Professional Documents

Culture Documents

Week 4 Final Quiz Solutions 1 12

Week 4 Final Quiz Solutions 1 12

Uploaded by

Learning PointCopyright:

Available Formats

You might also like

- Week 2 Quiz Answers - Explanations PDFDocument6 pagesWeek 2 Quiz Answers - Explanations PDFanar82% (11)

- Accounting Peer To Peer Assessment Solution KeyDocument5 pagesAccounting Peer To Peer Assessment Solution KeyLearning Point50% (2)

- Accounting Peer To Peer Assessment Solution KeyDocument5 pagesAccounting Peer To Peer Assessment Solution KeyLearning Point50% (2)

- Ratio Analysis - 10 Questions ExerciseDocument10 pagesRatio Analysis - 10 Questions ExerciseSaralita NairNo ratings yet

- Accounting: Making Sound Decisions: Non-Current AssetsDocument2 pagesAccounting: Making Sound Decisions: Non-Current AssetsAniruddha Rantu40% (5)

- AmZpMjcBQkemaTI3AaJHwA Final-exam-Accounting SolutionsDocument3 pagesAmZpMjcBQkemaTI3AaJHwA Final-exam-Accounting SolutionsPRANAV BHARARA0% (2)

- Test Answers For Accounts Payable 2015 - ElanceDocument14 pagesTest Answers For Accounts Payable 2015 - ElancesnezalatasNo ratings yet

- 3 Problem 1Document18 pages3 Problem 1bhavinii100% (1)

- CAT Review Qs PDFDocument4 pagesCAT Review Qs PDFSuy YanghearNo ratings yet

- IUMC-Cost Accounting-Basic Theory and Manufacturing Week 1 - PQs - 2Document9 pagesIUMC-Cost Accounting-Basic Theory and Manufacturing Week 1 - PQs - 2Muhammad ZubairNo ratings yet

- Ahuna Inc - Problem 37-B Chapter 3, PG 137Document4 pagesAhuna Inc - Problem 37-B Chapter 3, PG 137Tooba Hashmi100% (1)

- Bharat Chemicals Ltd. SolnDocument4 pagesBharat Chemicals Ltd. SolnJayash KaushalNo ratings yet

- Respuestas Primer Examen PDFDocument4 pagesRespuestas Primer Examen PDFpcostagi750% (2)

- Question-Ias 2 - Ias 16 and Ias 40 - Admin-2019-2020-1Document6 pagesQuestion-Ias 2 - Ias 16 and Ias 40 - Admin-2019-2020-1Letsah BrightNo ratings yet

- Chapter 12, Problem 29C: Sell or Process Further DecisionDocument5 pagesChapter 12, Problem 29C: Sell or Process Further DecisionMaritza Aulia ShakiraniNo ratings yet

- Exercise Financial Statements Without AdjustmentsDocument3 pagesExercise Financial Statements Without AdjustmentsShahrillNo ratings yet

- Midterm - Activity 3 - COmpleting The Accounting CycleDocument15 pagesMidterm - Activity 3 - COmpleting The Accounting CyclePampulan, Angela MayNo ratings yet

- CFAB - Accounting - QB - Chapter 11Document15 pagesCFAB - Accounting - QB - Chapter 11Huy NguyenNo ratings yet

- QuezDocument15 pagesQuezKent Jerome Salem PanubaganNo ratings yet

- 05 - Chapter 5 - Partnership AccountsDocument16 pages05 - Chapter 5 - Partnership Accountszubairkhan_leo100% (15)

- Chapter 12: Corporate Valuation and Financial Planning: Page 1Document33 pagesChapter 12: Corporate Valuation and Financial Planning: Page 1nouraNo ratings yet

- Cost AccountingDocument43 pagesCost AccountingAmina QamarNo ratings yet

- Revision QuestionsDocument3 pagesRevision QuestionsKA Mufas100% (2)

- Ias 7 Statement of Cashflows (F2)Document7 pagesIas 7 Statement of Cashflows (F2)Tawanda Tatenda Herbert100% (1)

