Professional Documents

Culture Documents

Midterm Reviewer in Sba

Midterm Reviewer in Sba

Uploaded by

Maribeth Anor0 ratings0% found this document useful (0 votes)

20 views7 pages1. Business analysis is a discipline for introducing and managing organizational change, whether in for-profit, non-profit, government or business contexts. It is used to identify and address needs for change in how organizations work and facilitate that change.

2. A business analyst is responsible for analyzing a company's business processes and technological systems as they relate to operations. While related to finance, the primary clients of a business analyst are business stakeholders seeking to resolve problems, not financial or technical managers.

3. Key mindsets for effective business analysis include focusing on business goals, solving the right problems, questioning assumptions, analyzing information before setting requirements, uncovering gaps, simplifying processes, and taking responsibility for shared understanding of business

Original Description:

Original Title

MIDTERM-REVIEWER-IN-SBA

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1. Business analysis is a discipline for introducing and managing organizational change, whether in for-profit, non-profit, government or business contexts. It is used to identify and address needs for change in how organizations work and facilitate that change.

2. A business analyst is responsible for analyzing a company's business processes and technological systems as they relate to operations. While related to finance, the primary clients of a business analyst are business stakeholders seeking to resolve problems, not financial or technical managers.

3. Key mindsets for effective business analysis include focusing on business goals, solving the right problems, questioning assumptions, analyzing information before setting requirements, uncovering gaps, simplifying processes, and taking responsibility for shared understanding of business

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

20 views7 pagesMidterm Reviewer in Sba

Midterm Reviewer in Sba

Uploaded by

Maribeth Anor1. Business analysis is a discipline for introducing and managing organizational change, whether in for-profit, non-profit, government or business contexts. It is used to identify and address needs for change in how organizations work and facilitate that change.

2. A business analyst is responsible for analyzing a company's business processes and technological systems as they relate to operations. While related to finance, the primary clients of a business analyst are business stakeholders seeking to resolve problems, not financial or technical managers.

3. Key mindsets for effective business analysis include focusing on business goals, solving the right problems, questioning assumptions, analyzing information before setting requirements, uncovering gaps, simplifying processes, and taking responsibility for shared understanding of business

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 7

MIDTERM REVIEWER IN SBA an issue or your clients describe it to you, you are in

fact observing the symptoms and hearing about

BUSINESS ANALYSIS AND FINANCIAL POLICY

pain points.

BUSINESS ANALYSIS We cannot assume that the problem described to

us is the real issue. It may be a symptom of a more

Is a discipline approach for introducing and managing complex problem or a pain point that has multiple

change to organizations, whether they are for profit, causes.

businesses, government or non-profit.

Before forging ahead to solve a problem set in front

Is used to identify and articulate the need for change in of you, make sure you understand it.

how organization work and to facilitate that change.

Discovering the real issue may turn out to be

IS BUSINESS ANALYST RELATED TO FINANCE? the hardest challenge you face when practicing

Business analyst is responsible for analyzing a business analysis.

company’s technological system and business processes

as the relate to company’s operation. 3. Question everything – perfectionist

Discovery and analysis are built on the

foundation of asking questions. Ask questions

to learn, to get information, to investigate, and

to understand. Ask questions instead of making

assumptions.

The questions you ask, and the questions you

don’t ask, have the power to influence the

success of the change.

Your most important role as a business analyst

is not in finding answers. It’s in asking the right

questions.

The 12 Mindset of a Perfect Business Analysis

4. Lead and facilitate

1. Focus on the business – calibrate solutions to

As a business analyst, you have a special role.

business goals- To excel at what you do, you

You may not be managing people in a

always need to start with the client and their

traditional sense. But you are the link between

needs.

the groups of people that don’t always

understand each other.

Who is your client when you are a business

You are accountable for helping them

analyst? Is it the project manager, the developer,

communicate, reach that understanding, and

the test lead, or the architect? Perhaps, a

work better together. You help manage the

business relationship manager, or your functional

relationships, explain, clarify and navigate

manager?

different opinions and agendas.

