Professional Documents

Culture Documents

Sony Export

Sony Export

Uploaded by

nikimeeraCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sony Export

Sony Export

Uploaded by

nikimeeraCopyright:

Available Formats

Who can export

1. Proprietorship

2. Partnership firm

3. Government undertaking

4. Public limited company

5. Section 25 Company

6. Registered society

7. HUF h. LLP

8. Private Limited Company j. Trust

What is the procedure for registration?

The organization will require a PAN card issued by the income tax department. An application for the

Importer Exporter Code Number is to be made to the regional office of Director General Foreign Trade. Your

jurisdictional office will be based on your address. With effect from 01.04.2016, this application for IEC is to

be made online. You will be issued 10 digits IEC if your application is in order. You also will be issued 15 digits

Alphanumeric Business Identification Number along with IEC. This BIN is based on a PAN Card number. You

will also be required to obtained EDI registration with the port, prior to the first export or the first import. To

avail export incentives and also for general guidance, registration with EPC/FIEO will be necessary.

What are the Documents required?

By DGFT's Notification dated 12-3-2015

1. Bill of Lading/ Airway Bill/ Ocean Bill

2. Commercial Invoice cum Packing List

3. Shipping Bill/ Bill of Export

By World Bank:- World Bank's 2015 Report listed 7 documents for export

1. Shipping Bill

2. Commercial Invoice

3. Packing List

4. Bill of Lading

5. Foreign Exchange Control Form (SDF)

6. Terminal Handling Receipt

7. Technical Standard Certificate: BIS/ISI

Other Statuary Document

1. Mates Receipt

2. Certificate of origin

3. Goods/ Cargo Insurance Certificate

4. Fumigation Certificate

5.

Consolidate Documents: Auxillary/Principle

Pre – Shipment Export Documents

Commercial Documents Regulatory Documents

Principal Auxiliary

Commercial Invoice Performa Invoice Exchange Control Declaration –

(incl. the one GR forms.

prescribed by the Shipping Instructions

host country) Shipping bill/Bill of Export

Intimation for inspection

Packing List. Port Trust copy of Shipping

Letter to Bank for bill/Export Application/Dock

Certificate of Origin. collection of payment Challan

from Buyer.

Certificate of Post Charges receipt

Inspection. Insurance declaration

Insurance Premium Payment

Shipping Order Certificate

Bill of Lading / Air

Way Bill / Combined Mate’s receipt

ARE I / ARE II Forms

Transport Document.

Application for the Vehicle Ticket

Bill of Exchange. Certificate of Origin

Freight payment Certificate

Shipment Advice.

Certificate of

Insurance (incl.

policy).

(Source: Adopted from ‘Standardized Pre-Shipment Export Documentation’, Export Facilitation Committee of

India, Ministry of Commerce, Govt. of India, 1990).

Post – Shipment Export Documents

Shipment advice docs Negotiation Docs (as Incentive claim

per L/C terms)

Shipment advice Commercial Invoice For Excise rebate:

Non-negotiable copy of Bill of Exchange (first Duplicate certified copy of ARE-1

Bill of Lading and Second of Original and ARE-2

Commercial Invoice. GR Form (in duplicate) Non-negotiable copy of bill of

lading or shipping bill.

Packing List. Full set of ‘clean on

board bill of lading’ (all For duty Drawback:

negotiable and non

Drawback claim Performa

negotiable as required)

Certified copy of commercial

Export Order/contract

invoice

copy

Non – negotiable copy of Bill of

Packing list

Lading.

Insurance policy (two

copies)

Consular and Customs

invoice

Bank certificate (as

prescribed)

L/C (Original)

Sample Of Certificate Attached Below

What are the differences between Incoterms® 2010 and Incoterms® 2020?

The main explanations of Incoterms® 2020 have remained the same, with a few key updates and changes. The main

change includes a new DPU term replacing DAT, along with other changes to Incoterms® as below. It’s imperative

that all parties involved in global trade understand these updates and how they may affect your supply chain.

