Professional Documents

Culture Documents

Audit of Receivables

Audit of Receivables

Uploaded by

Kimberly parciaCopyright:

Available Formats

You might also like

- Marstrat Sesi 4Document5 pagesMarstrat Sesi 4BUNGA DENINANo ratings yet

- 718 MP111 Individual Assignment S2 2022 Part 1Document23 pages718 MP111 Individual Assignment S2 2022 Part 1Rosalie BachillerNo ratings yet

- Accounting 1aDocument23 pagesAccounting 1aFaith Marasigan88% (16)

- Problem 1: Customer Balance Comments From Customer Audit FindingsDocument5 pagesProblem 1: Customer Balance Comments From Customer Audit FindingsReginald ValenciaNo ratings yet

- Audit of Cash Basis, Single Entry and Correction of Errors (Q)Document4 pagesAudit of Cash Basis, Single Entry and Correction of Errors (Q)Lesley Pascual Cortez100% (1)

- UCU Audit ProblemsDocument9 pagesUCU Audit ProblemsTCC FreezeNo ratings yet

- University of Caloocan City: Name: Score: Course/Year & Section: DateDocument3 pagesUniversity of Caloocan City: Name: Score: Course/Year & Section: DatePatricia Camille Austria0% (1)

- Case Studies in Working Capital Management and ShortDocument13 pagesCase Studies in Working Capital Management and ShortNguyễn Thế Long100% (1)

- Inventory Sap b1Document8 pagesInventory Sap b1Queen ValleNo ratings yet

- Porter's Five ForcesDocument25 pagesPorter's Five ForcesSwapnilBhosleNo ratings yet

- Indian Oil CorporationDocument51 pagesIndian Oil Corporationjignas cyber0% (1)

- Substantive Audit of Inventories CHAPTER 12 13Document14 pagesSubstantive Audit of Inventories CHAPTER 12 13Nexxus BaladadNo ratings yet

- 1 - CPAR - Audit of Inventory - Theo×ProbDocument5 pages1 - CPAR - Audit of Inventory - Theo×ProbMargaux CornetaNo ratings yet

- Exercises On Trade Receivables and Sales PDFDocument8 pagesExercises On Trade Receivables and Sales PDFShaira MaguddayaoNo ratings yet

- Handout Audit of InventoriesDocument4 pagesHandout Audit of InventoriesJAY AUBREY PINEDA0% (2)

- Intermediate 1A: Problem CompilationDocument24 pagesIntermediate 1A: Problem CompilationPatricia Nicole Barrios100% (4)

- Comprehensive Audit Problem Julie AngeloDocument8 pagesComprehensive Audit Problem Julie AngeloAnonymous LC5kFdtcNo ratings yet

- CHAPTER 03 - Pg.4-6Document4 pagesCHAPTER 03 - Pg.4-6JabonJohnKennethNo ratings yet

- Intermediate AccountingDocument7 pagesIntermediate AccountingMelissa Kayla Maniulit100% (1)

- NFJPIA - Mockboard 2011 - APDocument12 pagesNFJPIA - Mockboard 2011 - APHazel Iris CaguinginNo ratings yet

- Auditing Problems Final Preboard Examination Batch 87 SET: Cpa Review School of The Philippines ManilaDocument12 pagesAuditing Problems Final Preboard Examination Batch 87 SET: Cpa Review School of The Philippines ManilaMarwin AceNo ratings yet

- AP 2020 - Inventories 2Document9 pagesAP 2020 - Inventories 2Heinie Joy PauleNo ratings yet

- 2nd Quiz Aud ProbDocument4 pages2nd Quiz Aud ProbJohn Patrick Lazaro AndresNo ratings yet

- Following File Name: Family Name - First Name - Pre2 3A or 3B (As The Case May Be) - FinalexamDocument7 pagesFollowing File Name: Family Name - First Name - Pre2 3A or 3B (As The Case May Be) - FinalexamAnna TaylorNo ratings yet

- Quiz InventoriesDocument3 pagesQuiz Inventoriespg513487No ratings yet

- Cpa Review School of The Philippines Manila Auditing Problems Audit of Inventories Problem No. 1Document11 pagesCpa Review School of The Philippines Manila Auditing Problems Audit of Inventories Problem No. 1Angelou100% (1)

- Quiz On Inventories Set ADocument4 pagesQuiz On Inventories Set AJerico Mamaradlo0% (2)

- IA1-Handouts-01-Cash and Cash EquivalentsDocument5 pagesIA1-Handouts-01-Cash and Cash EquivalentsJessie John Credo Jr.No ratings yet

- ACC 102.key Answer - Quiz 1.inventoriesDocument5 pagesACC 102.key Answer - Quiz 1.inventoriesMa. Lou Erika BALITENo ratings yet

- 4 Questions ReceivablesDocument16 pages4 Questions ReceivablesYafasfasNo ratings yet

- Audit-of-Inventory Homework AnswersDocument5 pagesAudit-of-Inventory Homework AnswersMarnelli Catalan100% (1)

- NFJPIA Mockboard 2011 P1Document7 pagesNFJPIA Mockboard 2011 P1Jaymee Andomang Os-agNo ratings yet

- Cash, Receivables, Inventory Remedial QuizDocument8 pagesCash, Receivables, Inventory Remedial QuizHaydz AntonioNo ratings yet

- General Journal: Date Account Titles and Explanation CreditDocument4 pagesGeneral Journal: Date Account Titles and Explanation CreditHarriane Mae GonzalesNo ratings yet

- Inv AudDocument32 pagesInv AudAud Balanzi100% (1)

- ABM 12 F Adjusting Entries 2017Document1 pageABM 12 F Adjusting Entries 2017Baltazar Justiniano100% (1)

