Professional Documents

Culture Documents

Attempt All Questions. Your Answers Must Be Constructive and Precise

Attempt All Questions. Your Answers Must Be Constructive and Precise

Uploaded by

Zara AsrarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Attempt All Questions. Your Answers Must Be Constructive and Precise

Attempt All Questions. Your Answers Must Be Constructive and Precise

Uploaded by

Zara AsrarCopyright:

Available Formats

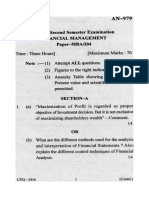

NATIONAL UNIVERSITY OF MODERN LANGUAGES, Islamabad

Department of Economics

END TERM EXAM, Spring 2021

Shift : Morning

th

Class: BS E & F (5 Semester) Total Marks: 30

Paper: Financial Management Time Allowed: 2 Hrs

Course Code: BECF-316 Instructor: Z M Akhtar

Attempt all questions. Your answers must be constructive and precise.

Q 1. (a) The economy of finance is all about the budgeting of capital and the cost which is borne on (2)

raising it. Why is it important for the firms to estimate the cost of capital before budgeting of

capital?

(b) The managers at Khawaja Corporation are about to recommend their final capital budget for (5)

next year. They have a self imposed budget limit of Rs 100,000. Five independent projects

are being considered. Mr. Ali the CEO has minimum financial analysis experience and relies

on his managers to recommend the projects that will increase the value of the firm by the

greatest amount. Given the following summary of the five projects, which ones should the

managers recommend?

Initial Cash Present Value of

Projects

Outlay Cash inflows

Project A (10,000) 14,000

Project B (25,000) 28,600

Project C (35,000) 38,250

Project D (40,000) 42,500

Project E (20,000) 22,100

(c) What is the decision rule for accepting or rejecting proposed projects when using net present (2)

value?

Q 2. (a) Razzaq Ibrahim, the founder of Ibrahim Leasing Corporation, thinks that the optimal capital (5)

structure of his company is 30 percent debt, 15 percent preferred stock, and the rest common

equity. If the company is in the 40 percent tax bracket, what is the weighted average cost of

capital given that: Yield to maturity of its debt is 10 percent

New preferred stock will have a face value of Rs. 30 and a dividend of Rs. 2 per share

Price of common stock is currently Rs. 100 per share and new common stock can be issued at

the same price. The expected dividend in one year is Rs. 4 per share and the growth rate is 6

percent. (Assume floatation costs are zero )

(b) Describe the sources of capital and how firms raise capital. (2)

(c) How do tax considerations affect the cost of debt and the cost of equity? (2)

Q 3. (a) What is Dividend? Discuss its different forms. (3)

(b) Mr. Zubair is a Director of Al-Rushd Enterprises. He is of the view that this year such sort (4)

of dividend policy should be designed which will boost the confidence of shareholders.

What should be his suggested points that may lead to devise a successful strategic dividend

policy?

(c) STOCK DIVIDEND STOCK SPLIT (5)

3% stock dividend issued 6 for 5 stock split

Before After Before After

Stock Stock Stock Stock

Dividend Dividend Split Split

No. of shares 1,000,000 ? No of Shares 4 Million ?

EPS 1 ? MPS 40 ?

MPS 20 ? EPS 1.5 ?

P/E ratio ? ? DPS 0.5 ?

MV Equity ? ? DY ? ?

P/E ratio ? ?

MV Equity ? ?

You are required to find the missing figures “?”. Your answers must be justified by proper

workings on the answer sheet.

You might also like

- Notes On Capital Structure PDFDocument9 pagesNotes On Capital Structure PDFRahamat Ali Sardar83% (12)

- Financial Management:: Professional Level Suggested Answers Nov-Dec 2020Document13 pagesFinancial Management:: Professional Level Suggested Answers Nov-Dec 2020Md Aliul AlimNo ratings yet

- Heriot-Watt University Finance - August 2021 Section I Case StudiesDocument4 pagesHeriot-Watt University Finance - August 2021 Section I Case StudiesSijan PokharelNo ratings yet

- CA Intermediate Mock Test Eco FM 16.10.2018 EM Only QuestionDocument6 pagesCA Intermediate Mock Test Eco FM 16.10.2018 EM Only QuestionTanmayNo ratings yet

