Professional Documents

Culture Documents

Niva - HR v2 - SS - v3

Niva - HR v2 - SS - v3

Uploaded by

siddharthsarawgiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Niva - HR v2 - SS - v3

Niva - HR v2 - SS - v3

Uploaded by

siddharthsarawgiCopyright:

Available Formats

P R E S E N T I N G

Health

Recharge S U P E R T O P - U P P L A N

GO THE

EXTRA

MILE FOR

YOUR LOVED

ONES.

NOW GET

` 95 LACS

MEDICAL COVER

WITH `5 LACS DEDUCTIBLE IN JUST

4,339

(1)

`

ONLY

Key Features

PRE & POST HOSPITALISATION

COVERAGE Up to `95 Lacs MEDICAL EXPENSES: Covered up

to Sum Insured

PHARMACY AND DIAGNOSTIC

e-CONSULTATION: Unlimited tele /

SERVICES: Available through our

online consultations

empanelled service providers

EASY CONVERTIBILITY: Convert DAY CARE TREATMENTS:

your policy to an indemnity policy Coverage for all day care

(without deductible) post 5 years(2) treatments up to sum insured

For your family’s health insurance

Call: 1860-500-8888

visit www.nivabupa.com

Product Name: Health Recharge | Product UIN: NBHHLIP22156V032122

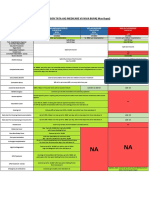

PRODUCT BENEFIT TABLE - HEALTH RECHARGE

(All amounts are in INR unless defined as percentage or number)

BASELINE COVER BENEFITS

Base Sum Insured per Policy Year 2L 3L/4L 5L/7.5L/10L/15L/25L/40L/

45L/65L/70L/90L/95L

Annual Aggregate Deductible(3) E-saver: 10k, 25k, 50k

Super Top-up: 1L to 10L in multiples of 1L

In-patient treatment

Nursing charges for Hospitalization as an inpatient

excluding Private Nursing charges

Medical Practitioners’ fees, excluding any charges or

fees for Standby Services

Physiotherapy, investigation and diagnostics

procedures directly related to the current admission

Medicines, drugs and consumables as prescribed by the Covered up to Sum Insured

treating Medical Practitioner

Intravenous fluids, blood transfusion, injection

administration charges and /or consumables

Operation theatre charges

The cost of prosthetics and other devices or equipment

if implanted internally during Surgery

Intensive Care Unit charges

Single private room; up to

Room Rent (per day) Up to 1% of Base Sum Insured per day

Sum Insured

Pre-Hospitalization Medical Expenses (60 days)

Post-Hospitalization Medical Expenses (90 days)

Day Care Treatment

Covered up to Sum Insured

Domiciliary treatment

Alternative treatment

Living Organ Donor Transplant

Emergency Ambulance Up to Rs.1,500 per hospitalization

e-Consultation Unlimited tele / online consultations

Pharmacy and diagnostic services Available through our empanelled service provider

Loyalty Additions Increase of 5% of expiring Base Sum Insured in a Policy Year; maximum

up to 50% of Base Sum Insured; no increase in sub-limits

(This benefit is applicable only for Base Sum Insured up to Rs. 25 Lac)

Mental Disorders Treatment Covered up to Sum Insured (sub-limit applicable on few conditions)

HIV / AIDS

Covered up to Sum Insured

Artificial Life Maintenance

Modern Treatments Covered up to Sum Insured (sub-limit applicable on few conditions)

OPTIONAL BENEFITS (which may be added at customer level at an additional premium)

Personal Accident cover

- Accident Death Options available: 1Lac, 2Lacs and 5Lacs to 50Lacs

- Accident Permanent Total Disability (in multiple of 5Lacs)

- Accident Permanent Partial Disability

Critical illness cover Options available: 1Lac to 10Lacs (in multiple of 1 Lac)

Single private room; covered up to Sum Insured (optional available

Modification in room rent Not applicable

only for deductible more than 50,000)

Niva Bupa Health Insurance Company Limited

Registered Office: C-98, First Floor, Lajpat Nagar, Part 1, New Delhi-110024

Disclaimer: Insurance is a subject matter of solicitation. Niva Bupa Health Insurance Company Limited (formerly known as Max Bupa Health Insurance Company Limited) (IRDAI

Registration No. 145). ‘Bupa’ and ‘HEARTBEAT’ logo are registered trademarks of their respective owners and are being used by Niva Bupa Health Insurance Company Limited

under license. Customer Helpline: 1860 500 8888 | www.nivabupa.com | Fax: 011 30902010. CIN No: U66000DL2008PLC182918. Product Name: Health Recharge | Product UIN:

