Professional Documents

Culture Documents

Lesson 8 Identifying and Assessing The ROMM

Lesson 8 Identifying and Assessing The ROMM

Uploaded by

Mark TaysonOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lesson 8 Identifying and Assessing The ROMM

Lesson 8 Identifying and Assessing The ROMM

Uploaded by

Mark TaysonCopyright:

Available Formats

College of Accountancy

IDENTIFYING AND ASSESSING RISK OF MATERIAL MISSTATEMENT

Contents:

1. Concept of Risk

2. Audit Risk Model

3. Identifying and Assessing the Risk of Material Misstatement

4. Risk Assessment Process

5. Significant Risk

6. Risks for Which Substantive Procedures Alone Do Not Provide Sufficient Appropriate

Audit Evidence

7. Revision of Risk Assessment

1. Concept of Risk

Auditing is accompanied by risk. From the reason why there is a need for audit, the

conduct of audit, up to the end of audit, risk is involved.

Risk - the possibility that something unpleasant or unwelcome will happen.

Information risk – risk that the information is misstated or misleading.

Engagement risk (auditor’s business risks) – risk such financial loss, loss from litigation,

adverse publicity, or other events arising in connection with the audit of financial statements (or

other engagement).

Business risk – A risk resulting from significant conditions, events, circumstances, actions or

inactions that could adversely affect an entity’s ability to achieve its objectives and execute its

strategies, or from the setting of inappropriate objectives and strategies.

Audit risk—Audit risk is the risk that the auditor gives an inappropriate audit opinion when the

financial statements are materially misstated. Audit risk has three components: inherent risk,

control risk and detection risk. Inherent risk and control risk are the risk of material misstatement

at the assertion level.

2. Audit Risk Model

Audit risk model is a model that expresses the general relationship of the components of

audit risk in mathematical terms to arrive at an acceptable level of detection risk. It is a tool used by

an auditor to determine the proper response to assessed risks of material misstatement at the

assertion level. It is expressed in the formula:

𝐴𝑢𝑑𝑖𝑡 𝑅𝑖𝑠𝑘 = 𝐼𝑛ℎ𝑒𝑟𝑒𝑛𝑡 𝑅𝑖𝑠𝑘 𝑥 𝐶𝑜𝑛𝑡𝑟𝑜𝑙 𝑅𝑖𝑠𝑘 𝑥 𝐷𝑒𝑡𝑒𝑐𝑡𝑖𝑜𝑛 𝑅𝑖𝑠𝑘

𝐴𝑢𝑑𝑖𝑡 𝑅𝑖𝑠𝑘

Or, 𝐷𝑒𝑡𝑒𝑐𝑡𝑖𝑜𝑛 𝑅𝑖𝑠𝑘 = 𝑅𝑂𝑀𝑀 (𝐼𝑛ℎ𝑒𝑟𝑒𝑛𝑡 𝑅𝑖𝑠𝑘 𝑥 𝐶𝑜𝑛𝑡𝑟𝑜𝑙 𝑅𝑖𝑠𝑘)

Audit risk—Audit risk is the risk that the auditor gives an inappropriate audit opinion

when the financial statements are materially misstated. Audit risk has three components: inherent

risk, control risk and detection risk.

Inherent risk—Inherent risk is the susceptibility of an account balance or class of

transactions to misstatement that could be material, individually or when aggregated with

misstatements in other balances of classes, assuming that there were no related internal controls.

Control risk—Control risk is the risk that a misstatement that could occur in an account

balance or class of transactions and that could be material, individually or when aggregated with

misstatements in other balances or classes, will not be prevented or detected and corrected on a

timely basis by the accounting and internal control systems. It is a function of the effectiveness

of the design, implementation and maintenance of internal control by management to address

identified risks that threaten the achievement of the entity’s objectives relevant to preparation of

the entity’s financial statements.

Instructor: Orlando L. Ananey Page 1 of 5

College of Accountancy

The risks of material misstatement at the assertion level consist of two components:

inherent risk and control risk. Inherent risk and control risk are the entity’s risks; they exist

independently of the audit of the financial statements.

