Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

16 viewsInternal Reconstruction

Internal Reconstruction

Uploaded by

shejal naikThis document contains summaries of 5 different past exam questions on the topic of capital reduction from question papers between 2015-2019. Each summary provides the calculation of the capital reduction amount, journal entries to record the reduction, and allocation of the reduction amount to write off various asset accounts. The summaries range from 3 to 5 sentences and concisely outline the key details and accounting entries for the capital reduction transactions.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Accountancy Assignment Grade 12Document4 pagesAccountancy Assignment Grade 12sharu SKNo ratings yet

- Answers For Problems On Financial Leverage - 1-4Document4 pagesAnswers For Problems On Financial Leverage - 1-4jeganrajraj80% (5)

- Chapter 5 MacroDocument26 pagesChapter 5 MacroKaren M.100% (8)

- The Hivemind Trading SystemDocument4 pagesThe Hivemind Trading SystemMaritimer88No ratings yet

- Suggested Answer CAP II December 2016Document88 pagesSuggested Answer CAP II December 2016Nirmal ShresthaNo ratings yet

- Presentation On Internal ReconstructionDocument23 pagesPresentation On Internal Reconstructionneeru79200040% (5)

- 5 Internal ReconstructionDocument31 pages5 Internal ReconstructionHariom PatidarNo ratings yet

- 12 Accountancy Accounting For Share Capital and Debenture Impq 1Document8 pages12 Accountancy Accounting For Share Capital and Debenture Impq 1Aejaz MohamedNo ratings yet

- 4 Internal ReconstructionDocument28 pages4 Internal Reconstructionss6555760No ratings yet

- Adv Acc - 3 CHDocument21 pagesAdv Acc - 3 CHhassan nassereddineNo ratings yet

- Pe2 Acc Nov05Document19 pagesPe2 Acc Nov05api-3825774No ratings yet

- Redemption of Preference SharesDocument13 pagesRedemption of Preference Sharessunil agarwalNo ratings yet

- Marking SchemeDocument6 pagesMarking Schemeraghu monnappaNo ratings yet

- Cor Acc Unit 01Document19 pagesCor Acc Unit 01vignesh iyerNo ratings yet

- Corporate Accounting Exam Questions PaperDocument7 pagesCorporate Accounting Exam Questions PaperAmmar Bin NasirNo ratings yet

- AdfDocument2 pagesAdfSalapataSalawowoBarrackNo ratings yet

- Balance Sheet As On 31/12/2016 (Balance Sheet After Reconstruction)Document8 pagesBalance Sheet As On 31/12/2016 (Balance Sheet After Reconstruction)GauravNo ratings yet

- Corporate AccountingDocument93 pagesCorporate AccountingKalp JainNo ratings yet

- Answer Key 2Document8 pagesAnswer Key 2Hari prakarsh NimiNo ratings yet

- 616806cf0cf2b988fbcdbd97 OriginalDocument20 pages616806cf0cf2b988fbcdbd97 OriginalTM GamingNo ratings yet

- AF210 Unit 4 Tutorial SolutionsDocument5 pagesAF210 Unit 4 Tutorial SolutionsChand DivneshNo ratings yet

- 47355bos37158iipc5mtp ADocument13 pages47355bos37158iipc5mtp AAnshuman RoutNo ratings yet

- Internal Reconstruction PQ SolDocument17 pagesInternal Reconstruction PQ SolKaran MokhaNo ratings yet

- Holding Company Class Note 1Document6 pagesHolding Company Class Note 1sahir112001No ratings yet

- 12 Accountancy Lyp 2017 Foreign Set3Document41 pages12 Accountancy Lyp 2017 Foreign Set3Ashish GangwalNo ratings yet

- BBS - 1st - Financial Accounting and AnalysisDocument46 pagesBBS - 1st - Financial Accounting and AnalysisJALDIMAINo ratings yet

- 6.XII Accountancy Marking SchemeDocument10 pages6.XII Accountancy Marking Schemecommerce12onlineclassesNo ratings yet

- Mid Term Examination November 2014 II Puc AccountancyDocument4 pagesMid Term Examination November 2014 II Puc AccountancyManju PNo ratings yet

- BBA-1.4-A.D.M Finance 2015 NewDocument3 pagesBBA-1.4-A.D.M Finance 2015 NewAnonymous NSNpGa3T93No ratings yet

- Accounts 2Document41 pagesAccounts 2SubodhSaxenaNo ratings yet

- RTP Dec 18 QNDocument21 pagesRTP Dec 18 QNbinu100% (1)

