Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

29 viewsHow Does The Manitoba Islamic Mortgage Compare With A Conventional Mortgage?

How Does The Manitoba Islamic Mortgage Compare With A Conventional Mortgage?

Uploaded by

Jakaria AhmedThe document compares a Manitoba Islamic Mortgage to a conventional mortgage. The Islamic mortgage is based on a shared ownership concept called "musharaka" where the customer and credit union jointly purchase a home. The customer contributes at least 20% of the purchase price and agrees to purchase the credit union's ownership share over 25 years through periodic payments. With each payment, ownership of the home transfers until the customer owns it solely. In contrast, a conventional mortgage involves the credit union loaning the full purchase amount to the customer, who repays it with interest over 25 years.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Fco Daw-CarpacoDocument1 pageFco Daw-CarpacoMuhammad SupiyanNo ratings yet

- Sbi Reverse Mortgage LoanDocument4 pagesSbi Reverse Mortgage LoanSukant Suku100% (3)

- Walmart Live Well - Report An Absence - How To Guide (EN) - Nov 2019Document7 pagesWalmart Live Well - Report An Absence - How To Guide (EN) - Nov 2019Jakaria Ahmed0% (2)

- ACU Islamic MortgageDocument4 pagesACU Islamic MortgagetilsidNo ratings yet

- Real Estate Finance Lecture - 3 - 2021Document14 pagesReal Estate Finance Lecture - 3 - 2021Zigma NetworkNo ratings yet

- Diminishing MusharakahDocument16 pagesDiminishing MusharakahhafidhNo ratings yet

- Lesson 4-The Law of MortgagesDocument13 pagesLesson 4-The Law of MortgagesJoseph TabiNo ratings yet

- Loan FinalDocument26 pagesLoan FinalAiza SaraNo ratings yet

- Chapter 6 - Islamic Home LoansDocument7 pagesChapter 6 - Islamic Home LoansVIDHYA A P PANIRSELVAM UnknownNo ratings yet

- Chapter Review Islamic Banking Law 551Document10 pagesChapter Review Islamic Banking Law 551diyanahimanpartnersNo ratings yet

- Mahtab Sir Pres.Document30 pagesMahtab Sir Pres.afsanajahan6758No ratings yet

- Topic 8-Nature of TakafulDocument19 pagesTopic 8-Nature of TakafulMUHAMMAD ZIKRI ZAINUDINNo ratings yet

- EQB Reverse Mortgage Homeowner BrochureDocument11 pagesEQB Reverse Mortgage Homeowner BrochureAlwin WNo ratings yet

- Islamic Finance PresentationDocument21 pagesIslamic Finance PresentationZINEB YDIRNo ratings yet

- CFPB Heloc-Brochure PrintDocument11 pagesCFPB Heloc-Brochure PrintJustinHarjoNo ratings yet

- Reverse Mortgage Guide (October 2023 Version)Document8 pagesReverse Mortgage Guide (October 2023 Version)gsdelacruzNo ratings yet

- Askari Islamic Bank PresentionDocument39 pagesAskari Islamic Bank PresentionAatiqa100% (1)

- Diminishing Musharakah: Center of Islamic FinanceDocument17 pagesDiminishing Musharakah: Center of Islamic Financeshahidkhan53No ratings yet

- Case Facts Principle: IssuesDocument11 pagesCase Facts Principle: IssuesYugenndraNaiduNo ratings yet

- Diminishing Musharakah: Meezan Bank's Guide To Islamic BankingDocument6 pagesDiminishing Musharakah: Meezan Bank's Guide To Islamic BankingSayed Sharif HashimiNo ratings yet

- Difference Between Islamic Banking & Conventional BankingDocument3 pagesDifference Between Islamic Banking & Conventional BankingMuhammad BurhanNo ratings yet

- Olaco v. Co Cho ChitDocument2 pagesOlaco v. Co Cho ChitDGDelfinNo ratings yet

- Unit 2 - ConsiderationDocument43 pagesUnit 2 - ConsiderationMs. Liney Susan VargheseNo ratings yet

- Revocation of GuaranteeDocument13 pagesRevocation of Guaranteeharipriya tharigondaNo ratings yet

- Considering A Reverse Mortgage - Consumer Financial Protection BureauDocument4 pagesConsidering A Reverse Mortgage - Consumer Financial Protection BureauChristopher MillerNo ratings yet

- Diminishing Musharakah MBLDocument17 pagesDiminishing Musharakah MBLAATIF IMTIAZNo ratings yet

- CREDIT Premid 2013-2014Document27 pagesCREDIT Premid 2013-2014alyza burdeosNo ratings yet

- Credit Trans 2Document9 pagesCredit Trans 2Janet AnotdeNo ratings yet

- IHF 18 19 Feb MUL 2013Document44 pagesIHF 18 19 Feb MUL 2013Habib Sultan KhelNo ratings yet

- Webbank Klarna Credit Account AgreementDocument7 pagesWebbank Klarna Credit Account AgreementLori Silva MillerNo ratings yet

