Professional Documents

Culture Documents

AF1 - Practical 1 - Short Term Company Finance

AF1 - Practical 1 - Short Term Company Finance

Uploaded by

Anonymous ReaperCopyright:

Available Formats

You might also like

- Cable TutorialDocument22 pagesCable TutorialRodriguez Villalobos Nelson100% (4)

- Worksheet On Profit and Loss AppropriationDocument66 pagesWorksheet On Profit and Loss AppropriationAditya ShrivastavaNo ratings yet

- Strategic Finance Mid-Term Examination 1Document6 pagesStrategic Finance Mid-Term Examination 1سردار عطا محمدNo ratings yet

- 01 Sample PaperDocument24 pages01 Sample Papergaming loverNo ratings yet

- 0438Document7 pages0438murtaza5500No ratings yet

- Weekly Test of AccountsDocument6 pagesWeekly Test of AccountsAMIN BUHARI ABDUL KHADER100% (1)

- Module 5 Answer KeysDocument5 pagesModule 5 Answer KeysJaspreetNo ratings yet

- Accounts 3Document42 pagesAccounts 3SubodhSaxenaNo ratings yet

- Chartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalDocument81 pagesChartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalPrashant Sagar GautamNo ratings yet

- RTP Dec 2020 QnsDocument13 pagesRTP Dec 2020 QnsbinuNo ratings yet

- 12 Account SP 01 PDFDocument24 pages12 Account SP 01 PDFJanvi KushwahaNo ratings yet

- 12 Accountancy Lyp 2017 Outside Delhi Set3Document42 pages12 Accountancy Lyp 2017 Outside Delhi Set3Ramprasad Sarkar100% (1)

- Allama Iqbal Open University, Islamabad: (Department of Commerce)Document4 pagesAllama Iqbal Open University, Islamabad: (Department of Commerce)ilyas muhammadNo ratings yet

- Quiz - Chapter 4 - Accounts Receivable - Ia 1 - 2020 EditionDocument4 pagesQuiz - Chapter 4 - Accounts Receivable - Ia 1 - 2020 EditionJennifer Reloso100% (1)

- Screenshot 2023-08-14 at 1.31.19 PMDocument4 pagesScreenshot 2023-08-14 at 1.31.19 PMEri ChaNo ratings yet

- Musharakah FinancingDocument23 pagesMusharakah FinancingTayyaba TariqNo ratings yet

- 04 Receivables - Additional DrillsDocument2 pages04 Receivables - Additional DrillsRazel MhinNo ratings yet

- 5 6305198873144984587 PDFDocument112 pages5 6305198873144984587 PDFNbut ddgfNo ratings yet

- Ho Workingcapmgt SbuDocument4 pagesHo Workingcapmgt SbuAngel Alejo AcobaNo ratings yet

- Aidcom Financial Accounting AnalysisDocument17 pagesAidcom Financial Accounting AnalysisAjmal K HussainNo ratings yet

- Cash ManagementDocument16 pagesCash ManagementdhruvNo ratings yet

- 12 Ac 3 CH Test1oDocument6 pages12 Ac 3 CH Test1orohitmahto18158920No ratings yet

- ACC 123 Quiz 1Document16 pagesACC 123 Quiz 1hwo50% (2)

- Dissolution of Partnership FirmDocument5 pagesDissolution of Partnership FirmDark SoulNo ratings yet

- Corporate Finance - I748 - Xid-3956405 - 1Document2 pagesCorporate Finance - I748 - Xid-3956405 - 1kashualNo ratings yet

- RERETESTDocument4 pagesRERETESTshveta0% (1)

- 12th BK Prelim Quesiton Paper March 2021Document8 pages12th BK Prelim Quesiton Paper March 2021Harendra PrajapatiNo ratings yet

- IV SEM - BA & BBA - 2021-22 - 2nd Periodical Exam PaperDocument2 pagesIV SEM - BA & BBA - 2021-22 - 2nd Periodical Exam PaperAria MazeNo ratings yet

- Corporate Accounting Imp QuestionsDocument10 pagesCorporate Accounting Imp QuestionsbalachandranharipriyaNo ratings yet

