Professional Documents

Culture Documents

Solutions To Exercises and Problems Exercises E5.1 Combination and Consolidation, Date of Acquisition (See Related E3.1)

Solutions To Exercises and Problems Exercises E5.1 Combination and Consolidation, Date of Acquisition (See Related E3.1)

Uploaded by

sunnyauliaCopyright:

Available Formats

You might also like

- Question 1 of The FAR ExamDocument5 pagesQuestion 1 of The FAR ExamShazaib Khalish0% (7)

- A Project Report On Portfolio-Management by Deepak ChoubeyDocument51 pagesA Project Report On Portfolio-Management by Deepak Choubeydeepakchoubey9066% (32)

- Practice Quiz - Quiz 1: FdnacctDocument6 pagesPractice Quiz - Quiz 1: FdnacctAnne MiguelNo ratings yet

- CFAP 1 AAFR Summer 2017Document10 pagesCFAP 1 AAFR Summer 2017Aqib SheikhNo ratings yet

- Q1) May 2011 ZA Q1 - Ear, Mouth & Nose Mouth LTD Nose LTDDocument8 pagesQ1) May 2011 ZA Q1 - Ear, Mouth & Nose Mouth LTD Nose LTDduong duongNo ratings yet

- Please Refer To Table 4-1 For The Following Questions. Table 4-1Document1 pagePlease Refer To Table 4-1 For The Following Questions. Table 4-1Megana PunithNo ratings yet

- Liquidity RatiosDocument3 pagesLiquidity RatiosMckenzie PalaganasNo ratings yet

- Advanced Accounting 2 - Chapter 4 James B. Cantorne Problem 1. T/FDocument7 pagesAdvanced Accounting 2 - Chapter 4 James B. Cantorne Problem 1. T/FJames CantorneNo ratings yet

- Tugas MK11Document2 pagesTugas MK11Nan BaeeeNo ratings yet

- Final PB Exam - Answers - SolutionsDocument10 pagesFinal PB Exam - Answers - SolutionsJazehl ValdezNo ratings yet

- Quiz IntAccDocument12 pagesQuiz IntAccTrixie HicaldeNo ratings yet

- Assessed Coursework 2 - S2 2020 UpdateDocument7 pagesAssessed Coursework 2 - S2 2020 UpdateArmaghan Ali MalikNo ratings yet

- Latihan Soal Kombis (Answered)Document6 pagesLatihan Soal Kombis (Answered)Fajar IskandarNo ratings yet

- Ap - Ap 2.1Document19 pagesAp - Ap 2.1viethoangduongkhanhNo ratings yet

- Exercise For Financial Statement Analysis and RatiosDocument15 pagesExercise For Financial Statement Analysis and RatiosViren JoshiNo ratings yet

- Problem 5-1Document7 pagesProblem 5-1Tammy AckleyNo ratings yet

- Quiz AE 120Document10 pagesQuiz AE 120Katrina MalecdanNo ratings yet

- Sol. Man. - Chapter 14 - Investments in Assoc. - Ia Part 1BDocument15 pagesSol. Man. - Chapter 14 - Investments in Assoc. - Ia Part 1BChristian James RiveraNo ratings yet

- Adobe Scan Jan 30, 2023Document6 pagesAdobe Scan Jan 30, 2023Karan RajakNo ratings yet

- Acct 4010 Ch2-Handout-SolutionDocument4 pagesAcct 4010 Ch2-Handout-Solutionlokyee801mikiNo ratings yet

- Name: Shania Rose P. Binwag Illustration 1Document3 pagesName: Shania Rose P. Binwag Illustration 1ShaniaRose BinwagNo ratings yet

- Sadecki Corporation Balance Sheets Dec-31 Assets 2014 2013Document9 pagesSadecki Corporation Balance Sheets Dec-31 Assets 2014 2013mohitgaba19No ratings yet

- Cashflow Practice Solution-AdditionalDocument5 pagesCashflow Practice Solution-AdditionalNadjah JNo ratings yet

- Review of Financial Statements and Its Analysis: Rheena B. Delos Santos BSBA-1A (FM2)Document12 pagesReview of Financial Statements and Its Analysis: Rheena B. Delos Santos BSBA-1A (FM2)RHIAN B.No ratings yet

- Financial Reporting Financial Statement Analysis and Valuation 8th Edition Wahlen Test Bank 1Document36 pagesFinancial Reporting Financial Statement Analysis and Valuation 8th Edition Wahlen Test Bank 1ericsuttonybmqwiorsa100% (35)

- Finals Quiz No. 1 AnswersDocument4 pagesFinals Quiz No. 1 AnswersMergierose DalgoNo ratings yet

- For Classroom Discussion: SolutionDocument4 pagesFor Classroom Discussion: SolutionMisherene MagpileNo ratings yet

- Chapter 9 Financial Reporting in Hyperinflationary EconomiesDocument10 pagesChapter 9 Financial Reporting in Hyperinflationary EconomiesKathrina RoxasNo ratings yet

- FAOMA Part 3 Quiz Complete SolutionsDocument3 pagesFAOMA Part 3 Quiz Complete SolutionsMary De JesusNo ratings yet

- Kelompok 6 - UTS AKMDocument18 pagesKelompok 6 - UTS AKM21-010 Desi MailaniNo ratings yet

- Online Ass Advance Acc NEWDocument6 pagesOnline Ass Advance Acc NEWRara Rarara30No ratings yet

- Chapter 4-Profitability Analysis: Multiple ChoiceDocument30 pagesChapter 4-Profitability Analysis: Multiple ChoiceRawan NaderNo ratings yet

- Decision Case 12-4Document2 pagesDecision Case 12-4cbarajNo ratings yet

- Final PB FAR Batch 7 Sept 2023Document38 pagesFinal PB FAR Batch 7 Sept 2023Leo M. SalibioNo ratings yet

- RATIO QuestionsDocument5 pagesRATIO QuestionsikkaNo ratings yet

- Cash Flow - HandoutDocument3 pagesCash Flow - HandoutMichelle ManuelNo ratings yet

- CH 13Document4 pagesCH 13Sri HimajaNo ratings yet

- Liabilities 31.3.20X1 Rs 31.3.20X2 Rs Assets: Course: Fac Quiz:5 Section B DATE: 02/09/2019Document3 pagesLiabilities 31.3.20X1 Rs 31.3.20X2 Rs Assets: Course: Fac Quiz:5 Section B DATE: 02/09/2019Amit GodaraNo ratings yet

- Exhibit 17. Goodwill Calculation and The Consolidated Balance SheetDocument4 pagesExhibit 17. Goodwill Calculation and The Consolidated Balance SheetЭниЭ.No ratings yet

- Kimberly Veguilla Rodríguez Prof. Ramos Martin Modulo 2. Tarea 1. Los Reportes de ContabilidadDocument4 pagesKimberly Veguilla Rodríguez Prof. Ramos Martin Modulo 2. Tarea 1. Los Reportes de ContabilidadKimberly VeguillaNo ratings yet

- 9381 - Soal Uas Akl 2Document14 pages9381 - Soal Uas Akl 2Kurnia Purnama Ayu0% (3)

- Answer 4 - Excel For Diff. Acctg.Document42 pagesAnswer 4 - Excel For Diff. Acctg.Rheu ReyesNo ratings yet

- Quiz 3 Acctg For Business Combination - EntriesDocument6 pagesQuiz 3 Acctg For Business Combination - EntriesNhicoleChoiNo ratings yet

- Bracknell Cash Flow QuestionDocument3 pagesBracknell Cash Flow Questionsanjay blakeNo ratings yet

- Property, Plant, Equipment: Abbey Corporation Statement of Financial Position DECEMBER 31,2015 AssetDocument4 pagesProperty, Plant, Equipment: Abbey Corporation Statement of Financial Position DECEMBER 31,2015 AssetAstri KaruniaNo ratings yet

- Chapter 5Document19 pagesChapter 5Izzy BNo ratings yet

- Study Unit Three Activity Ratios and Special IssuesDocument11 pagesStudy Unit Three Activity Ratios and Special IssuessimarjeetNo ratings yet

- Jawaban UTS AKL 1Document3 pagesJawaban UTS AKL 1nanda khairunnisaNo ratings yet

- Ratio Analysis - Advanced QuestionsDocument5 pagesRatio Analysis - Advanced Questionsrobinkapoor100% (2)

- Comparative Income StatementDocument12 pagesComparative Income StatementBISHAL ROYNo ratings yet

- Problem 8-9 Akl 2Document4 pagesProblem 8-9 Akl 2andi nanaNo ratings yet

- Chapter 7, Exercise 5Document53 pagesChapter 7, Exercise 5MagdalenaNo ratings yet

- Confra Financial StatementsDocument3 pagesConfra Financial StatementsPia ChanNo ratings yet

- Business Combination Stock AcquisitionDocument2 pagesBusiness Combination Stock AcquisitionTEOPE, EMERLIZA DE CASTRONo ratings yet

- MBA Accounts2Document5 pagesMBA Accounts2YgNo ratings yet

- Financial Statement Analysis QuestionsDocument4 pagesFinancial Statement Analysis QuestionsRisha OsfordNo ratings yet

- 5.ratio Analysis SumsDocument9 pages5.ratio Analysis Sumsvinay kumar nuwalNo ratings yet

- Kelompok 5 - Cash Flow - ALKDocument16 pagesKelompok 5 - Cash Flow - ALKSiti Ruhmana SiregarNo ratings yet

- Stock Acquisition Quiz 100% AnswerDocument2 pagesStock Acquisition Quiz 100% AnswerJohn BalanquitNo ratings yet

- 5th Year Pre-Final ExamDocument3 pages5th Year Pre-Final ExamJoshua UmaliNo ratings yet

- Chapter 5 SolutionDocument47 pagesChapter 5 SolutionJay-PNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- PROJECT-Service Dave 10 Adjustment. ..+-+Document48 pagesPROJECT-Service Dave 10 Adjustment. ..+-+Dave Peralta0% (1)

