Professional Documents

Culture Documents

The Exit Planning Questionnaire: The First Step To Exiting Your Business On Your Terms

The Exit Planning Questionnaire: The First Step To Exiting Your Business On Your Terms

Uploaded by

abhijit duttaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Exit Planning Questionnaire: The First Step To Exiting Your Business On Your Terms

The Exit Planning Questionnaire: The First Step To Exiting Your Business On Your Terms

Uploaded by

abhijit duttaCopyright:

Available Formats

The

Exit Planning

Questionnaire

The First Step to

Exiting Your Business

On Your Terms

by Richard E. Jackim, JD, MBA

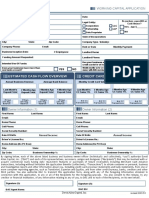

Exit Planning Questionnaire Client Company.

TABLE OF CONTENTS PAGE

Personal Information ........................................................................................................... 4

Your Instructions (Contingency Plan) ............................................................................. 10

Company Information ........................................................................................................ 11

Business Description......................................................................................................... 12

Company Background ....................................................................................................... 12

The Owners ......................................................................................................................... 13

Industry Data....................................................................................................................... 15

Markets and Competition .................................................................................................. 15

Operations........................................................................................................................... 16

Company Products ............................................................................................................ 17

Sales, Marketing and Distribution .................................................................................... 19

Customers ........................................................................................................................... 20

Suppliers ............................................................................................................................. 21

Information Technology .................................................................................................... 21

Insurance............................................................................................................................. 22

Personnel ............................................................................................................................ 23

Equipment, Machinery and Intangible Assets ................................................................ 26

Real Estate .......................................................................................................................... 26

Environmental Matters ...................................................................................................... 28

Safety ................................................................................................................................... 29

Opportunities for Growth .................................................................................................. 29

Inventory ............................................................................................................................. 30

Strengths and Weaknesses .............................................................................................. 30

Other .................................................................................................................................... 30

Price and Terms ................................................................................................................. 31

February 7, 2013 Page ii

Copyright © The Exit Planning Institute, Inc., 2005-2006

Exit Planning Questionnaire Client Company.

Financial Summary ............................................................................................................ 31

Taxes ................................................................................................................................... 33

Contracts ............................................................................................................................. 33

Litigation and Regulatory Compliance ............................................................................ 34

Exhibits................................................................................................................................ 34

February 7, 2013 Page iii

Copyright © The Exit Planning Institute, Inc., 2005-2006

Exit Planning Questionnaire Client Company.

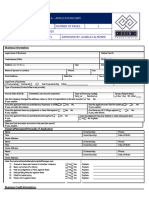

In completing this Questionnaire, please complete all blank spaces or indicate "NA" if "not applicable".

All dollar values may be rounded to the nearest thousand.

Personal Information

The succession planning process begins with a thorough understanding of you, your

current situation, and your objectives. Once your short-term and long-term objectives are

understood, they will define the course of the Succession Planning Coach process.

You and your family:

1. How old are you?

2. How old is your spouse?

3. Please list your children and their ages.

4. If you have grandchildren, please list

their names and ages.

5. Do you or your spouse have any serious

health issues?

6. Do any of your children have any serious

health issues?

7. Do you, or anyone in your extended

family (spouse, children and

grandchildren), have any special needs?

Please tell us about your hobbies outside of work. What do you do for fun?

If time and money was no object, what would you like to do:

Tomorrow?

Next Month?

Next Year?

In Five Years?

Do you have definite plans for what you will do after you retire from the company?

Yes No

February 7, 2013 Page 4

Copyright © The Exit Planning Institute, Inc., 2005-2006

Exit Planning Questionnaire Client Company.

If yes, what are those plans?

Your Professional Advisors:

Please provide us with the contact information for your professional advisors:

Profession Contact Information

Name:

Firm:

Attorney Address:

City, State, Zip:

Telephone:

Name:

Firm:

CPA Address:

City, State, Zip:

Telephone:

Name:

Firm:

Personal Financial Advisor Address:

City, State, Zip:

Telephone:

Name:

Firm:

Insurance Specialist Address:

City, State, Zip:

Telephone:

Name:

Firm:

Tax Advisor (if different from your attorney Address:

or CPA)

City, State, Zip:

Telephone:

February 7, 2013 Page 5

Copyright © The Exit Planning Institute, Inc., 2005-2006

Exit Planning Questionnaire Client Company.

Name:

Firm:

Other Address:

City, State, Zip:

Telephone:

Your Goals:

This is where we define the Who, What, and When of the succession planning process.

The Who

Do any members of your extended family have an interest in the business?

Yes No

If yes, describe:

Do any of your children or relatives have the necessary skills to run the business?

Yes No

If yes, describe who and their relationship to you:

Do any of your family members have strong feelings about what you should do with the business?

Do all of the owners agree about the possible sale of the business?

Yes No

If no, describe:

Have you thought about to whom you may wish to transfer your business?

Yes No

February 7, 2013 Page 6

Copyright © The Exit Planning Institute, Inc., 2005-2006

Exit Planning Questionnaire Client Company.

If yes, does it involve a transfer to:

Family members

Employees

Co-owners

Third party buyer

The What

What do you want to accomplish as part of the transfer of your business? Please rank the following in

order of importance to you (1-highest, 10-lowest).

