Professional Documents

Culture Documents

Blog - Narratives and Earnings On Chinese Equity What Changed

Blog - Narratives and Earnings On Chinese Equity What Changed

Uploaded by

Owm Close CorporationCopyright:

Available Formats

You might also like

- ICWIM Sample QuestionsDocument31 pagesICWIM Sample QuestionsSenthil Kumar K100% (7)

- Asset ManagementDocument16 pagesAsset Managementmkkamaraj89% (9)

- BBNG3103 International Business Zahayu Jamaludin 770209015360Document10 pagesBBNG3103 International Business Zahayu Jamaludin 770209015360zulkis73No ratings yet

- API 580 - RBI Question BankDocument30 pagesAPI 580 - RBI Question BankSabarni Mahapatra100% (3)

- PMCA Data Center Relocation (DCR) Pre-Planning GuideDocument71 pagesPMCA Data Center Relocation (DCR) Pre-Planning GuideJohn Sarazen100% (5)

- Er 20130708 Bull Phat DragonDocument3 pagesEr 20130708 Bull Phat DragonDavid SmithNo ratings yet

- Financial Market AnalysisDocument5 pagesFinancial Market AnalysisjamesNo ratings yet

- The World Economy... 22/03/2010Document2 pagesThe World Economy... 22/03/2010Rhb InvestNo ratings yet

- Why Taiwan's Large Banks Have Systemic Importance and Large Insurers Don'tDocument5 pagesWhy Taiwan's Large Banks Have Systemic Importance and Large Insurers Don'tapi-239405494No ratings yet

- Mark Baribeau Jennison Associates Navigating Global Equities ThroughDocument9 pagesMark Baribeau Jennison Associates Navigating Global Equities ThroughWarren RileyNo ratings yet

- CIO Note Feb 6 2018Document2 pagesCIO Note Feb 6 2018Anonymous 2LowCnVdfNo ratings yet

- Research Papers On Global Financial CrisisDocument4 pagesResearch Papers On Global Financial Crisisfvf237cz100% (1)

- China Outlook Q&ADocument3 pagesChina Outlook Q&Avenky2000No ratings yet

- Four in Four ReportDocument2 pagesFour in Four ReportValuEngine.comNo ratings yet

- Chinese Financial System Elliott YanDocument44 pagesChinese Financial System Elliott YanAbel ChanNo ratings yet

- er20130211BullPhatDragon PDFDocument2 pageser20130211BullPhatDragon PDFAmanda MooreNo ratings yet

- The International Financial Crisis and Its Impact: Convocation Address by Dr. C. RangarajanDocument5 pagesThe International Financial Crisis and Its Impact: Convocation Address by Dr. C. RangarajanAnand SoniNo ratings yet

- Divergent Vaccine Rollout Leading To Asymmetric Risk: DailyDocument4 pagesDivergent Vaccine Rollout Leading To Asymmetric Risk: DailyBokulNo ratings yet

- Journal of Regulation & Risk - North Asia, Winter 2015 EditionDocument164 pagesJournal of Regulation & Risk - North Asia, Winter 2015 EditionChrisRogersNo ratings yet

- Preqin Private Equity Spotlight June 2012Document17 pagesPreqin Private Equity Spotlight June 2012richard_dalaudNo ratings yet

- Economist-Insights 1 JulyDocument2 pagesEconomist-Insights 1 JulybuyanalystlondonNo ratings yet

- June 15, 2009 - Morning CallDocument3 pagesJune 15, 2009 - Morning Callkkeenan5008475No ratings yet

- Assessing The Impact of The Dodd-Frank Act Four Years LaterDocument36 pagesAssessing The Impact of The Dodd-Frank Act Four Years LaterAmerican Enterprise InstituteNo ratings yet

- Finance Term Paper IdeasDocument8 pagesFinance Term Paper Ideasc5q1thnj100% (1)

- The Influence of The Strong Economy On Financial Markets: All The Other Organs Take Their Tone."Document2 pagesThe Influence of The Strong Economy On Financial Markets: All The Other Organs Take Their Tone."Ronalie Sustuedo100% (1)

- The World Economy... - 21/004/2010Document2 pagesThe World Economy... - 21/004/2010Rhb InvestNo ratings yet

- The World Economy... - 10/08/2010Document2 pagesThe World Economy... - 10/08/2010Rhb InvestNo ratings yet

- The Weekly Ecomonic Update For The Week of April 20, 2015.Document2 pagesThe Weekly Ecomonic Update For The Week of April 20, 2015.mike1473No ratings yet

- China September CPIDocument4 pagesChina September CPIAnonymous Ht0MIJNo ratings yet

- ValuEngine Weekly Newsletter August 17, 2012Document9 pagesValuEngine Weekly Newsletter August 17, 2012ValuEngine.comNo ratings yet

- (LGT) 20210316 - DRU - Sector RotationDocument3 pages(LGT) 20210316 - DRU - Sector RotationRuehYinn YapNo ratings yet

- September 7th, 2012: Market OverviewDocument9 pagesSeptember 7th, 2012: Market OverviewValuEngine.comNo ratings yet

- Er 20120911 Bull Phat DragonDocument2 pagesEr 20120911 Bull Phat DragonLuke Campbell-SmithNo ratings yet

- Newsletter March 2015 FinalDocument9 pagesNewsletter March 2015 FinalavishathakkarNo ratings yet

- Finance Pytania 4Document4 pagesFinance Pytania 4Marta SzczerskaNo ratings yet

- Investing in the High Yield Municipal Market: How to Profit from the Current Municipal Credit Crisis and Earn Attractive Tax-Exempt Interest IncomeFrom EverandInvesting in the High Yield Municipal Market: How to Profit from the Current Municipal Credit Crisis and Earn Attractive Tax-Exempt Interest IncomeNo ratings yet

