Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

9 views15 Year Public Provident Fund Account

15 Year Public Provident Fund Account

Uploaded by

AndRoid DeveLoPerThe Public Provident Fund (PPF) account offers an interest rate of 7.1% per year. It can be opened with a minimum deposit of INR 500 and allows maximum deposits of INR 150,000 annually. Funds can be deposited lump sum or in installments. The account matures in 15 years but can be extended in blocks of 5 years. Partial withdrawals are permitted after 5 years under special circumstances. Deposits qualify for tax benefits and interest earned is tax-free.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Simplified Invoice: Invoice Number Date of Transaction Date of IssueDocument1 pageSimplified Invoice: Invoice Number Date of Transaction Date of IssueradhoinezerellyNo ratings yet

- TAX 667 TOPIC 7 Trade Association & ClubsDocument51 pagesTAX 667 TOPIC 7 Trade Association & Clubszarif nezuko100% (2)

- Accounting For Managers (Assignment One (E-Finance) ) Question OneDocument7 pagesAccounting For Managers (Assignment One (E-Finance) ) Question OnehananNo ratings yet

- Untitledpdf HTCDocument1 pageUntitledpdf HTCRahulSinghNo ratings yet

- Post Office Savings SchemesDocument8 pagesPost Office Savings SchemesKailashnath GantiNo ratings yet

- Public Provident Fund (PPF) : Name of The SchemeDocument5 pagesPublic Provident Fund (PPF) : Name of The SchemeSumit GuptaNo ratings yet

- What Is Sukanya Samriddhi YojanaDocument7 pagesWhat Is Sukanya Samriddhi Yojanaaarja sethiNo ratings yet

- Postal InsuranceDocument21 pagesPostal InsuranceMaha RasiNo ratings yet

- Post Office SchemesDocument27 pagesPost Office SchemesvarshapadiharNo ratings yet

- Sources of FinanceDocument24 pagesSources of FinanceAnkit Sinai TalaulikarNo ratings yet

- Public Provident Fund SchemeDocument3 pagesPublic Provident Fund SchemeAshish PatilNo ratings yet

- Public Provident Fund (PPF)Document3 pagesPublic Provident Fund (PPF)rupesh_kanabar1604100% (2)

- What Is PPF Account and The Benefits of Investing in PPF?Document2 pagesWhat Is PPF Account and The Benefits of Investing in PPF?Vikash SuranaNo ratings yet

- PPFrules 14 PDFDocument3 pagesPPFrules 14 PDFPratap Narayan SinghNo ratings yet

- SB and Jan Suraksha SchemesDocument54 pagesSB and Jan Suraksha SchemesSreemon P VNo ratings yet

- Post Office SchemesDocument10 pagesPost Office SchemesmuntaquirNo ratings yet

- National Savings Monthly IncomeDocument3 pagesNational Savings Monthly Incomejack sNo ratings yet

- 7 Must Know Facts About Public Provident FundDocument2 pages7 Must Know Facts About Public Provident FundAmit VermaNo ratings yet

- Post Office Monthly Income SchemeDocument7 pagesPost Office Monthly Income SchemeLaxman RathodNo ratings yet

- Government Business Products FinalDocument8 pagesGovernment Business Products FinalraghuviltapuramNo ratings yet

- PPF Section 80cDocument8 pagesPPF Section 80cPaymaster ServicesNo ratings yet

- Top 10 Reasons Why PPF Is An Attractive Investment!: E-Mail - Print - PDFDocument3 pagesTop 10 Reasons Why PPF Is An Attractive Investment!: E-Mail - Print - PDFsrirangar2993No ratings yet

- PPF & Sukanya SamriddhiDocument7 pagesPPF & Sukanya Samriddhicarry minatteeNo ratings yet

- PublicDocument9 pagesPublicpeepspopNo ratings yet

- Scheme Interest Payable, Rates, Periodicity Etc. Investment Limits and Denominations Salient Features Including Tax RebateDocument4 pagesScheme Interest Payable, Rates, Periodicity Etc. Investment Limits and Denominations Salient Features Including Tax RebatesumitakumariNo ratings yet

