Professional Documents

Culture Documents

Solution Practice 9 Business Combinations and Impairment

Solution Practice 9 Business Combinations and Impairment

Uploaded by

GuinevereCopyright:

Available Formats

You might also like

- Project in Government Accounting and Accounting FoDocument11 pagesProject in Government Accounting and Accounting FoRosy MoradosNo ratings yet

- IAS 36 Impairment of Assets Illustrative Examples PDFDocument17 pagesIAS 36 Impairment of Assets Illustrative Examples PDFMaey RoledaNo ratings yet

- Taxation Answer Sheet 2 PDFDocument37 pagesTaxation Answer Sheet 2 PDFGuinevere100% (1)

- Financial Statement Analysis Group Exercise: InstructionsDocument1 pageFinancial Statement Analysis Group Exercise: InstructionsMARY ACOSTANo ratings yet

- Practice 8: Business Combinations and Impairment Exercise 7.12 Impairment Loss For A CGU, Reversal of Impairment LossDocument7 pagesPractice 8: Business Combinations and Impairment Exercise 7.12 Impairment Loss For A CGU, Reversal of Impairment LossJingwen YangNo ratings yet

- Impairment of AssetDocument2 pagesImpairment of AssetQuỳnhNo ratings yet

- O Level Important Questions PDFDocument55 pagesO Level Important Questions PDFibraho100% (1)

- Topic 5 Tutorial Suggested SolutionsDocument3 pagesTopic 5 Tutorial Suggested Solutionsruksaarziya786No ratings yet

- MPACC512 Advanced Fin Reporting Answer Bank 2022Document44 pagesMPACC512 Advanced Fin Reporting Answer Bank 2022Tawanda Tatenda HerbertNo ratings yet

- 2018 - Exam 1 - Q1 - Sug SolDocument4 pages2018 - Exam 1 - Q1 - Sug SolmamitjasNo ratings yet

- ACC705 Corporate Accounting AssignmentDocument9 pagesACC705 Corporate Accounting AssignmentMuhammad AhsanNo ratings yet

- Q2 Lister LimitedDocument1 pageQ2 Lister Limitedamosmalusi5No ratings yet

- Accounting 1 2013Document3 pagesAccounting 1 2013Qasim IbrarNo ratings yet

- Assessed Coursework 2 - S2 2020 UpdateDocument7 pagesAssessed Coursework 2 - S2 2020 UpdateArmaghan Ali MalikNo ratings yet

- Cash Flow Statement ProblemDocument2 pagesCash Flow Statement Problemapi-3842194100% (2)

- Accounting GovernmentDocument21 pagesAccounting GovernmentJolianne SalvadoOfcNo ratings yet

- Question 2 FR April 2022 Question 2 CaputDocument6 pagesQuestion 2 FR April 2022 Question 2 CaputLaud ListowellNo ratings yet

- Pricilla AFAR Question PaperDocument2 pagesPricilla AFAR Question PaperjasonnumahnalkelNo ratings yet

- Facn311 Test 1 Solution 2019Document10 pagesFacn311 Test 1 Solution 20196lackzamokuhleNo ratings yet

- Financial Statement2 (Work Sheet)Document6 pagesFinancial Statement2 (Work Sheet)Arham RajpootNo ratings yet

- Daa 101 Introduction To Accounting Ii - RispahDocument4 pagesDaa 101 Introduction To Accounting Ii - RispahSpencerNo ratings yet

- QuestionDocument2 pagesQuestionKamoheloNo ratings yet

- Chapter 21 - QB - Q1 - SolutionDocument4 pagesChapter 21 - QB - Q1 - SolutionRichard SibekoNo ratings yet

- Company Accounting-IgcseDocument2 pagesCompany Accounting-IgcseGodfreyFrankMwakalingaNo ratings yet

- Partnership Accounting ChangesDocument3 pagesPartnership Accounting ChangesTariro NjanikeNo ratings yet