- The People United Will Leave The Banks DividedDocument4 pagesThe People United Will Leave The Banks DividedRicharnellia-RichieRichBattiest-CollinsNo ratings yet

- Nonprofit Investment and Development Solutions: A Guide to Thriving in Today's EconomyFrom EverandNonprofit Investment and Development Solutions: A Guide to Thriving in Today's EconomyNo ratings yet

- International Treasurer - October 2008 - The Financial Crisis Heats UpDocument16 pagesInternational Treasurer - October 2008 - The Financial Crisis Heats UpitreasurerNo ratings yet

- QEIC Fall ReportDocument37 pagesQEIC Fall ReportQEICNo ratings yet

- Sun Life Financial Report - EditedDocument22 pagesSun Life Financial Report - EditedtrmyespinaNo ratings yet

- Asian Development Bank Institute: ADBI Working Paper SeriesDocument15 pagesAsian Development Bank Institute: ADBI Working Paper SeriesAbdessamad MarrakechNo ratings yet

- er20121116BullPhatdragon PDFDocument2 pageser20121116BullPhatdragon PDFBelinda WinkelmanNo ratings yet

- er20130306BullPhatDragon PDFDocument2 pageser20130306BullPhatDragon PDFBrian FordNo ratings yet

- Global Financial Crisis and SecuritizationDocument6 pagesGlobal Financial Crisis and SecuritizationSumit KumramNo ratings yet

- Chaanakya Chaanakya Chaanakya Chaanakya: National HeadlinesDocument8 pagesChaanakya Chaanakya Chaanakya Chaanakya: National HeadlinesChaanakya_cuimNo ratings yet

- Federal Reserves Economic SymposiumDocument2 pagesFederal Reserves Economic SymposiumSubham MazumdarNo ratings yet

- Third Quarter 2016 Investment Outlook: Asset Class SectorDocument6 pagesThird Quarter 2016 Investment Outlook: Asset Class SectorAnonymous DJrec2No ratings yet

- China, Its Currency & The Global Economy: Presented by Fred Leamnson, CFP®, AIF®Document2 pagesChina, Its Currency & The Global Economy: Presented by Fred Leamnson, CFP®, AIF®api-118535366No ratings yet

- Lenders Risk HypothesisDocument6 pagesLenders Risk HypothesisWadiah AkbarNo ratings yet

- Aug 4thDocument15 pagesAug 4thshefalijnNo ratings yet

- Trading Strateg: April 2022 Pension Fund Rebalancing EstimatesDocument2 pagesTrading Strateg: April 2022 Pension Fund Rebalancing EstimatessirdquantsNo ratings yet

- Sub Prime CrisisDocument2 pagesSub Prime CrisisGomathiRachakondaNo ratings yet

- VIMC Investors Hold A Worthless BagDocument37 pagesVIMC Investors Hold A Worthless BagTrinity Research GroupNo ratings yet

- Research Paper On JP Morgan ChaseDocument7 pagesResearch Paper On JP Morgan Chaseafmcvhffm100% (1)

- Tracking The World Economy... - 12/10/2010Document2 pagesTracking The World Economy... - 12/10/2010Rhb InvestNo ratings yet

- Summary of Makers and Takers: by Rana Foroohar | Includes AnalysisFrom EverandSummary of Makers and Takers: by Rana Foroohar | Includes AnalysisNo ratings yet

- Annual Report 2010 - SADocument173 pagesAnnual Report 2010 - SALinh KuNo ratings yet

- Roundtwo Financial CrisisDocument21 pagesRoundtwo Financial CrisisIrene LyeNo ratings yet

- Muafa's Module 10 AssignmentDocument5 pagesMuafa's Module 10 AssignmentMuafa BasheerNo ratings yet

- Presented To:: Authored byDocument16 pagesPresented To:: Authored byankushsonigraNo ratings yet

- Rational Market Economics: A Compass for the Beginning InvestorFrom EverandRational Market Economics: A Compass for the Beginning InvestorNo ratings yet

- The Alchemy of Investment: Winning Strategies of Professional InvestmentFrom EverandThe Alchemy of Investment: Winning Strategies of Professional InvestmentNo ratings yet

- Life Insurance in Asia: Sustaining Growth in the Next DecadeFrom EverandLife Insurance in Asia: Sustaining Growth in the Next DecadeNo ratings yet

- Blog - The WisdomTree Q2 2022 Economic and Market Outlook in 10 Charts or LessDocument11 pagesBlog - The WisdomTree Q2 2022 Economic and Market Outlook in 10 Charts or LessOwm Close CorporationNo ratings yet

- 5 Key Factors Facing U.S. Treasury Yields - Seeking AlphaDocument12 pages5 Key Factors Facing U.S. Treasury Yields - Seeking AlphaOwm Close CorporationNo ratings yet

- ING Think Rates Spark Inflation Reasserts Itself As The Main Driver of Rates 2Document5 pagesING Think Rates Spark Inflation Reasserts Itself As The Main Driver of Rates 2Owm Close CorporationNo ratings yet

- Fed Hikes 50bp With Much More To Come: Economic and Financial AnalysisDocument5 pagesFed Hikes 50bp With Much More To Come: Economic and Financial AnalysisOwm Close CorporationNo ratings yet

- ING Think Us Housing Market Exhibits More Signs of SlowdownDocument6 pagesING Think Us Housing Market Exhibits More Signs of SlowdownOwm Close CorporationNo ratings yet

- Invasion Effect On PGMS: Base Case Unchanged, But Upside Price RiskDocument4 pagesInvasion Effect On PGMS: Base Case Unchanged, But Upside Price RiskOwm Close CorporationNo ratings yet

