Professional Documents

Culture Documents

3-8 (Bank Reconciliation) Maruya Company Bank Reconciliation - Adjusted Balance Method For The Month of April, 2020

3-8 (Bank Reconciliation) Maruya Company Bank Reconciliation - Adjusted Balance Method For The Month of April, 2020

Uploaded by

Exzyl Vixien Iexsha LoxinthOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

3-8 (Bank Reconciliation) Maruya Company Bank Reconciliation - Adjusted Balance Method For The Month of April, 2020

3-8 (Bank Reconciliation) Maruya Company Bank Reconciliation - Adjusted Balance Method For The Month of April, 2020

Uploaded by

Exzyl Vixien Iexsha LoxinthCopyright:

Available Formats

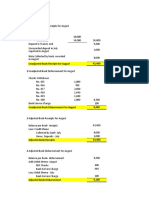

3-8 (Bank Reconciliation)

Maruya Company

Bank Reconciliation – Adjusted Balance Method

For the month of April, 2020

April

March 31 Receipts Disbursements April 30

Unadjusted bank balances P 21,560 P 220,450 P 218,970 P 23,040

Undeposited receipts:

March 9,060 (9,060)

April 10,120 10,120

Outstanding checks:

March (2,675) (2,675)

April 1,430 (1,430)

Erroneous bank debit (950) 950

Payment to creditor in cash _______ 1,210 1,210 _______

Adjusted bank balances P 27,945 P 222,720 P 217,985 P 32,680

Unadjusted book balances: P 16,545 P 222,190 P 216,055 P 22,680

NSF Checks:

Returned, recorded in April 1,040 1,040

Returned, recorded in May 860 (860)

Unrecorded bank collections:

March 12,150 (12,150)

April 11,640 11,640

Bank service charge:

March (750) (750)

April 420 (420)

Book error in December _______ ________ 360 (360)

Adjusted book balances P 27,945 P 222,720 P 217,985 P 32,680

Adjusting journal entries:

Date Particulars PR Debit Credit

2020

Apr. 3 Accounts receivable P 860

0

Cash in bank P 860

NSF check returned but recorded in May

Cash in bank 11,640

Note receivable 11,640

Unrecorded bank collections

Bank service charge 420

Cash in bank 420

Unrecorded bank service charge

Accounts payable 360

Cash in bank 360

Erroneous check drawn

3-9 (Cut-off Tests):

A. Which of the following cash transfers would appear as a deposit in transit on the December 31,

2021 bank reconciliation?

Bank Account A Bank Account B

Disbursing Date (Month/Day) Receiving Date (Month/Day)

Per Bank Per Books Per Bank Per Books

a. 12/31 12/30 12/31 12/30

b. 1/2 12/30 12/31 12/31

c. 1/3 12/31 1/2 1/2

d. 1/3 12/31 1/2 12/31

B. Which of the following transfers would not appear as an outstanding check on the December 31,

2021 bank reconciliation?

Bank Account A Bank Account B

Disbursing Date (Month/Day) Receiving Date (Month/Day)

Per Bank Per Books Per Bank Per Books

a. 12/31 12/30 12/31 12/30

b. 1/2 12/30 12/31 12/31

c. 1/3 12/31 1/2 1/2

d. 1/3 12/31 1/2 12/31

C. An auditor should trace bank transfers for the last part of the audit period and for the first part of

the subsequent period to detect whether

a. The cash receipts journal was held open for a few days after the year-end.

b. The last checks recorded before the year-end were actually mailed by the year-end.

c. Cash balances were overstated because of kiting.

d. Any unusual payments to or receipts from related parties occurred.