- 2016-2017 CredTrans by Sarona (Complete)Document168 pages2016-2017 CredTrans by Sarona (Complete)Devilleres Eliza DenNo ratings yet

- Daily Life - Asking For A Loan: Visit The - C 2009 Praxis Language LTDDocument3 pagesDaily Life - Asking For A Loan: Visit The - C 2009 Praxis Language LTDDiana PalacioNo ratings yet

- Sadat Sadman Anonto - 2013111630Document3 pagesSadat Sadman Anonto - 2013111630sadat.anontoNo ratings yet

- CredTrans LoanDocument95 pagesCredTrans LoanAiza SaraNo ratings yet

- CREDTRANS PRELIMS TSN v3.0 - Complete PDFDocument100 pagesCREDTRANS PRELIMS TSN v3.0 - Complete PDFHanahNo ratings yet

- MGT 489 Sec-16 Name-Adnan Mahfuz Khan ID - 1721938630 Submitted To: Mr. Syed Javed IqbalDocument5 pagesMGT 489 Sec-16 Name-Adnan Mahfuz Khan ID - 1721938630 Submitted To: Mr. Syed Javed IqbalAdnan KhanNo ratings yet

- Islamic ContractDocument7 pagesIslamic ContractnadeemuzairNo ratings yet

- Strategic FinanceDocument15 pagesStrategic FinanceSawaira QureshiNo ratings yet

- Relevant Product: Istisna: Subject of FatwaDocument2 pagesRelevant Product: Istisna: Subject of FatwaMr BalochNo ratings yet

- Topic 3 - Money SkillsDocument11 pagesTopic 3 - Money SkillsNjeri TimothysNo ratings yet

- Diminishing Musharakah - MBL - PpsDocument17 pagesDiminishing Musharakah - MBL - Ppsgul_e_sabaNo ratings yet

- Trust and Equitable Charge 2Document25 pagesTrust and Equitable Charge 2Vivienne Jarlath100% (1)

- IndemnityDocument7 pagesIndemnitysakkarvirani1No ratings yet

- Charitable ContractDocument21 pagesCharitable ContractNUR AIN AZZAHARA ASRINo ratings yet

- You Can Own Property in MexicoDocument2 pagesYou Can Own Property in MexicoDiana HerreraNo ratings yet

- Avtar SinghDocument3 pagesAvtar SinghAJNo ratings yet

- MM Legal IssueDocument6 pagesMM Legal Issuenur atyraNo ratings yet

- Applications of SukukDocument14 pagesApplications of SukukUsama AnsariiNo ratings yet

- Diminishing Musharakah MBLDocument17 pagesDiminishing Musharakah MBLUbaid ArifNo ratings yet

- Meezan Bank PresentationDocument17 pagesMeezan Bank PresentationHussnain RazaNo ratings yet

- Deed of Mortgage (DPC)Document4 pagesDeed of Mortgage (DPC)Rajdeep MukherjeeNo ratings yet

- Ooba Home Buyers Guide A4 PortraitDocument16 pagesOoba Home Buyers Guide A4 PortraitNtando MpiyakheNo ratings yet

- Enforcement of Security Interests in Banking TransactionsDocument20 pagesEnforcement of Security Interests in Banking TransactionsAbhjeet Kumar Sinha100% (2)

- TO Islamic Banking: Naina Jagesha Roll No - 22 Prof-In-Charge-Rashmi MamDocument12 pagesTO Islamic Banking: Naina Jagesha Roll No - 22 Prof-In-Charge-Rashmi Mamnaina_jageshaNo ratings yet

- Credit Trans FinalsDocument145 pagesCredit Trans FinalsCarls Raven DanaoNo ratings yet

- IF 2.5.2020 Diminishing MusharikahDocument17 pagesIF 2.5.2020 Diminishing MusharikahALI SHER HaidriNo ratings yet

- Diminishing MusharakahDocument42 pagesDiminishing Musharakahatiqa tanveerNo ratings yet

- Mortgage and Its Types: Pallavi Chopra Omama Iqbal Shubham Agarwal Anurat Singh Mohit Sharma Vinay VermaDocument11 pagesMortgage and Its Types: Pallavi Chopra Omama Iqbal Shubham Agarwal Anurat Singh Mohit Sharma Vinay VermaSomesh SiddharthNo ratings yet

- Outline Inroductions Difference Between Conventional and Islamic Banking Saving Accounts Instability of The EconomyDocument7 pagesOutline Inroductions Difference Between Conventional and Islamic Banking Saving Accounts Instability of The EconomybilawalNo ratings yet

- Name: Hunaid Ahmed. I.D: 9261. Course: Ibf.: Answer 1Document6 pagesName: Hunaid Ahmed. I.D: 9261. Course: Ibf.: Answer 1HUMNA AFTAB SHAHNo ratings yet

- Adelman and TaylorDocument2 pagesAdelman and TaylorJakaria AhmedNo ratings yet

- Strategies in Facilitating Systemic ChangeDocument2 pagesStrategies in Facilitating Systemic ChangeJakaria AhmedNo ratings yet