- Gmo Resources Strategy: FactsDocument2 pagesGmo Resources Strategy: FactsOwm Close CorporationNo ratings yet

- Blog - Fed Watch Nifty FiftyDocument3 pagesBlog - Fed Watch Nifty FiftyOwm Close CorporationNo ratings yet

- Lithium Exploration Budgets Rebounded in 2021 and Increased 25% Year Over Year To $249 MillionDocument3 pagesLithium Exploration Budgets Rebounded in 2021 and Increased 25% Year Over Year To $249 MillionOwm Close CorporationNo ratings yet

- An Impressive Start To The Year For Nickel As It Hits 10-Year HighDocument7 pagesAn Impressive Start To The Year For Nickel As It Hits 10-Year HighOwm Close CorporationNo ratings yet

- ING Think Japanese Investors Turn Cautious On Sovereign Bonds Ahead of Global QTDocument4 pagesING Think Japanese Investors Turn Cautious On Sovereign Bonds Ahead of Global QTOwm Close CorporationNo ratings yet

- Horizonte Furnace - 20220225-Award-Of-Furnace-ContractDocument4 pagesHorizonte Furnace - 20220225-Award-Of-Furnace-ContractOwm Close CorporationNo ratings yet

- En - 20220322 Award of Epcm Contract To AfryDocument4 pagesEn - 20220322 Award of Epcm Contract To AfryOwm Close CorporationNo ratings yet

- RBPlat Vs Northam BidDocument2 pagesRBPlat Vs Northam BidOwm Close CorporationNo ratings yet

- ING Think The Impact of The War in Ukraine On Food Agri Has Only Just Started To UnravelDocument7 pagesING Think The Impact of The War in Ukraine On Food Agri Has Only Just Started To UnravelOwm Close CorporationNo ratings yet

- ING Think Aluminium Caught Up in Nickels Wild RideDocument4 pagesING Think Aluminium Caught Up in Nickels Wild RideOwm Close CorporationNo ratings yet

- The Flip Side of Large M&A DealsDocument6 pagesThe Flip Side of Large M&A DealsOwm Close CorporationNo ratings yet

- News Release: Red Chris Block Cave Pre-Feasibility Study Confirms Low Cost, Long LifeDocument5 pagesNews Release: Red Chris Block Cave Pre-Feasibility Study Confirms Low Cost, Long LifeOwm Close CorporationNo ratings yet

- Rate Shock Pandemic Spreading - Juggling DynamiteDocument3 pagesRate Shock Pandemic Spreading - Juggling DynamiteOwm Close CorporationNo ratings yet

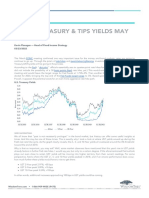

- Blog - Where Treasury TIPS Yields May Be HeadedDocument5 pagesBlog - Where Treasury TIPS Yields May Be HeadedOwm Close CorporationNo ratings yet

- Defective Rule 43 Application - Family LawDocument5 pagesDefective Rule 43 Application - Family LawOwm Close CorporationNo ratings yet

- Presidential Opening of The Aktogay Expansion Project FinalDocument1 pagePresidential Opening of The Aktogay Expansion Project FinalOwm Close CorporationNo ratings yet

- ASX Release: Karouni Plant Site Where Construction Commenced in February 2015Document6 pagesASX Release: Karouni Plant Site Where Construction Commenced in February 2015Owm Close CorporationNo ratings yet

- ING Think Why Us Secs Proposed Climate Disclosure Rules Are A Game ChangerDocument6 pagesING Think Why Us Secs Proposed Climate Disclosure Rules Are A Game ChangerOwm Close CorporationNo ratings yet

- Acquisition of Ferronickel Processing EquipmentDocument4 pagesAcquisition of Ferronickel Processing EquipmentOwm Close CorporationNo ratings yet

- ING Think Latam FX Outlook 2022 Return of The Pink TideDocument5 pagesING Think Latam FX Outlook 2022 Return of The Pink TideOwm Close CorporationNo ratings yet

- Nomad Royalty Company Acquires $75 Million Gold Stream On Ivanhoe Mines' Platreef PGM ProjectDocument6 pagesNomad Royalty Company Acquires $75 Million Gold Stream On Ivanhoe Mines' Platreef PGM ProjectOwm Close CorporationNo ratings yet

- 9119 Risk Breakdown StructureDocument5 pages9119 Risk Breakdown StructureNicolas ValleNo ratings yet

- D5 2 1Document95 pagesD5 2 1Uther GlastonburyNo ratings yet

- Land Use Suitability Analysis For Urban Development1Document18 pagesLand Use Suitability Analysis For Urban Development1indana zulfaNo ratings yet

- Ceoguidetogloballeadership BK DdiDocument23 pagesCeoguidetogloballeadership BK DdiNasir AliNo ratings yet

- Dynamic Response of High-Rise Buildings To Stochastic Wind: LoadsDocument12 pagesDynamic Response of High-Rise Buildings To Stochastic Wind: LoadsUma TamilNo ratings yet

- Liquidity ManagementDocument57 pagesLiquidity ManagementShanmuka SreenivasNo ratings yet

- Do Risk Assessment Tools Help Manage and Reduce Risk of Violence and Reoffending A Systematic ReviewDocument34 pagesDo Risk Assessment Tools Help Manage and Reduce Risk of Violence and Reoffending A Systematic ReviewGilberto Zúñiga MonjeNo ratings yet

- Anti-Piracy Trainees ManualDocument26 pagesAnti-Piracy Trainees ManualJerome E. Francisco100% (1)

- Role of Mobile in The Modern WorldDocument4 pagesRole of Mobile in The Modern WorldjunaidNo ratings yet

