Professional Documents

Culture Documents

Error Correction Exercise (2021-2022 2nd Sem) Test

Error Correction Exercise (2021-2022 2nd Sem) Test

Uploaded by

EMELY EMELYCopyright:

Available Formats

You might also like

- Notre Dame Educational Association: Mock Board Examination Financial Accounting and ReportingDocument17 pagesNotre Dame Educational Association: Mock Board Examination Financial Accounting and Reportingirishjade100% (1)

- Exercises. Correction of ErrorsDocument7 pagesExercises. Correction of ErrorsGia Sarah Barillo BandolaNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Apr 4/accounting For Business Combinations: General InstructionDocument8 pagesApr 4/accounting For Business Combinations: General InstructionJoannah maeNo ratings yet

- Unit 1. HandoutDocument3 pagesUnit 1. HandoutDaphneNo ratings yet

- Error CorrectionDocument2 pagesError CorrectionArnyl ReyesNo ratings yet

- Financial Accounting ProcessDocument7 pagesFinancial Accounting ProcessElla TuratoNo ratings yet

- May 2020 Error SHE Intangibles Liabilities LeasesDocument14 pagesMay 2020 Error SHE Intangibles Liabilities Leasesiraleigh17No ratings yet

- Audit of Receivables: Problem No. 1Document6 pagesAudit of Receivables: Problem No. 1Kathrina RoxasNo ratings yet

- Adjustments Quiz 1Document5 pagesAdjustments Quiz 1Christine Mae BurgosNo ratings yet

- Error Correction Sample ProblemsDocument42 pagesError Correction Sample ProblemsKatie BarnesNo ratings yet

- Problem 1-1 Effect of Counterbalancing and Non-Counterbalancing ErrorsDocument3 pagesProblem 1-1 Effect of Counterbalancing and Non-Counterbalancing ErrorsandreamrieNo ratings yet

- Accruals and Deferrals ActivityDocument2 pagesAccruals and Deferrals ActivityReese KimNo ratings yet

- ReceivablesDocument9 pagesReceivablesJerric CristobalNo ratings yet

- AP.m 1401 Correction of ErrorsDocument12 pagesAP.m 1401 Correction of ErrorsMark Lord Morales Bumagat75% (4)

- 5 6079864208529295481Document4 pages5 6079864208529295481Razel MhinNo ratings yet

- 2022 S1 2nd Sem Bookkeeping and Accounts Final ExamDocument18 pages2022 S1 2nd Sem Bookkeeping and Accounts Final ExamXuen Khun TanNo ratings yet

- Acctg 9a Midterm Exam CH 9 15 CabreraDocument4 pagesAcctg 9a Midterm Exam CH 9 15 CabreraDonalyn BannagaoNo ratings yet

- Adjusting Entries ActsDocument5 pagesAdjusting Entries ActsLori100% (1)

- Adjusting EntriesDocument7 pagesAdjusting EntriesMichael MagdaogNo ratings yet

- FAR - Midterms and FinalsDocument14 pagesFAR - Midterms and FinalsShanley Vanna EscalonaNo ratings yet

- Adjusting Entries With AnswersDocument7 pagesAdjusting Entries With AnswersMichael Magdaog100% (1)

- NOTES PROBLEMS ACCTG-323-newDocument3 pagesNOTES PROBLEMS ACCTG-323-newJoyluxxiNo ratings yet

- Qa - Installment SalesDocument3 pagesQa - Installment SalesSittie Ainna Acmed UnteNo ratings yet

- HOMEWORK ON CORRECTION OF ERRORS ZoomDocument26 pagesHOMEWORK ON CORRECTION OF ERRORS ZoomJazehl Joy Valdez100% (1)

- Revenue RecognitionDocument6 pagesRevenue RecognitionnaserNo ratings yet

- Auditing Problems QaDocument12 pagesAuditing Problems QaSheena CalderonNo ratings yet

- 2019.1.19 20 Aud Prob Error Correction Cash Inventory Non Financial Assets Equity PDFDocument25 pages2019.1.19 20 Aud Prob Error Correction Cash Inventory Non Financial Assets Equity PDFMae-shane SagayoNo ratings yet