A business analyst is a classic example of a

Your real clients are the business stakeholders

leader without authority, an influencer without

who have a problem you are helping to resolve.

seniority.

Everything you do has to be done with business

During a project, they will take on a variety of

needs in mind.

leadership roles — planning and leading the

requirements analysis process, organizing

2. Solve the right problem - would cost more to

diverse groups, managing expectations,

build or sell than its benefits

helping technical and business people

communicate, training and preparing business

If solving problems was easy, business analysts

groups for upcoming changes.

would have nothing to do. In reality, when you see

With a business analyst mindset, you have the Late discoveries are unpleasant and sometimes

right foundation to become a true leader — a even shocking if they require changes to solution

leader who strives to do the right thing, leads design.

others to do the right thing, and knows what It may be tempting to sweep the inconvenient

the right thing is. finding under the rug. The project may already

be late, or relationships already strained.

This is the time when the business analyst

5. Analysis before synthesis; information before mindset plays a crucial role.

requirements The role of a business analyst is to analyze the

gap and help the client make an informed

Business analysts don’t gather requirements — decision.

that’s the biggest misconception of the

profession.

They gather information about the current

state of business and investigate the root

causes of the problems.

Quality business requirements are the result of

synthesis: applying business analysis

techniques to the gathered information to

create the vision of the future state.

Finding a gap is a success, not a failure, as it

creates opportunities for improvement.

7. Simplify until nothing can be removed

Many companies are obsessed with automation

projects as they are expected to help reduce

6. Uncover gaps the cost of running business.

As business analysts get involved in these

Discovering gaps and inconvenient truths and is “automation initiatives”, they often struggle.

an occupational hazard of business analysis. Business processes tend to get more

Analysis activities may result in a discovery of complicated with every organizational change,

unexpected hidden problems that create risks redistribution of accountabilities or new

and become roadblocks to building better business rules.

solutions. These changes often go undocumented or live

These discoveries may be welcome or on sticky notes or one-page printouts taped to

unwelcome, depending on the timing. Early in the walls.

the project, we are more likely to acknowledge

and analyze every surprise.

8. Take responsibility of shared understanding the

business requirement.

Business analysts invest a lot of effort into

understanding the current state of business, all

its processes, terminology, and business rules.

They spend many hours with subject matter

experts, ask them questions, and produce

diagrams, user stories, documents, and tables.

They add a lot of details, cross-reference, and tag

requirements with multi-level numbers and

identifiers.

This work is important, and its outcomes help

clarify business requirements. But it is not

enough that a business analyst understands the 10. Be part of the solution

problem and the requirements for the future What’s the role of a business analyst once

solution. business requirements have been analyzed and

This understanding must be shared by all captured? Is that it? Can they move on to the

stakeholders involved in the business change, next project? While agile methodology explicitly

from executive sponsors to the development and expects everyone to work as part of the team

testing teams. through all sprint activities, in waterfall it’s not

The communication is only as good as the always as clear.

message received. And business requirements Even with waterfall approach, business analysts

are only as good as the understanding of play a key role in the development and roll-out

requirements by the intended audiences. of the product through the whole product life

cycle:

a) Clarify and explain requirements to everyone

9. Accept and embrace business change

involved in the development and

implementation

Business analysts help organizations implement

changes. Requirements define what needs to b) Recognize, analyze and manage requirements

change to achieve a desired future state. changes

Inevitably, as the analysis process results in

captured business requirements, and teams start c) Ensure that a solution design supports

working on the solution design and business needs

implementation, business systems will continue d) Oversee the design of non-technology

to change. components of the solution

The external environment, competitive

landscape, legislative changes, and internal e) Support user acceptance testing, training, and

politics all create minor or major ripples that adoption efforts

require organizations to adjust. f) Capture and transfer the knowledge

A business analyst can’t afford to get flustered by

change and should never take it personally. The real measure of a business analyst’s

Learn to expect change and master strategies for success comes from stakeholder satisfaction

handling it. with the implemented solution.

12. Learn, adapt and thrive

Business analysts have to learn all the time. It is

part of the job, part of the challenge, and a big

part of the attraction.