- Untitled 3Document2 pagesUntitled 3Jakaria AhmedNo ratings yet

- Untitled 11Document2 pagesUntitled 11Jakaria AhmedNo ratings yet

- Untitled 12Document2 pagesUntitled 12Jakaria AhmedNo ratings yet

- Staff (E.g., Organization Facilitators) - As A Group, Such District Staff HasDocument2 pagesStaff (E.g., Organization Facilitators) - As A Group, Such District Staff HasJakaria AhmedNo ratings yet

- Power From Implies Ability To Resist The Power of Others (Riger, 1993) - enDocument2 pagesPower From Implies Ability To Resist The Power of Others (Riger, 1993) - enJakaria AhmedNo ratings yet

- Key FacetsDocument2 pagesKey FacetsJakaria AhmedNo ratings yet

- Untitled 5Document2 pagesUntitled 5Jakaria AhmedNo ratings yet

- Untitled 6Document2 pagesUntitled 6Jakaria AhmedNo ratings yet

- Systemic Change For School Improvement: Howard S. Adelman and Linda TaylorDocument2 pagesSystemic Change For School Improvement: Howard S. Adelman and Linda TaylorJakaria AhmedNo ratings yet

- Adelman and TaylorDocument2 pagesAdelman and TaylorJakaria AhmedNo ratings yet

- Qualitative Research QualitativeDocument13 pagesQualitative Research QualitativeJakaria AhmedNo ratings yet

- Greater Toronto Area (GTA) Teachers' Perspectives On Teacher EfficacyDocument11 pagesGreater Toronto Area (GTA) Teachers' Perspectives On Teacher EfficacyJakaria AhmedNo ratings yet

- Cambridge Secondary BooklistDocument5 pagesCambridge Secondary BooklistJakaria AhmedNo ratings yet

- Understanding Lesson Planning - GlossaryDocument1 pageUnderstanding Lesson Planning - GlossaryJakaria AhmedNo ratings yet

- ParagraphDocument4 pagesParagraphJakaria Ahmed100% (1)

- Marketing: From Evolution To PresentDocument3 pagesMarketing: From Evolution To PresentJakaria AhmedNo ratings yet

- Student CalendarDocument12 pagesStudent CalendarJakaria AhmedNo ratings yet

- Cambridge Primary BooklistDocument22 pagesCambridge Primary BooklistJakaria Ahmed100% (1)

- Short Term Plan Templete: Pupil(s) / Group: Class Level: Class Teacher: DAY Sunday Monday StrandDocument4 pagesShort Term Plan Templete: Pupil(s) / Group: Class Level: Class Teacher: DAY Sunday Monday StrandJakaria AhmedNo ratings yet

- Government Owned & Controlled CorporationDocument19 pagesGovernment Owned & Controlled CorporationChanz CatlyNo ratings yet

- Tenders: Tender No. Description Last Date of Buying Date of Submission Tender Price R. O THE NotesDocument2 pagesTenders: Tender No. Description Last Date of Buying Date of Submission Tender Price R. O THE NotesAli MustafaNo ratings yet

- 20 Edp 6Document4 pages20 Edp 6coder 69No ratings yet

- KPMG Green Tax Index 2013 PDFDocument40 pagesKPMG Green Tax Index 2013 PDFSandeep K TiwariNo ratings yet

- Evangelita Vs Spouses Andolong III Et - Al.Document1 pageEvangelita Vs Spouses Andolong III Et - Al.Lara CacalNo ratings yet

- 5202 Rashed, With Solution - 123541Document10 pages5202 Rashed, With Solution - 123541RashedNo ratings yet

- Tinkoff Lifestyle Banking StrategyDocument46 pagesTinkoff Lifestyle Banking StrategyLinh Phuong Nguyen PhamNo ratings yet

- Siam Ahmed CV Part 1Document1 pageSiam Ahmed CV Part 1Siam AhmedNo ratings yet

- Financial Derivative AssignmentDocument14 pagesFinancial Derivative AssignmentSriSaraswathyNo ratings yet

- Business Simulation Module 1Document6 pagesBusiness Simulation Module 1Katrina LuzungNo ratings yet

- Group 3 Topic Potential Suppliers Inputs in Production 1Document16 pagesGroup 3 Topic Potential Suppliers Inputs in Production 1Angelo SorianoNo ratings yet

- Managing The Financial of Social VentureDocument13 pagesManaging The Financial of Social VentureNel ButalidNo ratings yet

- University of London (LSE)Document33 pagesUniversity of London (LSE)Dương DươngNo ratings yet

- Farmer's RightsDocument17 pagesFarmer's RightsAlexandra Lee AbanteNo ratings yet

- 2022 10 20 PH S CNVRGDocument7 pages2022 10 20 PH S CNVRGValiente RandzNo ratings yet

- Bonds Payable ReviewDocument6 pagesBonds Payable ReviewJyasmine Aura V. AgustinNo ratings yet

