Professional Documents

Culture Documents

Corporate Finance Project Stocks Hitachi-1

Corporate Finance Project Stocks Hitachi-1

Uploaded by

Shivangi Gupta Student, Jaipuria LucknowCopyright:

Available Formats

You might also like

- Matlab Code For Graphical Development of Fanno LineDocument2 pagesMatlab Code For Graphical Development of Fanno Lineaff123051No ratings yet

- 33 As Statistics Unit 5 TestDocument2 pages33 As Statistics Unit 5 TestThomas BeerNo ratings yet

- Matlab Code For Graphical Development of Rayleigh LineDocument2 pagesMatlab Code For Graphical Development of Rayleigh Lineaff123051No ratings yet

- Lecture 5 (Bivariate ND & Error Ellipses)Document5 pagesLecture 5 (Bivariate ND & Error Ellipses)Kismet100% (4)

- Diseño de ColumnasDocument17 pagesDiseño de ColumnasAmerico FloresNo ratings yet

- P Vs T PentanolDocument6 pagesP Vs T PentanolLaura Valentina Villalobos CastroNo ratings yet

- 65 b2203958 Lê Phương Thảo Dbdl3Document15 pages65 b2203958 Lê Phương Thảo Dbdl3lephuongthao19042004No ratings yet

- Ejemplo de Minimos CuadradosDocument6 pagesEjemplo de Minimos CuadradosJeam pool Chacchi guzmanNo ratings yet

- Tema: Mapas de Base y Tope Del Pozo Cabo Blanco, Calculo de Reserva de La Arena PetroliferaDocument7 pagesTema: Mapas de Base y Tope Del Pozo Cabo Blanco, Calculo de Reserva de La Arena PetroliferaMaricielo Quiros ChasqueroNo ratings yet

- Statistic ADocument9 pagesStatistic ACosmin VoicuNo ratings yet

- Cálculos Muestra37-S3 200 080515Document798 pagesCálculos Muestra37-S3 200 080515Laura_Cruz_GilNo ratings yet

- Area Weightage % CalculationDocument1 pageArea Weightage % CalculationRamen SarmaNo ratings yet

- Dự Báo Định Lượng - Tuần 2 - Ví DụDocument18 pagesDự Báo Định Lượng - Tuần 2 - Ví Dụphanngocduy2004.2019No ratings yet

- Modelo I - Ing. de Procesos - Uii - Hoja 1Document1 pageModelo I - Ing. de Procesos - Uii - Hoja 1MerryNo ratings yet

- Abstract MR 1Document41 pagesAbstract MR 1sreenivasulumNo ratings yet

- Winters Model Excel For SPCDocument14 pagesWinters Model Excel For SPCNitin ShankarNo ratings yet

- Distribusi Probabilitas A. DP GumbelDocument15 pagesDistribusi Probabilitas A. DP GumbelNoval AznurNo ratings yet

- Raport Gestiune ZilnicDocument10 pagesRaport Gestiune ZilnicBanu FerdaNo ratings yet

- Datos: Modelo de Regresión Lineal Simple Paso A PasoDocument27 pagesDatos: Modelo de Regresión Lineal Simple Paso A Pasowilson hidalgoNo ratings yet

- DDUGKY Salary - Employee-Wise - 2020-21 Final (00000002)Document291 pagesDDUGKY Salary - Employee-Wise - 2020-21 Final (00000002)stutiNo ratings yet

- Ventura, Mary Mickaella R - RetirementplanDocument6 pagesVentura, Mary Mickaella R - RetirementplanMary VenturaNo ratings yet

- Apa 610Document2 pagesApa 610Ciobanu Elena LuizaNo ratings yet

- Chart TitleDocument4 pagesChart TitleLeidy Coral YMNo ratings yet

- 2.multiple Regression Example No Home SalesDocument7 pages2.multiple Regression Example No Home SalesGirish KurkureNo ratings yet

- MCMC ResultsDocument23 pagesMCMC ResultsAuref RostamianNo ratings yet

- Diag. InteraccionDocument32 pagesDiag. InteraccionMauricio CalderonestelaNo ratings yet

- IV. Data, Perhitungan, Dan Grafik IV.1 Tabel Data IV.1.1 Uji Tarik Besi (Fe)Document17 pagesIV. Data, Perhitungan, Dan Grafik IV.1 Tabel Data IV.1.1 Uji Tarik Besi (Fe)Kukuh KDSNo ratings yet

- Hasil PenelitianDocument10 pagesHasil PenelitianmuslimNo ratings yet

- 207.52 STT Thời gian (phút) Khối lượng khay và VL (g) Khối lượng VL (g) W MDocument13 pages207.52 STT Thời gian (phút) Khối lượng khay và VL (g) Khối lượng VL (g) W MNguyễn PhanNo ratings yet

- Solargis RichbondDocument21 pagesSolargis RichbondSOUKAINANo ratings yet

- Yea-Tos-S606 11 ADocument1 pageYea-Tos-S606 11 AMikolaj KopernikNo ratings yet

- Group3 ChE3105 Computational Lab SolThermoDocument18 pagesGroup3 ChE3105 Computational Lab SolThermoDarlene FranciaNo ratings yet