Detection risk—Detection risk is the risk that an auditor’s substantive procedures will

not detect a misstatement that exists in an account balance or class of transactions that could be

material, individually or when aggregated with misstatements in other balances or classes. It

relates to the nature, timing, and extent of the auditor’s procedures that are determined by the

auditor to reduce audit risk to an acceptably low level. It is therefore a function of the

effectiveness of an audit procedure and of its application by the auditor. Matters such as:

• adequate planning;

• proper assignment of personnel to the engagement team;

• the application of professional skepticism; and

• supervision and review of the audit work performed,

assist to enhance the effectiveness of an audit procedure and of its application and reduce the

possibility that an auditor might select an inappropriate audit procedure, misapply an appropriate

audit procedure, or misinterpret the audit results.

For a given level of audit risk, the acceptable level of detection risk bears an inverse

relationship to the assessed risks of material misstatement at the assertion level. For example, the

greater the risks of material misstatement the auditor believes exists, the less the detection risk

that can be accepted and, accordingly, the more persuasive the audit evidence required by the

auditor.

3. Identifying and Assessing the Risk of Material Misstatement

The auditor shall identify and assess the risks of material misstatement at:

a. The financial statement level; and

b. The assertion level for classes of transactions, account balances, and disclosures, to

provide a basis for designing and performing further audit procedures.

Assessment of Risks of Material Misstatement at the F/S Level

Risks of material misstatement at the financial statement level refer to risks that

relate pervasively to the financial statements as a whole and potentially affect many

assertions. Risks of this nature are not necessarily risks identifiable with specific

assertions at the class of transactions, account balance, or disclosure level. Rather, they

represent circumstances that may increase the risks of material misstatement at the

assertion level, for example, through management override of internal control. Financial

statement level risks may be especially relevant to the auditor’s consideration of the risks

of material misstatement arising from fraud.

Risks at the financial statement level may derive in particular from a weak control

environment (although these risks may also relate to other factors, such as declining

economic conditions). For example, weaknesses such as management’s lack of

competence may have a more pervasive effect on the financial statements and may

require an overall response by the auditor.

The auditor’s understanding of internal control may raise doubts about the

auditability of an entity’s financial statements. For example:

• Concerns about the integrity of the entity’s management may be so serious as to

cause the auditor to conclude that the risk of management misrepresentation in the

financial statements is such that an audit cannot be conducted.

• Concerns about the condition and reliability of an entity’s records may cause the

auditor to conclude that it is unlikely that sufficient appropriate audit evidence

will be available to support an unqualified opinion on the financial statements.

Assessment of Risks of Material Misstatement at the Assertion Level

Instructor: Orlando L. Ananey Page 2 of 5

College of Accountancy

Risks of material misstatement at the assertion level for classes of transactions,

account balances, and disclosures need to be considered because such consideration

directly assists in determining the nature, timing, and extent of further audit procedures at

the assertion level necessary to obtain sufficient appropriate audit evidence. In identifying

and assessing risks of material misstatement at the assertion level, the auditor may

conclude that the identified risks relate more pervasively to the financial statements as a

whole and potentially affect many assertions.

4. Risk Assessment Process

For this purpose, the auditor shall:

1. Identify risks throughout the process of obtaining an understanding of the entity and its

environment, including relevant controls that relate to the risks, and by considering the

classes of transactions, account balances, and disclosures in the financial statements;

2. Assess the identified risks, and evaluate whether they relate more pervasively to the

financial statements as a whole and potentially affect many assertions;

3. Relate the identified risks to what can go wrong at the assertion level, taking account of

relevant controls that the auditor intends to test; and

4. Consider the likelihood of misstatement, including the possibility of multiple

misstatements, and whether the potential misstatement is of a magnitude that could result

in a material misstatement.

Information gathered by performing risk assessment procedures, including the audit

evidence obtained in evaluating the design of controls and determining whether they have been

implemented, is used as audit evidence to support the risk assessment. The risk assessment

determines the nature, timing, and extent of further audit procedures to be performed. In making

risk assessments, the auditor may identify the controls that are likely to prevent, or detect and

correct, material misstatement in specific assertions.

Generally, it is useful to obtain an understanding of controls and relate them to assertions

in the context of processes and systems in which they exist because individual control activities

often do not in themselves address a risk. Often, only multiple control activities, together with

other components of internal control, will be sufficient to address a risk.

