Professional Documents

Culture Documents

Import of Services Made On or After The Appointed Day Shall Be Liable To Tax Under

Import of Services Made On or After The Appointed Day Shall Be Liable To Tax Under

Uploaded by

Sayan SanyalCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Acceptance Letter From HogwartsDocument5 pagesAcceptance Letter From HogwartsSayan SanyalNo ratings yet

- William S Husel Et Al Court CaseDocument12 pagesWilliam S Husel Et Al Court CaseEllyn SantiagoNo ratings yet

- I. F. Standard Factory Testing, G. Painting, H. Loose PartsDocument2 pagesI. F. Standard Factory Testing, G. Painting, H. Loose PartsSayan SanyalNo ratings yet

- Hippogriff Feather Wands Excel in Transfiguration and Levitation EspeciallyDocument1 pageHippogriff Feather Wands Excel in Transfiguration and Levitation EspeciallySayan SanyalNo ratings yet

- Werewolf 2Document1 pageWerewolf 2Sayan SanyalNo ratings yet

- How To Encounter A NunduDocument2 pagesHow To Encounter A NunduSayan SanyalNo ratings yet

- Research About Dark SpellsDocument3 pagesResearch About Dark SpellsSayan SanyalNo ratings yet

- What's Your Take?: Book of ThothDocument2 pagesWhat's Your Take?: Book of ThothSayan SanyalNo ratings yet

- Bill Weasley Damocles Fenrir Greyback Hairy Snout Human Heart Lycanthropy Marlowe Forfang Remus Lupin Wagga Wagga Werewolf Wolfsbane PotionDocument1 pageBill Weasley Damocles Fenrir Greyback Hairy Snout Human Heart Lycanthropy Marlowe Forfang Remus Lupin Wagga Wagga Werewolf Wolfsbane PotionSayan SanyalNo ratings yet

- Seasum Apparium-2. Arania Exeme - 3. Mucus Adnauseum - 4. Lacarnum Inflamare - 5. Funnunculus - 6. Immobilius - 7. LegilimensDocument1 pageSeasum Apparium-2. Arania Exeme - 3. Mucus Adnauseum - 4. Lacarnum Inflamare - 5. Funnunculus - 6. Immobilius - 7. LegilimensSayan SanyalNo ratings yet

- Unknown Killing CursesDocument2 pagesUnknown Killing CursesSayan Sanyal100% (1)

- Match The Spell To The EffectDocument3 pagesMatch The Spell To The EffectSayan SanyalNo ratings yet

- CSS Criminology Past Papers McqsDocument29 pagesCSS Criminology Past Papers McqsDanish shahNo ratings yet

- SPC Power Corporation V SantosDocument2 pagesSPC Power Corporation V SantosAllen Windel Bernabe0% (1)

- CA Agro-Industrial Development Corporation vs. Court of AppealsDocument3 pagesCA Agro-Industrial Development Corporation vs. Court of AppealsSJ San JuanNo ratings yet

- Instant Download Strategic Management Theory An Integrated Approach 12th Edition Hill Test Bank PDF Full ChapterDocument10 pagesInstant Download Strategic Management Theory An Integrated Approach 12th Edition Hill Test Bank PDF Full Chapteramityleightonwfp9z100% (11)

- Velasco vs. Apostol (G.R. No. 44588)Document10 pagesVelasco vs. Apostol (G.R. No. 44588)aitoomuchtvNo ratings yet

- IMPORTANT NOTICE: This Order Covers Only The Determination Letter That WasDocument7 pagesIMPORTANT NOTICE: This Order Covers Only The Determination Letter That WasD ShafferNo ratings yet

- Rules On The Use of Body-Worn Cameras in The Execution of WarrantsDocument3 pagesRules On The Use of Body-Worn Cameras in The Execution of Warrantsjologs100% (1)

- Art 183 Jurisprudence RPCDocument5 pagesArt 183 Jurisprudence RPCAthena De GuzmanNo ratings yet

- The Negotiable Instruments Law of The Philippines - Chan Robles Virtual Law LibraryDocument1 pageThe Negotiable Instruments Law of The Philippines - Chan Robles Virtual Law LibraryNikkandra MarceloNo ratings yet

- Ker V IllinoisDocument7 pagesKer V IllinoisJaysonNo ratings yet

- Gov vs. Mun of BinalonanDocument3 pagesGov vs. Mun of Binalonanjillian vinluanNo ratings yet