- Alok IndustriesDocument61 pagesAlok IndustriesNeel DesaiNo ratings yet

- Travel Regulations: COPY No.Document77 pagesTravel Regulations: COPY No.Saurav Singh ChauhanNo ratings yet

- Chapter 5 ExercisesDocument11 pagesChapter 5 ExercisesjerryhollywhiteNo ratings yet

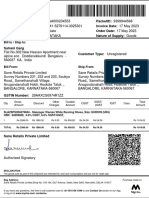

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDocument1 pageBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountSuhani GargNo ratings yet

- Option Chain 25 JuneDocument3 pagesOption Chain 25 JuneRJ LaxmikaantNo ratings yet

- Level 1 Mock Quali Q and AsDocument31 pagesLevel 1 Mock Quali Q and AsJ A M A I C ANo ratings yet

- Dissertation Projects For Mba FinanceDocument7 pagesDissertation Projects For Mba FinanceWriteMyPaperForMoneySiouxFalls100% (1)

- Afar.3202 Corporate LiquidationDocument6 pagesAfar.3202 Corporate Liquidationruel c armillaNo ratings yet

- 86d5d10 2149smartDocument1 page86d5d10 2149smartShailesh JainNo ratings yet

- 4009 Monticello CT Mrs Cindy Thaxton: Make Checks Payable To Og&EDocument1 page4009 Monticello CT Mrs Cindy Thaxton: Make Checks Payable To Og&EA Random GamerNo ratings yet

- Brunswick Distribution CaseDocument6 pagesBrunswick Distribution CaseAmeenii Mukhlis100% (1)

- Kdoe.1 - 2021 - 15.10 - Tran Thi Ha Vi - 1915530542Document19 pagesKdoe.1 - 2021 - 15.10 - Tran Thi Ha Vi - 1915530542Vi TrầnNo ratings yet

- 4.3 Arbitrage Pricing TheoryDocument27 pages4.3 Arbitrage Pricing TheoryJOACIM NALANo ratings yet

How Does The Manitoba Islamic Mortgage Compare With A Conventional Mortgage?

How Does The Manitoba Islamic Mortgage Compare With A Conventional Mortgage?

Uploaded by

Jakaria Ahmed0 ratings0% found this document useful (0 votes)

29 views1 pageThe document compares a Manitoba Islamic Mortgage to a conventional mortgage. The Islamic mortgage is based on a shared ownership concept called "musharaka" where the customer and credit union jointly purchase a home. The customer contributes at least 20% of the purchase price and agrees to purchase the credit union's ownership share over 25 years through periodic payments. With each payment, ownership of the home transfers until the customer owns it solely. In contrast, a conventional mortgage involves the credit union loaning the full purchase amount to the customer, who repays it with interest over 25 years.

Original Description:

Original Title

Untitled5

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document compares a Manitoba Islamic Mortgage to a conventional mortgage. The Islamic mortgage is based on a shared ownership concept called "musharaka" where the customer and credit union jointly purchase a home. The customer contributes at least 20% of the purchase price and agrees to purchase the credit union's ownership share over 25 years through periodic payments. With each payment, ownership of the home transfers until the customer owns it solely. In contrast, a conventional mortgage involves the credit union loaning the full purchase amount to the customer, who repays it with interest over 25 years.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

29 views1 pageHow Does The Manitoba Islamic Mortgage Compare With A Conventional Mortgage?

How Does The Manitoba Islamic Mortgage Compare With A Conventional Mortgage?

Uploaded by

Jakaria AhmedThe document compares a Manitoba Islamic Mortgage to a conventional mortgage. The Islamic mortgage is based on a shared ownership concept called "musharaka" where the customer and credit union jointly purchase a home. The customer contributes at least 20% of the purchase price and agrees to purchase the credit union's ownership share over 25 years through periodic payments. With each payment, ownership of the home transfers until the customer owns it solely. In contrast, a conventional mortgage involves the credit union loaning the full purchase amount to the customer, who repays it with interest over 25 years.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

How does the Manitoba Islamic Mortgage compare

with a Conventional Mortgage?

Manitoba Islamic Mortgage Conventional

Assiniboine Credit Union (ACU) is pleased to offer the Manitoba Islamic Mortgage. It is (musharaka or declining equity partnership) Mortgage

competitively priced and designed specially for the Manitoba Muslim community. Our

Islamic Mortgage Specialists, can assist you to purchase a home or transfer your existing You find the home you want to buy and You find the home you want to buy and

make an offer to purchase. make an offer to purchase.

mortgage to one that is compliant with your Islamic faith.

You enter into a contract with ACU to You arrange a loan from ACU with a

purchase the property together. fixed or variable interest rate.

Designed with the Manitoba The Islamic Financing Arrangement

Muslim Community The Manitoba Islamic Mortgage is based on a shared You contribute at least 20% of the purchase You purchase the home with a down

ACU worked closely with leaders of the Manitoba Islamic ownership concept called ‘musharaka.’ In the context of a price and ACU contributes the rest. payment and the money that ACU lends

Association to develop our specialized Islamic Mortgage mortgage, musharaka is a financing arrangement where Title to the property is registered in to you. Title to the property is registered

for you. It is available only in Manitoba. you and ACU each contribute to the purchase of a home your name, but ACU has a percentage in your name and you have 100% ownership

and each has an ownership share in the property. ownership in the property. in the property.