Conversely, some control activities may have a specific effect on an individual assertion

embodied in a particular class of transactions or account balance. For example, the control

activities that an entity established to ensure that its personnel are properly counting and

recording the annual physical inventory relate directly to the existence and completeness

assertions for the inventory account balance.

Controls can be either directly or indirectly related to an assertion. The more indirect the

relationship, the less effective that control may be in preventing, or detecting and correcting,

misstatements in that assertion. For example, a sales manager’s review of a summary of sales

activity for specific stores by region ordinarily is only indirectly related to the completeness

assertion for sales revenue. Accordingly, it may be less effective in reducing risk for that

assertion than controls more directly related to that assertion, such as matching shipping

documents with billing documents.

5. Significant Risk

Significant risk – An identified and assessed risk of material misstatement that, in the

auditor’s judgment, requires special audit consideration.

As part of the risk assessment, the auditor shall determine whether any of the risks

identified are, in the auditor’s judgment, a significant risk. In exercising this judgment, the

auditor shall exclude the effects of identified controls related to the risk. In exercising judgment

as to which risks are significant risks, the auditor shall consider at least the following:

a. Whether the risk is a risk of fraud;

Instructor: Orlando L. Ananey Page 3 of 5

College of Accountancy

b. Whether the risk is related to recent significant economic, accounting or other

developments and, therefore, requires specific attention;

c. The complexity of transactions;

d. Whether the risk involves significant transactions with related parties;

e. The degree of subjectivity in the measurement of financial information related to the risk,

especially those measurements involving a wide range of measurement uncertainty; and

f. Whether the risk involves significant transactions that are outside the normal course of

business for the entity, or that otherwise appear to be unusual.

Significant risks often relate to significant non-routine transactions or judgmental

matters. Non-routine transactions are transactions that are unusual, due to either size or nature,

and that therefore occur infrequently. Judgmental matters may include the development of

accounting estimates for which there is significant measurement uncertainty. Routine,

noncomplex transactions that are subject to systematic processing are less likely to give rise to

significant risks.

Risks of material misstatement may be greater for significant non-routine transactions

arising from matters such as the following:

• Greater management intervention to specify the accounting treatment.

• Greater manual intervention for data collection and processing.

• Complex calculations or accounting principles.

• The nature of non-routine transactions, which may make it difficult for the entity to

implement effective controls over the risks.

Risks of material misstatement may be greater for significant judgmental matters that

require the development of accounting estimates, arising from matters such as the following:

• Accounting principles for accounting estimates or revenue recognition may be subject to

differing interpretation.

• Required judgment may be subjective or complex, or require assumptions about the

effects of future events, for example, judgment about fair value.

When the auditor has determined that a significant risk exists, the auditor shall obtain an

understanding of the entity’s controls, including control activities, relevant to that risk.

Although risks relating to significant non-routine or judgmental matters are often less

likely to be subject to routine controls, management may have other responses intended to deal

with such risks. Accordingly, the auditor’s understanding of whether the entity has designed and

implemented controls for significant risks arising from non-routine or judgmental matters

includes whether and how management responds to the risks. Such responses might include:

• Control activities such as a review of assumptions by senior management or experts.

• Documented processes for estimations.

• Approval by those charged with governance.

For example, where there are one-off events such as the receipt of notice of a significant

lawsuit, consideration of the entity’s response may include such matters as whether it has been

referred to appropriate experts (such as internal or external legal counsel), whether an assessment

has been made of the potential effect, and how it is proposed that the circumstances are to be

disclosed in the financial statements.

In some cases, management may not have appropriately responded to significant risks of

material misstatement by implementing controls over these significant risks. This may indicate a

material weakness in the entity’s internal control.

6. Risks for Which Substantive Procedures Alone Do Not Provide Sufficient Appropriate

Audit Evidence

In respect of some risks, the auditor may judge that it is not possible or practicable to

obtain sufficient appropriate audit evidence only from substantive procedures. Such risks may

relate to the inaccurate or incomplete recording of routine and significant classes of transactions

Instructor: Orlando L. Ananey Page 4 of 5

College of Accountancy

or account balances, the characteristics of which often permit highly automated processing with

little or no manual intervention. In such cases, the entity’s controls over such risks are relevant to

the audit and the auditor shall obtain an understanding of them.

