Professional Documents

Culture Documents

Final 2021 CBG Summary Fs 2021 Signed

Final 2021 CBG Summary Fs 2021 Signed

Uploaded by

Fuaad DodooCopyright:

Available Formats

You might also like

- Your Electricity Bill ActualDocument1 pageYour Electricity Bill Actualyouness el aameryNo ratings yet

- Revision Planner - May 24 - Nov 24 - Bhavik ChokshiDocument1 pageRevision Planner - May 24 - Nov 24 - Bhavik ChokshiNick VincikNo ratings yet

- Awasr Oman and Partners SAOC - FS 2020 EnglishDocument42 pagesAwasr Oman and Partners SAOC - FS 2020 Englishabdullahsaleem91No ratings yet

- Consolidated Bank (Ghana) Limited: Unaudited Summary Financial StatementsDocument2 pagesConsolidated Bank (Ghana) Limited: Unaudited Summary Financial StatementsFuaad DodooNo ratings yet

- Globus Bank 2021 ABRIDGED FSDocument1 pageGlobus Bank 2021 ABRIDGED FSAwojuyigbeNo ratings yet

- Consolidated Bank (Ghana) Limited: Unaudited Summary Financial StatementsDocument2 pagesConsolidated Bank (Ghana) Limited: Unaudited Summary Financial StatementsFuaad DodooNo ratings yet

- GT BankDocument1 pageGT BankFuaad DodooNo ratings yet

- Q3 Financial Statement q3 For Period 30 September 2021Document2 pagesQ3 Financial Statement q3 For Period 30 September 2021Fuaad DodooNo ratings yet

- 2021 Full Year FinancialsDocument2 pages2021 Full Year FinancialsFuaad DodooNo ratings yet

- United Bank For Africa (Ghana) Limited Summary Financial Statements For The Year Ended 31 December 2020Document2 pagesUnited Bank For Africa (Ghana) Limited Summary Financial Statements For The Year Ended 31 December 2020Fuaad DodooNo ratings yet

- Societe Generale Ghana PLC 2021 Audited Financial StatementsDocument2 pagesSociete Generale Ghana PLC 2021 Audited Financial StatementsFuaad DodooNo ratings yet

- UBA FS-31Dec2021Document2 pagesUBA FS-31Dec2021Fuaad DodooNo ratings yet

- UBA - June2021 FN StatementsDocument2 pagesUBA - June2021 FN StatementsFuaad DodooNo ratings yet

- Adb Fin Statement - Dec 2020 - Final 2Document2 pagesAdb Fin Statement - Dec 2020 - Final 2Fuaad DodooNo ratings yet

- UBL Annual Report 2018-170Document1 pageUBL Annual Report 2018-170IFRS LabNo ratings yet

- BK Group PLC Financial Results: Net Interest Income 51,762,974 46,360,210Document3 pagesBK Group PLC Financial Results: Net Interest Income 51,762,974 46,360,210chegeNo ratings yet

- Boa Financials For q3 30 Sept. 2021Document1 pageBoa Financials For q3 30 Sept. 2021Fuaad DodooNo ratings yet

- UBA Ghana 2021 Q3 Financial StatementsDocument1 pageUBA Ghana 2021 Q3 Financial StatementsFuaad DodooNo ratings yet

- UBL Annual Report 2018-79Document1 pageUBL Annual Report 2018-79IFRS LabNo ratings yet

- Unaudited Summary Consolidated and Separate Financial StatementsDocument2 pagesUnaudited Summary Consolidated and Separate Financial Statementsbentilwilliams65No ratings yet

- Summary Consolidated and Separate Financial Statements For The Period Ended 30 Sept 2021 (Unaudited)Document1 pageSummary Consolidated and Separate Financial Statements For The Period Ended 30 Sept 2021 (Unaudited)Fuaad DodooNo ratings yet

- Financial Statement 2020Document3 pagesFinancial Statement 2020Fuaad DodooNo ratings yet

- Access BankDocument1 pageAccess BankFuaad DodooNo ratings yet

- Financial Publication MarchDocument2 pagesFinancial Publication MarchFuaad DodooNo ratings yet

- Societe Generale Ghana PLC Unaudited Financial Statements For The Half Year Ended 30 June 2021Document2 pagesSociete Generale Ghana PLC Unaudited Financial Statements For The Half Year Ended 30 June 2021Fuaad DodooNo ratings yet

- (In Millions) : Consolidated Statements of Cash FlowsDocument1 page(In Millions) : Consolidated Statements of Cash FlowsrocíoNo ratings yet

- Societe Generale Ghana PLC Unaudited Financial Statements For The Quarter Ended 30 September 2021Document2 pagesSociete Generale Ghana PLC Unaudited Financial Statements For The Quarter Ended 30 September 2021Fuaad DodooNo ratings yet

- Standard Chartered Bank Ghana PLC: Unaudited Financial Statements For The Period Ended 30 September 2021Document1 pageStandard Chartered Bank Ghana PLC: Unaudited Financial Statements For The Period Ended 30 September 2021Fuaad DodooNo ratings yet

- Societe Generale Ghana PLC Unaudited Financial Statements For The Quarter Ended 31 March 2022Document2 pagesSociete Generale Ghana PLC Unaudited Financial Statements For The Quarter Ended 31 March 2022Fuaad DodooNo ratings yet

- RBGH Financials - 31 December 2021 - Colour - 21.02.2022 (3 Full Pages)Document3 pagesRBGH Financials - 31 December 2021 - Colour - 21.02.2022 (3 Full Pages)Fuaad DodooNo ratings yet

- FBNBank Ghana Limited 3rd Quarter Financial Statement (2021)Document1 pageFBNBank Ghana Limited 3rd Quarter Financial Statement (2021)Fuaad DodooNo ratings yet

- Unaudited Financial Statements For The Period Ended 31 March, 2022Document2 pagesUnaudited Financial Statements For The Period Ended 31 March, 2022Fuaad DodooNo ratings yet

- Annual Financial Statement 2021Document3 pagesAnnual Financial Statement 2021kofiNo ratings yet