The ‘Declining Partnership Agreement’ was designed with

You agree to purchase ACU’s ownership You agree to repay the loan from ACU,

and approved by: You enter into a contract with ACU and agree to purchase share over a certain period of time, up to together with interest, over an agreed

ACU’s ownership share over an agreed period of time. 25 years. During this time, you have upon period of time.

• Shaikh Hosni Azzabi (Winnipeg, MB): Scholar of Islam During this time you have exclusive right to live in the exclusive right to live in the home.

and previous Imam for Winnipeg home. In return you agree to pay ACU a profit. At the In return, you agree to pay ACU a profit. You make regular payments to repay

• Dr. Mohammad Iqbal Masood Al-Nadvi (Toronto, ON): end of the contract you are the sole owner of your home. the principal and interest on the loan from

Chair of the Islamic Finance Advisory Board and one You carry out these agreements through ACU. You make these payments through a

a series of renewable payment arrangements series of renewable mortgage agreements

of the few people with authority to give an Islamic About ACU (1 to 5 years) during which you make each for a specified term (1 to 5 years) and

legal ruling (fatwa) Assiniboine Credit union is one of Canada's leading regular payments to ACU. Part of the fixed or variable rate of interest.

• Dr. Monzer Kahf (California, USA): Islamic finance expert financial co-operatives. We are owned by our members payment is to purchase a portion of

at the Islamic Fiqh Academy of the Organization and guided by International Co-operative Principles. ACU’s ownership share and the rest is the Over the course of the mortgage,

of the Islamic Conference (OIC); Shariah advisor to profit amount fixed for that period. you repay the loan in full.

several financial institutions worldwide, and professor

of Islamic banking and finance at Qatar faculty of Over the course of the contract, you purchase

the rest of ACU’s ownership share and

Islamic Studies. become the sole owner of the home.

Some Facts about the Manitoba Islamic Mortgage

Criteria Eligible Property The Declining Partnership Initial Contribution Title to the Property Promise to Buy Payment of Profit Payment Arrangements

As with all our mortgages, This mortgage is available Agreement Your initial contribution The property is registered You agree to purchase While carrying out the You carry out the Promise

you must be a member to purchase an existing The terms and conditions must be a minimum 20% in your name and you ACU’s ownership share in the Promise to Buy you have to Buy through a series

of ACU and meet our property, including a house of the contract with ACU of the purchase price or are responsible for all property over a specified exclusive right to occupy of renewable payment

standard criteria for or condominium, for use as are outlined in the appraised value of the obligations regarding period, up to 25 years. the home. In exchange arrangements, each for

mortgage financing. your primary residence. ‘Declining Partnership home and ACU contributes the property. ACU retains When you make your last for this, and ACU’s initial a specified term ranging

The property must be Agreement.’ It has been the balance. These amounts a percentage ownership, payment at the end of the contribution, you agree to from 1 to 5 years. In each

within Manitoba. At this approved by the ACU establish the percentage secured by the mortgage, Promise to Buy, you will pay ACU a profit. The term you make regular

time, buildings under Islamic Advisory Board for ownership that you and until you have purchased own 100% of your home. profit is comparable to payments to purchase a

construction, revenue use in purchasing a home. ACU have in the property all of ACU’s original the ‘best rate’ ACU would portion of ACU’s original

property, and property Refinancing is available to at the beginning of the contribution. charge for a conventional, contribution and pay the

on leased land are not transfer an existing mortgage contract. closed, fixed-rate mortgage. profit fixed for that period.

eligible. to one that is compliant No additional premium will Payments can be made on

with the Islamic faith. be charged. a weekly, bi-weekly, monthly

or semi-monthly basis.

You might also like

- Fco Daw-CarpacoDocument1 pageFco Daw-CarpacoMuhammad SupiyanNo ratings yet

- Sbi Reverse Mortgage LoanDocument4 pagesSbi Reverse Mortgage LoanSukant Suku100% (3)

- Walmart Live Well - Report An Absence - How To Guide (EN) - Nov 2019Document7 pagesWalmart Live Well - Report An Absence - How To Guide (EN) - Nov 2019Jakaria Ahmed0% (2)

- ACU Islamic MortgageDocument4 pagesACU Islamic MortgagetilsidNo ratings yet

- Real Estate Finance Lecture - 3 - 2021Document14 pagesReal Estate Finance Lecture - 3 - 2021Zigma NetworkNo ratings yet

- Diminishing MusharakahDocument16 pagesDiminishing MusharakahhafidhNo ratings yet

- Lesson 4-The Law of MortgagesDocument13 pagesLesson 4-The Law of MortgagesJoseph TabiNo ratings yet