Band new Incoterm® DPU Replaces DAT

The previous Incoterm® DAT (Delivered at Terminal) is now called DPU (Delivered at Place Unloaded. It was decided

to change the term to DPU to remove confusion that arose in the past. In the past, DAT required ‘Delivery at

Terminal (unloaded)’, however the word “terminal” caused confusion. The new term DPU (Delivery at Place

Unloaded) covers ‘any place, whether covered or not’.

Different level of insurance cover between CIF and CIP

CIF and CIP are the only two Incoterms® that require the seller to purchase insurance in the buyer’s name. Under

Incoterms® 2010 the insurance cover for both CIF and CIP was required under Institute Cargo Clause C. Under the

new Incoterms® 2020, CIP requires insurance cover complying with Institute Cargo Clause A. Clause A covers a more

comprehensive level of insurance which is usually suitable for manufactured goods, where Clause C would likely

apply to commodities.

Summary:

CIF remains the same, it requires ‘Institute Cargo Clause C’ insurance cover – Number of listed risks, subject to

itemized exclusions.

CIP now requires an upgraded ‘Institute Cargo Clause A’ insurance cover – All risk, subject to itemized exclusions.

Updated Costs and Listings

Costs became quite a problem with Incoterms® 2010 with some parties. In some cases carriers were changing their

pricing so sellers were often faced with new back charged terminal handling charges. Incoterms® 2020 now provides

much more detail around costs and now appear under the A9/B9 sections of the rule. This clearly states which costs

are allocated to each party.

Increased Security Requirements, Allocations and Costs

In a world with increasing security requirements, the Incoterms® 2020 rules now provide more detail around security

allocations and necessary costs. For each Incoterm® rule, the security allocations have been added to A4/A7 and the

associated costs have been added to A9/B9.

Buyer’s and Seller’s Own Transport

Under Incoterms® 2010 it was assumed that all transport would be undertaken by a third party transport provider.

Updates to Incoterms® 2020 allows for the provision for the buyer or seller’s own means of transport. This

recognizes that some buyers and sellers are using their own methods of transport, including trucks or planes to get

goods delivered.

This allows for the buyer’s own means of transport under the FCA rule

This allows for the seller’s own means of transport under DAP, DPU and DDP.

FCA, FOB and the Bill of Lading Process

Updates were made to the previous Incoterms® 2010 to encourage exporters of containerized goods to use the FCA

Incoterm®. In reality most parties were still using FOB when they should have been using FCA. This is because even

experienced sellers still wanted to use FOB because they wanted the contract to be under a Letter of Credit.

Therefore provisions have been made to the Incoterms® 2020 to state that the buyer must instruct the carrier to

issue a transport document stating that the goods have been loaded – i.e a Bill of Lading with an ‘on board’ notation.

In the past carriers have frequently refused to issue a Bill of Lading with a notation to the seller if they have received

the goods from an intermediary transport (such as a truck), instead of directly from the seller.

How to put Incoterms® 2020 into Practice on Exports Contracts?

The new Incoterms® 2020 have come into effect on the ‘effective’ date of the 1st January 2020. What does that

actually mean for your business? Trading partners can still carry on using Incoterms® 2010 if they prefer to, which

may occur when it is being used to confirm complex commercial agreements.

All parties must make it clear in contracts which Incoterms® version is being referred to in order to avoid any

misunderstanding. Different trading partners will incorporate Incoterms® into contracts at different times.

It is imperative that you check existing contracts to ensure that the Incoterms® edition year is included. If there is no

year stated then the following will apply:

Up to 31st December 2019 – Incoterms® 2010

From 1st January 2020 – Incoterms® 2020

If a different year is stated, for example Incoterms® 1990, then the respective terms will apply

The below is the structure that should be used on Sales Contracts:

[Incoterm® rule] [Named port/place/point] Incoterms® 2020

Examples:

CIF Mumbai Incoterms® 2020

DPU 1A0111, Vaibhav Khand, Indirapuram, Ghaziabad Incoterms® 2020

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Bridgestone PresentationDocument21 pagesBridgestone PresentationTeju Gavankar100% (1)

- Export Practice and ManagementDocument470 pagesExport Practice and ManagementrdrscribdNo ratings yet