- Class Work & Home Work Question of Final Account of Banking Conpany 22-23Document23 pagesClass Work & Home Work Question of Final Account of Banking Conpany 22-23DARK KING GamersNo ratings yet

- Amara Prabasari 119211078 (Final Exam - Financial Statement)Document3 pagesAmara Prabasari 119211078 (Final Exam - Financial Statement)Amara PrabasariNo ratings yet

- Accountancy & Financial ManagementDocument12 pagesAccountancy & Financial ManagementNitin FardeNo ratings yet

- XII - Accountancy U.T - 1 Set 1Document4 pagesXII - Accountancy U.T - 1 Set 1tanu1304262No ratings yet

- Cash Budget:: (A) Receipts & Payments MethodDocument6 pagesCash Budget:: (A) Receipts & Payments MethodGabriel BelmonteNo ratings yet

- Ty Baf TaxationDocument4 pagesTy Baf TaxationAkki GalaNo ratings yet

- Ty Baf TaxationDocument4 pagesTy Baf TaxationAkki GalaNo ratings yet

- A) Date Description Debit $ Credit $Document5 pagesA) Date Description Debit $ Credit $simranNo ratings yet

- 12 Acc SPR 2Document6 pages12 Acc SPR 2Yashasvi DhankharNo ratings yet

- Ca Final SFM (New Scheme) Dawn 2022 - ForexDocument98 pagesCa Final SFM (New Scheme) Dawn 2022 - Forexanand kachwaNo ratings yet

- CA Inter Advanced Accounting Full Test 1 May 2023 Unscheduled Test Paper 1674112111Document20 pagesCA Inter Advanced Accounting Full Test 1 May 2023 Unscheduled Test Paper 1674112111pari maheshwariNo ratings yet

- Receivables ExerciseDocument3 pagesReceivables ExerciseJERICKO LIAN DEL ROSARIONo ratings yet

- Accounts..std 12Document3 pagesAccounts..std 12Abhishek SharmaNo ratings yet

- Bcom 3 Sem Corporate Accounting 1 19102078 Oct 2019Document5 pagesBcom 3 Sem Corporate Accounting 1 19102078 Oct 2019xyxx1221No ratings yet

- Chartered Accountancy Professional Ii (CAP-II) : Education Department The Institute of Chartered Accountants of NepalDocument192 pagesChartered Accountancy Professional Ii (CAP-II) : Education Department The Institute of Chartered Accountants of NepalPrashant Sagar GautamNo ratings yet

- RTP June 2020 QNDocument14 pagesRTP June 2020 QNbinuNo ratings yet

- Assessement Test 6 - Change of PSR - Docx - 1661182024584Document2 pagesAssessement Test 6 - Change of PSR - Docx - 1661182024584Shreya PushkarnaNo ratings yet

- Group Assignment - March 2020Document10 pagesGroup Assignment - March 2020Dylan Rabin PereiraNo ratings yet

- Classroom Exercises On Receivables AnswersDocument4 pagesClassroom Exercises On Receivables AnswersJohn Cedfrey Narne100% (1)

- CBSE Class 12 Accountancy Question Paper 2017Document34 pagesCBSE Class 12 Accountancy Question Paper 2017gajendra kumarNo ratings yet

- 6a MTP Oct 2020Document13 pages6a MTP Oct 2020Bijay AgrawalNo ratings yet

- Ballari Institute of Technology and Management Ballari Department of Management Studies Advanced Financial ManagementDocument4 pagesBallari Institute of Technology and Management Ballari Department of Management Studies Advanced Financial ManagementJanet Jyothi DsouzaNo ratings yet

- Unit 2 - Accountingformanager - AnanduDocument52 pagesUnit 2 - Accountingformanager - Ananducraziestidiot31No ratings yet

- Unit - I: Section - ADocument22 pagesUnit - I: Section - AskirubaarunNo ratings yet

- Gupta'S - Personal Financial Statements and Plans: IMG-3 Personal Wealth ManagementDocument11 pagesGupta'S - Personal Financial Statements and Plans: IMG-3 Personal Wealth ManagementAnand YadavNo ratings yet

- Paper-1 Accounts Guess QuestionsDocument56 pagesPaper-1 Accounts Guess Questionsvishal sharmaNo ratings yet

