Professional Documents

Culture Documents

Goto Gojek Tokopedia: Equity Research

Goto Gojek Tokopedia: Equity Research

Uploaded by

stevanadika12345Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Goto Gojek Tokopedia: Equity Research

Goto Gojek Tokopedia: Equity Research

Uploaded by

stevanadika12345Copyright:

Available Formats

Equity Research

Company Update

Monday,11 April 2022

BUY GoTo Gojek Tokopedia (GOTO IJ)

Initiate Go far, Go hyperlocal

Last price (IDR) 338 The GoTo merger has given rise to new growth dimensions for GTV through

Target Price (IDR) 400 platform integration and the use of Gopay to capture fintech opportunities.

GoTo will ride Indonesia’s GTV growth with ~30% cagr 2021-25. Hyperlocal

Upside/Downside 18.3%

strategies will be employed for the instant delivery of groceries and cloud

Previous Target Price (IDR) - kitchen. We discern a pathway to positive EBIT in 2025. We initiate coverage on

GoTo with a BUY, applying P/GMV multiples on GoTo businesses. Shareholders

Stock Statistics

include leading techs that will ensure GoTo remains relevant in a very dynamic

Sector Technology sector.

No of Shrs (mn) 1,180,184

New growth dimensions stemming from the GoTo merger. The recent merger of

Major shareholders (%) Gojek and Tokopedia adds two new growth dimensions to GoTo, namely: a) the

network effects from platform integration leading to higher GTV generation with

Goto Peopleverse Fund 9.0

a higher frequency of orders and higher spend, b) Gopay turning into a key

SVF GT Subco 8.7 revenues pillar to seize fintech opportunities emanating from on-demand and e-

Estimated free float 13.7 commerce GTV, even more so with (a), and vice versa. Also, the merger itself has

created a vacuum for users previously served under the Tokopedia-Grab-OVO

partnership, a low hanging fruit for Gojek and Gopay, in our view.

Solid catalysts for GoTo. GoTo will ride the high GTV growth of ~30% cagr in 2021-

25. Catalysts include the increased mobility for Gojek post the pandemic. The

fintech catalyst is the low penetration of ~2.9% in Indonesia and the Tokopedia

catalyst is the instant delivery opportunity going hyperlocal and leveraging

Gojek’s fleet. Similarly, Gojek may utilize the hyperlocal approach to generate

more GTV through cloud kitchens & food delivery. Tokopedia’s nationwide

coverage – 17,000 islands, provides a market upside catalyst for Gojek logistics.

Discerning a profitability pathway. We discern a pathway to improving GoTo

profitability, stemming from: a) GTV high growth b) potentially lower promotions

as loyalty effects can kick-in from technology, and c) more efficient

sales/marketing by promoting unified offering(s) with e-commerce, delivery &

payments. Gojek itself has a favorable market position with +50% market share

expecting to post positive EBIT by 2023. This trajectory may prove enough to

create positive EBIT for GoTo by 2025. E-commerce and fintech pillars will be

closer and create breakeven EBIT by holding on to their market shares and

maintaining a solid user base.

GoTo steps for value creation in the longer term. GoTo is tied with shareholders

incl. Alibaba, Alphabet, Tencent and Microsoft. This ensures GoTo will stay at the

forefront of tech trends. This includes the adoption of blockchain, positioning in

the metaverse space and adoption of digital currencies. The GoTo platform is

highly generic, broad and collaborative, allowing the company to expand into new

income streams riding existing infra and accelerating the pathway to profitability.

Initiate coverage with a BUY, TP of IDR400: We employ a P/GMV multiple to

evaluate GoTo, as the company is focused on generating GTV. We evaluate the 3

business pillars separately. We assign a P/GMV multiple of 0.80x for the on-

demand business and e-commerce for the 2021-25 GMV, and 0.30x for the fintech

GTV. We initiate coverage on GoTo with a TP of IDR400.

Key Financials

Year to 31 Dec 2019A 2020A 2021F 2022F 2023F

Revenue (IDRbn) 2,304 3,328 7,366 11,096 16,035

EBITDA (IDRbn) (20,062) (8,920) (12,408) (10,398) (7,741)

EBITDA Growth (%) 77.3 (55.5) 39.1 (16.2) (25.6)

Niko Margaronis Net profit (IDRbn) (22,762) (14,209) (12,737) (11,774) (9,092)

(62-21) 5091 4100 ext. 3512 EPS (IDR) (19.3) (12.0) (10.8) (10.0) (7.7)

niko.margaronis@brids.co.id EPS growth (%) 102.5 (37.6) (10.4) (7.6) (22.8)

BVPS (IDR) 14.4 17.0 106.2 99.1 91.4

DPS (IDR) 1.5 1.0 0.7 0.7 0.7

PER (x) n/m n/m n/m n/m n/m

PBV (x) 33.2 28.0 4.5 4.8 5.2

bridanareksasekuritas.co.id EV/EBITDA (x)

See important

(27.9)

disclosure at the back

(62.0) (44.1)

of this report

(53.4)

1

(72.8)

Exhibit 1. Revenues and Growth Exhibit 2. Net Profits and Growth

Source: Company, BRI Danareksa Sekuritas estimates Source: Company, BRI Danareksa Sekuritas estimates

Exhibit 3. Margins Exhibit 4. Gearing Level

Source: Company, BRI Danareksa Sekuritas estimates Source: Company, BRI Danareksa Sekuritas estimates

bridanareksasekuritas.co.id See important disclosure at the back of this report 2

Diving into GoTo’s operations

Background: Gojek, Gopay, & Tokopedia problem

solvers

Gojek with Gopay and Tokopedia themselves came to the market as startups to

solve market problems for consumers, merchants & partner drivers as key

stakeholders creating a wider ecosystem of services based on the needs and

attributes of these 3 groups.

Those startups brought innovation in first/middle/last mile Logistics, Merchant

business solutions, Payment and financial services, Data & insights and

Technology implementation. They can be categorized by each group:

Consumers:

- All-in-one platform that meets daily needs

- Access to various goods and quality service at affordable prices

- Fast and reliable delivery of goods and services

- Integrated payment and financial services

- Integrated loyalty program

- Seamless user experience in the whole ecosystem

Merchants:

- Access to consumer networks that are wider than traditional channels

- Integrated technology solutions that makes it easier for traders to

develop and manage their businesses

- Integrated delivery infrastructure and order fulfillment

- Inclusive payment and financial services

- Education and training programs

Partner drivers:

- Increased opportunities for income

- Flexibility of work schedule

- GoTo own proprietary technology that increases driver partner’s

productivity

- Non-cash payments that makes it easier for partner drivers

- Educational programs, training and support for driver partners.

bridanareksasekuritas.co.id See important disclosure at the back of this report 3

Gojek & Tokopedia merger

The two merging and becoming GoTo creates two (2) new

dimensions namely Gojek and Tokopedia integration and

secondly promoting goto financial as a strategic pillar.