- Government SchemeDocument13 pagesGovernment Schemetbpm76hvqdNo ratings yet

- SSA - Short NotesDocument1 pageSSA - Short NotesPoorani SundaresanNo ratings yet

- Handbook On Govt Business Products 20210818174621Document9 pagesHandbook On Govt Business Products 20210818174621omvir singhNo ratings yet

- FAQs On PPFDocument21 pagesFAQs On PPFER SAABNo ratings yet

- PPF - Short NotesDocument1 pagePPF - Short NotesPoorani SundaresanNo ratings yet

- Public Provident FundDocument10 pagesPublic Provident FundJubin JainNo ratings yet

- Public Provident Fund Scheme 1968: Salient FeaturesDocument16 pagesPublic Provident Fund Scheme 1968: Salient FeaturesjyottsnaNo ratings yet

- Small Saving SchemeDocument30 pagesSmall Saving SchemePallaviNo ratings yet

- Assignment of Security Analysis & Portfolio Management On Post Office DepositsDocument6 pagesAssignment of Security Analysis & Portfolio Management On Post Office DepositsShubhamNo ratings yet

- Assignment of Security Analysis & Portfolio Management On Post Office DepositsDocument6 pagesAssignment of Security Analysis & Portfolio Management On Post Office DepositsShubhamNo ratings yet

- How To Open PPF AccountDocument6 pagesHow To Open PPF Accountnitinsharma1984No ratings yet

- Indian Post OfficeDocument75 pagesIndian Post OfficeEvanchalin mercyNo ratings yet

- Non-Marketable Financial Assets: Bank DepositsDocument8 pagesNon-Marketable Financial Assets: Bank DepositsDhruv MishraNo ratings yet

- Public Provident Fund (PPF) Scheme 1968Document1 pagePublic Provident Fund (PPF) Scheme 1968Karthic KeyanNo ratings yet

- Post OfficeDocument36 pagesPost Office24x7.kannada.newsNo ratings yet

- Public Provident Fund Scheme (PPF) Bod - 25112021Document5 pagesPublic Provident Fund Scheme (PPF) Bod - 25112021Priya KalraNo ratings yet

- Post Office SchemeDocument10 pagesPost Office SchememehtadiveshNo ratings yet

- BankDocument36 pagesBankSachin ManjhiNo ratings yet

- All GBD SchemesDocument26 pagesAll GBD SchemesElizabeth ThomasNo ratings yet

- 7816 - CBS PPF - PPFDocument14 pages7816 - CBS PPF - PPFsrinu reddyNo ratings yet

- SchemeDocument3 pagesSchemeavinash1109No ratings yet

- Aggarwal SahibDocument3 pagesAggarwal Sahibrohitsharma465No ratings yet

- Chapter 3Document25 pagesChapter 3Amala JosephNo ratings yet

- POSB All Schemes - Short Notes @sapostDocument10 pagesPOSB All Schemes - Short Notes @sapostanishpramanikNo ratings yet

- Kisan Vikas PatraDocument16 pagesKisan Vikas PatraAnonymous aAMqLLNo ratings yet

- Monthly Income Account Scheme: Prepared By: Jagdish Chosala Instructor, PTC VadodaraDocument10 pagesMonthly Income Account Scheme: Prepared By: Jagdish Chosala Instructor, PTC VadodarabhanupalavarapuNo ratings yet

- Govt Schemes 3.1.23Document27 pagesGovt Schemes 3.1.23Sumit Suman ChaudharyNo ratings yet

- PPF and NriDocument44 pagesPPF and NriHunny GargNo ratings yet

- Small Savings SchemesDocument10 pagesSmall Savings SchemesankitNo ratings yet

- Punjab National BankDocument28 pagesPunjab National Bankgauravdhawan1991No ratings yet

- 02 SCSS SchemeDocument3 pages02 SCSS Schemeరాజశేఖర్ రెడ్డి కందికొండNo ratings yet

- Top 5 Small Saving Schemes by Government of India GK Notes As PDFDocument6 pagesTop 5 Small Saving Schemes by Government of India GK Notes As PDFsachin vastrakarNo ratings yet