- CH 1Document16 pagesCH 1Mick MalickNo ratings yet

- Funeral Poverty Individual AssingmentDocument10 pagesFuneral Poverty Individual AssingmentMuhamad Nur HijirahNo ratings yet

- FRM Final ProjectDocument5 pagesFRM Final ProjectOkasha AliNo ratings yet

- 5266financial ManagementDocument458 pages5266financial ManagementMd. Ferdowsur Rahman100% (2)

- Trading PlanDocument2 pagesTrading PlanGirish NairNo ratings yet

- Poster ContentDocument2 pagesPoster ContentBienvenida Ycoy MontenegroNo ratings yet

- It Disaster Recovery and BCP Service LevelDocument1 pageIt Disaster Recovery and BCP Service LevelHector Eduardo ErmacoraNo ratings yet

- Types of Planning (FOM) FinalDocument17 pagesTypes of Planning (FOM) FinalAbhijeet SinghNo ratings yet

- 8 - Risk Based Thinking PDFDocument52 pages8 - Risk Based Thinking PDFdanu100% (1)

- Skipper-Limited 202 QuarterUpdateDocument8 pagesSkipper-Limited 202 QuarterUpdateSaran BaskarNo ratings yet

- PHD Report Security Survey FinalDocument9 pagesPHD Report Security Survey FinalChristian Dave Tad-awan100% (2)

- AAII Brain On Stocks Presentsation NYC 2014Document53 pagesAAII Brain On Stocks Presentsation NYC 2014ritholtz1No ratings yet

- Journal Accounting and AuditingDocument143 pagesJournal Accounting and AuditinghazemzNo ratings yet

- DISASTER Management in IndiaDocument25 pagesDISASTER Management in IndiaNikitha ShindeNo ratings yet

- Transition of CareDocument52 pagesTransition of CareAffan PresentationsNo ratings yet

- Risk Assessment Phoenix ParkDocument3 pagesRisk Assessment Phoenix ParkGerogia CoakleyNo ratings yet

- AirendsDocument130 pagesAirendsmiguel angel vanegas medinaNo ratings yet

Blog - Narratives and Earnings On Chinese Equity What Changed

Blog - Narratives and Earnings On Chinese Equity What Changed

Uploaded by

Owm Close CorporationOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Blog - Narratives and Earnings On Chinese Equity What Changed

Blog - Narratives and Earnings On Chinese Equity What Changed

Uploaded by

Owm Close CorporationCopyright:

Available Formats

WisdomTree BLOG ARTICLE

NARRATIVES AND EARNINGS ON

CHINESE EQUITY: WHAT CHANGED?

Liqian Ren — Director of Modern Alpha

03/25/2022

Last week, China’s State Council released a readout of the financial stability and development committee meeting

chaired by Vice Premier Liu He. It was a regular meeting but intended to address ongoing financial concerns—namely,

the collapsing Chinese stock market, particularly offshore China equities. The market went into an extreme rally in Hong

Kong, followed by a significant rally in U.S. offshore China stocks.

The readout was intended to address the common concerns contributing to falling stocks.

It addressed investors’ major concerns on macroeconomic conditions and policies, risk in the Chinese real estate market,

the regulation of platform companies and the audit regulatory relationship between the U.S. and China.

Media headlines here in the U.S. were more positive than the actual Chinese words of the release.

For example, it never said or implied “regulation on Big Tech will end soon,” but that’s one of the headlines all over

English media. The readout merely said it should quickly implement the current plans for large platform companies in a

transparent measure, coordinate news releases among departments and not upset the capital market with any sudden

news. This means the government has more plans it wants to implement. For example, after Ant Group is asked to spin

off the payment part of its business, it is expected Tencent will face something similar.

So, what did the government accomplish?

It did change the narrative away from constant “China Tech Crackdown” headlines.

What did it not accomplish?

It did not change a lingering worry that the Chinese government is losing credibility that it will put economic growth as

the highest priority with actual policies.

Specifically, here are the lingering worries:

1. Is the PBoC (People’s Bank of China) serious about using monetary tools like a large interest rate cut to stimulate

the economy?

2. How serious is China about working with the PCAOB (Public Company Accounting Oversight Board) to meet the

requirements of the HFCAA (Holding Foreign Companies Accountable Act)? We believe this risk could be

managed, since more than 90% of the WisdomTree ex-State-Owned China Index is already trading Hong Kong or

Chinese domestic shares, not U.S. shares, as many large-mid companies have a dual share listing, and liquidity in

Hong Kong has significantly improved.

3. How serious is the government’s fiscal stimulus? After the meeting readout, the Ministry of Finance said its property

tax experiment would not expand to additional cities this year. This is a very small fiscal impact issue, and more

concrete and bolder tax cuts and spending policies are needed to make Liu He’s plan of action credible.

Russia’s invasion of Ukraine is creating another headwind for China, as it faces the risk of secondary sanctions from the

U.S. and European countries.

A decoupling of U.S.-China in key sectors like semiconductors has already begun, with more sectors to come.

Russia is China’s immediate northern neighbor and a major supplier of energy. Broadly defined, China has lost significant

territory from Russian pressures over a very long history. There is also an increased mistrust of the U.S., as hundreds of

Chinese companies have been put on the U.S. sanctions list since 2016.

Currently, the word China’s been using is “independent” foreign relations, not “neutral,” because it couldn’t and won’t

completely cut off from Russia. Anecdotally, just in the last two days, there has been some shift in domestic media

WisdomTree.com 1-866-909-WISE (9473)

WisdomTree BLOG ARTICLE

toward pro-Ukraine coverage, as China’s president talked with President Biden on March 18.

