Professional Documents

Culture Documents

TH HĐNSV Buổi 5

TH HĐNSV Buổi 5

Uploaded by

Dỹ KhangOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TH HĐNSV Buổi 5

TH HĐNSV Buổi 5

Uploaded by

Dỹ KhangCopyright:

Available Formats

2-8 INTRODUCTORY PROJECT VALUATION South Tel Communications is

considering the purchase of a new software management system. The system is called B-

Image, and it is expected to reduce drastically the amount of time that company technicians

spend installing new software. South Tel’s technicians currently spend 6,000 hours per year

on installations, which costs South Tel $25 per hour. The owners of the B-Image system

claim that their software can reduce time on task by at least 25%. The system requires an

initial investment of $55,000 and an additional investment of $10,000 for technician training

on the new system. Annual upgrades will cost the firm $15,000 per year. The tax treatment of

software purchases sometimes calls for amortization of the initial cost over time; sometimes

the cost can be expensed in the year of the purchase. Before the tax experts are consulted and

for purposes of this initial analysis, South Tel has decided that it will expense the cost of the

software in the year of the expenditure. South Tel faces a 30% tax rate and uses a 9% cost of

capital to evaluate projects of this type.

a. Assume that South Tel has sufficient taxable income from other projects so that it can

expense the cost of the software immediately. What are the free cash flows for the project for

years zero through five?

b. Calculate the NPV and IRR for the project.

2-9 INTRODUCTORY PROJECT VALUATION The CT Computers Corporation is

considering whether to begin offering customers the option to have their old personal

computers (PCs) recycled when they purchase new systems. The recycling system would

require CT Computers to invest $600,000 in the grinders and magnets used in the recycling

process. The company estimates that for each system it recycles, it would generate $1.50 in

incremental revenues from the sale of scrap metal and plastics. The machinery has a five-year

useful life and will be depreciated using straight-line depreciation toward a zero salvage

value. CT Computers estimates that in the first year of the recycling investment, it could

recycle 100,000 PCs and that this number will grow by 25% per year over the remaining

four-year life of the recycling equipment. CT Computers uses a 15% discount rate to analyze

capital expenditures and pays taxes equal to 30%.

a. What are the project cash flows? You can assume that the recycled PCs cost CT Computers

nothing.

b. Calculate the NPV and IRR for the recycling investment opportunity. Is the investment a

good one based on these cash flow estimates?

c. Is the investment still a good one if only 75,000 units are recycled in the first year?

d. Redo your analysis for a scenario in which CT Computers incurs a cost of $0.20 per unit to

dispose of the toxic elements from the recycled computers. What is your recommendation

under these circumstances?

2-10 PROJECT VALUATION Glentech Manufacturing is considering the purchase of an

automated parts handler for the assembly and test area of its Phoenix, Arizona, plant. The

handler will cost $250,000 to purchase plus $10,000 for installation. If the company

undertakes the investment, it will automate part of the semiconductor test area and reduce

operating costs by $70,000 per year for the next ten years. Five years into the life of the

investment, however, Glentech will have to spend an additional $100,000 to update and

refurbish the handler. The investment in the handler will be depreciated using straight-line

depreciation over ten years, and the refurbishing costs will be depreciated over the remaining

five-year life of the handler (also using straight-line depreciation). In ten years, the handler is

expected to be worth $5,000, although its book value will be zero. Glentech’s tax rate is

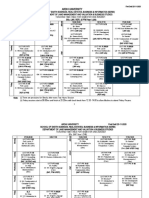

30%, and its opportunity cost of capital is 12%. Exhibit P2-10.1 contains cash flow

calculations for the project that can be used in performing a DCF evaluation of its

contribution to firm value. Answer each of the following questions concerning the project:

a. Is this a good project for Glentech? Explain your answer.

b. What can you tell about the project from the NPV profile found in Exhibit P2-10.1?

c. If the project were partially financed by borrowing, how would this affect the investment

cash flows? How would borrowing a portion of the investment outlay affect the value of the

investment to the firm?

d. The project calls for two investments: one immediately and one at the end of year 5. How

much would Glentech earn on its investment? How should you account for the additional

investment outlay in your calculations?

e. What are the considerations that make this investment somewhat risky? How would you

investigate the potential risks of this investment?