- Business & Finance: Time Allowed-2:15 Hours Total Marks - 100Document2 pagesBusiness & Finance: Time Allowed-2:15 Hours Total Marks - 100Laskar REAZNo ratings yet

- Model Questions BBS 3rd Year Fundamental of Financial Management PDFDocument9 pagesModel Questions BBS 3rd Year Fundamental of Financial Management PDFShah SujitNo ratings yet

- Fourth Semester 5 Year B.B.A. LL.B. Examination, June/July 2014 Financial ManagementDocument4 pagesFourth Semester 5 Year B.B.A. LL.B. Examination, June/July 2014 Financial ManagementsimranNo ratings yet

- 2021 ZB PaperDocument11 pages2021 ZB Papermandy YiuNo ratings yet

- Afm 1 AfDocument4 pagesAfm 1 AfDeepansh singhalNo ratings yet

- Question PaperDocument3 pagesQuestion PaperAmbrishNo ratings yet

- MQP - MBA - Sem2 - Financial Management (DMBA202) PDFDocument4 pagesMQP - MBA - Sem2 - Financial Management (DMBA202) PDFsanjeev misraNo ratings yet

- COM 96th AIBB Solved-FBDocument29 pagesCOM 96th AIBB Solved-FBShamima AkterNo ratings yet

- Mba 108 CDocument5 pagesMba 108 CRohit TushirNo ratings yet

- MN5207 Acounting and Financial Management 2019Document10 pagesMN5207 Acounting and Financial Management 2019Vimuth Chanaka PereraNo ratings yet

- Makerere University Business School Jinja CampusDocument54 pagesMakerere University Business School Jinja CampusIanNo ratings yet

- Use of Statistical Tables PermittedDocument2 pagesUse of Statistical Tables PermittedPAVAN KUMARNo ratings yet

- Sem 2 April 2023Document20 pagesSem 2 April 2023mr.shewalkarNo ratings yet

- CF WInter 2021Document2 pagesCF WInter 2021Ziya ShahNo ratings yet

- An 979 MBA Sem II Financial Management14Document4 pagesAn 979 MBA Sem II Financial Management14Riya AgrawalNo ratings yet

- Bangalore University Previous Year Question Paper AFM 2020Document3 pagesBangalore University Previous Year Question Paper AFM 2020Ramakrishna NagarajaNo ratings yet

- FIN 440: Individual Assignment Total: 50Document12 pagesFIN 440: Individual Assignment Total: 50ImrAn KhAnNo ratings yet

- 7 Corporate Finance - Prof. Gagan SharmaDocument4 pages7 Corporate Finance - Prof. Gagan SharmaVampireNo ratings yet

- Og FMDocument5 pagesOg FMSiva KumarNo ratings yet

- Academic Session 2022 MAY 2022 Semester: AssignmentDocument6 pagesAcademic Session 2022 MAY 2022 Semester: AssignmentChristopher KipsangNo ratings yet

- EF343.FSM (AL-I) Question CMA January-2023 Exam.Document4 pagesEF343.FSM (AL-I) Question CMA January-2023 Exam.GT Moringa LimitedNo ratings yet

- 6th Sem-FM - Model QP by Srijita Datta and Arunangsu Das Sarma-26Apr2020Document15 pages6th Sem-FM - Model QP by Srijita Datta and Arunangsu Das Sarma-26Apr2020Kashish GroverNo ratings yet

- CF Paper Summer 2015Document4 pagesCF Paper Summer 2015Vicky ThakkarNo ratings yet

- Test Portfolio & Mutual FundDocument11 pagesTest Portfolio & Mutual FundBijay AgrawalNo ratings yet

- 1 - SFM Test Papers & Suggested AnswersDocument18 pages1 - SFM Test Papers & Suggested AnswersUDESH DEBATANo ratings yet

- Financial ManagementDocument3 pagesFinancial Managementgundapola100% (2)

- MS-042 Dec 2021Document2 pagesMS-042 Dec 2021chanduNo ratings yet

- An Autonomous Institution, Affiliated To Anna University, ChennaiDocument7 pagesAn Autonomous Institution, Affiliated To Anna University, Chennaisibi chandanNo ratings yet