- RBGH Financials 30 June 2021 Colour 15.07.2021 2 Full Pages EdtDocument2 pagesRBGH Financials 30 June 2021 Colour 15.07.2021 2 Full Pages EdtFuaad DodooNo ratings yet

- RBGH Financials 31 December 2020 Colour 18.03.2021 3 Full PageseddDocument3 pagesRBGH Financials 31 December 2020 Colour 18.03.2021 3 Full PageseddFuaad DodooNo ratings yet

- Ratio Analysis of Lanka Ashok Leyland PLCDocument6 pagesRatio Analysis of Lanka Ashok Leyland PLCThe MutantzNo ratings yet

- United Bank For Africa PLC - Quarter 1 - Financial Statement For 2024 Financial Statements May 2024Document37 pagesUnited Bank For Africa PLC - Quarter 1 - Financial Statement For 2024 Financial Statements May 2024frederick aivborayeNo ratings yet

- Ford 18Document6 pagesFord 18Bhavdeep singh sidhuNo ratings yet

- Microsoft Corporation: (In Millions) Year Ended June 30, 2010 2009 2008Document1 pageMicrosoft Corporation: (In Millions) Year Ended June 30, 2010 2009 2008Dylan MakroNo ratings yet

- The Boeing Company and Subsidiaries Consolidated Statements of Cash FlowsDocument1 pageThe Boeing Company and Subsidiaries Consolidated Statements of Cash Flowsdivineyang05No ratings yet

- Lloyds Banking Group-2021-Annual-Report - Part2 - Financial ResultsDocument24 pagesLloyds Banking Group-2021-Annual-Report - Part2 - Financial ResultsyahbNo ratings yet

- Annual Report 2023Document27 pagesAnnual Report 2023ALNo ratings yet

- Zenith Bank 2020Document2 pagesZenith Bank 2020Fuaad DodooNo ratings yet

- Hade PDFDocument2 pagesHade PDFMaradewiNo ratings yet

- Dell Financial Data Mid Course Quiz 1668627324062Document10 pagesDell Financial Data Mid Course Quiz 1668627324062rohit goyalNo ratings yet

- Financial Statements: For The Year Ended 31 December 2019Document11 pagesFinancial Statements: For The Year Ended 31 December 2019RajithWNNo ratings yet

- Expressed in Canadian Dollars ($ CAD), Unaudited: Digital Bull Technologies LTDDocument5 pagesExpressed in Canadian Dollars ($ CAD), Unaudited: Digital Bull Technologies LTDDishant KhanejaNo ratings yet

- Quarterly Report 20221231Document21 pagesQuarterly Report 20221231Ang SHNo ratings yet

- Standard Chartered PLC Full Year 2022 ReportDocument9 pagesStandard Chartered PLC Full Year 2022 Reporthoneysgh.394No ratings yet

- Increase in Long Term Loans and AdvancesDocument2 pagesIncrease in Long Term Loans and Advancesusama siddiquiNo ratings yet

- M4 Example 2 SDN BHD FSADocument38 pagesM4 Example 2 SDN BHD FSAhanis nabilaNo ratings yet

- Enterprise Group PLC: Unaudited Financial Statements For The Year Ended 31 December 2021Document8 pagesEnterprise Group PLC: Unaudited Financial Statements For The Year Ended 31 December 2021Fuaad DodooNo ratings yet

- Statement of Cash FlowsDocument2 pagesStatement of Cash FlowsKartik SharmaNo ratings yet

- Arab Sudanese Bank: Sudanese Private Ccompany LTDDocument30 pagesArab Sudanese Bank: Sudanese Private Ccompany LTDShadow PrinceNo ratings yet

- Annual Report 2021Document3 pagesAnnual Report 2021hxNo ratings yet

- Masteel 4Q 2023Document12 pagesMasteel 4Q 2023GZHNo ratings yet

- Cash Flow Statement ConsolidatedDocument2 pagesCash Flow Statement Consolidatedsamarth rajvaidNo ratings yet

- Financial Statements Notes On The Financial StatementsDocument95 pagesFinancial Statements Notes On The Financial StatementsEvariste GaloisNo ratings yet

- Nvidia ExcelDocument8 pagesNvidia Excelbafsvideo4No ratings yet

- Hong Fok Corporation Limited: Revenue (Note 1)Document10 pagesHong Fok Corporation Limited: Revenue (Note 1)Theng RogerNo ratings yet

- Consolidated Financial Statements Mar 11Document17 pagesConsolidated Financial Statements Mar 11praynamazNo ratings yet

- Daily Equity Market Report - 18.10.2022Document1 pageDaily Equity Market Report - 18.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 17.10.2022Document1 pageDaily Equity Market Report - 17.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 14.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 14.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 11.10.2022Document1 pageDaily Equity Market Report - 11.10.2022Fuaad DodooNo ratings yet

- Press Release 2Document1 pagePress Release 2Fuaad DodooNo ratings yet

- 19th Edition of The Ghana Club 100 Rankings OutcomeDocument3 pages19th Edition of The Ghana Club 100 Rankings OutcomeFuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 07.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 07.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 28.09.2022Document1 pageDaily Equity Market Report - 28.09.2022Fuaad DodooNo ratings yet

- Substandard (Contaminated) Paediatric Medicines Identified in WHODocument4 pagesSubstandard (Contaminated) Paediatric Medicines Identified in WHOFuaad DodooNo ratings yet

- R9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Document4 pagesR9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Fuaad DodooNo ratings yet

- Daily Equity Market Report - 04.10.2022Document1 pageDaily Equity Market Report - 04.10.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 10.10.2022Document1 pageFixed Income Market Report - 10.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.10.2022Document1 pageDaily Equity Market Report - 06.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 03.10.2022 2022-10-03Document1 pageDaily Equity Market Report 03.10.2022 2022-10-03Fuaad DodooNo ratings yet

- Press ReleaseDocument1 pagePress ReleaseFuaad DodooNo ratings yet

- Regulatory Order To ECG - 221004 - 180752Document6 pagesRegulatory Order To ECG - 221004 - 180752Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.10.2022Document1 pageDaily Equity Market Report - 05.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 30.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 30.09.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 03.10.2022Document1 pageFixed Income Market Report - 03.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 29.09.2022Document1 pageDaily Equity Market Report - 29.09.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 26.09.2022Document1 pageFixed Income Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 27.09.2022Document1 pageDaily Equity Market Report - 27.09.2022Fuaad DodooNo ratings yet