- Error Correction Problem 1: Lord Gen A. Rilloraza, CPADocument5 pagesError Correction Problem 1: Lord Gen A. Rilloraza, CPAMae-shane SagayoNo ratings yet

- Exam-First YearDocument4 pagesExam-First YearJohnAllenMarillaNo ratings yet

- (169472718) MODAUD1 UNIT 1 - Analysis and Correction of ErrorsDocument5 pages(169472718) MODAUD1 UNIT 1 - Analysis and Correction of ErrorsJervin LabroNo ratings yet

- Assignment Fin AccDocument4 pagesAssignment Fin AccShaira SalandaNo ratings yet

- Auditing Problem ReviewerDocument10 pagesAuditing Problem ReviewerTina Llorca83% (6)

- Quiz ZDocument5 pagesQuiz ZShannen CalimagNo ratings yet

- (Template) Assignment - Audit of InventoriesDocument5 pages(Template) Assignment - Audit of InventoriesEdemson NavalesNo ratings yet

- Sample Problem AdjustingDocument17 pagesSample Problem AdjustingHanna Mae CatudayNo ratings yet

- Ad2 1Document13 pagesAd2 1MarjorieNo ratings yet

- Review of The Accounting ProcessDocument4 pagesReview of The Accounting ProcessAngel TumamaoNo ratings yet

- Review of The Accounting ProcessDocument4 pagesReview of The Accounting ProcessMichael Vincent Buan Suico100% (1)

- Hakdog PDFDocument18 pagesHakdog PDFJay Mark AbellarNo ratings yet

- Reviewer Interm 2Document3 pagesReviewer Interm 2Mae DionisioNo ratings yet

- Adjustments Quiz 1Document6 pagesAdjustments Quiz 1Christine Mae BurgosNo ratings yet

- AUDITING-Adjusting Entries-Correction of ErrorsDocument10 pagesAUDITING-Adjusting Entries-Correction of ErrorsJamhel MarquezNo ratings yet

- RP - Working Capital AuditDocument7 pagesRP - Working Capital AuditViky Rose EballeNo ratings yet

- Problem 1Document3 pagesProblem 1Robert Daniel Aquino0% (1)

- PRTC Cup 2017Document18 pagesPRTC Cup 2017Sherrizah Ferrer MaribbayNo ratings yet

- D22 TX ZAF FinalDocument14 pagesD22 TX ZAF FinalmunyaradziNo ratings yet

- Acctg 205B Prelim ExamDocument1 pageAcctg 205B Prelim ExamBella AyabNo ratings yet

- Orca Share Media1583315619577Document13 pagesOrca Share Media1583315619577Sebastian Vincent Pulga PedrosaNo ratings yet

- Lesson 1 ExtendDocument6 pagesLesson 1 ExtendRoel Cababao50% (2)

- A221 - Self-Study Chapter 3Document8 pagesA221 - Self-Study Chapter 3Shairah SaifullNo ratings yet

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 3.5 out of 5 stars3.5/5 (2)

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- The Barrington Guide to Property Management Accounting: The Definitive Guide for Property Owners, Managers, Accountants, and Bookkeepers to ThriveFrom EverandThe Barrington Guide to Property Management Accounting: The Definitive Guide for Property Owners, Managers, Accountants, and Bookkeepers to ThriveNo ratings yet

- Financial Analysis 101: An Introduction to Analyzing Financial Statements for beginnersFrom EverandFinancial Analysis 101: An Introduction to Analyzing Financial Statements for beginnersNo ratings yet

- How an Experienced Real Estate Professional Lost a Million Dollars on a Small Apartment ProjectFrom EverandHow an Experienced Real Estate Professional Lost a Million Dollars on a Small Apartment ProjectNo ratings yet

- Portfolio Manager's Review: The Magic Formula Issue, by The Manual of IdeasDocument401 pagesPortfolio Manager's Review: The Magic Formula Issue, by The Manual of IdeasThe Manual of Ideas100% (2)