- Business Accounting-Ii BS-VDocument2 pagesBusiness Accounting-Ii BS-Vzahid khanNo ratings yet

- Additional Questions 9Document3 pagesAdditional Questions 910 368 Zakwan BaigNo ratings yet

- Work Sheet 3 & 4 Business FinanceDocument3 pagesWork Sheet 3 & 4 Business FinancePrateek YadavNo ratings yet

- Unit 3 Retirement of A Partner - Problems With AnswersDocument13 pagesUnit 3 Retirement of A Partner - Problems With Answersds1619231No ratings yet

- Additional Questions-8Document13 pagesAdditional Questions-8stynx784No ratings yet

- Answer Key 3Document8 pagesAnswer Key 3Hari prakarsh NimiNo ratings yet

- Management Accounting PAPERDocument7 pagesManagement Accounting PAPERtemailggNo ratings yet

- 1MS-CLASS XII ACC - Common Board-2022-23 (2) - 230329 - 142033Document21 pages1MS-CLASS XII ACC - Common Board-2022-23 (2) - 230329 - 142033jiya.mehra.2306No ratings yet

- Corporate Accounts - Entire - IIDocument347 pagesCorporate Accounts - Entire - IIManjunath R IligerNo ratings yet

- Ans. Chapter-9Document6 pagesAns. Chapter-9upscmindworksNo ratings yet

- Corporate AccountingDocument25 pagesCorporate Accountingrakshithaparimala100No ratings yet

- Chapter 9 Online Test AnswersDocument3 pagesChapter 9 Online Test AnswerstishaunafrayNo ratings yet

- Problems On Internal ReconstructionDocument7 pagesProblems On Internal Reconstructionlokeshwarareddy1999No ratings yet

- Corrporate ModelDocument10 pagesCorrporate Modelnithinjoseph562005No ratings yet

- Hsslive Xii Acc 3 Admission of A Partner KeyDocument8 pagesHsslive Xii Acc 3 Admission of A Partner KeyShinu ShinadNo ratings yet

- Ans. Chapter-8Document6 pagesAns. Chapter-8dhirendra.ksingh1980No ratings yet

- Instruction: Attempt Any 4 Questions. Each Question Carries Equal MarksDocument3 pagesInstruction: Attempt Any 4 Questions. Each Question Carries Equal MarksSaurav KumarNo ratings yet

- Finance&Accounts T3 SolutionDocument4 pagesFinance&Accounts T3 Solutionkanika thakurNo ratings yet

- Shares Issued at Premium & DiscountDocument13 pagesShares Issued at Premium & DiscountAwab HamidNo ratings yet

- Sample Paper-1 (Target Term - 2) Answers: Book Recommended - Ultimate Book of Accountancy Class 12Document8 pagesSample Paper-1 (Target Term - 2) Answers: Book Recommended - Ultimate Book of Accountancy Class 12Beena ShibuNo ratings yet

- Purchase Consideration - SolutionDocument16 pagesPurchase Consideration - Solutionsarthak mendirattaNo ratings yet

- Remidial Assignment B.tech - Bbs n'22Document9 pagesRemidial Assignment B.tech - Bbs n'22Ramagopal VemuriNo ratings yet

- Duyao - Yvonne - Antonette - M2ModuleAssignment-Data FilesDocument14 pagesDuyao - Yvonne - Antonette - M2ModuleAssignment-Data FilesYvonne DuyaoNo ratings yet

- SP Uni CA 2013Document3 pagesSP Uni CA 2013mahendrabpatelNo ratings yet

- Shares & Debentures TestDocument10 pagesShares & Debentures TestAthul Krishna KNo ratings yet

- Accounting For Bonus and Right Issue: Topic - 4Document12 pagesAccounting For Bonus and Right Issue: Topic - 4Naga ChandraNo ratings yet

- Accountancy Answer Key - II Puc Annual Exam March 2019Document8 pagesAccountancy Answer Key - II Puc Annual Exam March 2019Akash kNo ratings yet

- Sample Question Paper 2022 Marking SchemeDocument16 pagesSample Question Paper 2022 Marking SchemeTûshar ThakúrNo ratings yet

- C.S. Executive - Answers For CC Test Paper - IDocument7 pagesC.S. Executive - Answers For CC Test Paper - Isekhar_gantiNo ratings yet

- Marking Scheme Mock Test I 2023 24Document9 pagesMarking Scheme Mock Test I 2023 24HARSH CHAURASIYANo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Module 1-1Document6 pagesModule 1-1shejal naikNo ratings yet