- Injunction Order Against Juan Peirano and Letizia MailhosDocument9 pagesInjunction Order Against Juan Peirano and Letizia MailhosGrupoEspectadorNo ratings yet

- Judgment of Supreme Court Devi Dutt - CIVIL APPEAL NO. 7631 OF 2002Document9 pagesJudgment of Supreme Court Devi Dutt - CIVIL APPEAL NO. 7631 OF 2002ANGRYOILMANNo ratings yet

- The Scope and Nature of JournalismDocument4 pagesThe Scope and Nature of JournalismnulllllNo ratings yet

- M4 - Gross Estate - Special Rules For Married Decedents - Students'Document14 pagesM4 - Gross Estate - Special Rules For Married Decedents - Students'micaella pasionNo ratings yet

- Maternity Benefits ActDocument10 pagesMaternity Benefits Actkanchan777No ratings yet

- BirthCertificate 8366594 UnlockedDocument1 pageBirthCertificate 8366594 Unlockedpsrimanta81No ratings yet

- Member Superintendents SchemeDocument3 pagesMember Superintendents SchemeMulki AbdillahNo ratings yet

- IPL HW 1Document52 pagesIPL HW 1Hyuga NejiNo ratings yet

- Republic of The Philippines Regional Trial Court BRANCH 59, Angeles City, PampangaDocument4 pagesRepublic of The Philippines Regional Trial Court BRANCH 59, Angeles City, PampangaEna MacaleNo ratings yet

- Manila Mining Corp Vs TanDocument1 pageManila Mining Corp Vs TanLinus ReyesNo ratings yet

- Turner V Lorenzo ShippingDocument2 pagesTurner V Lorenzo ShippingChic Pabalan67% (3)

- Leyte Police Provincial Office: Evidence MatrixDocument14 pagesLeyte Police Provincial Office: Evidence MatrixEva DiNo ratings yet

- Shreya Singhal v. Union of IndiaDocument33 pagesShreya Singhal v. Union of IndiaPonnu PonnoosNo ratings yet

- Proposed Geragos Questions For Curcio HearingDocument6 pagesProposed Geragos Questions For Curcio HearingTony OrtegaNo ratings yet

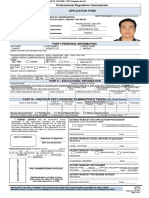

- Application Form: Professional Regulation CommissionDocument1 pageApplication Form: Professional Regulation CommissionErnesto OgarioNo ratings yet

- Phoenix Feeley Goes Topless in NJgiivl PDFDocument4 pagesPhoenix Feeley Goes Topless in NJgiivl PDFLyon02WindNo ratings yet

- Basic Concept & Residential Status of ItDocument15 pagesBasic Concept & Residential Status of ItKANNAN MNo ratings yet

- 32ND Chahrmcc - Hypothetical CaseDocument18 pages32ND Chahrmcc - Hypothetical CaseChala Yuye KemerNo ratings yet

Import of Services Made On or After The Appointed Day Shall Be Liable To Tax Under

Import of Services Made On or After The Appointed Day Shall Be Liable To Tax Under

Uploaded by

Sayan SanyalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Import of Services Made On or After The Appointed Day Shall Be Liable To Tax Under

Import of Services Made On or After The Appointed Day Shall Be Liable To Tax Under

Uploaded by

Sayan SanyalCopyright:

Available Formats

16

(xi) collection of tax at source;

(xii) assessment;

(xiii) refunds;

(xiv) audit;

(xv) inspection, search, seizure and arrest; 5

(xvi) demands and recovery;

(xvii) liability to pay in certain cases;

(xviii) advance ruling;

(xix) appeals and revision;

(xx) presumption as to documents; 10

(xxi) offences and penalties;

(xxii) job work;

(xxiii) electronic commerce;

(xxiv) transitional provisions; and

(xxv) miscellaneous provisions including the provisions relating to the 15

imposition of interest and penalty,

shall, mutatis mutandis, apply, so far as may be, in relation to integrated tax as they

apply in relation to central tax as if they are enacted under this Act:

Provided that in the case of tax deducted at source, the deductor shall deduct

tax at the rate of two per cent. from the payment made or credited to the supplier: 20