- Top 45 Logistics SCM Interview Questions AnswersDocument11 pagesTop 45 Logistics SCM Interview Questions AnswersAnonymous eILCSdHqJNo ratings yet

- Case Study No18Document4 pagesCase Study No18nick5990% (1)

- Certificado FORM-A PDFDocument2 pagesCertificado FORM-A PDFAnonymous xtfIrUNo ratings yet

- Requirement Gathering QuestionnaireDocument7 pagesRequirement Gathering Questionnairesanthosh kumarNo ratings yet

- Kotler Pom15 Im 12Document28 pagesKotler Pom15 Im 12Muhammad Umair100% (1)

- Case Study Ucp600Document1 pageCase Study Ucp600Sayed Fazal AbbasNo ratings yet

- Intel Lund 120502Document30 pagesIntel Lund 120502RizkiNo ratings yet

- Malaysian OriginDocument3 pagesMalaysian OriginEverest Lim Yong KeanNo ratings yet

- Customer'S Consignment AgreementDocument2 pagesCustomer'S Consignment AgreementNonny Atika NonnyNo ratings yet

- WEBERP Features DocumentDocument8 pagesWEBERP Features Documentsagarcn_698No ratings yet

- Bombas Triplex Now 1 Year Oper. Spares Rev-IDocument2 pagesBombas Triplex Now 1 Year Oper. Spares Rev-IAlfonso Alberto ArguelloNo ratings yet

- Wildeck CapabilitiesDocument24 pagesWildeck CapabilitiesMubashar SharifNo ratings yet

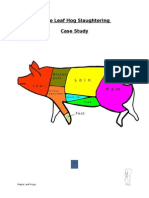

- Maple Leaf Case StudyDocument20 pagesMaple Leaf Case StudyshaneNo ratings yet

- Bectochem Consultants & Engineers Pvt. LTD.: Junction Box FLP/ Weather Proof 240 Length 155 Width 100 HeightDocument1 pageBectochem Consultants & Engineers Pvt. LTD.: Junction Box FLP/ Weather Proof 240 Length 155 Width 100 HeightBhavin VoraNo ratings yet

- Industry Profile of Courier IndustryDocument9 pagesIndustry Profile of Courier IndustryTharique Anwar100% (3)

- Marine Propulsion English Status January 2011Document20 pagesMarine Propulsion English Status January 2011Jodiel CoelhoNo ratings yet

- ExamplesDocument5 pagesExamplesY.AmNo ratings yet

- Artificial Intelligence in Global SalesDocument22 pagesArtificial Intelligence in Global SalesAnonymous JeFBOn35No ratings yet

- SPI Company Presentation November 2014 101114Document38 pagesSPI Company Presentation November 2014 101114Ahmad Yani S NoorNo ratings yet

- SUBJECT: Accounting 13 NC Descriptive Title: Auditing and Assurance Concepts and Applications 1Document5 pagesSUBJECT: Accounting 13 NC Descriptive Title: Auditing and Assurance Concepts and Applications 1Prince CalicaNo ratings yet

- Qatar Airways: Presented by Adarsh A R Akhil A Amal TomDocument13 pagesQatar Airways: Presented by Adarsh A R Akhil A Amal TomAkhilesh Krishnan100% (1)

- Ge 10HPDocument3 pagesGe 10HPPromocion de Ingenieria Metalurgica 2015-INo ratings yet

- IncotermsDocument4 pagesIncotermsCamille Angelie SoribelloNo ratings yet

- Conociendo El BL - CSFEDocument4 pagesConociendo El BL - CSFEStephania EscuderoNo ratings yet

- SIMP Model Catch Certificates PDFDocument9 pagesSIMP Model Catch Certificates PDFElvita RizkyNo ratings yet

- Asn SampleDocument7 pagesAsn SampleSaurabhDubeyNo ratings yet

- Updated Quality PlanDocument23 pagesUpdated Quality PlanThi PhamNo ratings yet

- Ignou Mco 5Document20 pagesIgnou Mco 5Manali TakkarNo ratings yet