Get full value for my business to fund my retirement or other business interests

Transfer wealth to my children or grandchildren

Provide benefit to my managers and employees

Maintain the long-term viability of the business

Minimize or eliminate capital gains taxes

Fund charitable endeavors

Minimize or eliminate estate taxes

Continuing to work at the company

Retaining a minority equity interest in the company

Other (please describe)

The When

When would you like to remove yourself from active involvement in the company?

When would you like to transfer ownership in the company in return for financial independence?

February 7, 2013 Page 7

Copyright © The Exit Planning Institute, Inc., 2005-2006

Exit Planning Questionnaire Client Company.

Are there any factors that could force you to sell the business in the foreseeable future?

Tax Planning

Tax Plan –

In the sale of a business, the critical factor is not the amount the business sells for but what you put in

your pocket after taxes. Expert tax planning can substantially reduce and/or delay the amount of taxes

paid from the proceeds of the sale. Once again, the maximum flexibility is achieved when tax planning

occurs prior to the sale of the business.

Have you developed a tax minimization plan for the sale of the business? Yes No

Has your tax plan been updated for the most recent tax law changes? Yes No

Estate Planning

Estate Plan -

Since business ownership often represents a substantial portion of an owner’s estate, it is important that

an estate plan be designed that takes into account all of the owner’s objectives including the sale of the

business. For the maximum flexibility, estate plans should be established long before a sale of the

business is completed.

Do you have an estate plan? Yes No

Has your estate plan been updated in the last two years? Yes No

Does the plan provide for the sale of the business? Yes No

Does the estate plan include an updated evaluation of the business? Yes No

Financial Planning

We respect your privacy, but helping you determined how much you NEED (not want) to net (after taxes)

from the sale of your company in order to fund your retirement or future goals is an important part of the

exit planning process. If you have completed a financial plan with a qualified financial advisor to

determine this, please provide us with a copy so that we can incorporate those findings into our analysis.

If you have not completed a detailed financial plan, please provide us with the following information so

that we can understand you current financial picture and give you with an “approximate” estimate of the

amount you will need to net from your exit.

Sources of Income

Current Salary & Benefits

Rents

Trust Payments

Other Income

Expenses

Current Annual Cost to Maintain your Lifestyle

Expected Annual Cost to Maintain your Lifestyle after you Exit

February 7, 2013 Page 8

Copyright © The Exit Planning Institute, Inc., 2005-2006

Exit Planning Questionnaire Client Company.

Assets Amount

Checking/Savings Account

IRAs

Savings Plans (401K, TDA)

Securities (stocks, bonds, mutual funds)

Real Estate

Liabilities

Credit Card Balances

Mortgages

Personal Loans

Personal Guarantees

Do your future plans call for any major capital expenditures including paying for a child or grandchild’s

education, buying or building a second home, buying or starting a business, or starting any other capital

intensive project in the foreseeable future?

Yes No

Insurance Planning

Do you have the following types of insurance? If so, please provide coverage amount.

Yes No Coverage

Life insurance

Disability

Health care

Long-term care

Do you have a contingency plan in place for the business should you become incapacitated?

Yes No

If yes, is the plan documented?

Yes No

Have you and your financial advisor calculated the amount of after-tax income you will need to live on

after the sale of the business? If yes, how much after-tax income will you need?

February 7, 2013 Page 9

Copyright © The Exit Planning Institute, Inc., 2005-2006

Exit Planning Questionnaire Client Company.

Do you have other sources of income besides income related to your business? If yes, describe:

Your Instructions (Contingency Plan)

Despite everyone’s best efforts and best wishes sometimes bad things happened to good people. There is

nothing that any of us can do about it except for plan for that possibility. In the following section we will

ask you a series of questions in order to develop a set of instructions that can be delivered to your family,

your management team, and your team of advisors in the event that you are suddenly unable to manage

your business or complete your exit plan.

Who would you like to manage your company? Please be as specific as possible about the people and the

key positions that you would like them to assume. If you feel it would be important to hire out outside

manager on an interim basis, please note that.

Name Comments

President

Sales/Marketing

Operations

Financial

What incentives, if any, should your family give key employees to stay with the company following your

death or disability?

Yes No Comments

Stay Bonus

Phantom Stock

Equity

Raise

Who should have oversight of the management team? We recommend having a board of directors

composed of trusted family members, friend and/or advisors.

Name Comments

February 7, 2013 Page 10

Copyright © The Exit Planning Institute, Inc., 2005-2006

Exit Planning Questionnaire Client Company.

What would you like your family to do with the company and within what time frame?

Yes No Comments

Continue to Own

Sell

Close & Liquidate

If a sale is appropriate, who do you think would be the most logical buyer(s)?

Name Comments

If a sale is appropriate, who would you like to handle the sale of the company?

Name: Comments

Firm:

Telephone:

Company Information

Basic Company Information

Company Address

City, State & Zip Code

State of Incorporation

Type of Entity

Date of Incorporation / S-Corp Election Date

Primary SIC

Secondary SIC(s)

Year Company was founded

February 7, 2013 Page 11

Copyright © The Exit Planning Institute, Inc., 2005-2006

Exit Planning Questionnaire Client Company.

First year of current ownership

Number of Owners

Number of Active owners

Number of Inactive owners

Business Description

Please provide a brief summary of your business, including the niche in which you serve. Please take as much

room as you feel you need to adequately provide a basic description of your business.

What is the percentage breakdown for products, services, etc.? Has there been any major change the last

few years?

What is the Company’s competitive edge? What is unique about the Company that distinguishes it from

others?

Does the business experience seasonal fluctuations? Describe.