- Pit Final 55kDocument15 pagesPit Final 55kBENJAMIN CHIHUANTITO KCANANo ratings yet

- I:/Lubes Crude Distillation/ephyde/example - Out: TBP AstmDocument8 pagesI:/Lubes Crude Distillation/ephyde/example - Out: TBP AstmEHNo ratings yet

- Dự Báo Định Lượng - Tuần 3 - Ví DụDocument8 pagesDự Báo Định Lượng - Tuần 3 - Ví Dụlephuongthao19042004No ratings yet

- 1.2.c Weigthed Moving Average A ExerciseDocument3 pages1.2.c Weigthed Moving Average A ExercisesidneyNo ratings yet

- GDP and ExportDocument13 pagesGDP and ExportpybyttydaylasdyctpNo ratings yet

- Fish Catch Data (1101)Document35 pagesFish Catch Data (1101)Gautam BindlishNo ratings yet

- Order Status Custom Date - Custom Date From 19/09/2021 To 19/09/2021Document12 pagesOrder Status Custom Date - Custom Date From 19/09/2021 To 19/09/2021sayem00001No ratings yet

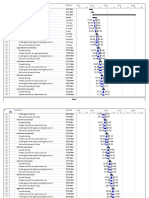

- Telangana State Public Service Commission::Hyderabad Forest Range Officer in Forest Department (Efs&T) NOTIFICATION NO.46/2017Document3 pagesTelangana State Public Service Commission::Hyderabad Forest Range Officer in Forest Department (Efs&T) NOTIFICATION NO.46/2017manikanth reddyNo ratings yet

- Econometrics Assignment 3Document16 pagesEconometrics Assignment 3Palak SharmaNo ratings yet

- Diagrama de Interaccion PILON (Ø16mmc/20cm)Document12 pagesDiagrama de Interaccion PILON (Ø16mmc/20cm)jhasmanyNo ratings yet

- V. Numerica Discreta V. Numerica Continua V. Numerica Continua V. Numerica Discreta Id Area Peri Shape PermDocument8 pagesV. Numerica Discreta V. Numerica Continua V. Numerica Continua V. Numerica Discreta Id Area Peri Shape PermLuis CarlosNo ratings yet

- Estimasi Sasaran Program Tahun 2017Document3 pagesEstimasi Sasaran Program Tahun 2017JoeKronjoNo ratings yet

- New Microsoft Excel Worksheet-17.10.2023Document6 pagesNew Microsoft Excel Worksheet-17.10.2023infoNo ratings yet

- Sasaran Program 2Document3 pagesSasaran Program 2JoeKronjoNo ratings yet

- Ies Indoor Report Photometric Filename: Bs101Ecoled4Sawt40120V-277V - P.Ies DESCRIPTION INFORMATION (From Photometric File)Document11 pagesIes Indoor Report Photometric Filename: Bs101Ecoled4Sawt40120V-277V - P.Ies DESCRIPTION INFORMATION (From Photometric File)Ankit JainNo ratings yet

- ASSESMENT YEAR 2007 TO 2008 .: BesikDocument23 pagesASSESMENT YEAR 2007 TO 2008 .: BesikprabhakarkarbharNo ratings yet

- Lectuer Multiple Reg-1-28-12-2021Document4 pagesLectuer Multiple Reg-1-28-12-2021Usman GhaniNo ratings yet

- 19th Hole-Lâm Hoàng KimDocument8 pages19th Hole-Lâm Hoàng Kimlamhoangkim23022003No ratings yet

- Temperature Thermistor Resistance Theorical ADC Value °C °F Kelvin Ω Input (V) Output (12bits)Document2 pagesTemperature Thermistor Resistance Theorical ADC Value °C °F Kelvin Ω Input (V) Output (12bits)doppler9effectNo ratings yet

- Hot Deformed BarDocument16 pagesHot Deformed Barmuhammad haroonNo ratings yet

- Simple DetectionDocument3 pagesSimple DetectionCheslyn EspadaNo ratings yet

- Nota: Introduzca Los Alphas: SES Alpha 1Document4 pagesNota: Introduzca Los Alphas: SES Alpha 1Paulo Pereira MongeNo ratings yet

- ProračunDocument6 pagesProračunEmina BošnjakovićNo ratings yet

- HidrologiDocument10 pagesHidrologiRika Novia PutriNo ratings yet

- Myfsa2u RepaymentDocument1 pageMyfsa2u RepaymentAhmad MNo ratings yet

- Exercise On Flood Routing JOSE 455 15Document5 pagesExercise On Flood Routing JOSE 455 15Gail Nathalie LiraNo ratings yet

- Height Diameter at Breast Heightbark Thickness: Regression StatisticsDocument27 pagesHeight Diameter at Breast Heightbark Thickness: Regression StatisticsJasonNo ratings yet

- ISA Temp and Pressures vs. AltitudeDocument5 pagesISA Temp and Pressures vs. AltitudeRalph SandfordNo ratings yet

- United States Census Figures Back to 1630From EverandUnited States Census Figures Back to 1630No ratings yet

- Null Hypothesis: There Is No Difference in The Waiting Time With Token and Without Tokens Alternate Hypothesis: H: There Is Difference in The Waiting Time With Token and Without TokensDocument3 pagesNull Hypothesis: There Is No Difference in The Waiting Time With Token and Without Tokens Alternate Hypothesis: H: There Is Difference in The Waiting Time With Token and Without Tokensphewphewphew200No ratings yet

