Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

7 viewsSBU

SBU

Uploaded by

Ánh NguyệtThis document analyzes an FPT company's business units (SBUs) using the Boston Matrix. It identifies 5 SBUs (A-E), assessing their market growth, revenue, competitors. It then sorts the SBUs into the Boston Matrix categories: Stars (A, E), Question Mark (B), Cash Cow (C), Dog (D). For each category, it outlines strategic solutions - actively investing in Stars, selectively investing in Question Marks, limiting investment but exploiting Cash Cows, and withdrawing or converting Dogs.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Roboshot Brochure enDocument19 pagesRoboshot Brochure envantuan17792No ratings yet

- 6.013 Electromagnetics and Applications: Mit OpencoursewareDocument13 pages6.013 Electromagnetics and Applications: Mit Opencoursewaresweetu_adit_eeNo ratings yet

- HHT FFT DifferencesDocument8 pagesHHT FFT Differencesbubo28No ratings yet

- 3492 0022 01 - LDocument16 pages3492 0022 01 - LJoe SmithNo ratings yet

- 2100-In040 - En-P HANDLING INSTRUCTIONSDocument12 pages2100-In040 - En-P HANDLING INSTRUCTIONSJosue Emmanuel Rodriguez SanchezNo ratings yet

- MCN Q&A With RationaleDocument62 pagesMCN Q&A With RationaleBooger777No ratings yet

- P e - First-Quarter-Exams 1st-SemDocument7 pagesP e - First-Quarter-Exams 1st-SemJieann BalicocoNo ratings yet

- Fin Irjmets1644296746Document4 pagesFin Irjmets1644296746ATHIRA V RNo ratings yet

- Cleaning, Sortation and GradingDocument33 pagesCleaning, Sortation and GradingRaisa100% (1)

- Jack ContentsDocument45 pagesJack ContentsVenkata DineshNo ratings yet

- Reflex Control of The Spine and Posture - A Review of The Literature From A Chiropractic PerspectiveDocument18 pagesReflex Control of The Spine and Posture - A Review of The Literature From A Chiropractic PerspectiveWeeHoe LimNo ratings yet

- 0 1 NO. Ga. of Vibrating Screen Bs 5' X 12' TD 53-270610-5XX 7Document4 pages0 1 NO. Ga. of Vibrating Screen Bs 5' X 12' TD 53-270610-5XX 7Benjamin MurphyNo ratings yet

- What Should Be The Value of Earthing Resistance For Minor SubstationsDocument22 pagesWhat Should Be The Value of Earthing Resistance For Minor SubstationsNirmal Raja100% (1)

- Viscosity-1 Viscometer-2 Relation Between Viscosity &temperature-3 Vogel Equation-4 Programming ofDocument71 pagesViscosity-1 Viscometer-2 Relation Between Viscosity &temperature-3 Vogel Equation-4 Programming ofDr_M_SolimanNo ratings yet

- Sol 4Document14 pagesSol 4spitcyclops0% (2)

- Question Bank-Unit 2: MATH 2300Document8 pagesQuestion Bank-Unit 2: MATH 2300ROHAN TRIVEDI 20SCSE1180013No ratings yet

- AutomobileDocument98 pagesAutomobilesrp188No ratings yet

- The Total Test Time Is 1 Hour. Please Beqin by Writinq Your Name BelowDocument13 pagesThe Total Test Time Is 1 Hour. Please Beqin by Writinq Your Name BelowSaci Louis NaniNo ratings yet

- Figure 1: Schematic Diagram of A Tray Dryer. (Geankoplis, 2003)Document2 pagesFigure 1: Schematic Diagram of A Tray Dryer. (Geankoplis, 2003)Nesha Arasu0% (1)

- PHD ThesisDocument232 pagesPHD Thesiskafle_yrs100% (1)