1) Merger Dimension 1, deeper integration of the Gojek and Tokopedia

platforms. Gojek and Tokopedia internalize into each other to the greatest

extent possible, formulating a new ecosystem flywheel. This will allow agents to

work more closely with each other, in this case the merchants and the drivers

synergizing with each other.

Exhibit 5. Ecosystem flywheels between partners (drivers and merchants) and consumer users

Source: GoTo

Merger synergies unmatched by competition. GoTo expects strong synergies

between its 2.5mn driver partners, 14mn merchants, working in a close loop to

deliver seamless services to 55mn consumers. This is supported by its own

logistics & fulfillment, merchant solutions, payment & financial services, data

insights, and network effects. Those merger synergies can be identified as

follows:

Network effects:

- More innovation

- More frequent use

- Higher Customer Engagement

- Deeper Understanding of Customers

- More diverse products and services

- Better user experience

Operational efficiencies:

- Higher sales volume and revenues

- Lower cost per user

- Lower cost per service

bridanareksasekuritas.co.id See important disclosure at the back of this report 4

This integration / merger is expected to penetrate further into the daily life of

the users making use of GoTo indispensable for everyday use.

Exhibit 6. Illustration of the GoTo platform used by the consumer

Source: GoTo

GOJEK biz in brief

Consumers can use Gojek’s proprietary technology and user interface, powered

by Google in the following ways:

Gojek on-demand transport using either: Goride motorcycle ride available in

Indonesia and Vietnam.

- Gocar car transport available in Indonesia, Singapore and Vietnam,

- Gocar L,

- GoTaxi in partnership with Bluebird using the argo meter,

- GoCorp for corporate clients available in Indonesia and Singapore.

- GoTransit multimode transportation,

- Food order & delivery using GoFood Pick up, GoFood Plus, GoMart, and

Cloud Kitchen using hyperlocal strategies. Cloud kitchens are essentially

virtual restaurants -- ones without a storefront – which find the lower

upfront and operating costs enticing. Traditional dine-ins use the model

to broaden reach. Besides sharing rent and revenues, cloud-kitchen

operators can generate insights that allow restaurants to dynamically

adjust locations, menus and marketing based on demand.

bridanareksasekuritas.co.id See important disclosure at the back of this report 5

Exhibit 7. Gojek on-demand services portfolio

Source: GoTo

Exhibit 8. Gojek comparison with Grab for motorcycle and car rides

Source: Measureable ai

Gojek logistic services such as:

- GoSend: C2C-based solution for the delivery of goods,

- GoKilat: B2B2C solution for merchants to monitor the delivery of goods,

- GoShop: consumer solution to order the delivery of goods,

- GoBox: solution for the delivery of large sized goods

Exhibit 9. Gojek application menu for GoFood delivery

Source: GoTo

bridanareksasekuritas.co.id See important disclosure at the back of this report 6

Tokopedia biz in brief

The consumer can buy online through Tokopedia’s marketplace. GoTo through

Tokopedia provides a complete technology infrastructure and trading solutions

with 99% reach of sub-districts in Indonesia, encouraging economic equity for

consumers and traders. Tokopedia has a balanced mix of service categories with

more than 638 million SKUs as of 30 September 2021. Redseer research suggests

that Tokopedia is one of the largest e-commerce players in Indonesia.

SimilarWeb suggests that during the first 7 months of 2021, Tokopedia

processed 380mn searches per month.

Exhibit 10. Tokopedia e-commerce services portfolio

Source: GoTo

Key services through Tokopedia are:

- The Tokopedia Marketplace. Established in 2015, the Tokopedia

marketplace has 12mn registered merchants as of 30.09.21 that

includes individual entrepreneurs and MSMEs. They sell fashion, beauty

& skincare, FMCG, child & mother care needs, household necessities,

automotive, electronic goods and accessories et al. Tokopedia also sells

services offline incl. phone credits, utility bills, toll fee cards, vouchers

and other payments.

- Tokopedia Official store, where thousands of local, international brands

and distributors sell their goods via the B2C model.

- Tokopedia Instant Commerce: Launched in July 2021, Tokopedia has

entered a significant growth area with Tokopedia Now, leveraging its

hyperlocal strategy to bring quick deliveries down to 30 minutes on

average.

- Interactive commerce with Tokopedia Play: for interactive e-commerce

employing live shopping & video to showcase the product and case use

influencers.

- Rural Commerce with Mitra Tokopedia: established in 2018, assisting

small partners incl. warungs to become Mitra partners and access

physical and digital goods. As of 30.09.21 there were 2mn Mitra

Tokopedia partners.

bridanareksasekuritas.co.id See important disclosure at the back of this report 7

Tokopedia Logistics & fulfillment

Tokopedia also undertakes the logistics and fulfilment of the orders made

through its channels. Tokopedia processes order deliveries throughout

Indonesia with 60% of the deliveries made the same day or next. Tokopedia has

13 established partners incl. Gojek to carry through fulfilment and sorting

deliveries in this wide geography incl. first, middle and last mile. Tokopedia seeks

to improve logistics and fulfilment for a wider selection of products for

consumers outside Jabodetabek. Moreover, it seeks to improve fulfilment

capacity through data integration with the Gojek fleet for the last mile and

create seamless same day delivery at affordable prices for the consumer. It also

seeks to better utilize the Gojek fleet and drive synergies making possible the

offering of an integrated eCommerce solution to its sellers.

Another emerging trend in eCommerce is free delivery. This gives Tokopedia a

distinctive edge if the logistics are in-house, reducing the cost of delivery to a

great degree and reducing the costs for its sellers and ultimately users. Sicepat

and Anteraja are recorded as key logistics partners for Tokopedia.

Through smart warehousing (Tokocabang) and PT SLS, a wholly owned

subsidiary of Tokopedia, merchants can store their inventory and handle their

fulfilment.

A hyperlocal strategy is key for GoTo’s growth into new areas such as fresh

groceries and cloud kitchen. This is made possible meeting the fulfillment of

merchants’ products and having faster deliveries with the availability of dark

stores and the largest fleet of drivers (vans, motors etc). Free delivery, safe and

fast delivery, including same-day and instant delivery options provided by Gojek

will add to the overall customer experience of Tokopedia users.

Exhibit 11. GoTo illustration of Hyperlocal strategies

Source: GoTo

Tokopedia also offers the following services to merchants:

P4P Pay for Performance advertising charging the merchant on a per click basis

for keywords at a price set through an online auction system.