- Loan FinalDocument26 pagesLoan FinalAiza SaraNo ratings yet

- Chapter 6 - Islamic Home LoansDocument7 pagesChapter 6 - Islamic Home LoansVIDHYA A P PANIRSELVAM UnknownNo ratings yet

- Chapter Review Islamic Banking Law 551Document10 pagesChapter Review Islamic Banking Law 551diyanahimanpartnersNo ratings yet

- Mahtab Sir Pres.Document30 pagesMahtab Sir Pres.afsanajahan6758No ratings yet

- Topic 8-Nature of TakafulDocument19 pagesTopic 8-Nature of TakafulMUHAMMAD ZIKRI ZAINUDINNo ratings yet

- EQB Reverse Mortgage Homeowner BrochureDocument11 pagesEQB Reverse Mortgage Homeowner BrochureAlwin WNo ratings yet

- Islamic Finance PresentationDocument21 pagesIslamic Finance PresentationZINEB YDIRNo ratings yet

- CFPB Heloc-Brochure PrintDocument11 pagesCFPB Heloc-Brochure PrintJustinHarjoNo ratings yet

- Reverse Mortgage Guide (October 2023 Version)Document8 pagesReverse Mortgage Guide (October 2023 Version)gsdelacruzNo ratings yet

- Askari Islamic Bank PresentionDocument39 pagesAskari Islamic Bank PresentionAatiqa100% (1)

- Diminishing Musharakah: Center of Islamic FinanceDocument17 pagesDiminishing Musharakah: Center of Islamic Financeshahidkhan53No ratings yet

- Case Facts Principle: IssuesDocument11 pagesCase Facts Principle: IssuesYugenndraNaiduNo ratings yet

- Diminishing Musharakah: Meezan Bank's Guide To Islamic BankingDocument6 pagesDiminishing Musharakah: Meezan Bank's Guide To Islamic BankingSayed Sharif HashimiNo ratings yet

- Difference Between Islamic Banking & Conventional BankingDocument3 pagesDifference Between Islamic Banking & Conventional BankingMuhammad BurhanNo ratings yet

- Olaco v. Co Cho ChitDocument2 pagesOlaco v. Co Cho ChitDGDelfinNo ratings yet

- Unit 2 - ConsiderationDocument43 pagesUnit 2 - ConsiderationMs. Liney Susan VargheseNo ratings yet

- Revocation of GuaranteeDocument13 pagesRevocation of Guaranteeharipriya tharigondaNo ratings yet

- Considering A Reverse Mortgage - Consumer Financial Protection BureauDocument4 pagesConsidering A Reverse Mortgage - Consumer Financial Protection BureauChristopher MillerNo ratings yet

- Diminishing Musharakah MBLDocument17 pagesDiminishing Musharakah MBLAATIF IMTIAZNo ratings yet

- CREDIT Premid 2013-2014Document27 pagesCREDIT Premid 2013-2014alyza burdeosNo ratings yet

- Credit Trans 2Document9 pagesCredit Trans 2Janet AnotdeNo ratings yet

- IHF 18 19 Feb MUL 2013Document44 pagesIHF 18 19 Feb MUL 2013Habib Sultan KhelNo ratings yet

- Webbank Klarna Credit Account AgreementDocument7 pagesWebbank Klarna Credit Account AgreementLori Silva MillerNo ratings yet

- 2016-2017 CredTrans by Sarona (Complete)Document168 pages2016-2017 CredTrans by Sarona (Complete)Devilleres Eliza DenNo ratings yet

- Daily Life - Asking For A Loan: Visit The - C 2009 Praxis Language LTDDocument3 pagesDaily Life - Asking For A Loan: Visit The - C 2009 Praxis Language LTDDiana PalacioNo ratings yet

- Sadat Sadman Anonto - 2013111630Document3 pagesSadat Sadman Anonto - 2013111630sadat.anontoNo ratings yet

- CredTrans LoanDocument95 pagesCredTrans LoanAiza SaraNo ratings yet

- CREDTRANS PRELIMS TSN v3.0 - Complete PDFDocument100 pagesCREDTRANS PRELIMS TSN v3.0 - Complete PDFHanahNo ratings yet

- MGT 489 Sec-16 Name-Adnan Mahfuz Khan ID - 1721938630 Submitted To: Mr. Syed Javed IqbalDocument5 pagesMGT 489 Sec-16 Name-Adnan Mahfuz Khan ID - 1721938630 Submitted To: Mr. Syed Javed IqbalAdnan KhanNo ratings yet

- Islamic ContractDocument7 pagesIslamic ContractnadeemuzairNo ratings yet

- Strategic FinanceDocument15 pagesStrategic FinanceSawaira QureshiNo ratings yet

- Relevant Product: Istisna: Subject of FatwaDocument2 pagesRelevant Product: Istisna: Subject of FatwaMr BalochNo ratings yet

- Topic 3 - Money SkillsDocument11 pagesTopic 3 - Money SkillsNjeri TimothysNo ratings yet

- Diminishing Musharakah - MBL - PpsDocument17 pagesDiminishing Musharakah - MBL - Ppsgul_e_sabaNo ratings yet