- Post OfficeDocument4 pagesPost OfficeidspdhuleNo ratings yet

- Post Office Saving Schemes in IndiaDocument10 pagesPost Office Saving Schemes in IndiaRagavendra RagsNo ratings yet

- The Basics of PPFDocument2 pagesThe Basics of PPFgvrnaiduNo ratings yet

- Your PPF InformationDocument3 pagesYour PPF InformationJitender ManralNo ratings yet

- Sukanya MORE INFODocument1 pageSukanya MORE INFOchakribw2005No ratings yet

- Tax Invoice: B.D. Inno Ventures Private LimitedDocument1 pageTax Invoice: B.D. Inno Ventures Private Limitedzeel dholakiyaNo ratings yet

- The Amortization of Fixed Assets in Terms of Deferred TaxesDocument12 pagesThe Amortization of Fixed Assets in Terms of Deferred TaxesMessiNo ratings yet

- Assignment #II - FinalDocument5 pagesAssignment #II - FinalthanNo ratings yet

- ISS 0744 CDocument1 pageISS 0744 CVinay RangariNo ratings yet

- Bookkeeping FinalDocument67 pagesBookkeeping FinalKatlene JoyNo ratings yet

- 114 (1) (Return of Income For A Person Deriving Income Only From Salary and Other Sources Eligible To File Salary Return) - 2020Document4 pages114 (1) (Return of Income For A Person Deriving Income Only From Salary and Other Sources Eligible To File Salary Return) - 2020asiashah1975No ratings yet

- Dupont DPC LBO AssignmentDocument3 pagesDupont DPC LBO Assignmentw_fibNo ratings yet

- Taxation Lesson 0 Course OutlineDocument14 pagesTaxation Lesson 0 Course OutlineStudy GirlNo ratings yet

- Income Tax Amendment - 2021 by CA Rajat MoghaDocument46 pagesIncome Tax Amendment - 2021 by CA Rajat MoghaOm Sai Enterprises100% (1)

- Factura Costa Rica PDFDocument1 pageFactura Costa Rica PDFzt3venNo ratings yet

- Zoom Business PDFDocument2 pagesZoom Business PDFElder F. RosalesNo ratings yet

- Rahman Industries LTD: Tax InvoiceDocument1 pageRahman Industries LTD: Tax InvoiceRashid KhanNo ratings yet

- 0135 PDFDocument2 pages0135 PDFCharith DissanayakeNo ratings yet

- Computing Gross Taxable Income and Tax DueDocument21 pagesComputing Gross Taxable Income and Tax DuepearlNo ratings yet

- Us-Orl-Or1: Express WorldwideDocument3 pagesUs-Orl-Or1: Express WorldwideAgi AgistriaNo ratings yet

- Earnings Deductions: Eicher Motors LimitedDocument1 pageEarnings Deductions: Eicher Motors LimitedR SEETHARAMANNo ratings yet

- Payroll SampleDocument6 pagesPayroll Samplepedpalina100% (15)

- Draft Exam Practice Kit For CA Professional Level Tax Planning & Compliance Covering Finance Act 2018Document303 pagesDraft Exam Practice Kit For CA Professional Level Tax Planning & Compliance Covering Finance Act 2018Optimal Management Solution100% (1)

- 05 Bir - SMRDocument1 page05 Bir - SMRMelany Trazo Calvez-EvangelistaNo ratings yet

- Guitnang Bayan II Project-SCHEDULEDocument783 pagesGuitnang Bayan II Project-SCHEDULEmaria cristina santosNo ratings yet

- GST Invoice Format ExcelDocument2 pagesGST Invoice Format ExcelDeepak ThakkerNo ratings yet

- 105 Invoice (Innotronix) 22-23Document1 page105 Invoice (Innotronix) 22-23account.adminNo ratings yet

- Guide To Accounting For Income Taxes NewDocument620 pagesGuide To Accounting For Income Taxes NewRahul Modi100% (1)

- Income From Property: by NJDocument8 pagesIncome From Property: by NJUmar ZahidNo ratings yet