- AP 2020 - Inventories 2Document9 pagesAP 2020 - Inventories 2Lora Mae JuanitoNo ratings yet

- AR and Allowance For Doubtful AccountsDocument5 pagesAR and Allowance For Doubtful AccountsmedinachrstianaNo ratings yet

- Ricardo Pangan ActivityDocument1 pageRicardo Pangan ActivityDanjie Barrios50% (2)

- Module 2Document11 pagesModule 2Deanne LumakangNo ratings yet

- Supplemental Material - Audit of Cash and Cash Equivalents Problem 1Document4 pagesSupplemental Material - Audit of Cash and Cash Equivalents Problem 1Airon Keith AlongNo ratings yet

- Drill-Receivables CompressDocument7 pagesDrill-Receivables CompressHannahbea LindoNo ratings yet

- Drill - ReceivablesDocument7 pagesDrill - ReceivablesMark Domingo MendozaNo ratings yet

- Cash Basis Accrual BasisDocument4 pagesCash Basis Accrual BasisForkenstein0% (1)

- National Certification III: Bookkeeping Mock Exam Merchandising Business With Perpetual Inventory SystemDocument11 pagesNational Certification III: Bookkeeping Mock Exam Merchandising Business With Perpetual Inventory SystemJohn Rex CapilloNo ratings yet

- Chapter 5 Caselette Audit of InventoryDocument33 pagesChapter 5 Caselette Audit of InventoryAnna Taylor100% (1)

- Name: Exercise: Exercise 8-5, Recording Bad Debts Course: Acc 422 DateDocument6 pagesName: Exercise: Exercise 8-5, Recording Bad Debts Course: Acc 422 DateHelping Five (H5)No ratings yet

- Applied - 3 MidtermDocument7 pagesApplied - 3 MidtermMarjorieNo ratings yet

- Auditing Practice Problem 5Document2 pagesAuditing Practice Problem 5Maria Fe FerrarizNo ratings yet

- Module VII Accounting Cycle of A Merchandising Business2Document3 pagesModule VII Accounting Cycle of A Merchandising Business2Marklein DumangengNo ratings yet

- College of Accountancy and Business Administration: Quiz: Intermediate Accounting 1Document5 pagesCollege of Accountancy and Business Administration: Quiz: Intermediate Accounting 1BSA 1BRICHELL ASHLEY M. PAGADUANNo ratings yet

- Ap104 Inventories PDFDocument6 pagesAp104 Inventories PDFMicaela Betis100% (1)

- Applied Auditing Review Course Pre-Board - FinalDocument13 pagesApplied Auditing Review Course Pre-Board - FinalROMAR A. PIGANo ratings yet

- Worksheet ProblemsDocument3 pagesWorksheet ProblemsClaren Sidnne MadridNo ratings yet

- AaDocument4 pagesAaJMerrill CaldaNo ratings yet

- National Federation of Junior Philipinne Institute of Accountants - National Capital Region Auditing (Aud)Document14 pagesNational Federation of Junior Philipinne Institute of Accountants - National Capital Region Auditing (Aud)Tricia Jen TobiasNo ratings yet

- Audit of Inventories - STDocument7 pagesAudit of Inventories - STFrancine Holler0% (2)

- Audit Problem Inventories Part 1Document4 pagesAudit Problem Inventories Part 1Rio Cyrel CelleroNo ratings yet

- NFJPIA - Mockboard 2011 - AP PDFDocument6 pagesNFJPIA - Mockboard 2011 - AP PDFJohnny EspinosaNo ratings yet

- Mockboard AP PDFDocument6 pagesMockboard AP PDFKathleen JaneNo ratings yet

- Investment in Financial InstrumentsDocument7 pagesInvestment in Financial InstrumentsKimberly parciaNo ratings yet

- Income Tax For Corporations, PartnershipsDocument22 pagesIncome Tax For Corporations, PartnershipsKimberly parciaNo ratings yet

- RIZAL Learning Task Module 1Document1 pageRIZAL Learning Task Module 1Kimberly parciaNo ratings yet

- Match The Following:: Materiality and Audit Risk MatchingDocument6 pagesMatch The Following:: Materiality and Audit Risk MatchingKimberly parciaNo ratings yet

- Audit Procedures: Learning OutcomesDocument5 pagesAudit Procedures: Learning OutcomesKimberly parciaNo ratings yet

- Audit Assertions and Audit ObjectivesDocument6 pagesAudit Assertions and Audit ObjectivesKimberly parciaNo ratings yet

- Position Paper - Fist Impressions LastsDocument2 pagesPosition Paper - Fist Impressions LastsKimberly parciaNo ratings yet

- Activity - Setting Up Intentions - PARCIA, Kimberly M.Document1 pageActivity - Setting Up Intentions - PARCIA, Kimberly M.Kimberly parciaNo ratings yet

- Rizal Law PassageDocument1 pageRizal Law PassageKimberly parciaNo ratings yet

- Position Paper - Fist Impressions LastsDocument2 pagesPosition Paper - Fist Impressions LastsKimberly parciaNo ratings yet

- Domestic Law: You Can Read More About This at Https://bit - ly/32v1cTLDocument5 pagesDomestic Law: You Can Read More About This at Https://bit - ly/32v1cTLKimberly parciaNo ratings yet

- How RA 1425 Become A LawDocument1 pageHow RA 1425 Become A LawKimberly parciaNo ratings yet

- STATS Introduction Statistical AnalysisDocument105 pagesSTATS Introduction Statistical AnalysisKimberly parciaNo ratings yet

- POPC 78945-VanGoghDocument32 pagesPOPC 78945-VanGoghKimberly parciaNo ratings yet