NBHHLIP22156V032122. UIN: NB/SS/CA/2021-22/371. (1) Illustration based on Health Recharge Product for Rs. 95 Lacs Sum Insured & Rs. 5 Lacs deductible, 2 Adults (Eldest

member 32 years old): Annual premium (Incl GST): Rs. 4,339/-. (2) This is a one-time option which will be available post completion of 5 years & before the eldest member

turns 50 years of age, without any Pre-Policy medical check-up. (3) You have to mandatorily choose an annual aggregate claim deductible amount in this Policy. Our liability

to make payment under the Policy in respect of any claim made in that Policy Year will only commence once the Deductible has been exhausted. Maximum Base Sum Insured

under e-saver (Annual Aggregate Deductible) plan is 5Lacs. *Health Recharge covers COVID-19 related hospitalization. For more details on terms and conditions, exclusions, risk

factors, waiting period & benefits, please read sales brochure carefully before concluding a sale.

Product Name: Health Recharge | Product UIN: NBHHLIP22156V032122

You might also like

- Tata Projects Offer Letter For Rayudu Sai Chandra Sekhar PDFDocument14 pagesTata Projects Offer Letter For Rayudu Sai Chandra Sekhar PDFAnonymous TX8oMMr280% (5)

- Ravi Offer LetterDocument13 pagesRavi Offer LetterShiva Prasad100% (1)

- Mental Health KeywordsDocument253 pagesMental Health KeywordsOchenilogbe50% (6)

- Human Recourse Management ReportDocument24 pagesHuman Recourse Management ReportPhạm Nhật Huy100% (1)

- Health RechargeDocument31 pagesHealth RechargeansanthoshanNo ratings yet

- HRv2 Single Sheeter 95LDocument2 pagesHRv2 Single Sheeter 95Lroxcox216No ratings yet

- Health Recharge - Single SheeterDocument2 pagesHealth Recharge - Single SheeterRavi JoshiNo ratings yet

- Health Recharge - Single SheeterDocument2 pagesHealth Recharge - Single SheeterChinmoy BaruahNo ratings yet

- Leaflet PDFDocument9 pagesLeaflet PDFVyshak SamakNo ratings yet

- Health - Pulse Single SheeterDocument2 pagesHealth - Pulse Single SheeterAnupam JainNo ratings yet

- SENIOR FIRST - 0 Co Payment - BRDocument2 pagesSENIOR FIRST - 0 Co Payment - BRiamshonalidixitNo ratings yet

- Health PulseDocument2 pagesHealth PulseAcma Renu SinghaniaNo ratings yet

- Health Insurance That Works For YouDocument5 pagesHealth Insurance That Works For YouTrinetra AgarwalNo ratings yet

- NOS2024Document11 pagesNOS2024abhi29111985No ratings yet

- Mediplus: 2019 Benefit GuideDocument24 pagesMediplus: 2019 Benefit GuideBruce FerreiraNo ratings yet

- Niva ReAssure SS v11Document2 pagesNiva ReAssure SS v11CHELLASWAMY RAMASWAMYNo ratings yet

- Or Brochure Revision v2Document8 pagesOr Brochure Revision v2arijit mukhkerjeeNo ratings yet

- Getb MKTG PD Mediharapan BrochureDocument30 pagesGetb MKTG PD Mediharapan Brochuresu maiyahNo ratings yet

- Be Your Own Superhero!: Don'T Let A Critical Illness Stop You. Be Financially Prepared WithDocument4 pagesBe Your Own Superhero!: Don'T Let A Critical Illness Stop You. Be Financially Prepared WithlawrenziNo ratings yet

- Comparison Tata Aig Medicare Vs Niva BupaDocument1 pageComparison Tata Aig Medicare Vs Niva BupaTikekar ShubhamNo ratings yet

- Care Supreme - BrochureDocument4 pagesCare Supreme - BrochureAarti A BhardwajNo ratings yet

- Reliance Health Gain PolicyDocument11 pagesReliance Health Gain PolicyMansi ParmarNo ratings yet

- Activ Care PBTDocument4 pagesActiv Care PBTAnkita KalaniNo ratings yet

- Niva PB ReAssure SS v5Document2 pagesNiva PB ReAssure SS v5samdsozaNo ratings yet

- Top Up INSUDocument1 pageTop Up INSUStar HealthNo ratings yet

- Health Advantage BrochureDocument11 pagesHealth Advantage BrochurevenkatNo ratings yet

- AIA Travel PA Plus Brochure 030123Document21 pagesAIA Travel PA Plus Brochure 030123Navin IndranNo ratings yet

- National Mediclaim Policy: BrochureDocument3 pagesNational Mediclaim Policy: Brochureshukla8No ratings yet

- Group Health Insurance ..Document9 pagesGroup Health Insurance ..Amrita PatraNo ratings yet