- Dfa6233 2017 2 PT PDFDocument6 pagesDfa6233 2017 2 PT PDFmy pcNo ratings yet

- f9 2018 Marjun QDocument6 pagesf9 2018 Marjun QDilawar HayatNo ratings yet

- 2016-2017 April Peper 2Document6 pages2016-2017 April Peper 2seyon sithamparanathanNo ratings yet

- Img 20200626 0001Document7 pagesImg 20200626 0001seyon sithamparanathanNo ratings yet

- Heriot-Watt University Finance - June 2021 Section I Case StudiesDocument4 pagesHeriot-Watt University Finance - June 2021 Section I Case StudiesSijan PokharelNo ratings yet

- This Test Is Only For Students of MS Consultancy ManagementDocument2 pagesThis Test Is Only For Students of MS Consultancy ManagementrudypatilNo ratings yet

- RM 3Document6 pagesRM 3Harsh KumarNo ratings yet

- Mba Executive - I Year 2 Semester / January 2021Document2 pagesMba Executive - I Year 2 Semester / January 2021gaurav jainNo ratings yet

- FM Eco Test BookDocument73 pagesFM Eco Test BookkonaNo ratings yet

- Gujarat Technological UniversityDocument3 pagesGujarat Technological UniversityAmul PatelNo ratings yet

- MBA108CDocument2 pagesMBA108CRohit TushirNo ratings yet

- Executive MSC in Project Management: Finance - Final ExaminationDocument6 pagesExecutive MSC in Project Management: Finance - Final ExaminationSamantha Meril PandithaNo ratings yet

- Executive MSC in Project Management: Finance - Final ExaminationDocument6 pagesExecutive MSC in Project Management: Finance - Final ExaminationSamantha Meril PandithaNo ratings yet

- Ba 4202 FM Important QuestionsDocument6 pagesBa 4202 FM Important QuestionsRishi vardhiniNo ratings yet

- Ix F&BDocument5 pagesIx F&BShahid OpuNo ratings yet

- Baf2104 Financial Management I, School BasedDocument4 pagesBaf2104 Financial Management I, School BasedLemaronNo ratings yet

- FM SM QPDocument6 pagesFM SM QPmewtwovarceusNo ratings yet

- Analytical Questions: Answer All: (Section A & B)Document1 pageAnalytical Questions: Answer All: (Section A & B)ShirazeNo ratings yet

- Question and AnsDocument33 pagesQuestion and AnsHawa MudalaNo ratings yet

- CA Inter - Nov 2018 - F M & Eco For Finance - Suggested AnswersDocument25 pagesCA Inter - Nov 2018 - F M & Eco For Finance - Suggested AnswersIshmael FofanahNo ratings yet

- Paper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementDocument23 pagesPaper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementZrake 24No ratings yet

- Section A: Compulsory: Question 1 (25 Marks)Document10 pagesSection A: Compulsory: Question 1 (25 Marks)mis gunNo ratings yet

- Test Paper: Chapter-1: Cost of CapitalDocument13 pagesTest Paper: Chapter-1: Cost of Capitalcofinab795No ratings yet

- P8 FM ECO Q MTP 1 Nov 23Document5 pagesP8 FM ECO Q MTP 1 Nov 23spyverse01No ratings yet

- TWO (2) Questions From SECTION B in The Answer Booklet Provided. All Question CarryDocument4 pagesTWO (2) Questions From SECTION B in The Answer Booklet Provided. All Question CarrynatlyhNo ratings yet

- BcvTnl-BMAN30111 Exam Paper 2019-20Document7 pagesBcvTnl-BMAN30111 Exam Paper 2019-20ruoningzhu7No ratings yet

- Investing in Early Childhood Development: Review of the World Bank's Recent ExperienceFrom EverandInvesting in Early Childhood Development: Review of the World Bank's Recent ExperienceNo ratings yet

- Future of Technology 2Document8 pagesFuture of Technology 2Zara AsrarNo ratings yet

- What Is Difference Between Doing A Job and in Network Marketing?Document3 pagesWhat Is Difference Between Doing A Job and in Network Marketing?Zara AsrarNo ratings yet

- Bang On in Network MarketingDocument4 pagesBang On in Network MarketingZara AsrarNo ratings yet

- Discuss What It Means To Be Socially Responsible and What Factors Influence That DecisionDocument4 pagesDiscuss What It Means To Be Socially Responsible and What Factors Influence That DecisionZara AsrarNo ratings yet