- Reliable and Cost-Effective Sump Pumping With Sulzer's EjectorDocument2 pagesReliable and Cost-Effective Sump Pumping With Sulzer's EjectorDavid Bottassi PariserNo ratings yet

- Ubd Template 2 0 Shortened VersionDocument6 pagesUbd Template 2 0 Shortened Versionapi-261286206No ratings yet

- Interpreting Fits and Tolerances:: - by William B MoringDocument14 pagesInterpreting Fits and Tolerances:: - by William B Moringwillmors31No ratings yet

- Component Replacement - 010Document11 pagesComponent Replacement - 010artemio hernandez gallegosNo ratings yet

- Production of Ceramic Foam Filters For Molten MetaDocument5 pagesProduction of Ceramic Foam Filters For Molten MetaVBCRC LABNo ratings yet

- Winchester Model 70 Bolt Action Rifle Owner's Manual: LicenseeDocument0 pagesWinchester Model 70 Bolt Action Rifle Owner's Manual: Licenseecarlosfanjul1No ratings yet

- Histochemistry ReportDocument7 pagesHistochemistry ReportThanashree ThanuNo ratings yet

- Is 9259 1979 PDFDocument15 pagesIs 9259 1979 PDFsagarNo ratings yet

- Lab Report 4.Document7 pagesLab Report 4.Usman Ali Usman AliNo ratings yet

- Automatic Tank Dewatering 1Document4 pagesAutomatic Tank Dewatering 1JADNo ratings yet

SBU

SBU

Uploaded by

Ánh Nguyệt0 ratings0% found this document useful (0 votes)

7 views3 pagesThis document analyzes an FPT company's business units (SBUs) using the Boston Matrix. It identifies 5 SBUs (A-E), assessing their market growth, revenue, competitors. It then sorts the SBUs into the Boston Matrix categories: Stars (A, E), Question Mark (B), Cash Cow (C), Dog (D). For each category, it outlines strategic solutions - actively investing in Stars, selectively investing in Question Marks, limiting investment but exploiting Cash Cows, and withdrawing or converting Dogs.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document analyzes an FPT company's business units (SBUs) using the Boston Matrix. It identifies 5 SBUs (A-E), assessing their market growth, revenue, competitors. It then sorts the SBUs into the Boston Matrix categories: Stars (A, E), Question Mark (B), Cash Cow (C), Dog (D). For each category, it outlines strategic solutions - actively investing in Stars, selectively investing in Question Marks, limiting investment but exploiting Cash Cows, and withdrawing or converting Dogs.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

7 views3 pagesSBU

SBU

Uploaded by

Ánh NguyệtThis document analyzes an FPT company's business units (SBUs) using the Boston Matrix. It identifies 5 SBUs (A-E), assessing their market growth, revenue, competitors. It then sorts the SBUs into the Boston Matrix categories: Stars (A, E), Question Mark (B), Cash Cow (C), Dog (D). For each category, it outlines strategic solutions - actively investing in Stars, selectively investing in Question Marks, limiting investment but exploiting Cash Cows, and withdrawing or converting Dogs.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 3

FPT COMPANY

1. SBU analysis in the Boston matrix

Based on the analysis of the market development level and relative market share. We

can compare each SBU with other SBUs by analyzing the BCG matrix of each SBU

in the BCG matrix. The Boston Matrix is divided into four subgroups:

Stars

This is considered the best portfolio or SBU for businesses. In this SBU, star products

have good growth and high market share, so they generate a lot of profit for

businesses. Products in this section are usually exclusive products or newly launched

products, which are loved and appreciated by customers. However, a product with a

high growth rate also means that it requires a large amount of capital investment. In

case, the star is well invested and developed, in the future even if the growth rate

decreases, it will also become a dairy cow, that is, even though the growth rate is low,

it still captures a high share in the market. . Therefore, the advice for businesses is to

invest more in the products of this star group.

Question mark

Question mark SBU refers to products with a high growth rate but low market share

in the market. Products in this group require a large amount of capital investment but

yield little profit. That's why people named these products as question mark SBU.