Provided further that in the case of tax collected at source, the operator shall

collect tax at such rate not exceeding two per cent, as may be notified on the

recommendations of the Council, of the net value of taxable supplies:

Provided also that for the purposes of this Act, the value of a supply shall

include any taxes, duties, cesses, fees and charges levied under any law for the time 25

being in force other than this Act, and the Goods and Services Tax (Compensation to

States) Act, if charged separately by the supplier:

Provided also that in cases where the penalty is leviable under the Central

Goods and Services Tax Act and the State Goods and Services Tax Act or the Union

Territory Goods and Services Tax Act, the penalty leviable under this Act shall be the 30

sum total of the said penalties.

Import of 21. Import of services made on or after the appointed day shall be liable to tax under

services made the provisions of this Act regardless of whether the transactions for such import of services

on or after the had been initiated before the appointed day:

appointed day.

Provided that if the tax on such import of services had been paid in full under the 35

existing law, no tax shall be payable on such import under this Act:

Provided further that if the tax on such import of services had been paid in part under

the existing law, the balance amount of tax shall be payable on such import under this Act.

Explanation.––For the purposes of this section, a transaction shall be deemed to

have been initiated before the appointed day if either the invoice relating to such supply or 40

payment, either in full or in part, has been received or made before the appointed day.

Power to make 22. (1) The Government may, on the recommendations of the Council, by notification,

rules. make rules for carrying out the provisions of this Act.

(2) Without prejudice to the generality of the provisions of sub-section (1), the

Government may make rules for all or any of the matters which by this Act are required to 45

be, or may be, prescribed or in respect of which provisions are to be or may be made by

rules.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Acceptance Letter From HogwartsDocument5 pagesAcceptance Letter From HogwartsSayan SanyalNo ratings yet

- William S Husel Et Al Court CaseDocument12 pagesWilliam S Husel Et Al Court CaseEllyn SantiagoNo ratings yet

- I. F. Standard Factory Testing, G. Painting, H. Loose PartsDocument2 pagesI. F. Standard Factory Testing, G. Painting, H. Loose PartsSayan SanyalNo ratings yet

- Hippogriff Feather Wands Excel in Transfiguration and Levitation EspeciallyDocument1 pageHippogriff Feather Wands Excel in Transfiguration and Levitation EspeciallySayan SanyalNo ratings yet

- Werewolf 2Document1 pageWerewolf 2Sayan SanyalNo ratings yet

- How To Encounter A NunduDocument2 pagesHow To Encounter A NunduSayan SanyalNo ratings yet

- Research About Dark SpellsDocument3 pagesResearch About Dark SpellsSayan SanyalNo ratings yet

- What's Your Take?: Book of ThothDocument2 pagesWhat's Your Take?: Book of ThothSayan SanyalNo ratings yet

- Bill Weasley Damocles Fenrir Greyback Hairy Snout Human Heart Lycanthropy Marlowe Forfang Remus Lupin Wagga Wagga Werewolf Wolfsbane PotionDocument1 pageBill Weasley Damocles Fenrir Greyback Hairy Snout Human Heart Lycanthropy Marlowe Forfang Remus Lupin Wagga Wagga Werewolf Wolfsbane PotionSayan SanyalNo ratings yet

- Seasum Apparium-2. Arania Exeme - 3. Mucus Adnauseum - 4. Lacarnum Inflamare - 5. Funnunculus - 6. Immobilius - 7. LegilimensDocument1 pageSeasum Apparium-2. Arania Exeme - 3. Mucus Adnauseum - 4. Lacarnum Inflamare - 5. Funnunculus - 6. Immobilius - 7. LegilimensSayan SanyalNo ratings yet

- Unknown Killing CursesDocument2 pagesUnknown Killing CursesSayan Sanyal100% (1)

- Match The Spell To The EffectDocument3 pagesMatch The Spell To The EffectSayan SanyalNo ratings yet

- CSS Criminology Past Papers McqsDocument29 pagesCSS Criminology Past Papers McqsDanish shahNo ratings yet

- SPC Power Corporation V SantosDocument2 pagesSPC Power Corporation V SantosAllen Windel Bernabe0% (1)

- CA Agro-Industrial Development Corporation vs. Court of AppealsDocument3 pagesCA Agro-Industrial Development Corporation vs. Court of AppealsSJ San JuanNo ratings yet