- Care Advantage 1Document27 pagesCare Advantage 1mohitNo ratings yet

- Care Supreme - BrochureDocument4 pagesCare Supreme - BrochureVivek HamseNo ratings yet

- Dnirc Silk Road Plan ADocument4 pagesDnirc Silk Road Plan AMoksh SharmaNo ratings yet

- PDF Document Icici Midi ClamDocument48 pagesPDF Document Icici Midi Clam3sanjaypatilNo ratings yet

- MCI One Pager Version 1.0 Oct 2020Document1 pageMCI One Pager Version 1.0 Oct 2020naval730107No ratings yet

- Benefits Summary 2021 - Employee - Fixed TermDocument17 pagesBenefits Summary 2021 - Employee - Fixed TermJohn SmihNo ratings yet

- Group MediCare 360 - BrochureDocument4 pagesGroup MediCare 360 - Brochuresubharam1997No ratings yet

- Enhanced IncomeShield Brochure - WebsiteDocument18 pagesEnhanced IncomeShield Brochure - WebsiteAntony VijayNo ratings yet

- Family Care Product Table of Benefits (Valid For Dubai Based Members)Document4 pagesFamily Care Product Table of Benefits (Valid For Dubai Based Members)Kannan SrinivasanNo ratings yet

- Corona Kavach - One Pager - Version 1.0 - July - 2020 PDFDocument1 pageCorona Kavach - One Pager - Version 1.0 - July - 2020 PDFRanjeeta BhanjNo ratings yet

- Corona Kavach STAR One PagerDocument1 pageCorona Kavach STAR One PagerRajat GuptaNo ratings yet

- Niva - SENIOR FIRST - SS - v3Document2 pagesNiva - SENIOR FIRST - SS - v3scrikanth03565No ratings yet

- Enhanced Income ShieldDocument18 pagesEnhanced Income ShieldHihiNo ratings yet

- Enhanced IncomeShield Brochure (Eng)Document15 pagesEnhanced IncomeShield Brochure (Eng)Kevin NgNo ratings yet

- Benefits Summary IndiaDocument9 pagesBenefits Summary IndiaABHISHEK BAGHNo ratings yet

- Overview BenefitsDocument5 pagesOverview BenefitsRobert IosifNo ratings yet

- Care ClassicDocument4 pagesCare ClassicrahulbihaniNo ratings yet

- Health Companion Health Insurance Plan - Health CompanionDocument2 pagesHealth Companion Health Insurance Plan - Health CompanionANAND MLNo ratings yet

- Activ Health - Platinum Enhanced - One PagerDocument2 pagesActiv Health - Platinum Enhanced - One PagerYashNo ratings yet

- Niva HSL Mediclaim Ghi Gpa Ss v3Document2 pagesNiva HSL Mediclaim Ghi Gpa Ss v3bradburywillsNo ratings yet

- Reassurance at Every Step: Keeps Giving You More!Document2 pagesReassurance at Every Step: Keeps Giving You More!rajatshrimalNo ratings yet

- Niva ReAssure SS v3Document2 pagesNiva ReAssure SS v3Arun GoyalNo ratings yet

- Niva ReAssure SS v3Document2 pagesNiva ReAssure SS v3megha mazumdarNo ratings yet

- Niva ReAssure SS v3Document2 pagesNiva ReAssure SS v3arya aroraNo ratings yet

- Niva ReAssure SS v3Document2 pagesNiva ReAssure SS v3PRADEEP GUPTANo ratings yet

- Reassurance at Every Step: Keeps Giving You More!Document2 pagesReassurance at Every Step: Keeps Giving You More!ASHOK NAGESHWARANNo ratings yet

- ReAssure SSDocument2 pagesReAssure SSAmit Kumar KandiNo ratings yet

- Diamond LeafletDocument6 pagesDiamond Leafletjinna kvpNo ratings yet

- Be Your Own Superhero!: Don'T Let A Critical Illness Stop You. Be Financially Prepared WithDocument4 pagesBe Your Own Superhero!: Don'T Let A Critical Illness Stop You. Be Financially Prepared WithursvinciNo ratings yet

- Is There A Health Plan That Covers Exceeding Medical Expenses Without Letting You Worry About Its Limit?Document4 pagesIs There A Health Plan That Covers Exceeding Medical Expenses Without Letting You Worry About Its Limit?Mohan PvdvrNo ratings yet

- Pacific Cross - 2020-10 (October 01)Document12 pagesPacific Cross - 2020-10 (October 01)Eeza OrtileNo ratings yet

- Chi - Health Elite Plus CoveragesDocument1 pageChi - Health Elite Plus CoveragesVikram VermaNo ratings yet