You might also like

- FAC1502 Assignment 4 2023Document193 pagesFAC1502 Assignment 4 2023Haat My Later100% (1)

- Low-Code/No-Code: Citizen Developers and the Surprising Future of Business ApplicationsFrom EverandLow-Code/No-Code: Citizen Developers and the Surprising Future of Business ApplicationsRating: 2.5 out of 5 stars2.5/5 (2)

- ME2Document13 pagesME2Aiman Padilla AbreuNo ratings yet

- 30 Apr 2021Document1 page30 Apr 2021Madhuri MadhuNo ratings yet

- Report On Sinclair CompanyDocument5 pagesReport On Sinclair CompanyVictor LimNo ratings yet

- Tutorial QuestionsDocument19 pagesTutorial QuestionsTan Ngoc TranNo ratings yet

- Soft Corporate Offer Sugar Icumsa-45Document7 pagesSoft Corporate Offer Sugar Icumsa-45lee kok onnNo ratings yet

- Forest Gump 11Document1 pageForest Gump 11Dennis KorirNo ratings yet

- Bài Tập Buổi 4 (Updated)Document4 pagesBài Tập Buổi 4 (Updated)Minh NguyenNo ratings yet

- 05 Exercises On Capital BudgetingDocument4 pages05 Exercises On Capital BudgetingAnshuman AggarwalNo ratings yet

- S 12Document15 pagesS 12AbhishekKumar0% (3)

- Day 1 Capital BudgetingDocument12 pagesDay 1 Capital BudgetingJohn Carlo Aquino100% (1)

- Exercises 270919Document3 pagesExercises 270919Kim AnhNo ratings yet

- MANAGERIAL FINANCE AssignmentDocument2 pagesMANAGERIAL FINANCE Assignmentfahim zamanNo ratings yet

- NPV & Capital Budgeting QuestionsDocument8 pagesNPV & Capital Budgeting QuestionsAnastasiaNo ratings yet

- Fin701 Module3Document22 pagesFin701 Module3Krista CataldoNo ratings yet

- Derivatives Project ReportDocument92 pagesDerivatives Project Reportkamdica83% (23)

- F9 Smart Study NotesDocument97 pagesF9 Smart Study NotesSteven Lino100% (5)

- Corporate Finance I: Home Assignment 2 Due by January 30Document2 pagesCorporate Finance I: Home Assignment 2 Due by January 30RahulNo ratings yet

- Tutorial Problems - Capital BudgetingDocument6 pagesTutorial Problems - Capital BudgetingMarcoBonaparte0% (1)

- 3-1 Scenario Analysis: Project Risk Analysis-ComprehensiveDocument4 pages3-1 Scenario Analysis: Project Risk Analysis-ComprehensiveMinh NguyenNo ratings yet

- Required:: Project A Would CostDocument10 pagesRequired:: Project A Would CostSad CharlieNo ratings yet

- ISSM 541 Winter 2015 Assignment 5Document5 pagesISSM 541 Winter 2015 Assignment 5Parul KhannaNo ratings yet

- Economics Tutorial-Sheet-2Document3 pagesEconomics Tutorial-Sheet-2Saburo SahibNo ratings yet

- Capital Budgeting ProcessDocument17 pagesCapital Budgeting ProcessAjmal SalamNo ratings yet

- Part 2 Long Term Decision 1Document4 pagesPart 2 Long Term Decision 1Aye Mya KhineNo ratings yet

- Project Management & Economics: Sessions 14 & 15 ExerciseDocument4 pagesProject Management & Economics: Sessions 14 & 15 ExerciseTown Obio EteteNo ratings yet

- Capital Budgeting Problems For Fin102Document2 pagesCapital Budgeting Problems For Fin102Marianne AgunoyNo ratings yet

- Acca QNSDocument10 pagesAcca QNSIshmael OneyaNo ratings yet

- Activity - Capital Investment AnalysisDocument5 pagesActivity - Capital Investment AnalysisKATHRYN CLAUDETTE RESENTENo ratings yet

- Nanyang Business School AB1201 Financial Management Tutorial 9: Cash Flow Estimation (Common Questions)Document8 pagesNanyang Business School AB1201 Financial Management Tutorial 9: Cash Flow Estimation (Common Questions)asdsadsaNo ratings yet

- I. Capital Budgeting (30 Questions)Document26 pagesI. Capital Budgeting (30 Questions)Joseph Prado Fernandez0% (1)

- Problems On Estimation of Cash Flows - 1Document2 pagesProblems On Estimation of Cash Flows - 1Shivu YatiNo ratings yet