- Question Bank Accountancy (055) Class XiiDocument5 pagesQuestion Bank Accountancy (055) Class XiiDHIRENDRA KUMARNo ratings yet

- Accountancy QP-Term II-Pre Board 1 - Class XIIDocument6 pagesAccountancy QP-Term II-Pre Board 1 - Class XIIRaunofficialNo ratings yet

- Ap103 ReceivablesDocument5 pagesAp103 Receivablesbright SpotifyNo ratings yet

- Sample Paper For Class 11 Accountancy Set 1 QuestionsDocument6 pagesSample Paper For Class 11 Accountancy Set 1 Questionsrenu bhattNo ratings yet

- Finding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesFrom EverandFinding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- 3706 CavinPolsonKallely ActuarialMathematics4 LoanSchedule CE2 Aug22Document15 pages3706 CavinPolsonKallely ActuarialMathematics4 LoanSchedule CE2 Aug22Anonymous ReaperNo ratings yet

- Biosphere: By-Cavin Kallely Sambhav Jain (3702)Document17 pagesBiosphere: By-Cavin Kallely Sambhav Jain (3702)Anonymous ReaperNo ratings yet

- Class:Fybsc Actuarial Science College:Thakur College of Science & Commerce Paper Name:Actuarial Statistics 1 Exam: Ce 2Document11 pagesClass:Fybsc Actuarial Science College:Thakur College of Science & Commerce Paper Name:Actuarial Statistics 1 Exam: Ce 2Anonymous ReaperNo ratings yet

- Credibility TheoryDocument6 pagesCredibility TheoryAnonymous ReaperNo ratings yet

- The Gujarat ModelDocument15 pagesThe Gujarat ModelThakur_rvsNo ratings yet

- 2 PBDocument8 pages2 PBc76991350No ratings yet

- Provisions For The Payment of Gratuity To The Employees As Prescribed Under The ActDocument2 pagesProvisions For The Payment of Gratuity To The Employees As Prescribed Under The ActRosyBardhiaNo ratings yet

- Admin Assistant Receptionist Job DescriptionDocument4 pagesAdmin Assistant Receptionist Job DescriptionMitTuyetNo ratings yet

- Azidus Laboratories - BA BE Capabilities Slide Deck - Feb 2019 PDFDocument35 pagesAzidus Laboratories - BA BE Capabilities Slide Deck - Feb 2019 PDFDeepakNo ratings yet

- Communication Skill For Assistance Umkm UpdatedDocument45 pagesCommunication Skill For Assistance Umkm UpdatedFadel TuasamuNo ratings yet

- 08CLecture - Welding Codes StandardsDocument15 pages08CLecture - Welding Codes StandardsDavid HuamanNo ratings yet

- Globular ProteinDocument4 pagesGlobular ProteinArvin O-CaféNo ratings yet

- (The Correlation of Organizational Role Stressors With Stress Level of ICU NursesDocument18 pages(The Correlation of Organizational Role Stressors With Stress Level of ICU NursesAnggriani Puspita AyuNo ratings yet

- Olierook - Mechanisms For Permeability Modification in The Damage Zone of A Normal FaultDocument19 pagesOlierook - Mechanisms For Permeability Modification in The Damage Zone of A Normal FaultUgik GeoNo ratings yet

- E Power of Movement Is Not Normally Associated WithDocument2 pagesE Power of Movement Is Not Normally Associated WithHamdan FatahNo ratings yet

- Immobilization SplintsDocument15 pagesImmobilization SplintssolituNo ratings yet

- Volvo Emissions Oraz Adblue SystemDocument33 pagesVolvo Emissions Oraz Adblue Systemasuskusz100% (1)

- Biosensors and Their Applications - A Review: SciencedirectDocument7 pagesBiosensors and Their Applications - A Review: SciencedirectNickson WafulaNo ratings yet

- TISSNET 2017 Official Paper EnglishDocument32 pagesTISSNET 2017 Official Paper Englishishmeet sachdevaNo ratings yet

- MT - 01 PCM JM Paper (26.06.2022) 12thDocument22 pagesMT - 01 PCM JM Paper (26.06.2022) 12thAnurag PatelNo ratings yet

