial Accounting JONGAY (AutoRecovered)Document24 pagesManagerial Accounting JONGAY (AutoRecovered)Jhoy AmoscoNo ratings yet

- Globalisation Trade and InvestmentDocument11 pagesGlobalisation Trade and InvestmentDegoNo ratings yet

- Pension Slip-1 UnlockedDocument2 pagesPension Slip-1 UnlockedSanjay KaleNo ratings yet

- G5-T6 How To Use RSIDocument4 pagesG5-T6 How To Use RSIThe ShitNo ratings yet

- Syllabus For Lecturer (10+2) CommerceDocument4 pagesSyllabus For Lecturer (10+2) CommerceAfad KhanNo ratings yet

- What Is Value Investing?Document10 pagesWhat Is Value Investing?Navaraj BaniyaNo ratings yet

- Analysis of General Banking Activities of Standard Bank LimitedDocument69 pagesAnalysis of General Banking Activities of Standard Bank LimitedJerin TasnimNo ratings yet

- Southeast Bank Annual Report 2016 PDFDocument446 pagesSoutheast Bank Annual Report 2016 PDFAnonymous XarIeNlgL6No ratings yet