- Consol Pack March22 LCDocument151 pagesConsol Pack March22 LCAries BautistaNo ratings yet

- 100 LBO Model JargonsDocument16 pages100 LBO Model Jargonsnaghulk1No ratings yet

- Chapter - 7Document11 pagesChapter - 7ErslanNo ratings yet

- Bank DataDocument9 pagesBank DataAnonymous KvNac2YIkNo ratings yet

- Comparative Financial Analysis of Apex Footwear LTD & Bata Shoe Company (Bangladesh) LTDDocument27 pagesComparative Financial Analysis of Apex Footwear LTD & Bata Shoe Company (Bangladesh) LTDMD. SAMIUL HASAN ARICNo ratings yet

- P19 - Practice Test Paper - Syl12 - Dec13 - Set 1 Cost Audit & Management AuditDocument9 pagesP19 - Practice Test Paper - Syl12 - Dec13 - Set 1 Cost Audit & Management AuditNagendra KrishnamurthyNo ratings yet

- Final ProjectDocument31 pagesFinal ProjectLipun baiNo ratings yet

- Internship Report On Nundhyar Engineering & Construction BattagramDocument65 pagesInternship Report On Nundhyar Engineering & Construction BattagramFaisal AwanNo ratings yet

- Govacct ReviewerDocument6 pagesGovacct Reviewerdinglasan.dymphnaNo ratings yet

- Annual Report Full 2004 05Document187 pagesAnnual Report Full 2004 05Naina BakshiNo ratings yet

- Quiz 1.1Document2 pagesQuiz 1.1Annalie Cono0% (1)

- Week 1 - FAR 6804 NotesDocument1 pageWeek 1 - FAR 6804 NotesKent Raysil PamaongNo ratings yet

- Retained EarningsDocument18 pagesRetained EarningsAngelie Bancale100% (1)

- 30 Contributed CapitalDocument12 pages30 Contributed CapitalJohn FloresNo ratings yet

- Afar Hedging Ja With AnswersDocument3 pagesAfar Hedging Ja With AnswersShigure KousakaNo ratings yet

- Accounting Process: Unit - 1 Basic Accounting Procedures - Journal EntriesDocument33 pagesAccounting Process: Unit - 1 Basic Accounting Procedures - Journal EntriesVenky VenkteshNo ratings yet

- Argon Dry Cleaners Is Owned and Operated by Kerry UlmanDocument1 pageArgon Dry Cleaners Is Owned and Operated by Kerry UlmanM Bilal SaleemNo ratings yet

- Minor Project ReportDocument69 pagesMinor Project ReportrimpaNo ratings yet

- Opening of Business End of Year 2Document10 pagesOpening of Business End of Year 2Mhd RahmanNo ratings yet

- 3.5 Published - Fitch China Oilfield Services LimitedDocument16 pages3.5 Published - Fitch China Oilfield Services LimitedAsim khanNo ratings yet

- Ind As 1, 7,8,10, 34Document40 pagesInd As 1, 7,8,10, 34Dr. Meghna DangiNo ratings yet

- Measuring and Evaluating The Performance of Banks and Their Principal CompetitorsDocument22 pagesMeasuring and Evaluating The Performance of Banks and Their Principal CompetitorsMarwa HassanNo ratings yet

- McampDocument14 pagesMcampSVS YRNo ratings yet

- A Study On Impact of Leverage On Profitability of Selected Automobile Companies in IndiaDocument61 pagesA Study On Impact of Leverage On Profitability of Selected Automobile Companies in IndiaRoshan Harsha CrNo ratings yet

- Annual Report 2012Document150 pagesAnnual Report 2012Ibnu IkhsanNo ratings yet

- LSA Financial ManagementDocument16 pagesLSA Financial ManagementAlok AgrawalNo ratings yet

Solutions To Exercises and Problems Exercises E5.1 Combination and Consolidation, Date of Acquisition (See Related E3.1)

Solutions To Exercises and Problems Exercises E5.1 Combination and Consolidation, Date of Acquisition (See Related E3.1)

Uploaded by

sunnyauliaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Solutions To Exercises and Problems Exercises E5.1 Combination and Consolidation, Date of Acquisition (See Related E3.1)

Solutions To Exercises and Problems Exercises E5.1 Combination and Consolidation, Date of Acquisition (See Related E3.1)

Uploaded by

sunnyauliaCopyright:

Available Formats

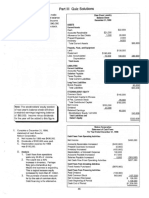

CHAPTER 5

SOLUTIONS TO EXERCISES AND PROBLEMS

EXERCISES

E5.1 Combination and Consolidation, Date of Acquisition (see related E3.1)

a. Calculation of goodwill:

Acquisition cost $ 27,000,000

Fair value of noncontrolling interest 2,750,000

Total fair value 29,750,000

Book value of Simon 14,000,000

Goodwill $ 15,750,000

Allocation of goodwill between controlling and noncontrolling interest:

Total goodwill $ 15,750,000

Progressive’s goodwill: $27,000,000 – 90%(14,000,000) 14,400,000

Goodwill to noncontrolling interest $ 1,350,000

b.

Consolidation Working Paper (in thousands)

Accounts Taken From Eliminations

Books

Consolidated

Progressive Simon Dr Cr Balances

Total assets $ 100,000 $ 20,000 $ 120,000

Investment in Simon 27,000 12,600 (E)

14,400 (R) --

Goodwill (R)15,750 _15,750

Total assets $ 127,000 $ 20,000 $ 135,750

Total liabilities $ 20,000 $ 6,000 $ 26,000

Common stock 10,270 3,000 (E) 3,000 10,270

Additional paid-in capital 66,730 7,000 (E) 7,000 66,730

Retained earnings 30,000 4,000 (E) 4,000 30,000

Noncontrolling interest 1,400 (E)

1,350 (R) 2,750

Total liabilities and equity $ 127,000 $ 20,000 $ 29,750 $ 29,750 $ 135,750

Note: Progressive’s balance sheet above reflects the following acquisition entry (in thousands):

Investment in Simon 27,000

Common stock 270

Additional paid-in capital 26,730

©Cambridge Business Publishers, 2010

Solutions Manual, Chapter 5 1

c.

Consolidated Balance Sheet, January 1, 2011 (in thousands)

Assets

Total assets $ 120,000

Goodwill 15,750

Total assets $ 135,750

Liabilities and stockholders’ equity

Total liabilities $ 26,000

Stockholders’ equity

Progressive’s stockholders’ equity:

Common stock 10,270

Additional paid-in capital 66,730

Retained earnings 30,000

Total Progressive’s stockholders’ equity 107,000

Noncontrolling interest 2,750

Total stockholders’ equity 109,750

Total liabilities and stockholders’ equity $ 135,750

E5.2 Date of Acquisition Consolidation with In-Process R&D

a. Calculation of goodwill:

Acquisition cost $ 10,000,000

Fair value of noncontrolling interest 2,000,000

Total fair value 12,000,000

Book value of Saylor $ 6,000,000

Fair value – book value:

Land 500,000

IPR&D 1,000,000 7,500,000

Goodwill $ 4,500,000

Allocation of goodwill between controlling and noncontrolling interest:

Total goodwill $ 4,500,000

Pennant’s goodwill: $10,000,000 – 80%(7,500,000) 4,000,000

Goodwill to noncontrolling interest $ 500,000

b. Consolidated Financial Statement Working Paper

(E)

Stockholders’

equity – Saylor 6,000,000

Investment in Saylor (80%) 4,800,000

Noncontrolling interest in Saylor (20%) 1,200,000

©Cambridge Business Publishers,

20102 100 Advanced Accounting, 1st

(R)

Land 500,000

IPR&D 1,000,000

Goodwill 4,500,000

Investment in Saylor (1) 5,200,000

Noncontrolling interest in Saylor (2) 800,000

(1) 80% x (500,000 + 1,000,000) + 4,000,000

(2) 20% x (500,000 + 1,000,000) + 500,000

E5.3 Date of Acquisition Consolidation, Bargain Purchase

a.

Acquisition cost $ 22,000,000

Fair value of noncontrolling interest 4,000,000

Total 26,000,000

Book value of Sparrow $ 25,000,000

Fair value – book value:

Land (800,000)

Other plant assets 2,000,000

Investments 1,500,000

Long-term debt (700,000)

Fair value of identifiable net assets 27,000,000

Gain on acquisition $ (1,000,000)

Peregrine’s acquisition entry:

Investment in Sparrow 23,000,000

Merger expenses 3,000,000

Cash 25,000,000

Gain on acquisition 1,000,000

b. Consolidated Financial Statement Working Paper

(E)

Stockholders’ equity –

Sparrow 25,000,000

Investment in Sparrow (80%) 20,000,000

Noncontrolling interest in

Sparrow (20%) 5,000,000

©Cambridge Business Publishers, 2010

Solutions Manual, Chapter 5 3

(R)

Other plant assets, net 2,000,000

Investments 1,500,000

Noncontrolling interest in

Sparrow (1) 1,000,000

Land 800,000

Long-term debt 700,000

Investment in Sparrow (2) 3,000,000

(1) $5,000,000 – 4,000,000

(2) $23,000,000 – 20,000,000

E5.4 Consolidated Balance Sheet, Date of Acquisition, with Goodwill: U.S. GAAP and

IFRS

a. Calculation of goodwill:

Acquisition cost [($3,000,000 + (200,000 x $80)) $ 19,000,000

Fair value of noncontrolling interest 1,800,000

Total fair value 20,800,000

Book value of Powerline $ 4,500,000

Fair value – book value:

Current assets 500,000

Plant and equipment 6,000,000

Brand names 2,000,000 13,000,000

Goodwill $ 7,800,000

Allocation of goodwill between controlling and noncontrolling interest:

Total goodwill $ 7,800,000

Microsoft’s goodwill: $19,000,000 – 90%(13,000,000) 7,300,000

Goodwill to noncontrolling interest $ 500,000

©Cambridge Business Publishers,

20104 100 Advanced Accounting, 1st

b.