- Hansen 2008Document30 pagesHansen 2008Jacobo CeballosNo ratings yet

- Pain Management ServiceDocument4 pagesPain Management ServiceTaeng GoNo ratings yet

- Ancient Egyptian IncenseDocument3 pagesAncient Egyptian IncenseRenata Trismegista100% (2)

- Maxillomandibular Advancement As The Initial Treatment of Obstructive Sleep Apnoea: Is The Mandibular Occlusal Plane The Key?Document9 pagesMaxillomandibular Advancement As The Initial Treatment of Obstructive Sleep Apnoea: Is The Mandibular Occlusal Plane The Key?Jorge Antonio Espinoza YañezNo ratings yet

- List of CESDocument1 pageList of CESresp-ectNo ratings yet

- Cummins Engine l10 Troubles ManualDocument20 pagesCummins Engine l10 Troubles Manuallisa100% (62)

- Actuator Ari PremioDocument12 pagesActuator Ari Premioluthfie.swaciptaNo ratings yet

- Mounting Hardware and Accessories Wilcoxon Sensing Technologies 2020Document9 pagesMounting Hardware and Accessories Wilcoxon Sensing Technologies 2020Fabian MolinengoNo ratings yet

- Learning Disabilities OtDocument48 pagesLearning Disabilities OtReeva de SaNo ratings yet

- 7 Dna Unit PacketDocument20 pages7 Dna Unit Packetapi-210832480No ratings yet

- Electrical Safety HAE EM EPS GDCC ES PDFDocument17 pagesElectrical Safety HAE EM EPS GDCC ES PDFkhleifat_613891No ratings yet

- Individual Differences and Work BehaviorDocument3 pagesIndividual Differences and Work BehaviorSunny Honey0% (1)

- Basic Services Allowed As Others Stay Closed: Gulf TimesDocument24 pagesBasic Services Allowed As Others Stay Closed: Gulf TimesmurphygtNo ratings yet

AF1 - Practical 1 - Short Term Company Finance

AF1 - Practical 1 - Short Term Company Finance

Uploaded by

Anonymous ReaperOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AF1 - Practical 1 - Short Term Company Finance

AF1 - Practical 1 - Short Term Company Finance

Uploaded by

Anonymous ReaperCopyright:

Available Formats

DSActEd Semester 2

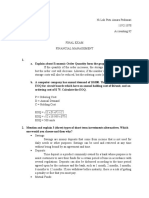

F.Y.B.Sc. (Actuarial Science) Actuarial Finance - 1

PRACTICAL 1: SHORT TERM COMPANY FINANCE

Q1 Company ABC Ltd sends out the invoices to some customer for the following amount

Name of customer Amount Date

Sheena Private Ltd Rs. 20,000/- 1st Jan 2007

Presha Private Ltd Rs.15000/- 16th Jan 2007

Zehnab Private Ltd Rs.50000/- 1st Mar 2007

Vanita Private Ltd Rs.25000/- 1st May 2007

Sophia Private Ltd Rs.5000/- 1st Jun 2007

At the same time it sends a copy of these invoices to its factor, Peera Ltd, in return for a

fixed percentage (%) i.e. 90% of invoice amount. Company ABC Ltd receives the money from

its customers on following dates –

Name of customer Amount Date

Sheena Private Ltd Rs.5000/- 31st Jan 2007

Presha Private Ltd Rs.10000/- 28th Feb 2007

Presha Private Ltd Rs.5000/- 31st Mar 2007

Zehnab Private Ltd Rs.20000/- 31st Mar 2007

Sheena Private Ltd Rs.15000/- 31st Mar 2007

Zehnab Private Ltd Rs.20000/- 30th Apr 2007

Vanita Private Ltd Rs.20000/- 31st May 2007

Zehnab Private Ltd Rs.10000/- 30th Jun 2007

Sophia Private Ltd Rs.5000/- 30th Jun 2007

Vanita Private Ltd Rs.5000/- 30th Jun 2007

Company ABC Ltd then sends the money to Peera Ltd. Upto 30th June 2007, simple interest

@ 3% per month has been incurred on the loan amount from Peera Ltd. Demonstrate with

the help of calculations, how will Peera Ltd settle its accounts with ABC Ltd upto 30th June

2007 under the scheme of RECOURSE FACTORING.