Display advertising, for placing advertisements charging the merchant on a per

impression cost at a price set through auction

Customized Marketing packages, offering advertising solution merchants that

includes TV, P4P exposure.

bridanareksasekuritas.co.id See important disclosure at the back of this report 8

2) Dimension 2 born from the merger: The new dimension born from this

merger is the distinction of the financial services unit goto financial under Goto’s

ecosystem flywheel. This is now promoted as a profit center that focuses on both

consumers and MSMEs with limited financial inclusion, access to financial

services, investments and liquidity. As such, the GoTo flywheel will be centered

on those 3 strategic pillars, i.e. on-demand, e-commerce and fintech. Tokopedia

is seen to be phasing out use of OVO and gradually connecting users with the

Gopay e-wallet.

Exhibit 12. goto financial promotion as a strategic revenues pillar and relevant organizational chart

Source: GoTo, TechinAsia

bridanareksasekuritas.co.id See important disclosure at the back of this report 9

goto financial biz in brief

goto financial key services include:

goto financial payments enabled by Gopay. Services under Gopay include:

- consumer payments such as e-money, e-wallet, GoPayLater, the

payment of installments and credit/debit cards, Gopay coins and auto-

debit.

- Merchant payments whereby Midtrans offers a payment gateway for

established merchants as well as small businesses connecting with all

Indonesian banks and enabling the integration of about 24 methods of

payments available. Gopay merchants can integrate e-money as well as

the IRIS national payments channel.

goto financial services. These include:

- GoPayLater at the end of the month: Under certain conditions,

consumers can receive credit to pay for goods/services in GoTo’s

ecosystem and outside, to mature at the end of the month. This bill will

be integrated with Gopay.

- GoPayLater with instalments

- GoModal merchant Lending: offers merchants liquidity and working

capital for transactions within GoTo’s ecosystem under certain

conditions.

- GoSure insurance: Consumers can buy insurance incl. health, life

insurance, personal safety, travel et al. from GoTo merchant partners.

- GoInvestasi investments, helping consumers to invest in gold and

mutual funds from GoTo partners.

Goto fintech solutions for merchants. These include MOKA and the GoBiz point-

of-sale cloud based solutions for small entrepreneurs (kaki lima) and social

ecommerce. The GoStore solution is specifically designed for social ecommerce

sellers to open stores online with Instagram Shop, Facebook Shop and Google

Shopping. goto financial actively engages with bank institutions for integrating

the top-up e-wallet service, offer financial services and digital banking with a

preference for Bank Jago in which GoTo holds a minority stake.

Exhibit 13. goto financial services portfolio

Source: GoTo

bridanareksasekuritas.co.id See important disclosure at the back of this report 10

Business projections and analysis:

GoTo on-demand services; ride hailing and

food delivery

The Indonesian GTV market for on-demand services ended 2021 with GTV of

Rp91.52tn with Gojek controlling ~53% of the market dominating the market

with GRAB. The on-demand market was challenging in 2020 due to Covid-19

mobility restrictions. Nonetheless, the trend is more than likely to reverse with

increased mobility from re-opening of the economy. As per Redseer, the market

is expected to grow by 27% cagr in 2021-25.

Exhibit 14. GoTo GTV on-demand services

Rp trillion GoTo GTV on-demand services

300

257

250

200

145

150 123 2021-25

cagr: 31%

90 92

100 77 68

57 56 48

33 40

50

0

2018 2019 2020 FY21e FY22 FY23 FY24 FY25

Indonesia on-demand GTV market GoTo on-demand GTV

Source: GoTo, Redseer, BRIDS

Gojek GTV for on-demand services was challenging in 2020 due to Covid-19

restrictions in mobility. Nonetheless, net revenues for GoTo was resilient as on-

demand food delivery benefited during the pandemic. We expect GoTo to ride

Indonesia’s GTV projection and conservatively maintain the same take rate of

20% to gross revenues during the projection period as well as high promotional

expenses amid rising competition in ride hailing and food delivery from new

players such as Shopee, AirAsia, Maxim, and Indriver expecting to see some

differentiation.

On the other hand, Tokopedia was tied operationally with OVO and GRAB. With

the recent merger we should expect more promotions to a large part of

Tokopedia users base to switch to Gojek ride hailing and delivery services.

We expect GoTo to maintain a minimum 45% of the acquisition market share

going to 2025, and maintain total market share at a minimum 50% level from

58% in 2021.

bridanareksasekuritas.co.id See important disclosure at the back of this report 11

Exhibit 15. GoTo on-demand gross revenues, take rate, net revenues

Rp trillion % take rate

35 20,2%

20,2% 20,2% 20,2% 20,2% 29,3

30 18,6%

25

13,5% cagr

20 11,0% 17,5 2021-

13,7 25: 31%

15

9,9

10 7,5 7,5

3,6

5

0

2018 2019 2020 FY21e FY22 FY23 FY24 FY25

Gross revenue on-demand Net revenue on-demand

Source: GoTo, Redseer, BRIDS

GoTo e-commerce services

As per Redseer, the Indonesian e-commerce GTV market ended 2021 at Rp964tn

with Gojek controlling ~23% of the market. The market is expected to grow by

25% cagr in the 2020-25 period. We expect GoTo to maintain a minimum 25% of

the acquisition market share going to 2025, gradually increasing the total market

share to around the 28% level.

Exhibit 16. GoTo e-commerce GTV

Rp trillion

2.500

1.966

2.000

1.500 1.230

964

1.000

638 570

399 317

500 248 235 2021-25

166 158

73 cagr: 25%

0

2018 2019 2020 FY21e FY22 FY23 FY24 FY25

Indonesia E-commerce GTV market GoTo e-commerce GTV*

Source: GoTo, Redseer, BRIDS

We expect GoTo ecommerce to ride the Indonesian GTV growth due to: a) the

extent of network merchants, b) increasing consumer adoption and penetration

with more users and higher buying frequency, c) the breadth of SKUs, d) the

improving ability to better serve the first & middle mile logistics, as well as

leverage the last mile to conduct delivery of e-groceries. This is especially true,

if GoTo manages to leverage the offline footprint of MPPA stores. We expect the

take rate to improve moderately to 3.1% on its gross revenues, because

competition with Shopee will likely remain stiff in the foreseeable future. E-

commerce revenues may thus grow by 36% cagr in 2021-25 and be maintained

at about the same rate for promotions cutting the gross revenues.

bridanareksasekuritas.co.id See important disclosure at the back of this report 12