- Product BrochureDocument10 pagesProduct Brochureathul.kcNo ratings yet

- The Best Laid Plans of Dogs and Vets: Transform Your Veterinary Practice Through Pet Health Care PlansFrom EverandThe Best Laid Plans of Dogs and Vets: Transform Your Veterinary Practice Through Pet Health Care PlansNo ratings yet

- Animal Management in Disasters, Volume 2, Animals and CommunitiesFrom EverandAnimal Management in Disasters, Volume 2, Animals and CommunitiesNo ratings yet

- Planning An Employee Benefits Program (Various Perspectives)Document20 pagesPlanning An Employee Benefits Program (Various Perspectives)Xtian PastorinNo ratings yet

- Classification of InsuranceDocument5 pagesClassification of InsuranceRajendranath BeheraNo ratings yet

- Form PDF 931954470220722Document7 pagesForm PDF 931954470220722vaierNo ratings yet

- Insurance Lawandpractice PDFDocument464 pagesInsurance Lawandpractice PDFKatiaNo ratings yet

- 2023-06-01 St. Mary's County Times With 2023 GraduatesDocument48 pages2023-06-01 St. Mary's County Times With 2023 GraduatesSouthern Maryland OnlineNo ratings yet

- TATA AIG Medicare - BrochureDocument2 pagesTATA AIG Medicare - Brochureonline accountNo ratings yet

- India Pharmaceuticals & Healthcare Report - Q2 2019Document75 pagesIndia Pharmaceuticals & Healthcare Report - Q2 2019Kiran SharmaNo ratings yet

- User Manual On Mediassist His Portal (Web Based Module) : Tcs ConfidentialDocument18 pagesUser Manual On Mediassist His Portal (Web Based Module) : Tcs ConfidentialNaina GargNo ratings yet

- MedicationDocument92 pagesMedicationAnuska SwartNo ratings yet

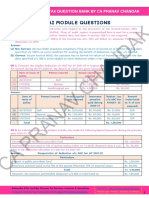

- 7 Deductions ICAI SM + PCA + Past RTPs + Past Exam Questions WatermarkDocument25 pages7 Deductions ICAI SM + PCA + Past RTPs + Past Exam Questions WatermarkSavya SachiNo ratings yet

- GSK Annual Report With DetailsDocument252 pagesGSK Annual Report With DetailsReal Will SelfNo ratings yet

- 2 Application - Form 2 - NEED SIGNATUREDocument1 page2 Application - Form 2 - NEED SIGNATUREAriane ComboyNo ratings yet

- Nothing Seems Impossible: Fixed Entry Age Fixed Entry Age Fixed Entry AgeDocument2 pagesNothing Seems Impossible: Fixed Entry Age Fixed Entry Age Fixed Entry AgeSJ WealthNo ratings yet

- Singlife Shield Singlife Health Plus Product SummaryDocument22 pagesSinglife Shield Singlife Health Plus Product SummaryKevin FongNo ratings yet

- Mapeh Quarter 1 NotesDocument11 pagesMapeh Quarter 1 NotesRod Kyle DestacamentoNo ratings yet

- Hospital Management Question BankDocument5 pagesHospital Management Question BankMATHANKUMAR.S75% (8)

- Affordable Care ActDocument23 pagesAffordable Care ActPanktiNo ratings yet

- Computation 2019Document16 pagesComputation 2019Giri SukumarNo ratings yet

- Dr. Padma Bhatia: Assistant Professor Department of Community Medicine G.M.C., Bhopal. M.P. IndiaDocument30 pagesDr. Padma Bhatia: Assistant Professor Department of Community Medicine G.M.C., Bhopal. M.P. IndiaSakshi SuriNo ratings yet

- Certificate of Insurance/Application No.: (Premium 2451.69 + GST 441.31)Document8 pagesCertificate of Insurance/Application No.: (Premium 2451.69 + GST 441.31)Aruncs 117No ratings yet

- Opening Statement of The DefendantsDocument283 pagesOpening Statement of The DefendantsThe Vancouver Sun100% (1)

- RB Health Plan One PagerDocument2 pagesRB Health Plan One PagersoniNo ratings yet

- GSK Patient Assistance Program Non-Vaccine Application: For Questions On How To Complete This Form, Call 1-866-728-4368Document4 pagesGSK Patient Assistance Program Non-Vaccine Application: For Questions On How To Complete This Form, Call 1-866-728-4368Jhoanna MonterolaNo ratings yet

- Policy DetailsDocument4 pagesPolicy Detailsmithunjai pandikannanNo ratings yet

- Reaction PaperDocument6 pagesReaction PaperAmanda Paula Palma100% (2)

- 2015-2016 BulletinDocument372 pages2015-2016 Bulletinbeku_ggs_bekuNo ratings yet