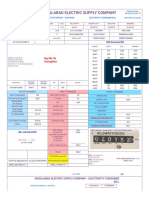

- Fesco Online BillDocument2 pagesFesco Online BillSaqLain AliNo ratings yet

- InvoiceDocument1 pageInvoiceNagendran NatarajanNo ratings yet

- Canons of TaxationDocument16 pagesCanons of Taxationdhwani shahNo ratings yet

15 Year Public Provident Fund Account

15 Year Public Provident Fund Account

Uploaded by

AndRoid DeveLoPer0 ratings0% found this document useful (0 votes)

9 views1 pageThe Public Provident Fund (PPF) account offers an interest rate of 7.1% per year. It can be opened with a minimum deposit of INR 500 and allows maximum deposits of INR 150,000 annually. Funds can be deposited lump sum or in installments. The account matures in 15 years but can be extended in blocks of 5 years. Partial withdrawals are permitted after 5 years under special circumstances. Deposits qualify for tax benefits and interest earned is tax-free.

Original Description:

Original Title

15 year Public Provident Fund Account

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe Public Provident Fund (PPF) account offers an interest rate of 7.1% per year. It can be opened with a minimum deposit of INR 500 and allows maximum deposits of INR 150,000 annually. Funds can be deposited lump sum or in installments. The account matures in 15 years but can be extended in blocks of 5 years. Partial withdrawals are permitted after 5 years under special circumstances. Deposits qualify for tax benefits and interest earned is tax-free.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

9 views1 page15 Year Public Provident Fund Account

15 Year Public Provident Fund Account

Uploaded by

AndRoid DeveLoPerThe Public Provident Fund (PPF) account offers an interest rate of 7.1% per year. It can be opened with a minimum deposit of INR 500 and allows maximum deposits of INR 150,000 annually. Funds can be deposited lump sum or in installments. The account matures in 15 years but can be extended in blocks of 5 years. Partial withdrawals are permitted after 5 years under special circumstances. Deposits qualify for tax benefits and interest earned is tax-free.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

15 year Public Provident Fund Account (PPF )

Minimum Amount for opening of account and

Interest payable, Rates, Periodicity etc.

maximum balance that can be retained

From 01.04.2020, interest rates are as

follows:-

Minimum INR. 500/- Maximum INR. 1,50,000/- in a

7.1 % per annum (compounded financial year.

yearly). Deposits can be made in lump-sum or in installments.

Salient features including Tax Rebate

An individual can open account with INR 500/- and a deposit minimum of INR 500/- in a

financial year and maximum INR 1,50,000/- (including amount deposited in minor account

opened on behalf of guardian).

Any account in which the account holder, having deposited five hundred rupees in the initial

year, fails to deposit the minimum amount in the following years, shall be treated as

discontinued and that account may be revived during its maturity period on payment of a fee

of fifty rupees along with arrears of minimum deposit of five hundred rupees for each year of

default

Joint account cannot be opened and only one account can be opened by a citizen in India

Account can be opened by cash / Cheque and In case of Cheque, the date of realization of

Cheque in Govt. account shall be date of opening of account

Nomination facility is available at the time of opening and also after opening of account.

Account can be transferred from one post office to another

The subscriber can open another account in the name of minors but subject to maximum

investment limit by adding balance in all accounts

Maturity period is 15 years but the same can be extended within one year of maturity for

further 5 years and so on

Maturity value can be retained without extension and without further deposits also

Premature closure is can be allowed after 5 years from the end of the year in which the

account was opened subject to the following conditions. 1% interest will be deducted from

the date of account opening

(i) In case of life threatening disease of account holder, spouse or dependent children.

(ii) In case of higher education of account holder or dependent children.

(iii) In case of change of resident status of account holder

Deposits qualify for deduction from income under Sec. 80C of IT Act

Interest is completely tax-free

Online Deposit facility is available through Intra Operable Netbanking/Mobile Banking..

Online Deposit facility is available through IPPB Saving Account..