- Potential Business PlanDocument3 pagesPotential Business Planshejal naikNo ratings yet

- Module1 PDFDocument45 pagesModule1 PDFshejal naikNo ratings yet

- Name: Mandar Naik Subject: Business Law Roll No.: 546 Semester: 5 Semester University No.: B1911449Document10 pagesName: Mandar Naik Subject: Business Law Roll No.: 546 Semester: 5 Semester University No.: B1911449shejal naikNo ratings yet

- Comparison of Mail, Telephone, Strategies For Household Health SurveysDocument8 pagesComparison of Mail, Telephone, Strategies For Household Health Surveysshejal naikNo ratings yet

- Business TaxationDocument4 pagesBusiness Taxationshejal naikNo ratings yet

- 37524E240 Reg. NoDocument7 pages37524E240 Reg. Noshejal naikNo ratings yet

- What Is MR?: What Are The Problems Faced by The Indian Researcher?Document6 pagesWhat Is MR?: What Are The Problems Faced by The Indian Researcher?shejal naikNo ratings yet

- Welcome To White Elephant Cottage Dandeli: Quick LinkDocument1 pageWelcome To White Elephant Cottage Dandeli: Quick Linkshejal naikNo ratings yet

- MR Notes 5 and 10 MarksDocument23 pagesMR Notes 5 and 10 Marksshejal naikNo ratings yet

- Estimation of Working CapitalDocument2 pagesEstimation of Working Capitalshejal naikNo ratings yet

- FAR - Earnings Per ShareDocument7 pagesFAR - Earnings Per ShareJohn Mahatma Agripa100% (2)

- 1.5 Common Probability DistributionDocument48 pages1.5 Common Probability DistributionMarioNo ratings yet

- Impact of Dividend Announcements On Stock Prices With Special Reference To Banking Companies in IndiaDocument8 pagesImpact of Dividend Announcements On Stock Prices With Special Reference To Banking Companies in IndiaThejo Jose100% (1)

- Letter From Madoff Victim Lawrence R. VelvelDocument3 pagesLetter From Madoff Victim Lawrence R. VelvelDealBook100% (24)

- Latest 2021 Heiken Ashi Intraday Strategy To Win BigDocument12 pagesLatest 2021 Heiken Ashi Intraday Strategy To Win Bigcliff BrooksNo ratings yet

- Adrian Et. Al. Federal Reserve CP Funding Facility NYFed 2011Document15 pagesAdrian Et. Al. Federal Reserve CP Funding Facility NYFed 2011Yichuan WangNo ratings yet

- ADR CasesDocument122 pagesADR Casesmae krisnalyn niezNo ratings yet

- Levine Smume7 Bonus Ch02Document2 pagesLevine Smume7 Bonus Ch02Kiran SoniNo ratings yet

- Finoptions Management Solutions: Assignment - 1Document2 pagesFinoptions Management Solutions: Assignment - 1Gaurav SomaniNo ratings yet

- Modigliani & Miller + WACCDocument39 pagesModigliani & Miller + WACCNaoman ChNo ratings yet

- ABnormal Returns With Momentum Contrarian Strategies Using ETFsDocument12 pagesABnormal Returns With Momentum Contrarian Strategies Using ETFsjohan-sNo ratings yet

- Guidance Note On Accounting For SecuritisationDocument11 pagesGuidance Note On Accounting For Securitisationapi-3828505No ratings yet

- A.I.G. Chief's Memo On U.S. Exit From InsurerDocument1 pageA.I.G. Chief's Memo On U.S. Exit From InsurerDealBookNo ratings yet

- FM-Lupin - Assignment-II Sridhar RaviDocument5 pagesFM-Lupin - Assignment-II Sridhar Ravisridhar mohantyNo ratings yet

- Sanjay Bakshi: Dear StudentsDocument2 pagesSanjay Bakshi: Dear StudentsBharat SahniNo ratings yet

- Ds Iron Condor StrategiaDocument43 pagesDs Iron Condor StrategiaFernando ColomerNo ratings yet

- Exit Offer Letter and Delisting Circular PDFDocument172 pagesExit Offer Letter and Delisting Circular PDFInvest StockNo ratings yet

- Presentation ON Commercial PapersDocument12 pagesPresentation ON Commercial PapersShweta NagpalNo ratings yet

- 03 Prudential Bank V PanisDocument2 pages03 Prudential Bank V PanisNatalia ArmadaNo ratings yet