- Imf MeetingDocument1 pageImf MeetingFuaad DodooNo ratings yet

- Daily Equity Market Report 20.09.2022 2022-09-20Document1 pageDaily Equity Market Report 20.09.2022 2022-09-20Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 23.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 23.09.2022Fuaad DodooNo ratings yet

- Auctresults 1817Document1 pageAuctresults 1817Fuaad DodooNo ratings yet

- Daily Equity Market Report - 22.09.2022Document1 pageDaily Equity Market Report - 22.09.2022Fuaad DodooNo ratings yet

- Nimed Financial Market Review (16.09.2022)Document4 pagesNimed Financial Market Review (16.09.2022)Fuaad DodooNo ratings yet

- Daily Equity Market Report - 26.09.2022Document1 pageDaily Equity Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 19.09.2022Document1 pageDaily Equity Market Report - 19.09.2022Fuaad DodooNo ratings yet

- MGT 337 TermpaperDocument25 pagesMGT 337 TermpaperTamim RahmanNo ratings yet

- Current Assets Exercises VDocument40 pagesCurrent Assets Exercises VHenok Fikadu100% (1)

- COM01P105S23U00Document35 pagesCOM01P105S23U00SHAMPA SINHAROYNo ratings yet

- Chapter 9Document15 pagesChapter 9Duffin AngganaNo ratings yet

- F. Guerrero - Social Sustainability at NIKE, Disabled People As A WorkforceDocument3 pagesF. Guerrero - Social Sustainability at NIKE, Disabled People As A WorkforceFelipe GuerreroNo ratings yet

- Cash and Accrual BasisDocument24 pagesCash and Accrual BasisAlexa LeeNo ratings yet

- 304 Ope Som-Mcq-2019Document7 pages304 Ope Som-Mcq-2019Prafull P KulkarniNo ratings yet

- ReviewDocument6 pagesReviewgabrenillaNo ratings yet

- Assignment 4 CCMA-3Document10 pagesAssignment 4 CCMA-3JaspreetNo ratings yet

- Gaurav Reliance JioDocument76 pagesGaurav Reliance JiogoswamiphotostatNo ratings yet

- DBMS Lab - Assignment 3Document2 pagesDBMS Lab - Assignment 3sgdfsfgNo ratings yet

- 2010 Sustainability Banco SantanderDocument56 pages2010 Sustainability Banco SantanderCetty RotondoNo ratings yet

- Revenue Memorandum Circular No. 91-2012: Bureau of Internal RevenueDocument3 pagesRevenue Memorandum Circular No. 91-2012: Bureau of Internal RevenueHenson MontalvoNo ratings yet

- RC Mapping EDCDocument5 pagesRC Mapping EDCDhio Reza PrasetyoNo ratings yet

- Barter Ph. HistoryDocument7 pagesBarter Ph. HistoryMark Anthony M GaboNo ratings yet

- COSO GuidanceDocument71 pagesCOSO GuidancemahmudtohaNo ratings yet

- 2013 Sample MC Questions - 60Document11 pages2013 Sample MC Questions - 60Patricia Kim LeeNo ratings yet

- Atl Tinkerfest 2021 - Tinkerpreneur: Home Registration Form LogoutDocument2 pagesAtl Tinkerfest 2021 - Tinkerpreneur: Home Registration Form LogoutINDRA DAVENo ratings yet

- Ateneo Celadon YES Report 2014-2015Document45 pagesAteneo Celadon YES Report 2014-2015Aldrin Derrick ChuaNo ratings yet

- SLCM Main Book CS Vikas Vohra (Old Syllabus) (June 23)Document583 pagesSLCM Main Book CS Vikas Vohra (Old Syllabus) (June 23)A0913KHUSHI RUNGTANo ratings yet

- Sobrecostos Logisticos PeruDocument31 pagesSobrecostos Logisticos PeruPablo CorraloNo ratings yet

- Sylvian Ruf NEWfDocument2 pagesSylvian Ruf NEWfsyruffNo ratings yet

- Background CitycellDocument32 pagesBackground CitycellMahmudur RashidNo ratings yet

- Jawaban Soal Latihan Ch.10Document3 pagesJawaban Soal Latihan Ch.10Wira DinataNo ratings yet

- MKMA1105. Principles of MarketingDocument8 pagesMKMA1105. Principles of MarketingThuy DungNo ratings yet

- Executive Summary & Project Information Study - Salang Subdivision (Malaybalay City)Document2 pagesExecutive Summary & Project Information Study - Salang Subdivision (Malaybalay City)clinnton macaNo ratings yet

- Bank Management Board of Directors: QualificationsDocument2 pagesBank Management Board of Directors: QualificationsFarrah MarieNo ratings yet

- SssssssssssssssadsaasdaDocument85 pagesSssssssssssssssadsaasdaGabriell LazarNo ratings yet

Final 2021 CBG Summary Fs 2021 Signed

Final 2021 CBG Summary Fs 2021 Signed

Uploaded by

Fuaad DodooOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Final 2021 CBG Summary Fs 2021 Signed

Final 2021 CBG Summary Fs 2021 Signed

Uploaded by

Fuaad DodooCopyright:

Available Formats

Consolidated Bank (Ghana) Limited

Summary Financial Statements for the year ended 31 December 2021

All amounts are in thousands of Ghana cedis unless otherwise stated

SUMMARY STATEMENT OF COMPREHENSIVE INCOME SUMMARY STATEMENT OF CASH FLOWS FOR THE YEAR ENDED 31 DECEMBER 2021

FOR THE PERIOD ENDED 31 DECEMBER 2021

2021 2020

2021 2020

Profit before income tax 102,656 76,716

Interest income 1,485,497 1,139,385 Adjustments for:

Interest expense (861,115) (625,853) Depreciation and amortisation 55,305 56,423

Net interest income 624,382 513,532 Impairment losses on loans and advances 21,687 17,419