- Instant Download Strategic Management Theory An Integrated Approach 12th Edition Hill Test Bank PDF Full ChapterDocument10 pagesInstant Download Strategic Management Theory An Integrated Approach 12th Edition Hill Test Bank PDF Full Chapteramityleightonwfp9z100% (11)

- Velasco vs. Apostol (G.R. No. 44588)Document10 pagesVelasco vs. Apostol (G.R. No. 44588)aitoomuchtvNo ratings yet

- IMPORTANT NOTICE: This Order Covers Only The Determination Letter That WasDocument7 pagesIMPORTANT NOTICE: This Order Covers Only The Determination Letter That WasD ShafferNo ratings yet

- Rules On The Use of Body-Worn Cameras in The Execution of WarrantsDocument3 pagesRules On The Use of Body-Worn Cameras in The Execution of Warrantsjologs100% (1)

- Art 183 Jurisprudence RPCDocument5 pagesArt 183 Jurisprudence RPCAthena De GuzmanNo ratings yet

- The Negotiable Instruments Law of The Philippines - Chan Robles Virtual Law LibraryDocument1 pageThe Negotiable Instruments Law of The Philippines - Chan Robles Virtual Law LibraryNikkandra MarceloNo ratings yet

- Ker V IllinoisDocument7 pagesKer V IllinoisJaysonNo ratings yet

- Gov vs. Mun of BinalonanDocument3 pagesGov vs. Mun of Binalonanjillian vinluanNo ratings yet

- Injunction Order Against Juan Peirano and Letizia MailhosDocument9 pagesInjunction Order Against Juan Peirano and Letizia MailhosGrupoEspectadorNo ratings yet

- Judgment of Supreme Court Devi Dutt - CIVIL APPEAL NO. 7631 OF 2002Document9 pagesJudgment of Supreme Court Devi Dutt - CIVIL APPEAL NO. 7631 OF 2002ANGRYOILMANNo ratings yet

- The Scope and Nature of JournalismDocument4 pagesThe Scope and Nature of JournalismnulllllNo ratings yet

- M4 - Gross Estate - Special Rules For Married Decedents - Students'Document14 pagesM4 - Gross Estate - Special Rules For Married Decedents - Students'micaella pasionNo ratings yet

- Maternity Benefits ActDocument10 pagesMaternity Benefits Actkanchan777No ratings yet

- BirthCertificate 8366594 UnlockedDocument1 pageBirthCertificate 8366594 Unlockedpsrimanta81No ratings yet

- Member Superintendents SchemeDocument3 pagesMember Superintendents SchemeMulki AbdillahNo ratings yet

- IPL HW 1Document52 pagesIPL HW 1Hyuga NejiNo ratings yet

- Republic of The Philippines Regional Trial Court BRANCH 59, Angeles City, PampangaDocument4 pagesRepublic of The Philippines Regional Trial Court BRANCH 59, Angeles City, PampangaEna MacaleNo ratings yet

- Manila Mining Corp Vs TanDocument1 pageManila Mining Corp Vs TanLinus ReyesNo ratings yet

- Turner V Lorenzo ShippingDocument2 pagesTurner V Lorenzo ShippingChic Pabalan67% (3)

- Leyte Police Provincial Office: Evidence MatrixDocument14 pagesLeyte Police Provincial Office: Evidence MatrixEva DiNo ratings yet

- Shreya Singhal v. Union of IndiaDocument33 pagesShreya Singhal v. Union of IndiaPonnu PonnoosNo ratings yet

- Proposed Geragos Questions For Curcio HearingDocument6 pagesProposed Geragos Questions For Curcio HearingTony OrtegaNo ratings yet

- Application Form: Professional Regulation CommissionDocument1 pageApplication Form: Professional Regulation CommissionErnesto OgarioNo ratings yet

- Phoenix Feeley Goes Topless in NJgiivl PDFDocument4 pagesPhoenix Feeley Goes Topless in NJgiivl PDFLyon02WindNo ratings yet

- Basic Concept & Residential Status of ItDocument15 pagesBasic Concept & Residential Status of ItKANNAN MNo ratings yet

- 32ND Chahrmcc - Hypothetical CaseDocument18 pages32ND Chahrmcc - Hypothetical CaseChala Yuye KemerNo ratings yet