Risks of material misstatement may relate directly to the recording of routine classes of

transactions or account balances, and the preparation of reliable financial statements. Such risks

may include risks of inaccurate or incomplete processing for routine and significant classes of

transactions such as an entity’s revenue, purchases, and cash receipts or cash payments.

Where such routine business transactions are subject to highly automated processing with

little or no manual intervention, it may not be possible to perform only substantive procedures in

relation to the risk. For example, the auditor may consider this to be the case in circumstances

where a significant amount of an entity’s information is initiated, recorded, processed, or

reported only in electronic form such as in an integrated system. In such cases:

• Audit evidence may be available only in electronic form, and its sufficiency and

appropriateness usually depend on the effectiveness of controls over its accuracy and

completeness.

• The potential for improper initiation or alteration of information to occur and not be

detected may be greater if appropriate controls are not operating effectively.

7. Revision of Risk Assessment

The auditor’s assessment of the risks of material misstatement at the assertion level may

change during the course of the audit as additional audit evidence is obtained. In circumstances

where the auditor obtains audit evidence from performing further audit procedures, or if new

information is obtained, either of which is inconsistent with the audit evidence on which the

auditor originally based the assessment, the auditor shall revise the assessment and modify the

further planned audit procedures accordingly.

During the audit, information may come to the auditor’s attention that differs

significantly from the information on which the risk assessment was based. For example, the risk

assessment may be based on an expectation that certain controls are operating effectively. In

performing tests of those controls, the auditor may obtain audit evidence that they were not

operating effectively at relevant times during the audit. Similarly, in performing substantive

procedures the auditor may detect misstatements in amounts or frequency greater than is

consistent with the auditor’s risk assessments. In such circumstances, the risk assessment may

not appropriately reflect the true circumstances of the entity and the further planned audit

procedures may not be effective in detecting material misstatements.

Instructor: Orlando L. Ananey Page 5 of 5

You might also like

- Pnpa CrossroadDocument248 pagesPnpa CrossroadLorenz Paul ClaveriaNo ratings yet

- Draft QRC Collateral Warranty - MCOL 22 5 14Document5 pagesDraft QRC Collateral Warranty - MCOL 22 5 14Mohamed A.HanafyNo ratings yet

- CH - 9 Assessing The Risk of Material MisstatementDocument14 pagesCH - 9 Assessing The Risk of Material MisstatementOmar C100% (2)

- Summary of CH 9 Assessing The Risk of Material MisstatementDocument19 pagesSummary of CH 9 Assessing The Risk of Material MisstatementMutia WardaniNo ratings yet

- Brain Teaser Questions Chapter 6Document4 pagesBrain Teaser Questions Chapter 6ainmazni officialNo ratings yet

- Auditing - Chapter 3Document54 pagesAuditing - Chapter 3Tesfaye SimeNo ratings yet

- Auditing Concepts: 1. Professional SkepticismDocument8 pagesAuditing Concepts: 1. Professional SkepticismPhebieon MukwenhaNo ratings yet

- Audit and AssuaranceDocument131 pagesAudit and AssuaranceApala EbenezerNo ratings yet

- School of Business, Economics and Management Bps430: Audit Practice and Performance Review Chapter 4: The Theory of AuditingDocument73 pagesSchool of Business, Economics and Management Bps430: Audit Practice and Performance Review Chapter 4: The Theory of AuditingChibwe ChinyamaNo ratings yet

- Control RiskDocument19 pagesControl RiskAnonymous HBzUFPliGsNo ratings yet

- Chapter 3Document14 pagesChapter 3Donald HollistNo ratings yet

- Audit RisksDocument4 pagesAudit RisksAliAwaisNo ratings yet

- Chapter 4 SolutionsDocument13 pagesChapter 4 SolutionsjessicaNo ratings yet

- Chapter 3: Process of Assurance: Planning The AssignmentDocument12 pagesChapter 3: Process of Assurance: Planning The AssignmentShahid MahmudNo ratings yet

- Lecture 6-Audit RiksDocument6 pagesLecture 6-Audit Riksakii ramNo ratings yet

- Arens Auditing16e SM 09Document28 pagesArens Auditing16e SM 09김현중No ratings yet

- 10 Identifying and Assessing RiskDocument3 pages10 Identifying and Assessing RiskIrish SanchezNo ratings yet