Consolidation Working Paper (in thousands)

Accounts Taken From Eliminations

Books

Consolidated

Microsoft Powerline Dr Cr Balances

Current assets $ 7,000 $ 2,000 (R) 500 $ 9,500

Plant and equipment, net 35,000 7,000 (R) 6,000 48,000

Investment in Powerline 19,000 4,050 (E)

14,950 (R) --

Brand names (R) 2,000 2,000

Goodwill (R) 7,800 7,800

Total assets $ 61,000 $ 9,000 $ 67,300

Current liabilities $ 5,000 $ 1,500 $ 6,500

Long-term liabilities 20,000 3,000 23,000

Common stock, par value 5,000 100 (E) 100 5,000

Additional paid-in capital 20,000 1,400 (E) 1,400 20,000

Retained earnings 11,000 3,000 (E) 3,000 11,000

Noncontrolling interest 450 (E)

1,350 (R) 1,800

Total liabilities and equity $ 61,000 $ 9,000 $ 20,800 $ 20,800 $ 67,300

Note 1: Microsoft’s balance sheet above reflects the following acquisition entry (in thousands):

Investment in Powerline 19,000

Cash 3,000

Common stock 2,000

Additional paid-in capital 14,000

Note 2: The $14,950,000 credit to investment in entry (R) = 90% (500,000 + 6,000,000

+ 2,000,000) + 7,300,000 (goodwill).

The $1,350,000 credit to noncontrolling interest in entry (R) = 10% (500,000 +

6,000,000 + 2,000,000) + 500,000 (goodwill).

c.

Calculation of goodwill:

Acquisition cost $ 19,000,000

90% x fair value of identifiable net assets 90% x $13,000,000 11,700,000

Goodwill $ 7,300,000

©Cambridge Business Publishers, 2010

Solutions Manual, Chapter 5 5

Consolidation Working Paper (in thousands)

Accounts Taken From Eliminations

Books

Consolidated

Microsoft Powerline Dr Cr Balances

Current assets $ 7,000 $ 2,000 (R) 500 $ 9,500

Plant and equipment, net 35,000 7,000 (R) 6,000 48,000

Investment in Powerline 19,000 4,050 (E)

14,950 (R) --

Brand names (R) 2,000 2,000

Goodwill (R) 7,300 7,300

Total assets $ 61,000 $ 9,000 $ 66,800

Current liabilities $ 5,000 $ 1,500 $ 6,500

Long-term liabilities 20,000 3,000 23,000

Common stock, par value 5,000 100 (E) 100 5,000

Additional paid-in capital 20,000 1,400 (E) 1,400 20,000

Retained earnings 11,000 3,000 (E) 3,000 11,000

Noncontrolling interest 450 (E)

850 (R) 1,300

Total liabilities and equity $ 61,000 $ 9,000 $ 20,300 $ 20,300 $ 66,800

Note: The IFRS alternative valuation method attributes no goodwill to the noncontrolling

interest.

E5.5 Consolidation Eliminating Entries, Date of Acquisition: U.S. GAAP and IFRS

(amounts in thousands)

a.

Perma’s acquisition entry:

Investment in Seismic 14,000

Merger expenses 400

Cash 400

Common stock, par value 2,000

Additional paid-in capital 12,000

©Cambridge Business Publishers,

20106 100 Advanced Accounting, 1st

Consolidation eliminating entries:

(E)

Common stock 200

Additional paid-in capital 4,000

Retained earnings 6,000

Accumulated OCI 500

Treasury stock 700

Investment in Seismic 8,100

Noncontrolling interest in 900

Seismic

(R)

Plant assets, net 3,000

Trademarks 1,000

Customer lists 800

Long-term debt 100

Goodwill (1) 1,700

Investment in Seismic (2) 5,900

Noncontrolling interest in

Seismic (3) 700

(1) ($14,000 + $1,600) – ($9,000 + $3,000 + $1,000 + $800 + $100) = $15,600 – $13,900

(2) 90% x ($3,000 + $1,000 + $800 + $100) + ($14,000 – 90% x $13,900)

(3) 10% x $4,900 + [$1,700 – ($14,000 – 90% x $13,900)]

b. Consolidation eliminating entries:

(E)

Common stock 200

Additional paid-in capital 4,000

Retained earnings 6,000

Accumulated OCI 500

Treasury stock 700

Investment in Seismic 8,100

Noncontrolling interest in

Seismic 900

(R)

Plant assets, net 3,000

Trademarks 1,000

Customer lists 800

Long-term debt 100

Goodwill (4) 1,490

Investment in Seismic 5,900

Noncontrolling interest in

Seismic (5) 490

(4) $14,000 – 90% x $13,900

©Cambridge Business Publishers, 2010

Solutions Manual, Chapter 5 7

(5) 10% x ($3,000 + $1,000 + $800 + $100)

Note: The IFRS alternative valuation method attributes no goodwill to the noncontrolling

interest.

E5.6 Consolidation at End of First Year (see related E4.3)

a. Calculation of goodwill is as follows:

Acquisition cost ($10,000,000 + $300,000) $ 10,300,000

Fair value of noncontrolling interest 6,500,000

Total 16,800,000

Book value of Saddlestone $ 7,200,000

Identifiable intangibles 2,000,000 9,200,000

Goodwill $ 7,600,000

Allocation of goodwill between controlling and noncontrolling interest:

Total goodwill $ 7,600,000

Peak’s goodwill: $10,300,000 – 60%($9,200,000) 4,780,000

Goodwill to noncontrolling interest $ 2,820,000

b. 2011 equity in net income and noncontrolling interest in net income:

Noncontrolling

Total Equity in NI interest in NI

Saddlestone’s reported net income $ 3,000,000 $ 1,800,000 $ 1,200,000

Revaluation writeoff:

Identifiable intangibles $2,000,000/5 (400,000) (240,000) (160,000)

$ 2,600,000 $ 1,560,000 $ 1,040,000

c. Consolidation working paper eliminating entries for 2011:

(C)

Equity in net income of S 1,560,000

Dividends – Saddlestone 600,000

Investment in Saddlestone 960,000

(E)

Stockholders’ equity—

Saddlestone, 1/1 7,200,000

Investment in Saddlestone 4,320,000

Noncontrolling interest in

Saddlestone 2,880,000

©Cambridge Business Publishers,

20108 100 Advanced Accounting, 1st

(R)

Identifiable intangibles 2,000,000

Goodwill 7,600,000

Investment in Saddlestone

(1) 5,980,000

Noncontrolling interest in

Saddlestone (2) 3,620,000

(1) 60% x $2,000,000 + $4,780,000

(2) 40% x $2,000,000 + $2,820,000

(O)

Amortization expense 400,000

Identifiable intangibles 400,000

(N)

Noncontrolling interest in

income of Saddlestone 1,040,000

Dividends – Saddlestone 400,000

Noncontrolling interest in

Saddlestone 640,000

E5.7 Consolidation Two Years after Acquisition

(all numbers in thousands)

a.

Calculation of 2012 equity in net income and noncontrolling interest in net income:

Noncontrolling

Total Equity in NI interest in NI

Silver Nugget’s reported NI for 2012

($100,000 – $80,000 – $14,000 = $6,000) $ 6,000 $ 4,800 $ 1,200

Revaluation write-off:

Identifiable intangibles ($20,000/5) (4,000) (3,200) (800)

$ 2,000 $ 1,600 $ 400

©Cambridge Business Publishers, 2010

Solutions Manual, Chapter 5 9

b.

Consolidation Working Paper, December 31, 2012

Trial Balances Taken Eliminations

From Books

Dr (Cr)

Mirror Silver Consolidated

Resorts Nugget Dr Cr Balances

Current assets $ 35,000 $ 5,000 $ 40,000

Plant and equipment, net 215,700 140,000 355,700

Intangibles 350,000 51,000 (R) 16,000 4,000 (O) 413,000

Investment in Silver Nugget 86,400 -- 400 (C)

17,200 (E)

68,800 (R) --

Goodwill (R) 68,000 68,000

Current liabilities (50,000) (20,000) (70,000)

Long-term debt (600,000) (150,000) (750,000)

Common stock (500) (100) (E) 100 (500)

Additional paid-in capital (6,000) (5,500) (E) 5,500 (6,000)

Retained earnings, Jan. 1 (25,000) (17,500) (E) 17,500 (25,000)

Treasury stock 4,000 1,600 1,600 (E) 4,000

Noncontrolling interest 4,300 (E) (19,600)

15,200 (R)

100 (N)

Dividends 2,000 1,500 1,200 (C) 2,000

300 (N)

Sales revenue (800,000) (100,000) (900,000)

Equity in income of Silver

Nugget (1,600) -- (C) 1,600 --

Cost of goods sold 650,000 80,000 730,000

Operating expenses 140,000 14,000 (O) 4,000 158,000

Noncontrolling interest in NI -- -- (N) 400 400

$ -0- $ -0- $ 113,100 $ 113,100 $ -0-

©Cambridge Business Publishers,

201010 100 Advanced Accounting, 1st

E5.8 Consolidation after Several Years

a.

Paulin’s acquisition cost $ 1,800,000

Fair value of noncontrolling interest 600,000

Total 2,400,000

Fair value of identifiable net assets:

1,850,000 – 10,000 + 20,000 + 100,000 + 40,000 2,000,000

Goodwill $ 400,000

Paulin’s share of goodwill = $1,800,000 – 75%($2,000,000) = $300,000

Noncontrolling interest’s share of goodwill = $100,000

b.