- FAC1601-oct2014 Suggested Sol eDocument7 pagesFAC1601-oct2014 Suggested Sol ePhelane FNo ratings yet

- Nkome TradersDocument2 pagesNkome Tradersrethaxaba82No ratings yet

- Q3 NNF LimitedDocument2 pagesQ3 NNF Limitedamosmalusi5No ratings yet

- Income TaxesDocument37 pagesIncome TaxesAngelaMariePeñarandaNo ratings yet

- HI5020 Tutorial Question Assignment T3 2020 FinalDocument7 pagesHI5020 Tutorial Question Assignment T3 2020 FinalAamirNo ratings yet

- Financial Statement Analysis - AssignmentDocument6 pagesFinancial Statement Analysis - AssignmentJennifer JosephNo ratings yet

- Retirment of PartnerDocument30 pagesRetirment of PartnerRoozbeh ElaviaNo ratings yet

- Q1 Here Is The Post-Adjustment Trial Balance of Status Cymbal LTD at 30 June 2019Document3 pagesQ1 Here Is The Post-Adjustment Trial Balance of Status Cymbal LTD at 30 June 2019kietNo ratings yet

- Statement of Cash FlowsDocument11 pagesStatement of Cash FlowsanjuNo ratings yet

- 14207Document6 pages14207genenegetachew64No ratings yet

- Accounting Worksheet 2 Answer SheetDocument31 pagesAccounting Worksheet 2 Answer Sheetzeldazitha87No ratings yet

- CRANBERRY PLC Scenario Chapter 12Document3 pagesCRANBERRY PLC Scenario Chapter 12Nguyễn Thanh Thanh HươngNo ratings yet

- Sem I Acc - NEP-UGCF 2022Document8 pagesSem I Acc - NEP-UGCF 2022Raj AbhishekNo ratings yet

- Tutorial QuestionsDocument2 pagesTutorial QuestionsNishika KaranNo ratings yet

- Midterm 5101Document4 pagesMidterm 5101MD Hafizul Islam HafizNo ratings yet

- ACCT10002 Tutorial 9 ExercisesDocument6 pagesACCT10002 Tutorial 9 ExercisesJING NIENo ratings yet

- Acc311 2021Document4 pagesAcc311 2021hoghidan1No ratings yet

- ACC 401-2023 GA 2-EvenDocument3 pagesACC 401-2023 GA 2-EvenOhene Asare PogastyNo ratings yet

- Acc.2023 Practical Exam Sample QN - PaperDocument5 pagesAcc.2023 Practical Exam Sample QN - PaperMidhun PerozhiNo ratings yet

- Solved StatamentsDocument16 pagesSolved StatamentsHaris AhnedNo ratings yet

- QUESTION 6 Financial Reporting May 2021 KOLIDocument6 pagesQUESTION 6 Financial Reporting May 2021 KOLILaud ListowellNo ratings yet

- Assets: Instruction: Write The Solution of The Problems Below (In Good Form)Document5 pagesAssets: Instruction: Write The Solution of The Problems Below (In Good Form)Christine CalimagNo ratings yet

- Capital Reorganization QuestionsDocument20 pagesCapital Reorganization QuestionsProf. OBESENo ratings yet

- Drafting Financial Statements: (International Stream)Document7 pagesDrafting Financial Statements: (International Stream)api-19836745No ratings yet

- Problem SolutionsDocument5 pagesProblem Solutionsmd nayonNo ratings yet

- 4 Tangible Fixed Assets: DR CR 000 000Document7 pages4 Tangible Fixed Assets: DR CR 000 000Fazal Rehman MandokhailNo ratings yet

- The Following List of Accounts For Company Y Ltd. Is Available at The End of 200XDocument2 pagesThe Following List of Accounts For Company Y Ltd. Is Available at The End of 200Xai0412No ratings yet