China’s dynamic zero COVID-19 policy is also still in place, battling Omicron with some lockdowns and mobilized

testing, as the high transmission is making it harder to contain like Delta. So far, its impact on manufacturing and the

global supply chain is still subdued, as Chinese companies have quickly learned to use Olympic bubble-style

management to keep factories open. The impact of the domestic service economy is significant, which will continue to

dampen domestic consumption.

For investors, our thesis on China is still earnings. With our free fund comparison tool, we can see that ex-state-owned

companies are still delivering significant earnings growth.

We believe the Russian war and earnings are the top factors to pay attention to for China equity. Can Chinese companies

continue making money in the face of all these risks?

That’s the most important question for long-term investors.

For definitions of terms in the chart above, please visit the glossary.

For more on this topic, please listen to one of our latest China of Tomorrow podcast, where Liqian Ren speaks

with Bruce Liu about global semiconductor industry and China equity.

China of Tomorrow by WisdomTree Asset Management · Interview with Esoterica Capital

For standardized performance and the most recent month-end performance click here NOTE, this material is intended

for electronic use only. Individuals who intend to print and physically deliver to an investor must print the monthly

performance report to accompany this blog.

View the online version of this article here.

WisdomTree.com 1-866-909-WISE (9473)

WisdomTree BLOG ARTICLE

IMPORTANT INFORMATION

U.S. investors only: Click here to obtain a WisdomTree ETF prospectus which contains investment objectives,

risks, charges, expenses, and other information; read and consider carefully before investing.

There are risks involved with investing, including possible loss of principal. Foreign investing involves currency, political

and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller

companies may experience greater price volatility. Investments in emerging markets, currency, fixed income and

alternative investments include additional risks. Please see prospectus for discussion of risks.

Past performance is not indicative of future results. This material contains the opinions of the author, which are subject to

change, and should not to be considered or interpreted as a recommendation to participate in any particular trading

strategy, or deemed to be an offer or sale of any investment product and it should not be relied on as such. There is no

guarantee that any strategies discussed will work under all market conditions. This material represents an assessment of

the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future

results. This material should not be relied upon as research or investment advice regarding any security in particular. The

user of this information assumes the entire risk of any use made of the information provided herein. Neither WisdomTree

nor its affiliates, nor Foreside Fund Services, LLC, or its affiliates provide tax or legal advice. Investors seeking tax or legal

advice should consult their tax or legal advisor. Unless expressly stated otherwise the opinions, interpretations or findings

expressed herein do not necessarily represent the views of WisdomTree or any of its affiliates.

The MSCI information may only be used for your internal use, may not be reproduced or re-disseminated in any form and

may not be used as a basis for or component of any financial instruments or products or indexes. None of the MSCI

information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind

of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an

indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on

an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of

its affiliates and each entity involved in compiling, computing or creating any MSCI information (collectively, the “MSCI

Parties”) expressly disclaims all warranties. With respect to this information, in no event shall any MSCI Party have any

liability for any direct, indirect, special, incidental, punitive, consequential (including loss profits) or any other damages (

www.msci.com)

Jonathan Steinberg, Jeremy Schwartz, Rick Harper, Christopher Gannatti, Bradley Krom, Tripp Zimmerman, Michael

Barrer, Anita Rausch, Kevin Flanagan, Brendan Loftus, Joseph Tenaglia, Jeff Weniger, Matt Wagner, Alejandro Saltiel,

Ryan Krystopowicz, Kara Marciscano, Jianing Wu and Brian Manby are registered representatives of Foreside Fund

Services, LLC.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.

You cannot invest directly in an index.

WisdomTree.com 1-866-909-WISE (9473)

WisdomTree BLOG ARTICLE

DEFINITIONS

People’s Bank of China (PBOC) : is the central bank of the People’s Republic of China with the power to control

monetary policy and regulate financial institutions in mainland China.

Liquidity : The degree to which an asset or security can be bought or sold in the market without affecting the asset’s

price. Liquidity is characterized by a high level of trading activity. Assets that can be easily bought or sold are known as

liquid asset.

WisdomTree.com 1-866-909-WISE (9473)

You might also like

- ICWIM Sample QuestionsDocument31 pagesICWIM Sample QuestionsSenthil Kumar K100% (7)

- Asset ManagementDocument16 pagesAsset Managementmkkamaraj89% (9)

- BBNG3103 International Business Zahayu Jamaludin 770209015360Document10 pagesBBNG3103 International Business Zahayu Jamaludin 770209015360zulkis73No ratings yet

- API 580 - RBI Question BankDocument30 pagesAPI 580 - RBI Question BankSabarni Mahapatra100% (3)

- PMCA Data Center Relocation (DCR) Pre-Planning GuideDocument71 pagesPMCA Data Center Relocation (DCR) Pre-Planning GuideJohn Sarazen100% (5)

- Er 20130708 Bull Phat DragonDocument3 pagesEr 20130708 Bull Phat DragonDavid SmithNo ratings yet

- Financial Market AnalysisDocument5 pagesFinancial Market AnalysisjamesNo ratings yet

- The World Economy... 22/03/2010Document2 pagesThe World Economy... 22/03/2010Rhb InvestNo ratings yet

- Why Taiwan's Large Banks Have Systemic Importance and Large Insurers Don'tDocument5 pagesWhy Taiwan's Large Banks Have Systemic Importance and Large Insurers Don'tapi-239405494No ratings yet

- Mark Baribeau Jennison Associates Navigating Global Equities ThroughDocument9 pagesMark Baribeau Jennison Associates Navigating Global Equities ThroughWarren RileyNo ratings yet

- CIO Note Feb 6 2018Document2 pagesCIO Note Feb 6 2018Anonymous 2LowCnVdfNo ratings yet