Noncontrolling

Investment interest

January 2007 balance $ 1,800,000 $ 600,000

Change in Stevan’s retained earnings, 2007-2012:

(1,550,000 – 1,000,000), divided 75:25 412,500 137,500

Writeoff of Stevan’s identifiable net asset

revaluations, 2007-2012: (-10,000 + 20,000 + 60,000

+ 40,000), divided 75:25 (82,500) (27,500)

Goodwill impairment, 2007-2012:

(400,000 – 250,000), divided 75:25 (112,500) (37,500)

Balance, end of 2012 $ 2,017,500 $ 672,500

c.

(E)

Stockholders’

equity-Stevan 2,400,000

Investment in Stevan 1,800,000

Noncontrolling interest in Stevan 600,000

(R)

Equipment, net (1) 40,000

Goodwill 250,000

Investment in Stevan (2) 217,500

Noncontrolling interest in Stevan (3) 72,500

(1) $100,000 – (6/10) x $100,000

(2) 75% x ($40,000 + $250,000)

(3) 25% x ($40,000 + $250,000)

©Cambridge Business Publishers, 2010

Solutions Manual, Chapter 5 11

E5.9 Consolidated Cash Flow from Operations

Consolidated net income ($15,000,000 + $5,000,000) $20,000,000

+ Consolidated depreciation expense 3,000,000

+ Amortization of previously unrecognized identifiable intangibles 1,400,000

- Amortization of premium created when revaluing LT debt (80,000)

- 40% of undistributed equity method income (.4 x $1,700,000) (680,000)

+ Decrease in noncash current operating assets 2,800,000

- Decrease in current operating liabilities (2,100,000)

Cash flow from operating activities $24,340,000

Note: The $8,000,000 net income reported by the 75%-owned subsidiary is already included in

consolidated income, and is therefore not separately reported.

E5.10 Consolidated Cash Flow from Operations

Consolidated net income (1) $ 981,600

+ Consolidated depreciation expense (2) 180,000

+ Consolidated amortization expense (3) 25,000

+ Goodwill impairment loss 30,000

- Undistributed equity investment income (4) (18,000)

Cash flow from operating activities $ 1,198,600

(1) Calculation of equity in net income:

P’s share of reported income 80% x $200,000 $ 160,000

P’s share of revaluation write-offs:

Depreciation (1,600)

Amortization (8,000)

Goodwill impairment loss (24,000)

Equity in net income $ 126,400

Calculation of consolidated net income:

Parent’s reported income $ 950,000

Subsidiary’s reported income 200,000

Less equity in net income of subsidiary (126,400)

Less revaluation writeoffs:

Depreciation (2,000)

Amortization (10,000)

Goodwill impairment loss (30,000)

Consolidated net income $ 981,600

(2) $150,000 + $28,000 + $2,000

(3) $15,000 + $10,000

(4) $45,000 - $27,000

©Cambridge Business Publishers,

201012 100 Advanced Accounting, 1st

E5.11 Consolidation at Date of Acquisition, IFRS

(in millions)

a. Calculation of goodwill:

Acquisition cost € 67

Less 49% fair value of identifiable net assets 49% x (22.5) (11)

Goodwill € 78

Noncontrolling interests = 51% x €(22.5) = €(11.5)

b.

(E)

Investment in ASTAR 10

Noncontrolling interest 10.5

Stockholders’ equity-ASTAR 20.5

(R)

Noncurrent financial assets 2

Goodwill 78

Noncontrolling interests 1

Intangible assets 4

Investment in ASTAR 77

E5.12 Consolidation Worksheet, Date of Acquisition and One Year Later, IFRS

(in millions)

a. Calculation of goodwill:

Acquisition cost € 787

Fair value of identifiable net assets:

Book value € (118)

Revaluations:

Customer lists 150

Trade name 25

Assumed liabilities (484)

Deferred tax assets, net 123

Total fair value of identifiable net assets (304)

Vivendi’s share x 85% (258)

Goodwill € 1,045

Noncontrolling interests = 15% x (304) = €(46)

©Cambridge Business Publishers, 2010

Solutions Manual, Chapter 5 13

b.

(E)

Investment in TPS 100

Noncontrolling interest 18

Stockholders’ equity-TPS 118

(R)

Goodwill 1,045

Customer lists 150

Trade name 25

Deferred tax assets, net 123

Noncontrolling interest 28

Assumed liabilities 484

Investment in TPS 887

c. Calculation of equity in net loss of TPS and noncontrolling interest in TPS income is as

follows:

Noncontrolling

Equity in NL interest in NI

TPS’ reported income for 2007 € 68.00 €12.00

Revaluation write-offs:

Customer lists (€150/5) (25.50) (4.50)

Goodwill impairment (100.00) --

Trade name impairment (4.25) (0.75)

€ (61.75) € 6.75

(C)

Investment in TPS 61.75

Equity in net loss of TPS 61.75

(E)

Investment in TPS 100

Noncontrolling interest 18

Stockholders’ equity-TPS 118

(R)

Goodwill 1,045

Customer lists 150

Trade name 25

Deferred tax assets, net 123

Noncontrolling interest 28

Assumed liabilities 484

Investment in TPS 887

©Cambridge Business Publishers,

201014 100 Advanced Accounting, 1st

(O)

Amortization expense 30

Impairment losses 105

Customer lists 30

Goodwill 100

Trade name 5

(N)

Noncontrolling interest in NI 6.75

Noncontrolling interest 6.75

©Cambridge Business Publishers, 2010

Solutions Manual, Chapter 5 15

PROBLEMS

P5.1 Consolidation Working Paper, Date of Acquisition

(all numbers in millions)

a. Calculation of goodwill:

Acquisition cost $ 1,200

Fair value of noncontrolling interest _375

Total fair value 1,575

Book value of Bagota $ 500

Fair value – book value:

Property, plant and equipment (200)

Patents and trademarks 45

Customer-related intangibles 30

Long-term liabilities 25 _400

Goodwill $ 1,175

Allocation of goodwill between controlling and noncontrolling interest:

Total goodwill $ 1,175

Hershey’s goodwill: $1,200 – 75%(400) 900

Goodwill to noncontrolling interest $ 275

b.

Consolidation Working Paper (in millions)

Accounts Taken From Eliminations

Books

Consolidated

Hershey Bagota Dr Cr Balances

Current assets $ 1,500 $ 325 $ 1,825

PP&E, net 1,600 600 200 (R) 2,000

Investment in Bagota 1,200 -- 375 (E)

825 (R) --

Patents and trademarks 1,300 75 (R) 45 1,420

Customer-related intangs -- (R) 30 30

Goodwill (R) 1,175 1,175

Total assets $ 5,600 $ 1,000 $ 6,450

Current liabilities $ 1,600 $ 100 $ 1,700

Long-term liabilities 1,900 400 (R) 25 2,275

Common stock, par value 300 10 (E) 10 300

Additional paid-in capital 1,950 200 (E) 200 1,950

Retained earnings 3,900 300 (E) 300 3,900

Treasury stock (4,000) -- (4,000)

Accumulated OCI (50) (10) 10 (E) (50)

Noncontrolling interest 125 (E)

250 (R) 375

Total liabilities and equity $ 5,600 $ 1,000 $ 1,785 $ 1,785 $ 6,450

©Cambridge Business Publishers,

201016 100 Advanced Accounting, 1st

c.

Consolidated Balance Sheet, July 1, 2011

Assets

Current assets $ 1,825

Property, plant and equipment, net 2,000

Goodwill 1,175

Other intangibles 1,450

Total assets $ 6,450

Liabilities and stockholders’ equity

Current liabilities $ 1,700

Long-term liabilities 2,275

Total liabilities 3,975

Stockholders’ equity

Hershey’s stockholders’ equity:

Common stock 300

Additional paid-in capital 1,950

Retained earnings 3,900

Treasury stock (4,000)

Accumulated other comprehensive loss (50)

Total Hershey stockholders’ equity 2,100

Noncontrolling interest 375

Total stockholders’ equity 2,475

Total liabilities and stockholders’ equity $ 6,450

P5.2 Consolidated Balance Sheet Working Paper, Date of Acquisition, Bargain Purchase

(see related P3.4)

a. (amounts in millions)

Acquisition cost $ 1,000

Fair value of noncontrolling interest 200

Total $ 1,200

Book value of Saxon $ 1,295

Fair value – book value:

Inventory 100

Long-term marketable securities (50)

Land 245

Buildings and equipment, net 300

Long-term debt 110

Fair value of identifiable net assets 2,000

Gain on acquisition $ (800)

©Cambridge Business Publishers, 2010

Solutions Manual, Chapter 5 17

Paxon’s acquisition entry:

Investment in Saxon 1,800

Cash 1,000

Gain on acquisition 800

b.

Consolidation Working Paper (in millions)

Accounts Taken From Eliminations

Books

Consolidated

Paxon Saxon Dr Cr Balances

Cash and receivables $ 1,860 $ 720 $ 2,580

Inventory 1,700 900 (R) 100 2,700

Marketable securities -- 300 50 (R) 250

Investment in Saxon 1,800 1,036 (E) --

764 (R)

Land 650 175 (R) 245 1,070

Buildings and equipment 3,400 600 (R) 300 4,300

Accumulated depreciation (1,000) -- (1,000)

Total assets $ 8,410 $ 2,695 $ 9,900

Current liabilities $ 1,500 $ 1,000 $ 2,500

Long-term debt 2,000 400 (R) 110 2,290

Common stock, par value 500 100 (E) 100 500

Additional paid-in capital 1,200 350 (E) 350 1,200

Retained earnings 3,210 845 (E) 845 3,210

Noncontrolling interest -- -- (R) 59 259 (E) 200

Total liabilities and equity $ 8,410 $ 2,695 $ 2,109 $ 2,109 $ 9,900

Note: In journal entry form, the eliminating entries are:

(E)

Common stock, par value 100

Additional paid-in capital 350

Retained earnings 845

Investment in Saxon 1,036

Noncontrolling interest 259

(R)

Inventory 100

Land 245

Buildings and equipment 300

Long-term debt 110

Noncontrolling interest 59

Marketable securities 50

Investment in Saxon 764

©Cambridge Business Publishers,

201018 100 Advanced Accounting, 1st

The adjustment to noncontrolling interest brings its balance to fair value at the acquisition date.