- Q7 Mguni LimitedDocument2 pagesQ7 Mguni Limitedamosmalusi5No ratings yet

- Mock ExamDocument4 pagesMock ExamAna-Maria GhNo ratings yet

- NOMSA NYANDOWE - ACC136 November 2020 Question PaperDocument8 pagesNOMSA NYANDOWE - ACC136 November 2020 Question Papernomsanyandowe371No ratings yet

- Llagas 01 Laboratory Exercise 1Document5 pagesLlagas 01 Laboratory Exercise 1Angela Fye LlagasNo ratings yet

- Financial Reporting and Analysis Final OSADocument9 pagesFinancial Reporting and Analysis Final OSATracy-lee JacobsNo ratings yet

- KZN 2020 June P1 Memo 2Document7 pagesKZN 2020 June P1 Memo 2shandren19No ratings yet

- What Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Document12 pagesWhat Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Nguyễn HoàngNo ratings yet

- Net Sales Cash Accounts Receivable Merchandise Inventory Preapid Expense Property, Palnt, and EquipmentDocument6 pagesNet Sales Cash Accounts Receivable Merchandise Inventory Preapid Expense Property, Palnt, and EquipmentMadina MamasalievaNo ratings yet

- Capital Asset Investment: Strategy, Tactics and ToolsFrom EverandCapital Asset Investment: Strategy, Tactics and ToolsRating: 1 out of 5 stars1/5 (1)

- D. Factory Overhead Costs Incurred Were Less Than Overhead Costs Charged To ProductionDocument4 pagesD. Factory Overhead Costs Incurred Were Less Than Overhead Costs Charged To ProductionGuinevereNo ratings yet

- Cash Sales Credit Sales: ACCT201B Practice Questions Chapter 8Document9 pagesCash Sales Credit Sales: ACCT201B Practice Questions Chapter 8GuinevereNo ratings yet

- DocxDocument20 pagesDocxGuinevereNo ratings yet

- Partnership Accounting Table of Contents: Partnership Formation, Operation & DissolutionDocument18 pagesPartnership Accounting Table of Contents: Partnership Formation, Operation & DissolutionGuinevereNo ratings yet

- 25781306Document19 pages25781306GuinevereNo ratings yet

- DocxDocument8 pagesDocxGuinevereNo ratings yet

- Questions Problems Pre BQTAP 2018 2019Document12 pagesQuestions Problems Pre BQTAP 2018 2019GuinevereNo ratings yet

- ACC3100 Fall 2017 Mid Term 1 Exam Practice Question From Test BankDocument100 pagesACC3100 Fall 2017 Mid Term 1 Exam Practice Question From Test BankGuinevereNo ratings yet

- Chapter 7Document18 pagesChapter 7Kogilavani Balakrishnan0% (1)

- Iac 11 Probs PDFDocument12 pagesIac 11 Probs PDFGuinevereNo ratings yet

- Cpa Review School of The Philippines Mani LaDocument2 pagesCpa Review School of The Philippines Mani LaGuinevereNo ratings yet

- Finacc Quiz 2 PDF FreeDocument11 pagesFinacc Quiz 2 PDF FreeGuinevereNo ratings yet

- Practical Accounting 2 Topic: Long-Term Construction Contracts C. GonzagaDocument10 pagesPractical Accounting 2 Topic: Long-Term Construction Contracts C. GonzagaGuinevereNo ratings yet

- Learning Objective 7-1: Chapter 7 Audit EvidenceDocument33 pagesLearning Objective 7-1: Chapter 7 Audit EvidenceGuinevereNo ratings yet

- Taxation of IndividualsDocument3 pagesTaxation of IndividualsGuinevereNo ratings yet

- PPTXDocument140 pagesPPTXGuinevereNo ratings yet

- Cost-Volume-Profit Analysis: Solutions To Chapter 8 QuestionsDocument15 pagesCost-Volume-Profit Analysis: Solutions To Chapter 8 QuestionsGuinevereNo ratings yet

- UNIT-4 - Income-From-BusinessDocument114 pagesUNIT-4 - Income-From-BusinessGuinevereNo ratings yet