- Tax Case Digest 5Document11 pagesTax Case Digest 5Tammy YahNo ratings yet

- Idioms BussinesDocument33 pagesIdioms Bussinesmadalinam78No ratings yet

- Pepsi Mechanical EngineerDocument21 pagesPepsi Mechanical Engineerlennardo LeslieNo ratings yet

- Schlegelmilch 2003Document18 pagesSchlegelmilch 2003Prijoy JaniNo ratings yet

- Materi Transfer PricingDocument20 pagesMateri Transfer Pricingteamjkt48merchNo ratings yet

- CABINAS - Partnership Formation & OperationDocument16 pagesCABINAS - Partnership Formation & OperationJoshua CabinasNo ratings yet

- 2012 Itr1 Pr21Document5 pages2012 Itr1 Pr21MRLogan123No ratings yet

- Upto 1000 Solved MCQs of MKT501 Marketing Management WWW - VustudentsDocument228 pagesUpto 1000 Solved MCQs of MKT501 Marketing Management WWW - VustudentsLyla Abbas Khan100% (24)

- Financial Forecasting For Strategic GrowthDocument3 pagesFinancial Forecasting For Strategic GrowthVergel MartinezNo ratings yet

- Analisis Kelayak Investasi PT. Pertamina Patra Niaga Dalam Kerjasama Pembangunan Pengoperasian Terminal Aspal Curah DumaiDocument142 pagesAnalisis Kelayak Investasi PT. Pertamina Patra Niaga Dalam Kerjasama Pembangunan Pengoperasian Terminal Aspal Curah DumaibustamilNo ratings yet

- VCOSS VICBUDGET UPDATE Web PDFDocument10 pagesVCOSS VICBUDGET UPDATE Web PDFVCOSSNo ratings yet

- CM Assignment - 1Document10 pagesCM Assignment - 1Sanjana SinghNo ratings yet

- Ab 3Document2 pagesAb 3sanpoung809No ratings yet

- SPYKAR JEANS (1) ................ WordDocument21 pagesSPYKAR JEANS (1) ................ WordNishant Bhimraj Ramteke75% (4)

- The All Consuming Nation Chasing The American Dream Since World War Ii Lytle Full ChapterDocument67 pagesThe All Consuming Nation Chasing The American Dream Since World War Ii Lytle Full Chaptertodd.thompson395100% (11)

- Leverage Represents The Use of Fixed Costs Items To Magnify The Firm'sDocument19 pagesLeverage Represents The Use of Fixed Costs Items To Magnify The Firm'sAngela Dela PeñaNo ratings yet

- Consumer Behaviour Towards Big BazaarDocument87 pagesConsumer Behaviour Towards Big BazaarRahul Pandey71% (28)

- CCAPM EPP 2017 Final SlidesDocument52 pagesCCAPM EPP 2017 Final SlidesEbenezerNo ratings yet

- Thanapriya SOP - CompressedDocument7 pagesThanapriya SOP - CompressedlkayoungcplNo ratings yet

- Annual Report 2020 21 VFinalDocument400 pagesAnnual Report 2020 21 VFinalKshitij SrivastavaNo ratings yet

- Betting On The Blind Side - Vanity FairDocument3 pagesBetting On The Blind Side - Vanity FairSww WisdomNo ratings yet

- Compute For The Unit Contribution MarginDocument9 pagesCompute For The Unit Contribution Marginmusic niNo ratings yet

- BZ Us Top 100 Report DLDocument97 pagesBZ Us Top 100 Report DLClaudiuNo ratings yet

- Tata Steel Corus Acquisition Financial DetailsDocument6 pagesTata Steel Corus Acquisition Financial DetailsSandarbh Agarwal0% (1)

- Strategy Implementation Strategy Implementation and Its ProcessDocument4 pagesStrategy Implementation Strategy Implementation and Its ProcessReymond AdayaNo ratings yet

- MWG CEO Bai Thuyet Trinh FINAL BAN TIENG ANHDocument21 pagesMWG CEO Bai Thuyet Trinh FINAL BAN TIENG ANHRandyNo ratings yet

