Professional Documents

Culture Documents

What I Know Questions: What I Learned What Is Post-Closing Trial Balance?

What I Know Questions: What I Learned What Is Post-Closing Trial Balance?

Uploaded by

Mylene Heraga0 ratings0% found this document useful (0 votes)

3 views2 pagesA post-closing trial balance is run after closing entries to verify that all temporary accounts have balances of zero and beginning balances are correct. It also ensures debits and credits remain balanced after closing entries. A reversing entry undoes adjusting entries made in the prior period at the beginning of the new period, while closing entries close temporary accounts against permanent accounts to start the new period with zero balances. Reversing entries are made to clear prepaid and accrual accounts, whereas closing entries zero out income statement account balances and transfer them to retained earnings.

Original Description:

Original Title

00006

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentA post-closing trial balance is run after closing entries to verify that all temporary accounts have balances of zero and beginning balances are correct. It also ensures debits and credits remain balanced after closing entries. A reversing entry undoes adjusting entries made in the prior period at the beginning of the new period, while closing entries close temporary accounts against permanent accounts to start the new period with zero balances. Reversing entries are made to clear prepaid and accrual accounts, whereas closing entries zero out income statement account balances and transfer them to retained earnings.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

3 views2 pagesWhat I Know Questions: What I Learned What Is Post-Closing Trial Balance?

What I Know Questions: What I Learned What Is Post-Closing Trial Balance?

Uploaded by

Mylene HeragaA post-closing trial balance is run after closing entries to verify that all temporary accounts have balances of zero and beginning balances are correct. It also ensures debits and credits remain balanced after closing entries. A reversing entry undoes adjusting entries made in the prior period at the beginning of the new period, while closing entries close temporary accounts against permanent accounts to start the new period with zero balances. Reversing entries are made to clear prepaid and accrual accounts, whereas closing entries zero out income statement account balances and transfer them to retained earnings.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

What I Know Questions: What I Learned

A post-closing trial balance What is post-closing trial I learned that a post-

is a report that is run to balance? closing trial balance is the

verify that all temporary final trial balance prepared

accounts have been before the new accounting

closed and their beginning period begins. Used to

balance reset to zero. make sure that beginning

balances are correct, the

post-closing trial balance is

also used to ensure that

debits and credits remain

in balance after closing

entries have been

completed. And the

purpose of closing entries

is to close all temporary

accounts and adjust the

balances of real accounts

such as owner’s capital.

Like all of your trial

balances, the post-closing

balance of debits and

credits must match.

A reversing entry is a What is reversing entry? First, I lerned that a

journal entry made in an reversing entry is an

accounting period, which optional journal entry that

reverses selected entries is recorded at the

made in the immediately beginning of an accounting

preceding period. The period to undo the prior

reversing entry typically period’s adjusting entries.

occurs at the beginning of In other words, these

an accounting period. entries cancel out or

reverse the adjusting

journal entries recorded at

the end of the prior

accounting period.

Second, The purpose of

recording reversing entries

is clear out the prepaid and

accrual entries from the

prior period, so that

transactions in the current

period can be recorded

normally. Since

GAAP(General Accepted

Accounting Principles) and

the accrual basis of

accounting requires that

revenues and expenses be

matched in the periods in

which they occur, accrual

journal entries are

recorded at the end of

each period.

The difference between What is the difference I learned to distinguished

closing entries and between closing and closing entries from

reversing entry is that, reversing entry? reversing entries. In

Closing Entries are used addition to this, I also

to close the books. These learned that not all

entries "close" the adjusting entries are

"temporary accounts" reversed in subsequent

against "permanent periods though. “Accruals”

accounts." For example, are an example of a type

income statement account of adjusting entry that are

balances would be pretty much always

transferred to retained reversed in the following

earnings. This effectively period. For example, if a

zeroes out the income company shipped a

statement account product before year-end

balances so that you are but didn’t have time to

starting from scratch to send out an invoice before

begin the new year. On the year-end, it would “accrue”

other hand, Reversing the revenue at year-end to

Entries are made in the get the revenue in the

next period (usually on the proper period. However,

first day of the next period, then it would need to

such as January 1). They reverse the accrual in the

reverse adjusting entries next period when the

made at the end of the last invoice will be entered into

period. period. the accounting system and

sent out. This is because

the invoice will be coded to

credit revenue (and debit

A/R), and if you didn’t

reverse the accrual from

the prior period, then the

revenue would have been

recorded twice – once in

the prior period and again

in the current .