- Research Papers On Global Financial CrisisDocument4 pagesResearch Papers On Global Financial Crisisfvf237cz100% (1)

- China Outlook Q&ADocument3 pagesChina Outlook Q&Avenky2000No ratings yet

- Four in Four ReportDocument2 pagesFour in Four ReportValuEngine.comNo ratings yet

- Chinese Financial System Elliott YanDocument44 pagesChinese Financial System Elliott YanAbel ChanNo ratings yet

- er20130211BullPhatDragon PDFDocument2 pageser20130211BullPhatDragon PDFAmanda MooreNo ratings yet

- The International Financial Crisis and Its Impact: Convocation Address by Dr. C. RangarajanDocument5 pagesThe International Financial Crisis and Its Impact: Convocation Address by Dr. C. RangarajanAnand SoniNo ratings yet

- Divergent Vaccine Rollout Leading To Asymmetric Risk: DailyDocument4 pagesDivergent Vaccine Rollout Leading To Asymmetric Risk: DailyBokulNo ratings yet

- Journal of Regulation & Risk - North Asia, Winter 2015 EditionDocument164 pagesJournal of Regulation & Risk - North Asia, Winter 2015 EditionChrisRogersNo ratings yet

- Preqin Private Equity Spotlight June 2012Document17 pagesPreqin Private Equity Spotlight June 2012richard_dalaudNo ratings yet

- Economist-Insights 1 JulyDocument2 pagesEconomist-Insights 1 JulybuyanalystlondonNo ratings yet

- June 15, 2009 - Morning CallDocument3 pagesJune 15, 2009 - Morning Callkkeenan5008475No ratings yet

- Assessing The Impact of The Dodd-Frank Act Four Years LaterDocument36 pagesAssessing The Impact of The Dodd-Frank Act Four Years LaterAmerican Enterprise InstituteNo ratings yet

- Finance Term Paper IdeasDocument8 pagesFinance Term Paper Ideasc5q1thnj100% (1)

- The Influence of The Strong Economy On Financial Markets: All The Other Organs Take Their Tone."Document2 pagesThe Influence of The Strong Economy On Financial Markets: All The Other Organs Take Their Tone."Ronalie Sustuedo100% (1)

- The World Economy... - 21/004/2010Document2 pagesThe World Economy... - 21/004/2010Rhb InvestNo ratings yet

- The World Economy... - 10/08/2010Document2 pagesThe World Economy... - 10/08/2010Rhb InvestNo ratings yet

- The Weekly Ecomonic Update For The Week of April 20, 2015.Document2 pagesThe Weekly Ecomonic Update For The Week of April 20, 2015.mike1473No ratings yet

- China September CPIDocument4 pagesChina September CPIAnonymous Ht0MIJNo ratings yet

- ValuEngine Weekly Newsletter August 17, 2012Document9 pagesValuEngine Weekly Newsletter August 17, 2012ValuEngine.comNo ratings yet

- (LGT) 20210316 - DRU - Sector RotationDocument3 pages(LGT) 20210316 - DRU - Sector RotationRuehYinn YapNo ratings yet

- September 7th, 2012: Market OverviewDocument9 pagesSeptember 7th, 2012: Market OverviewValuEngine.comNo ratings yet

- Er 20120911 Bull Phat DragonDocument2 pagesEr 20120911 Bull Phat DragonLuke Campbell-SmithNo ratings yet

- Newsletter March 2015 FinalDocument9 pagesNewsletter March 2015 FinalavishathakkarNo ratings yet

- Finance Pytania 4Document4 pagesFinance Pytania 4Marta SzczerskaNo ratings yet

- Investing in the High Yield Municipal Market: How to Profit from the Current Municipal Credit Crisis and Earn Attractive Tax-Exempt Interest IncomeFrom EverandInvesting in the High Yield Municipal Market: How to Profit from the Current Municipal Credit Crisis and Earn Attractive Tax-Exempt Interest IncomeNo ratings yet

- The People United Will Leave The Banks DividedDocument4 pagesThe People United Will Leave The Banks DividedRicharnellia-RichieRichBattiest-CollinsNo ratings yet

- Nonprofit Investment and Development Solutions: A Guide to Thriving in Today's EconomyFrom EverandNonprofit Investment and Development Solutions: A Guide to Thriving in Today's EconomyNo ratings yet

- International Treasurer - October 2008 - The Financial Crisis Heats UpDocument16 pagesInternational Treasurer - October 2008 - The Financial Crisis Heats UpitreasurerNo ratings yet

- QEIC Fall ReportDocument37 pagesQEIC Fall ReportQEICNo ratings yet

- Sun Life Financial Report - EditedDocument22 pagesSun Life Financial Report - EditedtrmyespinaNo ratings yet

- Asian Development Bank Institute: ADBI Working Paper SeriesDocument15 pagesAsian Development Bank Institute: ADBI Working Paper SeriesAbdessamad MarrakechNo ratings yet

- er20121116BullPhatdragon PDFDocument2 pageser20121116BullPhatdragon PDFBelinda WinkelmanNo ratings yet

- er20130306BullPhatDragon PDFDocument2 pageser20130306BullPhatDragon PDFBrian FordNo ratings yet

- Global Financial Crisis and SecuritizationDocument6 pagesGlobal Financial Crisis and SecuritizationSumit KumramNo ratings yet

- Chaanakya Chaanakya Chaanakya Chaanakya: National HeadlinesDocument8 pagesChaanakya Chaanakya Chaanakya Chaanakya: National HeadlinesChaanakya_cuimNo ratings yet

- Federal Reserves Economic SymposiumDocument2 pagesFederal Reserves Economic SymposiumSubham MazumdarNo ratings yet