- Principles of Management Set 1Document6 pagesPrinciples of Management Set 1prolay80No ratings yet

- Managerial Accounting Solutions Chapter 3 PDFDocument42 pagesManagerial Accounting Solutions Chapter 3 PDFadam_garcia_81No ratings yet

- Sanjay Kanojiya-ElectricalDocument1 pageSanjay Kanojiya-ElectricalAMANNo ratings yet

Error Correction Exercise (2021-2022 2nd Sem) Test

Error Correction Exercise (2021-2022 2nd Sem) Test

Uploaded by

EMELY EMELYOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Error Correction Exercise (2021-2022 2nd Sem) Test

Error Correction Exercise (2021-2022 2nd Sem) Test

Uploaded by

EMELY EMELYCopyright:

Available Formats

ASSIGNMENT – ERROR CORRECTION

I.When the records of Merlitaw Merchandising Company were reviewed at the close of 2013, the

errors listed below were discovered.

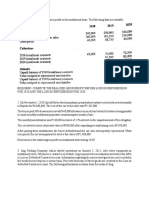

1. For each item, indicate the effects of each of the following errors by writing O for

overstatement, U for understatement and X for no effect in the appropriate column.

2012 2013

Re, Re,

N Asse Liabilit RE,before after N Asse Liabilit RE,before after

I t y closing closing I t y closing closing

Failure to record purchases

of merchandise

on account of

P25,000 at the end of 2012.

Sale of merchandise on account on

December 30,2012 amounting to

P20,000

was not recorded until the customer

paid his account on january 2013.

Depreciation expense on equipment

in 2012 was overstated by P10,000.

Paid one year insurance premium of

P24,00 effective April 1,2012.

The entire amount was debited to

expense account and no adjustment

was made at the end of 2012.

On December 31,2012, the

Company acquired a parcel of land

and a building at a total cost of

P500,000. The entire amount paid

was debited to land account. A

reasonable estimate of the cost

that should have been alocated to

the building was P200,000. The

building has an estimated life

of 20 years.

Failure to record supplies on hand

at the end of 2012. The supplies

on hand amounted to P5,000.

Understatement of 2012 ending

inventory worth P24,000.

Failure to record accrued interest

on notes payable at the end of

2012.Notes payable,principal

amount P100,000;interest rate,

10%;acquired March 31,2012.

Failure to recognize unearned rent

at the end of 2012 worth P12,000.

Goods received in December 2012

were recorded as purchases when

paid in 2013. The goods were

excluded

from the 2012 ending inventory.

II.The income statement of Menand Inc. showed the following net income:

2020 P1,750,000

2021 2,000,000

An examination of the accounting records for the year ended December 31,2014 revealed that

several errors were made. The following errors were discovered:

a. Salary accrued at year end and were consistently omitted:

2020 P100,000

2021 140,000

b. The footings and extensions showed that the inventory on December 31,2020 was overstated

by P190,000.

c. Prepaid insurance of P120,000 applicable to 2022 was expensed in 2021.

d. Interest receivable of p20,000 was not recorded on December 31,2021.

e. On December 26,2021 an equipment costing P400,000 was sold for P220,000. At the date of

sale, the equipment had an accumulated depreciation of P240,000. The cash received was

recorded as miscellaneous income in 2021.

f. A building which had a fair value of P1,200,000 was accepted form the city government as a

donation on January 1.2020. The building that was estimated to be useful for another 10

years was to be used as factory site as a condition on the grant. Legal fees incurred in

relation to the donation was at P100,000 and was charged to 2020 operating expenses.

Another P200,000 was incurred to remodel and renovate the building prior to use. The

building was capitalized at P200,000 (renovation cost) and was depreciated over remaining

life using straight line.