Impairment losses on other financial assets 48,377 53,660

Fee and commission income 88,012 56,176

Net interest income (624,382) (513,532)

Fee and commission expense (8,260) (8,578) Lease remeasurement impact 4,560 -

Net fee and commission income 79,752 47,598 Unrealised exchange losses on leases 3,636 13,557

Profit on disposal (110) (837)

Net trading income 69,914 52,394

Fair value changes recognised in profit or loss (staff loan) 4,560 4,301

Other operating income 4,639 16,066 (383,711) (292,293)

Changes in:

Operating income 778,687 629,590

Loans and advances to customers (490,431) (633,858)

Impairment losses on loans and advances (21,687) (17,419) Other assets 17,320 (58,550)

Impairment losses on other financial assets (48,377) (53,660) Investment securities 113,983 (1,481,492)

Personnel expenses (332,753) (253,643) Non-pledged assets (131,922) (290,545)

Deposits from customers (115,043) 1,769,768

Depreciation and amortisation (55,305) (56,423)

Mandatory cash reserve (342,797) (197,289)

Other expenses (217,909) (171,729)

Borrowed funds 812,166 916,346

Profit before income tax 102,656 76,716 66,712 264,343

Other liabilities

Cash flow used in operations (453,723) (3,570)

Income tax charge (21,412) (26,559)

Interest received 1,480,937 1,139,385

Financial sector recovery levy (3,850) -

Interest paid (856,663) (625,853)

National fiscal stabilisation levy (5,133) (3,836)

Taxes and levies paid (40,255) (42,822)

Profit for the year 72,261 46,321

Net cash flow used in operating activities 130,296 467,140

Other comprehensive income: Cash flow from investing activities

Items that may be reclassified to profit or loss Acquisition of property and equipment (45,755) (38,599)

Proceeds from disposal of property and equipment 164 313

Changes in the fair value of debt instruments at fair value

(16,064) 31,312 Acquisition of intangible assets (12,483) (22,564)

through other comprehensive income

Net cash flow generated from investing activities (58,074) (60,850)

Deferred income tax (charge)/credit relating to other

4,016 (7,828)

comprehensive income items Cash flow from financing activities

(12,048) 23,484 Payment of principal portion of lease liabilities (44,763) (36,337)

Net cash flow generated from financing activities (44,763) (36,337)

Total comprehensive income 60,213 69,805

Net increase in cash and cash equivalents 27,459 369,953

Balance at beginning of the year 769,179 399,226

SUMMARY STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER 2021 Cash and cash equivalents at 31 December 796,638 769,179

2021 2020

SUMMARY STATEMENT OF CHANGES IN EQUITY FOR THE PERIOD ENDED 31 DECEMBER 2021

ASSETS

Cash and bank balances 1,332,426 763,879 Stated Retained Statutory Fair value

Total

Capital earnings reserve reserve

Investment securities 6,731,794 7,060,759

Non-pledged trading assets 971,140 839,218 Balance at 1 January 2021 450,000 34,844 57,684 21,020 563,548

Loans and advances to customers 1,330,480 861,736 Profit for the period 72,261 72,261

Intangible assets 30,217 28,702 Fair value adjustment on investment

(12,048) (12,048)

securities

Right-of-use assets 68,308 90,956

Total comprehensive income for the

Property and equipment 146,608 115,616 - 72,261 - (12,048) 60,213

year

Current income tax assets 223 -

Regulatory and other reserve transfers

Deferred income tax assets 17,507 13,006

Transfer to statutory reserve - (36,131) 36,131 - -

Other assets 122,461 187,890

Net transfer to reserves - (36,131) 36,131 - -

Total assets 10,751,164 9,961,762

Transactions with owners

LIABILITIES

Additional capital issued 177,784 177,784

Deposits from customers 6,751,075 6,866,118

Net Transactions with owners 177,784 - - - 177,784

Borrowed funds 2,426,796 1,614,630

Lease liabilities 78,585 103,719 Balance at 31 December 2021 627,784 70,974 93,815 8,972 801,545

Other liabilities 693,163 804,369

Stated Retained Statutory Fair value

Total

Current income tax liability - 9,378 Capital earnings reserve reserve

Total liabilities 9,949,619 9,398,214

Balance at 1 January 2020 450,000 11,683 34,524 (2,464) 493,743

EQUITY Profit for the period 46,321 46,321

Stated capital 627,784 450,000 Fair value adjustment on investment

- 23,484 23,484

securities

Retained earnings 70,974 34,844

Total comprehensive income for the

Fair value reserve 8,972 21,020 - 46,321 - 23,484 69,805

year

Statutory reserve 93,815 57,684

Regulatory and other reserve transfers

Total equity 801,545 563,548

Transfer to statutory reserve - (23,160) 23,160 - -

Total equity and liabilities 10,751,164 9,961,762 Net transfer to reserves - (23,160) 23,160 - -

Balance at 31 December 2020 450,000 34,844 57,684 21,020 563,548

Consolidated Bank (Ghana) Limited

Summary Financial Statements for the year ended 31 December 2021

All amounts are in thousands of Ghana cedis unless otherwise stated

The Board of Directors has overall responsibility for the establishment and oversight of the Bank’s

REPORT OF THE DIRECTORS

risk management framework. The Risk and Cyber & Information Security Committees of the Board is

The Directors have the pleasure in presenting their report and the summary financial statements responsible for developing and monitoring the Bank’s risk management policies over specified areas.

for the period ended 31 December 2021.

Key risk ratios for the Bank are summarised below :

STATEMENT OF DIRECTORS’ RESPONSIBILITIES

The Bank’s directors are responsible for the preparation of the financial statements that give a 2021 2020

true and fair view of Consolidated Bank (Ghana) Limited’s financial position at 31 December 2021,

and of the profit or loss and cash flows for the period then ended, and the notes to the financial Non-performing loan ratio 0.71% 0.12%

statements which include a summary of significant accounting policies and other explanatory Capital Adequacy Ratio 21.6% 19.8%

notes, in accordance with International Financial Reporting Standards, and in the manner required

Common equity tier 1/RWA 21.4% 18.9%

by the Companies Act, 2019 (Act 992), and the Banks and Specialised Deposit Taking Institutions

Act, 2016 (Act 930). Leverage ratio 6.1% 4.5%

Liquidity ratio 83% 73%

The directors’ responsibilities include: designing, implementing and maintaining internal

controls relevant to the preparation and fair presentation of financial statements that are free Default in statutory liquidity (Times) 1 Nil

from material misstatement, whether due to fraud or error, selecting and applying appropriate

Default in statutory liquidity Sanctions (GH¢) 42,755 Nil

accounting policies, and making accounting estimates that are reasonable in the circumstances.