- Advanced Auditing Chapter FourDocument52 pagesAdvanced Auditing Chapter FourmirogNo ratings yet

- The Audit Risk ModelDocument7 pagesThe Audit Risk ModelNatya NindyagitayaNo ratings yet

- Arens AAS17 SM 08Document23 pagesArens AAS17 SM 08林芷瑜No ratings yet

- Manjares - AUDIT RISKDocument2 pagesManjares - AUDIT RISKApril ManjaresNo ratings yet

- Assessing The Risk of Material Misstatement: Concept Checks P. 242Document23 pagesAssessing The Risk of Material Misstatement: Concept Checks P. 242hsingting yuNo ratings yet

- Chapter 5Document11 pagesChapter 5fekadegebretsadik478729No ratings yet

- Ch5 Audit EvidenceDocument47 pagesCh5 Audit Evidencekitababekele26No ratings yet

- Risk-Based Approach To Conducting A Quality AuditDocument55 pagesRisk-Based Approach To Conducting A Quality AuditKyla Marie MojicoNo ratings yet

- Summary Audit Chapter 6Document9 pagesSummary Audit Chapter 6RilvinaNo ratings yet

- Audit PlanningDocument29 pagesAudit PlanningReshyl HicaleNo ratings yet

- Chapter 9 Assesing The Risk of Material Misstatement: Nama: Anissa Dinar Paraswansa NIM:12030122410010Document6 pagesChapter 9 Assesing The Risk of Material Misstatement: Nama: Anissa Dinar Paraswansa NIM:12030122410010Anissa DinarNo ratings yet

- Audit Opinion Audited Financial Statements An Unqualified Opinion Financial StatementsDocument4 pagesAudit Opinion Audited Financial Statements An Unqualified Opinion Financial StatementsTahrimNaheenNo ratings yet

- Aud339 Audit Planning Part 2Document26 pagesAud339 Audit Planning Part 2Nur IzzahNo ratings yet

- Tutorial - 3-Answers - For - Selected - Questions PresentationDocument6 pagesTutorial - 3-Answers - For - Selected - Questions Presentationcynthiama7777No ratings yet

- Audit RiskDocument5 pagesAudit RiskFermie Shell100% (1)

- Lecture 3-Risk Materiality-Jan 2020Document99 pagesLecture 3-Risk Materiality-Jan 2020Ching XueNo ratings yet

- Interactive Training On Overall Audit Process and DocumentationDocument19 pagesInteractive Training On Overall Audit Process and DocumentationAmenu AdagneNo ratings yet

- PBEPIII Inherent Risk PDFDocument5 pagesPBEPIII Inherent Risk PDFkim romanoNo ratings yet

- Tema EnglezaDocument7 pagesTema EnglezaLupitu Aura DanielaNo ratings yet

- Assessment of Audit RiskDocument9 pagesAssessment of Audit RiskAli KhanNo ratings yet

- Boynton SM Ch.05Document23 pagesBoynton SM Ch.05Eza RNo ratings yet

- The Risk-Based Audit ModelDocument2 pagesThe Risk-Based Audit ModelJoshel MaeNo ratings yet

- Psa 240 Fraud Error and Non ComplianceDocument26 pagesPsa 240 Fraud Error and Non ComplianceAngelica Nicole TamayoNo ratings yet

- CH 5Document2 pagesCH 5Scholastica DaniaNo ratings yet

- What Is A Risk-Based Audit Approach?Document4 pagesWhat Is A Risk-Based Audit Approach?migraneNo ratings yet

- Assessing The Risk of Material MisstatementDocument2 pagesAssessing The Risk of Material MisstatementAri PrtmaNo ratings yet

- Audit Risk ModelDocument12 pagesAudit Risk ModelDennis Njonjo100% (1)

- Risks of Material Misstatement at Financial Statement Level Vs Assertion LevelDocument1 pageRisks of Material Misstatement at Financial Statement Level Vs Assertion Levelmelissa.britsNo ratings yet

- AuditingDocument99 pagesAuditingWen Xin GanNo ratings yet

- Acca F 8 L3Document20 pagesAcca F 8 L3Fahmi AbdullaNo ratings yet

- Risk AssessmentDocument9 pagesRisk AssessmentAshley Levy San PedroNo ratings yet