- Productivity Compensation Regression1Document3 pagesProductivity Compensation Regression1phewphewphew200No ratings yet

- 9Document2 pages9phewphewphew200No ratings yet

- Surat Bhumi SOR - W.E.F. - 01-06-2014Document5 pagesSurat Bhumi SOR - W.E.F. - 01-06-2014phewphewphew200No ratings yet

- Construction Solutions OverseasDocument30 pagesConstruction Solutions Overseasphewphewphew200No ratings yet

- Acuro Organics Limited PDFDocument25 pagesAcuro Organics Limited PDFphewphewphew200No ratings yet

- Epudur I: Ultra-High Performance Concrete For Machine BedsDocument12 pagesEpudur I: Ultra-High Performance Concrete For Machine Bedsphewphewphew200No ratings yet

- Ultra High Performance Concrete (Uhpc) : Npca White PaperDocument19 pagesUltra High Performance Concrete (Uhpc) : Npca White Paperphewphewphew200No ratings yet

- Project After PertDocument4 pagesProject After Pertphewphewphew200No ratings yet

- Project: Project 1.1 Date: Thu 19-01-17Document2 pagesProject: Project 1.1 Date: Thu 19-01-17phewphewphew200No ratings yet

- Design of SlabDocument12 pagesDesign of Slabphewphewphew200No ratings yet

- Design of Column: U CK C y SC CT SC 2 CT SC SC 2Document2 pagesDesign of Column: U CK C y SC CT SC 2 CT SC SC 2phewphewphew200No ratings yet

- Measures of Location Averages: Arithmetic Average .148 Correct Average .145321Document15 pagesMeasures of Location Averages: Arithmetic Average .148 Correct Average .145321Nel BorniaNo ratings yet

- Opm101chapter8 000Document43 pagesOpm101chapter8 000Manprita BasumataryNo ratings yet

- Lecture - 4 - Classification - Logistic RegressionDocument32 pagesLecture - 4 - Classification - Logistic RegressionbberkcanNo ratings yet

- Coefficient of Variation (Meaning and InterpretationDocument10 pagesCoefficient of Variation (Meaning and Interpretationwawan GunawanNo ratings yet

- Design and Analysis of Experiments: David Yanez Department of Biostatistics University of WashingtonDocument27 pagesDesign and Analysis of Experiments: David Yanez Department of Biostatistics University of WashingtonNguyen TriNo ratings yet

- Gsa 1Document14 pagesGsa 1Afza MaisarahNo ratings yet

- 2020 Math ATextpart 2Document204 pages2020 Math ATextpart 2ValerieNo ratings yet

- Uji Statistik: Frequencies StatisticsDocument6 pagesUji Statistik: Frequencies StatisticsAndi JhumpyooNo ratings yet

- Home Assignment CO2Document3 pagesHome Assignment CO2kowshik emmadisettyNo ratings yet

- Third Year Nursing Research and Stastics 51-62Document12 pagesThird Year Nursing Research and Stastics 51-62Nosy ParkerNo ratings yet

- Tabel Binomial IndividualDocument4 pagesTabel Binomial IndividualFerdiawan Hadi SusantoNo ratings yet

- PPT09 - Simple Linear Regression and CorrelationDocument53 pagesPPT09 - Simple Linear Regression and CorrelationaekimNo ratings yet

- Demo StatDocument5 pagesDemo StatCalventas Tualla Khaye JhayeNo ratings yet

- Final Exam - Quantitative1Document9 pagesFinal Exam - Quantitative1Laarnie BbbbNo ratings yet

- Name: Goutam Mandal Roll No: 1916034 PGPEM-2019 Assignment-IIDocument11 pagesName: Goutam Mandal Roll No: 1916034 PGPEM-2019 Assignment-IIGoutam MandalNo ratings yet

- Copulas Bivariate Option PricingDocument14 pagesCopulas Bivariate Option PricingRenan CintraNo ratings yet

- Estimation of ParametersDocument37 pagesEstimation of ParametersReflecta123No ratings yet

- 4 - Analyze - Intro To Hypothesis TestingDocument29 pages4 - Analyze - Intro To Hypothesis TestingParaschivescu CristinaNo ratings yet

- Federal Urdu University (Abdul Haq)Document10 pagesFederal Urdu University (Abdul Haq)Anee NoushadNo ratings yet

- ARIMA Forecasting Using RDocument9 pagesARIMA Forecasting Using RTalhaNo ratings yet

- Syllabus 321-02 Fall 11Document4 pagesSyllabus 321-02 Fall 11tiberianxzeroNo ratings yet

- 11 Acceptance Sampling SSPDocument29 pages11 Acceptance Sampling SSPbhabatosh pandaNo ratings yet

- (GAM) Application PDFDocument30 pages(GAM) Application PDFannisa rahmasariNo ratings yet

- Chapter 4 ExercisesDocument2 pagesChapter 4 ExercisesGracielle Buera20% (5)