- Lesson 1 STATISTICAL ANALYSISDocument7 pagesLesson 1 STATISTICAL ANALYSISKimberly parciaNo ratings yet

- Market Structures and Pricing DecisionsDocument24 pagesMarket Structures and Pricing DecisionsKimberly parciaNo ratings yet

- ReengineeringDocument3 pagesReengineeringKimberly parciaNo ratings yet

- EconomicsDocument2 pagesEconomicsKimberly parciaNo ratings yet

- UNIT 6 Shopping-TresiaDocument3 pagesUNIT 6 Shopping-TresiaTresiasidaurukgmail.com SayanganakorangNo ratings yet

- VAT On Sale of Goods and ServicesDocument14 pagesVAT On Sale of Goods and Servicesdennilyn recaldeNo ratings yet

- Sales and Distribution Management: Case study:-"HEALTHY World"Document7 pagesSales and Distribution Management: Case study:-"HEALTHY World"prachi jainNo ratings yet

- Smirnoff Ice Marketing Planning ProcessDocument6 pagesSmirnoff Ice Marketing Planning ProcessKoolaid23No ratings yet

- A Study On Distribution Practices.: With Reference To FMCG, Paints & Hardware IndustryDocument19 pagesA Study On Distribution Practices.: With Reference To FMCG, Paints & Hardware IndustryAMRUTHA KNo ratings yet

- Accounting For Manufacturing BusinessDocument1 pageAccounting For Manufacturing BusinesswtfenjiNo ratings yet

- Acctg132 - Prelim ExaminationDocument5 pagesAcctg132 - Prelim ExaminationRalph Ernest HulguinNo ratings yet

- Practice Questions (CH 2)Document6 pagesPractice Questions (CH 2)enkeltvrelseNo ratings yet

- Target Costing Literature ReviewDocument8 pagesTarget Costing Literature Reviewsmvancvkg100% (1)

- Chapter 12Document46 pagesChapter 12Hiếu NguyễnNo ratings yet

- HP-Cisco FinalPPTDocument15 pagesHP-Cisco FinalPPTKarthikeyan Gopal100% (1)

- Group Assignment Franchising and Licensing (Ars 3063)Document3 pagesGroup Assignment Franchising and Licensing (Ars 3063)Aqhi Ruldin100% (1)

- Bull-Whip Effect: A Critical Analysis ofDocument15 pagesBull-Whip Effect: A Critical Analysis ofHarsh ShahNo ratings yet

- Bus - Math Test (FINAL)Document4 pagesBus - Math Test (FINAL)Marylyd tiuNo ratings yet

- Bussiness StrategyDocument25 pagesBussiness StrategyKhizra AmirNo ratings yet

- Assignment 2-LAW 416Document8 pagesAssignment 2-LAW 416Ariff DanielNo ratings yet

- Quiz in CSSDocument3 pagesQuiz in CSSjayson reyesNo ratings yet

- Apple Blossom 1 Flowcharts, Organization Charts, Analytical ProcedureDocument3 pagesApple Blossom 1 Flowcharts, Organization Charts, Analytical ProcedureMaulana MuslimNo ratings yet

- Multi ProductsDocument24 pagesMulti ProductsBrahma Paital100% (1)

- 3 - Solution Guide - Short Term Budgeting AssignmentDocument3 pages3 - Solution Guide - Short Term Budgeting AssignmentEdward Glenn BaguiNo ratings yet

- Oracle: Question & AnswersDocument4 pagesOracle: Question & AnswersShabeena Momin0% (1)

- Ap Value Added Tax ACT - 2005: (As Amended by Act 4 of 2009)Document127 pagesAp Value Added Tax ACT - 2005: (As Amended by Act 4 of 2009)parul_shukla_1No ratings yet

- How To Handle With Affiliate MarketingDocument2 pagesHow To Handle With Affiliate MarketingTechno KryonNo ratings yet

- Module 8Document99 pagesModule 8Arnel De Los SantosNo ratings yet

- Chapter 2: E-Commerce Business Models and ConceptsDocument5 pagesChapter 2: E-Commerce Business Models and ConceptsAli ZainNo ratings yet

Audit of Receivables

Audit of Receivables

Uploaded by

Kimberly parciaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Audit of Receivables

Audit of Receivables

Uploaded by

Kimberly parciaCopyright:

Available Formats

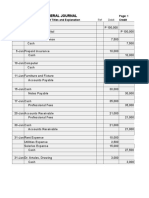

Accounting 43 Auditing and Assurance – Concepts and Applications

Audit of Receivables

PROBLEM 1

You were engaged to perform an audit of the accounts of the Montealegre Corporation for the year ended December 31,

2014, and have observed the taking of the physical inventory of the company on December 30, 2012. Only merchandise

shipped by the client to customers up to and including December 30, 2012 have been eliminated from inventory. The

inventory as determined by physical inventory count has been recorded on the books by the company’s controller. No

perpetual inventory records are maintained. All sales are made on an FOB shipping point basis. You are to assume that

all purchase invoices have been correctly recorded.

The following lists of sales invoice are entered in the sales books for the months of December 2014 and January 2015,

respectively.

Sales Invoice Sales Cost of Date shipped

Amount Invoice Goods Sold

Date

Dec. 2014 A P 30,000 Dec. 21 P20,000 Dec. 31, 2014

B 22,000 Dec. 31 18,000 Dec. 31,2014

C 10,000 Dec. 29 6,000 Dec. 30,2014

D 40,000 Dec. 31 24,000 Jan. 3, 2015

E 100,000 Dec. 30 56,000 Dec. 29, 2014*

F 20,000 Dec. 30 80,000 Jan.2, 2013

Jan. 2015 G 60.000 Dec. 31 40,000 Dec. 30,2012

H 40,000 Jan. 2 23,000 Jan.2, 2013

I 80,000 Jan. 3 55,000 Dec.31, 2012

J 90,000 Jan. 4 64,000 Dec.29,2012

*Shipped to consignee. Verification from the consignee indicates that 60% of the merchandise is still unsold at December

31, 2014.