- Chapter 6 Risk Assessment (PART 1)Document9 pagesChapter 6 Risk Assessment (PART 1)Aravinthan INSAF SmartClassNo ratings yet

- Audit RiskDocument1 pageAudit RiskSUBMERINNo ratings yet

- Effective Internal Control - R: Procedures To Be Performed Are Matters For The Professional Judgment of The AuditorDocument5 pagesEffective Internal Control - R: Procedures To Be Performed Are Matters For The Professional Judgment of The Auditorlorie anne valleNo ratings yet

- 1 - Audit PlanningDocument15 pages1 - Audit PlanningWaynie Jane OsingNo ratings yet

- The Risk Based AuditDocument6 pagesThe Risk Based AuditHana AlmiraNo ratings yet

- Definition and Meaning of Risk-Based Auditing: Chapter One: Introduction and Over-All ViewDocument13 pagesDefinition and Meaning of Risk-Based Auditing: Chapter One: Introduction and Over-All ViewWally AranasNo ratings yet

- Risk Assessment and Internal Control - E-NotesDocument55 pagesRisk Assessment and Internal Control - E-NotesManavNo ratings yet

- AUD339 (NOTES CP5) - Audit Planning & Fieldwork 2Document28 pagesAUD339 (NOTES CP5) - Audit Planning & Fieldwork 2pinocchiooNo ratings yet

- Auditor's Responsability in Errors and FraudsDocument12 pagesAuditor's Responsability in Errors and FraudszafarabbasrizviNo ratings yet

- Accountancy (AC1218) : Answer Key - Principles of Auditing CourseDocument15 pagesAccountancy (AC1218) : Answer Key - Principles of Auditing CourseMarijo JuanilloNo ratings yet

- Audit RiskDocument1 pageAudit RiskJhoanna Rose AlingalanNo ratings yet

- Audit Risk Isa 400Document2 pagesAudit Risk Isa 400dennychiwarahNo ratings yet

- Mastering Financial Risk Management : Strategies for SuccessFrom EverandMastering Financial Risk Management : Strategies for SuccessNo ratings yet

- Lesson 16 Considering Work of Other PractitionersDocument7 pagesLesson 16 Considering Work of Other PractitionersMark TaysonNo ratings yet

- Lesson 16 Job Order CostingDocument3 pagesLesson 16 Job Order CostingMark TaysonNo ratings yet

- Lesson 10 Understanding The Entity and Its EnvironmentDocument8 pagesLesson 10 Understanding The Entity and Its EnvironmentMark TaysonNo ratings yet

- Lesson 15 Home Office, Branch and Agency AccountingDocument11 pagesLesson 15 Home Office, Branch and Agency AccountingMark TaysonNo ratings yet

- Lesson 15 Considering Fraud, Error and Non-Compliance With Laws and RegulationsDocument8 pagesLesson 15 Considering Fraud, Error and Non-Compliance With Laws and RegulationsMark TaysonNo ratings yet

- Lesson 14 Audit SamplingDocument9 pagesLesson 14 Audit SamplingMark TaysonNo ratings yet

- Lesson 4 Professional StandardsDocument8 pagesLesson 4 Professional StandardsMark TaysonNo ratings yet

- Lesson 6 Pre-Engagement ActivitiesDocument5 pagesLesson 6 Pre-Engagement ActivitiesMark TaysonNo ratings yet

- Lesson 3 Financial Statements AuditDocument5 pagesLesson 3 Financial Statements AuditMark TaysonNo ratings yet

- Lesson 1 Assurance EngagementsDocument7 pagesLesson 1 Assurance EngagementsMark TaysonNo ratings yet

- 2 Corporate LiquidationDocument12 pages2 Corporate LiquidationMark Tayson100% (1)

- Lesson 2 Auditing OverviewDocument2 pagesLesson 2 Auditing OverviewMark TaysonNo ratings yet

- 5 Long-Term Construction ContractDocument12 pages5 Long-Term Construction ContractMark TaysonNo ratings yet

- Chapter 4 Review KEYDocument4 pagesChapter 4 Review KEYMark TaysonNo ratings yet

- 1b Partnership OperationDocument7 pages1b Partnership OperationMark TaysonNo ratings yet

- 1d Partnership LiquidationDocument8 pages1d Partnership LiquidationMark TaysonNo ratings yet