Exhibit 17. GoTo e-commerce gross revenues, take rate, net revenues

Rp trillion % take rate

20 3,1%

2,9% 17,9

2,6% 2,6% 2,6%

14,1

15 2,2%

10,6 10,0 cagr

10 8,4

7,6 2021-

1,0%

0,8% 5,5 25: 36%

4,4 4,2

5 3,5

1,7 2,1

0,6 0,0 0,0 0,0

0

2018 2019 2020 FY21e FY22 FY23 FY24 FY25

Gross revenue e-commerce* Net revenue e-commerce

Source: GoTo, Redseer, BRIDS

GoTo Fintech services

As per Redseer, the Indonesian fintech GTV market will close 2021 at ~Rp400tn,

grow slowly in the beginning in one of the least penetrated markets before

taking off with GTV expected to increase more than 2-fold by 2025 as financial

inclusion and empowerment of the underbanked population kicks in. Gojek

controls ~23% of the market with the other players DANA and OVO playing a

significant role in this space. E-wallets have been used as supporting instruments

for ride-hailing and e-commerce, but we expect goto financial to grow with the

rise of consumer investments and merchant empowerment. The market is

expected to grow by 25% cagr in the 2020-25 period. We expect GoTo to

maintain a minimum 25% of acquisition market share going to 2025, and

increase gradually the total market share to around the 28% level by leveraging

the consumers and merchants of Gojek and Tokopedia.

Exhibit 18. GoTo fintech GTV

Rp trillion

1.200

1.002

1.000

800

600 503

440

400

400 2021-25 cagr:

255 222 26%

202

200 129118 120

35 61

0

2018 2019 2020 FY21e FY22 FY23 FY24 FY25

Indonesia GTV fintech market GoTo Fintech GTV

Source: GoTo, Redseer, BRIDS

We expect the goto financial services pillar to focus on consumer penetration

for e-wallets and online payments initially. The market is projected to be massive

but to lure users we expect GoTo to keep the take rate at low levels and offer

strong promotions which shave the gross revenues. Nonetheless, GoTo’s net

revenues are expected to grow by an impressive 27% cagr 2021-25. The GoTo

merger effects should support Gopay growth with Tokopedia transactions for

virtual goods such as mobile phone credits, bill payments et al. incl.

BuyNowPayLater options.

bridanareksasekuritas.co.id See important disclosure at the back of this report 13

Exhibit 19. GoTo fintech gross revenues, take rate, net revenues

Rp trillion

8 7,5

1,5%

1,2% 1,3%

7 1,0% 1,0%

0,9% 5,7 cagr

6 0,6% 0,6% 2021-

5 25: 27%

4

3

2 1,1 0,9 1,2 1,0 1,1 1,2

0,7 0,7 0,7 0,9

1

0

2018 2019 2020 FY21e FY22 FY23 FY24 FY25

Gross revenue Fintech Net revenue Fintech Take rate Fintech

Source: GoTo, Redseer, BRIDS

User behavior in 2021-25

We are in line with GTV market growth expectations of Redseer due to combined

effects of low e-commerce penetration and the potential for geographic and

demographic expansion, services innovation, fintech opportunities, e-groceries

and cloud kitchen sectoral proliferations exhibiting 30% average cagr in 2021-25

in on-demand, e-commerce and fintech. On-demand market penetration is ~5%

and Gojek is the leader. Ecommerce penetration is 6% and Tokopedia is the

leader, e-wallet penetration is 2.9% and gotofinancial is the leader.

The current timing offers the best opportunity for investments in digital

adoption for a tech company to be the leader in the future (new consumers from

Covid-19, increased buying and paying frequency, lifestyle changes).

Those trends will reflect positively on the monthly frequency of buying in the

next years and on the average value/expenditure per order. We remain

conservative as to the size of the customer base, as we see an overlap incurring

among the platforms and thus we apply small increases in the 2021-25 period.

Exhibit 20. LTM annual transaction users & average orders per month

Users mn (x)

80 4,5 5,0

4,1 4,5

70 3,8

3,4 4,0

60 3,1 3,1 3,5

50 2,7 2,7

3,0

40 2,5

30 2,0

1,5

20

1,0

10 0,5

0 0,0

2018 2019 2020 FY21e FY22 FY23 FY24 FY25

LTM annual transaction users Orders per user per month

Source: GoTo, BRIDS

bridanareksasekuritas.co.id See important disclosure at the back of this report 14

Exhibit 21. Total annual orders & average value per order

orders mn (x)

4.000 348k 400k

3.500 315k 350k

281k

3.000 244k 300k

2.500 219k 250k

179k

2.000 200k

131k

1.500 114k 150k

1.000 100k

500 50k

0 0k

2018 2019 2020 FY21e FY22 FY23 FY24 FY25

Orders Value per order

Source: GoTo, BRIDS

GoTo profitability overview

We see that competitors in on-demand services and e-commerce are well

funded currently. Given those high growth rates, we conservatively reduce the

promotional expenses onto GoTo’s gross revenues at a low rate of approx. 42%.

Exhibit 22. Promotional expenses as a % of GoTo’s gross revenues

Rp trillion

2018 2019 2020 FY21e FY22 FY23 FY24 FY25

0

-2,9 -6,4 -5,1

-7,4

-5 -10,9 -21,6

59% 61%

-10 50% 50%

43% 42%

-15

-20

-25

Promotions to customers Promotions as % of Gross revenue

Source: GoTo, BRIDS

During the IPO public expose, GoTo asserted that with the merger Goto

marketing can become more effective. GoTo is essentially in a position to

promote gopay, Tokopedia and delivery in one integrated marketing effort. We

therefore foresee a reduction in the rate of sales & marketing costs as a

percentage of GoTo’s total gross revenues going forward.

bridanareksasekuritas.co.id See important disclosure at the back of this report 15

Exhibit 23. Sales & marketing expense as a % of GoTo’s gross revenues

Rp trillion

2018 2019 2020 FY21e FY22 FY23 FY24 FY25

0

-2

-4

-6

-8 -20%

-27% -32%

-10 -42%

-12

-14

-146%

-16 -168%

Sales & marketing expenses % of gross revenue bf adj.

Source: GoTo, BRIDS

Visibility for positive EBIT in 2025.

GoTo recently merged/acquired Tokopedia in May 2021 which itself is a major

market event, creating an unparallel local behemoth bringing additional

revenues for the e-commerce, delivery business, and its fintech business with

gradually improving take rates.

The merger should bring a number of cost efficiencies in the last mile logistics,

data analytics through a bigger pool of data, better customer loyalty through

seamless service among GoTo platforms, helping to keep overall costs under

control.

We thus expect on-demand services to turn EBIT positive around 2024. We also

expect e-commerce to gradually bring down costs as a percentage of gross

revenues, although e-commerce EBIT will remain negative in the examined

2021-25 period.

We also see a reduction path for EBIT losses in the fintech biz till 2025. The

combined effect will be positive EBIT and EBITDA in 2025.