[Assume 100% of invoice amount for the calculation of interest amount]

Q2 A trader whose current sales are Rs. 15 lakhs per annum and average collection period is 30

days wants to persue a more liberal credit policy to improve sales. A study made by

consultant firm reveals the following information.

Credit policy Increase in collection period Increase in sales

A 15 days 60000

B 30 days 90000

C 45 days 150000

D 60 days 180000

E 90 days 200000

Selling price per unit is Rs.5

Average cost per unit is Rs.4

Variable cost per unit is Rs.2.75

The required rate of return on additional investment is 20%

Assume 360 days a year

There are no bad debts

Which of the above policy would you recommend for adoption?

Page 1 of 2

DSActEd Semester 2

F.Y.B.Sc. (Actuarial Science) Actuarial Finance - 1

Q3 Waste Co is a waste management company, with one sole shareholder/director, Mr Trusty.

It collects two types of waste from businesses – recyclable waste and confidential waste.

Since companies have increasingly become aware of both the need for recycling and the

need to protect confidential information, Waste Co’s client base has expanded rapidly over

the past two years.

As the business has expanded, Mr Trusty has had less time available to focus on credit

control. This has resulted in a steady deterioration in accounts receivable collection and a

rapid increase in Mr Trusty’s overdraft, despite high profits. Mr Trusty’s bank has now

refused to extend his overdraft any further and has suggested that he either employ a credit

controller or factor his accounts receivable.

The following information is available:

1. Credit sales for the year ending 30 November 2007 were $2,550,000, and average

accounts receivable days were 60. Sales are expected to increase by 25% over the next

year.

2. If Mr Trusty employs a good credit controller, the cost to the business will be $47,000

per annum. It is anticipated that the accounts receivable days can then be reduced to

40.

3. A local factoring organisation has offered to factor the company’s accounts receivable

on the following terms:

An advance of 80% of the value of sales invoices (which Mr Trusty would fully

utilise).

An estimated reduction in accounts receivable days to 35.

An annual administration fee of 1.3% of turnover.

Interest charge on advances of 12% per annum.

4. Current overdraft rates are 10% per annum.

5. Assume there are 365 days in a year.

Calculate whether it is financially beneficial for Waste Co to factor its accounts receivables for

the next year, as compared to employing a credit controller.

_____________________________

Page 2 of 2

You might also like

- Cable TutorialDocument22 pagesCable TutorialRodriguez Villalobos Nelson100% (4)

- Worksheet On Profit and Loss AppropriationDocument66 pagesWorksheet On Profit and Loss AppropriationAditya ShrivastavaNo ratings yet

- Strategic Finance Mid-Term Examination 1Document6 pagesStrategic Finance Mid-Term Examination 1سردار عطا محمدNo ratings yet

- 01 Sample PaperDocument24 pages01 Sample Papergaming loverNo ratings yet

- 0438Document7 pages0438murtaza5500No ratings yet

- Weekly Test of AccountsDocument6 pagesWeekly Test of AccountsAMIN BUHARI ABDUL KHADER100% (1)

- Module 5 Answer KeysDocument5 pagesModule 5 Answer KeysJaspreetNo ratings yet

- Accounts 3Document42 pagesAccounts 3SubodhSaxenaNo ratings yet

- Chartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalDocument81 pagesChartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalPrashant Sagar GautamNo ratings yet

- RTP Dec 2020 QnsDocument13 pagesRTP Dec 2020 QnsbinuNo ratings yet

- 12 Account SP 01 PDFDocument24 pages12 Account SP 01 PDFJanvi KushwahaNo ratings yet

- 12 Accountancy Lyp 2017 Outside Delhi Set3Document42 pages12 Accountancy Lyp 2017 Outside Delhi Set3Ramprasad Sarkar100% (1)

- Allama Iqbal Open University, Islamabad: (Department of Commerce)Document4 pagesAllama Iqbal Open University, Islamabad: (Department of Commerce)ilyas muhammadNo ratings yet