- Third Quarter 2016 Investment Outlook: Asset Class SectorDocument6 pagesThird Quarter 2016 Investment Outlook: Asset Class SectorAnonymous DJrec2No ratings yet

- China, Its Currency & The Global Economy: Presented by Fred Leamnson, CFP®, AIF®Document2 pagesChina, Its Currency & The Global Economy: Presented by Fred Leamnson, CFP®, AIF®api-118535366No ratings yet

- Lenders Risk HypothesisDocument6 pagesLenders Risk HypothesisWadiah AkbarNo ratings yet

- Aug 4thDocument15 pagesAug 4thshefalijnNo ratings yet

- Trading Strateg: April 2022 Pension Fund Rebalancing EstimatesDocument2 pagesTrading Strateg: April 2022 Pension Fund Rebalancing EstimatessirdquantsNo ratings yet

- Sub Prime CrisisDocument2 pagesSub Prime CrisisGomathiRachakondaNo ratings yet

- VIMC Investors Hold A Worthless BagDocument37 pagesVIMC Investors Hold A Worthless BagTrinity Research GroupNo ratings yet

- Research Paper On JP Morgan ChaseDocument7 pagesResearch Paper On JP Morgan Chaseafmcvhffm100% (1)

- Tracking The World Economy... - 12/10/2010Document2 pagesTracking The World Economy... - 12/10/2010Rhb InvestNo ratings yet

- Summary of Makers and Takers: by Rana Foroohar | Includes AnalysisFrom EverandSummary of Makers and Takers: by Rana Foroohar | Includes AnalysisNo ratings yet

- Annual Report 2010 - SADocument173 pagesAnnual Report 2010 - SALinh KuNo ratings yet

- Roundtwo Financial CrisisDocument21 pagesRoundtwo Financial CrisisIrene LyeNo ratings yet

- Muafa's Module 10 AssignmentDocument5 pagesMuafa's Module 10 AssignmentMuafa BasheerNo ratings yet

- Presented To:: Authored byDocument16 pagesPresented To:: Authored byankushsonigraNo ratings yet

- Rational Market Economics: A Compass for the Beginning InvestorFrom EverandRational Market Economics: A Compass for the Beginning InvestorNo ratings yet

- The Alchemy of Investment: Winning Strategies of Professional InvestmentFrom EverandThe Alchemy of Investment: Winning Strategies of Professional InvestmentNo ratings yet

- Life Insurance in Asia: Sustaining Growth in the Next DecadeFrom EverandLife Insurance in Asia: Sustaining Growth in the Next DecadeNo ratings yet

- Blog - The WisdomTree Q2 2022 Economic and Market Outlook in 10 Charts or LessDocument11 pagesBlog - The WisdomTree Q2 2022 Economic and Market Outlook in 10 Charts or LessOwm Close CorporationNo ratings yet

- 5 Key Factors Facing U.S. Treasury Yields - Seeking AlphaDocument12 pages5 Key Factors Facing U.S. Treasury Yields - Seeking AlphaOwm Close CorporationNo ratings yet

- ING Think Rates Spark Inflation Reasserts Itself As The Main Driver of Rates 2Document5 pagesING Think Rates Spark Inflation Reasserts Itself As The Main Driver of Rates 2Owm Close CorporationNo ratings yet

- Fed Hikes 50bp With Much More To Come: Economic and Financial AnalysisDocument5 pagesFed Hikes 50bp With Much More To Come: Economic and Financial AnalysisOwm Close CorporationNo ratings yet

- ING Think Us Housing Market Exhibits More Signs of SlowdownDocument6 pagesING Think Us Housing Market Exhibits More Signs of SlowdownOwm Close CorporationNo ratings yet

- Invasion Effect On PGMS: Base Case Unchanged, But Upside Price RiskDocument4 pagesInvasion Effect On PGMS: Base Case Unchanged, But Upside Price RiskOwm Close CorporationNo ratings yet

- Gmo Resources Strategy: FactsDocument2 pagesGmo Resources Strategy: FactsOwm Close CorporationNo ratings yet

- Blog - Fed Watch Nifty FiftyDocument3 pagesBlog - Fed Watch Nifty FiftyOwm Close CorporationNo ratings yet

- Lithium Exploration Budgets Rebounded in 2021 and Increased 25% Year Over Year To $249 MillionDocument3 pagesLithium Exploration Budgets Rebounded in 2021 and Increased 25% Year Over Year To $249 MillionOwm Close CorporationNo ratings yet

- An Impressive Start To The Year For Nickel As It Hits 10-Year HighDocument7 pagesAn Impressive Start To The Year For Nickel As It Hits 10-Year HighOwm Close CorporationNo ratings yet

- ING Think Japanese Investors Turn Cautious On Sovereign Bonds Ahead of Global QTDocument4 pagesING Think Japanese Investors Turn Cautious On Sovereign Bonds Ahead of Global QTOwm Close CorporationNo ratings yet

- Horizonte Furnace - 20220225-Award-Of-Furnace-ContractDocument4 pagesHorizonte Furnace - 20220225-Award-Of-Furnace-ContractOwm Close CorporationNo ratings yet

- En - 20220322 Award of Epcm Contract To AfryDocument4 pagesEn - 20220322 Award of Epcm Contract To AfryOwm Close CorporationNo ratings yet

- RBPlat Vs Northam BidDocument2 pagesRBPlat Vs Northam BidOwm Close CorporationNo ratings yet

- ING Think The Impact of The War in Ukraine On Food Agri Has Only Just Started To UnravelDocument7 pagesING Think The Impact of The War in Ukraine On Food Agri Has Only Just Started To UnravelOwm Close CorporationNo ratings yet

- ING Think Aluminium Caught Up in Nickels Wild RideDocument4 pagesING Think Aluminium Caught Up in Nickels Wild RideOwm Close CorporationNo ratings yet