- 4 Revenue From Contracts With Customers (PFRS 15)Document11 pages4 Revenue From Contracts With Customers (PFRS 15)Mark TaysonNo ratings yet

- 1c Partnership DissolutionDocument9 pages1c Partnership DissolutionMark TaysonNo ratings yet

- SPA IrrevocableDocument4 pagesSPA IrrevocablejoshboracayNo ratings yet

- Miasms: Reaction Patterns in Chronic DiseaseDocument21 pagesMiasms: Reaction Patterns in Chronic DiseaseShukan MankadNo ratings yet

- Cruz V COA, G.R. No. 138489 (2001)Document4 pagesCruz V COA, G.R. No. 138489 (2001)Zoe AnnNo ratings yet

- BSLA Curriculum - 0Document8 pagesBSLA Curriculum - 0Chau TruongNo ratings yet

- Wagner and PhilosophyDocument2 pagesWagner and PhilosophyAnonymous uv3mbgrNo ratings yet

- MANTEGAZZA - The Sexual Rel - of MankindDocument360 pagesMANTEGAZZA - The Sexual Rel - of MankindStudentul2000100% (2)

- Case Digest On de La Camara vs. Enage 41 SCRA 1: November 10, 2010Document61 pagesCase Digest On de La Camara vs. Enage 41 SCRA 1: November 10, 2010Cherry Ann LayuganNo ratings yet

- PW Multi-Party SystemDocument49 pagesPW Multi-Party SystemSanket Patel100% (1)

- Australia Anti-Bullying Policy - 1oct12Document7 pagesAustralia Anti-Bullying Policy - 1oct12Maheshwaran IrulappanNo ratings yet

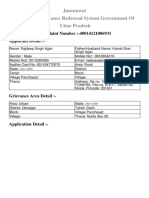

- JansunwaiDocument3 pagesJansunwaiDeepankaj KumarNo ratings yet

- Henri Fayol 14 PrinciplesDocument16 pagesHenri Fayol 14 PrinciplesSandeep RuhilNo ratings yet

- Lesson 3 and 4Document13 pagesLesson 3 and 4Bryce EdenNo ratings yet

- 049 China Airlines V ChiokDocument2 pages049 China Airlines V ChiokClyde TanNo ratings yet

- Fact Value PolicyDocument2 pagesFact Value PolicyMaxwell AlexanderNo ratings yet

- Barriers To Effective CommunicationDocument25 pagesBarriers To Effective CommunicationGlenda VestraNo ratings yet

- Jane Austen, Notes OnDocument18 pagesJane Austen, Notes OnJulianna BorbelyNo ratings yet

- Job Descriptions of Academic StaffDocument25 pagesJob Descriptions of Academic StaffJorge Nicolás LuceroNo ratings yet

- PRC Allowable CalculatorsDocument3 pagesPRC Allowable CalculatorsbbacissejNo ratings yet

- De Registration LetterDocument3 pagesDe Registration LetterberuwenNo ratings yet

- What To Expect at A CRA InterviewDocument18 pagesWhat To Expect at A CRA InterviewadiNo ratings yet

- Mini Dictionary - 20231125 - 171537 - 0000Document15 pagesMini Dictionary - 20231125 - 171537 - 0000annpriv45No ratings yet

- Batman The Dark Knight and The Moral PhilosophyDocument2 pagesBatman The Dark Knight and The Moral PhilosophyMusharaf AsadNo ratings yet

- Black Magick Manifesto Timothy PDFDocument34 pagesBlack Magick Manifesto Timothy PDFHuy TranNo ratings yet

- Major Segmentation Variables For Consumer MarketsDocument6 pagesMajor Segmentation Variables For Consumer MarketsRitu BatraNo ratings yet

- VV AA - Michel Foucault Philosopher PDFDocument369 pagesVV AA - Michel Foucault Philosopher PDFAntonio Pepe Giménez VascoNo ratings yet

- Topic 14 - Organizational ChangeDocument20 pagesTopic 14 - Organizational Changewong6804No ratings yet

- OSHMS Audit ChecklistDocument107 pagesOSHMS Audit ChecklistShahril ZainulNo ratings yet

- Case DigestDocument7 pagesCase DigestAndrei ArkovNo ratings yet