Professional Documents

Culture Documents

Chapter 13C Optional Standard Deductions

Chapter 13C Optional Standard Deductions

Uploaded by

Jason MablesOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 13C Optional Standard Deductions

Chapter 13C Optional Standard Deductions

Uploaded by

Jason MablesCopyright:

Available Formats

CHAPTER 13-C

OPTIONAL STANDARD DEDUCTIONS

Learning Objectives:

This chapter, readers are expected to demonstrate:

1. Understanding of the nature of the optional standard deduction (OSD)

2. Knowledge of the taxpayers who can claim the OSD

3. Comprehension of the concept of operating income or revenue and a non-operating income for individual

taxpayers

4. Comprehension of the rules of OSD for general professional partnership and the partners

OPTIONAL STANDARD DEDUCTION (OSD)

The OSD is in lieu of the itemized deductions including NOLCO allowable under the NIRC and special laws.

Under the OSD, the allowable deduction of the taxpayer is simply presumed as a percentage of gross sales or

receipt for individuals and gross income for corporations. There is no need to support every item of expense.

The OSD, however, does not relieve the taxpayer of the responsibility to deduct withholding tax on certain

income payments as required by the NIRC.

Who can claim OSD?

As a rule, all taxpayers who are subject to tax on taxable net income can claim deductions except the

following:

A. Non-resident alien engaged in trade or business (NRA-ETB)

B. Taxpayers mandated to use itemized deductions

Mandatory itemized deductions (RR2-2014)

1. Corporations mandated to use the itemized deductions:

a. Exempt GOCCs and non-stock, non-profit corporations with no taxable income

b. Those with income subject to special/preferential tax rates

c. Those with income subject to regular corporate income tax and special preferential tax

2. Individual taxpayers mandated to use the itemized deductions:

a. Exempt individuals under the NIRC and special laws with no other taxable income

b. Those with income subject to special/preferential tax rates

c. Those with income subject to regular income tax and special/preferential income tax

3. Non-resident alien not engaged in trade or business

PERCENTAGE OF OPTIONAL STANDARD DEDUCTIONS

1. Individual taxpayers - 40% of total sales/revenues/receipts/fees

Those selling goods under the accrual basis - 40% of gross sales

Those selling goods under the cash basis - 40% of gross receipts

Those selling services under the accrual basis - 40% of revenue

2. Corporate taxpayers - 40% of gross income

The Individual OSD

Since the OSD of individuals is based on gross receipts or gross sales, it is deemed to replace all items of

deductions against gross receipts or gross sales in computing net income, such as:

The Corporate OSD

Since the corporate OSD is based on gross income, it is deemed to replace all items of deductions from gross

income in computing net income.

Table of Comparison on OSD:

Individual OSD replaces Corporate OSD replaces

Cost of sales/cost of services? YES NO

Regular Allowable Itemized? YES YES

Special Allowable Deductions? YES YES

Net Operating loss carry-over? YES YES

Personal Exemption? NO Not Applicable

RULES ON DETERMINATION OF OSD FOR INDIVIDUAL TAXPAYERS

Gross Sales - As clarified by RR16-2008, gross sales is the accounting concept of net sales

Gross Receipts - Amounts actually or constructively received during the taxable year or amounts earned as

gross revenue during the taxable year.

The optional standard deduction for individual taxpayers is specifically computed as:

Net Sales/Revenues/Receipts/Fees P xxx,xxx

Add: Other taxable income from operation

Not subject to final tax P xxx,xxx

Total Sales/Revenues/Receipts/Fees P xxx,xxx

Multiply by: OSD percentage 40%

Optional Standard Deduction P xxx,xxx

Other taxable income from operations not subject to final tax

This includes those revenues or receipts arising from incidental or secondary operations of business or

profession.