The adjustment to the investment eliminates the remaining balance.

c.

Consolidated Balance Sheet, December 31, 2012 (amounts in millions)

Assets

Cash and receivables $ 2,580

Inventory 2,700

Current assets 5,280

Long-term marketable securities 250

Land 1,070

Buildings and equipment, net of $1,000 accumulated depreciation 3,300

Total assets $ 9,900

Liabilities and stockholders’ equity

Current liabilities $ 2,500

Long-term debt 2,290

Total liabilities 4,790

Stockholders’ equity

Paxon stockholders’ equity:

Common stock 500

Additional paid-in capital 1,200

Retained earnings 3,210

Total Paxon stockholders’ equity 4,910

Noncontrolling interest 200

Total stockholders’ equity 5,110

Total liabilities and stockholders’ equity $ 9,900

P5.3 Consolidation Eliminating Entries, Date of Acquisition

(all amounts in thousands)

a.

Investment in Stark 7,600

Merger expenses 250

Cash 7,250

Earnings contingency liability 600

b. Consolidation working paper eliminating entries:

(E)

Common stock 1,000

Retained earnings 4,000

Investment in Stark 3,750

Noncontrolling interest 1,250

©Cambridge Business Publishers, 2010

Solutions Manual, Chapter 5 19

(R)

Inventories 500

Intangibles 200

In-process research and

development 1,000

Goodwill (1) 3,730

Noncurrent liabilities 300

Cash and receivables 100

Plant assets, net 200

Lawsuit liability 380

Investment in Stark (2) 3,850

Noncontrolling interest (3) 1,200

(1) Calculation of goodwill:

Acquisition cost $ 7,600

Fair value of noncontrolling interest 2,450

Total fair value 10,050

Book value of Stark $ 5,000

Fair value – book value:

Cash and receivables (100)

Inventories 500

Plant assets, net (200)

Intangibles 200

Noncurrent liabilities 300

IPR&D 1,000

Lawsuit liability (380) 6,320

Goodwill $ 3,730

Allocation of goodwill between controlling and noncontrolling interest:

Total goodwill $ 3,730

Penn’s goodwill: $7,600 – 75%(6,320) 2,860

Goodwill to noncontrolling interest $ 870

(2) $7,600 – 3,750, or 75% x (6,320 – 5,000) + 2,860.

(3) $2,450 – 1,250, or 25% x (6,320 – 5,000) + 870.

©Cambridge Business Publishers,

201020 100 Advanced Accounting, 1st

P5.4 Consolidated Working Paper One Year after Acquisition, Bargain Purchase

(see related P4.4)

(all amounts in millions)

a. Calculation of gain on acquisition:

Acquisition cost $ 1,620

Fair value of noncontrolling interest 180

1,800

Book value ($100 + 350 + 845) $ 1,295

Excess of fair value over book value:

Inventory 100

Marketable securities (50)

Land 245

Buildings and equipment 300

Long-term debt (discount) 110 2,000

Gain on acquisition $ (200)

b.

Noncontrolling

Total Equity in NI interest in NI

Saxon’s reported net income for 2013

($10,000 + 10 – 8,000 – 40 – 25 – 1,600 =

$345) $ 345 $ 310.5 $ 34.5

Revaluation writeoffs:

Inventory (100) (90) (10)

Marketable securities 50 45 5

Buildings and equipment ($300/20) (15) (13.5) (1.5)

Long-term debt ($110/5) (22) (19.8) (2.2)

$ 258 $ 232.2 $ 25.8

©Cambridge Business Publishers, 2010

Solutions Manual, Chapter 5 21

c.

Consolidation Working Paper, December 31, 2013

Trial Balances Taken Eliminations

From Books

Dr (Cr)

Consolidated

Paxon Saxon Dr Cr Balances

Cash and receivables $ 3,270 $ 800 $ 4,070

Inventory 2,260 940 (R) 100 100 (O-1) 3,200

Marketable securities -- -- (O-2) 50 50 (R) --

Investment in Saxon 1,962.2 -- 142.2 (C) --

1,165.5 (E)

654.5 (R)

Land 650 300 (R) 245 1,195

Buildings and equipment, net 3,600 1,150 (R) 300 15 (O-3) 5,035

Current liabilities (2,020) (1,200) (3,220)

Long-term debt (5,000) (450) (R) 110 22 (O-4) (5,362)

Common stock (500) (100) (E) 100 (500)

Additional paid-in capital (1,200) (350) (E) 350 (1,200)

Retained earnings, Jan. 1 (2,410) (845) (E) 845 (2,410)

Noncontrolling interest -- -- 129.5 (E) (195.8)

50.5 (R)

15.8 (N)

Dividends 500 100 90 (C) 500

10 (N)

Sales revenue (30,000) (10,000) (40,000)

Equity in income of Saxon (232.2) -- (C) 232.2 --

Gain on sale of securities -- (10) 50 (O-2) (60)

Gain on acquisition (200) -- (200)

Cost of goods sold 26,000 8,000 (O-1) 100 34,100

Depreciation expense 300 40 (O-3) 15 355

Interest expense 250 25 (O-4) 22 297

Other operating expenses 2,770 1,600 4,370

Noncontrolling interest in NI -- -- (N) 25.8 25.8

$ -0- $ -0- $ 2,495 $ 2,495 $ -0-

©Cambridge Business Publishers,

201022 100 Advanced Accounting, 1st

P5.5 Consolidated Working Paper Two Years after Acquisition, Bargain Purchase

(see related P5.4)

(all amounts in millions)

a.

Equity in Noncontrolling

Total NI interest in NI

Saxon’s reported net income for 2014

($12,000 – 9,500 – 60 – 40 – 2,200 = $200) $ 200 $ 180 $ 20

Revaluation writeoffs:

Buildings and equipment ($300/20) (15) (13.5) (1.5)

Long-term debt ($110/5) (22) (19.8) (2.2)

$ 163 $ 146.7 $ 16.3

Note: Inventory (FIFO) and marketable securities revaluations were realized through sale in

2013.

b.

Consolidation Working Paper, December 31, 2014

Trial Balances Eliminations

Taken From Books

Dr (Cr)

Consolidated

Paxon Saxon Dr Cr Balances

Cash and receivables $ 3,000 $ 850 $ 3,850

Inventory 2,500 950 3,450

Investment in Saxon 2,063.9 -- 101.7 (C) --

1,386 (E)

576.2 (R)

Land 650 250 (R) 245 1,145

Buildings and equipment, net 5,905 1,440 (R) 285 15 (O-1) 7,615

Current liabilities (2,500) (1,000) (3,500)

Long-term debt (6,000) (800) (R) 88 22 (O-2) (6,734)

Common stock (500) (100) (E) 100 (500)

Additional paid-in capital (1,200) (350) (E) 350 (1,200)

Retained earnings, Jan. 1 (3,022.2) (1,090) (E) 1,090 (3,022.2)

Noncontrolling interest -- -- 154 (E) (207.1)

41.8 (R)

11.3 (N)

Dividends 500 50 45 (C) 500

5 (N)

Sales revenue (35,000) (12,000) (47,000)

Equity in income of Saxon (146.7) -- (C) 146.7 --

Cost of goods sold 30,000 9,500 39,500

Depreciation expense 450 60 (O-1) 15 525

Interest expense 300 40 (O-2) 22 362

Other operating expenses 3,000 2,200 5,200

Noncontrolling interest in NI -- -- (N) 16.3 16.3

$ -0- $ -0- $ 2,358 $ 2,358 $ -0-

©Cambridge Business Publishers, 2010

Solutions Manual, Chapter 5 23

P5.6 Consolidation Working Paper, Second Year Following Acquisition

(amounts in millions)

a. Calculation of goodwill is as follows:

Acquisition cost $ 600

Fair value of noncontrolling interest 225

Total 825

Book value of S $ 580

Identifiable intangibles 100 680

Goodwill $ 145

Allocation of goodwill between controlling and noncontrolling interest:

Total goodwill $ 145

Harrah’s goodwill: $600 – 70% x $680 124

Goodwill to noncontrolling interest $ 21

b. Calculation of 2008 equity in net loss and noncontrolling interest in net loss:

Equity in Noncontrolling

Total NL interest in NL

Emerald Safari Resort reported income

($2,200 + 300 + 200 – 1,670 – 1,000 = $30) $ 30 $ 21 $ 9

Revaluation writeoffs:

Identifiable intangibles ( 8) (5.6) (2.4)

Goodwill (145) (124) (21)

$ (123) $ (108.6) $ (14.4)

©Cambridge Business Publishers,

201024 100 Advanced Accounting, 1st

c.