Every project, every change, brings something

new and unique to the business. To be

successful, business analysts must be able to

enjoy and welcome the new and the unknown,

be ready to learn and adapt.

Throughout their career, they will be able to

expand their professional knowledge in many

directions:

a) New industries

b) Business disciplines (finance, human

11. Expect human behavior from human being resources, marketing, or operations

While the business analysis profession is management)

closely associated with information c) Technologies and software products

technology, it is based on a lot of social d) Data management, analytics and business

activities and interactions. intelligence

As a business analyst, you work with people e) Product development methodologies

to help solve problems created by people to f) Architecture frameworks and modelling

build solutions that will be used by people. g) Software design principles and quality

People are not always predictable. Dealing assurance methods

with them will have an element of h) Leadership, negotiation, and conflict

uncertainty. They have fears, biases, and resolution

emotions. i) Business analysis tools & techniques

They will have their good days and bad days, j) Project management, communications, and

and sometimes they will go back on their training skills

word or change their mind when it’s most k) The breadth of new skills and domain

inconvenient. expertise that a business analyst can acquire

Business analysts may need to deal with on the job will generously open a wide

difficult situations and difficult people. It will selection of further career choices for them.

require perception, empathy, intuition, and And thus, the principles of the BA mindset

the ability to look beyond petty and trivial. It will support business analysts in their

will require a business analyst mindset. professional development and finding true

job satisfaction in this rewarding career.

Asking for clarification and rationale works most

of the time if requested politely and

Problem scenario A

respectfully. A request for clarification may

Problem: need to be brokered or a line of communication

created. This is a case where rational

Stakeholders disagree on a vital point, and the side with persistence pays off.

higher authority is winning even though it does not

have a solid argument. A business analyst needs to know the “why”

behind the requirements, so that she can

Challenge: facilitate shared understanding of these

Challenging authority is intimidating. Stepping in requirements and support determining the best

between two parties that are disagreeing and taking on solution. This should be a sufficient justification

a referee role can be emotionally taxing. A business for a conversation with the stakeholder who put

analyst is unwilling to arbitrate or wants the sides to forward the requirements in question.

settle their differences themselves. FINANCIAL POLICY

Constructive business analyst mindset: Financial policies refers to policies related to the

The opposing sides may not be willing or ready to regulation, supervision, and oversight of the financial

settle their differences on all points, but business and payment systems, including markets and

analyst should help facilitate consensus on the institutions, with the view to promoting financial

particular questions relevant to the project. stability, market efficiency, and client-asset and

consumer protection.

The consensus should be based on facts and

analysis, use real business data to validate

assumptions and an objective evaluation of pros WHAT FINANCIAL POLICIES SHOULD A COMPANY

and cons to avoid subjective decisions. This will HAVE?

require diplomacy, assertiveness, and objectivity

under pressure. Here is a list of financial policies and procedures you

should have in place.

Problem scenario B

Division of Duties.

Problem

Authorizations.

An executive request that does not makes

sense, is eating up too much time or takes Receipts/Disbursement Procedures.

business requirements in the wrong direction.

Payroll.

Challenge:

New Vendors.

Managing stakeholder relationships is tricky,

especially with the most powerful stakeholders.

Sometimes a business analyst does not have WORKING CAPITAL FINANCING POLICY

access or a line of communication to these

Working capital financing policy basically deals

stakeholders, and may not even have an

with the sources and the amount of working

opportunity to challenge or question the

capital that a company should maintain. A firm

requirements.

is not only concerned about the amount of

Constructive business analyst mindset: current assets but also about the proportions of

short-term and long-term sources for financing

Occasionally, such request may turn out to be a

the current assets.

misunderstanding, a case of a broken

telephone, or a question that is misinterpreted The methods businesses use to raise money.

as a request by an overzealous team member.