- White PaperDocument43 pagesWhite Papercdsv1978No ratings yet

- Topic 13 Exotic OptionsDocument54 pagesTopic 13 Exotic OptionsBharat ReddyNo ratings yet

- Gift of Vehicle Form 0319fillDocument2 pagesGift of Vehicle Form 0319fillKarma Pema DorjeNo ratings yet

- ORI (Old Republic International Corporation) Statement of Changes in Beneficial Ownership of Securities (4) 2022-05-31Document2 pagesORI (Old Republic International Corporation) Statement of Changes in Beneficial Ownership of Securities (4) 2022-05-31Ki IphoneNo ratings yet

- The Effect of Tick Size On Volatility, Trader Behavior, and Market QualityDocument37 pagesThe Effect of Tick Size On Volatility, Trader Behavior, and Market QualityKovacs ImreNo ratings yet

- Solutions (Chapter14)Document7 pagesSolutions (Chapter14)Engr Fizza AkbarNo ratings yet

- Sec 93-102 Assurance FundDocument2 pagesSec 93-102 Assurance FundEi Ar TaradjiNo ratings yet

- Kumo TraderDocument3 pagesKumo Traderhenrykayode4No ratings yet

- Practice Set For AbmDocument104 pagesPractice Set For AbmDURGANo ratings yet

Internal Reconstruction

Internal Reconstruction

Uploaded by

shejal naik0 ratings0% found this document useful (0 votes)

16 views4 pagesThis document contains summaries of 5 different past exam questions on the topic of capital reduction from question papers between 2015-2019. Each summary provides the calculation of the capital reduction amount, journal entries to record the reduction, and allocation of the reduction amount to write off various asset accounts. The summaries range from 3 to 5 sentences and concisely outline the key details and accounting entries for the capital reduction transactions.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains summaries of 5 different past exam questions on the topic of capital reduction from question papers between 2015-2019. Each summary provides the calculation of the capital reduction amount, journal entries to record the reduction, and allocation of the reduction amount to write off various asset accounts. The summaries range from 3 to 5 sentences and concisely outline the key details and accounting entries for the capital reduction transactions.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

16 views4 pagesInternal Reconstruction

Internal Reconstruction

Uploaded by

shejal naikThis document contains summaries of 5 different past exam questions on the topic of capital reduction from question papers between 2015-2019. Each summary provides the calculation of the capital reduction amount, journal entries to record the reduction, and allocation of the reduction amount to write off various asset accounts. The summaries range from 3 to 5 sentences and concisely outline the key details and accounting entries for the capital reduction transactions.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 4

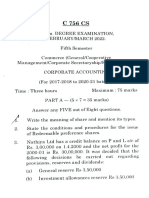

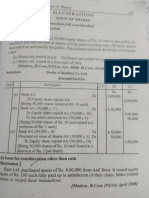

1.

From 2019 QP , Q No is 16 from section B, Appeared for 5 Marks

Solution:- Calculation of capital reduction

100000 equity shares of Rs 10 each fully paid reduced by Rs 7 Per share (7 *100000) = 700000

20000 share of Rs 100 each fully paid be reduced by Rs 20 per share (20*20000) = 400000

Total Amount available = 1100000

Journal Entries

Date Particulars LF Debit (Rs) Credit(Rs)

01 Equity Share capital A/c….. Dr (7 *100000) 700000

To Capital Reduction A/c ------ 700000

(Being Equity shares of Rs 10 each are reduced by

Rs 7 Per share)

02 Equity Share capital A/c…. Dr (20*20000) 400000

To Capital Reduction A/c 400000

(Being Equity shares of Rs 100 each are reduced

by Rs 20 Per share)

03 Capital Reduction A/c….. Dr 1100000

To Accumulated Loss A/c 460000

To Patents 640000

(Being amount of capital reduction is used to

write off accumulated loss and patents)

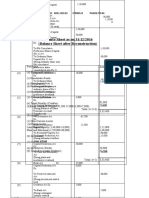

2. From 2018 QP, Q No is 14, from section B, for 5 Marks

Solution :- Calculation of capital reduction

10000 equity shares of Rs 10 each fully paid be reduced by Rs 7 per share(7*10000) =70000

2000 Preference shares of Rs 100 each fully paid be reduced by Rs 20 per share(20*2000)=40000

Total amount available =110000

Journal Entries

Date Particulars LF Debit (Rs) Credit(Rs)

01 Equity share capital A/c ….. Dr (7*10000) 70000

To Capital Reduction A/c 70000

(Being equity shares of Rs 10 each reduced by Rs

7 per share)