You might also like

- Statements PDFDocument4 pagesStatements PDFSami Ullah Khan Larhi78% (9)

- Quiz - Chapter 3 - Bank ReconciliationDocument6 pagesQuiz - Chapter 3 - Bank ReconciliationSHE82% (11)

- NBF Bank Statement 08 2020 PDFDocument1 pageNBF Bank Statement 08 2020 PDFswalsassist hkNo ratings yet

- ReSA B44 FAR First PB Exam Questions Answers SolutionsDocument17 pagesReSA B44 FAR First PB Exam Questions Answers SolutionsWesNo ratings yet

- Cash Problems Proof of CashDocument25 pagesCash Problems Proof of CashAnna Taylor75% (4)

- Accounting10 (Reviewer)Document5 pagesAccounting10 (Reviewer)Erika Panit ReyesNo ratings yet

- QUIZ Cash APDocument11 pagesQUIZ Cash APJanelleNo ratings yet

- Bank Reconciliation: QuizDocument4 pagesBank Reconciliation: QuizBrgy Baloling50% (2)

- 100% Key Answers For The 2 First Quizzes - ACT1104Document34 pages100% Key Answers For The 2 First Quizzes - ACT1104moncarla lagonNo ratings yet

- Prelim-Pr 2a14fb4488c3b5b235Document11 pagesPrelim-Pr 2a14fb4488c3b5b235Romina LopezNo ratings yet

- Chapter 3 - Bank ReconciliationDocument2 pagesChapter 3 - Bank ReconciliationJerome_JadeNo ratings yet

- Encode JobDocument12 pagesEncode JobRainNo ratings yet

- Auditing Problems: Jipbautista16 - Cpar - 2021Document2 pagesAuditing Problems: Jipbautista16 - Cpar - 2021Ivy BautistaNo ratings yet

- Quiz Audit of CashDocument3 pagesQuiz Audit of CashwesNo ratings yet

- For Rent HeheDocument19 pagesFor Rent HeheGabriel AfricaNo ratings yet

- Audit Prob Q6 Proof of Cash 2021Document9 pagesAudit Prob Q6 Proof of Cash 2021Ivy BautistaNo ratings yet

- Bank Reconciliation L1Document4 pagesBank Reconciliation L1C XNo ratings yet

- Exercises On Cash PDFDocument6 pagesExercises On Cash PDFFely MaataNo ratings yet

- Bank Reconciliation Proof of CashDocument15 pagesBank Reconciliation Proof of CashPrinx CarvsNo ratings yet

- Problem 1Document8 pagesProblem 1Mikaela JeanNo ratings yet

- Cvcitc: College of Business and Accountancy Department of Accountancy Proof of CashDocument2 pagesCvcitc: College of Business and Accountancy Department of Accountancy Proof of CashTyrelle Dela CruzNo ratings yet

- RM - Cash and Cash EquivalentsDocument3 pagesRM - Cash and Cash Equivalentsncaacademics.nfjpia2324No ratings yet

- Chapter 7 Practice SolutionsDocument5 pagesChapter 7 Practice Solutionslemanhan240103No ratings yet

- 5 6248879817396060958Document6 pages5 6248879817396060958Jeff GonzalesNo ratings yet

- Intermediate Accounting I - Cash and Cash EquivalentsDocument4 pagesIntermediate Accounting I - Cash and Cash EquivalentsJoovs JoovhoNo ratings yet

- Proof of Cash Problems 4 PDF FreeDocument9 pagesProof of Cash Problems 4 PDF FreeAngieNo ratings yet

- MC - Bank Reconciliation and Proof of CashDocument4 pagesMC - Bank Reconciliation and Proof of CashGwen Ashley Dela PenaNo ratings yet

- 1 Review CceDocument10 pages1 Review CceJobelle Candace Flores AbreraNo ratings yet

- Bank Reconciliation StatementDocument4 pagesBank Reconciliation StatementMichael BwireNo ratings yet

- BRS ProblemsDocument28 pagesBRS ProblemsKutbuddin JawadwalaNo ratings yet

- Cash Problem 1Document3 pagesCash Problem 1Dawson Dela CruzNo ratings yet

- Bank Recon and POC ProblemsDocument3 pagesBank Recon and POC ProblemsJanine IgdalinoNo ratings yet