No attachment under court decree order

The PPF account can be opened in all departmental post offices

Loan can be taken after the expiry of one year from the end of the year in which the initial

subscription was made but before expiry of five years from the end of the year in which the

initial subscription was made

Withdrawal can be taken after the expiry of five years from the end of the year in which the

account was opened.

You might also like

- Simplified Invoice: Invoice Number Date of Transaction Date of IssueDocument1 pageSimplified Invoice: Invoice Number Date of Transaction Date of IssueradhoinezerellyNo ratings yet

- TAX 667 TOPIC 7 Trade Association & ClubsDocument51 pagesTAX 667 TOPIC 7 Trade Association & Clubszarif nezuko100% (2)

- Accounting For Managers (Assignment One (E-Finance) ) Question OneDocument7 pagesAccounting For Managers (Assignment One (E-Finance) ) Question OnehananNo ratings yet

- Untitledpdf HTCDocument1 pageUntitledpdf HTCRahulSinghNo ratings yet

- Post Office Savings SchemesDocument8 pagesPost Office Savings SchemesKailashnath GantiNo ratings yet

- Public Provident Fund (PPF) : Name of The SchemeDocument5 pagesPublic Provident Fund (PPF) : Name of The SchemeSumit GuptaNo ratings yet

- What Is Sukanya Samriddhi YojanaDocument7 pagesWhat Is Sukanya Samriddhi Yojanaaarja sethiNo ratings yet

- Postal InsuranceDocument21 pagesPostal InsuranceMaha RasiNo ratings yet

- Post Office SchemesDocument27 pagesPost Office SchemesvarshapadiharNo ratings yet

- Sources of FinanceDocument24 pagesSources of FinanceAnkit Sinai TalaulikarNo ratings yet

- Public Provident Fund SchemeDocument3 pagesPublic Provident Fund SchemeAshish PatilNo ratings yet

- Public Provident Fund (PPF)Document3 pagesPublic Provident Fund (PPF)rupesh_kanabar1604100% (2)

- What Is PPF Account and The Benefits of Investing in PPF?Document2 pagesWhat Is PPF Account and The Benefits of Investing in PPF?Vikash SuranaNo ratings yet

- PPFrules 14 PDFDocument3 pagesPPFrules 14 PDFPratap Narayan SinghNo ratings yet

- SB and Jan Suraksha SchemesDocument54 pagesSB and Jan Suraksha SchemesSreemon P VNo ratings yet

- Post Office SchemesDocument10 pagesPost Office SchemesmuntaquirNo ratings yet

- National Savings Monthly IncomeDocument3 pagesNational Savings Monthly Incomejack sNo ratings yet

- 7 Must Know Facts About Public Provident FundDocument2 pages7 Must Know Facts About Public Provident FundAmit VermaNo ratings yet

- Post Office Monthly Income SchemeDocument7 pagesPost Office Monthly Income SchemeLaxman RathodNo ratings yet

- Government Business Products FinalDocument8 pagesGovernment Business Products FinalraghuviltapuramNo ratings yet

- PPF Section 80cDocument8 pagesPPF Section 80cPaymaster ServicesNo ratings yet

- Top 10 Reasons Why PPF Is An Attractive Investment!: E-Mail - Print - PDFDocument3 pagesTop 10 Reasons Why PPF Is An Attractive Investment!: E-Mail - Print - PDFsrirangar2993No ratings yet

- PPF & Sukanya SamriddhiDocument7 pagesPPF & Sukanya Samriddhicarry minatteeNo ratings yet

- PublicDocument9 pagesPublicpeepspopNo ratings yet

- Scheme Interest Payable, Rates, Periodicity Etc. Investment Limits and Denominations Salient Features Including Tax RebateDocument4 pagesScheme Interest Payable, Rates, Periodicity Etc. Investment Limits and Denominations Salient Features Including Tax RebatesumitakumariNo ratings yet

- Government SchemeDocument13 pagesGovernment Schemetbpm76hvqdNo ratings yet

- SSA - Short NotesDocument1 pageSSA - Short NotesPoorani SundaresanNo ratings yet

- Handbook On Govt Business Products 20210818174621Document9 pagesHandbook On Govt Business Products 20210818174621omvir singhNo ratings yet