- 7001 Assignment #3Document9 pages7001 Assignment #3南玖No ratings yet

- FA Consolidation Test - Questions S20-A21 PDFDocument16 pagesFA Consolidation Test - Questions S20-A21 PDFAlpha MpofuNo ratings yet

- Notes On Inventory ValuationDocument7 pagesNotes On Inventory ValuationNouman Mujahid100% (2)

- Chapter # 6 Departmental AccountDocument36 pagesChapter # 6 Departmental AccountRooh Ullah KhanNo ratings yet

- Job CostingDocument18 pagesJob CostingBiswajeet DashNo ratings yet

- AkuntansiDocument3 pagesAkuntansier4sallNo ratings yet

- Cash Flow ProblemsDocument6 pagesCash Flow Problemsvkbm42No ratings yet

- BE4-1. The Adjusted Trial Balance of Pacific Scientific Corporation OnDocument10 pagesBE4-1. The Adjusted Trial Balance of Pacific Scientific Corporation OnNguyễn Linh NhiNo ratings yet

- Problem 2-2: J.L. Gregory CompanyDocument5 pagesProblem 2-2: J.L. Gregory CompanyKAPIL MBA 2021-23 (Delhi)No ratings yet

- Problem 13-1 - Chapter 13 - SolutionDocument6 pagesProblem 13-1 - Chapter 13 - Solutionppdisme100% (1)

- CAPITAL STRUCTURE Sums OnlinePGDMDocument6 pagesCAPITAL STRUCTURE Sums OnlinePGDMSoumendra RoyNo ratings yet

- 21 Problems For CB NewDocument31 pages21 Problems For CB NewNguyễn Thảo MyNo ratings yet

- Course Outline (Electronic Commerce and Computer Aided Accounting and Business Systems)Document4 pagesCourse Outline (Electronic Commerce and Computer Aided Accounting and Business Systems)Fraz InamNo ratings yet

- FA Work BookDocument59 pagesFA Work BookUnais AhmedNo ratings yet

- 3246accounting - CA IPCCDocument116 pages3246accounting - CA IPCCPrashant Pandey100% (1)

- T2&T4Document204 pagesT2&T4សារុន កែវវរលក្ខណ៍No ratings yet

- IAS 2 Summary-MergedDocument19 pagesIAS 2 Summary-MergedShameel IrshadNo ratings yet

- L3-L4 CostsheetDocument30 pagesL3-L4 CostsheetDhawal RajNo ratings yet

- Single Entry System and Incomplete Records NotesDocument5 pagesSingle Entry System and Incomplete Records NotesKristen Shaw100% (5)

- To Consolidated Financial Statements: Syllabus Guide Detailed OutcomesDocument51 pagesTo Consolidated Financial Statements: Syllabus Guide Detailed OutcomesDavid MorganNo ratings yet

- Basics of AccountingDocument3 pagesBasics of AccountingAjesh Mukundan PNo ratings yet

- Revaluation of Partnership AssetsDocument32 pagesRevaluation of Partnership AssetsERICK MLINGWANo ratings yet

- Energy Vending Inc Journal Entries - CompressDocument9 pagesEnergy Vending Inc Journal Entries - Compressadharsh veeraNo ratings yet

- OG1 9 Branch AccountingDocument25 pagesOG1 9 Branch AccountingsridhartksNo ratings yet

- F9Chap4 TutorSlidesDocument31 pagesF9Chap4 TutorSlidesSeema Parboo-AliNo ratings yet

- ACCA F3 CH#5: Sale Returns, Purchases Returns, Discounts NotesDocument40 pagesACCA F3 CH#5: Sale Returns, Purchases Returns, Discounts NotesMuhammad AzamNo ratings yet

- COST 1 Costing ProblemsDocument75 pagesCOST 1 Costing Problemstrixie maeNo ratings yet

- Chapter 9 SolutionsDocument7 pagesChapter 9 SolutionsRose McMahon50% (2)