1. Prepare the necessary adjusting journal entries at December 31, 2014 in connection with the foregoing date.

PROBLEM 2

You are assigned to audit the Montilla Merchandising, Inc for the year ending June 30, 2014. The accounts receivable

were circularized as at June 30, 2014 and the following exceptions have not been disposed of.

Customer Balance Comments from Customers Audit Findings

Alejandro P 30,000 Balance was paid on June 29, 2014 Montilla received mailed check on July

2, 2014.

Banta 74,000 Balance was offset by our June 10 Montilla credited accounts payable for

shipment of tires. P74,000 to record purchase of tires.

Cada 16,200 The above balance has been paid. The balance was credited to customer

Llamoso.

Delfino 10,000 Our records show a bigger balance, A new confirmation was mailed.

please check

Espiritu 24,000 We do not owe Montilla anything on The shipment costing P16,500 was

June 30 as goods were received in made on June 29 2014 and the goods

July 2014, FOB destination. were not included in recording the

June 30, 2014 inventory.

Follero 15,000 Our deposit of P60,000 should cover Montilla had previously credited the

this balance. deposit to sales.

Garcia 85,000 We never received these goods. The shipment was erroneously made

to another customer, and the goods

costing P59,000 are now on its way to

Grebialde. The shipment was made

FOB destination.

Hababag 10,000 We are rejecting the price, which is Montilla’s clerk erroneously computed

too much. the unit price at P200. The correct

pricing should have been at P150 per

unit.

Igloso 180,000 Amount is okay. Since this is on Goods cost P120,000, and were

consignment, we will remit payment excluded in Montilla’s inventory.

upon selling the goods.

Rey Joseph M. Redoblado | 1

Accounting 43 Auditing and Assurance – Concepts and Applications

Audit of Receivables

Jaca 5,000 CM no. 3256 cancels this balance. The CM dated May 31, 2014 was

recorded by Motillla in July 2014.

2. Provide the audit adjusting entries.

PROBLEM 3

The Accounts Receivable control account balance of J.A. Serrano Company was P214,100 as of December 31, 2014.

The subsidiary ledger accounts of the Company are summarized below. Credit terms are 60 days net.

Account Name Date Debit Credit Balance

Siapno May 31 5,000 5,000

July 1 3,000 2,000

July 7 5,000 7,000

Sept. 1 3,000 4,000

Sept. 25 8,000 12,000

Nov. 1 3,000 9,000

Dec. 10 3,000 12,000

Celeste Aug. 8 8,400 8,400

Oct. 4 8,400 -

Nov. 25 22,000 22,000

Sabio Jan. 1 120,000 120,000

Two-month, 12%

note

Mar. 1 122,400 (2,400)

Dec. 1 100,000 97,600

Two-month, 6% note

Manganiban Feb. 3 10,000 10,000

Aug. 3 10,000 20,000

Toscano Feb. 10 30,000 30,000

April 9 30,000 -

May 4 40,000 40,000

July 2 40,000 -

Sept. 6 52,780 52,780

Nov. 25 2,220 55,000

Sañosa July 17 5,000 5,000

Aug. 16 4,440 9,440

Sept. 30 (open) 7,500 16,940

Oct. 15 9,440 7,500

Oct. 18 6,000 13,500

Dec. 20 6,000 7,500

The allowance for uncollectible accounts, before audit, has a credit balance of P5,000. The Allowance for Uncollectible

Accounts is to be adjusted to balance determined as follows:

Accounts not due 1 percent

Accounts 160 days past due 2 percent

Accounts 6 1-120 days 5 percent

Accounts over 120 days past due 50 percent

The provision is to be based only on the trade accounts. Except where payments are earmarked, the oldest items are paid

first.

3. Prepare the audit working papers for the aging of accounts receivable.

4. Provide the necessary audit adjustments as at December 31, 2014.

Rey Joseph M. Redoblado | 2

Accounting 43 Auditing and Assurance – Concepts and Applications

Audit of Receivables

PROBLEM 4

You have substantially completed the audit of Alejandro Black, Inc. (ABI) for the year ended April 30, 2014. ABI sells

household appliances. In preparation for your conference with the officers of the company, you are now going over your

working paper, which contain analysis and schedules as well as findings, and information that may require adjustments to

come up with audited balances as of April 30, 2014.

The following are the audit working papers relating to receivables:

ACCOUNTS RECEIVABLE - TRADE

Reconciliation Between General Ledger and the Total Subsidiary Ledger

April 30, 2014

Total of subsidiary ledger balances 5,635,700

Undelivered sales, based on sales orders received up to April 30, 2014 per JV no. *2,732,900

4030

Goods consigned to LCC, SM Naga and others **3,260,700

Collections received from Catanduanes and Sorsogon branches on May 1 based on ***(1,092,800)

official receipts dated April 30, 2014 for sales made on April 15, 2014

Balance per general ledger P10,536,500

*Goods are physically segregated during inventory count. Sales invoices for these were issued on May 1 and deliveries to

customers were made on May 2.

**These goods were physically verified in customers’ stores. Under the terms of consignment, goods are billed to

customers, based upon their sales report.

***Subsequently deposited on May 2, 2014.

Customers are billed at 20% above cost. Terms 30 days.