- Trust and Equitable Charge 2Document25 pagesTrust and Equitable Charge 2Vivienne Jarlath100% (1)

- IndemnityDocument7 pagesIndemnitysakkarvirani1No ratings yet

- Charitable ContractDocument21 pagesCharitable ContractNUR AIN AZZAHARA ASRINo ratings yet

- You Can Own Property in MexicoDocument2 pagesYou Can Own Property in MexicoDiana HerreraNo ratings yet

- Avtar SinghDocument3 pagesAvtar SinghAJNo ratings yet

- MM Legal IssueDocument6 pagesMM Legal Issuenur atyraNo ratings yet

- Applications of SukukDocument14 pagesApplications of SukukUsama AnsariiNo ratings yet

- Diminishing Musharakah MBLDocument17 pagesDiminishing Musharakah MBLUbaid ArifNo ratings yet

- Meezan Bank PresentationDocument17 pagesMeezan Bank PresentationHussnain RazaNo ratings yet

- Deed of Mortgage (DPC)Document4 pagesDeed of Mortgage (DPC)Rajdeep MukherjeeNo ratings yet

- Ooba Home Buyers Guide A4 PortraitDocument16 pagesOoba Home Buyers Guide A4 PortraitNtando MpiyakheNo ratings yet

- Enforcement of Security Interests in Banking TransactionsDocument20 pagesEnforcement of Security Interests in Banking TransactionsAbhjeet Kumar Sinha100% (2)

- TO Islamic Banking: Naina Jagesha Roll No - 22 Prof-In-Charge-Rashmi MamDocument12 pagesTO Islamic Banking: Naina Jagesha Roll No - 22 Prof-In-Charge-Rashmi Mamnaina_jageshaNo ratings yet

- Credit Trans FinalsDocument145 pagesCredit Trans FinalsCarls Raven DanaoNo ratings yet

- IF 2.5.2020 Diminishing MusharikahDocument17 pagesIF 2.5.2020 Diminishing MusharikahALI SHER HaidriNo ratings yet

- Diminishing MusharakahDocument42 pagesDiminishing Musharakahatiqa tanveerNo ratings yet

- Mortgage and Its Types: Pallavi Chopra Omama Iqbal Shubham Agarwal Anurat Singh Mohit Sharma Vinay VermaDocument11 pagesMortgage and Its Types: Pallavi Chopra Omama Iqbal Shubham Agarwal Anurat Singh Mohit Sharma Vinay VermaSomesh SiddharthNo ratings yet

- Outline Inroductions Difference Between Conventional and Islamic Banking Saving Accounts Instability of The EconomyDocument7 pagesOutline Inroductions Difference Between Conventional and Islamic Banking Saving Accounts Instability of The EconomybilawalNo ratings yet

- Name: Hunaid Ahmed. I.D: 9261. Course: Ibf.: Answer 1Document6 pagesName: Hunaid Ahmed. I.D: 9261. Course: Ibf.: Answer 1HUMNA AFTAB SHAHNo ratings yet

- Adelman and TaylorDocument2 pagesAdelman and TaylorJakaria AhmedNo ratings yet

- Strategies in Facilitating Systemic ChangeDocument2 pagesStrategies in Facilitating Systemic ChangeJakaria AhmedNo ratings yet

- Untitled 3Document2 pagesUntitled 3Jakaria AhmedNo ratings yet

- Untitled 11Document2 pagesUntitled 11Jakaria AhmedNo ratings yet

- Untitled 12Document2 pagesUntitled 12Jakaria AhmedNo ratings yet

- Staff (E.g., Organization Facilitators) - As A Group, Such District Staff HasDocument2 pagesStaff (E.g., Organization Facilitators) - As A Group, Such District Staff HasJakaria AhmedNo ratings yet

- Power From Implies Ability To Resist The Power of Others (Riger, 1993) - enDocument2 pagesPower From Implies Ability To Resist The Power of Others (Riger, 1993) - enJakaria AhmedNo ratings yet

- Key FacetsDocument2 pagesKey FacetsJakaria AhmedNo ratings yet

- Untitled 5Document2 pagesUntitled 5Jakaria AhmedNo ratings yet

- Untitled 6Document2 pagesUntitled 6Jakaria AhmedNo ratings yet

- Systemic Change For School Improvement: Howard S. Adelman and Linda TaylorDocument2 pagesSystemic Change For School Improvement: Howard S. Adelman and Linda TaylorJakaria AhmedNo ratings yet

- Adelman and TaylorDocument2 pagesAdelman and TaylorJakaria AhmedNo ratings yet

- Qualitative Research QualitativeDocument13 pagesQualitative Research QualitativeJakaria AhmedNo ratings yet

- Greater Toronto Area (GTA) Teachers' Perspectives On Teacher EfficacyDocument11 pagesGreater Toronto Area (GTA) Teachers' Perspectives On Teacher EfficacyJakaria AhmedNo ratings yet

- Cambridge Secondary BooklistDocument5 pagesCambridge Secondary BooklistJakaria AhmedNo ratings yet