- SPC XL 2010 For Microsoft Excel: Use The Links Below To Explore The Examples Control Chart ExamplesDocument56 pagesSPC XL 2010 For Microsoft Excel: Use The Links Below To Explore The Examples Control Chart ExamplesRavindra ErabattiNo ratings yet

- IBM SPSS Step-by-Step Guide - Histograms and Descriptive Statistics (PDF)Document4 pagesIBM SPSS Step-by-Step Guide - Histograms and Descriptive Statistics (PDF)Melfran Valera ReyesNo ratings yet

- Data Reduction TechniquesDocument10 pagesData Reduction TechniquesVinjamuri Joshi ManoharNo ratings yet

- Final Exam Answer Scheme (Set A)Document18 pagesFinal Exam Answer Scheme (Set A)Mohammad FaisalNo ratings yet

Corporate Finance Project Stocks Hitachi-1

Corporate Finance Project Stocks Hitachi-1

Uploaded by

Shivangi Gupta Student, Jaipuria LucknowOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Corporate Finance Project Stocks Hitachi-1

Corporate Finance Project Stocks Hitachi-1

Uploaded by

Shivangi Gupta Student, Jaipuria LucknowCopyright:

Available Formats

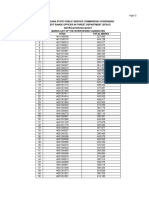

SUMMARY OUTPUT

Regression Statistics

Multiple R 0.3597371833

R Square 0.1294108411

Adjusted R Square 0.1144006832

Standard Error 0.0928501746

Observations 60

ANOVA

df SS MS F Significance F

Regression 1 0.0743277263 0.074328 8.621551 0.0047565652

Residual 58 0.50002698527 0.008621

Total 59 0.57435471157

Coefficients Standard Error t Stat P-value Lower 95% Upper 95%

Intercept -0.0002453514 0.01243970566 -0.019723 0.984332 -0.0251461278 0.0246554249

X Variable 1 0.6640536542 0.22615722759 2.936248 0.004757 0.2113507776 1.1167565308

R hitachi= a+b R nifty

a -0.000245

b 0.664054 MARKET RISK

11% change in stocks of Hitachi is due to change in Nifty.