Exhibit 24. GoTo EBIT profits (losses) per business

Rp trillion

2018 2019 2020 FY21e FY22 FY23 FY24 FY25

10

4,0

5

0

-1,0 -0,1

-5 -2,4 -2,3 -2,6 -1,7

-3,2

-4,5-5,1

-6,1-5,9

-10 -7,9

-10,8

-15

-20 -16,9

On-demand EBIT E-commerce EBIT Fintech EBIT

Source: GoTo, BRIDS

bridanareksasekuritas.co.id See important disclosure at the back of this report 16

Exhibit 25. GoTo net losses & profits in 2025

Rp trillion

2018 2019 2020 FY21e FY22 FY23 FY24 FY25

5 1,4

0

-5

-10

-15 -11,2 -11,6

-12,6

-14,2

-20

-25 -22,8

Source: GoTo, BRIDS

GoTo steps for value creation in the longer term.

GoTo’s long term shareholders include Alibaba, Alphabet, Tencent and

Microsoft. This ensures GoTo will always be at the forefront of tech

developments and new business initiatives staying relevant and ensuring

business continuity. This includes the adoption of blockchain tech, positioning in

the metaverse space and the use of digital currencies. The GoTo platform is

highly generic and extensive and is able to expand into new income streams thus

accelerating the path to profitability.

GoTo has the room to expand regionally. Gojek has ventured into markets such

as Singapore, Vietnam and India. Tokopedia has kept focus solely on Indonesia,

and with the GoTo merger can get an easier entry into Gojek’s foreign markets

using Gojek’s already built infrastructure. Moreover, GoTo sources talent from

Singapore, India, Vietnam, and Indonesia for human capital to remain

competitive and resourceful.

GoTo has also prepared its next step which is to list the company in the US and

potentially raise more funding. To that end, it is developing its ESG by preparing

to invest in the EV ecosystem in Indonesia and committing to zero emissions and

zero waste targets.

bridanareksasekuritas.co.id See important disclosure at the back of this report 17

GoTo valuation overview

We employ a P/GMV multiple to evaluate GoTo, as the effort of the merged

company is focused on generating GTV and maintaining a solid customer base.

We expect the customer base to remain loyal with large promotions and

marketing expenses done by the Company, to increase buying frequency and

increase also expenditure per order. Loyalty will be strengthened further as

adjacent businesses such as fintech services and entertainment are being

developed.

We evaluate the 3 business pillars separately. Using as a reference the multiple

valuations of peers from abroad we assign a P/GMV multiple of 0.80x for the on-

demand business and e-commerce for the 2021-25 GMV, and 0.30x for the

fintech GTV. We initiate coverage on GoTo with a TP of IDR400.

Exhibit 26. Multiples valuation benchmarking for technology companies

Market P/GMV EV/Revenue EV/EBITDA ---- PE ---- ---- PB ----

Company Country Cap 2022 2023 2022 2023 2022 2023 2022 2023 2022 2023

(US$m) (x) (x) (x) (x) (x) (x) (x) (x) (x) (x)

E-COMMERCE

Shopify Canada 80,790 6.19 5.16 12.3 9.3 156.2 99.5 226.5 145.8 7.2 7.0

JD.com US 89,018 0.15 0.13 0.4 0.3 19.2 12.3 28.3 19.2 2.6 2.3

Mercadolibre Vietnam 59,149 1.65 1.37 6.2 4.6 67.3 41.6 157.8 86.6 32.2 24.6

Americanas SA Taiwan 5,703 0.44 0.36 1.0 0.9 7.8 6.7 92.3 31.4 1.7 1.6

PINDUODUO IN-ADR US 53,102 0.13 0.11 2.3 1.8 17.3 10.6 20.0 12.8 5.0 3.9

ETSY INC US 15,365 0.93 0.78 6.1 5.0 21.3 17.3 25.3 19.6 13.4 8.4

Allegro.EU sa Poland 6,938 0.56 0.47 4.3 3.3 14.6 12.7 25.5 22.2 2.7 2.4

OnlineEbay Inc

Marketplace US 31,950 0.37 0.30 3.2 3.0 8.9 8.5 13.7 13.1 3.9 3.7

OnlineVIPSHOP HOLD-ADR

Marketplace China 5,697 0.19 0.16 0.2 0.2 2.7 2.4 6.1 5.5 0.9 0.8

Dada

Internet Nexus

Media LTD-ADR

& services China 2,043 0.23 0.19 1.1 0.8 (10.4) 18.7 (12.5) 18.2 2.3 2.1

Farfetch

Specialty LTD

Online Class A

Retailers UK 5,701 0.81 0.67 1.8 1.5 161.2 41.3 (11.4) (13.8) (24.9) (12.0)

OnlineBukalapak.com

Marketplace Indonesia 2,494 0.21 0.17 4.1 2.7 (9.0) (14.6) (33.7) (62.1) 1.7 1.7

Simple average 1.0 0.8 3.6 2.8 38.1 21.4 44.8 24.9 4.0 3.9

Median 0.4 0.3 2.7 2.2 16.0 12.5 22.6 18.7 2.6 2.4

FINTECH

Paypal

Internet Media & Services US 131,692 0.09 0.07 4.5 3.7 17.2 14.0 24.0 19.4 5.2 4.2

Data &Kakaopay Corp

Transaction Processors S. Korea 14,395 0.14 0.11 N/A N/A N/A N/A 378.6 142.9 14.3 13.4

Data &Pagseguro Digital

Transaction Ltd - CL A

Processors Brazil 6,256 0.05 0.04 2.0 1.6 7.0 5.0 17.7 12.3 2.4 2.0

Data &One 97n Communications

Transaction Processors Ltd India 5,262 0.04 0.03 7.5 5.0 (16.6) (14.8) (18.1) (17.7) 3.2 3.8

Data &Adyen NV

Transaction Processors Netherlands 57,731 0.07 0.06 34.7 22.4 54.6 40.0 79.6 58.0 21.0 15.3

Data &StoneCo Ltd Processors

Transaction Brazil 3,475 0.05 0.05 2.2 1.8 5.0 4.0 32.4 14.9 1.2 1.1

Data &Block Inc

Transaction Processors US 73,047 0.36 0.30 3.8 3.1 92.7 54.9 101.6 63.4 18.0 5.7

Data &Visa Inc

Transaction Processors US 467,858 0.03 0.03 16.6 14.6 23.7 20.8 30.8 26.7 12.2 10.9