02 Preference share capital A/c…. Dr(20*2000) 40000

To Capital Reduction A/c 40000

(Being Preference shares of Rs 100 each reduced

by Rs 20 per share)

03 Capital Reduction A/c….. Dr 110000

To P&L A/c 45000

To Patents 65000

(Being amount of capital reduction is used to

write off P&L A/c(Loss) & Patents)

3. From 2017 Question Paper, Section B, Question No is 17 for 5 marks

Solution:- Calculation of capital reduction

40000 equity shares of Rs 10 each are reduced to Rs 5 each (5*40000) = 200000

20000 preference shares of Rs 10 each are reduced to Rs 4 each(6*20000) = 120000

Total Amount available = 320000

Journal entries in the books of swati Ltd

Date Particulars LF Debit (Rs) Credit(Rs)

01 Equity share capital A/c …. Dr(5*40000) 200000

To Capital reduction A/c 200000

(Being equity shares of Rs each are reduced to Rs 5

per share)

02 Preference share capital A/c…Dr (6*20000) 120000

To capital Reduction A/c 120000

(Being preference shares of Rs 10 each are reduced

to Rs 4 each)

03 Capital reduction A/c…. Dr 320000

To Losses A/c 130000

To Goodwill A/c 60000

To Patents A/c 80000

To Preliminary Expenses A/c 50000

(Being Amount of capital reduction is used to write

off the above fictitious assets)

Total 640000 640000

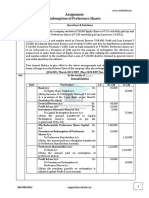

4. From 2016 Question Paper, Question No is 16, from section B, for 5 marks

Solution:- Calculation of capital reduction

20000 equity shares of Rs 10 each are reduced to Rs 5 per share(5*20000) = 100000

10000 Preference shares of Rs 10 each are reduced to Rs 6 per share(4*10000) = 40000

Total amount available for capital reduction 140000

Journal Entries

Date Particulars LF Debit(Rs) Credit(Rs)

01 Equity share capital A/c….. Dr (5*20000) 100000

To capital Reduction A/c 100000

(Being equity shares of Rs 10 each are reduced

to Rs 5 per share)

02 Preference share capital A/c …. Dr(4*10000) 40000

To Capital reduction A/c 40000

(Being Preference shares of Rs 10 Each are

reduced to Rs 6 per share)

03 Capital Reduction A/c ….. Dr 140000

To Accumulated Loss A/c 80000

To Goodwill A/c 30000

To Patents A/c 25000

To Preliminary Expenses A/c 5000

(Being Amount of capital reduction is used to

write off Above fictitious assets)

Total 280000 280000

5. From 2015 Question Paper, Q No is 17, from Section B, for 5 marks

Solution:- Calculation of capital reduction

100000 Equity shares of Rs 10 each are reduced by Rs 7 per share(7*100000) = 700000

20000 prefrence shares of Rs 100 each are reduced By Rs 20 per share(20*20000)= 400000

Total Amount Available =1100000

Journal Entries in the books of Bad Luck Co Ltd

Date Particulars LF Debit(Rs) Credit(Rs)

01 Equity Share capital A/c…. Dr(7*100000) 700000

Preference share Capital A/c Dr (20*20000) 400000

To capital reduction A/c 1100000

(Being equity shares of Rs 10 each are reduced

by Rs 7 per share and Preference shares of Rs

100 are reduced by Rs 20 per share)

02 Capital Reduction A/c…. Dr 1100000

To Accumulated loss A/c 360000

To Preliminary Expenses A/c 100000

To Patents A/c 640000

(Being Amount of capital reduction is used to

write off above fictitious assets)

You might also like

- Accountancy Assignment Grade 12Document4 pagesAccountancy Assignment Grade 12sharu SKNo ratings yet

- Answers For Problems On Financial Leverage - 1-4Document4 pagesAnswers For Problems On Financial Leverage - 1-4jeganrajraj80% (5)

- Chapter 5 MacroDocument26 pagesChapter 5 MacroKaren M.100% (8)

- The Hivemind Trading SystemDocument4 pagesThe Hivemind Trading SystemMaritimer88No ratings yet

- Suggested Answer CAP II December 2016Document88 pagesSuggested Answer CAP II December 2016Nirmal ShresthaNo ratings yet

- Presentation On Internal ReconstructionDocument23 pagesPresentation On Internal Reconstructionneeru79200040% (5)

- 5 Internal ReconstructionDocument31 pages5 Internal ReconstructionHariom PatidarNo ratings yet