Consolidation Working Paper, December 31, 2008

Trial Balances Eliminations

Taken From Books

Dr (Cr)

Emerald

Safari Consolidated

Harrah’s Resort Dr Cr Balances

Current assets $ 1,400 $ 200 $ 1,600

Land, buildings, riverboats and 17,696.2 2,549 20,245.2

equipment, net

Intangible assets 2,500 800 (R) 95 8 (O) 3,387

Investment in Emerald 515.2 -- (C) 112.1 436.8 (E) --

190.5 (R)

Goodwill -- -- (R) 145 145 (O) --

Current liabilities (1,500) (300) (1,800)

Long-term liabilities (14,000) (2,600) (16,600)

Common stock (20) (4) (E) 4 (20)

Capital surplus (5,500) (320) (E) 320 (5,500)

Retained earnings, Jan. 1 (900) (300) (E) 300 (900)

Noncontrolling interest -- -- (N) 15.9 187.2 (E) (220.8)

49.5 (R)

Dividends 100 5 3.5 (C) 100

1.5 (N)

Casino revenues (6,600) (2,200) (8,800)

Food and beverage revenues (1,400) (300) (1,700)

Rooms revenues (1,000) (200) (1,200)

Equity in net loss of Emerald 108.6 -- 108.6 (C) --

Direct casino, food and beverage, 7,200 1,670 8,870

rooms expenses

General and administrative expenses 1,400 1,000 2,400

Amortization expense (O) 8 8

Goodwill impairment loss (O) 145 145

Noncontrolling interest in net loss -- -- 14.4 (N) (14.4)

$ -0- $ -0- $ 1,145 $ 1,145 $ -0-

©Cambridge Business Publishers, 2010

Solutions Manual, Chapter 5 25

P5.7 Equity Method and Eliminating Entries Three Years after Acquisition (see related

P4.2)

a. Calculation of equity in net income and noncontrolling interest in net income for 2012:

Equity in Noncontrolling

Total NI interest in NI

Sea Coast’s reported net income for 2012 $ 130,000 $ 117,000 $ 13,000

Revaluation writeoffs:

Plant assets ($100,000)/10 10,000 9,000 1,000

Identifiable intangibles $300,000/20 (1) (15,000) (13,500) (1,500)

$ 125,000 $ 112,500 $ 12,500

(1) $300,000 = $1,800,000 + 200,000 – (1,400,000 + 400,000 – 100,000)

b. Calculation of investment balance at December 31, 2012:

Investment in Sea Coast, December 31, 2009 $1,800,000

90% x Sea Coast’s reported income, 2010-2012 360,000

90% x Sea Coast’s reported dividends, 2010-2012

(60% of reported income) (216,000)

Revaluation writeoffs, 2010-2012:

Plant assets [($100,000)/10] x 3 x 90% 27,000

Identifiable intangibles ($300,000/20) x 3 x 90% (40,500)

Investment in Sea Coast, December 31, 2012 $1,930,500

Note: Under LIFO and increasing inventory, the revalued inventory is assumed to still be on

hand.

c. Calculation of noncontrolling interest balance at December 31, 2012:

Fair value of noncontrolling interest, December 31, 2009 $200,000

10% x Sea Coast’s reported income, 2010-2012 40,000

10% x Sea Coast’s reported dividends, 2010-2012 (60% of reported (24,000)

income)

Revaluation writeoffs, 2010-2012:

Plant assets [($100,000)/10] x 3 x 10% 3,000

Identifiable intangibles ($300,000/20) x 3 x 10% (4,500)

Noncontrolling interest in Sea Coast, December 31, 2012 $214,500

©Cambridge Business Publishers,

201026 100 Advanced Accounting, 1st

d. Consolidation working paper eliminating entries for 2012:

(C)

Equity in net income of Sea Coast 112,500

Dividends – Sea Coast

(.6 x $130,000 x 90%) 70,200

Investment in Sea

Coast 42,300

(E)

Stockholders’ equity—Sea Coast, 1/1 1,508,000

Investment in Sea

Coast 1,357,200

Noncontrolling interest

in Sea Coast 150,800

Sea Coast’s stockholders’ equity, January 1, 2012 = $1,400,000 + (1 - .6)(400,000 – 130,000) =

$1,508,000.

(R)

Inventory 400,000

Identifiable intangibles 270,000

Plant assets, net 80,000

Investment in Sea

Coast 531,000

Noncontrolling interest

in Sea Coast 59,000

Revaluations at January 1, 2012 = original revaluations less writeoffs for 2010 and 2011.

(O)

Plant assets, net 10,000

Amortization expense 15,000

Depreciation expense 10,000

Identifiable intangibles 15,000

(N)

Noncontrolling interest in NI of Sea

Coast 12,500

Dividends – Sea Coast

(.6 x $130,000 x 10%) 7,800

Noncontrolling interest

in Sea Coast 4,700

©Cambridge Business Publishers, 2010

Solutions Manual, Chapter 5 27

P5.8 Consolidation Working Paper after Several Years

(amounts in thousands)

a. Calculation of goodwill:

Acquisition cost $ 50,000

Fair value of noncontrolling interest 10,000

Total fair value 60,000

Book value of Piedmont $ 23,000

Fair value – book value of franchise rights 15,000 38,000

Goodwill $ 22,000

Allocation of goodwill between controlling and noncontrolling interest:

Total goodwill $ 22,000

Coca-Cola Consolidated’s goodwill: $50,000 – 75%(38,000) 21,500

Goodwill to noncontrolling interest $ 500

b. Calculation of equity in net loss and noncontrolling interest in net loss for 2010:

Equity in Noncontrolling

Total NL interest in NL

Piedmont’s reported net income for 2010

(1) $ 3,000 $ 2,250 $ 750

Revaluation write-offs:

Franchise rights impairment (3,000) (2,250) (750)

Goodwill impairment ($4,000 in the

21.5:.5 ratio from a. above) (4,000) (3,909) (91)

$ (4,000) $ (3,909) $ (91)

(1) $3,000 = $300,000 – (175,000 + 114,000 + 8,000)

c. Calculation of investment balance at December 31, 2010:

Investment in Piedmont, January 1, 2003 $ 50,000

75% x Piedmont reported income less dividends, 2003-2009 (1) 5,850

75% x Revaluation write-offs for franchise rights, 2003-2009 (1,500)

Equity in net loss, 2010 (3,909)

Investment in Piedmont, December 31, 2010 $ 50,441

(1) Change in book value 2003-2009 of $7,800 (= $30,800 – $23,000) is attributed to

accumulated income less dividends, since the stock accounts did not change; $30,800 =

$1,000 + $12,000 + $18,000 – $200.

©Cambridge Business Publishers,

201028 100 Advanced Accounting, 1st

d.

Consolidation Working Paper, December 31, 2010

Trial Balances Eliminations

Taken From Books

Dr (Cr)

Coca-Cola Consolidated

Consolidated Piedmont Dr Cr Balances

Current assets $ 160,000 $ 30,000 $ 190,000

Property, plant & equipment, net 250,000 233,800 483,800

Franchise rights, net 485,650 -- (R) 13,000 3,000 (O) 495,650

Investment in Piedmont 50,441 -- (C) 3,909 23,100 (E) --

31,250 (R)

Goodwill -- -- (R) 22,000 4,000 (O) 18,000

Current liabilities (120,000) (20,000) (140,000)

Long-term debt (700,000) (210,000) (910,000)

Common stock (12,000) (1,000) (E) 1,000 (12,000)

Additional paid-in capital (100,000) (12,000) (E) 12,000 (100,000)

Retained earnings, Jan. 1 (50,500) (18,000) (E) 18,000 (50,500)

Accumulated other 12,000 -- 12,000

comprehensive loss

Treasury stock 30,000 200 200 (E) 30,000

Noncontrolling interest -- -- (N) 91 7,700 (E) (11,359)

3,750 (R)

Dividends 2,000 -- 2,000

Net sales (1,200,000) (300,000) (1,500,000)

Equity in loss of Piedmont 3,909 -- 3,909 (C) --

Cost of sales 760,000 175,000 935,000

Selling, delivery and 400,000 114,000 514,000

administrative expenses

Amortization expense 500 -- (O) 3,000 3,500

Interest expense 28,000 8,000 36,000

Goodwill impairment loss -- -- (O) 4,000 4,000

Noncontrolling interest in NI -- -- 91 (N) (91)

$ -0- $ -0- $ 77,000 $77,000 $ -0-

©Cambridge Business Publishers, 2010

Solutions Manual, Chapter 5 29

e.

Consolidated Income Statement and Statement of Retained Earnings,

Year Ended December 31, 2010

Net sales $ 1,500,000

Cost of sales (935,000)

Gross profit 565,000

Selling, delivery and administrative expenses (514,000)

Amortization expense (3,500)

Interest expense (36,000)

Goodwill impairment loss (4,000)

Consolidated net income 7,500

Plus: Net loss attributable to noncontrolling interest 91

Net income attributable to Coca-Cola Consolidated 7,591

Plus retained earnings, January 1 50,500

Less dividends _(2,000)

Retained earnings, December 31 $ 56,091

Consolidated Balance Sheet, December 31, 2010

Assets

Current assets $ 190,000

Property, plant and equipment, net 483,800

Franchise rights, net 495,650

Goodwill 18,000

Total assets $ 1,187,450

Liabilities and stockholders’ equity

Current liabilities $ 140,000

Long-term liabilities 910,000

Total liabilities 1,050,000

Stockholders’ equity

Coca-Cola Consolidated stockholders’ equity:

Common stock 12,000

Additional paid-in capital 100,000

Retained earnings 56,091

Treasury stock (30,000)

Accumulated other comprehensive loss (12,000)

Total Coca-Cola Consolidated stockholders’ equity 126,091

Noncontrolling interest 11,359

Total stockholders’ equity 137,450

Total liabilities and stockholders’ equity $ 1,187,450

©Cambridge Business Publishers,

201030 100 Advanced Accounting, 1st

P5.9 Consolidated Statement of Cash Flows

Sunny Valley Resort and Subsidiary

Consolidated Statement of Cash Flows

For the year 2012

Cash from operating activities

Consolidated net income ($400,000 + $24,000) (1) $ 424,000

Add (subtract) items not affecting cash:

Depreciation expense $ 350,000

Goodwill impairment loss 30,000

Loss on retirement of plant assets (2) 50,000 430,000

Changes in current assets and liabilities:

Increase in other current assets (400,000)

Decrease in current liabilities (268,000) (668,000)

Net cash from operating activities 186,000

Cash from investing activities

Acquisition of plant assets (3) (300,000)

Cash from financing activities

Increase in noncurrent liabilities 100,000

Dividends paid to controlling stockholders (70,000)

Dividends paid to noncontrolling stockholders (16,000) 14,000

Net decrease in cash (100,000)

Plus cash balance, January 1 700,000

Cash balance, December 31 $ 600,000

(1) Noncontrolling interest in net income = $120,000 x 20%

(2) $1,600,000 + 350,000 – 1,500,000 = $450,000 accumulated depreciation on plant assets

scrapped; $500,000 – 450,000 = $50,000 loss on retirement of plant assets.