- Quiz - Chapter 4 - Accounts Receivable - Ia 1 - 2020 EditionDocument4 pagesQuiz - Chapter 4 - Accounts Receivable - Ia 1 - 2020 EditionJennifer Reloso100% (1)

- Screenshot 2023-08-14 at 1.31.19 PMDocument4 pagesScreenshot 2023-08-14 at 1.31.19 PMEri ChaNo ratings yet

- Musharakah FinancingDocument23 pagesMusharakah FinancingTayyaba TariqNo ratings yet

- 04 Receivables - Additional DrillsDocument2 pages04 Receivables - Additional DrillsRazel MhinNo ratings yet

- 5 6305198873144984587 PDFDocument112 pages5 6305198873144984587 PDFNbut ddgfNo ratings yet

- Ho Workingcapmgt SbuDocument4 pagesHo Workingcapmgt SbuAngel Alejo AcobaNo ratings yet

- Aidcom Financial Accounting AnalysisDocument17 pagesAidcom Financial Accounting AnalysisAjmal K HussainNo ratings yet

- Cash ManagementDocument16 pagesCash ManagementdhruvNo ratings yet

- 12 Ac 3 CH Test1oDocument6 pages12 Ac 3 CH Test1orohitmahto18158920No ratings yet

- ACC 123 Quiz 1Document16 pagesACC 123 Quiz 1hwo50% (2)

- Dissolution of Partnership FirmDocument5 pagesDissolution of Partnership FirmDark SoulNo ratings yet

- Corporate Finance - I748 - Xid-3956405 - 1Document2 pagesCorporate Finance - I748 - Xid-3956405 - 1kashualNo ratings yet

- RERETESTDocument4 pagesRERETESTshveta0% (1)

- 12th BK Prelim Quesiton Paper March 2021Document8 pages12th BK Prelim Quesiton Paper March 2021Harendra PrajapatiNo ratings yet

- IV SEM - BA & BBA - 2021-22 - 2nd Periodical Exam PaperDocument2 pagesIV SEM - BA & BBA - 2021-22 - 2nd Periodical Exam PaperAria MazeNo ratings yet

- Corporate Accounting Imp QuestionsDocument10 pagesCorporate Accounting Imp QuestionsbalachandranharipriyaNo ratings yet

- Class Work & Home Work Question of Final Account of Banking Conpany 22-23Document23 pagesClass Work & Home Work Question of Final Account of Banking Conpany 22-23DARK KING GamersNo ratings yet

- Amara Prabasari 119211078 (Final Exam - Financial Statement)Document3 pagesAmara Prabasari 119211078 (Final Exam - Financial Statement)Amara PrabasariNo ratings yet

- Accountancy & Financial ManagementDocument12 pagesAccountancy & Financial ManagementNitin FardeNo ratings yet

- XII - Accountancy U.T - 1 Set 1Document4 pagesXII - Accountancy U.T - 1 Set 1tanu1304262No ratings yet

- Cash Budget:: (A) Receipts & Payments MethodDocument6 pagesCash Budget:: (A) Receipts & Payments MethodGabriel BelmonteNo ratings yet

- Ty Baf TaxationDocument4 pagesTy Baf TaxationAkki GalaNo ratings yet

- Ty Baf TaxationDocument4 pagesTy Baf TaxationAkki GalaNo ratings yet

- A) Date Description Debit $ Credit $Document5 pagesA) Date Description Debit $ Credit $simranNo ratings yet

- 12 Acc SPR 2Document6 pages12 Acc SPR 2Yashasvi DhankharNo ratings yet

- Ca Final SFM (New Scheme) Dawn 2022 - ForexDocument98 pagesCa Final SFM (New Scheme) Dawn 2022 - Forexanand kachwaNo ratings yet

- CA Inter Advanced Accounting Full Test 1 May 2023 Unscheduled Test Paper 1674112111Document20 pagesCA Inter Advanced Accounting Full Test 1 May 2023 Unscheduled Test Paper 1674112111pari maheshwariNo ratings yet

- Receivables ExerciseDocument3 pagesReceivables ExerciseJERICKO LIAN DEL ROSARIONo ratings yet