You might also like

- EECOMEDYCLUBbusiness Plan Template 2019Document38 pagesEECOMEDYCLUBbusiness Plan Template 2019Robert FearNo ratings yet

- Advanced Financial Reporting Questions and AnswersDocument3 pagesAdvanced Financial Reporting Questions and AnswersMEYVIELYKERNo ratings yet

- 13.performance of Substantive Testing and Summary of Results of Substantive TestingDocument3 pages13.performance of Substantive Testing and Summary of Results of Substantive TestingKen Aaron DelosReyes PedroNo ratings yet

- 2019 AICPA Released Questions FAR Blank Answer KeyDocument50 pages2019 AICPA Released Questions FAR Blank Answer KeyGift ChaliNo ratings yet

- 704Document3 pages704Bhoomi GhariwalaNo ratings yet

- Module 8 (Activity 1) : Activity 1: What I Know ChartDocument3 pagesModule 8 (Activity 1) : Activity 1: What I Know ChartMylene HeragaNo ratings yet

- Module7 (Activity 1) : What I Know Questions: What I Learned What Is Closing Entries?Document3 pagesModule7 (Activity 1) : What I Know Questions: What I Learned What Is Closing Entries?Mylene HeragaNo ratings yet

- Steps in Accounting CycleDocument2 pagesSteps in Accounting CycleCindy Rose MarianoNo ratings yet

- We Have Learned in The Past Modules That The Basic Financial Statements IncludeDocument4 pagesWe Have Learned in The Past Modules That The Basic Financial Statements IncludeSophia Grace NiduazaNo ratings yet

- Accounting CycleDocument35 pagesAccounting CycleCJ MacasioNo ratings yet

- Chapter 4 - Completing The Accounting CycleDocument1 pageChapter 4 - Completing The Accounting CycleLê Nguyễn Anh ThưNo ratings yet

- The Accounting CycleDocument6 pagesThe Accounting CycleTumamudtamud, JenaNo ratings yet

- The Accounting ProcessDocument36 pagesThe Accounting ProcessNobu NobuNo ratings yet

- Posting Refers To The Process of Transferring Entries In: ExplanationDocument2 pagesPosting Refers To The Process of Transferring Entries In: ExplanationJames Ryan AlzonaNo ratings yet

- Installment06 ModuleDocument5 pagesInstallment06 ModuleMocha FurrerNo ratings yet

- Trial BalanceDocument19 pagesTrial Balancejombui2022No ratings yet

- The Accounting Equation: A L + OeDocument49 pagesThe Accounting Equation: A L + OeAna Marie ValenzuelaNo ratings yet

- Topic 5 HI5001 - SolutionDocument5 pagesTopic 5 HI5001 - SolutionMd Jahid HossainNo ratings yet

- The Accounting Equation: A L + OeDocument61 pagesThe Accounting Equation: A L + OeAna Marie ValenzuelaNo ratings yet

- True or FalseDocument5 pagesTrue or FalseMyka Ellah FortalezaNo ratings yet

- 1dd472d8-3b87-4940-be3a-9d676384377cDocument19 pages1dd472d8-3b87-4940-be3a-9d676384377cmakouapenda2000No ratings yet

- The Financial Reporting SystemDocument2 pagesThe Financial Reporting SystemKpopNo ratings yet

- CHAPTER 6 Completing The Accounting CycleDocument3 pagesCHAPTER 6 Completing The Accounting Cyclemojii caarrNo ratings yet