- Part 2 Capital Budgeting Concepts - Qs 16 Mar 2024Document20 pagesPart 2 Capital Budgeting Concepts - Qs 16 Mar 2024Ayame KusuragiNo ratings yet

- SFM Practice QuestionsDocument13 pagesSFM Practice QuestionsAmmar Ahsan0% (1)

- Chapter-3 ExercisesDocument17 pagesChapter-3 Exercisesminhanhvu2406No ratings yet

- Capital Budgeting Illustrative NumericalsDocument6 pagesCapital Budgeting Illustrative NumericalsPriyanka Dargad100% (1)

- 3 - 0607 - Making Capital Investment Decisions. Risk Analysis, Real OptionsDocument3 pages3 - 0607 - Making Capital Investment Decisions. Risk Analysis, Real OptionsPham Ngoc VanNo ratings yet

- FDHDFGSGJHDFHDSHJDDocument8 pagesFDHDFGSGJHDFHDSHJDbabylovelylovelyNo ratings yet

- 20PT31 Cf-IiDocument4 pages20PT31 Cf-IiSakthivelayudham BhyramNo ratings yet

- EmptyDocument2 pagesEmptyPranav ChaudhariNo ratings yet

- Financial Management 2: Capital Budgeting Problems and Exercises PART 1 Problems Problem 1Document7 pagesFinancial Management 2: Capital Budgeting Problems and Exercises PART 1 Problems Problem 1Robert RamirezNo ratings yet

- ANGELICADocument7 pagesANGELICAAngel Reconalla Lapadan100% (2)

- Sheet 2 Engineering EconomyDocument3 pagesSheet 2 Engineering Economywasem.1048No ratings yet

- Add - L Problems CBDocument4 pagesAdd - L Problems CBJamesCarlSantiagoNo ratings yet

- SEEM2440: Engineering Economics (2022 - 2023 Term 1) : Assignment 3 Due: 10:00 PM, November 29 (Tuesday), 2022Document3 pagesSEEM2440: Engineering Economics (2022 - 2023 Term 1) : Assignment 3 Due: 10:00 PM, November 29 (Tuesday), 2022韩思嘉No ratings yet

- Capital Budgeting ProcessDocument17 pagesCapital Budgeting ProcessjanineNo ratings yet

- Ie342 SS4Document8 pagesIe342 SS4slnyzclrNo ratings yet

- Tutorial 3a-Cash Flow EstimationDocument3 pagesTutorial 3a-Cash Flow EstimationPrincessCC20No ratings yet

- FINC71-101 Tutorial Solution 08Document7 pagesFINC71-101 Tutorial Solution 08xiaociao199203No ratings yet

- Avp Wacc InitailDocument3 pagesAvp Wacc InitailYasir AamirNo ratings yet

- For Students Capital BudgetingDocument3 pagesFor Students Capital Budgetingwew123No ratings yet

- Quiz FM FinalDocument2 pagesQuiz FM FinalTú ĐoànNo ratings yet

- BT Lựa Chọn Dự Án EDocument2 pagesBT Lựa Chọn Dự Án EstormspiritlcNo ratings yet

- Capital Budgeting Assignment QuestionsDocument3 pagesCapital Budgeting Assignment QuestionsNgaiza3No ratings yet

- Zcmc6122 Set 1 Sem 1 2022-2023 Individual Assignment 4Document9 pagesZcmc6122 Set 1 Sem 1 2022-2023 Individual Assignment 4Mira DenisNo ratings yet

- Financial Management-Capital Budgeting:: Answer The Following QuestionsDocument2 pagesFinancial Management-Capital Budgeting:: Answer The Following QuestionsMitali JulkaNo ratings yet

- Capital BudgetingDocument19 pagesCapital BudgetingJane Masigan50% (2)

- Annual Worth IRR Capital Recovery CostDocument30 pagesAnnual Worth IRR Capital Recovery CostadvikapriyaNo ratings yet

- Idoc - Pub 169018566 Engineering Economy 7th Edition Solution Manual Blank Tarquin 160312152003Document6 pagesIdoc - Pub 169018566 Engineering Economy 7th Edition Solution Manual Blank Tarquin 160312152003Tural RamazanovNo ratings yet

- HW Week 5 Fin/571Document5 pagesHW Week 5 Fin/571trelvisd0% (1)

- Problem 12-1aDocument8 pagesProblem 12-1aJose Ramon AlemanNo ratings yet

- Tutorial Capital BudgetingDocument4 pagesTutorial Capital Budgetingmi luNo ratings yet