The directors have made an assessment of the Bank’s ability to continue as a going concern and

7. CONTINGENT LIABILITIES

have no reason to believe the business will not be a going concern.

2021 2020

PRINCIPAL ACTIVITIES

Letters of credit 478,752 107,553

The Bank is licensed to carry out universal banking business in Ghana, and there was no change in

the nature of the Bank’s business during the period. Letters of guarantee 305,111 187,926

Undrawn commitments 52,910 85,001

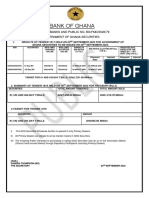

APPROVAL OF THE FINANCIAL STATEMENTS

The financial statements of the Bank were approved by the Board of Directors on 28 March, 2022. 836,773 380,480

8. CORPORATE SOCIAL RESPONSIBILITIES

NOTES TO THE SUMMARY FINANCIAL STATEMENTS

The Bank spent a total of GH¢3,055,435 (2020: GH¢3,349,220) on corporate social responsibilities

1. GENERAL INFORMATION during the year. These are mainly in the form of sponsorships in the areas of agriculture, education,

Consolidated Bank (Ghana) Limited, (the Bank) is a limited liability company incorporated and health, security and social partnerships.

domiciled in Ghana. The registered office is 1st Floor Manet Tower 3, Airport City, Accra. The

Bank commenced universal banking operations in August 2018 and operates under the Bank and The financial statements do not contain any untrue statements, misleading facts or omit material

Specialised Deposit-Taking Institutions Act, 2016 (Act 930). facts to the best of our knowledge.

2. BASIS OF PREPARATION

The Bank’s financial statements have been prepared on a historical cost basis and in accordance

with International Financial Reporting Standards (IFRS) and in the manner required by the

Companies Act, 2019 (Act 992) and the Banks and Specialised Deposit-Taking Institutions Act, 2016

(Act 930).

Welbeck Abra-Appiah Daniel Wilson Addo

The summary financial statements in this publication is an extract from the financial statements (Chairman) (Managing Director)

for the year ended 31 December 2021. The full set of the financial statements are available for

inspection at the Bank’s Head Office at 1st Floor Manet Tower 3, Airport City, Accra. INDEPENDENT AUDITOR’S REPORT ON THE SUMMARY FINANCIAL STATEMENTS TO THE

MEMBERS OF CONSOLIDATED BANK (GHANA) LIMITED

3. SIGNIFICANT ACCOUNTING POLICIES

The principal accounting policies applied in the preparation of these summary financial statements OUR OPINION

are consistent with the accounting policies applied in the audited financial statements of the Bank In our opinion, the accompanying summary financial statements of Consolidated Bank (Ghana)

for the year ended 31 December, 2021. These policies have been consistently applied to all the Limited (the “Bank”), are consistent, in all material respects, with the audited financial statements

years presented, unless otherwise stated. of the Bank for the year ended 31 December 2021, on the basis described in the notes.

THE SUMMARY FINANCIAL YEAR STATEMENTS

4. FUNCTIONAL AND PRESENTATION CURRENCY

These summary financial statements are presented in Ghana Cedis, which is the Bank’s functional

The Bank’s summary financial statements derived from the audited financial statements for the

currency. year ended 31 December 2021 comprise:

5. BASIS OF MEASUREMENT

• the summary statement of financial position as at 31 December 2021;

These summary financial statements have been prepared on a historical cost basis except for the

• the summary statement of comprehensive income for the year then ended;

following items:

• the summary statement of changes in equity for the year then ended;

• Non-derivative financial instruments at fair value through profit or loss. • the summary statement of cash flows for the year then ended; and

• Non-pledged trading assets • the related notes to the summary financial statements.

which are measured at fair value. The summary financial statements do not contain all the disclosures required by International

Financial Reporting Standards, the Companies Act, 2019 (Act 992) and the Banks and Specialised

6. RISK MANAGEMENT Deposit-Taking Institutions Act, 2016 (Act 930). Reading the summary financial statements and the

The Bank’s activities expose the business to risks. These risks are managed in a targeted manner. auditor’s report thereon, therefore, is not a substitute for reading the audited financial statements

The core functions of the Bank’s risk management are to identify all key risks for the Bank, measure and the auditor’s report thereon. The audited financial statements, and the summary financial

these risks, manage the risk positions and determine capital allocations. The risks arising from statements, do not reflect the effects of events that occurred subsequent to the date of our report

financial instruments to which the Bank is exposed are: on the audited financial statements.

• credit risk THE AUDITED FINANCIAL STATEMENTS AND OUR REPORT THEREON

• liquidity risk

We expressed an unmodified audit opinion on the audited financial statements in our report

• market risk

dated 29 March 2022. That report also includes the communication of key audit matters. Key audit

• operational risk matters are those matters that, in our professional judgement, were of most significance in our

Credit risk is the risk of suffering financial loss, should any of the Bank’s customers, clients or audit of the audited financial statements of the current period.

market counterparties fail to fulfil their contractual obligations to the Bank. Credit risk arises

DIRECTORS’ RESPONSIBILITY FOR THE SUMMARY FINANCIAL STATEMENTS

mainly from commercial and consumer loans and advances and loan commitments arising from

The directors are responsible for the preparation of the summary financial statements on the basis

such lending activities, but can also arise from credit enhancements, financial guarantees, letters described in the notes.

of credit, endorsements and acceptances.