Company Background

Discuss when and why the Company was founded:

Discuss when and how the present owners assumed their current ownership interest:

Are there any subsidiaries or divisions of the Company? If so, what are they and what do they do?

February 7, 2013 Page 12

Copyright © The Exit Planning Institute, Inc., 2005-2006

Exit Planning Questionnaire Client Company.

How long has the Company operated from its present location. If the Company relocated to its present

location in the last 5 years explain the reason for the move and from where:

Is the Company relocatable? Discuss how this could be accomplished:

Has the Company been profitable since its founding? If not, since what year has the Company been

profitable?

Has the Company made any acquisitions or been the target of an acquisition during its history? If so,

please describe.

Have the owners attempted to sell the company in the past? If so, please provide details including when,

was an intermediary used and if so whom, and what was the out come of that effort.

To the best of your knowledge, has the business, its principals or any affiliated business ever had any

problems with any federal, state or local government regulatory agency?

Yes No

Is the business required to make regular reports or filings with regulatory agencies?

Yes No

If so, are all required reports/filings current?

Yes No

Does the business or its principals require any specific licenses or permits (other than those normally

required for most businesses or individuals) to conducts its business? If yes, please list:

The Owners

Describe the present ownership of the Company and percentage owned by each owner:

Relationship or position with

Name % Owner age Stock basis

company

February 7, 2013 Page 13

Copyright © The Exit Planning Institute, Inc., 2005-2006

Exit Planning Questionnaire Client Company.

Is any of the ownership held in trusts, estates, partnerships or corporations? If yes, describe

Is the ownership as officially reflected on the issued stock certificate, partnership agreements and/or other

records, any different than as stated above?

Yes No

Did any of the present owners acquire their share from another present or former owner?

Yes No

If yes, are the records of such transactions complete and readily available?

Yes No

Are there any other forms of ownership not reflected above, such as preferred stock, convertible debt,

options, warrants, debentures, entailed partnership interests, ESOPs?

Yes No

If yes, describe

Is any of the stock or other form of ownership subject to:

- A pledge or lien Yes No

- An option or first refusal Yes No

- Buy/Sell agreement Yes No

- Proxy or voting trust Yes No

- Loan agreement restrictions Yes No

- Any other agreement Yes No

Do the shareholders have a written shareholder agreement including buy/sell provisions?

Yes No

Is the buy/sell agreement funded with insurance or other funding sources?

Yes No

February 7, 2013 Page 14

Copyright © The Exit Planning Institute, Inc., 2005-2006

Exit Planning Questionnaire Client Company.

Has an ESOP plan ever been formed or discussed with employees?

Yes No

If yes, describe:

Has ownership in the business been promised or discussed in the past with any employees or affiliated

persons?

Yes No

Discuss what the present owners were doing prior to starting or joining the Company:

Discuss the owners’ present role(s) in the company and how their time is spent:

Why is the Company for sale?

Are all of the owners willing to assist new owners through a reasonable transition period? If, so how long

and are there any special conditions?

Industry Data

Describe your industry? Size? Fragmentation? Growth rates? Trends? Barriers to entry?

Are most of the companies in the industry operating locally, statewide, regionally or nationwide?

Markets and Competition

List major competitors by market segment? Where are they located (city and state), what are their annual

revenues, how many employees do they have?

February 7, 2013 Page 15

Copyright © The Exit Planning Institute, Inc., 2005-2006

Exit Planning Questionnaire Client Company.

Describe your Company’s current and historical market share per market section? How does it compare to

major competitors?

Discuss the average size of competitors.

How is the Company different from its competitors? Explain:

Operations

Describe your plant, warehouse, production areas and offices (size, location, equipment that allows you to

manufacture your product):

Does the plant operate at full capacity? If not, what would you estimate is the unused potential?

Describe the age and quality of equipment?

Describe any recent major capital improvements and future needs?

How many full time/part time employees?

How many shifts are operated and at what times?

Summarize the average wage rates by facility.

Describe the Company’s manufacturing processes and systems. List any special certifications here.

February 7, 2013 Page 16

Copyright © The Exit Planning Institute, Inc., 2005-2006

Exit Planning Questionnaire Client Company.

Are there formal production planning processes in effect?

Yes No

Is a graphical layout of the plant available?

Yes No

Are there standard data available for product costs including direct, indirect and overhead costs?

Yes No

Is a formal research and development program in place?

Yes No

Describe the Company’s inventory management and control systems

Describe in detail how the Company’s products are manufactured/services are rendered from start to

finish beginning with when the sale is made:

List each of the Company’s departments (e.g. sales, engineering, production, purchasing, installation,

shipping, etc.) involved in manufacturing, their function, special expertise, industry and Company

experience. Also note how many employees are in each department:

Are there any key operating statistics used by the Company to measure growth, performance, etc.?

Discuss:

Company Products

List all of the products the Company manufactures/services the Company provides and a brief description

of each product/service and their applications:

What are the attributes of your product(s) in their market (price, quality, service, features, and flexibility)?

Product(s) Attribute(s)

February 7, 2013 Page 17

Copyright © The Exit Planning Institute, Inc., 2005-2006

Exit Planning Questionnaire Client Company.

How does the price and quality of the Company’s products/services compare with that of major

competitors?

Do you have any trademarks, trade names, or copyrights that give your product(s) a unique edge?

Yes No

What are typical lead times for major products from order to shipping?

Product(s) Lead times

What are your companys basic warranty terms?

What has been the history of warranty expense?

Does the company have product liability insurance? If yes, please provide: coverage amount:

Are any of your companys products subject to technological obsolescence? If yes, describe

Describe and quantify historical and projected sales trends by market segment and major product/service

line.