(3) X = cost of plant assets acquired; $4,200,000 + X – 500,000 = $4,000,000; X = $300,000.

©Cambridge Business Publishers, 2010

Solutions Manual, Chapter 5 31

P5.10 Consolidated Statement of Cash Flows

Prime Casinos and Saratoga International Hotels

Consolidated Statement of Cash Flows

For the Year ended December 31, 2013

(in millions)

Cash from operating activities:

Consolidated net income $ 612

Add (subtract) items not affecting cash from operations:

Depreciation expense $ 250

Goodwill impairment loss 25

Loss on sale of plant assets 10 285

Changes in current assets and liabilities:

Increase in other current assets (100)

Increase in current liabilities 250 150

Net cash from operating activities 1,047

Cash from investing activities:

Sale of plant assets (1) 15

Acquisition of plant assets (675) (660)

Cash from financing activities:

Increase in long-term liabilities 150

Issuance of capital stock 200

Dividends paid to majority stockholders (435)

Dividends paid to noncontrolling interest (2) (2) (87)

Net increase in cash 300

Plus cash balance, January 1, 2013 200

Cash balance, December 31, 2013 $ 500

(1) Cost of plant assets sold = $2,500 + $675 - $3,100 = $75

Accumulated depreciation on plant assets sold = $800 + $250 - $1,000 = $50

Cash received from sale of plant assets = $75 - $50 - $10 = $15

(2) $150 + 12 – 160 = $2

©Cambridge Business Publishers,

201032 100 Advanced Accounting, 1st

P5.11 Consolidation Two Years after Acquisition, IFRS

(all dollar amounts in millions)

a. Calculation of goodwill is as follows:

Acquisition cost € 4,000

Book value of Monaco € 1,000

Revaluations:

Inventory (100)

Property, plant and equipment 400

Identifiable intangibles 300

Fair value of identifiable net assets 1,600

x 80% 1,280

Goodwill € 2,720

b. Calculation of equity in net income and noncontrolling interest in net income for 2010:

Noncontrolling

Total Equity in NI interest in NI

Monaco’s reported net income for 2010 (1) € 600 € 480 € 120

Revaluation writeoffs:

Property, plant and equipment $400/10 (40) (32) (8)

Identifiable intangibles $300/3 (100) (80) (20)

Goodwill (200) (200) --

€ 260 € 168 € 92

(1) $600 = $3,500 – (2,500 + 400)

©Cambridge Business Publishers, 2010

Solutions Manual, Chapter 5 33

c.

Consolidation Working Paper, December 31, 2010

Trial Balances Eliminations

Taken From Books

Dr (Cr)

Consolidated

Rendezvous Monaco Dr Cr Balances

Current assets € 500 € 900 € 1,400

Property, plant and equipment, net 3,000 2,000 (R) 360 40 (O) 5,320

Investment in Monaco 4,316 -- 128 (C)

1,120 (E)

3,068 (R) --

Identifiable intangibles -- 200 (R) 200 100 (O) 300

Goodwill -- -- (R) 2,620 200 (O) 2,420

Liabilities (4,648) (1,150) (5,798)

Capital stock (1,500) (800) (E) 800 (1,500)

Retained earnings, Jan. 1 (1,000) (600) (E) 600 (1,000)

Noncontrolling interest -- -- 280 (E)

112 (R)

82 (N) (474)

Dividends -- 50 40 (C)

10 (N) --

Sales revenue (5,000) (3,500) (8,500)

Equity in net income of Monaco (168) -- (C) 168 --

Cost of sales 4,200 2,500 6,700

Goodwill impairment loss -- -- (O) 200 200

Administrative and other operating (O) 40

expenses 300 400 (O) 100 840

Noncontrolling interest in NI -- -- (N) 92 92

€ -0- € -0- € 5,180 € 5,180 € -0-

©Cambridge Business Publishers,

201034 100 Advanced Accounting, 1st

P5.12 Consolidation Several Years after Acquisition, IFRS

(dollar amounts in thousands)

a. Calculation of goodwill is as follows:

Acquisition cost € 120,000

Book value of Wholesome € 74,000

Revaluations:

Plant and equipment (15,000)

Identifiable intangibles 25,000

Long-term debt (4,000)

Fair value of identifiable net assets 80,000

x 75% 60,000

Goodwill € 60,000

b. Calculation of equity in net income and noncontrolling interest in net income for 2010:

Noncontrolling

Total Equity in NI interest in NI

Wholesome’s reported net income for 2010

(1) € 5,000 € 3,750 € 1,250

Revaluation writeoffs:

Property, plant and equipment

(€15,000/10) 1,500 1,125 375

Identifiable intangibles (€25,000/10) (2,500) (1,875) (625)

Goodwill (1,000) (1,000) --

€ 3,000 € 2,000 € 1,000

(1) €5,000 = €140,000 – (65,000 + 70,000)

©Cambridge Business Publishers, 2010

Solutions Manual, Chapter 5 35

c.

Consolidation Working Paper, December 31, 2010

Trial Balances Eliminations

Taken From Books

Dr (Cr)

Consolidated

Orchid Wholesome Dr Cr Balances

Current assets € 35,000 € 20,000 € 55,000

Property, plant and equipment, net 260,500 192,000 (O) 1,500 9,000 (R) 445,000

Investment in Wholesome 133,500 -- 2,000 (C)

69,000 (E)

62,500 (R) --

Identifiable intangibles 100,000 10,000 (R) 15,000 2,500 (O) 122,500

Goodwill -- -- (R) 58,000 1,000 (O) 57,000

Current liabilities (30,000) (25,000) (55,000)

Long-term debt (350,000) (100,000) (450,000)

Capital stock (80,000) (54,000) (E) 54,000 (80,000)

Retained earnings, Jan. 1 (60,000) (38,000) (E) 38,000 (60,000)

Noncontrolling interest -- -- 23,000 (E)

1,500 (R)

1,000 (N) (25,500)

Sales revenue (400,000) (140,000) (540,000)

Equity in net income of Wholesome (2,000) -- (C) 2,000 --

Cost of goods sold 250,000 65,000 315,000

Goodwill impairment loss -- -- (O) 1,000 1,000

Other operating expenses 143,000 70,000 (O) 2,500 1,500 (O) 214,000

Noncontrolling interest in NI -- -- (N) 1,000 1,000

€ -0- € -0- € 173,000 €173,000 € -0-

©Cambridge Business Publishers,

201036 100 Advanced Accounting, 1st

You might also like

- Question 1 of The FAR ExamDocument5 pagesQuestion 1 of The FAR ExamShazaib Khalish0% (7)

- A Project Report On Portfolio-Management by Deepak ChoubeyDocument51 pagesA Project Report On Portfolio-Management by Deepak Choubeydeepakchoubey9066% (32)

- Practice Quiz - Quiz 1: FdnacctDocument6 pagesPractice Quiz - Quiz 1: FdnacctAnne MiguelNo ratings yet

- CFAP 1 AAFR Summer 2017Document10 pagesCFAP 1 AAFR Summer 2017Aqib SheikhNo ratings yet

- Q1) May 2011 ZA Q1 - Ear, Mouth & Nose Mouth LTD Nose LTDDocument8 pagesQ1) May 2011 ZA Q1 - Ear, Mouth & Nose Mouth LTD Nose LTDduong duongNo ratings yet

- Please Refer To Table 4-1 For The Following Questions. Table 4-1Document1 pagePlease Refer To Table 4-1 For The Following Questions. Table 4-1Megana PunithNo ratings yet

- Liquidity RatiosDocument3 pagesLiquidity RatiosMckenzie PalaganasNo ratings yet

- Advanced Accounting 2 - Chapter 4 James B. Cantorne Problem 1. T/FDocument7 pagesAdvanced Accounting 2 - Chapter 4 James B. Cantorne Problem 1. T/FJames CantorneNo ratings yet

- Tugas MK11Document2 pagesTugas MK11Nan BaeeeNo ratings yet

- Final PB Exam - Answers - SolutionsDocument10 pagesFinal PB Exam - Answers - SolutionsJazehl ValdezNo ratings yet

- Quiz IntAccDocument12 pagesQuiz IntAccTrixie HicaldeNo ratings yet

- Assessed Coursework 2 - S2 2020 UpdateDocument7 pagesAssessed Coursework 2 - S2 2020 UpdateArmaghan Ali MalikNo ratings yet

- Latihan Soal Kombis (Answered)Document6 pagesLatihan Soal Kombis (Answered)Fajar IskandarNo ratings yet

- Ap - Ap 2.1Document19 pagesAp - Ap 2.1viethoangduongkhanhNo ratings yet

- Exercise For Financial Statement Analysis and RatiosDocument15 pagesExercise For Financial Statement Analysis and RatiosViren JoshiNo ratings yet

- Problem 5-1Document7 pagesProblem 5-1Tammy AckleyNo ratings yet

- Quiz AE 120Document10 pagesQuiz AE 120Katrina MalecdanNo ratings yet

- Sol. Man. - Chapter 14 - Investments in Assoc. - Ia Part 1BDocument15 pagesSol. Man. - Chapter 14 - Investments in Assoc. - Ia Part 1BChristian James RiveraNo ratings yet

- Adobe Scan Jan 30, 2023Document6 pagesAdobe Scan Jan 30, 2023Karan RajakNo ratings yet

- Acct 4010 Ch2-Handout-SolutionDocument4 pagesAcct 4010 Ch2-Handout-Solutionlokyee801mikiNo ratings yet

- Name: Shania Rose P. Binwag Illustration 1Document3 pagesName: Shania Rose P. Binwag Illustration 1ShaniaRose BinwagNo ratings yet

- Sadecki Corporation Balance Sheets Dec-31 Assets 2014 2013Document9 pagesSadecki Corporation Balance Sheets Dec-31 Assets 2014 2013mohitgaba19No ratings yet