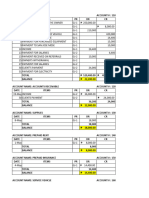

Maturity matching : Also known as “Hedging Policy” or WORKING CAPITAL FINANCING POLICY

“Moderate Approach”. This strategy ensures that the

Aggressive matching : Involves the maximum risk,

current assets of a company are always in sync with

and thus, also bring the potential for multiplied

short-term liabilities.

growth. Companies ensure their current assets,

In essence, this working capital financing policy aims to such as the value of debtors, are minimized by

balance the two extreme strategies, both in terms of ensuring timely payments or minimum credit sales.

risk and growth potential. Matches the maturity of the

At the same time, management also maintains that

assets with the maturity of the financing.

payments to creditors are delayed to the furthest.

Uses short term (temporary) capital to finance

some permanent assets.

Conservative matching : An organization

undertakes this strategy only when it requires

minimizing risk to the furthest.

Under this policy, the management regulates the

credit limits stringently to ensure low risk. Uses

long-term (permanent) capital to finance some

temporary assets.

Long-term financing= Non-current assets + Permanent

Working Capital

Short-term financing=Temporary Working Capital

WORKING CAPITAL REQUIREMENT

Under a conservative approach, the working capital you

need to maintain is substantial as it involves the

provision of idle capital for exigencies.

Under an aggressive strategy, the working capital Long-term financing= Non-current assets + Permanent

requirement is notably low, which speaks to high risk, Working Capital

but the cost is saved. When considering the hedging

policy, this factor is neither too high, nor too low. Short-term financing=Temporary Working Capital

COMPARISON OF WORKING CAPITAL FINANCING

POLICIES

Liquidity

While following an aggressive strategy, liquidity is

usually low since short-term funds are primarily

used to finance both fixed and fluctuating current

assets. A company is thus left with minimal idle

funds.

Conversely, in the case of a conservative strategy,

liquidity is usually high. It is because companies

mainly use long-term sources of finance, which

leaves them with sufficient idle funds to address

emergencies.

Hedging strategy involves moderate liquidity,

ensuring a balance between idle funds and their

cost.

Profitability

In a conservative approach, interest cost is higher

compared to the other two working capital

policies.

Thus, naturally, it lowers profits. In general,

aggressive policies offer the highest returns since

the cost involved is kept to a minimum.

As you can guess, in observing the matching

strategy, profits generated are moderate.

WORKING CAPITAL REQUIREMENT

Under a conservative approach, the working

capital you need to maintain is substantial as it

involves the provision of idle capital for

exigencies.

Under an aggressive strategy, the working capital

requirement is notably low, which speaks to high

risk, but the cost is saved.

When considering the hedging policy, this factor

is neither too high, nor too low.

You might also like

- Richard S. Love - Superperformance Stocks - An Investment Strategy For The Individual Investor Based On The 4-Year Political Cycle (1977) PDFDocument256 pagesRichard S. Love - Superperformance Stocks - An Investment Strategy For The Individual Investor Based On The 4-Year Political Cycle (1977) PDFduyphung1234100% (5)

- Vision Is 10%,-Implementation The RestDocument3 pagesVision Is 10%,-Implementation The Restanshie1398No ratings yet

- Socratic Sales The 21 Best Sales Questions For Mastering Lead Qualification and AcceDocument13 pagesSocratic Sales The 21 Best Sales Questions For Mastering Lead Qualification and Acceutube3805100% (2)

- Sliced Bread PLC Is A Divisionalized Company Among Its DivisionsDocument2 pagesSliced Bread PLC Is A Divisionalized Company Among Its DivisionsAmit PandeyNo ratings yet

- Accounting For Business CombinationsDocument19 pagesAccounting For Business Combinationsvinanovia50% (2)

- 2nd Building A Problem Solving Culture That LastsDocument7 pages2nd Building A Problem Solving Culture That LastsMichael Thompson100% (1)

- Module 6 Qualities and Roles of A Good Business AnalystDocument4 pagesModule 6 Qualities and Roles of A Good Business AnalystJames Clifford SottoNo ratings yet

- 3.1bsbafm - Cy2 - Hand CheckDocument2 pages3.1bsbafm - Cy2 - Hand CheckYOFC AEILINNo ratings yet