- 12 Accountancy Accounting For Share Capital and Debenture Impq 1Document8 pages12 Accountancy Accounting For Share Capital and Debenture Impq 1Aejaz MohamedNo ratings yet

- 4 Internal ReconstructionDocument28 pages4 Internal Reconstructionss6555760No ratings yet

- Adv Acc - 3 CHDocument21 pagesAdv Acc - 3 CHhassan nassereddineNo ratings yet

- Pe2 Acc Nov05Document19 pagesPe2 Acc Nov05api-3825774No ratings yet

- Redemption of Preference SharesDocument13 pagesRedemption of Preference Sharessunil agarwalNo ratings yet

- Marking SchemeDocument6 pagesMarking Schemeraghu monnappaNo ratings yet

- Cor Acc Unit 01Document19 pagesCor Acc Unit 01vignesh iyerNo ratings yet

- Corporate Accounting Exam Questions PaperDocument7 pagesCorporate Accounting Exam Questions PaperAmmar Bin NasirNo ratings yet

- AdfDocument2 pagesAdfSalapataSalawowoBarrackNo ratings yet

- Balance Sheet As On 31/12/2016 (Balance Sheet After Reconstruction)Document8 pagesBalance Sheet As On 31/12/2016 (Balance Sheet After Reconstruction)GauravNo ratings yet

- Corporate AccountingDocument93 pagesCorporate AccountingKalp JainNo ratings yet

- Answer Key 2Document8 pagesAnswer Key 2Hari prakarsh NimiNo ratings yet

- 616806cf0cf2b988fbcdbd97 OriginalDocument20 pages616806cf0cf2b988fbcdbd97 OriginalTM GamingNo ratings yet

- AF210 Unit 4 Tutorial SolutionsDocument5 pagesAF210 Unit 4 Tutorial SolutionsChand DivneshNo ratings yet

- 47355bos37158iipc5mtp ADocument13 pages47355bos37158iipc5mtp AAnshuman RoutNo ratings yet

- Internal Reconstruction PQ SolDocument17 pagesInternal Reconstruction PQ SolKaran MokhaNo ratings yet

- Holding Company Class Note 1Document6 pagesHolding Company Class Note 1sahir112001No ratings yet

- 12 Accountancy Lyp 2017 Foreign Set3Document41 pages12 Accountancy Lyp 2017 Foreign Set3Ashish GangwalNo ratings yet

- BBS - 1st - Financial Accounting and AnalysisDocument46 pagesBBS - 1st - Financial Accounting and AnalysisJALDIMAINo ratings yet

- 6.XII Accountancy Marking SchemeDocument10 pages6.XII Accountancy Marking Schemecommerce12onlineclassesNo ratings yet

- Mid Term Examination November 2014 II Puc AccountancyDocument4 pagesMid Term Examination November 2014 II Puc AccountancyManju PNo ratings yet

- BBA-1.4-A.D.M Finance 2015 NewDocument3 pagesBBA-1.4-A.D.M Finance 2015 NewAnonymous NSNpGa3T93No ratings yet

- Accounts 2Document41 pagesAccounts 2SubodhSaxenaNo ratings yet

- RTP Dec 18 QNDocument21 pagesRTP Dec 18 QNbinu100% (1)

- Business Accounting-Ii BS-VDocument2 pagesBusiness Accounting-Ii BS-Vzahid khanNo ratings yet

- Additional Questions 9Document3 pagesAdditional Questions 910 368 Zakwan BaigNo ratings yet

- Work Sheet 3 & 4 Business FinanceDocument3 pagesWork Sheet 3 & 4 Business FinancePrateek YadavNo ratings yet

- Unit 3 Retirement of A Partner - Problems With AnswersDocument13 pagesUnit 3 Retirement of A Partner - Problems With Answersds1619231No ratings yet

- Additional Questions-8Document13 pagesAdditional Questions-8stynx784No ratings yet

- Answer Key 3Document8 pagesAnswer Key 3Hari prakarsh NimiNo ratings yet

- Management Accounting PAPERDocument7 pagesManagement Accounting PAPERtemailggNo ratings yet

- 1MS-CLASS XII ACC - Common Board-2022-23 (2) - 230329 - 142033Document21 pages1MS-CLASS XII ACC - Common Board-2022-23 (2) - 230329 - 142033jiya.mehra.2306No ratings yet

- Corporate Accounts - Entire - IIDocument347 pagesCorporate Accounts - Entire - IIManjunath R IligerNo ratings yet