ALLOWANCE FOR UNCOLLECTIBLE TRADE RECEIVABLES

Analysis of Movement During the Year

April 30, 2014

Allowance, May 1, 2013 1,020,000

Movement during the period May 1, 2013 - April 30, 2014

Provisions 3,425,625

Write offs (4,164,370)

Allowance, April 30, 2014 281,255

Aging of accounts receivable-trade, based on accounts receivable schedule as of April 30, 2014, before considering any

adjustments on the accounts:

Per Client Per Audit

Current 4,469,760 4,067,320

31-60 days 267,320 402,440

61-90 days 455,440 267,320

91 days and over 443,180 898,620

Total 5,635,700 5,635,700

A review of collectibility of each account disclosed the following:

a. A customer with an account balance of P168,000 classified as 91 days and over in aging can no longer be located by

company lawyers. He has known assets and his liabilities to other creditors totaled to P5,000,000. The other creditors

have the same experience as the company. The lawyers suggested that this account be written off, to which the

company president agreed.

b. It is the company policy to provide monthly for accounts doubtful of collection, based on aging schedule, as follows:

2% for current; 5% for 31 to 60 days; 10% for 61 to 90 days; and 30% for 91 days and over. Monthly write-offs are

charged against the allowance. At the end of the year, the credit and collection manager, the lawyers, together with a

representative of its external auditor, undertake a review of collectibility of each account.

5. Provide the correct balance of Trade Accounts Receivable - Gross.

Rey Joseph M. Redoblado | 3

Accounting 43 Auditing and Assurance – Concepts and Applications

Audit of Receivables

6. Provide the correct balance of Allowance for Uncollectible Trade Receivables

7. Provide the correct balance of Uncollectible Accounts Expense

PROBLEM 5

During the course of the audit of the financial statements of Banta, Inc. for the year ended Dec. 31, 2014, you examined

the Trade Notes Receivable account represented by the following items.

1. A four-month note dated Nov. 30, 2014 from the Mary Co., P100,000; interest rate, 100 percent discounted without

recourse on Nov. 30, 2014 at 8%. Banta recorded the proceeds received as a credit to Liability on Discounted

Notes.

2. A 90-day note dated Nov. 1, 2014 from Grace, P250,000; interest rate at 8 percent; the note is for subscriptions to

2,500 shares of the preference share capital of Banta, Inc. at P100 per share.

3. A 60 day note dated May 3, 2014 from Kalbo Company P30,000; interest rate, 6 percent; dishonored at maturity;

judgment obtained on Oct. 10, 2014, collection doubtful.

4. A 90-day note dated Jan. 4, 2014 from the president of Banta, Inc. - Sony Ramosa, P800,000; no interest; note not

renewed; president confirmed.

5. A 120-day note dated Sept. 14, 2014, from the Mamo Company, P60,000; interest rate, 9 percent1 note is held by

bank as collateral.

6. A two year non-interest bearing note from Melody Company for P200,000 received and dated August 31, 2014. The

note was received in exchange for equipment sold. The equipment had an original cost of P400,000 and had an

accumulated depreciation on January 1, 2014 of P160,000. Such equipment is being depreciated at a rate of 10% a

year, rounded the nearest month. The prevailing interest rate for a note of this type is 12%. Banta recorded the sale

by debiting notes receivable and crediting equipment at the face value of the note. No depreciation has yet been

provided on this equipment for the year 2014.

8. Prepare a worksheet for the analysis of Trade Notes Receivable with the following columns:

Maker

Due Date

Balance per Client

Adjustment

Balance per Audit

No. of Days Interest is Accrued

Interest Receivable

Remarks

9. Prepare the audit adjusting entries at December 31, 2014.

PROBLEM 6

Antonis Inc. had the following long-term receivable accounts balances at December 31, 2014:

Note receivable from sale of division P1,500,000

Note receivable from officer 4,000,000

Transactions during 2014 and other information relative to Antonis long-term receivables were as follows:

a) The P1,500,000 note receivable is dated April 1, 2013, bears interest at 9% and represents the balance of the

consideration received from the sale of Antonis’ gift items division to M Company. Principal payments of P500,000

plus appropriate interest are due on April 1, 2014, 2015 and 2016. The first principal and interest payment was made

on April 1, 2014. Collection of the note installment is reasonably assured.

b) The P4,000,000 note receivable is dated December 31, 2013, bears interest at 9%, and is due on December 31,

2014. The note is due from M. Alegre, president of the Antonis, Inc. and is collaterized by 100,000 shares of Antonis’

ordinary share capital. Interest is payable annually on December 31 and all interest payments were paid on their due

dates through December 31, 2014. The quoted market price of Antonis ordinary share was P45 per share on

December 31, 2014.

c) On October 1, 2014, Antonis sold a patent to DDD Company in exchange of a two-year P1,000,000 non-interest

bearing note due on October 31, 2016. There was no established price for the patent, and the note had no ready

market. The prevailing rate of interest for a note of this type at Oct. 1, 2014 was 12%. The patent had a carrying value

of P800,000 at January 1, 2014, and the amortization for the year ended Dec. 31, 2014 would have been P160,000.

The collection of the note is reasonably assured.

Rey Joseph M. Redoblado | 4

Accounting 43 Auditing and Assurance – Concepts and Applications

Audit of Receivables

d) On September 1, 2014, Antonis sold a parcel of land to CGC Company for P20,000,000 under installment sales

contract. CGC made a P6,000,000 cash down payment on Sept. 1, 2014 and signed a four-year note for the

P14,000,000 balance. The equal annual payments of principal and interest on the note will be P5,003,252 payable on

Sept. 1 2015 through Sept. 1, 2018. The land could have sold at an established cash price of P20,000,000, the cost

of the land to Antonis was P15,000,000. Circumstances are such that the collection of the installments on the notes is

reasonably assured.

10. Determine the non-current portion of the long-term receivables at December 31, 2014.

11. Prepare a schedule showing the current portion of the long-term receivables and accrued interest receivable that would

appear in Antonis’ Statement of Financial Position at December 31, 2014.