Required:

1. Correct net income in 2020.

2. Correct net income in 2021.

3. What is the retroactive adjustment to the 2022 beginning retained earnings ?

4. What is the net effect of errors to the 2021 working capital?

5. What is the correct carrying value of the building as of December 31,2021?

You might also like

- Notre Dame Educational Association: Mock Board Examination Financial Accounting and ReportingDocument17 pagesNotre Dame Educational Association: Mock Board Examination Financial Accounting and Reportingirishjade100% (1)

- Exercises. Correction of ErrorsDocument7 pagesExercises. Correction of ErrorsGia Sarah Barillo BandolaNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Apr 4/accounting For Business Combinations: General InstructionDocument8 pagesApr 4/accounting For Business Combinations: General InstructionJoannah maeNo ratings yet

- Unit 1. HandoutDocument3 pagesUnit 1. HandoutDaphneNo ratings yet

- Error CorrectionDocument2 pagesError CorrectionArnyl ReyesNo ratings yet

- Financial Accounting ProcessDocument7 pagesFinancial Accounting ProcessElla TuratoNo ratings yet

- May 2020 Error SHE Intangibles Liabilities LeasesDocument14 pagesMay 2020 Error SHE Intangibles Liabilities Leasesiraleigh17No ratings yet

- Audit of Receivables: Problem No. 1Document6 pagesAudit of Receivables: Problem No. 1Kathrina RoxasNo ratings yet

- Adjustments Quiz 1Document5 pagesAdjustments Quiz 1Christine Mae BurgosNo ratings yet

- Error Correction Sample ProblemsDocument42 pagesError Correction Sample ProblemsKatie BarnesNo ratings yet

- Problem 1-1 Effect of Counterbalancing and Non-Counterbalancing ErrorsDocument3 pagesProblem 1-1 Effect of Counterbalancing and Non-Counterbalancing ErrorsandreamrieNo ratings yet

- Accruals and Deferrals ActivityDocument2 pagesAccruals and Deferrals ActivityReese KimNo ratings yet

- ReceivablesDocument9 pagesReceivablesJerric CristobalNo ratings yet

- AP.m 1401 Correction of ErrorsDocument12 pagesAP.m 1401 Correction of ErrorsMark Lord Morales Bumagat75% (4)

- 5 6079864208529295481Document4 pages5 6079864208529295481Razel MhinNo ratings yet

- 2022 S1 2nd Sem Bookkeeping and Accounts Final ExamDocument18 pages2022 S1 2nd Sem Bookkeeping and Accounts Final ExamXuen Khun TanNo ratings yet

- Acctg 9a Midterm Exam CH 9 15 CabreraDocument4 pagesAcctg 9a Midterm Exam CH 9 15 CabreraDonalyn BannagaoNo ratings yet

- Adjusting Entries ActsDocument5 pagesAdjusting Entries ActsLori100% (1)

- Adjusting EntriesDocument7 pagesAdjusting EntriesMichael MagdaogNo ratings yet

- FAR - Midterms and FinalsDocument14 pagesFAR - Midterms and FinalsShanley Vanna EscalonaNo ratings yet

- Adjusting Entries With AnswersDocument7 pagesAdjusting Entries With AnswersMichael Magdaog100% (1)

- NOTES PROBLEMS ACCTG-323-newDocument3 pagesNOTES PROBLEMS ACCTG-323-newJoyluxxiNo ratings yet

- Qa - Installment SalesDocument3 pagesQa - Installment SalesSittie Ainna Acmed UnteNo ratings yet

- HOMEWORK ON CORRECTION OF ERRORS ZoomDocument26 pagesHOMEWORK ON CORRECTION OF ERRORS ZoomJazehl Joy Valdez100% (1)

- Revenue RecognitionDocument6 pagesRevenue RecognitionnaserNo ratings yet

- Auditing Problems QaDocument12 pagesAuditing Problems QaSheena CalderonNo ratings yet

- 2019.1.19 20 Aud Prob Error Correction Cash Inventory Non Financial Assets Equity PDFDocument25 pages2019.1.19 20 Aud Prob Error Correction Cash Inventory Non Financial Assets Equity PDFMae-shane SagayoNo ratings yet

- Error Correction Problem 1: Lord Gen A. Rilloraza, CPADocument5 pagesError Correction Problem 1: Lord Gen A. Rilloraza, CPAMae-shane SagayoNo ratings yet