AUDITOR’S RESPONSIBILITY

Liquidity risk is the risk that the Bank will encounter difficulty in meeting obligations associated Our responsibility is to express an opinion on whether the summary financial statements are

with its financial liabilities that are settled by delivering cash or another financial asset when they consistent, in all material respects, with the audited financial statements based on our procedures,

fall due. which were conducted in accordance with International Standard on Auditing 810 (Revised),

‘Engagements to Report on Summary Financial Statements’.

Market risk is the risk that changes in market prices – such as interest rates, foreign exchange rates

and credit spreads (not relating to changes in the obligor’s/issuer’s credit standing) – will affect the The engagement partner on the audit resulting in this independent auditor’s report is Michael

Bank’s income or the value of its holdings of financial instruments. The Bank separates exposures Asiedu-Antwi (ICAG/P/1138).

to market risk into either trading or non-trading portfolios.

Operational risk is the risk of direct or indirect loss that the Bank will suffer due to an event or

action resulting from the failure of its internal processes, people and systems, or from external

events.

PricewaterhouseCoopers (ICAG/F/2022/028)

The Bank regularly reviews its risk management policies and systems to reflect changes in markets, Chartered Accountants

products and best market practice. The Bank’s aim is to achieve an appropriate balance between Accra, Ghana

risk and return and minimise potential adverse effects on the Bank’s financial performance. The 29 March 2022

Bank defines risk as the possibility of losses or profits foregone, which may be caused by internal

or external factors.

You might also like

- Your Electricity Bill ActualDocument1 pageYour Electricity Bill Actualyouness el aameryNo ratings yet

- Revision Planner - May 24 - Nov 24 - Bhavik ChokshiDocument1 pageRevision Planner - May 24 - Nov 24 - Bhavik ChokshiNick VincikNo ratings yet

- Awasr Oman and Partners SAOC - FS 2020 EnglishDocument42 pagesAwasr Oman and Partners SAOC - FS 2020 Englishabdullahsaleem91No ratings yet

- Consolidated Bank (Ghana) Limited: Unaudited Summary Financial StatementsDocument2 pagesConsolidated Bank (Ghana) Limited: Unaudited Summary Financial StatementsFuaad DodooNo ratings yet

- Globus Bank 2021 ABRIDGED FSDocument1 pageGlobus Bank 2021 ABRIDGED FSAwojuyigbeNo ratings yet

- Consolidated Bank (Ghana) Limited: Unaudited Summary Financial StatementsDocument2 pagesConsolidated Bank (Ghana) Limited: Unaudited Summary Financial StatementsFuaad DodooNo ratings yet

- GT BankDocument1 pageGT BankFuaad DodooNo ratings yet

- Q3 Financial Statement q3 For Period 30 September 2021Document2 pagesQ3 Financial Statement q3 For Period 30 September 2021Fuaad DodooNo ratings yet

- 2021 Full Year FinancialsDocument2 pages2021 Full Year FinancialsFuaad DodooNo ratings yet

- United Bank For Africa (Ghana) Limited Summary Financial Statements For The Year Ended 31 December 2020Document2 pagesUnited Bank For Africa (Ghana) Limited Summary Financial Statements For The Year Ended 31 December 2020Fuaad DodooNo ratings yet

- Societe Generale Ghana PLC 2021 Audited Financial StatementsDocument2 pagesSociete Generale Ghana PLC 2021 Audited Financial StatementsFuaad DodooNo ratings yet

- UBA FS-31Dec2021Document2 pagesUBA FS-31Dec2021Fuaad DodooNo ratings yet

- UBA - June2021 FN StatementsDocument2 pagesUBA - June2021 FN StatementsFuaad DodooNo ratings yet

- Adb Fin Statement - Dec 2020 - Final 2Document2 pagesAdb Fin Statement - Dec 2020 - Final 2Fuaad DodooNo ratings yet

- UBL Annual Report 2018-170Document1 pageUBL Annual Report 2018-170IFRS LabNo ratings yet

- BK Group PLC Financial Results: Net Interest Income 51,762,974 46,360,210Document3 pagesBK Group PLC Financial Results: Net Interest Income 51,762,974 46,360,210chegeNo ratings yet

- Boa Financials For q3 30 Sept. 2021Document1 pageBoa Financials For q3 30 Sept. 2021Fuaad DodooNo ratings yet

- UBA Ghana 2021 Q3 Financial StatementsDocument1 pageUBA Ghana 2021 Q3 Financial StatementsFuaad DodooNo ratings yet

- UBL Annual Report 2018-79Document1 pageUBL Annual Report 2018-79IFRS LabNo ratings yet

- Unaudited Summary Consolidated and Separate Financial StatementsDocument2 pagesUnaudited Summary Consolidated and Separate Financial Statementsbentilwilliams65No ratings yet

- Summary Consolidated and Separate Financial Statements For The Period Ended 30 Sept 2021 (Unaudited)Document1 pageSummary Consolidated and Separate Financial Statements For The Period Ended 30 Sept 2021 (Unaudited)Fuaad DodooNo ratings yet

- Financial Statement 2020Document3 pagesFinancial Statement 2020Fuaad DodooNo ratings yet

- Access BankDocument1 pageAccess BankFuaad DodooNo ratings yet

- Financial Publication MarchDocument2 pagesFinancial Publication MarchFuaad DodooNo ratings yet

- Societe Generale Ghana PLC Unaudited Financial Statements For The Half Year Ended 30 June 2021Document2 pagesSociete Generale Ghana PLC Unaudited Financial Statements For The Half Year Ended 30 June 2021Fuaad DodooNo ratings yet

- (In Millions) : Consolidated Statements of Cash FlowsDocument1 page(In Millions) : Consolidated Statements of Cash FlowsrocíoNo ratings yet

- Societe Generale Ghana PLC Unaudited Financial Statements For The Quarter Ended 30 September 2021Document2 pagesSociete Generale Ghana PLC Unaudited Financial Statements For The Quarter Ended 30 September 2021Fuaad DodooNo ratings yet

- Standard Chartered Bank Ghana PLC: Unaudited Financial Statements For The Period Ended 30 September 2021Document1 pageStandard Chartered Bank Ghana PLC: Unaudited Financial Statements For The Period Ended 30 September 2021Fuaad DodooNo ratings yet