- Chap 1 - Inventory Valuation (Questions)Document4 pagesChap 1 - Inventory Valuation (Questions)90 SHAMAZNo ratings yet

- Accounting Exercises (Management Accounting)Document2 pagesAccounting Exercises (Management Accounting)arvin sibayan100% (1)

- F2 Mock 5Document9 pagesF2 Mock 5deepakNo ratings yet

- Bharat Chemicals Ltd. CPHi46l2eHDocument2 pagesBharat Chemicals Ltd. CPHi46l2eHChickooNo ratings yet

- Cash Flow Statement ProblemDocument2 pagesCash Flow Statement Problemapi-3842194100% (2)

- Problems On Income StatementDocument3 pagesProblems On Income Statementcnagadeepa100% (2)

- Basics of Accounting 4 Ledger & Trial BalanceDocument21 pagesBasics of Accounting 4 Ledger & Trial Balancejiten zopeNo ratings yet

- 6 AnsDocument9 pages6 AnsAj PotXzs Ü100% (2)

- F7 Mock Answers 201603Document12 pagesF7 Mock Answers 201603DG Mero Nepal GreatNo ratings yet

- Thegodfather CF Student CdADocument8 pagesThegodfather CF Student CdAPablo MichavilaNo ratings yet

- S6 - Strategic ManagementDocument548 pagesS6 - Strategic ManagementLearning Point100% (1)

- IAS - 36 (Impairement of Asset)Document5 pagesIAS - 36 (Impairement of Asset)Learning PointNo ratings yet

- Danish Iqbal: ObjectiveDocument3 pagesDanish Iqbal: ObjectiveLearning PointNo ratings yet

- Games Wing Complete Comprehensive ReportDocument84 pagesGames Wing Complete Comprehensive ReportLearning PointNo ratings yet

- Business IntelligenceDocument17 pagesBusiness IntelligenceLearning PointNo ratings yet

- Accounting: Making Sound Decisions: Prof. Marc BadiaDocument1 pageAccounting: Making Sound Decisions: Prof. Marc BadiaLearning PointNo ratings yet

- Lecture Notes T01Document9 pagesLecture Notes T01Learning PointNo ratings yet

- Topic 2: Present Value: (A) Simple vs. Compound InterestDocument12 pagesTopic 2: Present Value: (A) Simple vs. Compound InterestLearning PointNo ratings yet

- Sales Data Power BiDocument792 pagesSales Data Power BiLearning PointNo ratings yet

- Brochure For Potential Investors in Tourism SectorDocument20 pagesBrochure For Potential Investors in Tourism SectorMerima GZNRNo ratings yet

- Conceptual Framework Elements of Financial StatementsDocument18 pagesConceptual Framework Elements of Financial StatementsmaricrisNo ratings yet

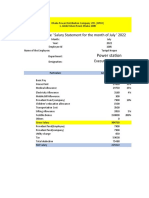

- Tariqul Hoque ' Salary Statement For The Month of July ' 2022Document6 pagesTariqul Hoque ' Salary Statement For The Month of July ' 2022Sadman Rafid FardeenNo ratings yet

- The Impact of Personal Income Tax On Employees' Motivation To Work: The Case of EthiopiaDocument25 pagesThe Impact of Personal Income Tax On Employees' Motivation To Work: The Case of EthiopiaYehualashet MekonninNo ratings yet

- Consolidation of Foreign Subsidiaries UpdatedDocument9 pagesConsolidation of Foreign Subsidiaries UpdateddemolaojaomoNo ratings yet

- Tax Calculator A y 2006 07 To 2011 12Document8 pagesTax Calculator A y 2006 07 To 2011 12Bhaskar Kumar ShawNo ratings yet

- Myanmar Foreign Investment LawDocument15 pagesMyanmar Foreign Investment LawAyeChan AungNo ratings yet

- Cash Flow Statement Format 2021Document5 pagesCash Flow Statement Format 2021VV MusicNo ratings yet