What has been average annual price increase for the last three years?

What increase is probable in the next three years?

What are your company’s gross profit margins by product/service?

February 7, 2013 Page 18

Copyright © The Exit Planning Institute, Inc., 2005-2006

Exit Planning Questionnaire Client Company.

Product/Service Gross Margin %

What process do you use to set prices for your products and services?

What is the average sale size, in dollars, of the Company?

How are your products/services shipped/delivered to customers?

Sales, Marketing and Distribution

Describe the marketing and selling strategy by market segment:

Describe the method(s) of distribution to each market segment served:

Describe the sales team, their territories, and their experience in the industry:

Does the sales team generate all Company sales? If not, what percent? Where does the remainder of

sales come from?

How are your sales people compensated?

What methods does the Company use to market its products? (e.g. brochures, advertisements,

convention/trade shows, videos, website.

February 7, 2013 Page 19

Copyright © The Exit Planning Institute, Inc., 2005-2006

Exit Planning Questionnaire Client Company.

Customers

Who are the company’s customers?

How many accounts or customers does the Company have?

Discuss any unique arrangements that have been negotiated (i.e. pricing, purchase or exclusivity agreements

or commitments):

Where does the Company sell its products and/or services? (local, state, region, national, international)

What are the percentage breakdowns for each?

During the last year did any customer account for greater than 10% of revenues? If so, how much?

What percent of revenues did the top 5 customers account for? What about the top 10?

Discuss the Company’s ability to retain customers and generate repeat business. Comment on the length

of time the most loyal customers and the largest customers have been doing business with the Company.

How did you gain these customers?

Have any large customers been lost or added in the last 18 months that will materially affect the business?

Is backlog a factor in your business?

Yes No

If yes, what is your average backlog?

February 7, 2013 Page 20

Copyright © The Exit Planning Institute, Inc., 2005-2006

Exit Planning Questionnaire Client Company.

What are your normal credit terms?

Do you have any product(s) on consignment to:

Yes No

Customers

Distributors

Suppliers

Comment on the Company’s relationship with its suppliers:

Discuss any unique arrangements that have been negotiated or special cost control arrangements (i.e.

pricing, purchase or exclusivity agreements or commitments):

List the Company’s top 5 suppliers, the length of the relationship and the products they supply/provide to

your Company:

Supplier # of years Items supplied

1.

2.

3.

4.

5.

If your present key suppliers could not supply you, would you have any difficulty in replacing them readily?

Yes No

Does your company have any sole source suppliers?

Yes No

Is consent or approval required from any supplier(s) in order to sell the stock or assets of your company?

Yes No

Do any supplier relationships require the personal guarantees of the shareholders?

Yes No

Information Technology

What are your major hardware and software configurations?

February 7, 2013 Page 21

Copyright © The Exit Planning Institute, Inc., 2005-2006

Exit Planning Questionnaire Client Company.

Function Hardware Software

Accounting

Payroll

Quotes

Order entry

Production

Inventory

Other

Has the Company developed any special software for operations or customers? Explain.

Number of PCs, operating system, networked together

Are there any major future EDP plans? If yes, describe:

Is there a disaster recovery plan in place?

Yes No

Do you rely on outside vendors and consultants?

Yes No

Does your company have an operating website? If yes, what is the address

Insurance

Insurance coverage for the business is vital during the period before a sale since it is often the owner’s

largest asset and must be protected. After the sale of the business, in the best case, the company’s

liability insurance will extend beyond the closing for any liability that occurred during the period prior to

the sale. Personal disability and life insurance coverage should provide sufficient protection for each

shareholder according to his/her individual situation.

Is the business adequately insured for both physical loss and potential liability? Yes No

Will the company’s liability insurance provide prior period coverage after a sale? Yes No

Does the business have business interruption insurance? Yes No

Is the shareholders’ Buy/Sell agreement covered by life insurance? Yes No

Does each shareholder have sufficient disability and life insurance coverage? Yes No

February 7, 2013 Page 22

Copyright © The Exit Planning Institute, Inc., 2005-2006

Exit Planning Questionnaire Client Company.

Name of Insurer, Limits and Policy Expiration Date for Commercial General Liability, Workman’s

Compensation, and Umbrella Policy

Does the Company have any outstanding lawsuits? Explain details and status:

Personnel

List key management personnel (including the sales team) with a description of their position,

responsibilities, department’s functions, their experience in the industry, length of time with the

Company, age, special expertise, leadership in any relevant outside trade organizations, and their salaries:

Comment on management’s opinion about the likelihood of key personnel and other employees

remaining after the sale:

Do any employees have non-compete or non-solicitation agreements? If so, who?

Do any employees have employment agreements?

List all Departments and the number of employees by department.

Department Employees

Estimate the length of time the average employee has been with the Company:

Is the business a party to a union contract?

Yes No

If yes, please provide name of union, contract expiration date, number of employees covered

February 7, 2013 Page 23

Copyright © The Exit Planning Institute, Inc., 2005-2006

Exit Planning Questionnaire Client Company.

If you have a union, does the union have a multi-employer pension plan?

Yes No

Has the company ever experienced a strike?

Yes No

If yes, what was the date of the last strike?

In general, would you describe your company’s employee relations as?

Strong Average Weak

Have you had any difficulty (beyond filing of required reports) with any state or federal government

agencies with jurisdiction over employment practices, such as OSHA, EEOC, INS, department of labor,

etc.?