- Module 6 TAXATION OF CORPORATIONS PDFDocument60 pagesModule 6 TAXATION OF CORPORATIONS PDFGuinevereNo ratings yet

- Break-Even Point and Cost-Volume-Profit Analysis: QuestionsDocument34 pagesBreak-Even Point and Cost-Volume-Profit Analysis: QuestionsGuinevereNo ratings yet

- Law QuestionsDocument14 pagesLaw QuestionsAlthea CagakitNo ratings yet

- Jurnal Analisis HBUDocument18 pagesJurnal Analisis HBUAprileo RidwanNo ratings yet

- SSRN-Influência Dos Credores No Governo SocietárioDocument79 pagesSSRN-Influência Dos Credores No Governo SocietáriobarbaramacaricoNo ratings yet

- From The Basel Iii Compliance Professionals Association (Biiicpa)Document4 pagesFrom The Basel Iii Compliance Professionals Association (Biiicpa)Vinay SonkhiyaNo ratings yet

- 12 x10 Financial Statement AnalysisDocument22 pages12 x10 Financial Statement AnalysisaizaNo ratings yet

- HANA230228RDocument7 pagesHANA230228RsozodaaaNo ratings yet

- The Scope For Islamic Banking in Maldives: Annex: 1 - Survey QuestionnaireDocument3 pagesThe Scope For Islamic Banking in Maldives: Annex: 1 - Survey QuestionnaireShirwaan MohamedNo ratings yet

- Assignment - 1-Financial Statement Analysis-Jnu-12th BatchDocument4 pagesAssignment - 1-Financial Statement Analysis-Jnu-12th BatchImran KhanNo ratings yet

- FABM 1 Lesson 7 The Accounting EquationDocument19 pagesFABM 1 Lesson 7 The Accounting EquationTiffany Ceniza100% (1)

- Chapter 8Document4 pagesChapter 8rakibulislammbstu01No ratings yet

- ALCOAnnual RPRT 2012 Consov 2Document100 pagesALCOAnnual RPRT 2012 Consov 2kristinamanalangNo ratings yet

- PartCorp. Exercise June 4Document4 pagesPartCorp. Exercise June 4ginalynNo ratings yet

- Rfbt102 CorpoDocument13 pagesRfbt102 CorpoNathalie GetinoNo ratings yet

- Kraft Heinz's Goodwill Charge Tops Consumer-Staples Record - WSJDocument6 pagesKraft Heinz's Goodwill Charge Tops Consumer-Staples Record - WSJUyen HoangNo ratings yet

- Chapter 1 AbcDocument24 pagesChapter 1 AbcChennie Mae Pionan SorianoNo ratings yet

- Valuation of Bonds and SharesDocument19 pagesValuation of Bonds and SharesSandeep GillNo ratings yet

- Terms Sheet SampleDocument4 pagesTerms Sheet SampleKamil JagieniakNo ratings yet

- Far660 - Special Feb 2020 QuestionDocument5 pagesFar660 - Special Feb 2020 QuestionHanis ZahiraNo ratings yet

- Cgapter 9Document7 pagesCgapter 9Rena Jocelle NalzaroNo ratings yet

- FN281 Financial Management QuestionsDocument10 pagesFN281 Financial Management QuestionsRashid JalalNo ratings yet

- Reading 22 Slides - Understanding Balance SheetsDocument41 pagesReading 22 Slides - Understanding Balance SheetstamannaakterNo ratings yet

- Valuation of SharesDocument11 pagesValuation of Shareslekha1997No ratings yet

- Excel Sheet For LedgerDocument6 pagesExcel Sheet For LedgergggNo ratings yet

- A Study of Corporate Governance Practices in India PDFDocument402 pagesA Study of Corporate Governance Practices in India PDFMohamed RilwanNo ratings yet

- General Banking UBLDocument61 pagesGeneral Banking UBLaslammalg100% (1)