Data &Mastercard

TransactionInc

Processors US 341,677 0.04 0.03 15.7 13.4 26.2 21.7 34.2 28.1 40.0 28.2

Simple average 0.10 0.08 10.9 8.2 26.2 18.2 75.6 38.7 13.0 9.4

Median 0.05 0.05 6.0 4.4 20.4 17.4 32.4 26.7 12.2 5.7

RIDE HAILING LOGISTICS / FOOD DELIVERY

LYFT

Internet Inc -A

Media & Services US 12,064 0.36 0.30 2.5 2.0 30.2 15.0 54.1 21.4 7.9 6.0

Just

Internet Eat Takeaway.com

Media & Services NV Netherlands 7,560 0.21 0.17 1.3 1.1 (35.0) 179.1 (10.2) (18.0) 0.5 0.5

Doordash

Internet Media & Services US 38,642 0.76 0.64 5.8 4.7 111.7 51.4 652.4 99.3 8.0 7.6

Delivery Hero Germany 11,309 0.23 0.19 5.7 4.2 N/A N/A (8.1) (13.5) 5.7 9.3

Didi Chuxing Inc China 12,444 0.22 0.18 1.0 0.8 (18.9) (33.6) (4.9) (7.0) N/A N/A

UBER US 63,076 0.59 0.49 2.6 2.1 53.8 22.4 (82.7) 67.8 4.4 4.0

Ocado Group Plc UK 11,991 0.51 0.43 3.3 2.8 161.4 48.0 (31.0) (38.8) 6.6 8.0

MEITUAN-B Dianping China 123,411 0.97 0.81 3.2 2.4 (280.4) 40.3 (93.6) 78.7 6.8 6.3

GRAB Philipine 13,019 0.61 0.51 9.6 5.6 N/A N/A (8.5) (10.2) 2.2 2.7

Simple average 0.5 0.4 3.9 2.9 3.3 46.1 52.0 20.0 5.3 5.6

Median 0.5 0.4 3.2 2.4 30.2 40.3 (8.5) (7.0) 6.2 6.2

Exhibit 27. GoTo P/GMV multiple based valuation

2020 2021F 2022F 2023F 2024F 2025F

IDR mn - - - - - -

Applied P/GTV mobility 0.8x 30,372,879 36,592,998 51,028,272 68,634,317 88,596,362 109,937,319

Applied P/GTV ecommerce 0.8x 119,527,065 177,276,655 239,487,064 303,631,588 367,806,407 433,174,214

Applied P/GTV Fintech 0.3x 33,877,782 57,311,013 62,924,964 82,750,040 108,969,612 143,461,206

TP (IDR): 156 230 299 386 479 582

Overall GoTo GTV 330,176,359 458,373,777 572,894,050 741,165,846 933,735,500 1,157,093,436

Source: GoTo, BRIDS

bridanareksasekuritas.co.id See important disclosure at the back of this report 18

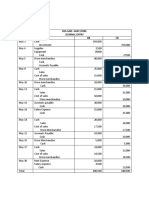

Exhibit 28. Income Statement

Year to 31 Dec (IDRbn) 2019A 2020A 2021F 2022F 2023F

Revenue 2,304 3,328 7,366 11,096 16,035

COGS (2,781) (2,439) (3,288) (3,500) (4,148)

Gross profit (477) 889 4,078 7,596 11,887

EBITDA (20,062) (8,920) (12,408) (10,398) (7,741)

Oper. profit (21,024) (10,167) (14,260) (12,497) (9,815)

Interest income 247 212 226 226 226

Interest expense (112) (186) (192) (192) (192)

Forex Gain/(Loss) (153) (2,139) 58 58 58

Income From Assoc. Co’s (314) (421) 115 (97) (97)

Other Income (Expenses) (2,804) (4,087) 588 0 0

Pre-tax profit (24,160) (16,789) (13,465) (12,502) (9,819)

Income tax 78 53 53 53 53

Minority interest 1,320 2,527 674 674 674

Net profit (22,762) (14,209) (12,737) (11,774) (9,092)

Core Net Profit (19,805) (7,982) (13,382) (11,832) (9,149)

Exhibit 29. Balance Sheet

Year to 31 Dec (IDRbn) 2019A 2020A 2021F 2022F 2023F

Cash & cash equivalent 6,104 15,319 20,247 9,589 1,019

Receivables 2,371 833 1,001 1,322 1,681

Inventory 72 42 57 61 72

Other Curr. Asset 757 3,331 3,510 3,531 3,566

Fixed assets - Net 675 827 1,333 1,333 1,333

Other non-curr.asset 11,414 9,756 118,193 117,838 117,741

Total asset 21,393 30,109 144,341 133,674 125,412

ST Debt 1,006 854 1,571 0 0

Payables 2,145 1,970 5,600 5,712 5,825

Other Curr. Liabilities 1,950 2,940 5,816 5,182 5,224

Long Term Debt 889 3,233 1,545 650 650

Other LT. Liabilities 540 312 3,158 3,158 3,158

Total Liabilities 6,529 9,309 17,690 14,702 14,857

Shareholder'sFunds 17,017 20,116 125,293 116,940 107,848

Minority interests (2,154) 683 1,358 2,032 2,706

Total Equity & Liabilities 21,393 30,109 144,341 133,674 125,412

bridanareksasekuritas.co.id See important disclosure at the back of this report 19

Exhibit 30. Cash Flow

Year to 31 Dec (IDRbn) 2019A 2020A 2021F 2022F 2023F

Net income (22,762) (14,209) (12,737) (11,774) (9,092)

Depreciation and Amort. 962 1,247 1,853 2,100 2,074

Change in Working Capital (770) 1,312 4,947 (868) (250)

OtherOper. Cash Flow (1,319,950) (2,528,764) (672,934) (674,383) (674,383)

Operating Cash Flow (1,342,519) (2,540,414) (678,872) (684,926) (681,651)

Capex (1,185) (1,399) (2,359) (2,100) (2,074)

Others Inv. Cash Flow 1,778 3,581 (106,707) 323 323

Investing Cash Flow 593 2,182 (109,066) (1,776) (1,751)

Net change in debt 1,106 843 120 (2,208) 0

New Capital 22,625 2,245 118,515 15,785 0

Dividend payment 0 0 0 0 0

Other Fin. Cash Flow (211) 20,240 556 (11,206) 1,157

Financing Cash Flow 23,520 23,328 119,191 2,370 1,157

Net Change in Cash (1,318,406) (2,514,904) (668,747) (684,332) (682,245)

Cash - begin of the year 5,806 6,104 15,319 20,247 9,589

Cash - end of the year 6,104 15,319 20,247 9,589 1,019

Exhibit 31. Key Ratios

Year to 31 Dec 2019A 2020A 2021F 2022F 2023F

Growth (%)

Sales 60.4 44.4 121.3 50.6 44.5

EBITDA 77.3 (55.5) 39.1 (16.2) (25.6)

Operating profit 76.1 (51.6) 40.3 (12.4) (21.5)