Yes No

If yes, describe:

Have you ever had employee disputes of any consequence, such as claims or wrongful termination,

arbitration, discrimination, unfair labor practices, commission disputes, etc., even if such disputes never

resulted in any formal claims or action?

Yes No

If yes, describe:

Are there written job descriptions for each job?

Yes No

Does the company use outside independent contractors?

Yes No

Does the company do routine drug testing for new hires?

Yes No

Do you have an employee manual?

Yes No

Do you have a policy and procedures manual?

Yes No

February 7, 2013 Page 24

Copyright © The Exit Planning Institute, Inc., 2005-2006

Exit Planning Questionnaire Client Company.

Do the company award employees merit increases?

Yes No

If yes, please provide timing of increases and average annual increase last 5 years

How are increases determined

Is a formal employee training program in place?

Yes No

If yes, describe:

Please check off all employee benefits plans.

Responsibility

Company Joint

Medical

Dental

Vision

Vacation plans

Life insurance

Disability

Bonus & incentive plans

Stock option plans

Profit sharing

Thrift plans

Post-retirement plans

Other

Are there any company benefit plans that are unfunded and provide an exposure?

Yes No

Are any employees aware of the sale of the Company?

How is morale?

February 7, 2013 Page 25

Copyright © The Exit Planning Institute, Inc., 2005-2006

Exit Planning Questionnaire Client Company.

Have there been any layoffs in the last 3 years?

How competitive are employee pay and benefits? Do you do anything unique to attract or retain

employees?

Please provide organizational chart and management biographies.

Equipment, Machinery and Intangible Assets

Please provide a detailed list of all significant or material equipment or machinery that the Company

owns and uses including date acquired, cost, description, book value and the fair market value.

Asset Description Date Acq. Book Value FMV

Please provide a list of all intellectual property (patents, trademarks, service marks, copyrights) that the

Company owns and uses.

Asset Description

Real Estate

Is the real estate used in the business (more than one may apply)

Yes No

Owned by the business entity itself?

Owned by an affiliated party?

Owned by an unaffiliated third party?

Subject to an IRB (industrial revenue bond) or IDB(industrial development

bond)?

February 7, 2013 Page 26

Copyright © The Exit Planning Institute, Inc., 2005-2006

Exit Planning Questionnaire Client Company.

Please provide a detailed list of all land and improvements owned including date acquired, cost,

description, book value and the fair market value.

Asset Description Date Acq. Book Value FMV

For real estate owned by the business or affiliated parties, what would be preferred?

Prefer to sell real estate

Prefer not to sell

For any owned real estate, please provide the following: (please check if attached)

Physical description or property and improvements

Any third party appraisals available

Legal owner(s)

Mortgages/liens data

Environmental reports, if any

For real estate leased from any third parties, please provide the following: (please check if available)

A copy of the current lease

Expiration date(s) and renewal options

Identity of owners, managers and agents

Description of property and improvements

Environmental reports, if any

For real estate leased from unaffiliated third parties,

Yes No

Are any leases not formally documented?

Are any leases personally guaranteed?

Do you have an option, first refusal or any other agreement regarding the purchase of

this property?

If not, are you aware that anyone else may have?

Do you believe the current landlord would be interested in continuing or extending the

lease?

Do you believe the current owner would be interested in selling?

Do you believe a buyer of your business could readily terminate this lease if desired

without a significant penalty?

Does lease state that landlord's consent to assignment is required?

Have there been any environmental inspections, surveys or reports on the property in the

last five years?

February 7, 2013 Page 27

Copyright © The Exit Planning Institute, Inc., 2005-2006

Exit Planning Questionnaire Client Company.

Yes No

For each piece of real estate used by the company, can you identify the prior uses of the

site and facilities?

Does any of the real estate or neighbors have a history of manufacturing, waste disposal,

chemical storage, etc?

Is there adjacent land available for expansion purposes?

Can the present location accommodate future growth? If so, how much?

What is the potential sales volume that could be handled with the current facilities?

Owner's estimate of the Fair Market Value of all real estate:

Environmental Matters

Do any facilities generate hazardous waste? If yes, describe:

Are there air discharge permits and water discharge permits in place and current?

Yes No

Are there any outstanding orders, enforcements, action audits or reports either from federal or applicable

state EPA or similar authority? If yes, describe:

Are there any underground tanks, asbestos or other hazardous substance(s) on any site? If yes, describe:

Is there a specific employee assigned the environmental responsibility? If yes, provide that person’s

function/title

Is a formal environmental compliance program in effect?

Yes No

Are there any ground water problems?

Yes No Don't know

February 7, 2013 Page 28

Copyright © The Exit Planning Institute, Inc., 2005-2006

Exit Planning Questionnaire Client Company.

Does the company use any outside professionals to dispose of or otherwise handle certain materials?

Yes No

Has the company ever had any accidental spills or discharges?

Yes No

Do you use lubricants or other substances which, although not dangerous, could cause environmental

problems?

Yes No

Have you had visits, inspections, or surveys by any environmental or health authorities within the last

three years?

Yes No

If yes, have any reports been unfavorable?

Yes No

Would you and the other owners be willing to indemnify a new owner of the business against any liability

for environmental or other regulatory problems predating your sale of the business?

Yes No Don't know

Are you aware of any environmental problems with properties previously owned or used by the

company?

Yes No

Safety

If there a formal safety program in place?

Yes No

Are there facility sprinkler protection systems?

Yes No

What was the date of your last OSHA inspection (Month & Year)?