- Review of The Accounting Process: Reclassification Entries - Entries ThatDocument7 pagesReview of The Accounting Process: Reclassification Entries - Entries ThatDUDUNG dudongNo ratings yet

- FABM 2 Reviewer PrelimsDocument2 pagesFABM 2 Reviewer Prelimssushi nakiriNo ratings yet

- 20240220-POA2024 Ch3Document14 pages20240220-POA2024 Ch3Vũ Mạnh KhiêmNo ratings yet

- Foa p1 Module 2 For Bsa & Bsais StudentsDocument64 pagesFoa p1 Module 2 For Bsa & Bsais StudentsMiquel VillamarinNo ratings yet

- Chapter 4 - Completing The Accounting CycleDocument2 pagesChapter 4 - Completing The Accounting CyclePárk Jigoo'sNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Supplementary Material Module 5Document10 pagesSupplementary Material Module 5Darwin Dionisio ClementeNo ratings yet

- Accounting Cycle JournalizingDocument9 pagesAccounting Cycle JournalizingLecz GenwinNo ratings yet

- CLM (Paper-V)Document115 pagesCLM (Paper-V)vidushi aroraNo ratings yet

- Acctg 121 MidtermsDocument8 pagesAcctg 121 MidtermsShane JesuitasNo ratings yet

- Financial Accounting: Unit-2Document20 pagesFinancial Accounting: Unit-2Garima KwatraNo ratings yet

- CH4Document49 pagesCH4星喬No ratings yet

- Finacre 2Document3 pagesFinacre 2Dwight Gabriel C. GarciaNo ratings yet

- CHAPTER 3 Recording Business TransactionsDocument5 pagesCHAPTER 3 Recording Business Transactionsmojii caarrNo ratings yet

- Chapter 2 Accounting Process Part 1 PDFDocument66 pagesChapter 2 Accounting Process Part 1 PDFRajesh PatilNo ratings yet

- Chapter 4Document6 pagesChapter 4meahangela.labadan.23No ratings yet

- Accounting Process (Millan, 2022)Document3 pagesAccounting Process (Millan, 2022)didit.canonNo ratings yet

- Accounting - Chapter 3 Accrual Accounting ConceptsDocument27 pagesAccounting - Chapter 3 Accrual Accounting ConceptsheinlinnNo ratings yet

- 5A Review of Accounting Process PDFDocument7 pages5A Review of Accounting Process PDFAldrin Jay SalcedoNo ratings yet

- AIS Midterm NotesDocument30 pagesAIS Midterm NotesArielle CabritoNo ratings yet

- PERIODICALDocument5 pagesPERIODICALmingmingpspspspsNo ratings yet

- Bus103 Endofperiodadjustments PDFDocument5 pagesBus103 Endofperiodadjustments PDFYssa SadjiNo ratings yet

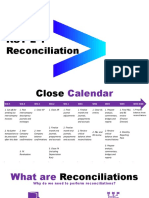

- Reconciliation and MEC72Document19 pagesReconciliation and MEC72Sumanth AmbatiNo ratings yet

- Accounting Process (NC III BOOKKEEPING REVIEWER)Document9 pagesAccounting Process (NC III BOOKKEEPING REVIEWER)GloryMae MercadoNo ratings yet

- The Accounting CycleDocument9 pagesThe Accounting Cycletoma hawkNo ratings yet

- The Accounting CycleDocument8 pagesThe Accounting CycleKathyrine Claire EdrolinNo ratings yet

- Chapter 4 - Closing Entries - Classified Financial StatementsDocument17 pagesChapter 4 - Closing Entries - Classified Financial StatementsNaeemullah baigNo ratings yet

- Ch02PPT Analyzing and Recording Transactions Revised 20220930Document128 pagesCh02PPT Analyzing and Recording Transactions Revised 20220930khaijieheng0No ratings yet

- Accounting Cycle: Names of Sub-UnitsDocument7 pagesAccounting Cycle: Names of Sub-UnitsHermann Schmidt EbengaNo ratings yet