- Corporate Social Responsibility: Learning OutcomesDocument25 pagesCorporate Social Responsibility: Learning OutcomesHitesh KarmurNo ratings yet

- Financial Statement Analysis: Project Report ON "Motherson Sumi Systems LTD"Document17 pagesFinancial Statement Analysis: Project Report ON "Motherson Sumi Systems LTD"writik sahaNo ratings yet

- Shareholders' Equity Problems (Gallery Company)Document19 pagesShareholders' Equity Problems (Gallery Company)Nikki San GabrielNo ratings yet

- Ümmüşnur Özcan - CartwrightlumberworksheetDocument7 pagesÜmmüşnur Özcan - CartwrightlumberworksheetUMMUSNUR OZCANNo ratings yet

Solution Practice 9 Business Combinations and Impairment

Solution Practice 9 Business Combinations and Impairment

Uploaded by

GuinevereOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Solution Practice 9 Business Combinations and Impairment

Solution Practice 9 Business Combinations and Impairment

Uploaded by

GuinevereCopyright:

Available Formats

lOMoARcPSD|6314851

Solution Practice 9 Business Combinations AND Impairment

Body Defences (University of Western Australia)

StuDocu is not sponsored or endorsed by any college or university

Downloaded by Glenda Albania (egalbania@gmail.com)

lOMoARcPSD|6314851

PRACTICE 9: BUSINESS COMBINATIONS AND IMPAIRMENT

Exercise 7.12

Impairment loss for a CGU, reversal of impairment loss

One of the CGUs of Cooper Ltd is associated with the manufacture of wine barrels. At

30 June 2019, Cooper Ltd believed, based on an analysis of economic indicators, that

the assets of the unit were impaired.

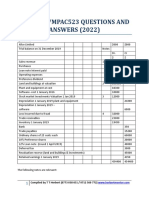

The carrying amounts of the assets and liabilities of the unit at 30 June 2019 were:

Buildings $ 420 000

Accumulated depreciation — buildings* (180 000)

Factory machinery 220 000

Accumulated depreciation — machinery** (40 000)

Goodwill 15 000

Inventories 80 000

Receivables 40 000

Allowance for doubtful debts (5 000)

Cash 20 000

Accounts payable 30 000

Loans 20 000

*Depreciated at $60 000 p.a.

**Depreciated at $45 000 p.a.

Cooper Ltd determined the recoverable amount of the unit to be $535 000. The

receivables were considered to be collectable, except those considered doubtful. The

company allocated the impairment loss in accordance with AASB 136/IAS 36.

During the 2019–20 period, Cooper Ltd increased the depreciation charge on buildings

to $65 000 p.a., and to $50 000 p.a. for factory machinery. The inventories on hand at 1

July 2019 were sold by the end of the year. At 30 June 2020, Cooper Ltd, because of a

return in the market to the use of traditional barrels for wines and an increase in wine

production, assessed the recoverable amount of the CGU to be $30 000 greater than the

carrying amount of the unit. As a result, Cooper Ltd recognised a reversal of the

impairment loss.

Required

1. Prepare the journal entries for Cooper Ltd at 30 June 2019 and 2020. (LO5 and

LO6)

2. What differences would arise in relation to the answer in requirement 1 if the

recoverable amount at 30 June 2020 was $20 000 greater than the carrying amount

of the unit? (LO5 and LO6)

3. If the recoverable amount of the buildings at 30 June 2020 was $175 000, how would

this change the answer to requirement 2? (LO5 and LO6)

Downloaded by Glenda Albania (egalbania@gmail.com)

lOMoARcPSD|6314851

COOPER LTD

1. Carrying amount of assets:

Buildings $240 000

Factory machinery 180 000

Goodwill 15 000

Inventory 80 000

Receivables 35 000

Cash 20 000

570 000

Value in use 535 000

Impairment loss $35 000

Goodwill is written down by $15 000, and the balance of the impairment loss, namely $20

000 is written off across the other relevant assets.