Were there significant OSHA claims If yes, describe

Are the land and buildings clean, well-maintained and in compliance with building codes and regulations?

Yes No

Opportunities for Growth

Describe any opportunities to grow sales, net income and cash flow.

February 7, 2013 Page 29

Copyright © The Exit Planning Institute, Inc., 2005-2006

Exit Planning Questionnaire Client Company.

Comment on the growth of the business in recent years:

Do you think growth will continue for the foreseeable future? Why or why not?

What is necessary to sustain future growth?

Inventory

FIFO or LIFO? Is the inventory current and useable within 3 months? If not, what percent is?

Strengths and Weaknesses

In Management’s opinion what are the five greatest strengths of the Company? Please describe in detail

why each is a strength.

Describe why you believe your Company is an excellent or unique acquisition opportunity for a buyer:

What would you say are the weaknesses of the Company?

Other

Is there anything that would to your knowledge adversely affect the value of the Company?

February 7, 2013 Page 30

Copyright © The Exit Planning Institute, Inc., 2005-2006

Exit Planning Questionnaire Client Company.

Price and Terms

Are you open to an asset or stock purchase?

What is your flexibility regarding the terms of the deal, i.e., would you consider taking stock in the buyer

or a note from the buyer for a portion of the purchase price?

Which of the following transaction structures which would you prefer. Assume that you needed $90 to

comfortably retire so both transactions below meet your minimum requirements. This is not a test. There

is no right or wrong answer. It is simple a matter of personal preference and risk tolerance.

A. $100 in cash, OR

B. $90 in cash plus $30 payable over 3 years at 8% interest

Financial Summary

Please provide as much of the following information as possible:

1. For the last five fiscal years and the current year to date:

Company financial statements

Breakdown of sales by product/service group (in both dollars and units)

Sales and gross margin for top 25 customers

Gross margin by major product/service group

Breakdown of cost of goods sold (eg. material, labor, overhead), depreciation

included in COGS

Breakdown of general and administrative expenses

Breakdown of selling expenses

Product development expenses

Details of any extraordinary one-time or non-recurring items in historical financial

statements

Accounts receivable aging report, write-off & bad debt history

Inventory valuation and inventory write-down history

Accounts payable aging report

2. Next year budget

3. Current strategic plan and five year forecast with detailed assumptions

4. Summary of terms and covenant of existing indebtedness

5. Commitments for pending and proposed major capital projects

6. Description of major capital projects over the past three years including dollar amounts

7. Capital budget for the next three years

Are the company financial statements prepared in accordance with generally accepted accounting

principals (GAAP)?

Yes No

On what basis does the company recognize revenue? Cash or Accrual?

February 7, 2013 Page 31

Copyright © The Exit Planning Institute, Inc., 2005-2006

Exit Planning Questionnaire Client Company.

For each of the past five years, our financial statements were:

Audited Reviewed Compiled In house

1999

2000

2001

2002

2003

Have there been any changes in accounting methods in the last three years? If yes, Describe

Are there any key operating statistics used by the Company to measure growth, performance, etc.?

Discuss:

How long have you used the same accounting firm?

Does your accountant provide an annual management letter?

Yes No

Describe significant accounting policies.

Describe contingent liabilities, off-balance sheet assets and liabilities.

Complete the Owner Adjustments on the attached schedule below.

Schedule Of Owner Adjustments

Year Current 200_ 200_ 200_ 199_ 199_

YTD

Excess salary and bonus

Owner;s portion of payroll exp.

Excess vehicle expenses

Owners’ health/life/disability

Insurance

Charity/church

February 7, 2013 Page 32

Copyright © The Exit Planning Institute, Inc., 2005-2006

Exit Planning Questionnaire Client Company.

Non-business travel & ent.

Other non-business expenses

(Country club dues, tuitions,

home maintenance,

Above market rates in related

party transactions

Total Owners’ Adjustments

Taxes

Is the business current at this time in its filing of any returns for any payment of:

Current Not Current

Federal, state, or local income and franchise taxes

Payroll (withholding, FICA, disability)?

Real estate taxes

Personal property taxes

Sales taxes

In the past have there ever been any inquiries, review, audits, investigations, assessments or other

problems with a taxing authority?

Yes No

Does the company have a deferred tax liability at the federal, state, or local level? And is it fully and

properly accrued on the balance sheet?

Yes No

When was your last IRS audit? Findings?

Contracts

Describe significant customer and supplier contracts.

Describe significant real and personal property leases and contracts.

Describe any third party guarantees of a material nature.

Describe any unusual contracts of activities.

February 7, 2013 Page 33

Copyright © The Exit Planning Institute, Inc., 2005-2006

Exit Planning Questionnaire Client Company.

Describe any licensing or joint venture agreements.

Litigation and Regulatory Compliance

Describe all pending litigation.