- Accounts..std 12Document3 pagesAccounts..std 12Abhishek SharmaNo ratings yet

- Bcom 3 Sem Corporate Accounting 1 19102078 Oct 2019Document5 pagesBcom 3 Sem Corporate Accounting 1 19102078 Oct 2019xyxx1221No ratings yet

- Chartered Accountancy Professional Ii (CAP-II) : Education Department The Institute of Chartered Accountants of NepalDocument192 pagesChartered Accountancy Professional Ii (CAP-II) : Education Department The Institute of Chartered Accountants of NepalPrashant Sagar GautamNo ratings yet

- RTP June 2020 QNDocument14 pagesRTP June 2020 QNbinuNo ratings yet

- Assessement Test 6 - Change of PSR - Docx - 1661182024584Document2 pagesAssessement Test 6 - Change of PSR - Docx - 1661182024584Shreya PushkarnaNo ratings yet

- Group Assignment - March 2020Document10 pagesGroup Assignment - March 2020Dylan Rabin PereiraNo ratings yet

- Classroom Exercises On Receivables AnswersDocument4 pagesClassroom Exercises On Receivables AnswersJohn Cedfrey Narne100% (1)

- CBSE Class 12 Accountancy Question Paper 2017Document34 pagesCBSE Class 12 Accountancy Question Paper 2017gajendra kumarNo ratings yet

- 6a MTP Oct 2020Document13 pages6a MTP Oct 2020Bijay AgrawalNo ratings yet

- Ballari Institute of Technology and Management Ballari Department of Management Studies Advanced Financial ManagementDocument4 pagesBallari Institute of Technology and Management Ballari Department of Management Studies Advanced Financial ManagementJanet Jyothi DsouzaNo ratings yet

- Unit 2 - Accountingformanager - AnanduDocument52 pagesUnit 2 - Accountingformanager - Ananducraziestidiot31No ratings yet

- Unit - I: Section - ADocument22 pagesUnit - I: Section - AskirubaarunNo ratings yet

- Gupta'S - Personal Financial Statements and Plans: IMG-3 Personal Wealth ManagementDocument11 pagesGupta'S - Personal Financial Statements and Plans: IMG-3 Personal Wealth ManagementAnand YadavNo ratings yet

- Paper-1 Accounts Guess QuestionsDocument56 pagesPaper-1 Accounts Guess Questionsvishal sharmaNo ratings yet

- Question Bank Accountancy (055) Class XiiDocument5 pagesQuestion Bank Accountancy (055) Class XiiDHIRENDRA KUMARNo ratings yet

- Accountancy QP-Term II-Pre Board 1 - Class XIIDocument6 pagesAccountancy QP-Term II-Pre Board 1 - Class XIIRaunofficialNo ratings yet

- Ap103 ReceivablesDocument5 pagesAp103 Receivablesbright SpotifyNo ratings yet

- Sample Paper For Class 11 Accountancy Set 1 QuestionsDocument6 pagesSample Paper For Class 11 Accountancy Set 1 Questionsrenu bhattNo ratings yet

- Finding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesFrom EverandFinding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- 3706 CavinPolsonKallely ActuarialMathematics4 LoanSchedule CE2 Aug22Document15 pages3706 CavinPolsonKallely ActuarialMathematics4 LoanSchedule CE2 Aug22Anonymous ReaperNo ratings yet

- Biosphere: By-Cavin Kallely Sambhav Jain (3702)Document17 pagesBiosphere: By-Cavin Kallely Sambhav Jain (3702)Anonymous ReaperNo ratings yet

- Class:Fybsc Actuarial Science College:Thakur College of Science & Commerce Paper Name:Actuarial Statistics 1 Exam: Ce 2Document11 pagesClass:Fybsc Actuarial Science College:Thakur College of Science & Commerce Paper Name:Actuarial Statistics 1 Exam: Ce 2Anonymous ReaperNo ratings yet

- Credibility TheoryDocument6 pagesCredibility TheoryAnonymous ReaperNo ratings yet

- The Gujarat ModelDocument15 pagesThe Gujarat ModelThakur_rvsNo ratings yet

- 2 PBDocument8 pages2 PBc76991350No ratings yet

- Provisions For The Payment of Gratuity To The Employees As Prescribed Under The ActDocument2 pagesProvisions For The Payment of Gratuity To The Employees As Prescribed Under The ActRosyBardhiaNo ratings yet