Lower 95.0% Upper 95.0%

-0.0251461278 0.0246554249

0.2113507776 1.1167565308

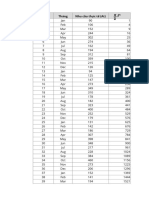

DATE NIFTY SECTOR INDEX M&M Nifty ret Sector index ret M&M ret

1-Nov-16 8,224.50 9,113.80 592.55

1-Dec-16 8,185.80 9,141.75 592.35 -0.47% 0.31% -0.03%

1-Jan-17 8,561.30 9,837.75 620.05 4.59% 7.61% 4.68%

1-Feb-17 8,879.60 9,654.65 656.08 3.72% -1.86% 5.81%

1-Mar-17 9,173.75 9,880.20 643.45 3.31% 2.34% -1.93%

1-Apr-17 9,304.05 10,255.15 667.78 1.42% 3.79% 3.78%

1-May-17 9,621.25 10,870.80 708.47 3.41% 6.00% 6.09%

1-Jun-17 9,520.90 10,540.25 674.3 -1.04% -3.04% -4.82%

1-Jul-17 10,077.10 11,002.65 701.65 5.84% 4.39% 4.06%

1-Aug-17 9,917.90 10,612.55 672.4 -1.58% -3.55% -4.17%

1-Sep-17 9,788.60 10,811.25 627.13 -1.30% 1.87% -6.73%

1-Oct-17 10,335.30 11,370.00 672.4 5.59% 5.17% 7.22%

1-Nov-17 10,226.55 11,292.90 703.28 -1.05% -0.68% 4.59%

1-Dec-17 10,530.70 12,009.70 751.1 2.97% 6.35% 6.80%

1-Jan-18 11,027.70 11,611.90 763.05 4.72% -3.31% 1.59%

1-Feb-18 10,492.85 11,157.20 728.35 -4.85% -3.92% -4.55%

1-Mar-18 10,113.70 10,821.35 738.9 -3.61% -3.01% 1.45%

1-Apr-18 10,739.35 11,625.75 873.3 6.19% 7.43% 18.19%

1-May-18 10,736.15 10,994.45 922.95 -0.03% -5.43% 5.69%

1-Jun-18 10,714.30 10,709.05 897.7 -0.20% -2.60% -2.74%

1-Jul-18 11,356.50 10,973.75 935.95 5.99% 2.47% 4.26%

1-Aug-18 11,680.50 11,009.25 965.3 2.85% 0.32% 3.14%

1-Sep-18 10,930.45 9,590.25 860.95 -6.42% -12.89% -10.81%

1-Oct-18 10,386.60 8,820.55 765.95 -4.98% -8.03% -11.03%

1-Nov-18 10,876.75 9,270.20 790.9 4.72% 5.10% 3.26%

1-Dec-18 10,862.55 9,235.55 803.85 -0.13% -0.37% 1.64%

1-Jan-19 10,830.95 8,218.40 680.05 -0.29% -11.01% -15.40%

1-Feb-19 10,792.50 8,355.15 645.9 -0.36% 1.66% -5.02%

1-Mar-19 11,623.90 8,335.35 673.9 7.70% -0.24% 4.34%

1-Apr-19 11,748.15 8,350.60 645.3 1.07% 0.18% -4.24%

1-May-19 11,922.80 8,175.50 647.05 1.49% -2.10% 0.27%

1-Jun-19 11,788.85 7,928.05 655.35 -1.12% -3.03% 1.28%

1-Jul-19 11,118.00 6,851.65 550 -5.69% -13.58% -16.08%

1-Aug-19 11,023.25 7,009.30 528.8 -0.85% 2.30% -3.85%

1-Sep-19 11,474.45 7,493.15 547.15 4.09% 6.90% 3.47%

1-Oct-19 11,877.45 8,449.50 606.45 3.51% 12.76% 10.84%

1-Nov-19 12,056.05 8,086.00 530.55 1.50% -4.30% -12.52%

1-Dec-19 12,168.45 8,248.30 531.55 0.93% 2.01% 0.19%

1-Jan-20 11,962.10 8,086.55 567.15 -1.70% -1.96% 6.70%

1-Feb-20 11,201.75 6,903.95 457.05 -6.36% -14.62% -19.41%

1-Mar-20 8,597.75 4,731.30 284.95 -23.25% -31.47% -37.65%

1-Apr-20 9,859.90 5,901.40 366.65 14.68% 24.73% 28.67%

1-May-20 9,580.30 6,218.80 436.35 -2.84% 5.38% 19.01%

1-Jun-20 10,302.10 6,719.15 510.7 7.53% 8.05% 17.04%

1-Jul-20 11,073.45 7,279.75 606.45 7.49% 8.34% 18.75%

1-Aug-20 11,387.50 7,840.35 606.9 2.84% 7.70% 0.07%

1-Sep-20 11,247.55 7,908.10 607.9 -1.23% 0.86% 0.16%

1-Oct-20 11,642.40 7,758.40 594 3.51% -1.89% -2.29%

1-Nov-20 12,968.95 8,891.60 722 11.39% 14.61% 21.55%

1-Dec-20 13,981.75 9,193.50 720.6 7.81% 3.40% -0.19%

1-Jan-21 13,634.60 9,813.15 749.6 -2.48% 6.74% 4.02%

1-Feb-21 14,529.15 10,169.90 806.4 6.56% 3.64% 7.58%

1-Mar-21 14,690.70 9,862.45 795.25 1.11% -3.02% -1.38%

1-Apr-21 14,631.10 9,640.85 752.55 -0.41% -2.25% -5.37%

1-May-21 15,582.80 10,491.85 807.95 6.50% 8.83% 7.36%

1-Jun-21 15,721.50 10,600.35 777.7 0.89% 1.03% -3.74%

1-Jul-21 15,763.05 10,048.50 743.1 0.26% -5.21% -4.45%

1-Aug-21 17,132.20 10,034.45 793.3 8.69% -0.14% 6.76%

1-Sep-21 17,618.15 10,598.45 803.05 2.84% 5.62% 1.23%

1-Oct-21 17,671.65 11,297.45 884.25 0.30% 6.60% 10.11%

1-Nov-21 18,102.75 10,603.55 835.5 2.44% -6.14% -5.51%

Average 1.47% 0.58% 1.13%

Absolute 5 yr 120.11% 16.35% 41.00%

Annual SI 24.02 3.27 8.20

CAGR 17% 3% 7%

SD 5.34% 7.94% 10.33%

Prob(Ret<0) 39.16% 47.08% 45.65%

Prob(Ret<-5) 11.30% 24.12% 27.66%

COMPANY Beta 1.5018024

SECTOR Beta 1.20333296

LEVERED BETA AND UNLEVERED BETA

βL=βU{1+Debt/Equity(1-Tax)}

Year Debt

2017 680.29

2018 720.9

2019 954.78

2020 895.55

2021 920.77

Average Debt/Equity Ratio 1.40522310678605

CAPM MODEL

Rf+(Rm-Rf)*βL

Risk free return(Rf)

Company stock return(Rm)

Market Premium(Rm-Rf)

ke(Cost of equity) 5.68%

YEAR TOTAL DEBT(d)

2017 680.29

2018 720.9

2019 954.78

2020 895.55

2021 920.77

Equity D/E

440.23 1.545306

535.2 1.346973

612.99 1.557578

688.52 1.300688

721.85 1.27557

βL 1.317254

βU 0.664054

7%

6%

-1%

TOTAL EQUITY(e) We Wd Interest Cost kd βU βL ke

440.23 39% 61% 43.9 0.045 0.66 1.38 0.0562

535.2 43% 57% 19.8 0.019 0.66 1.29 0.0571

612.99 39% 61% 26.9 0.020 0.66 1.39 0.0561

688.52 43% 57% 50.2 0.039 0.66 1.27 0.0573

721.85 44% 56% 135.6 0.103 0.66 1.26 0.0574

WACC

4.95%

3.54%

3.40% MAXIMUM VALUE CREATION

4.71%

8.30%

You might also like

- Matlab Code For Graphical Development of Fanno LineDocument2 pagesMatlab Code For Graphical Development of Fanno Lineaff123051No ratings yet

- 33 As Statistics Unit 5 TestDocument2 pages33 As Statistics Unit 5 TestThomas BeerNo ratings yet