Exhibits

A. Submit Company Brochures and Marketing Materials

B. Submit any articles about the Company that might be of interest to an acquirer

C. Submit the most recent Income Tax Return of the Company

D. Submit any business plans, financing proposals, or other similar documents for your business

prepared in the last 3-5 years

February 7, 2013 Page 34

Copyright © The Exit Planning Institute, Inc., 2005-2006

You might also like

- Employment Application-Short FormDocument2 pagesEmployment Application-Short Formapi-386690050No ratings yet

- Jack TarDocument5 pagesJack Tarionus_200367% (3)

- Business Credit ApplicationDocument1 pageBusiness Credit ApplicationGURMUKH SINGHNo ratings yet

- SAP Japan Customer Innovation Center Solutions August 9th, 2010Document90 pagesSAP Japan Customer Innovation Center Solutions August 9th, 2010Taro Yamada100% (1)

- WACC Case StudyDocument2 pagesWACC Case StudyMuhammad AdeelNo ratings yet

- ING Reliastar 08 ContractDocument4 pagesING Reliastar 08 ContractWilliam Rowan100% (4)

- Subcontractor Prequalification FormDocument4 pagesSubcontractor Prequalification FormMartens HategeNo ratings yet

- Company Logo: Simprex Logistic HR DeptDocument28 pagesCompany Logo: Simprex Logistic HR DeptVishalsaNo ratings yet

- Business Credit Application - Charly USA: Name/AddressDocument2 pagesBusiness Credit Application - Charly USA: Name/Addressjose luis anguloNo ratings yet

- The Care Continues..Document24 pagesThe Care Continues..Aman KhanNo ratings yet

- Cleanme Application FDocument14 pagesCleanme Application F208048022No ratings yet

- Umesh Saini BDA Offer LetterDocument4 pagesUmesh Saini BDA Offer LetterUmesh SainiNo ratings yet

- Dream Venture Planning Document 3Document7 pagesDream Venture Planning Document 3Magda GarzaNo ratings yet

- Bluedart DHL Franchise Application Form.Document5 pagesBluedart DHL Franchise Application Form.Kundan KumarNo ratings yet

- Business Credit ApplicationDocument1 pageBusiness Credit ApplicationAsadNo ratings yet

- Wipro Company Application FormDocument6 pagesWipro Company Application FormGuru PrasadNo ratings yet

- Legal Requirments of Business ManagementDocument42 pagesLegal Requirments of Business ManagementAasi RaoNo ratings yet

- Application Form M-Sport LTDDocument6 pagesApplication Form M-Sport LTDJayNo ratings yet

- Candidates Particular Form - NewDocument4 pagesCandidates Particular Form - Newsadhanalavenkateswarlu2No ratings yet

- Business Credit Application TemplateDocument1 pageBusiness Credit Application Templatemygst0108No ratings yet

- Credit Application Form 01Document1 pageCredit Application Form 01loganathan owNo ratings yet

- Business Credit Application 02Document1 pageBusiness Credit Application 02raj dosNo ratings yet

- Feasibility Report TempDocument16 pagesFeasibility Report TempSidra ShakeelNo ratings yet

- Augusta Loan Application PDFDocument9 pagesAugusta Loan Application PDFLaura Peters ShapiroNo ratings yet

- Dating Service Business PlanDocument4 pagesDating Service Business Planprkn26yeNo ratings yet

- Application FormDocument2 pagesApplication FormBrookeNo ratings yet

- Employment Application - Mitchan Cellular: Applicant Data How Were You Referred To Us? Position Applying ForDocument3 pagesEmployment Application - Mitchan Cellular: Applicant Data How Were You Referred To Us? Position Applying ForCMBSNo ratings yet

- Business Plan IndianaDocument7 pagesBusiness Plan Indianam00d18srNo ratings yet

- Application Form: For Non-Teaching/support PostsDocument8 pagesApplication Form: For Non-Teaching/support PostsmaximuscenNo ratings yet

- DAC Loan ApplicationDocument1 pageDAC Loan ApplicationDunhamNo ratings yet

- Prudential Agent Contracting KitDocument5 pagesPrudential Agent Contracting KitWilliam Rowan100% (1)

- Fifco Usa Brands Breweries Job Application FormDocument6 pagesFifco Usa Brands Breweries Job Application FormAnishaNo ratings yet

- Leave Valuation Forms - 1000Document162 pagesLeave Valuation Forms - 1000Ghada AldukhiNo ratings yet

- Startup Payroll Services and Software GustoDocument1 pageStartup Payroll Services and Software Gustops.harsha2004No ratings yet

- Tart-P Asics: An Overview To Starting Your Own BusinessDocument28 pagesTart-P Asics: An Overview To Starting Your Own Business1ncognit0No ratings yet

- Seasonal NSPDocument14 pagesSeasonal NSPsuzanneyell6No ratings yet

- Capella Pay Application: Company ProfileDocument10 pagesCapella Pay Application: Company ProfileTanveer HussainNo ratings yet

- IVD Member Question A IreDocument1 pageIVD Member Question A IrecdproductionNo ratings yet

- IVD Member Question A IreDocument1 pageIVD Member Question A IrecdproductionNo ratings yet

- Personal Information: What Position Did You Want To Apply ForDocument5 pagesPersonal Information: What Position Did You Want To Apply ForyolandaNo ratings yet

- Business Financing Application: Credit RequestDocument8 pagesBusiness Financing Application: Credit RequestKent WhiteNo ratings yet

- Joining Form - Summer TraineesDocument5 pagesJoining Form - Summer TraineesSachin BeniwalNo ratings yet

- Planworth Application Form 2022Document5 pagesPlanworth Application Form 2022bobbyteohNo ratings yet

- Business Credit App 0Document12 pagesBusiness Credit App 0Kent WhiteNo ratings yet

- EXIM Application FormDocument3 pagesEXIM Application Formchristian.gomez.gtNo ratings yet

- Food Biz Work BookDocument53 pagesFood Biz Work BookChristoph KayNo ratings yet

- New FormDocument2 pagesNew FormGerard LumagueNo ratings yet

- NEIS Application Form COMBINEDDocument14 pagesNEIS Application Form COMBINEDBelinda L MartinNo ratings yet