- Bus Ad 4 Official Midterm ModuleDocument12 pagesBus Ad 4 Official Midterm ModuleJophie AndreilleNo ratings yet

- Adjusting Entry StudentDocument31 pagesAdjusting Entry Studentxie diccionNo ratings yet

- RWANDA National Savings Mobilization StrategyDocument72 pagesRWANDA National Savings Mobilization Strategygodwin SemunyuNo ratings yet

- AHM Chapter 1 - SolutionsDocument26 pagesAHM Chapter 1 - SolutionsNitin KhareNo ratings yet

- Income Tax - ElaineDocument11 pagesIncome Tax - ElaineSamsung AccountNo ratings yet

- Caie Igcse Economics 0455 Theory v1Document16 pagesCaie Igcse Economics 0455 Theory v1Mehri MustafayevaNo ratings yet

- kế toán quản trị bt chap2Document15 pageskế toán quản trị bt chap2Tung DucNo ratings yet

- CACTUS MAY 2023 CIC02774 PayslipDocument1 pageCACTUS MAY 2023 CIC02774 Payslipuraza.octavoNo ratings yet

- MBA 1st Sem QuestionsDocument9 pagesMBA 1st Sem QuestionsDattathree YennamNo ratings yet

- Recognition & Derecognition 5Document27 pagesRecognition & Derecognition 5sajedulNo ratings yet

- Mat Feb 2007Document26 pagesMat Feb 2007sreenivasNo ratings yet

- Income Taxation - Ampongan (SolMan)Document56 pagesIncome Taxation - Ampongan (SolMan)John Dale Mondejar75% (12)

- Group B Teresita Buenaflor ShoesDocument38 pagesGroup B Teresita Buenaflor ShoesAlexandrea San Buenaventura BaayNo ratings yet

- Jawaban LKS AccountingDocument69 pagesJawaban LKS AccountingAnggi PukjkNo ratings yet

- ADocument2 pagesACandelNo ratings yet

- Eco 121Document4 pagesEco 121Arpit Bajaj100% (1)

- Consolidated Income Statement or Statement of Profit or Loss and Other Comprehensive IncomeDocument4 pagesConsolidated Income Statement or Statement of Profit or Loss and Other Comprehensive IncomeOmolaja IbukunNo ratings yet

- Problem 1 C7Document5 pagesProblem 1 C7Erica CastroNo ratings yet

- Set A - Prelim Exam in COGM6Document5 pagesSet A - Prelim Exam in COGM6kaii 1234No ratings yet

- IntAcc Chapter 41Document4 pagesIntAcc Chapter 41Cheesca Macabanti - 12 Euclid-Digital ModularNo ratings yet

- Lembar Kerja Komputer Ukk Tina Nur Aisyah Xii Ak 1 25Document30 pagesLembar Kerja Komputer Ukk Tina Nur Aisyah Xii Ak 1 25RizalJalilPujaKesumaNo ratings yet

Week 4 Final Quiz Solutions 1 12

Week 4 Final Quiz Solutions 1 12

Uploaded by

Learning PointOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Week 4 Final Quiz Solutions 1 12

Week 4 Final Quiz Solutions 1 12

Uploaded by

Learning PointCopyright:

Available Formats

Foundations

of Management Specialization

Accounting: Making Sound Decisions

Prof. Marc Badia

FINAL QUIZ SOLUTIONS 1-12

1)

A/P

200 BB

Payment to

suppliers 1.450 1.500 purchases of inventory on credit

250 EB

2)

Prepaid insurance

BB 4

Prepayment 36 34 Insurance expense

EB 6

3)

Building and equipment

BB 540

Purchase

equipment 120 80 Gross value of buildings and equipment sold

EB 580

Accumulated

depreciation

484 BB

Accumulated depr. 50 40 Depreciation expense

building & equip.

sold 474 EB

Net Book Value building and equipment sold = 80 - 50 = 30

4)