- Cashflow Practice Solution-AdditionalDocument5 pagesCashflow Practice Solution-AdditionalNadjah JNo ratings yet

- Review of Financial Statements and Its Analysis: Rheena B. Delos Santos BSBA-1A (FM2)Document12 pagesReview of Financial Statements and Its Analysis: Rheena B. Delos Santos BSBA-1A (FM2)RHIAN B.No ratings yet

- Financial Reporting Financial Statement Analysis and Valuation 8th Edition Wahlen Test Bank 1Document36 pagesFinancial Reporting Financial Statement Analysis and Valuation 8th Edition Wahlen Test Bank 1ericsuttonybmqwiorsa100% (35)

- Finals Quiz No. 1 AnswersDocument4 pagesFinals Quiz No. 1 AnswersMergierose DalgoNo ratings yet

- For Classroom Discussion: SolutionDocument4 pagesFor Classroom Discussion: SolutionMisherene MagpileNo ratings yet

- Chapter 9 Financial Reporting in Hyperinflationary EconomiesDocument10 pagesChapter 9 Financial Reporting in Hyperinflationary EconomiesKathrina RoxasNo ratings yet

- FAOMA Part 3 Quiz Complete SolutionsDocument3 pagesFAOMA Part 3 Quiz Complete SolutionsMary De JesusNo ratings yet

- Kelompok 6 - UTS AKMDocument18 pagesKelompok 6 - UTS AKM21-010 Desi MailaniNo ratings yet

- Online Ass Advance Acc NEWDocument6 pagesOnline Ass Advance Acc NEWRara Rarara30No ratings yet

- Chapter 4-Profitability Analysis: Multiple ChoiceDocument30 pagesChapter 4-Profitability Analysis: Multiple ChoiceRawan NaderNo ratings yet

- Decision Case 12-4Document2 pagesDecision Case 12-4cbarajNo ratings yet

- Final PB FAR Batch 7 Sept 2023Document38 pagesFinal PB FAR Batch 7 Sept 2023Leo M. SalibioNo ratings yet

- RATIO QuestionsDocument5 pagesRATIO QuestionsikkaNo ratings yet

- Cash Flow - HandoutDocument3 pagesCash Flow - HandoutMichelle ManuelNo ratings yet

- CH 13Document4 pagesCH 13Sri HimajaNo ratings yet

- Liabilities 31.3.20X1 Rs 31.3.20X2 Rs Assets: Course: Fac Quiz:5 Section B DATE: 02/09/2019Document3 pagesLiabilities 31.3.20X1 Rs 31.3.20X2 Rs Assets: Course: Fac Quiz:5 Section B DATE: 02/09/2019Amit GodaraNo ratings yet

- Exhibit 17. Goodwill Calculation and The Consolidated Balance SheetDocument4 pagesExhibit 17. Goodwill Calculation and The Consolidated Balance SheetЭниЭ.No ratings yet

- Kimberly Veguilla Rodríguez Prof. Ramos Martin Modulo 2. Tarea 1. Los Reportes de ContabilidadDocument4 pagesKimberly Veguilla Rodríguez Prof. Ramos Martin Modulo 2. Tarea 1. Los Reportes de ContabilidadKimberly VeguillaNo ratings yet

- 9381 - Soal Uas Akl 2Document14 pages9381 - Soal Uas Akl 2Kurnia Purnama Ayu0% (3)

- Answer 4 - Excel For Diff. Acctg.Document42 pagesAnswer 4 - Excel For Diff. Acctg.Rheu ReyesNo ratings yet

- Quiz 3 Acctg For Business Combination - EntriesDocument6 pagesQuiz 3 Acctg For Business Combination - EntriesNhicoleChoiNo ratings yet

- Bracknell Cash Flow QuestionDocument3 pagesBracknell Cash Flow Questionsanjay blakeNo ratings yet

- Property, Plant, Equipment: Abbey Corporation Statement of Financial Position DECEMBER 31,2015 AssetDocument4 pagesProperty, Plant, Equipment: Abbey Corporation Statement of Financial Position DECEMBER 31,2015 AssetAstri KaruniaNo ratings yet

- Chapter 5Document19 pagesChapter 5Izzy BNo ratings yet

- Study Unit Three Activity Ratios and Special IssuesDocument11 pagesStudy Unit Three Activity Ratios and Special IssuessimarjeetNo ratings yet

- Jawaban UTS AKL 1Document3 pagesJawaban UTS AKL 1nanda khairunnisaNo ratings yet

- Ratio Analysis - Advanced QuestionsDocument5 pagesRatio Analysis - Advanced Questionsrobinkapoor100% (2)

- Comparative Income StatementDocument12 pagesComparative Income StatementBISHAL ROYNo ratings yet

- Problem 8-9 Akl 2Document4 pagesProblem 8-9 Akl 2andi nanaNo ratings yet

- Chapter 7, Exercise 5Document53 pagesChapter 7, Exercise 5MagdalenaNo ratings yet

- Confra Financial StatementsDocument3 pagesConfra Financial StatementsPia ChanNo ratings yet

- Business Combination Stock AcquisitionDocument2 pagesBusiness Combination Stock AcquisitionTEOPE, EMERLIZA DE CASTRONo ratings yet

- MBA Accounts2Document5 pagesMBA Accounts2YgNo ratings yet

- Financial Statement Analysis QuestionsDocument4 pagesFinancial Statement Analysis QuestionsRisha OsfordNo ratings yet

- 5.ratio Analysis SumsDocument9 pages5.ratio Analysis Sumsvinay kumar nuwalNo ratings yet

- Kelompok 5 - Cash Flow - ALKDocument16 pagesKelompok 5 - Cash Flow - ALKSiti Ruhmana SiregarNo ratings yet

- Stock Acquisition Quiz 100% AnswerDocument2 pagesStock Acquisition Quiz 100% AnswerJohn BalanquitNo ratings yet

- 5th Year Pre-Final ExamDocument3 pages5th Year Pre-Final ExamJoshua UmaliNo ratings yet

- Chapter 5 SolutionDocument47 pagesChapter 5 SolutionJay-PNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- PROJECT-Service Dave 10 Adjustment. ..+-+Document48 pagesPROJECT-Service Dave 10 Adjustment. ..+-+Dave Peralta0% (1)

- Consol Pack March22 LCDocument151 pagesConsol Pack March22 LCAries BautistaNo ratings yet

- 100 LBO Model JargonsDocument16 pages100 LBO Model Jargonsnaghulk1No ratings yet

- Chapter - 7Document11 pagesChapter - 7ErslanNo ratings yet

- Bank DataDocument9 pagesBank DataAnonymous KvNac2YIkNo ratings yet

- Comparative Financial Analysis of Apex Footwear LTD & Bata Shoe Company (Bangladesh) LTDDocument27 pagesComparative Financial Analysis of Apex Footwear LTD & Bata Shoe Company (Bangladesh) LTDMD. SAMIUL HASAN ARICNo ratings yet

- P19 - Practice Test Paper - Syl12 - Dec13 - Set 1 Cost Audit & Management AuditDocument9 pagesP19 - Practice Test Paper - Syl12 - Dec13 - Set 1 Cost Audit & Management AuditNagendra KrishnamurthyNo ratings yet

- Final ProjectDocument31 pagesFinal ProjectLipun baiNo ratings yet

- Internship Report On Nundhyar Engineering & Construction BattagramDocument65 pagesInternship Report On Nundhyar Engineering & Construction BattagramFaisal AwanNo ratings yet

- Govacct ReviewerDocument6 pagesGovacct Reviewerdinglasan.dymphnaNo ratings yet

- Annual Report Full 2004 05Document187 pagesAnnual Report Full 2004 05Naina BakshiNo ratings yet

- Quiz 1.1Document2 pagesQuiz 1.1Annalie Cono0% (1)

- Week 1 - FAR 6804 NotesDocument1 pageWeek 1 - FAR 6804 NotesKent Raysil PamaongNo ratings yet

- Retained EarningsDocument18 pagesRetained EarningsAngelie Bancale100% (1)

- 30 Contributed CapitalDocument12 pages30 Contributed CapitalJohn FloresNo ratings yet

- Afar Hedging Ja With AnswersDocument3 pagesAfar Hedging Ja With AnswersShigure KousakaNo ratings yet

- Accounting Process: Unit - 1 Basic Accounting Procedures - Journal EntriesDocument33 pagesAccounting Process: Unit - 1 Basic Accounting Procedures - Journal EntriesVenky VenkteshNo ratings yet

- Argon Dry Cleaners Is Owned and Operated by Kerry UlmanDocument1 pageArgon Dry Cleaners Is Owned and Operated by Kerry UlmanM Bilal SaleemNo ratings yet

- Minor Project ReportDocument69 pagesMinor Project ReportrimpaNo ratings yet

- Opening of Business End of Year 2Document10 pagesOpening of Business End of Year 2Mhd RahmanNo ratings yet

- 3.5 Published - Fitch China Oilfield Services LimitedDocument16 pages3.5 Published - Fitch China Oilfield Services LimitedAsim khanNo ratings yet

- Ind As 1, 7,8,10, 34Document40 pagesInd As 1, 7,8,10, 34Dr. Meghna DangiNo ratings yet

- Measuring and Evaluating The Performance of Banks and Their Principal CompetitorsDocument22 pagesMeasuring and Evaluating The Performance of Banks and Their Principal CompetitorsMarwa HassanNo ratings yet

- McampDocument14 pagesMcampSVS YRNo ratings yet

- A Study On Impact of Leverage On Profitability of Selected Automobile Companies in IndiaDocument61 pagesA Study On Impact of Leverage On Profitability of Selected Automobile Companies in IndiaRoshan Harsha CrNo ratings yet

- Annual Report 2012Document150 pagesAnnual Report 2012Ibnu IkhsanNo ratings yet

- LSA Financial ManagementDocument16 pagesLSA Financial ManagementAlok AgrawalNo ratings yet