- Single Application Petro Canada.Document8 pagesSingle Application Petro Canada.Nicole BurkeNo ratings yet

- Individuals English Agreement Full SetDocument40 pagesIndividuals English Agreement Full SetanwarelkaNo ratings yet

- Nevada Business Registration Form InstructionsDocument3 pagesNevada Business Registration Form InstructionstibymiaNo ratings yet

- A To Z Group of Companies ProfileDocument29 pagesA To Z Group of Companies Profileroopesh_1986No ratings yet

- Fpre Institusi Dan Pembukaan RDNDocument33 pagesFpre Institusi Dan Pembukaan RDNIwan DidiNo ratings yet

- Campa Cola Form DraftDocument6 pagesCampa Cola Form Draftsinhabeauty807No ratings yet

- Overseas Franchise Application Form TemplateDocument7 pagesOverseas Franchise Application Form TemplatePresident's Office (UB Group)No ratings yet

- Personal Particulars: Application For Employment With (Your Company Name)Document12 pagesPersonal Particulars: Application For Employment With (Your Company Name)Nana Opoku-AmankwahNo ratings yet

- Growing Business Application 2014Document2 pagesGrowing Business Application 2014PGCOCNo ratings yet

- Application FormDocument6 pagesApplication Formarasu046No ratings yet

- Candidate Application FormDocument2 pagesCandidate Application FormMårk MèrçådøNo ratings yet

- Part A Answer - 1Document7 pagesPart A Answer - 1Ankur ChopraNo ratings yet

- Campa Cola (Registration Form)Document5 pagesCampa Cola (Registration Form)kshu6104No ratings yet

- Application Form For Potato Corner FranchiseDocument4 pagesApplication Form For Potato Corner FranchiseMary Rose Roma PurinoNo ratings yet

- Financial Accounting and Reporting - QUIZ 6Document4 pagesFinancial Accounting and Reporting - QUIZ 6JINGLE FULGENCIONo ratings yet

- 61089bos49694 Ipc Nov2019 gp1Document93 pages61089bos49694 Ipc Nov2019 gp1iswerya n.sNo ratings yet

- IridiumDocument7 pagesIridiumSazzad Hossain TuhinNo ratings yet

- Steps in Consolidation Working Papers On The Date of AcquisitionDocument3 pagesSteps in Consolidation Working Papers On The Date of AcquisitionPinky DaisiesNo ratings yet

- ARKA - Arkha Jayanti Persada TBK.: RTI AnalyticsDocument1 pageARKA - Arkha Jayanti Persada TBK.: RTI AnalyticsfarialNo ratings yet

- Sample Business Valuation - BAGDocument43 pagesSample Business Valuation - BAGjeygar12No ratings yet

- Tuan Sing Holdings: SingaporeDocument7 pagesTuan Sing Holdings: Singaporeinsideout123No ratings yet

- Sample ProblemDocument3 pagesSample ProblemZaldy Magante MalasagaNo ratings yet

- Accounting Grade 12 LAST MILE 2022 QP and MemoDocument225 pagesAccounting Grade 12 LAST MILE 2022 QP and MemomaboleunNo ratings yet

- Corporate Valuation, Value-Based Management, and Corporate GovernanceDocument12 pagesCorporate Valuation, Value-Based Management, and Corporate GovernanceCOLONEL ZIKRIANo ratings yet

- Prelim AE27 First Sem 2324Document4 pagesPrelim AE27 First Sem 2324HotcheeseramyeonNo ratings yet

- Chapter 26Document7 pagesChapter 26JaMa Azolman DualNo ratings yet

- Consolidated Financial Statements-Intra-Entity Asset TransactionsDocument185 pagesConsolidated Financial Statements-Intra-Entity Asset TransactionsMarwa HassanNo ratings yet

- IntangiblesDocument3 pagesIntangiblesJP DCNo ratings yet

- ChapDocument74 pagesChapTote FrotyNo ratings yet

- Acc Gr11 May 2009 PaperDocument13 pagesAcc Gr11 May 2009 PaperSam ChristieNo ratings yet

- A5 Question PaperDocument3 pagesA5 Question PaperAryan GuptaNo ratings yet

- PT Sam Putra Inti: Balance SheetDocument21 pagesPT Sam Putra Inti: Balance SheetIkhsan Al IzyraNo ratings yet

- What Is The Meaning of Book Value Per Share?Document6 pagesWhat Is The Meaning of Book Value Per Share?Emely Grace YanongNo ratings yet

- 2003 BMGF 990pf Part 2Document296 pages2003 BMGF 990pf Part 2shikha.mindfulNo ratings yet

- Chapter 03 - Adjusting The Accounts: Multiple Choice QuestionsDocument11 pagesChapter 03 - Adjusting The Accounts: Multiple Choice QuestionsVIERENT 502020052No ratings yet

- P9-1 Polly and Subsidiaries: Sea's BooksDocument9 pagesP9-1 Polly and Subsidiaries: Sea's BooksFarrell DmNo ratings yet

- Accounting PPT - Intangible AssetDocument58 pagesAccounting PPT - Intangible AssetGokul RamNo ratings yet

- Solutions To ProblemsDocument33 pagesSolutions To ProblemsggjjyyNo ratings yet

- Hotel Companies CompetitorsDocument16 pagesHotel Companies CompetitorsOladipupo Mayowa PaulNo ratings yet

- Chapter 5 - Problem 3Document5 pagesChapter 5 - Problem 3ArtisanNo ratings yet