Establishment Primary Income Other Operating Income

Retail Stores Sales of Goods Consignment commission

Display rack rental

Manufacturing Business Sales of Goods Sale of scrap

Installment Dealers Sales of Goods Interest Income

Accounting Firm Professional Fees Income from seminars

Interest from client notes

Reimbursement for out-of-pocket

expenses

Non-operating income

1. Gains from dealings in properties

2. Distribution from a GPP, exempt, co-ownership and taxable estates or trusts

3. Casual active income

4. Passive income or those not connected to the primary or secondary activities of the business such as:

a. Interest income on advances to employees

b. Investment income subject to regular tax

RULES ON DETERMINATION OF OSD FOR CORPORATE TAXPAYERS

Gross Income

Under NIRC, gross income was restrictively defined as:

a. The gross sales less sales return, discounts and allowances and cost of sales, or

b. Gross receipts, less sales returns, discounts and allowances and cost of services

However, under the amendment introduced by RA 9504, gross income for purposes of the corporate OSD

pertains to all gross income subject to the regular income tax. There is no distinction between gross income

from operations and gross income from non-operating sources. Thus, the corporate OSD is computed as

follows:

Net Sales/Revenues/Receipts/Fees P xxx,xxx

Less: Cost of sales or services P xxx,xxx

Gross income from operations P xxx,xxx

Add: Other taxable income, not subject to final tax P xxx,xxx

Total Gross income P xxx,xxx

Multiply by: OSD percentage 40%

Optional Standard Deduction P xxx,xxx

OSD FOR GENERAL PROFESSIONAL PARTNERSHIPS

A GPP is not a taxable entity. It is merely viewed as a “pass-through” entity where income is ultimately taxed

to the partners. Each partner shall report as gross income his distributive share, actually or constructively

received, in the net income of the GPP.

Determination of net income of a GPP

For purposes of computing the distributive share of the partners, the net income of the partnership shall be

computed in the same manner as a corporation.

Thus, the GPP can choose either the itemized deduction or the optional standard deduction in computing its

net income. The allowable deduction for a GPP electing to deduct OSD shall be 40% of gross income similar to

corporations.

Deduction against partner’s share in net income

A partner can claim itemized deductions which are in the nature of an ordinary and necessary expense for the

practice of profession which were not claimed by the GPP in computing its net income during the year. These

may include expenses incurred by the partner in connection with the performance of his duties to the GPP

that are, by agreement, non-reimbursable by or non-chargeable to the GPP.

Conditions for deductibility of partner’s expenses

A partner can claim only itemized deductions from his share in the net income of a GPP, provided that the GPP

also uses Itemized deductions in computing its distributive net income.

A partner cannot claim OSD against his share in the net income because the same is an item of gross income,

not a revenue, sale, fee, or receipt. Note that for individual taxpayers, OSD is deductible only against gross

sales, gross receipts, or revenue but not against gross income.

The following table summarizes the rules:

GPP mode of deduction Partner’s mode of deduction Status

Itemized Itemized Allowed

Itemized OSD Not allowed

OSD Itemized Not allowed

OSD OSD Not allowed

Share in the net income vs. Actual profit distribution

The share in the net income is computed from the net income of the GPP as determined by tax rules. The

actual profit distribution is computed from net income as determined by generally accepted accounting rules.

The latter is the actual amount of profit that will be transferred to the capital of each partner.

These two normally differ because of the following:

a. Deductibility limits or requirements on some items of deductions

b. Use of OSD by the GPP

You might also like

- Gann Wave Order Block Trading Master Active Trading With ProvenDocument107 pagesGann Wave Order Block Trading Master Active Trading With Provenjakhotiasarvesh9100% (3)

- Regular Income Tax - Itemized DeductionsDocument12 pagesRegular Income Tax - Itemized DeductionsJaneNo ratings yet

- Chapter 5 Final Income Taxation Summary BanggawanDocument8 pagesChapter 5 Final Income Taxation Summary Banggawanyours truly,100% (3)

- Income-Tax-Banggawan 2019-cr7 Compress Income-Tax-Banggawan 2019-cr7 CompressDocument11 pagesIncome-Tax-Banggawan 2019-cr7 Compress Income-Tax-Banggawan 2019-cr7 CompressEarth PirapatNo ratings yet

- Shareholders Equity Problems - Answers 1Document5 pagesShareholders Equity Problems - Answers 1hyunsuk fhebieNo ratings yet

- M6 - Deductions P4 (13C) Students'Document43 pagesM6 - Deductions P4 (13C) Students'micaella pasionNo ratings yet