- Intacc Quiz1Document15 pagesIntacc Quiz1Armina BagsicNo ratings yet

- Accounting Grade 11 Revision Term 1 - 2023Document15 pagesAccounting Grade 11 Revision Term 1 - 2023sihlemooi3No ratings yet

- Problem 1-21: RequiredDocument4 pagesProblem 1-21: RequiredRizalito SisonNo ratings yet

- Audit of Cash - SW8Document7 pagesAudit of Cash - SW8d.pagkatoytoyNo ratings yet

- Additional Illustrations-14Document8 pagesAdditional Illustrations-14Gulneer LambaNo ratings yet

- Bank Reconciliation StatementsDocument25 pagesBank Reconciliation StatementsVernan ZivanaiNo ratings yet

- 112 ReconSeatworkDocument2 pages112 ReconSeatworkGinie Lyn RosalNo ratings yet

- Tutorial ListDocument14 pagesTutorial ListAnggaNo ratings yet

- Quiz 1 - Audit of CashDocument4 pagesQuiz 1 - Audit of CashmillescaasiNo ratings yet

- Do The Drill Cash Intaud1Document3 pagesDo The Drill Cash Intaud1ダニエルNo ratings yet

- A) B) C) D) E) A) B) C) D) E) A) B) C) D) E) A) B) C) D) E)Document3 pagesA) B) C) D) E) A) B) C) D) E) A) B) C) D) E) A) B) C) D) E)Mharvie LorayaNo ratings yet

- Quiz CCEDocument5 pagesQuiz CCEwesNo ratings yet

- Bank Recon SeatworkDocument4 pagesBank Recon SeatworkMary Lyn DatuinNo ratings yet

- Assignment - Cash and CEDocument4 pagesAssignment - Cash and CEAleah Jehan AbuatNo ratings yet

- Cash and CE Problems ExercisesDocument3 pagesCash and CE Problems ExercisesMa. Erika Charisse DacerNo ratings yet

- Assignment 01 Petty Cash Fund Bank ReconciliationDocument4 pagesAssignment 01 Petty Cash Fund Bank ReconciliationMituzella MharielNo ratings yet

- Ap-5907 CashDocument11 pagesAp-5907 CashSaoxalo ONo ratings yet

- Cash SeatworkDocument3 pagesCash SeatworkRed TigerNo ratings yet

- Cash N Cash Equivalent Problem Set 1Document3 pagesCash N Cash Equivalent Problem Set 1Jamaica DavidNo ratings yet

- Assignment 1. Your Client, A Successful Small Business, Has Never Given Much Attention To A SoundDocument6 pagesAssignment 1. Your Client, A Successful Small Business, Has Never Given Much Attention To A SoundThricia Mae Lorenzo IgnacioNo ratings yet

- End of Chapter Problems 3-1 (Cash Count)Document3 pagesEnd of Chapter Problems 3-1 (Cash Count)Exzyl Vixien Iexsha LoxinthNo ratings yet

- Cash & Cash Equivalent TheoryDocument17 pagesCash & Cash Equivalent Theoryjoneth.duenasNo ratings yet

- 3Document4 pages3Francis Lloyd TongsonNo ratings yet

- Auditing For Cash SolmanDocument5 pagesAuditing For Cash SolmanJoseph FelipeNo ratings yet

- Bank Rec AmendedDocument12 pagesBank Rec AmendedAchala GalabadaarachchiNo ratings yet

- BUS 142 - Exercises CH 8Document22 pagesBUS 142 - Exercises CH 8Jess IcaNo ratings yet

- CM2 - Cash and Cash Equivalents - Comprehensive Problems PDFDocument6 pagesCM2 - Cash and Cash Equivalents - Comprehensive Problems PDFArrow KielNo ratings yet

- Audprob Cash2 Bsa4 2Document5 pagesAudprob Cash2 Bsa4 2Mark Gelo WinchesterNo ratings yet