- Matlab Code For Graphical Development of Rayleigh LineDocument2 pagesMatlab Code For Graphical Development of Rayleigh Lineaff123051No ratings yet

- Lecture 5 (Bivariate ND & Error Ellipses)Document5 pagesLecture 5 (Bivariate ND & Error Ellipses)Kismet100% (4)

- Diseño de ColumnasDocument17 pagesDiseño de ColumnasAmerico FloresNo ratings yet

- P Vs T PentanolDocument6 pagesP Vs T PentanolLaura Valentina Villalobos CastroNo ratings yet

- 65 b2203958 Lê Phương Thảo Dbdl3Document15 pages65 b2203958 Lê Phương Thảo Dbdl3lephuongthao19042004No ratings yet

- Ejemplo de Minimos CuadradosDocument6 pagesEjemplo de Minimos CuadradosJeam pool Chacchi guzmanNo ratings yet

- Tema: Mapas de Base y Tope Del Pozo Cabo Blanco, Calculo de Reserva de La Arena PetroliferaDocument7 pagesTema: Mapas de Base y Tope Del Pozo Cabo Blanco, Calculo de Reserva de La Arena PetroliferaMaricielo Quiros ChasqueroNo ratings yet

- Statistic ADocument9 pagesStatistic ACosmin VoicuNo ratings yet

- Cálculos Muestra37-S3 200 080515Document798 pagesCálculos Muestra37-S3 200 080515Laura_Cruz_GilNo ratings yet

- Area Weightage % CalculationDocument1 pageArea Weightage % CalculationRamen SarmaNo ratings yet

- Dự Báo Định Lượng - Tuần 2 - Ví DụDocument18 pagesDự Báo Định Lượng - Tuần 2 - Ví Dụphanngocduy2004.2019No ratings yet

- Modelo I - Ing. de Procesos - Uii - Hoja 1Document1 pageModelo I - Ing. de Procesos - Uii - Hoja 1MerryNo ratings yet

- Abstract MR 1Document41 pagesAbstract MR 1sreenivasulumNo ratings yet

- Winters Model Excel For SPCDocument14 pagesWinters Model Excel For SPCNitin ShankarNo ratings yet

- Distribusi Probabilitas A. DP GumbelDocument15 pagesDistribusi Probabilitas A. DP GumbelNoval AznurNo ratings yet

- Raport Gestiune ZilnicDocument10 pagesRaport Gestiune ZilnicBanu FerdaNo ratings yet

- Datos: Modelo de Regresión Lineal Simple Paso A PasoDocument27 pagesDatos: Modelo de Regresión Lineal Simple Paso A Pasowilson hidalgoNo ratings yet

- DDUGKY Salary - Employee-Wise - 2020-21 Final (00000002)Document291 pagesDDUGKY Salary - Employee-Wise - 2020-21 Final (00000002)stutiNo ratings yet

- Ventura, Mary Mickaella R - RetirementplanDocument6 pagesVentura, Mary Mickaella R - RetirementplanMary VenturaNo ratings yet

- Apa 610Document2 pagesApa 610Ciobanu Elena LuizaNo ratings yet

- Chart TitleDocument4 pagesChart TitleLeidy Coral YMNo ratings yet

- 2.multiple Regression Example No Home SalesDocument7 pages2.multiple Regression Example No Home SalesGirish KurkureNo ratings yet

- MCMC ResultsDocument23 pagesMCMC ResultsAuref RostamianNo ratings yet

- Diag. InteraccionDocument32 pagesDiag. InteraccionMauricio CalderonestelaNo ratings yet

- IV. Data, Perhitungan, Dan Grafik IV.1 Tabel Data IV.1.1 Uji Tarik Besi (Fe)Document17 pagesIV. Data, Perhitungan, Dan Grafik IV.1 Tabel Data IV.1.1 Uji Tarik Besi (Fe)Kukuh KDSNo ratings yet

- Hasil PenelitianDocument10 pagesHasil PenelitianmuslimNo ratings yet

- 207.52 STT Thời gian (phút) Khối lượng khay và VL (g) Khối lượng VL (g) W MDocument13 pages207.52 STT Thời gian (phút) Khối lượng khay và VL (g) Khối lượng VL (g) W MNguyễn PhanNo ratings yet

- Solargis RichbondDocument21 pagesSolargis RichbondSOUKAINANo ratings yet

- Yea-Tos-S606 11 ADocument1 pageYea-Tos-S606 11 AMikolaj KopernikNo ratings yet

- Group3 ChE3105 Computational Lab SolThermoDocument18 pagesGroup3 ChE3105 Computational Lab SolThermoDarlene FranciaNo ratings yet

- Pit Final 55kDocument15 pagesPit Final 55kBENJAMIN CHIHUANTITO KCANANo ratings yet

- I:/Lubes Crude Distillation/ephyde/example - Out: TBP AstmDocument8 pagesI:/Lubes Crude Distillation/ephyde/example - Out: TBP AstmEHNo ratings yet

- Dự Báo Định Lượng - Tuần 3 - Ví DụDocument8 pagesDự Báo Định Lượng - Tuần 3 - Ví Dụlephuongthao19042004No ratings yet

- 1.2.c Weigthed Moving Average A ExerciseDocument3 pages1.2.c Weigthed Moving Average A ExercisesidneyNo ratings yet