- Understanding Lesson Planning - GlossaryDocument1 pageUnderstanding Lesson Planning - GlossaryJakaria AhmedNo ratings yet

- ParagraphDocument4 pagesParagraphJakaria Ahmed100% (1)

- Marketing: From Evolution To PresentDocument3 pagesMarketing: From Evolution To PresentJakaria AhmedNo ratings yet

- Student CalendarDocument12 pagesStudent CalendarJakaria AhmedNo ratings yet

- Cambridge Primary BooklistDocument22 pagesCambridge Primary BooklistJakaria Ahmed100% (1)

- Short Term Plan Templete: Pupil(s) / Group: Class Level: Class Teacher: DAY Sunday Monday StrandDocument4 pagesShort Term Plan Templete: Pupil(s) / Group: Class Level: Class Teacher: DAY Sunday Monday StrandJakaria AhmedNo ratings yet

- Government Owned & Controlled CorporationDocument19 pagesGovernment Owned & Controlled CorporationChanz CatlyNo ratings yet

- Tenders: Tender No. Description Last Date of Buying Date of Submission Tender Price R. O THE NotesDocument2 pagesTenders: Tender No. Description Last Date of Buying Date of Submission Tender Price R. O THE NotesAli MustafaNo ratings yet

- 20 Edp 6Document4 pages20 Edp 6coder 69No ratings yet

- KPMG Green Tax Index 2013 PDFDocument40 pagesKPMG Green Tax Index 2013 PDFSandeep K TiwariNo ratings yet

- Evangelita Vs Spouses Andolong III Et - Al.Document1 pageEvangelita Vs Spouses Andolong III Et - Al.Lara CacalNo ratings yet

- 5202 Rashed, With Solution - 123541Document10 pages5202 Rashed, With Solution - 123541RashedNo ratings yet

- Tinkoff Lifestyle Banking StrategyDocument46 pagesTinkoff Lifestyle Banking StrategyLinh Phuong Nguyen PhamNo ratings yet

- Siam Ahmed CV Part 1Document1 pageSiam Ahmed CV Part 1Siam AhmedNo ratings yet

- Financial Derivative AssignmentDocument14 pagesFinancial Derivative AssignmentSriSaraswathyNo ratings yet

- Business Simulation Module 1Document6 pagesBusiness Simulation Module 1Katrina LuzungNo ratings yet

- Group 3 Topic Potential Suppliers Inputs in Production 1Document16 pagesGroup 3 Topic Potential Suppliers Inputs in Production 1Angelo SorianoNo ratings yet

- Managing The Financial of Social VentureDocument13 pagesManaging The Financial of Social VentureNel ButalidNo ratings yet

- University of London (LSE)Document33 pagesUniversity of London (LSE)Dương DươngNo ratings yet

- Farmer's RightsDocument17 pagesFarmer's RightsAlexandra Lee AbanteNo ratings yet

- 2022 10 20 PH S CNVRGDocument7 pages2022 10 20 PH S CNVRGValiente RandzNo ratings yet

- Bonds Payable ReviewDocument6 pagesBonds Payable ReviewJyasmine Aura V. AgustinNo ratings yet

- Alok IndustriesDocument61 pagesAlok IndustriesNeel DesaiNo ratings yet

- Travel Regulations: COPY No.Document77 pagesTravel Regulations: COPY No.Saurav Singh ChauhanNo ratings yet

- Chapter 5 ExercisesDocument11 pagesChapter 5 ExercisesjerryhollywhiteNo ratings yet

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDocument1 pageBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountSuhani GargNo ratings yet

- Option Chain 25 JuneDocument3 pagesOption Chain 25 JuneRJ LaxmikaantNo ratings yet

- Level 1 Mock Quali Q and AsDocument31 pagesLevel 1 Mock Quali Q and AsJ A M A I C ANo ratings yet

- Dissertation Projects For Mba FinanceDocument7 pagesDissertation Projects For Mba FinanceWriteMyPaperForMoneySiouxFalls100% (1)

- Afar.3202 Corporate LiquidationDocument6 pagesAfar.3202 Corporate Liquidationruel c armillaNo ratings yet

- 86d5d10 2149smartDocument1 page86d5d10 2149smartShailesh JainNo ratings yet

- 4009 Monticello CT Mrs Cindy Thaxton: Make Checks Payable To Og&EDocument1 page4009 Monticello CT Mrs Cindy Thaxton: Make Checks Payable To Og&EA Random GamerNo ratings yet

- Brunswick Distribution CaseDocument6 pagesBrunswick Distribution CaseAmeenii Mukhlis100% (1)

- Kdoe.1 - 2021 - 15.10 - Tran Thi Ha Vi - 1915530542Document19 pagesKdoe.1 - 2021 - 15.10 - Tran Thi Ha Vi - 1915530542Vi TrầnNo ratings yet

- 4.3 Arbitrage Pricing TheoryDocument27 pages4.3 Arbitrage Pricing TheoryJOACIM NALANo ratings yet