Interest payable

25 BB

Interest paid 60 55 Interest expense

20 EB

5) Taxes payable

35 BB

Tax paid 120 110 Tax expense

25 EB

6)

Retained earnings

120 BB

Net

Dividends paid 30 336 income

426 EB

Solution to questions 7, 8 and 9:

Income Statement in year x4

Total Revenues 2.200

Less: Cost of sales (1.400)

7) Gross margin 800

Less: Operating expenses

Selling and administration salaries (240)

Insurance expense (34)

Gain on sale of buildings and equipment 15

Depreciation expense (40)

8) Operating profit 501

Interest expense (55)

9) Profit before tax 446

Income taxes (110)

Net profit 336

Solution to questions 10, 11 and 12:

Cash Flow Statement for x4 (amounts in €000)

Receipts from customers 2.100

Payments to suppliers (1.450)

Payments of salaries (240)

Prepayments of insurance (36)

Payments of interest (60)

Payments of taxes (120)

12) Cash Flow from Operations 194

Purchase of building and equipment (120)

Purchase of brand (40)

Proceeds from sale of building & equipment 45

10) Cash Flow from Investing (115)

Loan repayment (150)

Payment of dividends (30)

11) Cash Flow from Financing (180)

Cash initial balance 340

Change in cash (CFO+CFI+CFF) (101)

Cash ending balance 239

You might also like

- Week 2 Quiz Answers - Explanations PDFDocument6 pagesWeek 2 Quiz Answers - Explanations PDFanar82% (11)

- Accounting Peer To Peer Assessment Solution KeyDocument5 pagesAccounting Peer To Peer Assessment Solution KeyLearning Point50% (2)

- Accounting Peer To Peer Assessment Solution KeyDocument5 pagesAccounting Peer To Peer Assessment Solution KeyLearning Point50% (2)

- Ratio Analysis - 10 Questions ExerciseDocument10 pagesRatio Analysis - 10 Questions ExerciseSaralita NairNo ratings yet

- Accounting: Making Sound Decisions: Non-Current AssetsDocument2 pagesAccounting: Making Sound Decisions: Non-Current AssetsAniruddha Rantu40% (5)

- AmZpMjcBQkemaTI3AaJHwA Final-exam-Accounting SolutionsDocument3 pagesAmZpMjcBQkemaTI3AaJHwA Final-exam-Accounting SolutionsPRANAV BHARARA0% (2)

- Test Answers For Accounts Payable 2015 - ElanceDocument14 pagesTest Answers For Accounts Payable 2015 - ElancesnezalatasNo ratings yet

- 3 Problem 1Document18 pages3 Problem 1bhavinii100% (1)

- CAT Review Qs PDFDocument4 pagesCAT Review Qs PDFSuy YanghearNo ratings yet

- IUMC-Cost Accounting-Basic Theory and Manufacturing Week 1 - PQs - 2Document9 pagesIUMC-Cost Accounting-Basic Theory and Manufacturing Week 1 - PQs - 2Muhammad ZubairNo ratings yet

- Ahuna Inc - Problem 37-B Chapter 3, PG 137Document4 pagesAhuna Inc - Problem 37-B Chapter 3, PG 137Tooba Hashmi100% (1)

- Bharat Chemicals Ltd. SolnDocument4 pagesBharat Chemicals Ltd. SolnJayash KaushalNo ratings yet

- Respuestas Primer Examen PDFDocument4 pagesRespuestas Primer Examen PDFpcostagi750% (2)

- Question-Ias 2 - Ias 16 and Ias 40 - Admin-2019-2020-1Document6 pagesQuestion-Ias 2 - Ias 16 and Ias 40 - Admin-2019-2020-1Letsah BrightNo ratings yet

- Chapter 12, Problem 29C: Sell or Process Further DecisionDocument5 pagesChapter 12, Problem 29C: Sell or Process Further DecisionMaritza Aulia ShakiraniNo ratings yet