- FAQs On PPFDocument21 pagesFAQs On PPFER SAABNo ratings yet

- PPF - Short NotesDocument1 pagePPF - Short NotesPoorani SundaresanNo ratings yet

- Public Provident FundDocument10 pagesPublic Provident FundJubin JainNo ratings yet

- Public Provident Fund Scheme 1968: Salient FeaturesDocument16 pagesPublic Provident Fund Scheme 1968: Salient FeaturesjyottsnaNo ratings yet

- Small Saving SchemeDocument30 pagesSmall Saving SchemePallaviNo ratings yet

- Assignment of Security Analysis & Portfolio Management On Post Office DepositsDocument6 pagesAssignment of Security Analysis & Portfolio Management On Post Office DepositsShubhamNo ratings yet

- Assignment of Security Analysis & Portfolio Management On Post Office DepositsDocument6 pagesAssignment of Security Analysis & Portfolio Management On Post Office DepositsShubhamNo ratings yet

- How To Open PPF AccountDocument6 pagesHow To Open PPF Accountnitinsharma1984No ratings yet

- Indian Post OfficeDocument75 pagesIndian Post OfficeEvanchalin mercyNo ratings yet

- Non-Marketable Financial Assets: Bank DepositsDocument8 pagesNon-Marketable Financial Assets: Bank DepositsDhruv MishraNo ratings yet

- Public Provident Fund (PPF) Scheme 1968Document1 pagePublic Provident Fund (PPF) Scheme 1968Karthic KeyanNo ratings yet

- Post OfficeDocument36 pagesPost Office24x7.kannada.newsNo ratings yet

- Public Provident Fund Scheme (PPF) Bod - 25112021Document5 pagesPublic Provident Fund Scheme (PPF) Bod - 25112021Priya KalraNo ratings yet

- Post Office SchemeDocument10 pagesPost Office SchememehtadiveshNo ratings yet

- BankDocument36 pagesBankSachin ManjhiNo ratings yet

- All GBD SchemesDocument26 pagesAll GBD SchemesElizabeth ThomasNo ratings yet

- 7816 - CBS PPF - PPFDocument14 pages7816 - CBS PPF - PPFsrinu reddyNo ratings yet

- SchemeDocument3 pagesSchemeavinash1109No ratings yet

- Aggarwal SahibDocument3 pagesAggarwal Sahibrohitsharma465No ratings yet

- Chapter 3Document25 pagesChapter 3Amala JosephNo ratings yet

- POSB All Schemes - Short Notes @sapostDocument10 pagesPOSB All Schemes - Short Notes @sapostanishpramanikNo ratings yet

- Kisan Vikas PatraDocument16 pagesKisan Vikas PatraAnonymous aAMqLLNo ratings yet

- Monthly Income Account Scheme: Prepared By: Jagdish Chosala Instructor, PTC VadodaraDocument10 pagesMonthly Income Account Scheme: Prepared By: Jagdish Chosala Instructor, PTC VadodarabhanupalavarapuNo ratings yet

- Govt Schemes 3.1.23Document27 pagesGovt Schemes 3.1.23Sumit Suman ChaudharyNo ratings yet

- PPF and NriDocument44 pagesPPF and NriHunny GargNo ratings yet

- Small Savings SchemesDocument10 pagesSmall Savings SchemesankitNo ratings yet

- Punjab National BankDocument28 pagesPunjab National Bankgauravdhawan1991No ratings yet

- 02 SCSS SchemeDocument3 pages02 SCSS Schemeరాజశేఖర్ రెడ్డి కందికొండNo ratings yet

- Top 5 Small Saving Schemes by Government of India GK Notes As PDFDocument6 pagesTop 5 Small Saving Schemes by Government of India GK Notes As PDFsachin vastrakarNo ratings yet

- Post OfficeDocument4 pagesPost OfficeidspdhuleNo ratings yet

- Post Office Saving Schemes in IndiaDocument10 pagesPost Office Saving Schemes in IndiaRagavendra RagsNo ratings yet