- Practice Exercises: Donor'S TaxDocument37 pagesPractice Exercises: Donor'S TaxErica NicolasuraNo ratings yet

- Franco FM Taxation 7Document4 pagesFranco FM Taxation 7Kim FloresNo ratings yet

- Business and Transfer Taxation Chapter 13A Discussion Questions AnswerDocument2 pagesBusiness and Transfer Taxation Chapter 13A Discussion Questions AnswerKarla Faye Lagang100% (1)

- Chapter 14 Income Taxation For IndividualsDocument19 pagesChapter 14 Income Taxation For IndividualsShane Sigua-Salcedo100% (2)

- Lesson 2 Percentage TaxesDocument15 pagesLesson 2 Percentage Taxesman ibeNo ratings yet

- Unit 6 Supply Chain ManagementDocument33 pagesUnit 6 Supply Chain Managementटलक जंग सरकारNo ratings yet

- Chapter 13B Special Allowable Itemized DeductionsDocument3 pagesChapter 13B Special Allowable Itemized DeductionsJason Mables100% (1)

- Chapter 13a Regular Allowable Itemized DeductionsDocument6 pagesChapter 13a Regular Allowable Itemized DeductionsJason Mables100% (1)

- Chap. 6 8Document44 pagesChap. 6 82vpsrsmg7jNo ratings yet

- 8% Income Tax OptionDocument14 pages8% Income Tax OptionZaaavnn VannnnnNo ratings yet

- Bus Tax Chap 6Document3 pagesBus Tax Chap 6yayayaNo ratings yet

- .Arch94-03 - Corporate Income TaxationDocument18 pages.Arch94-03 - Corporate Income TaxationShintaro KisaragiNo ratings yet

- Chapter 10 Tabag - Serrano NotesDocument5 pagesChapter 10 Tabag - Serrano NotesNatalie SerranoNo ratings yet

- AIS Chap 9 NotesDocument7 pagesAIS Chap 9 NotesKrisshaNo ratings yet

- Chapter 6 Income Tax by Banggawan Chapter 6 Income Tax by BanggawanDocument11 pagesChapter 6 Income Tax by Banggawan Chapter 6 Income Tax by BanggawanEarth PirapatNo ratings yet

- Chapter 12 Dealings in PropertiesDocument6 pagesChapter 12 Dealings in PropertiesAlyssa BerangberangNo ratings yet

- Lim Tax 5 Quiz AnswerDocument4 pagesLim Tax 5 Quiz AnswerIvan AnaboNo ratings yet

- Income TaxationDocument39 pagesIncome TaxationMerlajoy VillanuevaNo ratings yet

- Chapter 7 Introduction To Regular Income TaxDocument18 pagesChapter 7 Introduction To Regular Income TaxDANICKA JANE ENERONo ratings yet

- Activity Chapter 1: Ans. SolutionDocument3 pagesActivity Chapter 1: Ans. SolutionRandelle James Fiesta100% (1)

- Chapter 6 To Chapter 8Document4 pagesChapter 6 To Chapter 8Jarren BasilanNo ratings yet

- Tandem Activity GE Allowable DeductionsDocument6 pagesTandem Activity GE Allowable DeductionsErin CruzNo ratings yet

- Chapter 15 Regular Income Taxation CorporationsDocument9 pagesChapter 15 Regular Income Taxation CorporationsMary Jane PabroaNo ratings yet

- Chapter 13 Principles of DeductionDocument5 pagesChapter 13 Principles of DeductionJason Mables100% (1)

- 02 Handout 1Document9 pages02 Handout 1PopoyNo ratings yet

- Chapter 7 Introduction To Regular Income TaxationDocument8 pagesChapter 7 Introduction To Regular Income TaxationJason MablesNo ratings yet

- CA 51014 - Strategic Cost Management Capital BudgetingDocument9 pagesCA 51014 - Strategic Cost Management Capital BudgetingMark FloresNo ratings yet

- Chapter 15 BDocument3 pagesChapter 15 BErinNo ratings yet

- Taxation CH 5Document6 pagesTaxation CH 5Kristel Nuyda LobasNo ratings yet

- Chapter 1 Introduction To Business Taxes PDFDocument6 pagesChapter 1 Introduction To Business Taxes PDFDudz Matienzo100% (1)