- Value Received: Assets - Liabilities Owner's (Or Stockholders') EquityDocument2 pagesValue Received: Assets - Liabilities Owner's (Or Stockholders') EquityQueensen Mera CantonjosNo ratings yet

- CH 4Document12 pagesCH 4singhvaishnavi2807No ratings yet

- Writing Book ReportsDocument14 pagesWriting Book ReportsRaine BalcortaNo ratings yet

- Chap 16Document8 pagesChap 16Hoàng Bảo TrâmNo ratings yet

- CHP-Process and Bases of AccountingDocument14 pagesCHP-Process and Bases of Accountingmailyjain.21No ratings yet

- Peter Baskerville: What Are The Steps in The Accounting Process?Document3 pagesPeter Baskerville: What Are The Steps in The Accounting Process?Ananthakumar ANo ratings yet

- Notebook 1. Introduction To Accounting - The Accounting CycleDocument3 pagesNotebook 1. Introduction To Accounting - The Accounting CycleCherry RodriguezNo ratings yet

- The Accounting Cycle Transaction Cycle and Source DocumentsDocument1 pageThe Accounting Cycle Transaction Cycle and Source DocumentsPrincess Frean VillegasNo ratings yet

- E-Trade Receivables Appendix 1-GlobalDocument39 pagesE-Trade Receivables Appendix 1-Globalharris adiyonoNo ratings yet

- AccountingDocument1 pageAccountingRya MarianoNo ratings yet

- Lesson 5.adjusting Entries and Adjusted Trial BalanceDocument5 pagesLesson 5.adjusting Entries and Adjusted Trial BalanceDacer, Rhycheall HeartNo ratings yet

- Korean Business Dictionary: American and Korean Business Terms for the Internet AgeFrom EverandKorean Business Dictionary: American and Korean Business Terms for the Internet AgeNo ratings yet

- DocumentDocument1 pageDocumentMylene HeragaNo ratings yet

- DocumentDocument2 pagesDocumentMylene HeragaNo ratings yet

- Acc 103 Group 6Document6 pagesAcc 103 Group 6Mylene HeragaNo ratings yet

- Bam 12Document4 pagesBam 12Mylene HeragaNo ratings yet

- Bam 11Document3 pagesBam 11Mylene HeragaNo ratings yet

- DocumentDocument1 pageDocumentMylene HeragaNo ratings yet

- 24Document2 pages24Mylene HeragaNo ratings yet

- UntitledDocument1 pageUntitledMylene HeragaNo ratings yet

- Module 8 (Activity 5) : Activity 5: Check For UnderstandingDocument1 pageModule 8 (Activity 5) : Activity 5: Check For UnderstandingMylene HeragaNo ratings yet

- 18Document1 page18Mylene HeragaNo ratings yet

- 20Document1 page20Mylene HeragaNo ratings yet

- Module 21 (Activity 1)Document3 pagesModule 21 (Activity 1)Mylene HeragaNo ratings yet

- Name: ANGEL LOCSIN Class Number: BLOCK 3 Section: BSA 1-COC Schedule: 8 AM - 11 AM Date: MARCH 22, 2022Document2 pagesName: ANGEL LOCSIN Class Number: BLOCK 3 Section: BSA 1-COC Schedule: 8 AM - 11 AM Date: MARCH 22, 2022Mylene HeragaNo ratings yet

- Module 24 (Activity 1)Document4 pagesModule 24 (Activity 1)Mylene HeragaNo ratings yet

- 21Document1 page21Mylene HeragaNo ratings yet

- Module 22 (Activity 1)Document3 pagesModule 22 (Activity 1)Mylene HeragaNo ratings yet

- What I Know Questions: What I Learned What Is Gong Concern Concept?Document4 pagesWhat I Know Questions: What I Learned What Is Gong Concern Concept?Mylene HeragaNo ratings yet

- Module 8 (Activity 1) : Activity 1: What I Know ChartDocument3 pagesModule 8 (Activity 1) : Activity 1: What I Know ChartMylene HeragaNo ratings yet