- 3.3 - Bank Reconciliation and Proof of CashDocument5 pages3.3 - Bank Reconciliation and Proof of CashxxxNo ratings yet

- Burden of ProofDocument43 pagesBurden of ProofKenneth PenusNo ratings yet

- Rural Banking - SCRIPTDocument16 pagesRural Banking - SCRIPTArchisha GargNo ratings yet

- SD FlowDocument6 pagesSD FlowFarooq AhmedNo ratings yet

- Institute of Finance ManagementDocument4 pagesInstitute of Finance Managementchrispin bernadNo ratings yet

- Rodriguez - Azuero AbogadosDocument11 pagesRodriguez - Azuero AbogadosRodriguez-Azuero AbogadosNo ratings yet

- NRB Global LifeDocument10 pagesNRB Global Lifeshovon575No ratings yet

- RGGHDDocument2 pagesRGGHDbeer mohamedNo ratings yet

- Chapter 9 Problem 1 SolutionDocument8 pagesChapter 9 Problem 1 SolutionAustin Coles83% (6)

- Evidence of Intent To Commit An Actual Fraud MF GlobalDocument19 pagesEvidence of Intent To Commit An Actual Fraud MF GlobalInvestor ProtectionNo ratings yet

- Recording Procedures-Barangay FundsDocument21 pagesRecording Procedures-Barangay FundsMarliezel Sarda100% (1)

- Untitled Form - Google FormsDocument5 pagesUntitled Form - Google Formsmanoj kumar DasNo ratings yet

- DebitDocument33 pagesDebitAmitNo ratings yet

- Online Applications (Through Website of ESIC at (: WWW - Esic.nic - inDocument17 pagesOnline Applications (Through Website of ESIC at (: WWW - Esic.nic - invasava dipakNo ratings yet

- 849-10 - Risk Management For Law FirmsDocument4 pages849-10 - Risk Management For Law FirmsArk GroupNo ratings yet

- Important Weekly Current Affairs PDF 15 To 21 March 2023Document16 pagesImportant Weekly Current Affairs PDF 15 To 21 March 2023Vinay KumarNo ratings yet

- Issue of Co-Branded Credit CardsDocument4 pagesIssue of Co-Branded Credit CardsAwadhesh Kumar KureelNo ratings yet

- LeasesDocument5 pagesLeasesElla Montefalco50% (2)

- Messaging Standardization For Mobile PaymentsDocument8 pagesMessaging Standardization For Mobile PaymentsMatthew ProtonotariosNo ratings yet

- Fire InsuranceDocument4 pagesFire InsuranceAya NamuzarNo ratings yet

- Ind Nifty BankDocument2 pagesInd Nifty Bankdata manageNo ratings yet

- 01 Insular Life v. EbradoDocument1 page01 Insular Life v. EbradoBasil MaguigadNo ratings yet

- Ncnda Imfpa Euro 2m - Fnle-1Document19 pagesNcnda Imfpa Euro 2m - Fnle-1Angga Larnezza KuntaraNo ratings yet

- Engineering EconomyDocument37 pagesEngineering EconomyxxkooonxxNo ratings yet

- Shamrao Vithal Co-Operative Bank LTD Recruitment 2013 Divisional Manager (Legal) Post - Oct 2013Document1 pageShamrao Vithal Co-Operative Bank LTD Recruitment 2013 Divisional Manager (Legal) Post - Oct 2013malaarunNo ratings yet

- Mission Statement: SBI Articulates Nine Core ValuesDocument6 pagesMission Statement: SBI Articulates Nine Core ValuesPaneer MomosNo ratings yet

- Broker Appointment Form FNL AM 20110217 1Document1 pageBroker Appointment Form FNL AM 20110217 1Jowell BolinaoNo ratings yet

- Marketing and Operations of The Banking SectorDocument36 pagesMarketing and Operations of The Banking SectorVineeth MudaliyarNo ratings yet

- Madhya Pradesh 0Document19 pagesMadhya Pradesh 0Saurabh AnandNo ratings yet