Net profit 102.5 (37.6) (10.4) (7.6) (22.8)

Profitability (%)

Gross margin (20.7) 26.7 55.4 68.5 74.1

EBITDA margin (870.8) (268.0) (168.4) (93.7) (48.3)

Operating margin (912.5) (305.5) (193.6) (112.6) (61.2)

Net margin (988.0) (427.0) (172.9) (106.1) (56.7)

ROAA (108.5) (55.2) (14.6) (8.5) (7.0)

ROAE (131.9) (76.5) (17.5) (9.7) (8.1)

Leverage

Net Gearing (x) (0.3) (0.5) (0.1) (0.1) 0.0

Interest Coverage (x) (187.9) (54.6) (74.4) (65.2) (51.2)

Source : GoTo, Danareksa Estimates

bridanareksasekuritas.co.id See important disclosure at the back of this report 20

bridanareksasekuritas.co.id See important disclosure at the back of this report 21

You might also like

- Noship Affiliate Guide by Illecom v1Document6 pagesNoship Affiliate Guide by Illecom v1Jimoh RihanatNo ratings yet

- 1 Chapter One - Challanges of Environments (31.01.2023)Document12 pages1 Chapter One - Challanges of Environments (31.01.2023)LixieNo ratings yet

- Multiple Choice Questions - IMCDocument4 pagesMultiple Choice Questions - IMCSharp Tooth60% (5)

- 12 Strategies in Franchising Chapter 1 & 2Document17 pages12 Strategies in Franchising Chapter 1 & 2milrosebatilo2012100% (3)

- LEGO and Indonesian Toys MarketDocument4 pagesLEGO and Indonesian Toys MarketOvinaufal100% (1)

- Mid Exam BSEM - BLEMBA 25 - 29318428 - Aditya Tri SudewoDocument3 pagesMid Exam BSEM - BLEMBA 25 - 29318428 - Aditya Tri SudewoAditya Tri Sudewo100% (1)

- Bukalapak Market AnalysisDocument4 pagesBukalapak Market AnalysisHari Camel IINo ratings yet

- The Production and Operations Operations Management in NOKIA FirmDocument2 pagesThe Production and Operations Operations Management in NOKIA FirmAkshath Mavinkurve0% (1)

- Baker Adhesives Case Study AnalysisDocument4 pagesBaker Adhesives Case Study Analysisariani fNo ratings yet

- United Parcel Service ADocument16 pagesUnited Parcel Service ANazzala Zakka WaliNo ratings yet

- Bistrat TIROCA GojekDocument4 pagesBistrat TIROCA GojekRendy FranataNo ratings yet

- Vodafone Presentation 150225051112 Conversion Gate02 PDFDocument18 pagesVodafone Presentation 150225051112 Conversion Gate02 PDFPanos KoupasNo ratings yet

- Inc.Document5 pagesInc.yousafkhalid48683% (6)

- Wealth Management Yung KeeDocument3 pagesWealth Management Yung KeeEsther OuNo ratings yet

- Hongkong Disneyland PPT Syndicate 666Document17 pagesHongkong Disneyland PPT Syndicate 666rizkielimbong100% (1)

- The Financial Detective ASLIDocument5 pagesThe Financial Detective ASLIAntonius CliffSetiawanNo ratings yet

- Delphi CorpDocument4 pagesDelphi Corpadrian_lozano_zNo ratings yet

- PM School EbookDocument234 pagesPM School EbookAkshay Tyagi100% (1)

- Gojek Tokopedia MergerDocument8 pagesGojek Tokopedia Mergerfatih jumongNo ratings yet

- Investment Procedure: Private & ConfidentialDocument9 pagesInvestment Procedure: Private & ConfidentialMuhammadNo ratings yet

- Take Home Test (UTS People Part)Document1 pageTake Home Test (UTS People Part)kusumawi2311No ratings yet

- Quietly Brilliant HTCDocument2 pagesQuietly Brilliant HTCOxky Setiawan WibisonoNo ratings yet

- Final Exam - GM 8 - BelsDocument2 pagesFinal Exam - GM 8 - BelsR NaritaNo ratings yet

- 3rd Case SG2 Daikin PDFDocument24 pages3rd Case SG2 Daikin PDFSabila SyarafinaNo ratings yet

- Fiesta Case PDFDocument3 pagesFiesta Case PDFMuhammad Nurisman SyarifNo ratings yet

- CH 7Document26 pagesCH 7api-254900507No ratings yet

- Mid Exam BSEM - SMEMBA 3 - 29318436 - Armita OctafianyDocument6 pagesMid Exam BSEM - SMEMBA 3 - 29318436 - Armita Octafianyarmita octafianyNo ratings yet

- Forward Integration - Kalbe FarmaDocument17 pagesForward Integration - Kalbe Farmasatria12No ratings yet

- Quiz 1 Entree19 Farah Andayani 29320028Document30 pagesQuiz 1 Entree19 Farah Andayani 29320028Farah Andayani RNo ratings yet

- Rico 29319100 Corporate Strategy Case IndofoodDocument4 pagesRico 29319100 Corporate Strategy Case IndofoodMifta ZanariaNo ratings yet

- Whitepaper PDFDocument44 pagesWhitepaper PDFVicky SusantoNo ratings yet

- Ikea Group Yearly Summary Fy14Document43 pagesIkea Group Yearly Summary Fy14ArraNo ratings yet

- Group 7 Case 1 - LEGODocument19 pagesGroup 7 Case 1 - LEGORAY NICOLE MALINGINo ratings yet

- CrocsDocument14 pagesCrocsOjasvita123100% (2)

- Case Study LegoDocument6 pagesCase Study LegoIvaAmelyaPutri0% (1)

- Microsoft CEO Satya NadellaDocument3 pagesMicrosoft CEO Satya NadellaypatelsNo ratings yet

- Session 12 - Positioning Applied - LEGODocument1 pageSession 12 - Positioning Applied - LEGODiego Benavente PatiñoNo ratings yet

- Google Company Overview PDFDocument3 pagesGoogle Company Overview PDFJillNo ratings yet

- Brand Equity & Crafting Brand Positioning: Gucci CaseDocument7 pagesBrand Equity & Crafting Brand Positioning: Gucci CaseAyu Pritandya PertiwiNo ratings yet

- Competitve Advantage Adidas & My SelfDocument17 pagesCompetitve Advantage Adidas & My SelfVedini Kanzi WidyaNo ratings yet

- About GojekDocument6 pagesAbout GojekDaffa IqbalNo ratings yet

- Porter Five Forces AnalysisDocument6 pagesPorter Five Forces Analysisnaseeb_kakar_3No ratings yet

- Case Study Week 2 LegoDocument3 pagesCase Study Week 2 LegoLinh HoangNo ratings yet