- GEN4Document7 pagesGEN4Mylene HeragaNo ratings yet

- GEN5Document8 pagesGEN5Mylene HeragaNo ratings yet

- Rent SeekingDocument2 pagesRent SeekingMylene HeragaNo ratings yet

- 111111Document15 pages111111Mylene HeragaNo ratings yet

- Module 20Document3 pagesModule 20Mylene HeragaNo ratings yet

- Jennifer TorresDocument12 pagesJennifer TorresMylene HeragaNo ratings yet

- Financial Management Teaching Material1Document72 pagesFinancial Management Teaching Material1Semere Deribe100% (2)

- November 2022 - QSDocument3 pagesNovember 2022 - QSfareen faridNo ratings yet

- (DS Smith) : Academic Year Assessment Number Assessment TypeDocument45 pages(DS Smith) : Academic Year Assessment Number Assessment Typeprajwal sedhaiNo ratings yet

- Assignment 1 POF..Document3 pagesAssignment 1 POF..Anees RahmanNo ratings yet

- Cheat Sheet Chapter 10Document8 pagesCheat Sheet Chapter 10richard mathengeNo ratings yet

- Inventory CycleDocument38 pagesInventory CycleSarah Laras WitaNo ratings yet

- Syllabus CMA&FM Paper 10 PDFDocument422 pagesSyllabus CMA&FM Paper 10 PDFSa100% (2)

- Astra Account September 2021Document119 pagesAstra Account September 2021Risyep HidayatullahNo ratings yet

- FABM1 ModuleDocument7 pagesFABM1 ModuleKylie Nadine De Roma50% (2)

- Top 33 Investment Banking Interview Questions AnswersDocument7 pagesTop 33 Investment Banking Interview Questions AnswersRidwan KabirNo ratings yet

- Depreciation ProblemsDocument14 pagesDepreciation ProblemsTayyab AliNo ratings yet

- Chapter 4Document4 pagesChapter 4Irah LouiseNo ratings yet

- Ac208 2019 11Document6 pagesAc208 2019 11brian mgabi100% (1)

- CH 8 Inventory ManagementDocument12 pagesCH 8 Inventory ManagementMichelle Davinna Michael HerryNo ratings yet

- Case 03-62: #REF! #REF! #REF!Document8 pagesCase 03-62: #REF! #REF! #REF!saad bin sadaqatNo ratings yet

- Bali Company Worksheet For The Year Ended December 31, 2020: InstructionsDocument4 pagesBali Company Worksheet For The Year Ended December 31, 2020: Instructionsshera haniNo ratings yet

- HMSP - Icmd 2009 (B02)Document4 pagesHMSP - Icmd 2009 (B02)IshidaUryuuNo ratings yet

- Lecture 2 - Regulatory FrameworkDocument29 pagesLecture 2 - Regulatory FrameworkFarwa AroojNo ratings yet

- BCTC Case 2Document10 pagesBCTC Case 2Trâm Nguyễn QuỳnhNo ratings yet

- AST Chapter 2 MCPDocument4 pagesAST Chapter 2 MCPElleNo ratings yet

- Understanding Profitability: Dhof@iastate - EduDocument56 pagesUnderstanding Profitability: Dhof@iastate - EduLeilanie Felicita GrandeNo ratings yet

- 0452 w03 QP 1Document11 pages0452 w03 QP 1MahmozNo ratings yet

- Financial Statements: Historical Results 2012 2013 2014Document2 pagesFinancial Statements: Historical Results 2012 2013 2014yugyeom rojasNo ratings yet

- BF Vertical Analysis Act 6Document6 pagesBF Vertical Analysis Act 6Sheyn LeeNo ratings yet

- The Five (5) Major AccountsDocument26 pagesThe Five (5) Major AccountsAppleCorpuzDelaRosaNo ratings yet

- Commercial Operations Proposed BA New TitlesDocument12 pagesCommercial Operations Proposed BA New TitlesletiendabaNo ratings yet