12. Determine the total amount of interest income during the year 2014.

13. Determine the amount of gains or losses on sale of assets during the year 2014.

PROBLEM 7

You are assigned to assess the collectibility of the receivables carried in the books of Bulilit Bataller Company (BBC), your

audit client. The working trial balance prepared at December 31, 2014 showed the following balances:

Note receivable P6,000,000

Account receivable 4,000,000

In the course of your examination, you discovered the following:

Note receivable from F P2,000,000

Note receivable from G 3,000,000

Note receivable from T 1,000,000

No interest has yet been recorded by BBC during 2014 on any of the notes above.

Company F is undergoing bankruptcy proceedings and has negotiated for a restructuring of its notes receivable. The note

was for a four-year period and interest of 10% is collectible annually. All interest accrued before 2014 has been collected.

The note matured on December 31, 2013. No further interest will be collected during the four-year term.

The note receivable from Company G is a three-year non-interest bearing note, with face value of P3,000,000. The note

was received in exchange for a piece of land sold by BBC on May 1, 2014. The land was carried in the books at the date

of sale at P2,000,000. The difference between the face amount of the note and the carrying value of the land was credited

to gain on sale of land. The market interest rate for a note of this type is 10%.

The notes receivable from Company T bears interest at 10%. The note was received from sale of goods in the normal

course of business. The note is dated October 1, 2014 and matures on March 31, 2015.

14. Prepare any audit adjustments as a result of the foregoing.

15. Determine the carrying value of the notes that would appear under the current assets section and non-current assets

section of the Statement of Financial Position at December 31, 2014.

16. Determine the amount of impairment loss on receivables and interest revenue that would appear in profit or loss for the

year 2014.

-End-

Rey Joseph M. Redoblado | 5

You might also like

- Marstrat Sesi 4Document5 pagesMarstrat Sesi 4BUNGA DENINANo ratings yet

- 718 MP111 Individual Assignment S2 2022 Part 1Document23 pages718 MP111 Individual Assignment S2 2022 Part 1Rosalie BachillerNo ratings yet

- Accounting 1aDocument23 pagesAccounting 1aFaith Marasigan88% (16)

- Problem 1: Customer Balance Comments From Customer Audit FindingsDocument5 pagesProblem 1: Customer Balance Comments From Customer Audit FindingsReginald ValenciaNo ratings yet

- Audit of Cash Basis, Single Entry and Correction of Errors (Q)Document4 pagesAudit of Cash Basis, Single Entry and Correction of Errors (Q)Lesley Pascual Cortez100% (1)

- UCU Audit ProblemsDocument9 pagesUCU Audit ProblemsTCC FreezeNo ratings yet

- University of Caloocan City: Name: Score: Course/Year & Section: DateDocument3 pagesUniversity of Caloocan City: Name: Score: Course/Year & Section: DatePatricia Camille Austria0% (1)

- Case Studies in Working Capital Management and ShortDocument13 pagesCase Studies in Working Capital Management and ShortNguyễn Thế Long100% (1)

- Inventory Sap b1Document8 pagesInventory Sap b1Queen ValleNo ratings yet

- Porter's Five ForcesDocument25 pagesPorter's Five ForcesSwapnilBhosleNo ratings yet

- Indian Oil CorporationDocument51 pagesIndian Oil Corporationjignas cyber0% (1)

- Substantive Audit of Inventories CHAPTER 12 13Document14 pagesSubstantive Audit of Inventories CHAPTER 12 13Nexxus BaladadNo ratings yet

- 1 - CPAR - Audit of Inventory - Theo×ProbDocument5 pages1 - CPAR - Audit of Inventory - Theo×ProbMargaux CornetaNo ratings yet

- Exercises On Trade Receivables and Sales PDFDocument8 pagesExercises On Trade Receivables and Sales PDFShaira MaguddayaoNo ratings yet

- Handout Audit of InventoriesDocument4 pagesHandout Audit of InventoriesJAY AUBREY PINEDA0% (2)

- Intermediate 1A: Problem CompilationDocument24 pagesIntermediate 1A: Problem CompilationPatricia Nicole Barrios100% (4)

- Comprehensive Audit Problem Julie AngeloDocument8 pagesComprehensive Audit Problem Julie AngeloAnonymous LC5kFdtcNo ratings yet

- CHAPTER 03 - Pg.4-6Document4 pagesCHAPTER 03 - Pg.4-6JabonJohnKennethNo ratings yet

- Intermediate AccountingDocument7 pagesIntermediate AccountingMelissa Kayla Maniulit100% (1)

- NFJPIA - Mockboard 2011 - APDocument12 pagesNFJPIA - Mockboard 2011 - APHazel Iris CaguinginNo ratings yet

- Auditing Problems Final Preboard Examination Batch 87 SET: Cpa Review School of The Philippines ManilaDocument12 pagesAuditing Problems Final Preboard Examination Batch 87 SET: Cpa Review School of The Philippines ManilaMarwin AceNo ratings yet

- AP 2020 - Inventories 2Document9 pagesAP 2020 - Inventories 2Heinie Joy PauleNo ratings yet

- 2nd Quiz Aud ProbDocument4 pages2nd Quiz Aud ProbJohn Patrick Lazaro AndresNo ratings yet

- Following File Name: Family Name - First Name - Pre2 3A or 3B (As The Case May Be) - FinalexamDocument7 pagesFollowing File Name: Family Name - First Name - Pre2 3A or 3B (As The Case May Be) - FinalexamAnna TaylorNo ratings yet