- Exercise Financial Statements Without AdjustmentsDocument3 pagesExercise Financial Statements Without AdjustmentsShahrillNo ratings yet

- Midterm - Activity 3 - COmpleting The Accounting CycleDocument15 pagesMidterm - Activity 3 - COmpleting The Accounting CyclePampulan, Angela MayNo ratings yet

- CFAB - Accounting - QB - Chapter 11Document15 pagesCFAB - Accounting - QB - Chapter 11Huy NguyenNo ratings yet

- QuezDocument15 pagesQuezKent Jerome Salem PanubaganNo ratings yet

- 05 - Chapter 5 - Partnership AccountsDocument16 pages05 - Chapter 5 - Partnership Accountszubairkhan_leo100% (15)

- Chapter 12: Corporate Valuation and Financial Planning: Page 1Document33 pagesChapter 12: Corporate Valuation and Financial Planning: Page 1nouraNo ratings yet

- Cost AccountingDocument43 pagesCost AccountingAmina QamarNo ratings yet

- Revision QuestionsDocument3 pagesRevision QuestionsKA Mufas100% (2)

- Ias 7 Statement of Cashflows (F2)Document7 pagesIas 7 Statement of Cashflows (F2)Tawanda Tatenda Herbert100% (1)

- 7001 Assignment #3Document9 pages7001 Assignment #3南玖No ratings yet

- FA Consolidation Test - Questions S20-A21 PDFDocument16 pagesFA Consolidation Test - Questions S20-A21 PDFAlpha MpofuNo ratings yet

- Notes On Inventory ValuationDocument7 pagesNotes On Inventory ValuationNouman Mujahid100% (2)

- Chapter # 6 Departmental AccountDocument36 pagesChapter # 6 Departmental AccountRooh Ullah KhanNo ratings yet

- Job CostingDocument18 pagesJob CostingBiswajeet DashNo ratings yet

- AkuntansiDocument3 pagesAkuntansier4sallNo ratings yet

- Cash Flow ProblemsDocument6 pagesCash Flow Problemsvkbm42No ratings yet

- BE4-1. The Adjusted Trial Balance of Pacific Scientific Corporation OnDocument10 pagesBE4-1. The Adjusted Trial Balance of Pacific Scientific Corporation OnNguyễn Linh NhiNo ratings yet

- Problem 2-2: J.L. Gregory CompanyDocument5 pagesProblem 2-2: J.L. Gregory CompanyKAPIL MBA 2021-23 (Delhi)No ratings yet

- Problem 13-1 - Chapter 13 - SolutionDocument6 pagesProblem 13-1 - Chapter 13 - Solutionppdisme100% (1)

- CAPITAL STRUCTURE Sums OnlinePGDMDocument6 pagesCAPITAL STRUCTURE Sums OnlinePGDMSoumendra RoyNo ratings yet

- 21 Problems For CB NewDocument31 pages21 Problems For CB NewNguyễn Thảo MyNo ratings yet

- Course Outline (Electronic Commerce and Computer Aided Accounting and Business Systems)Document4 pagesCourse Outline (Electronic Commerce and Computer Aided Accounting and Business Systems)Fraz InamNo ratings yet

- FA Work BookDocument59 pagesFA Work BookUnais AhmedNo ratings yet

- 3246accounting - CA IPCCDocument116 pages3246accounting - CA IPCCPrashant Pandey100% (1)

- T2&T4Document204 pagesT2&T4សារុន កែវវរលក្ខណ៍No ratings yet

- IAS 2 Summary-MergedDocument19 pagesIAS 2 Summary-MergedShameel IrshadNo ratings yet

- L3-L4 CostsheetDocument30 pagesL3-L4 CostsheetDhawal RajNo ratings yet

- Single Entry System and Incomplete Records NotesDocument5 pagesSingle Entry System and Incomplete Records NotesKristen Shaw100% (5)

- To Consolidated Financial Statements: Syllabus Guide Detailed OutcomesDocument51 pagesTo Consolidated Financial Statements: Syllabus Guide Detailed OutcomesDavid MorganNo ratings yet