- Exam-First YearDocument4 pagesExam-First YearJohnAllenMarillaNo ratings yet

- (169472718) MODAUD1 UNIT 1 - Analysis and Correction of ErrorsDocument5 pages(169472718) MODAUD1 UNIT 1 - Analysis and Correction of ErrorsJervin LabroNo ratings yet

- Assignment Fin AccDocument4 pagesAssignment Fin AccShaira SalandaNo ratings yet

- Auditing Problem ReviewerDocument10 pagesAuditing Problem ReviewerTina Llorca83% (6)

- Quiz ZDocument5 pagesQuiz ZShannen CalimagNo ratings yet

- (Template) Assignment - Audit of InventoriesDocument5 pages(Template) Assignment - Audit of InventoriesEdemson NavalesNo ratings yet

- Sample Problem AdjustingDocument17 pagesSample Problem AdjustingHanna Mae CatudayNo ratings yet

- Ad2 1Document13 pagesAd2 1MarjorieNo ratings yet

- Review of The Accounting ProcessDocument4 pagesReview of The Accounting ProcessAngel TumamaoNo ratings yet

- Review of The Accounting ProcessDocument4 pagesReview of The Accounting ProcessMichael Vincent Buan Suico100% (1)

- Hakdog PDFDocument18 pagesHakdog PDFJay Mark AbellarNo ratings yet

- Reviewer Interm 2Document3 pagesReviewer Interm 2Mae DionisioNo ratings yet

- Adjustments Quiz 1Document6 pagesAdjustments Quiz 1Christine Mae BurgosNo ratings yet

- AUDITING-Adjusting Entries-Correction of ErrorsDocument10 pagesAUDITING-Adjusting Entries-Correction of ErrorsJamhel MarquezNo ratings yet

- RP - Working Capital AuditDocument7 pagesRP - Working Capital AuditViky Rose EballeNo ratings yet

- Problem 1Document3 pagesProblem 1Robert Daniel Aquino0% (1)

- PRTC Cup 2017Document18 pagesPRTC Cup 2017Sherrizah Ferrer MaribbayNo ratings yet

- D22 TX ZAF FinalDocument14 pagesD22 TX ZAF FinalmunyaradziNo ratings yet

- Acctg 205B Prelim ExamDocument1 pageAcctg 205B Prelim ExamBella AyabNo ratings yet

- Orca Share Media1583315619577Document13 pagesOrca Share Media1583315619577Sebastian Vincent Pulga PedrosaNo ratings yet

- Lesson 1 ExtendDocument6 pagesLesson 1 ExtendRoel Cababao50% (2)

- A221 - Self-Study Chapter 3Document8 pagesA221 - Self-Study Chapter 3Shairah SaifullNo ratings yet

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 3.5 out of 5 stars3.5/5 (2)

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- The Barrington Guide to Property Management Accounting: The Definitive Guide for Property Owners, Managers, Accountants, and Bookkeepers to ThriveFrom EverandThe Barrington Guide to Property Management Accounting: The Definitive Guide for Property Owners, Managers, Accountants, and Bookkeepers to ThriveNo ratings yet

- Financial Analysis 101: An Introduction to Analyzing Financial Statements for beginnersFrom EverandFinancial Analysis 101: An Introduction to Analyzing Financial Statements for beginnersNo ratings yet

- How an Experienced Real Estate Professional Lost a Million Dollars on a Small Apartment ProjectFrom EverandHow an Experienced Real Estate Professional Lost a Million Dollars on a Small Apartment ProjectNo ratings yet

- Portfolio Manager's Review: The Magic Formula Issue, by The Manual of IdeasDocument401 pagesPortfolio Manager's Review: The Magic Formula Issue, by The Manual of IdeasThe Manual of Ideas100% (2)

- Tax Case Digest 5Document11 pagesTax Case Digest 5Tammy YahNo ratings yet

- Idioms BussinesDocument33 pagesIdioms Bussinesmadalinam78No ratings yet

- Pepsi Mechanical EngineerDocument21 pagesPepsi Mechanical Engineerlennardo LeslieNo ratings yet