- Ans. Chapter-9Document6 pagesAns. Chapter-9upscmindworksNo ratings yet

- Corporate AccountingDocument25 pagesCorporate Accountingrakshithaparimala100No ratings yet

- Chapter 9 Online Test AnswersDocument3 pagesChapter 9 Online Test AnswerstishaunafrayNo ratings yet

- Problems On Internal ReconstructionDocument7 pagesProblems On Internal Reconstructionlokeshwarareddy1999No ratings yet

- Corrporate ModelDocument10 pagesCorrporate Modelnithinjoseph562005No ratings yet

- Hsslive Xii Acc 3 Admission of A Partner KeyDocument8 pagesHsslive Xii Acc 3 Admission of A Partner KeyShinu ShinadNo ratings yet

- Ans. Chapter-8Document6 pagesAns. Chapter-8dhirendra.ksingh1980No ratings yet

- Instruction: Attempt Any 4 Questions. Each Question Carries Equal MarksDocument3 pagesInstruction: Attempt Any 4 Questions. Each Question Carries Equal MarksSaurav KumarNo ratings yet

- Finance&Accounts T3 SolutionDocument4 pagesFinance&Accounts T3 Solutionkanika thakurNo ratings yet

- Shares Issued at Premium & DiscountDocument13 pagesShares Issued at Premium & DiscountAwab HamidNo ratings yet

- Sample Paper-1 (Target Term - 2) Answers: Book Recommended - Ultimate Book of Accountancy Class 12Document8 pagesSample Paper-1 (Target Term - 2) Answers: Book Recommended - Ultimate Book of Accountancy Class 12Beena ShibuNo ratings yet

- Purchase Consideration - SolutionDocument16 pagesPurchase Consideration - Solutionsarthak mendirattaNo ratings yet

- Remidial Assignment B.tech - Bbs n'22Document9 pagesRemidial Assignment B.tech - Bbs n'22Ramagopal VemuriNo ratings yet

- Duyao - Yvonne - Antonette - M2ModuleAssignment-Data FilesDocument14 pagesDuyao - Yvonne - Antonette - M2ModuleAssignment-Data FilesYvonne DuyaoNo ratings yet

- SP Uni CA 2013Document3 pagesSP Uni CA 2013mahendrabpatelNo ratings yet

- Shares & Debentures TestDocument10 pagesShares & Debentures TestAthul Krishna KNo ratings yet

- Accounting For Bonus and Right Issue: Topic - 4Document12 pagesAccounting For Bonus and Right Issue: Topic - 4Naga ChandraNo ratings yet

- Accountancy Answer Key - II Puc Annual Exam March 2019Document8 pagesAccountancy Answer Key - II Puc Annual Exam March 2019Akash kNo ratings yet

- Sample Question Paper 2022 Marking SchemeDocument16 pagesSample Question Paper 2022 Marking SchemeTûshar ThakúrNo ratings yet

- C.S. Executive - Answers For CC Test Paper - IDocument7 pagesC.S. Executive - Answers For CC Test Paper - Isekhar_gantiNo ratings yet

- Marking Scheme Mock Test I 2023 24Document9 pagesMarking Scheme Mock Test I 2023 24HARSH CHAURASIYANo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Module 1-1Document6 pagesModule 1-1shejal naikNo ratings yet

- Potential Business PlanDocument3 pagesPotential Business Planshejal naikNo ratings yet

- Module1 PDFDocument45 pagesModule1 PDFshejal naikNo ratings yet

- Name: Mandar Naik Subject: Business Law Roll No.: 546 Semester: 5 Semester University No.: B1911449Document10 pagesName: Mandar Naik Subject: Business Law Roll No.: 546 Semester: 5 Semester University No.: B1911449shejal naikNo ratings yet

- Comparison of Mail, Telephone, Strategies For Household Health SurveysDocument8 pagesComparison of Mail, Telephone, Strategies For Household Health Surveysshejal naikNo ratings yet

- Business TaxationDocument4 pagesBusiness Taxationshejal naikNo ratings yet

- 37524E240 Reg. NoDocument7 pages37524E240 Reg. Noshejal naikNo ratings yet

- What Is MR?: What Are The Problems Faced by The Indian Researcher?Document6 pagesWhat Is MR?: What Are The Problems Faced by The Indian Researcher?shejal naikNo ratings yet

- Welcome To White Elephant Cottage Dandeli: Quick LinkDocument1 pageWelcome To White Elephant Cottage Dandeli: Quick Linkshejal naikNo ratings yet