- Basics of AccountingDocument3 pagesBasics of AccountingAjesh Mukundan PNo ratings yet

- Revaluation of Partnership AssetsDocument32 pagesRevaluation of Partnership AssetsERICK MLINGWANo ratings yet

- Energy Vending Inc Journal Entries - CompressDocument9 pagesEnergy Vending Inc Journal Entries - Compressadharsh veeraNo ratings yet

- OG1 9 Branch AccountingDocument25 pagesOG1 9 Branch AccountingsridhartksNo ratings yet

- F9Chap4 TutorSlidesDocument31 pagesF9Chap4 TutorSlidesSeema Parboo-AliNo ratings yet

- ACCA F3 CH#5: Sale Returns, Purchases Returns, Discounts NotesDocument40 pagesACCA F3 CH#5: Sale Returns, Purchases Returns, Discounts NotesMuhammad AzamNo ratings yet

- COST 1 Costing ProblemsDocument75 pagesCOST 1 Costing Problemstrixie maeNo ratings yet

- Chapter 9 SolutionsDocument7 pagesChapter 9 SolutionsRose McMahon50% (2)

- Chap 1 - Inventory Valuation (Questions)Document4 pagesChap 1 - Inventory Valuation (Questions)90 SHAMAZNo ratings yet

- Accounting Exercises (Management Accounting)Document2 pagesAccounting Exercises (Management Accounting)arvin sibayan100% (1)

- F2 Mock 5Document9 pagesF2 Mock 5deepakNo ratings yet

- Bharat Chemicals Ltd. CPHi46l2eHDocument2 pagesBharat Chemicals Ltd. CPHi46l2eHChickooNo ratings yet

- Cash Flow Statement ProblemDocument2 pagesCash Flow Statement Problemapi-3842194100% (2)

- Problems On Income StatementDocument3 pagesProblems On Income Statementcnagadeepa100% (2)

- Basics of Accounting 4 Ledger & Trial BalanceDocument21 pagesBasics of Accounting 4 Ledger & Trial Balancejiten zopeNo ratings yet

- 6 AnsDocument9 pages6 AnsAj PotXzs Ü100% (2)

- F7 Mock Answers 201603Document12 pagesF7 Mock Answers 201603DG Mero Nepal GreatNo ratings yet

- Thegodfather CF Student CdADocument8 pagesThegodfather CF Student CdAPablo MichavilaNo ratings yet

- S6 - Strategic ManagementDocument548 pagesS6 - Strategic ManagementLearning Point100% (1)

- IAS - 36 (Impairement of Asset)Document5 pagesIAS - 36 (Impairement of Asset)Learning PointNo ratings yet

- Danish Iqbal: ObjectiveDocument3 pagesDanish Iqbal: ObjectiveLearning PointNo ratings yet

- Games Wing Complete Comprehensive ReportDocument84 pagesGames Wing Complete Comprehensive ReportLearning PointNo ratings yet

- Business IntelligenceDocument17 pagesBusiness IntelligenceLearning PointNo ratings yet

- Accounting: Making Sound Decisions: Prof. Marc BadiaDocument1 pageAccounting: Making Sound Decisions: Prof. Marc BadiaLearning PointNo ratings yet

- Lecture Notes T01Document9 pagesLecture Notes T01Learning PointNo ratings yet

- Topic 2: Present Value: (A) Simple vs. Compound InterestDocument12 pagesTopic 2: Present Value: (A) Simple vs. Compound InterestLearning PointNo ratings yet

- Sales Data Power BiDocument792 pagesSales Data Power BiLearning PointNo ratings yet

- Brochure For Potential Investors in Tourism SectorDocument20 pagesBrochure For Potential Investors in Tourism SectorMerima GZNRNo ratings yet

- Conceptual Framework Elements of Financial StatementsDocument18 pagesConceptual Framework Elements of Financial StatementsmaricrisNo ratings yet