- GDP and ExportDocument13 pagesGDP and ExportpybyttydaylasdyctpNo ratings yet

- Fish Catch Data (1101)Document35 pagesFish Catch Data (1101)Gautam BindlishNo ratings yet

- Order Status Custom Date - Custom Date From 19/09/2021 To 19/09/2021Document12 pagesOrder Status Custom Date - Custom Date From 19/09/2021 To 19/09/2021sayem00001No ratings yet

- Telangana State Public Service Commission::Hyderabad Forest Range Officer in Forest Department (Efs&T) NOTIFICATION NO.46/2017Document3 pagesTelangana State Public Service Commission::Hyderabad Forest Range Officer in Forest Department (Efs&T) NOTIFICATION NO.46/2017manikanth reddyNo ratings yet

- Econometrics Assignment 3Document16 pagesEconometrics Assignment 3Palak SharmaNo ratings yet

- Diagrama de Interaccion PILON (Ø16mmc/20cm)Document12 pagesDiagrama de Interaccion PILON (Ø16mmc/20cm)jhasmanyNo ratings yet

- V. Numerica Discreta V. Numerica Continua V. Numerica Continua V. Numerica Discreta Id Area Peri Shape PermDocument8 pagesV. Numerica Discreta V. Numerica Continua V. Numerica Continua V. Numerica Discreta Id Area Peri Shape PermLuis CarlosNo ratings yet

- Estimasi Sasaran Program Tahun 2017Document3 pagesEstimasi Sasaran Program Tahun 2017JoeKronjoNo ratings yet

- New Microsoft Excel Worksheet-17.10.2023Document6 pagesNew Microsoft Excel Worksheet-17.10.2023infoNo ratings yet

- Sasaran Program 2Document3 pagesSasaran Program 2JoeKronjoNo ratings yet

- Ies Indoor Report Photometric Filename: Bs101Ecoled4Sawt40120V-277V - P.Ies DESCRIPTION INFORMATION (From Photometric File)Document11 pagesIes Indoor Report Photometric Filename: Bs101Ecoled4Sawt40120V-277V - P.Ies DESCRIPTION INFORMATION (From Photometric File)Ankit JainNo ratings yet

- ASSESMENT YEAR 2007 TO 2008 .: BesikDocument23 pagesASSESMENT YEAR 2007 TO 2008 .: BesikprabhakarkarbharNo ratings yet

- Lectuer Multiple Reg-1-28-12-2021Document4 pagesLectuer Multiple Reg-1-28-12-2021Usman GhaniNo ratings yet

- 19th Hole-Lâm Hoàng KimDocument8 pages19th Hole-Lâm Hoàng Kimlamhoangkim23022003No ratings yet

- Temperature Thermistor Resistance Theorical ADC Value °C °F Kelvin Ω Input (V) Output (12bits)Document2 pagesTemperature Thermistor Resistance Theorical ADC Value °C °F Kelvin Ω Input (V) Output (12bits)doppler9effectNo ratings yet

- Hot Deformed BarDocument16 pagesHot Deformed Barmuhammad haroonNo ratings yet

- Simple DetectionDocument3 pagesSimple DetectionCheslyn EspadaNo ratings yet

- Nota: Introduzca Los Alphas: SES Alpha 1Document4 pagesNota: Introduzca Los Alphas: SES Alpha 1Paulo Pereira MongeNo ratings yet

- ProračunDocument6 pagesProračunEmina BošnjakovićNo ratings yet

- HidrologiDocument10 pagesHidrologiRika Novia PutriNo ratings yet

- Myfsa2u RepaymentDocument1 pageMyfsa2u RepaymentAhmad MNo ratings yet

- Exercise On Flood Routing JOSE 455 15Document5 pagesExercise On Flood Routing JOSE 455 15Gail Nathalie LiraNo ratings yet

- Height Diameter at Breast Heightbark Thickness: Regression StatisticsDocument27 pagesHeight Diameter at Breast Heightbark Thickness: Regression StatisticsJasonNo ratings yet

- ISA Temp and Pressures vs. AltitudeDocument5 pagesISA Temp and Pressures vs. AltitudeRalph SandfordNo ratings yet

- United States Census Figures Back to 1630From EverandUnited States Census Figures Back to 1630No ratings yet

- Null Hypothesis: There Is No Difference in The Waiting Time With Token and Without Tokens Alternate Hypothesis: H: There Is Difference in The Waiting Time With Token and Without TokensDocument3 pagesNull Hypothesis: There Is No Difference in The Waiting Time With Token and Without Tokens Alternate Hypothesis: H: There Is Difference in The Waiting Time With Token and Without Tokensphewphewphew200No ratings yet

- Productivity Compensation Regression1Document3 pagesProductivity Compensation Regression1phewphewphew200No ratings yet

- 9Document2 pages9phewphewphew200No ratings yet

- Surat Bhumi SOR - W.E.F. - 01-06-2014Document5 pagesSurat Bhumi SOR - W.E.F. - 01-06-2014phewphewphew200No ratings yet

- Construction Solutions OverseasDocument30 pagesConstruction Solutions Overseasphewphewphew200No ratings yet