- Societe Generale Ghana PLC Unaudited Financial Statements For The Quarter Ended 31 March 2022Document2 pagesSociete Generale Ghana PLC Unaudited Financial Statements For The Quarter Ended 31 March 2022Fuaad DodooNo ratings yet

- RBGH Financials - 31 December 2021 - Colour - 21.02.2022 (3 Full Pages)Document3 pagesRBGH Financials - 31 December 2021 - Colour - 21.02.2022 (3 Full Pages)Fuaad DodooNo ratings yet

- FBNBank Ghana Limited 3rd Quarter Financial Statement (2021)Document1 pageFBNBank Ghana Limited 3rd Quarter Financial Statement (2021)Fuaad DodooNo ratings yet

- Unaudited Financial Statements For The Period Ended 31 March, 2022Document2 pagesUnaudited Financial Statements For The Period Ended 31 March, 2022Fuaad DodooNo ratings yet

- Annual Financial Statement 2021Document3 pagesAnnual Financial Statement 2021kofiNo ratings yet

- RBGH Financials 30 June 2021 Colour 15.07.2021 2 Full Pages EdtDocument2 pagesRBGH Financials 30 June 2021 Colour 15.07.2021 2 Full Pages EdtFuaad DodooNo ratings yet

- RBGH Financials 31 December 2020 Colour 18.03.2021 3 Full PageseddDocument3 pagesRBGH Financials 31 December 2020 Colour 18.03.2021 3 Full PageseddFuaad DodooNo ratings yet

- Ratio Analysis of Lanka Ashok Leyland PLCDocument6 pagesRatio Analysis of Lanka Ashok Leyland PLCThe MutantzNo ratings yet

- United Bank For Africa PLC - Quarter 1 - Financial Statement For 2024 Financial Statements May 2024Document37 pagesUnited Bank For Africa PLC - Quarter 1 - Financial Statement For 2024 Financial Statements May 2024frederick aivborayeNo ratings yet

- Ford 18Document6 pagesFord 18Bhavdeep singh sidhuNo ratings yet

- Microsoft Corporation: (In Millions) Year Ended June 30, 2010 2009 2008Document1 pageMicrosoft Corporation: (In Millions) Year Ended June 30, 2010 2009 2008Dylan MakroNo ratings yet

- The Boeing Company and Subsidiaries Consolidated Statements of Cash FlowsDocument1 pageThe Boeing Company and Subsidiaries Consolidated Statements of Cash Flowsdivineyang05No ratings yet

- Lloyds Banking Group-2021-Annual-Report - Part2 - Financial ResultsDocument24 pagesLloyds Banking Group-2021-Annual-Report - Part2 - Financial ResultsyahbNo ratings yet

- Annual Report 2023Document27 pagesAnnual Report 2023ALNo ratings yet

- Zenith Bank 2020Document2 pagesZenith Bank 2020Fuaad DodooNo ratings yet

- Hade PDFDocument2 pagesHade PDFMaradewiNo ratings yet

- Dell Financial Data Mid Course Quiz 1668627324062Document10 pagesDell Financial Data Mid Course Quiz 1668627324062rohit goyalNo ratings yet

- Financial Statements: For The Year Ended 31 December 2019Document11 pagesFinancial Statements: For The Year Ended 31 December 2019RajithWNNo ratings yet

- Expressed in Canadian Dollars ($ CAD), Unaudited: Digital Bull Technologies LTDDocument5 pagesExpressed in Canadian Dollars ($ CAD), Unaudited: Digital Bull Technologies LTDDishant KhanejaNo ratings yet

- Quarterly Report 20221231Document21 pagesQuarterly Report 20221231Ang SHNo ratings yet

- Standard Chartered PLC Full Year 2022 ReportDocument9 pagesStandard Chartered PLC Full Year 2022 Reporthoneysgh.394No ratings yet

- Increase in Long Term Loans and AdvancesDocument2 pagesIncrease in Long Term Loans and Advancesusama siddiquiNo ratings yet

- M4 Example 2 SDN BHD FSADocument38 pagesM4 Example 2 SDN BHD FSAhanis nabilaNo ratings yet

- Enterprise Group PLC: Unaudited Financial Statements For The Year Ended 31 December 2021Document8 pagesEnterprise Group PLC: Unaudited Financial Statements For The Year Ended 31 December 2021Fuaad DodooNo ratings yet

- Statement of Cash FlowsDocument2 pagesStatement of Cash FlowsKartik SharmaNo ratings yet

- Arab Sudanese Bank: Sudanese Private Ccompany LTDDocument30 pagesArab Sudanese Bank: Sudanese Private Ccompany LTDShadow PrinceNo ratings yet

- Annual Report 2021Document3 pagesAnnual Report 2021hxNo ratings yet

- Masteel 4Q 2023Document12 pagesMasteel 4Q 2023GZHNo ratings yet

- Cash Flow Statement ConsolidatedDocument2 pagesCash Flow Statement Consolidatedsamarth rajvaidNo ratings yet

- Financial Statements Notes On The Financial StatementsDocument95 pagesFinancial Statements Notes On The Financial StatementsEvariste GaloisNo ratings yet

- Nvidia ExcelDocument8 pagesNvidia Excelbafsvideo4No ratings yet

- Hong Fok Corporation Limited: Revenue (Note 1)Document10 pagesHong Fok Corporation Limited: Revenue (Note 1)Theng RogerNo ratings yet

- Consolidated Financial Statements Mar 11Document17 pagesConsolidated Financial Statements Mar 11praynamazNo ratings yet

- Daily Equity Market Report - 18.10.2022Document1 pageDaily Equity Market Report - 18.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 17.10.2022Document1 pageDaily Equity Market Report - 17.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 14.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 14.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 11.10.2022Document1 pageDaily Equity Market Report - 11.10.2022Fuaad DodooNo ratings yet

- Press Release 2Document1 pagePress Release 2Fuaad DodooNo ratings yet

- 19th Edition of The Ghana Club 100 Rankings OutcomeDocument3 pages19th Edition of The Ghana Club 100 Rankings OutcomeFuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 07.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 07.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 28.09.2022Document1 pageDaily Equity Market Report - 28.09.2022Fuaad DodooNo ratings yet