- Tariqul Hoque ' Salary Statement For The Month of July ' 2022Document6 pagesTariqul Hoque ' Salary Statement For The Month of July ' 2022Sadman Rafid FardeenNo ratings yet

- The Impact of Personal Income Tax On Employees' Motivation To Work: The Case of EthiopiaDocument25 pagesThe Impact of Personal Income Tax On Employees' Motivation To Work: The Case of EthiopiaYehualashet MekonninNo ratings yet

- Consolidation of Foreign Subsidiaries UpdatedDocument9 pagesConsolidation of Foreign Subsidiaries UpdateddemolaojaomoNo ratings yet

- Tax Calculator A y 2006 07 To 2011 12Document8 pagesTax Calculator A y 2006 07 To 2011 12Bhaskar Kumar ShawNo ratings yet

- Myanmar Foreign Investment LawDocument15 pagesMyanmar Foreign Investment LawAyeChan AungNo ratings yet

- Cash Flow Statement Format 2021Document5 pagesCash Flow Statement Format 2021VV MusicNo ratings yet

- Bus Ad 4 Official Midterm ModuleDocument12 pagesBus Ad 4 Official Midterm ModuleJophie AndreilleNo ratings yet

- Adjusting Entry StudentDocument31 pagesAdjusting Entry Studentxie diccionNo ratings yet

- RWANDA National Savings Mobilization StrategyDocument72 pagesRWANDA National Savings Mobilization Strategygodwin SemunyuNo ratings yet

- AHM Chapter 1 - SolutionsDocument26 pagesAHM Chapter 1 - SolutionsNitin KhareNo ratings yet

- Income Tax - ElaineDocument11 pagesIncome Tax - ElaineSamsung AccountNo ratings yet

- Caie Igcse Economics 0455 Theory v1Document16 pagesCaie Igcse Economics 0455 Theory v1Mehri MustafayevaNo ratings yet

- kế toán quản trị bt chap2Document15 pageskế toán quản trị bt chap2Tung DucNo ratings yet

- CACTUS MAY 2023 CIC02774 PayslipDocument1 pageCACTUS MAY 2023 CIC02774 Payslipuraza.octavoNo ratings yet

- MBA 1st Sem QuestionsDocument9 pagesMBA 1st Sem QuestionsDattathree YennamNo ratings yet

- Recognition & Derecognition 5Document27 pagesRecognition & Derecognition 5sajedulNo ratings yet

- Mat Feb 2007Document26 pagesMat Feb 2007sreenivasNo ratings yet

- Income Taxation - Ampongan (SolMan)Document56 pagesIncome Taxation - Ampongan (SolMan)John Dale Mondejar75% (12)

- Group B Teresita Buenaflor ShoesDocument38 pagesGroup B Teresita Buenaflor ShoesAlexandrea San Buenaventura BaayNo ratings yet

- Jawaban LKS AccountingDocument69 pagesJawaban LKS AccountingAnggi PukjkNo ratings yet

- ADocument2 pagesACandelNo ratings yet

- Eco 121Document4 pagesEco 121Arpit Bajaj100% (1)

- Consolidated Income Statement or Statement of Profit or Loss and Other Comprehensive IncomeDocument4 pagesConsolidated Income Statement or Statement of Profit or Loss and Other Comprehensive IncomeOmolaja IbukunNo ratings yet

- Problem 1 C7Document5 pagesProblem 1 C7Erica CastroNo ratings yet

- Set A - Prelim Exam in COGM6Document5 pagesSet A - Prelim Exam in COGM6kaii 1234No ratings yet

- IntAcc Chapter 41Document4 pagesIntAcc Chapter 41Cheesca Macabanti - 12 Euclid-Digital ModularNo ratings yet

- Lembar Kerja Komputer Ukk Tina Nur Aisyah Xii Ak 1 25Document30 pagesLembar Kerja Komputer Ukk Tina Nur Aisyah Xii Ak 1 25RizalJalilPujaKesumaNo ratings yet