Because it can grow into stars but can also be turned into dogs depending on the

market as well as the business plan of the business. Therefore, business leaders need

to consider carefully to come up with a reasonable business strategy for the products

of this group.

Cash cows

Dairy cows are SBUs representing a group of products with low market growth but

high market share. Products in this group will help businesses earn relatively stable

profits. On the other hand, dairy products provide profits that help the company turn

the question mark SBU into the market.

Therefore, companies should invest heavily in dairy SBU to maintain current

productivity and revenue levels as well as generate passive profit for the company in

the future.

Dogs

The dog refers to products that have a low growth rate and market. For products in

this group, it is not necessary for businesses to invest resources because it will not

earn the profits or market share that the company wants.

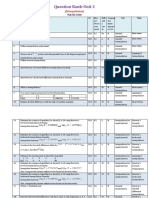

2. Define a portfolio of SBUs and assess their future prospects

Market

SBU Product Number of opponents Revenue

growth

A Telecommunication 3 3000 27%

B Digital content 5 1800 59%

C System integration 4 4024 22%

D Production and distribution 7 17680 13%

of IT products into

telecommunications

E Education 9 540 36%

3. Sort the SBUs into the BCG matrix

Starts Question Marks

AE B

Cash Cows Dogs

C D

4. Define a strategy for each SBU

Stars: SBUs A and E.

- These SBUs have a high growth rate and a relatively high growth market share,

which is common among SBUs that are in a strong growth phase. These products

are starting to enter the growth phase, developing with competitive advantages and

opportunities for growth, the potential for profit and long-term growth, and the

ability to bring the greatest profit for the business.

- Strategic solution:

+ Actively invest and grow to strengthen the leading position of the product line

+ Invest in perfecting product structure, installing new production lines, and

penetrating deeply into the market.

Question marks: SBU B

- SBU B in this box are usually newly established in an industry with high growth

(59%) and relatively low market share, but they have high growth potential, if

invested in the right direction If the market accepts it, the SBU in this box will

move to the start box and vice versa if the market doesn't accept it, it will move to

the dead spot.

- Strategic solutions: The company must invest in the right direction and invest

selectively and promote customers to know about the company's products.

Cash Cows: SBU C

- Has a low growth rate and a relatively high market share. There is a position but

the growth potential starts to slow down. This product is in the saturation stage

(ripe) profits decrease, and sales decrease.

- Strategic solution:

+ Enterprises should limit investment but focus on exploiting and actively recovering

profits.

+ Carry out promotional activities, promotions, and discounts.

Dogs: SBU D

- Has a relatively low market share and low market growth rate, is unlikely to be

profitable, the product is entering a recession phase. SBUs are not capable of

growth, and development or are losing money. Once the products of this SBU

have great improvements in quality and design, these SBUs can switch to

questionable or star box but often have to invest large capital and face many

difficulties in transitioning to a recession.

- Strategic solution:

+ Actively recover investment capital.

+ Cut costs.

+ Find measures to convert or withdraw from the market.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Roboshot Brochure enDocument19 pagesRoboshot Brochure envantuan17792No ratings yet

- 6.013 Electromagnetics and Applications: Mit OpencoursewareDocument13 pages6.013 Electromagnetics and Applications: Mit Opencoursewaresweetu_adit_eeNo ratings yet

- HHT FFT DifferencesDocument8 pagesHHT FFT Differencesbubo28No ratings yet

- 3492 0022 01 - LDocument16 pages3492 0022 01 - LJoe SmithNo ratings yet

- 2100-In040 - En-P HANDLING INSTRUCTIONSDocument12 pages2100-In040 - En-P HANDLING INSTRUCTIONSJosue Emmanuel Rodriguez SanchezNo ratings yet

- MCN Q&A With RationaleDocument62 pagesMCN Q&A With RationaleBooger777No ratings yet