- Seven Secrets 1 2Document9 pagesSeven Secrets 1 2Philip Greenwood100% (3)

- Biz Skills2 All PDF MergedDocument122 pagesBiz Skills2 All PDF MergedRitesh KumarNo ratings yet

- Management ConsultancyDocument16 pagesManagement ConsultancyAman GillNo ratings yet

- Nothing Is ImpossibleDocument20 pagesNothing Is Impossibleapi-576371967No ratings yet

- Answers Examples and Guidance Question NotesDocument20 pagesAnswers Examples and Guidance Question NotesLes BakerNo ratings yet

- NextGenLeaders-ProblemSolving&CriticalThinking-WorkbookDocument22 pagesNextGenLeaders-ProblemSolving&CriticalThinking-WorkbookAisha ShaikhNo ratings yet

- What Makes An Effective ExecutiveDocument4 pagesWhat Makes An Effective ExecutiveErnie SchultzeNo ratings yet

- Evaluating Competencies WorksheetDocument6 pagesEvaluating Competencies WorksheetHR Partners Co., Ltd.No ratings yet

- Business Skill CoursebookDocument281 pagesBusiness Skill CoursebookJoão ViniciusNo ratings yet

- Competency ExamplesDocument7 pagesCompetency ExamplesAnonymous q9eCZHMuSNo ratings yet

- Flawless Consulting Chapter 3-Flawless Consulting: Later To Decide What To Do and Evaluate The Results."Document8 pagesFlawless Consulting Chapter 3-Flawless Consulting: Later To Decide What To Do and Evaluate The Results."Sanya Godiyal100% (1)

- Excellence in Execution (68 Pages)Document68 pagesExcellence in Execution (68 Pages)Gwladys BettoNo ratings yet

- What Is The Purpose and Role of Research?: Manager vs. ResearcherDocument7 pagesWhat Is The Purpose and Role of Research?: Manager vs. ResearcherArushi SinghNo ratings yet

- Uhubs - 1 - 1 Coaching Best PracticesDocument11 pagesUhubs - 1 - 1 Coaching Best PracticesAdrianNo ratings yet

- Cracking The Consulting Interview: Select Experiences of Kearney HiresDocument31 pagesCracking The Consulting Interview: Select Experiences of Kearney HiresMustafa KhanNo ratings yet

- Lecture-02 (Definition of Intrapreneurs)Document3 pagesLecture-02 (Definition of Intrapreneurs)Shanewaz Mahmood SohelNo ratings yet

- Module 5 Business Analyst As The Problem Solver and How They Evolved.Document7 pagesModule 5 Business Analyst As The Problem Solver and How They Evolved.James Clifford SottoNo ratings yet

- Behavioural Training Brochure: Perspective That MattersDocument29 pagesBehavioural Training Brochure: Perspective That MattersZe RoNo ratings yet

- ExecutionDocument10 pagesExecutionnavkar_centreforskills100% (1)

- Problem Solving: Competency Development GuideDocument3 pagesProblem Solving: Competency Development GuideStephanie AlvaradoNo ratings yet

- HBR New Project Dont Analyse, ActDocument6 pagesHBR New Project Dont Analyse, ActyroacespedesNo ratings yet

- SH Cybersecurity Interview Prep Guide 2022Document5 pagesSH Cybersecurity Interview Prep Guide 2022DizzyDudeNo ratings yet

- Communicating For Work Purposes (Reading Material)Document22 pagesCommunicating For Work Purposes (Reading Material)Nico EslawanNo ratings yet

- Unshackling Leadership 240226 065025Document11 pagesUnshackling Leadership 240226 065025Badal DashNo ratings yet

- First Time Manager - Mccormick Et Al - EbsDocument12 pagesFirst Time Manager - Mccormick Et Al - EbsSatria IndraprastaNo ratings yet

- OB Pre-Read 1Document14 pagesOB Pre-Read 1Aditi GoyalNo ratings yet

- A Study On Problem Situations Faced by A Manager and Skills Used To Tackle ThemDocument10 pagesA Study On Problem Situations Faced by A Manager and Skills Used To Tackle Themandy williamNo ratings yet