- Quiz InventoriesDocument3 pagesQuiz Inventoriespg513487No ratings yet

- Cpa Review School of The Philippines Manila Auditing Problems Audit of Inventories Problem No. 1Document11 pagesCpa Review School of The Philippines Manila Auditing Problems Audit of Inventories Problem No. 1Angelou100% (1)

- Quiz On Inventories Set ADocument4 pagesQuiz On Inventories Set AJerico Mamaradlo0% (2)

- IA1-Handouts-01-Cash and Cash EquivalentsDocument5 pagesIA1-Handouts-01-Cash and Cash EquivalentsJessie John Credo Jr.No ratings yet

- ACC 102.key Answer - Quiz 1.inventoriesDocument5 pagesACC 102.key Answer - Quiz 1.inventoriesMa. Lou Erika BALITENo ratings yet

- 4 Questions ReceivablesDocument16 pages4 Questions ReceivablesYafasfasNo ratings yet

- Audit-of-Inventory Homework AnswersDocument5 pagesAudit-of-Inventory Homework AnswersMarnelli Catalan100% (1)

- NFJPIA Mockboard 2011 P1Document7 pagesNFJPIA Mockboard 2011 P1Jaymee Andomang Os-agNo ratings yet

- Cash, Receivables, Inventory Remedial QuizDocument8 pagesCash, Receivables, Inventory Remedial QuizHaydz AntonioNo ratings yet

- General Journal: Date Account Titles and Explanation CreditDocument4 pagesGeneral Journal: Date Account Titles and Explanation CreditHarriane Mae GonzalesNo ratings yet

- Inv AudDocument32 pagesInv AudAud Balanzi100% (1)

- ABM 12 F Adjusting Entries 2017Document1 pageABM 12 F Adjusting Entries 2017Baltazar Justiniano100% (1)

- AP 2020 - Inventories 2Document9 pagesAP 2020 - Inventories 2Lora Mae JuanitoNo ratings yet

- AR and Allowance For Doubtful AccountsDocument5 pagesAR and Allowance For Doubtful AccountsmedinachrstianaNo ratings yet

- Ricardo Pangan ActivityDocument1 pageRicardo Pangan ActivityDanjie Barrios50% (2)

- Module 2Document11 pagesModule 2Deanne LumakangNo ratings yet

- Supplemental Material - Audit of Cash and Cash Equivalents Problem 1Document4 pagesSupplemental Material - Audit of Cash and Cash Equivalents Problem 1Airon Keith AlongNo ratings yet

- Drill-Receivables CompressDocument7 pagesDrill-Receivables CompressHannahbea LindoNo ratings yet

- Drill - ReceivablesDocument7 pagesDrill - ReceivablesMark Domingo MendozaNo ratings yet

- Cash Basis Accrual BasisDocument4 pagesCash Basis Accrual BasisForkenstein0% (1)

- National Certification III: Bookkeeping Mock Exam Merchandising Business With Perpetual Inventory SystemDocument11 pagesNational Certification III: Bookkeeping Mock Exam Merchandising Business With Perpetual Inventory SystemJohn Rex CapilloNo ratings yet

- Chapter 5 Caselette Audit of InventoryDocument33 pagesChapter 5 Caselette Audit of InventoryAnna Taylor100% (1)

- Name: Exercise: Exercise 8-5, Recording Bad Debts Course: Acc 422 DateDocument6 pagesName: Exercise: Exercise 8-5, Recording Bad Debts Course: Acc 422 DateHelping Five (H5)No ratings yet

- Applied - 3 MidtermDocument7 pagesApplied - 3 MidtermMarjorieNo ratings yet

- Auditing Practice Problem 5Document2 pagesAuditing Practice Problem 5Maria Fe FerrarizNo ratings yet

- Module VII Accounting Cycle of A Merchandising Business2Document3 pagesModule VII Accounting Cycle of A Merchandising Business2Marklein DumangengNo ratings yet

- College of Accountancy and Business Administration: Quiz: Intermediate Accounting 1Document5 pagesCollege of Accountancy and Business Administration: Quiz: Intermediate Accounting 1BSA 1BRICHELL ASHLEY M. PAGADUANNo ratings yet

- Ap104 Inventories PDFDocument6 pagesAp104 Inventories PDFMicaela Betis100% (1)

- Applied Auditing Review Course Pre-Board - FinalDocument13 pagesApplied Auditing Review Course Pre-Board - FinalROMAR A. PIGANo ratings yet

- Worksheet ProblemsDocument3 pagesWorksheet ProblemsClaren Sidnne MadridNo ratings yet

- AaDocument4 pagesAaJMerrill CaldaNo ratings yet

- National Federation of Junior Philipinne Institute of Accountants - National Capital Region Auditing (Aud)Document14 pagesNational Federation of Junior Philipinne Institute of Accountants - National Capital Region Auditing (Aud)Tricia Jen TobiasNo ratings yet

- Audit of Inventories - STDocument7 pagesAudit of Inventories - STFrancine Holler0% (2)

- Audit Problem Inventories Part 1Document4 pagesAudit Problem Inventories Part 1Rio Cyrel CelleroNo ratings yet

- NFJPIA - Mockboard 2011 - AP PDFDocument6 pagesNFJPIA - Mockboard 2011 - AP PDFJohnny EspinosaNo ratings yet

- Mockboard AP PDFDocument6 pagesMockboard AP PDFKathleen JaneNo ratings yet

- Investment in Financial InstrumentsDocument7 pagesInvestment in Financial InstrumentsKimberly parciaNo ratings yet

- Income Tax For Corporations, PartnershipsDocument22 pagesIncome Tax For Corporations, PartnershipsKimberly parciaNo ratings yet

- RIZAL Learning Task Module 1Document1 pageRIZAL Learning Task Module 1Kimberly parciaNo ratings yet