- P e - First-Quarter-Exams 1st-SemDocument7 pagesP e - First-Quarter-Exams 1st-SemJieann BalicocoNo ratings yet

- Fin Irjmets1644296746Document4 pagesFin Irjmets1644296746ATHIRA V RNo ratings yet

- Cleaning, Sortation and GradingDocument33 pagesCleaning, Sortation and GradingRaisa100% (1)

- Jack ContentsDocument45 pagesJack ContentsVenkata DineshNo ratings yet

- Reflex Control of The Spine and Posture - A Review of The Literature From A Chiropractic PerspectiveDocument18 pagesReflex Control of The Spine and Posture - A Review of The Literature From A Chiropractic PerspectiveWeeHoe LimNo ratings yet

- 0 1 NO. Ga. of Vibrating Screen Bs 5' X 12' TD 53-270610-5XX 7Document4 pages0 1 NO. Ga. of Vibrating Screen Bs 5' X 12' TD 53-270610-5XX 7Benjamin MurphyNo ratings yet

- What Should Be The Value of Earthing Resistance For Minor SubstationsDocument22 pagesWhat Should Be The Value of Earthing Resistance For Minor SubstationsNirmal Raja100% (1)

- Viscosity-1 Viscometer-2 Relation Between Viscosity &temperature-3 Vogel Equation-4 Programming ofDocument71 pagesViscosity-1 Viscometer-2 Relation Between Viscosity &temperature-3 Vogel Equation-4 Programming ofDr_M_SolimanNo ratings yet

- Sol 4Document14 pagesSol 4spitcyclops0% (2)

- Question Bank-Unit 2: MATH 2300Document8 pagesQuestion Bank-Unit 2: MATH 2300ROHAN TRIVEDI 20SCSE1180013No ratings yet

- AutomobileDocument98 pagesAutomobilesrp188No ratings yet

- The Total Test Time Is 1 Hour. Please Beqin by Writinq Your Name BelowDocument13 pagesThe Total Test Time Is 1 Hour. Please Beqin by Writinq Your Name BelowSaci Louis NaniNo ratings yet

- Figure 1: Schematic Diagram of A Tray Dryer. (Geankoplis, 2003)Document2 pagesFigure 1: Schematic Diagram of A Tray Dryer. (Geankoplis, 2003)Nesha Arasu0% (1)

- PHD ThesisDocument232 pagesPHD Thesiskafle_yrs100% (1)

- Reliable and Cost-Effective Sump Pumping With Sulzer's EjectorDocument2 pagesReliable and Cost-Effective Sump Pumping With Sulzer's EjectorDavid Bottassi PariserNo ratings yet

- Ubd Template 2 0 Shortened VersionDocument6 pagesUbd Template 2 0 Shortened Versionapi-261286206No ratings yet

- Interpreting Fits and Tolerances:: - by William B MoringDocument14 pagesInterpreting Fits and Tolerances:: - by William B Moringwillmors31No ratings yet

- Component Replacement - 010Document11 pagesComponent Replacement - 010artemio hernandez gallegosNo ratings yet

- Production of Ceramic Foam Filters For Molten MetaDocument5 pagesProduction of Ceramic Foam Filters For Molten MetaVBCRC LABNo ratings yet

- Winchester Model 70 Bolt Action Rifle Owner's Manual: LicenseeDocument0 pagesWinchester Model 70 Bolt Action Rifle Owner's Manual: Licenseecarlosfanjul1No ratings yet

- Histochemistry ReportDocument7 pagesHistochemistry ReportThanashree ThanuNo ratings yet

- Is 9259 1979 PDFDocument15 pagesIs 9259 1979 PDFsagarNo ratings yet

- Lab Report 4.Document7 pagesLab Report 4.Usman Ali Usman AliNo ratings yet

- Automatic Tank Dewatering 1Document4 pagesAutomatic Tank Dewatering 1JADNo ratings yet