- Schlegelmilch 2003Document18 pagesSchlegelmilch 2003Prijoy JaniNo ratings yet

- Materi Transfer PricingDocument20 pagesMateri Transfer Pricingteamjkt48merchNo ratings yet

- CABINAS - Partnership Formation & OperationDocument16 pagesCABINAS - Partnership Formation & OperationJoshua CabinasNo ratings yet

- 2012 Itr1 Pr21Document5 pages2012 Itr1 Pr21MRLogan123No ratings yet

- Upto 1000 Solved MCQs of MKT501 Marketing Management WWW - VustudentsDocument228 pagesUpto 1000 Solved MCQs of MKT501 Marketing Management WWW - VustudentsLyla Abbas Khan100% (24)

- Financial Forecasting For Strategic GrowthDocument3 pagesFinancial Forecasting For Strategic GrowthVergel MartinezNo ratings yet

- Analisis Kelayak Investasi PT. Pertamina Patra Niaga Dalam Kerjasama Pembangunan Pengoperasian Terminal Aspal Curah DumaiDocument142 pagesAnalisis Kelayak Investasi PT. Pertamina Patra Niaga Dalam Kerjasama Pembangunan Pengoperasian Terminal Aspal Curah DumaibustamilNo ratings yet

- VCOSS VICBUDGET UPDATE Web PDFDocument10 pagesVCOSS VICBUDGET UPDATE Web PDFVCOSSNo ratings yet

- CM Assignment - 1Document10 pagesCM Assignment - 1Sanjana SinghNo ratings yet

- Ab 3Document2 pagesAb 3sanpoung809No ratings yet

- SPYKAR JEANS (1) ................ WordDocument21 pagesSPYKAR JEANS (1) ................ WordNishant Bhimraj Ramteke75% (4)

- The All Consuming Nation Chasing The American Dream Since World War Ii Lytle Full ChapterDocument67 pagesThe All Consuming Nation Chasing The American Dream Since World War Ii Lytle Full Chaptertodd.thompson395100% (11)

- Leverage Represents The Use of Fixed Costs Items To Magnify The Firm'sDocument19 pagesLeverage Represents The Use of Fixed Costs Items To Magnify The Firm'sAngela Dela PeñaNo ratings yet

- Consumer Behaviour Towards Big BazaarDocument87 pagesConsumer Behaviour Towards Big BazaarRahul Pandey71% (28)

- CCAPM EPP 2017 Final SlidesDocument52 pagesCCAPM EPP 2017 Final SlidesEbenezerNo ratings yet

- Thanapriya SOP - CompressedDocument7 pagesThanapriya SOP - CompressedlkayoungcplNo ratings yet

- Annual Report 2020 21 VFinalDocument400 pagesAnnual Report 2020 21 VFinalKshitij SrivastavaNo ratings yet

- Betting On The Blind Side - Vanity FairDocument3 pagesBetting On The Blind Side - Vanity FairSww WisdomNo ratings yet

- Compute For The Unit Contribution MarginDocument9 pagesCompute For The Unit Contribution Marginmusic niNo ratings yet

- BZ Us Top 100 Report DLDocument97 pagesBZ Us Top 100 Report DLClaudiuNo ratings yet

- Tata Steel Corus Acquisition Financial DetailsDocument6 pagesTata Steel Corus Acquisition Financial DetailsSandarbh Agarwal0% (1)

- Strategy Implementation Strategy Implementation and Its ProcessDocument4 pagesStrategy Implementation Strategy Implementation and Its ProcessReymond AdayaNo ratings yet

- MWG CEO Bai Thuyet Trinh FINAL BAN TIENG ANHDocument21 pagesMWG CEO Bai Thuyet Trinh FINAL BAN TIENG ANHRandyNo ratings yet

- Principles of Management Set 1Document6 pagesPrinciples of Management Set 1prolay80No ratings yet

- Managerial Accounting Solutions Chapter 3 PDFDocument42 pagesManagerial Accounting Solutions Chapter 3 PDFadam_garcia_81No ratings yet

- Sanjay Kanojiya-ElectricalDocument1 pageSanjay Kanojiya-ElectricalAMANNo ratings yet