- Alibaba Group - From Strength To Strength - An Overview of The Business Units of The World's Largest E-Commerce CompanyDocument67 pagesAlibaba Group - From Strength To Strength - An Overview of The Business Units of The World's Largest E-Commerce CompanyKitchenConnectionNo ratings yet

- Nike Vs AdidasDocument25 pagesNike Vs AdidasSandhyaNo ratings yet

- Business Strategy Classs AssignmentDocument2 pagesBusiness Strategy Classs AssignmentRaymond Yonathan HutapeaNo ratings yet

- Case StudyDocument20 pagesCase StudyGouthamKumarNo ratings yet

- PT BukalapakDocument1 pagePT BukalapakTrenz YTNo ratings yet

- Syndicate 1 & 2 - Gucci CaseDocument31 pagesSyndicate 1 & 2 - Gucci CaserizqighaniNo ratings yet

- Indofood CBP Sukses Makmur: Assessing The New Potential Sales DriverDocument9 pagesIndofood CBP Sukses Makmur: Assessing The New Potential Sales DriverRizqi HarryNo ratings yet

- Telkom Case For MidtestDocument12 pagesTelkom Case For MidtestDimo HutahaeanNo ratings yet

- 19e Section6 LN Chapter09Document10 pages19e Section6 LN Chapter09benbenchenNo ratings yet

- Go JekDocument10 pagesGo JekSandro Fernando SethieawanNo ratings yet

- Case Study CiscoSystemsDocument8 pagesCase Study CiscoSystemsRẚihẚn KẚiserNo ratings yet

- Mystic Monk Coffee CaseDocument4 pagesMystic Monk Coffee CaseMelchiade NanemaNo ratings yet

- Financial Insight - Syndicate 5Document8 pagesFinancial Insight - Syndicate 5Yunia Apriliani KartikaNo ratings yet

- Ankur Joshi Rohit Kathotia A Case Study byDocument18 pagesAnkur Joshi Rohit Kathotia A Case Study byMAYANK SWARNKARNo ratings yet

- Crocs Case StudyDocument18 pagesCrocs Case StudyAndrea BonfantiNo ratings yet

- General Electric CaseDocument12 pagesGeneral Electric CaseIshan GuptaNo ratings yet

- Strategic Management - Diversification The Walt Disney - Kel 7 PDFDocument30 pagesStrategic Management - Diversification The Walt Disney - Kel 7 PDFrendim0% (1)

- Vodafone Strtegy ManagementDocument59 pagesVodafone Strtegy Managementjaysaradar0% (1)

- Eastboro Case Write Up For Presentation1Document4 pagesEastboro Case Write Up For Presentation1Paula Elaine ThorpeNo ratings yet

- Richa 2009212 Sarita Bhutani 2009222 Prakhar Chawla 2009225 Sameer Bhardwaj 2009238 Shalini Singh 2009239 Vishal Gurao 2009306 Submitted ToDocument29 pagesRicha 2009212 Sarita Bhutani 2009222 Prakhar Chawla 2009225 Sameer Bhardwaj 2009238 Shalini Singh 2009239 Vishal Gurao 2009306 Submitted TosaritaNo ratings yet

- GOTO IJ - MNC Sekuritas Equity Report (170323)Document28 pagesGOTO IJ - MNC Sekuritas Equity Report (170323)Anonymous XoUqrqyuNo ratings yet

- GOTO Initiation 01072022 enDocument22 pagesGOTO Initiation 01072022 ensudah kawinNo ratings yet

- Maha-L'azurde Marketing Plan PDFDocument24 pagesMaha-L'azurde Marketing Plan PDFMaha MansourNo ratings yet

- Assignment No 1Document10 pagesAssignment No 1Amna TaimuriNo ratings yet

- Quizlet 1Document24 pagesQuizlet 1gauri deshmukhNo ratings yet

- Communicatietraining Engels 3 23-24Document174 pagesCommunicatietraining Engels 3 23-24ouassima.chNo ratings yet

- Treasury Management - CompanyDocument10 pagesTreasury Management - CompanyRM ValenciaNo ratings yet

- RB - Ecommerce - TORDocument7 pagesRB - Ecommerce - TORosamaNo ratings yet

- BFS 3256 MKT of Financial Service NotesDocument68 pagesBFS 3256 MKT of Financial Service NotesNyaramba DavidNo ratings yet

- Digital Marketing Pricing Packages in NigeriaDocument6 pagesDigital Marketing Pricing Packages in NigeriaSeye AlebiosuNo ratings yet

- INTACC 1 - InventoriesDocument8 pagesINTACC 1 - InventoriesRandom Vids100% (1)

- Students Industrial Visit ReportsDocument17 pagesStudents Industrial Visit ReportsText81No ratings yet

- Top 10 MLM Companies in BDDocument12 pagesTop 10 MLM Companies in BDkazi yakub aliNo ratings yet

- M and S Code of ConductDocument43 pagesM and S Code of ConductpeachdramaNo ratings yet

- Theoretical Approach To Budget SettingDocument28 pagesTheoretical Approach To Budget SettingsidpandeNo ratings yet

- Animation, Visual Effects, Gaming and Comics Policy 2017-2022Document26 pagesAnimation, Visual Effects, Gaming and Comics Policy 2017-2022chellamanis9953No ratings yet

- Technopreneurship in Small Medium EnterprisegrouptwoDocument50 pagesTechnopreneurship in Small Medium EnterprisegrouptwoKurt Martine LacraNo ratings yet

- Revision File For Book Bind1 2Document77 pagesRevision File For Book Bind1 2carl fuerzasNo ratings yet

- Research Hel S: Expansion Abroad: ChallengeDocument3 pagesResearch Hel S: Expansion Abroad: Challengerajthakre81No ratings yet

- 03 Park Micro10 PP Stu ch03Document50 pages03 Park Micro10 PP Stu ch03Aarushi WadhwaNo ratings yet

- PT Jaya Real Property TBK: Company PresentationDocument46 pagesPT Jaya Real Property TBK: Company PresentationEric KurniawanNo ratings yet

- Business Unit 2Document16 pagesBusiness Unit 2Ania ZielińskaNo ratings yet

- Online Marketing Literature Review PDFDocument10 pagesOnline Marketing Literature Review PDFgvzrznqf100% (1)

- Corporate Mergers and AcquisitionsDocument9 pagesCorporate Mergers and AcquisitionsSurekha BukkeNo ratings yet

- Case 107Document7 pagesCase 107lucia VallsNo ratings yet

- On Nirma CaseDocument36 pagesOn Nirma CaseAditya100% (1)

- Miranda Accounting 2.2Document4 pagesMiranda Accounting 2.2Joedy Mar MirandaNo ratings yet