Carrying Proportion Allocation Net Carrying

Amount of Loss Amount

Buildings 240 000 24/42 11 429 228 571

Machinery 180 000 18/42 8 571 171 429

420 000 20 000

The journal entry for 2019 is:

DR Impairment loss 35 000

CR Goodwill 15 000

CR Accumulated depreciation and

impairment losses – buildings 11 429

CR Accumulated depreciation and

impairment losses – machinery 8 571

(Allocation of impairment loss)

At 30 June 2020, the two assets are reported as follows.

Buildings $420 000

Accumulated depreciation

and impairment losses 256 429 [180 000 + 11 429 + 65 000]

163 571

Factory machinery $220 000

Accumulated depreciation and

impairment losses 98 571 [40 000 + 8 571 + 50 000]

121 429

Downloaded by Glenda Albania (egalbania@gmail.com)

lOMoARcPSD|6314851

The carrying amounts of these assets if no impairment loss had occurred would have been:

Buildings $420 000

Accumulated depreciation

and impairment losses 240 000 [180 000 + 60 000]

180 000

Factory machinery $220 000

Accumulated depreciation and

impairment losses 85 000 [40 000 + 45 000]

135 000

The differences between the carrying amounts recorded at 30 June 2020 and the carrying

amounts if no impairment losses had been recorded are:

Buildings $16 429 [180 000 – 163 571]

Factory machinery $13 571 [135 000 – 121 429]

$30 000

As the recoverable amount at 30 June 2020 exceeds the carrying amount by $30 000, then the

total amount can be recognised.

DR Accumulated depreciation and

impairment losses – buildings 16 429

DR Accumulated depreciation and

impairment losses – factory machinery 13 571

CR Income: reversal of impairment loss 30 000

(Reversal of impairment loss)

2. If the excess of the recoverable amount over carrying amounts at 30 June 2020 was only

$20 000, then the reversal would be based on a pro rata allocation based on carrying amounts

at time of reversal.

Carrying Proportion Allocation Net Carrying

Amount of Excess Amount

Buildings 163 571 0.57 11 479 175 050

Machinery 121 429 0.43 8 521 129 950

285 000 20 000

The entry would be:

DR Accumulated depreciation and

impairment losses – buildings 11 479

DR Accumulated depreciation and

Impairment losses – factory machinery 8 521

CR Income: reversal of impairment loss 20 000

(Reversal of impairment loss)

Downloaded by Glenda Albania (egalbania@gmail.com)

lOMoARcPSD|6314851

3. If the recoverable amount of the buildings at 30 June 2020 was only $175 000, then the

reversal of the impairment for buildings could only be $11 429 (i.e. $175 000 less $163 571).

Hence the balance of $50 (i.e. $11 479 - $11 429) could be allocated to factory machinery.

The journal entry is:

DR Accumulated depreciation and

impairment losses – buildings 11 429

DR Accumulated depreciation and

impairment losses – factory machinery 8 571

CR Income: reversal of impairment loss 20 000

(Reversal of impairment loss)

The $8571 allocated to factory machinery still does not exceed the carrying amount if the

asset had never been impaired. The factory machinery will now be shown as:

Factory machinery $220 000

Accumulated depreciation and

impairment losses 90 000 [40 000 + 8571 +50 000 – 8571]

$130 000

Downloaded by Glenda Albania (egalbania@gmail.com)

lOMoARcPSD|6314851

Exercise 25.9

Accounting for a business combination by the acquirer

Doctor Ltd was finding difficulty in raising finance for expansion while Who Ltd was

interested in achieving economies by marketing a wider range of products. They entered

discussions on how they could mutually achieve added benefits to both companies. They

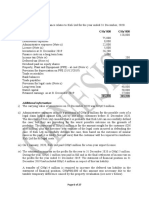

prepared the following financial positions of the companies at 30 June 2020.