- Accounting 203 Chapter 12 TestDocument3 pagesAccounting 203 Chapter 12 TestAnbang XiaoNo ratings yet

- Engineering Economics and Finacial Management (HUM 3051)Document5 pagesEngineering Economics and Finacial Management (HUM 3051)uday KiranNo ratings yet

- Leveraging Technology for Property Tax Management in Asia and the Pacific–Guidance NoteFrom EverandLeveraging Technology for Property Tax Management in Asia and the Pacific–Guidance NoteNo ratings yet

- NDB 2019 Ara 1 PDFDocument150 pagesNDB 2019 Ara 1 PDFFábio BorgesNo ratings yet

- Depository SystemDocument20 pagesDepository SystemSuhail AkhterNo ratings yet

- Approaches To Financial ManagementDocument16 pagesApproaches To Financial Managementarko banerjeeNo ratings yet

- 2014-02-03 US (Szymoniak) V Ace Doc 271 3rd Amended ComplaintDocument214 pages2014-02-03 US (Szymoniak) V Ace Doc 271 3rd Amended Complaintlarry-612445100% (1)

- G-7 FX Weekly ReportDocument15 pagesG-7 FX Weekly ReportAaron UitenbroekNo ratings yet

- Organigramme General AnglaisDocument1 pageOrganigramme General Anglaisnhiivt.03No ratings yet

- LME Trading Calendar 2017 2027Document14 pagesLME Trading Calendar 2017 2027Omkar PranavNo ratings yet

- Pubbid062719ncr (WD)Document11 pagesPubbid062719ncr (WD)Clodualdo Iv Dela CernaNo ratings yet

- Bank Reconciliation StatementDocument33 pagesBank Reconciliation StatementMd TahirNo ratings yet

- Spouses Constantino V Hon CuisiaDocument8 pagesSpouses Constantino V Hon CuisiaJohn Basil ManuelNo ratings yet

- SOA Exam MFE - Yufeng Guo (Fall 2008)Document432 pagesSOA Exam MFE - Yufeng Guo (Fall 2008)Joseph Guy Evans HilaireNo ratings yet

- IRC CalculationDocument115 pagesIRC CalculationNgô Túc HòaNo ratings yet

- Pension Calculation Sheet 2018 For Federal PunjabDocument6 pagesPension Calculation Sheet 2018 For Federal PunjabFaisal MehmoodNo ratings yet

- أثر المحاسبة الإبداعية على جودة القوائم المالية دراسة عينة من الاكاديمين والمهنيين في مجال المحاسبة والمراجعةDocument16 pagesأثر المحاسبة الإبداعية على جودة القوائم المالية دراسة عينة من الاكاديمين والمهنيين في مجال المحاسبة والمراجعةwindowsmaxNo ratings yet

- Ardhi University: Mr. Kafullah/Ms. Jenesta Lecture R-62Document14 pagesArdhi University: Mr. Kafullah/Ms. Jenesta Lecture R-62Betson EsromNo ratings yet

- Introduction To Computational Finance and Financial EconometricsDocument54 pagesIntroduction To Computational Finance and Financial EconometricsMR 2No ratings yet

- Curriculum Vitae: Amar Nath PuttaparthiDocument3 pagesCurriculum Vitae: Amar Nath PuttaparthikartheekroyalNo ratings yet

- Test Reconciliation Grade 11Document6 pagesTest Reconciliation Grade 11Stars2323100% (2)

- ProfileDocument60 pagesProfileA Kumar LegacyNo ratings yet

- Coca-Cola Financial AnalysisDocument6 pagesCoca-Cola Financial AnalysisAditya Pal Singh Mertia RMNo ratings yet

- Application Form - Car Park Rental 2023 PDFDocument2 pagesApplication Form - Car Park Rental 2023 PDFRozaimi AdliNo ratings yet

- The Following Material Represents The Cover Page and Summary ofDocument2 pagesThe Following Material Represents The Cover Page and Summary oftrilocksp SinghNo ratings yet

- Open The Column E For Marks of 50 or Greater, and "Fail" For Marks Below 50. in Next Column Print The Grades of StudentsDocument3 pagesOpen The Column E For Marks of 50 or Greater, and "Fail" For Marks Below 50. in Next Column Print The Grades of StudentsShaun PollockNo ratings yet

- IDX Monthly-Des-2017Document116 pagesIDX Monthly-Des-2017miiekoNo ratings yet