- Match The Following:: Materiality and Audit Risk MatchingDocument6 pagesMatch The Following:: Materiality and Audit Risk MatchingKimberly parciaNo ratings yet

- Audit Procedures: Learning OutcomesDocument5 pagesAudit Procedures: Learning OutcomesKimberly parciaNo ratings yet

- Audit Assertions and Audit ObjectivesDocument6 pagesAudit Assertions and Audit ObjectivesKimberly parciaNo ratings yet

- Position Paper - Fist Impressions LastsDocument2 pagesPosition Paper - Fist Impressions LastsKimberly parciaNo ratings yet

- Activity - Setting Up Intentions - PARCIA, Kimberly M.Document1 pageActivity - Setting Up Intentions - PARCIA, Kimberly M.Kimberly parciaNo ratings yet

- Rizal Law PassageDocument1 pageRizal Law PassageKimberly parciaNo ratings yet

- Position Paper - Fist Impressions LastsDocument2 pagesPosition Paper - Fist Impressions LastsKimberly parciaNo ratings yet

- Domestic Law: You Can Read More About This at Https://bit - ly/32v1cTLDocument5 pagesDomestic Law: You Can Read More About This at Https://bit - ly/32v1cTLKimberly parciaNo ratings yet

- How RA 1425 Become A LawDocument1 pageHow RA 1425 Become A LawKimberly parciaNo ratings yet

- STATS Introduction Statistical AnalysisDocument105 pagesSTATS Introduction Statistical AnalysisKimberly parciaNo ratings yet

- POPC 78945-VanGoghDocument32 pagesPOPC 78945-VanGoghKimberly parciaNo ratings yet

- Lesson 1 STATISTICAL ANALYSISDocument7 pagesLesson 1 STATISTICAL ANALYSISKimberly parciaNo ratings yet

- Market Structures and Pricing DecisionsDocument24 pagesMarket Structures and Pricing DecisionsKimberly parciaNo ratings yet

- ReengineeringDocument3 pagesReengineeringKimberly parciaNo ratings yet

- EconomicsDocument2 pagesEconomicsKimberly parciaNo ratings yet

- UNIT 6 Shopping-TresiaDocument3 pagesUNIT 6 Shopping-TresiaTresiasidaurukgmail.com SayanganakorangNo ratings yet

- VAT On Sale of Goods and ServicesDocument14 pagesVAT On Sale of Goods and Servicesdennilyn recaldeNo ratings yet

- Sales and Distribution Management: Case study:-"HEALTHY World"Document7 pagesSales and Distribution Management: Case study:-"HEALTHY World"prachi jainNo ratings yet

- Smirnoff Ice Marketing Planning ProcessDocument6 pagesSmirnoff Ice Marketing Planning ProcessKoolaid23No ratings yet

- A Study On Distribution Practices.: With Reference To FMCG, Paints & Hardware IndustryDocument19 pagesA Study On Distribution Practices.: With Reference To FMCG, Paints & Hardware IndustryAMRUTHA KNo ratings yet

- Accounting For Manufacturing BusinessDocument1 pageAccounting For Manufacturing BusinesswtfenjiNo ratings yet

- Acctg132 - Prelim ExaminationDocument5 pagesAcctg132 - Prelim ExaminationRalph Ernest HulguinNo ratings yet

- Practice Questions (CH 2)Document6 pagesPractice Questions (CH 2)enkeltvrelseNo ratings yet

- Target Costing Literature ReviewDocument8 pagesTarget Costing Literature Reviewsmvancvkg100% (1)

- Chapter 12Document46 pagesChapter 12Hiếu NguyễnNo ratings yet

- HP-Cisco FinalPPTDocument15 pagesHP-Cisco FinalPPTKarthikeyan Gopal100% (1)

- Group Assignment Franchising and Licensing (Ars 3063)Document3 pagesGroup Assignment Franchising and Licensing (Ars 3063)Aqhi Ruldin100% (1)

- Bull-Whip Effect: A Critical Analysis ofDocument15 pagesBull-Whip Effect: A Critical Analysis ofHarsh ShahNo ratings yet

- Bus - Math Test (FINAL)Document4 pagesBus - Math Test (FINAL)Marylyd tiuNo ratings yet

- Bussiness StrategyDocument25 pagesBussiness StrategyKhizra AmirNo ratings yet

- Assignment 2-LAW 416Document8 pagesAssignment 2-LAW 416Ariff DanielNo ratings yet

- Quiz in CSSDocument3 pagesQuiz in CSSjayson reyesNo ratings yet

- Apple Blossom 1 Flowcharts, Organization Charts, Analytical ProcedureDocument3 pagesApple Blossom 1 Flowcharts, Organization Charts, Analytical ProcedureMaulana MuslimNo ratings yet

- Multi ProductsDocument24 pagesMulti ProductsBrahma Paital100% (1)

- 3 - Solution Guide - Short Term Budgeting AssignmentDocument3 pages3 - Solution Guide - Short Term Budgeting AssignmentEdward Glenn BaguiNo ratings yet

- Oracle: Question & AnswersDocument4 pagesOracle: Question & AnswersShabeena Momin0% (1)

- Ap Value Added Tax ACT - 2005: (As Amended by Act 4 of 2009)Document127 pagesAp Value Added Tax ACT - 2005: (As Amended by Act 4 of 2009)parul_shukla_1No ratings yet

- How To Handle With Affiliate MarketingDocument2 pagesHow To Handle With Affiliate MarketingTechno KryonNo ratings yet

- Module 8Document99 pagesModule 8Arnel De Los SantosNo ratings yet

- Chapter 2: E-Commerce Business Models and ConceptsDocument5 pagesChapter 2: E-Commerce Business Models and ConceptsAli ZainNo ratings yet