- The Basics of PPFDocument2 pagesThe Basics of PPFgvrnaiduNo ratings yet

- Your PPF InformationDocument3 pagesYour PPF InformationJitender ManralNo ratings yet

- Sukanya MORE INFODocument1 pageSukanya MORE INFOchakribw2005No ratings yet

- Tax Invoice: B.D. Inno Ventures Private LimitedDocument1 pageTax Invoice: B.D. Inno Ventures Private Limitedzeel dholakiyaNo ratings yet

- The Amortization of Fixed Assets in Terms of Deferred TaxesDocument12 pagesThe Amortization of Fixed Assets in Terms of Deferred TaxesMessiNo ratings yet

- Assignment #II - FinalDocument5 pagesAssignment #II - FinalthanNo ratings yet

- ISS 0744 CDocument1 pageISS 0744 CVinay RangariNo ratings yet

- Bookkeeping FinalDocument67 pagesBookkeeping FinalKatlene JoyNo ratings yet

- 114 (1) (Return of Income For A Person Deriving Income Only From Salary and Other Sources Eligible To File Salary Return) - 2020Document4 pages114 (1) (Return of Income For A Person Deriving Income Only From Salary and Other Sources Eligible To File Salary Return) - 2020asiashah1975No ratings yet

- Dupont DPC LBO AssignmentDocument3 pagesDupont DPC LBO Assignmentw_fibNo ratings yet

- Taxation Lesson 0 Course OutlineDocument14 pagesTaxation Lesson 0 Course OutlineStudy GirlNo ratings yet

- Income Tax Amendment - 2021 by CA Rajat MoghaDocument46 pagesIncome Tax Amendment - 2021 by CA Rajat MoghaOm Sai Enterprises100% (1)

- Factura Costa Rica PDFDocument1 pageFactura Costa Rica PDFzt3venNo ratings yet

- Zoom Business PDFDocument2 pagesZoom Business PDFElder F. RosalesNo ratings yet

- Rahman Industries LTD: Tax InvoiceDocument1 pageRahman Industries LTD: Tax InvoiceRashid KhanNo ratings yet

- 0135 PDFDocument2 pages0135 PDFCharith DissanayakeNo ratings yet

- Computing Gross Taxable Income and Tax DueDocument21 pagesComputing Gross Taxable Income and Tax DuepearlNo ratings yet

- Us-Orl-Or1: Express WorldwideDocument3 pagesUs-Orl-Or1: Express WorldwideAgi AgistriaNo ratings yet

- Earnings Deductions: Eicher Motors LimitedDocument1 pageEarnings Deductions: Eicher Motors LimitedR SEETHARAMANNo ratings yet

- Payroll SampleDocument6 pagesPayroll Samplepedpalina100% (15)

- Draft Exam Practice Kit For CA Professional Level Tax Planning & Compliance Covering Finance Act 2018Document303 pagesDraft Exam Practice Kit For CA Professional Level Tax Planning & Compliance Covering Finance Act 2018Optimal Management Solution100% (1)

- 05 Bir - SMRDocument1 page05 Bir - SMRMelany Trazo Calvez-EvangelistaNo ratings yet

- Guitnang Bayan II Project-SCHEDULEDocument783 pagesGuitnang Bayan II Project-SCHEDULEmaria cristina santosNo ratings yet

- GST Invoice Format ExcelDocument2 pagesGST Invoice Format ExcelDeepak ThakkerNo ratings yet

- 105 Invoice (Innotronix) 22-23Document1 page105 Invoice (Innotronix) 22-23account.adminNo ratings yet

- Guide To Accounting For Income Taxes NewDocument620 pagesGuide To Accounting For Income Taxes NewRahul Modi100% (1)

- Income From Property: by NJDocument8 pagesIncome From Property: by NJUmar ZahidNo ratings yet

- Fesco Online BillDocument2 pagesFesco Online BillSaqLain AliNo ratings yet

- InvoiceDocument1 pageInvoiceNagendran NatarajanNo ratings yet

- Canons of TaxationDocument16 pagesCanons of Taxationdhwani shahNo ratings yet