- Acuro Organics Limited PDFDocument25 pagesAcuro Organics Limited PDFphewphewphew200No ratings yet

- Epudur I: Ultra-High Performance Concrete For Machine BedsDocument12 pagesEpudur I: Ultra-High Performance Concrete For Machine Bedsphewphewphew200No ratings yet

- Ultra High Performance Concrete (Uhpc) : Npca White PaperDocument19 pagesUltra High Performance Concrete (Uhpc) : Npca White Paperphewphewphew200No ratings yet

- Project After PertDocument4 pagesProject After Pertphewphewphew200No ratings yet

- Project: Project 1.1 Date: Thu 19-01-17Document2 pagesProject: Project 1.1 Date: Thu 19-01-17phewphewphew200No ratings yet

- Design of SlabDocument12 pagesDesign of Slabphewphewphew200No ratings yet

- Design of Column: U CK C y SC CT SC 2 CT SC SC 2Document2 pagesDesign of Column: U CK C y SC CT SC 2 CT SC SC 2phewphewphew200No ratings yet

- Measures of Location Averages: Arithmetic Average .148 Correct Average .145321Document15 pagesMeasures of Location Averages: Arithmetic Average .148 Correct Average .145321Nel BorniaNo ratings yet

- Opm101chapter8 000Document43 pagesOpm101chapter8 000Manprita BasumataryNo ratings yet

- Lecture - 4 - Classification - Logistic RegressionDocument32 pagesLecture - 4 - Classification - Logistic RegressionbberkcanNo ratings yet

- Coefficient of Variation (Meaning and InterpretationDocument10 pagesCoefficient of Variation (Meaning and Interpretationwawan GunawanNo ratings yet

- Design and Analysis of Experiments: David Yanez Department of Biostatistics University of WashingtonDocument27 pagesDesign and Analysis of Experiments: David Yanez Department of Biostatistics University of WashingtonNguyen TriNo ratings yet

- Gsa 1Document14 pagesGsa 1Afza MaisarahNo ratings yet

- 2020 Math ATextpart 2Document204 pages2020 Math ATextpart 2ValerieNo ratings yet

- Uji Statistik: Frequencies StatisticsDocument6 pagesUji Statistik: Frequencies StatisticsAndi JhumpyooNo ratings yet

- Home Assignment CO2Document3 pagesHome Assignment CO2kowshik emmadisettyNo ratings yet

- Third Year Nursing Research and Stastics 51-62Document12 pagesThird Year Nursing Research and Stastics 51-62Nosy ParkerNo ratings yet

- Tabel Binomial IndividualDocument4 pagesTabel Binomial IndividualFerdiawan Hadi SusantoNo ratings yet

- PPT09 - Simple Linear Regression and CorrelationDocument53 pagesPPT09 - Simple Linear Regression and CorrelationaekimNo ratings yet

- Demo StatDocument5 pagesDemo StatCalventas Tualla Khaye JhayeNo ratings yet

- Final Exam - Quantitative1Document9 pagesFinal Exam - Quantitative1Laarnie BbbbNo ratings yet

- Name: Goutam Mandal Roll No: 1916034 PGPEM-2019 Assignment-IIDocument11 pagesName: Goutam Mandal Roll No: 1916034 PGPEM-2019 Assignment-IIGoutam MandalNo ratings yet

- Copulas Bivariate Option PricingDocument14 pagesCopulas Bivariate Option PricingRenan CintraNo ratings yet

- Estimation of ParametersDocument37 pagesEstimation of ParametersReflecta123No ratings yet

- 4 - Analyze - Intro To Hypothesis TestingDocument29 pages4 - Analyze - Intro To Hypothesis TestingParaschivescu CristinaNo ratings yet

- Federal Urdu University (Abdul Haq)Document10 pagesFederal Urdu University (Abdul Haq)Anee NoushadNo ratings yet

- ARIMA Forecasting Using RDocument9 pagesARIMA Forecasting Using RTalhaNo ratings yet

- Syllabus 321-02 Fall 11Document4 pagesSyllabus 321-02 Fall 11tiberianxzeroNo ratings yet

- 11 Acceptance Sampling SSPDocument29 pages11 Acceptance Sampling SSPbhabatosh pandaNo ratings yet

- (GAM) Application PDFDocument30 pages(GAM) Application PDFannisa rahmasariNo ratings yet

- Chapter 4 ExercisesDocument2 pagesChapter 4 ExercisesGracielle Buera20% (5)

- SPC XL 2010 For Microsoft Excel: Use The Links Below To Explore The Examples Control Chart ExamplesDocument56 pagesSPC XL 2010 For Microsoft Excel: Use The Links Below To Explore The Examples Control Chart ExamplesRavindra ErabattiNo ratings yet

- IBM SPSS Step-by-Step Guide - Histograms and Descriptive Statistics (PDF)Document4 pagesIBM SPSS Step-by-Step Guide - Histograms and Descriptive Statistics (PDF)Melfran Valera ReyesNo ratings yet

- Data Reduction TechniquesDocument10 pagesData Reduction TechniquesVinjamuri Joshi ManoharNo ratings yet

- Final Exam Answer Scheme (Set A)Document18 pagesFinal Exam Answer Scheme (Set A)Mohammad FaisalNo ratings yet