- MR Notes 5 and 10 MarksDocument23 pagesMR Notes 5 and 10 Marksshejal naikNo ratings yet

- Estimation of Working CapitalDocument2 pagesEstimation of Working Capitalshejal naikNo ratings yet

- FAR - Earnings Per ShareDocument7 pagesFAR - Earnings Per ShareJohn Mahatma Agripa100% (2)

- 1.5 Common Probability DistributionDocument48 pages1.5 Common Probability DistributionMarioNo ratings yet

- Impact of Dividend Announcements On Stock Prices With Special Reference To Banking Companies in IndiaDocument8 pagesImpact of Dividend Announcements On Stock Prices With Special Reference To Banking Companies in IndiaThejo Jose100% (1)

- Letter From Madoff Victim Lawrence R. VelvelDocument3 pagesLetter From Madoff Victim Lawrence R. VelvelDealBook100% (24)

- Latest 2021 Heiken Ashi Intraday Strategy To Win BigDocument12 pagesLatest 2021 Heiken Ashi Intraday Strategy To Win Bigcliff BrooksNo ratings yet

- Adrian Et. Al. Federal Reserve CP Funding Facility NYFed 2011Document15 pagesAdrian Et. Al. Federal Reserve CP Funding Facility NYFed 2011Yichuan WangNo ratings yet

- ADR CasesDocument122 pagesADR Casesmae krisnalyn niezNo ratings yet

- Levine Smume7 Bonus Ch02Document2 pagesLevine Smume7 Bonus Ch02Kiran SoniNo ratings yet

- Finoptions Management Solutions: Assignment - 1Document2 pagesFinoptions Management Solutions: Assignment - 1Gaurav SomaniNo ratings yet

- Modigliani & Miller + WACCDocument39 pagesModigliani & Miller + WACCNaoman ChNo ratings yet

- ABnormal Returns With Momentum Contrarian Strategies Using ETFsDocument12 pagesABnormal Returns With Momentum Contrarian Strategies Using ETFsjohan-sNo ratings yet

- Guidance Note On Accounting For SecuritisationDocument11 pagesGuidance Note On Accounting For Securitisationapi-3828505No ratings yet

- A.I.G. Chief's Memo On U.S. Exit From InsurerDocument1 pageA.I.G. Chief's Memo On U.S. Exit From InsurerDealBookNo ratings yet

- FM-Lupin - Assignment-II Sridhar RaviDocument5 pagesFM-Lupin - Assignment-II Sridhar Ravisridhar mohantyNo ratings yet

- Sanjay Bakshi: Dear StudentsDocument2 pagesSanjay Bakshi: Dear StudentsBharat SahniNo ratings yet

- Ds Iron Condor StrategiaDocument43 pagesDs Iron Condor StrategiaFernando ColomerNo ratings yet

- Exit Offer Letter and Delisting Circular PDFDocument172 pagesExit Offer Letter and Delisting Circular PDFInvest StockNo ratings yet

- Presentation ON Commercial PapersDocument12 pagesPresentation ON Commercial PapersShweta NagpalNo ratings yet

- 03 Prudential Bank V PanisDocument2 pages03 Prudential Bank V PanisNatalia ArmadaNo ratings yet

- White PaperDocument43 pagesWhite Papercdsv1978No ratings yet

- Topic 13 Exotic OptionsDocument54 pagesTopic 13 Exotic OptionsBharat ReddyNo ratings yet

- Gift of Vehicle Form 0319fillDocument2 pagesGift of Vehicle Form 0319fillKarma Pema DorjeNo ratings yet

- ORI (Old Republic International Corporation) Statement of Changes in Beneficial Ownership of Securities (4) 2022-05-31Document2 pagesORI (Old Republic International Corporation) Statement of Changes in Beneficial Ownership of Securities (4) 2022-05-31Ki IphoneNo ratings yet

- The Effect of Tick Size On Volatility, Trader Behavior, and Market QualityDocument37 pagesThe Effect of Tick Size On Volatility, Trader Behavior, and Market QualityKovacs ImreNo ratings yet

- Solutions (Chapter14)Document7 pagesSolutions (Chapter14)Engr Fizza AkbarNo ratings yet

- Sec 93-102 Assurance FundDocument2 pagesSec 93-102 Assurance FundEi Ar TaradjiNo ratings yet

- Kumo TraderDocument3 pagesKumo Traderhenrykayode4No ratings yet

- Practice Set For AbmDocument104 pagesPractice Set For AbmDURGANo ratings yet