- What Are Project Management Skills (And Why Do They Matter?)Document10 pagesWhat Are Project Management Skills (And Why Do They Matter?)Izhar MazariNo ratings yet

- Guide To Case AnalysisDocument12 pagesGuide To Case AnalysisNguyễn Hương GiangNo ratings yet

- Perfprmance TASK 1.1 Strategic Thinking Skills Image AnalysisDocument10 pagesPerfprmance TASK 1.1 Strategic Thinking Skills Image AnalysisNenita Angela Atienza LizadaNo ratings yet

- Execution SummaryDocument10 pagesExecution SummaryAnone SoreeNo ratings yet

- Principles of Counseling - S3Document17 pagesPrinciples of Counseling - S3ScribdTranslationsNo ratings yet

- Transition From Manager To LeaderDocument32 pagesTransition From Manager To LeaderKAMRAN SHEREENNo ratings yet

- Job Readiness: by Vedant DahibawkarDocument7 pagesJob Readiness: by Vedant Dahibawkarvedant100% (1)

- HBR. When You Think The Strategy Is Wrong.Document5 pagesHBR. When You Think The Strategy Is Wrong.Vasya SoimaNo ratings yet

- Week 6 - Group 5Document2 pagesWeek 6 - Group 5Công NguyênNo ratings yet

- Tom Peters Masterclass 1Document8 pagesTom Peters Masterclass 1Karla Kangleon100% (1)

- Mintzberg Leadership ModelDocument9 pagesMintzberg Leadership ModelRoselyn Zafe TimbalNo ratings yet

- Kurnia Workplace InsightsDocument4 pagesKurnia Workplace InsightsKurnia SeptriadiNo ratings yet

- Leadership - Hot Executive TopsDocument6 pagesLeadership - Hot Executive TopsSalim HajjeNo ratings yet

- Introduction To OBDocument23 pagesIntroduction To OBphuongnm106No ratings yet

- Anita VishwakarmaDocument4 pagesAnita VishwakarmaANITA vishwakarmaNo ratings yet

- PalitawDocument3 pagesPalitawArnel Aralar Jr BSHM 2104No ratings yet

- Entrepreneurial Mind Chapter 1-2: Beliefs and Assumptions That Empower Entrepreneurs 1. The Sky Is The LimitDocument12 pagesEntrepreneurial Mind Chapter 1-2: Beliefs and Assumptions That Empower Entrepreneurs 1. The Sky Is The LimitNyah MallariNo ratings yet

- Managing Yourself-CaseDocument6 pagesManaging Yourself-CaseNiharika RajputNo ratings yet

- People Development ArticlesDocument35 pagesPeople Development ArticlespundaleekakamathNo ratings yet

- GE 117 ModuleDocument12 pagesGE 117 ModuleKarl Dave AlmeriaNo ratings yet

- Section 1 - 10 Essential Skills Needed To Make An Excellent Consultant - ROJODocument4 pagesSection 1 - 10 Essential Skills Needed To Make An Excellent Consultant - ROJOJohnny VuNo ratings yet

- Personal Entrepreneurial Competencies and Skills (Pecs)Document27 pagesPersonal Entrepreneurial Competencies and Skills (Pecs)John Isidro Jacob AnticNo ratings yet

- Entrepreneurship Chapter 1Document24 pagesEntrepreneurship Chapter 1Night BravoNo ratings yet

- What To Ask The Person in The MirrorDocument12 pagesWhat To Ask The Person in The MirrorPaula Villalobos SilvaNo ratings yet

- Entrepreneurial Competence EssayDocument15 pagesEntrepreneurial Competence EssaylouNo ratings yet

- JobsBasedInnovation June2018Document16 pagesJobsBasedInnovation June2018venu4u498No ratings yet

- What's the Big Idea? (Review and Analysis of Davenport, Prusak and Wilson's Book)From EverandWhat's the Big Idea? (Review and Analysis of Davenport, Prusak and Wilson's Book)No ratings yet