- Admin Assistant Receptionist Job DescriptionDocument4 pagesAdmin Assistant Receptionist Job DescriptionMitTuyetNo ratings yet

- Azidus Laboratories - BA BE Capabilities Slide Deck - Feb 2019 PDFDocument35 pagesAzidus Laboratories - BA BE Capabilities Slide Deck - Feb 2019 PDFDeepakNo ratings yet

- Communication Skill For Assistance Umkm UpdatedDocument45 pagesCommunication Skill For Assistance Umkm UpdatedFadel TuasamuNo ratings yet

- 08CLecture - Welding Codes StandardsDocument15 pages08CLecture - Welding Codes StandardsDavid HuamanNo ratings yet

- Globular ProteinDocument4 pagesGlobular ProteinArvin O-CaféNo ratings yet

- (The Correlation of Organizational Role Stressors With Stress Level of ICU NursesDocument18 pages(The Correlation of Organizational Role Stressors With Stress Level of ICU NursesAnggriani Puspita AyuNo ratings yet

- Olierook - Mechanisms For Permeability Modification in The Damage Zone of A Normal FaultDocument19 pagesOlierook - Mechanisms For Permeability Modification in The Damage Zone of A Normal FaultUgik GeoNo ratings yet

- E Power of Movement Is Not Normally Associated WithDocument2 pagesE Power of Movement Is Not Normally Associated WithHamdan FatahNo ratings yet

- Immobilization SplintsDocument15 pagesImmobilization SplintssolituNo ratings yet

- Volvo Emissions Oraz Adblue SystemDocument33 pagesVolvo Emissions Oraz Adblue Systemasuskusz100% (1)

- Biosensors and Their Applications - A Review: SciencedirectDocument7 pagesBiosensors and Their Applications - A Review: SciencedirectNickson WafulaNo ratings yet

- TISSNET 2017 Official Paper EnglishDocument32 pagesTISSNET 2017 Official Paper Englishishmeet sachdevaNo ratings yet

- MT - 01 PCM JM Paper (26.06.2022) 12thDocument22 pagesMT - 01 PCM JM Paper (26.06.2022) 12thAnurag PatelNo ratings yet

- Hansen 2008Document30 pagesHansen 2008Jacobo CeballosNo ratings yet

- Pain Management ServiceDocument4 pagesPain Management ServiceTaeng GoNo ratings yet

- Ancient Egyptian IncenseDocument3 pagesAncient Egyptian IncenseRenata Trismegista100% (2)

- Maxillomandibular Advancement As The Initial Treatment of Obstructive Sleep Apnoea: Is The Mandibular Occlusal Plane The Key?Document9 pagesMaxillomandibular Advancement As The Initial Treatment of Obstructive Sleep Apnoea: Is The Mandibular Occlusal Plane The Key?Jorge Antonio Espinoza YañezNo ratings yet

- List of CESDocument1 pageList of CESresp-ectNo ratings yet

- Cummins Engine l10 Troubles ManualDocument20 pagesCummins Engine l10 Troubles Manuallisa100% (62)

- Actuator Ari PremioDocument12 pagesActuator Ari Premioluthfie.swaciptaNo ratings yet

- Mounting Hardware and Accessories Wilcoxon Sensing Technologies 2020Document9 pagesMounting Hardware and Accessories Wilcoxon Sensing Technologies 2020Fabian MolinengoNo ratings yet

- Learning Disabilities OtDocument48 pagesLearning Disabilities OtReeva de SaNo ratings yet

- 7 Dna Unit PacketDocument20 pages7 Dna Unit Packetapi-210832480No ratings yet

- Electrical Safety HAE EM EPS GDCC ES PDFDocument17 pagesElectrical Safety HAE EM EPS GDCC ES PDFkhleifat_613891No ratings yet

- Individual Differences and Work BehaviorDocument3 pagesIndividual Differences and Work BehaviorSunny Honey0% (1)

- Basic Services Allowed As Others Stay Closed: Gulf TimesDocument24 pagesBasic Services Allowed As Others Stay Closed: Gulf TimesmurphygtNo ratings yet