It was agreed that it would be mutually advantageous for Doctor Ltd to specialise in

manufacturing, and for marketing, purchasing and promotion to be handled by Who

Ltd. Accordingly, Who Ltd sold part of its assets to Doctor Ltd on 1 July 2020, the

identifiable assets acquired having the following fair values.

The acquisition was satisfied by the issue of 40 000 ‘A’ ordinary shares (fully paid) in

Doctor Ltd.

Downloaded by Glenda Albania (egalbania@gmail.com)

lOMoARcPSD|6314851

Required

1. Assuming the assets acquired constitute a business, show the journal entries to

record the above transactions in the records of Doctor Ltd:

(a) if the fair value of the ‘A’ ordinary shares of Doctor Ltd was $2 per share

(b) if the fair value of the ‘A’ ordinary shares of Doctor Ltd was $2.20 per share.

2. Show the statement of financial position of Doctor Ltd after the transactions,

assuming the fair value of Doctor’s Ltd’s ‘A’ ordinary shares was $2.20 per share.

(LO6)

DOCTOR LTD – WHO LTD

1.

(a)

Assuming the fair value of “A” ordinary shares was $2 per share:

Acquisition analysis:

Net fair value of identifiable assets and

liabilities acquired $22 000 (inventory)

+ $34 000 (land and buildings)

+ $27 000 (plant and machinery)

= $83 000

Consideration transferred 40 000 shares x $2.00

= $80 000

Gain on bargain purchase = $3 000

Journal entries:

Inventories Dr 22 000

Land and buildings Dr 34 000

Plant and machinery Dr 27 000

Gain on bargain purchase Cr 3 000

Share capital “A” Ordinary Cr 80 000

(Assets acquired and shares issued)

(b)

Assuming the fair value of “A” ordinary shares was $2.20 per share:

Acquisition analysis:

Net fair value of identifiable assets

and liabilities acquired = $83 000

Consideration transferred = 40 000 shares x $2.20

= $88 000

Goodwill = $5 000

Downloaded by Glenda Albania (egalbania@gmail.com)

lOMoARcPSD|6314851

Journal entries:

Inventory Dr 22 000

Land and buildings Dr 34 000

Plant and machinery Dr 27 000

Goodwill Dr 5 000

Share capital “A” Ordinary Cr 88 000

(Assets acquired and shares issued)

DOCTOR LTD

Statement of Financial Position

as at 30 June 2020

$

Current Assets

Cash 12 000

Accounts receivable 18 000

Inventory 65 000

Total Current Assets 95 000

Non-Current Assets

Land and buildings 57 000

Plant and machinery 79 000

less Accumulated depreciation 34 000 45 000

Goodwill 5 000

Total Non-Current Assets 107 000

Total Assets 202 000

Current Liabilities

Accounts payable 42 000

Non-current Liabilities

Debentures 20 000

Total Liabilities 62 000

Net Assets 140 000

Equity

Share capital

40 000 ordinary shares, fully paid 40 000

40 000 “A” ordinary shares, fully paid 88 000 128 000

Retained earnings 12 000

Total Equity 140 000

Downloaded by Glenda Albania (egalbania@gmail.com)

You might also like

- Project in Government Accounting and Accounting FoDocument11 pagesProject in Government Accounting and Accounting FoRosy MoradosNo ratings yet

- IAS 36 Impairment of Assets Illustrative Examples PDFDocument17 pagesIAS 36 Impairment of Assets Illustrative Examples PDFMaey RoledaNo ratings yet

- Taxation Answer Sheet 2 PDFDocument37 pagesTaxation Answer Sheet 2 PDFGuinevere100% (1)

- Financial Statement Analysis Group Exercise: InstructionsDocument1 pageFinancial Statement Analysis Group Exercise: InstructionsMARY ACOSTANo ratings yet

- Practice 8: Business Combinations and Impairment Exercise 7.12 Impairment Loss For A CGU, Reversal of Impairment LossDocument7 pagesPractice 8: Business Combinations and Impairment Exercise 7.12 Impairment Loss For A CGU, Reversal of Impairment LossJingwen YangNo ratings yet