- The Flip Side of Large M&A DealsDocument6 pagesThe Flip Side of Large M&A DealsOwm Close CorporationNo ratings yet

- News Release: Red Chris Block Cave Pre-Feasibility Study Confirms Low Cost, Long LifeDocument5 pagesNews Release: Red Chris Block Cave Pre-Feasibility Study Confirms Low Cost, Long LifeOwm Close CorporationNo ratings yet

- Rate Shock Pandemic Spreading - Juggling DynamiteDocument3 pagesRate Shock Pandemic Spreading - Juggling DynamiteOwm Close CorporationNo ratings yet

- Blog - Where Treasury TIPS Yields May Be HeadedDocument5 pagesBlog - Where Treasury TIPS Yields May Be HeadedOwm Close CorporationNo ratings yet

- Defective Rule 43 Application - Family LawDocument5 pagesDefective Rule 43 Application - Family LawOwm Close CorporationNo ratings yet

- Presidential Opening of The Aktogay Expansion Project FinalDocument1 pagePresidential Opening of The Aktogay Expansion Project FinalOwm Close CorporationNo ratings yet

- ASX Release: Karouni Plant Site Where Construction Commenced in February 2015Document6 pagesASX Release: Karouni Plant Site Where Construction Commenced in February 2015Owm Close CorporationNo ratings yet

- ING Think Why Us Secs Proposed Climate Disclosure Rules Are A Game ChangerDocument6 pagesING Think Why Us Secs Proposed Climate Disclosure Rules Are A Game ChangerOwm Close CorporationNo ratings yet

- Acquisition of Ferronickel Processing EquipmentDocument4 pagesAcquisition of Ferronickel Processing EquipmentOwm Close CorporationNo ratings yet

- ING Think Latam FX Outlook 2022 Return of The Pink TideDocument5 pagesING Think Latam FX Outlook 2022 Return of The Pink TideOwm Close CorporationNo ratings yet

- Nomad Royalty Company Acquires $75 Million Gold Stream On Ivanhoe Mines' Platreef PGM ProjectDocument6 pagesNomad Royalty Company Acquires $75 Million Gold Stream On Ivanhoe Mines' Platreef PGM ProjectOwm Close CorporationNo ratings yet

- 9119 Risk Breakdown StructureDocument5 pages9119 Risk Breakdown StructureNicolas ValleNo ratings yet

- D5 2 1Document95 pagesD5 2 1Uther GlastonburyNo ratings yet

- Land Use Suitability Analysis For Urban Development1Document18 pagesLand Use Suitability Analysis For Urban Development1indana zulfaNo ratings yet

- Ceoguidetogloballeadership BK DdiDocument23 pagesCeoguidetogloballeadership BK DdiNasir AliNo ratings yet

- Dynamic Response of High-Rise Buildings To Stochastic Wind: LoadsDocument12 pagesDynamic Response of High-Rise Buildings To Stochastic Wind: LoadsUma TamilNo ratings yet

- Liquidity ManagementDocument57 pagesLiquidity ManagementShanmuka SreenivasNo ratings yet

- Do Risk Assessment Tools Help Manage and Reduce Risk of Violence and Reoffending A Systematic ReviewDocument34 pagesDo Risk Assessment Tools Help Manage and Reduce Risk of Violence and Reoffending A Systematic ReviewGilberto Zúñiga MonjeNo ratings yet

- Anti-Piracy Trainees ManualDocument26 pagesAnti-Piracy Trainees ManualJerome E. Francisco100% (1)

- Role of Mobile in The Modern WorldDocument4 pagesRole of Mobile in The Modern WorldjunaidNo ratings yet

- CH 1Document16 pagesCH 1Mick MalickNo ratings yet

- Funeral Poverty Individual AssingmentDocument10 pagesFuneral Poverty Individual AssingmentMuhamad Nur HijirahNo ratings yet

- FRM Final ProjectDocument5 pagesFRM Final ProjectOkasha AliNo ratings yet

- 5266financial ManagementDocument458 pages5266financial ManagementMd. Ferdowsur Rahman100% (2)

- Trading PlanDocument2 pagesTrading PlanGirish NairNo ratings yet

- Poster ContentDocument2 pagesPoster ContentBienvenida Ycoy MontenegroNo ratings yet

- It Disaster Recovery and BCP Service LevelDocument1 pageIt Disaster Recovery and BCP Service LevelHector Eduardo ErmacoraNo ratings yet

- Types of Planning (FOM) FinalDocument17 pagesTypes of Planning (FOM) FinalAbhijeet SinghNo ratings yet

- 8 - Risk Based Thinking PDFDocument52 pages8 - Risk Based Thinking PDFdanu100% (1)

- Skipper-Limited 202 QuarterUpdateDocument8 pagesSkipper-Limited 202 QuarterUpdateSaran BaskarNo ratings yet

- PHD Report Security Survey FinalDocument9 pagesPHD Report Security Survey FinalChristian Dave Tad-awan100% (2)

- AAII Brain On Stocks Presentsation NYC 2014Document53 pagesAAII Brain On Stocks Presentsation NYC 2014ritholtz1No ratings yet

- Journal Accounting and AuditingDocument143 pagesJournal Accounting and AuditinghazemzNo ratings yet

- DISASTER Management in IndiaDocument25 pagesDISASTER Management in IndiaNikitha ShindeNo ratings yet

- Transition of CareDocument52 pagesTransition of CareAffan PresentationsNo ratings yet

- Risk Assessment Phoenix ParkDocument3 pagesRisk Assessment Phoenix ParkGerogia CoakleyNo ratings yet

- AirendsDocument130 pagesAirendsmiguel angel vanegas medinaNo ratings yet