- Case Study-Hain Celestial: Student Name Institution Affiliation DateDocument5 pagesCase Study-Hain Celestial: Student Name Institution Affiliation DategeofreyNo ratings yet

- Article 1828-1867Document5 pagesArticle 1828-1867ChaNo ratings yet

- VAT - OPT Illustrative ExamplesDocument6 pagesVAT - OPT Illustrative ExamplesFerb CruzadaNo ratings yet

- Chapter 8 Exclusions From Gross IncomeDocument4 pagesChapter 8 Exclusions From Gross IncomeMary Jane PabroaNo ratings yet

- Tax Reviewer (Mfp-2)Document13 pagesTax Reviewer (Mfp-2)Mikaela Pamatmat100% (1)

- Intermediate Accounting 3 1. Chapter 4: Share-Based Payments (Part 2)Document5 pagesIntermediate Accounting 3 1. Chapter 4: Share-Based Payments (Part 2)happy240823100% (1)

- MSQ 02 Variable Absorption CostingDocument11 pagesMSQ 02 Variable Absorption CostingDanica ConcepcionNo ratings yet

- Quiz 2 ExclusionsDocument3 pagesQuiz 2 ExclusionshotgirlsummerNo ratings yet

- Passive Income Subject To Final TaxDocument2 pagesPassive Income Subject To Final TaxKyle LauritoNo ratings yet

- Chapter 6: Job Order Costing Exercise 6-1Document25 pagesChapter 6: Job Order Costing Exercise 6-1Iyah AmranNo ratings yet

- Solution To Problem 1-3: Liability For BonusesDocument16 pagesSolution To Problem 1-3: Liability For BonusesNaddieNo ratings yet

- Answers, Solutions and Clarifications To Form 6Document5 pagesAnswers, Solutions and Clarifications To Form 6Annie LindNo ratings yet

- IA3 Chapter 1Document4 pagesIA3 Chapter 1Juliana ChengNo ratings yet

- 2.1.1 Quiz 2 - Answer KeyDocument7 pages2.1.1 Quiz 2 - Answer KeyMark Emil BaritNo ratings yet

- Income Taxation Quiz2Document3 pagesIncome Taxation Quiz2Printing PandaNo ratings yet

- Quizzers On Percentage TaxationDocument10 pagesQuizzers On Percentage Taxation?????No ratings yet

- TAX-1202: Special Allowable Itemized Deductions: - T R S ADocument2 pagesTAX-1202: Special Allowable Itemized Deductions: - T R S AAlexander Dimalipos100% (1)

- Individual Tax Payer - TeachersDocument8 pagesIndividual Tax Payer - TeachersKhervin EvangelistaNo ratings yet

- Regular Income Taxation: Individuals: Chapter Overview and ObjectivesDocument27 pagesRegular Income Taxation: Individuals: Chapter Overview and ObjectivesJane HandumonNo ratings yet

- Chapter 8 Regular Income Tax - Exclusion From Gross IncomeDocument2 pagesChapter 8 Regular Income Tax - Exclusion From Gross IncomeJason MablesNo ratings yet

- Corresponding Supporting ScheduleDocument3 pagesCorresponding Supporting Schedulealmira garciaNo ratings yet

- TAX 1301 Answers Accounting Periods MethodsDocument6 pagesTAX 1301 Answers Accounting Periods Methodsrav dano100% (1)

- Income Tax Banggawan Ch11 CompressDocument10 pagesIncome Tax Banggawan Ch11 CompressRhian BarzanaNo ratings yet

- This Study Resource Was: TAX-702A: Income TAX Rates Corporations (A)Document7 pagesThis Study Resource Was: TAX-702A: Income TAX Rates Corporations (A)Erika Bermas MedenillaNo ratings yet

- Compilation TaxreportingDocument292 pagesCompilation TaxreportingAna Marie VirayNo ratings yet

- CHAPTER 13 C - Optional Standard DeductionDocument2 pagesCHAPTER 13 C - Optional Standard DeductionDeviane CalabriaNo ratings yet

- Deductions From Gross Income PhilDocument7 pagesDeductions From Gross Income PhilchezrginNo ratings yet