- Substandard (Contaminated) Paediatric Medicines Identified in WHODocument4 pagesSubstandard (Contaminated) Paediatric Medicines Identified in WHOFuaad DodooNo ratings yet

- R9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Document4 pagesR9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Fuaad DodooNo ratings yet

- Daily Equity Market Report - 04.10.2022Document1 pageDaily Equity Market Report - 04.10.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 10.10.2022Document1 pageFixed Income Market Report - 10.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.10.2022Document1 pageDaily Equity Market Report - 06.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 03.10.2022 2022-10-03Document1 pageDaily Equity Market Report 03.10.2022 2022-10-03Fuaad DodooNo ratings yet

- Press ReleaseDocument1 pagePress ReleaseFuaad DodooNo ratings yet

- Regulatory Order To ECG - 221004 - 180752Document6 pagesRegulatory Order To ECG - 221004 - 180752Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.10.2022Document1 pageDaily Equity Market Report - 05.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 30.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 30.09.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 03.10.2022Document1 pageFixed Income Market Report - 03.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 29.09.2022Document1 pageDaily Equity Market Report - 29.09.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 26.09.2022Document1 pageFixed Income Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 27.09.2022Document1 pageDaily Equity Market Report - 27.09.2022Fuaad DodooNo ratings yet

- Imf MeetingDocument1 pageImf MeetingFuaad DodooNo ratings yet

- Daily Equity Market Report 20.09.2022 2022-09-20Document1 pageDaily Equity Market Report 20.09.2022 2022-09-20Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 23.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 23.09.2022Fuaad DodooNo ratings yet

- Auctresults 1817Document1 pageAuctresults 1817Fuaad DodooNo ratings yet

- Daily Equity Market Report - 22.09.2022Document1 pageDaily Equity Market Report - 22.09.2022Fuaad DodooNo ratings yet

- Nimed Financial Market Review (16.09.2022)Document4 pagesNimed Financial Market Review (16.09.2022)Fuaad DodooNo ratings yet

- Daily Equity Market Report - 26.09.2022Document1 pageDaily Equity Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 19.09.2022Document1 pageDaily Equity Market Report - 19.09.2022Fuaad DodooNo ratings yet

- MGT 337 TermpaperDocument25 pagesMGT 337 TermpaperTamim RahmanNo ratings yet

- Current Assets Exercises VDocument40 pagesCurrent Assets Exercises VHenok Fikadu100% (1)

- COM01P105S23U00Document35 pagesCOM01P105S23U00SHAMPA SINHAROYNo ratings yet

- Chapter 9Document15 pagesChapter 9Duffin AngganaNo ratings yet

- F. Guerrero - Social Sustainability at NIKE, Disabled People As A WorkforceDocument3 pagesF. Guerrero - Social Sustainability at NIKE, Disabled People As A WorkforceFelipe GuerreroNo ratings yet

- Cash and Accrual BasisDocument24 pagesCash and Accrual BasisAlexa LeeNo ratings yet

- 304 Ope Som-Mcq-2019Document7 pages304 Ope Som-Mcq-2019Prafull P KulkarniNo ratings yet

- ReviewDocument6 pagesReviewgabrenillaNo ratings yet

- Assignment 4 CCMA-3Document10 pagesAssignment 4 CCMA-3JaspreetNo ratings yet

- Gaurav Reliance JioDocument76 pagesGaurav Reliance JiogoswamiphotostatNo ratings yet

- DBMS Lab - Assignment 3Document2 pagesDBMS Lab - Assignment 3sgdfsfgNo ratings yet

- 2010 Sustainability Banco SantanderDocument56 pages2010 Sustainability Banco SantanderCetty RotondoNo ratings yet

- Revenue Memorandum Circular No. 91-2012: Bureau of Internal RevenueDocument3 pagesRevenue Memorandum Circular No. 91-2012: Bureau of Internal RevenueHenson MontalvoNo ratings yet

- RC Mapping EDCDocument5 pagesRC Mapping EDCDhio Reza PrasetyoNo ratings yet

- Barter Ph. HistoryDocument7 pagesBarter Ph. HistoryMark Anthony M GaboNo ratings yet

- COSO GuidanceDocument71 pagesCOSO GuidancemahmudtohaNo ratings yet

- 2013 Sample MC Questions - 60Document11 pages2013 Sample MC Questions - 60Patricia Kim LeeNo ratings yet

- Atl Tinkerfest 2021 - Tinkerpreneur: Home Registration Form LogoutDocument2 pagesAtl Tinkerfest 2021 - Tinkerpreneur: Home Registration Form LogoutINDRA DAVENo ratings yet

- Ateneo Celadon YES Report 2014-2015Document45 pagesAteneo Celadon YES Report 2014-2015Aldrin Derrick ChuaNo ratings yet

- SLCM Main Book CS Vikas Vohra (Old Syllabus) (June 23)Document583 pagesSLCM Main Book CS Vikas Vohra (Old Syllabus) (June 23)A0913KHUSHI RUNGTANo ratings yet

- Sobrecostos Logisticos PeruDocument31 pagesSobrecostos Logisticos PeruPablo CorraloNo ratings yet

- Sylvian Ruf NEWfDocument2 pagesSylvian Ruf NEWfsyruffNo ratings yet

- Background CitycellDocument32 pagesBackground CitycellMahmudur RashidNo ratings yet

- Jawaban Soal Latihan Ch.10Document3 pagesJawaban Soal Latihan Ch.10Wira DinataNo ratings yet

- MKMA1105. Principles of MarketingDocument8 pagesMKMA1105. Principles of MarketingThuy DungNo ratings yet

- Executive Summary & Project Information Study - Salang Subdivision (Malaybalay City)Document2 pagesExecutive Summary & Project Information Study - Salang Subdivision (Malaybalay City)clinnton macaNo ratings yet

- Bank Management Board of Directors: QualificationsDocument2 pagesBank Management Board of Directors: QualificationsFarrah MarieNo ratings yet

- SssssssssssssssadsaasdaDocument85 pagesSssssssssssssssadsaasdaGabriell LazarNo ratings yet