- Problem-Solving Skills: Creative Idea To Solve The Problem | How to Unblock The Cause and Solve It in Easy StepsFrom EverandProblem-Solving Skills: Creative Idea To Solve The Problem | How to Unblock The Cause and Solve It in Easy StepsNo ratings yet

- OM-Project (Mr. Anand)Document4 pagesOM-Project (Mr. Anand)Kashish ParikhNo ratings yet

- Case Study 2 - ReportDocument10 pagesCase Study 2 - ReportTomás TavaresNo ratings yet

- A Comparative Study On Customer Perception Towards LIC of India in View of Increased Competition by Private Companies A Research Done in 2009Document55 pagesA Comparative Study On Customer Perception Towards LIC of India in View of Increased Competition by Private Companies A Research Done in 2009pratiush0792% (13)

- Brokerlist 20141015135322Document1 pageBrokerlist 20141015135322abhaykatNo ratings yet

- Final Audit - Addl Questions (Chapter 1)Document9 pagesFinal Audit - Addl Questions (Chapter 1)Savya SachiNo ratings yet

- Course Ouline Financial InstitutionsDocument5 pagesCourse Ouline Financial InstitutionsSherif ElSheemyNo ratings yet

- Suspense Accounts Question With Suggested AnsDocument8 pagesSuspense Accounts Question With Suggested AnsKingsley MweembaNo ratings yet

- Act BulletinDocument27 pagesAct BulletinpapergateNo ratings yet

- Annual Report 2018Document159 pagesAnnual Report 2018Fani Dwi PutraNo ratings yet

- Business Model CanvasDocument24 pagesBusiness Model CanvasNuman YusufNo ratings yet

- CVP Class Illustrations.Document4 pagesCVP Class Illustrations.Sam DizongaNo ratings yet

- TB Chapter12Document33 pagesTB Chapter12Jacques Leo MonedaNo ratings yet

- Pelatihan Penyusunan Laporan Keuangan Bagi Usaha Industri Kreatif Di TangerangDocument7 pagesPelatihan Penyusunan Laporan Keuangan Bagi Usaha Industri Kreatif Di Tangerangfaesal fazlurahmanNo ratings yet

- ABC VED AnalysisDocument12 pagesABC VED AnalysisKumar GaneshNo ratings yet

- BancassuranceDocument10 pagesBancassuranceShruti DesaiNo ratings yet

- Outcome of Board Meeting - Buy-Back of Equity Shares of The Company (Board Meeting)Document2 pagesOutcome of Board Meeting - Buy-Back of Equity Shares of The Company (Board Meeting)Shyam SunderNo ratings yet

- Clean Securities Syllabus-1Document10 pagesClean Securities Syllabus-1Aron MenguitoNo ratings yet

- Separate Financial Statements: Final PronouncementDocument15 pagesSeparate Financial Statements: Final Pronouncementiced jaipurNo ratings yet

- PGDMSM Placement 2023 24Document32 pagesPGDMSM Placement 2023 24prakash lightNo ratings yet

- Week7 Equity MKT 1: You Have CompletedDocument5 pagesWeek7 Equity MKT 1: You Have CompletedDerek LowNo ratings yet

- KYC Officers - 210724Document29 pagesKYC Officers - 210724anriyasNo ratings yet

- Financial Report: Prepared By: Jackielou R. GallardeDocument5 pagesFinancial Report: Prepared By: Jackielou R. GallardeAndrew Arciosa CalsoNo ratings yet

- Amit ConstDocument1 pageAmit Constks4427552No ratings yet

- Barongo - Dissertation FinalDocument88 pagesBarongo - Dissertation Finalkripa poudelNo ratings yet

- Ledger 2Document4 pagesLedger 2Hellarica AnabiezaNo ratings yet

- Concept of Credit: Fund Based Non Fund BasedDocument23 pagesConcept of Credit: Fund Based Non Fund BasedarunapecNo ratings yet

- B. 1712 BVCA Articles - Practical Law Drafting NotesDocument78 pagesB. 1712 BVCA Articles - Practical Law Drafting NotesApolo apoloNo ratings yet