- Chapter 1. Presentation of ContentsDocument8 pagesChapter 1. Presentation of ContentsJason MablesNo ratings yet

- Midterm Exam in Life Works and Writings of RizalDocument2 pagesMidterm Exam in Life Works and Writings of RizalJason MablesNo ratings yet

- Chapter 13a Regular Allowable Itemized DeductionsDocument6 pagesChapter 13a Regular Allowable Itemized DeductionsJason Mables100% (1)

- Chapter 6 Capital Gains TaxationDocument34 pagesChapter 6 Capital Gains TaxationJason Mables100% (1)

- Midterm Exam in Economic DevelopmentDocument3 pagesMidterm Exam in Economic DevelopmentJason Mables100% (1)

- Chapter 13 Principles of DeductionDocument5 pagesChapter 13 Principles of DeductionJason Mables100% (1)

- Chapter 10 Compensation IncomeDocument4 pagesChapter 10 Compensation IncomeJason MablesNo ratings yet

- Chapter 7 Introduction To Regular Income TaxationDocument8 pagesChapter 7 Introduction To Regular Income TaxationJason MablesNo ratings yet

- Chapter 9 Regular Income Tax - Inclusion From Gross IncomeDocument5 pagesChapter 9 Regular Income Tax - Inclusion From Gross IncomeJason MablesNo ratings yet

- Chapter 8 Regular Income Tax - Exclusion From Gross IncomeDocument2 pagesChapter 8 Regular Income Tax - Exclusion From Gross IncomeJason MablesNo ratings yet

- Chapter 5 Final Income TaxationDocument26 pagesChapter 5 Final Income TaxationJason MablesNo ratings yet

- Unit Number/ Heading Learning Outcomes: Intermediate Accounting Ii (Ae 16) Learning Material: Other Employee BenefitsDocument7 pagesUnit Number/ Heading Learning Outcomes: Intermediate Accounting Ii (Ae 16) Learning Material: Other Employee BenefitsJason MablesNo ratings yet

- Chapter 2 Value Added Tax On ImportationDocument9 pagesChapter 2 Value Added Tax On ImportationJason MablesNo ratings yet

- Noncurrent Asset Held For SaleDocument8 pagesNoncurrent Asset Held For SaleJason MablesNo ratings yet

- Chapter 13B Special Allowable Itemized DeductionsDocument3 pagesChapter 13B Special Allowable Itemized DeductionsJason Mables100% (1)

- Module 9 Topic 2Document10 pagesModule 9 Topic 2Jason MablesNo ratings yet

- Chapter 1: The Objective of General Purpose Financial ReportingDocument2 pagesChapter 1: The Objective of General Purpose Financial ReportingJason MablesNo ratings yet

- Chapter 1 Introduction To Consumption TaxesDocument6 pagesChapter 1 Introduction To Consumption TaxesJason MablesNo ratings yet

- BSP Organizational StructureDocument1 pageBSP Organizational StructureJason MablesNo ratings yet

- Figure 1. Market Demand Schedule For High Quality Organic BreadDocument12 pagesFigure 1. Market Demand Schedule For High Quality Organic BreadJason MablesNo ratings yet

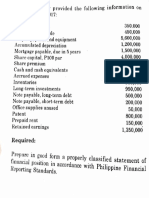

- Assignment 1 Statement of Financial Position-Compressed - Compressed - Compressed-Min-CompressedDocument10 pagesAssignment 1 Statement of Financial Position-Compressed - Compressed - Compressed-Min-CompressedJason MablesNo ratings yet

- Statement of FInancial PositionDocument10 pagesStatement of FInancial PositionJason MablesNo ratings yet

- System Design: Activity-Based Costing and ManagementDocument27 pagesSystem Design: Activity-Based Costing and ManagementJason MablesNo ratings yet

- Lesson 3 Anthropological PerspectiveDocument5 pagesLesson 3 Anthropological PerspectiveJason MablesNo ratings yet

- Chapter 2. Central Bank Origins, Structure, FunctionsDocument6 pagesChapter 2. Central Bank Origins, Structure, FunctionsJason MablesNo ratings yet

- NISM Series XII Securities Markets Foundation Workbook February 2018Document210 pagesNISM Series XII Securities Markets Foundation Workbook February 2018Prajakta Mahadik100% (1)

- Case Study - Brasil FINALDocument39 pagesCase Study - Brasil FINALBruno GrazianiNo ratings yet

- Contract Management in Construction IndustryDocument3 pagesContract Management in Construction IndustryShubham KesarwaniNo ratings yet

- Reviewer For 2nd MTGDocument7 pagesReviewer For 2nd MTGFrancis GuinooNo ratings yet

- Luftman (2000)Document52 pagesLuftman (2000)Siti FauziahNo ratings yet

- Syed Hussein Alatas The Myth of The Lazy Native - A Study of The Image of The Malays, Filipinos and Javanese From The 16th To The 20th Century and Its Function in The IdeoDocument292 pagesSyed Hussein Alatas The Myth of The Lazy Native - A Study of The Image of The Malays, Filipinos and Javanese From The 16th To The 20th Century and Its Function in The IdeomehrdadaraNo ratings yet

- Chapter 1 Module 1 I. Basic Concept in Tourism Planning and DevelopmentDocument5 pagesChapter 1 Module 1 I. Basic Concept in Tourism Planning and DevelopmentRishina CabilloNo ratings yet

- Project Paper ShahriarDocument29 pagesProject Paper ShahriarSyed Md. Shahariar ShamimNo ratings yet

- AP Vision 2029 SummaryDocument24 pagesAP Vision 2029 Summaryrahulsen65100% (1)

- MSF LCR Fallcr Tools For LRM in The Banks 1626896525Document6 pagesMSF LCR Fallcr Tools For LRM in The Banks 1626896525G GNo ratings yet

- The Sunday Times Business 16 July 2023Document14 pagesThe Sunday Times Business 16 July 2023windfieldNo ratings yet

- Role of National and International Community and StateDocument3 pagesRole of National and International Community and StateAashish PokharelNo ratings yet

- Singapore Tour 3DDocument13 pagesSingapore Tour 3DNidhi KaushikNo ratings yet

- CCIT Module 2 - TAXES, TAX LAWS and TAX ADMINISTRATIONDocument15 pagesCCIT Module 2 - TAXES, TAX LAWS and TAX ADMINISTRATIONAngelo OñedoNo ratings yet

- PPR MA Economics 1Document41 pagesPPR MA Economics 1raunakyadav009No ratings yet

- Partnership Formation, Operation, and Change in Ownership: Summary of Items by TopicDocument676 pagesPartnership Formation, Operation, and Change in Ownership: Summary of Items by TopicAera GarcesNo ratings yet

- Introduction To The Principles and Forms Under Abs (Access and Benefit Sharing)Document6 pagesIntroduction To The Principles and Forms Under Abs (Access and Benefit Sharing)Shashwat DroliaNo ratings yet

- Excel To MySQL PDFDocument12 pagesExcel To MySQL PDFsendano 0No ratings yet

- Bir Ruling Da 192-08Document2 pagesBir Ruling Da 192-08norliza albutraNo ratings yet

- Chapter 1 - Introduction To AisDocument9 pagesChapter 1 - Introduction To AisHychell Mae Ramos DerepasNo ratings yet

- 1601CDocument2 pages1601CRoldan Agad SarenNo ratings yet

- Test Bank For Staffing Organizations 9th EditionDocument20 pagesTest Bank For Staffing Organizations 9th EditionCatherine Smith100% (29)

- Residential Status and Tax Incidence: Dr. Niti SaxenaDocument11 pagesResidential Status and Tax Incidence: Dr. Niti SaxenaYusufNo ratings yet

- 3-5 - Thailand - 20080526 - Thailand Single Window E-Logistics - Seoul v2.0Document38 pages3-5 - Thailand - 20080526 - Thailand Single Window E-Logistics - Seoul v2.0glassyglassNo ratings yet

- Why ISO 9001Document19 pagesWhy ISO 9001Arun K SharmaNo ratings yet

- MT ProgramDocument12 pagesMT ProgramAbhishek RaoNo ratings yet

- The Balance Sheet of Poodle Company at The End of PDFDocument1 pageThe Balance Sheet of Poodle Company at The End of PDFCharlotteNo ratings yet