- Impairment of AssetDocument2 pagesImpairment of AssetQuỳnhNo ratings yet

- O Level Important Questions PDFDocument55 pagesO Level Important Questions PDFibraho100% (1)

- Topic 5 Tutorial Suggested SolutionsDocument3 pagesTopic 5 Tutorial Suggested Solutionsruksaarziya786No ratings yet

- MPACC512 Advanced Fin Reporting Answer Bank 2022Document44 pagesMPACC512 Advanced Fin Reporting Answer Bank 2022Tawanda Tatenda HerbertNo ratings yet

- 2018 - Exam 1 - Q1 - Sug SolDocument4 pages2018 - Exam 1 - Q1 - Sug SolmamitjasNo ratings yet

- ACC705 Corporate Accounting AssignmentDocument9 pagesACC705 Corporate Accounting AssignmentMuhammad AhsanNo ratings yet

- Q2 Lister LimitedDocument1 pageQ2 Lister Limitedamosmalusi5No ratings yet

- Accounting 1 2013Document3 pagesAccounting 1 2013Qasim IbrarNo ratings yet

- Assessed Coursework 2 - S2 2020 UpdateDocument7 pagesAssessed Coursework 2 - S2 2020 UpdateArmaghan Ali MalikNo ratings yet

- Cash Flow Statement ProblemDocument2 pagesCash Flow Statement Problemapi-3842194100% (2)

- Accounting GovernmentDocument21 pagesAccounting GovernmentJolianne SalvadoOfcNo ratings yet

- Question 2 FR April 2022 Question 2 CaputDocument6 pagesQuestion 2 FR April 2022 Question 2 CaputLaud ListowellNo ratings yet

- Pricilla AFAR Question PaperDocument2 pagesPricilla AFAR Question PaperjasonnumahnalkelNo ratings yet

- Facn311 Test 1 Solution 2019Document10 pagesFacn311 Test 1 Solution 20196lackzamokuhleNo ratings yet

- Financial Statement2 (Work Sheet)Document6 pagesFinancial Statement2 (Work Sheet)Arham RajpootNo ratings yet

- Daa 101 Introduction To Accounting Ii - RispahDocument4 pagesDaa 101 Introduction To Accounting Ii - RispahSpencerNo ratings yet

- QuestionDocument2 pagesQuestionKamoheloNo ratings yet

- Chapter 21 - QB - Q1 - SolutionDocument4 pagesChapter 21 - QB - Q1 - SolutionRichard SibekoNo ratings yet

- Company Accounting-IgcseDocument2 pagesCompany Accounting-IgcseGodfreyFrankMwakalingaNo ratings yet

- Partnership Accounting ChangesDocument3 pagesPartnership Accounting ChangesTariro NjanikeNo ratings yet

- FAC1601-oct2014 Suggested Sol eDocument7 pagesFAC1601-oct2014 Suggested Sol ePhelane FNo ratings yet

- Nkome TradersDocument2 pagesNkome Tradersrethaxaba82No ratings yet

- Q3 NNF LimitedDocument2 pagesQ3 NNF Limitedamosmalusi5No ratings yet

- Income TaxesDocument37 pagesIncome TaxesAngelaMariePeñarandaNo ratings yet

- HI5020 Tutorial Question Assignment T3 2020 FinalDocument7 pagesHI5020 Tutorial Question Assignment T3 2020 FinalAamirNo ratings yet

- Financial Statement Analysis - AssignmentDocument6 pagesFinancial Statement Analysis - AssignmentJennifer JosephNo ratings yet

- Retirment of PartnerDocument30 pagesRetirment of PartnerRoozbeh ElaviaNo ratings yet

- Q1 Here Is The Post-Adjustment Trial Balance of Status Cymbal LTD at 30 June 2019Document3 pagesQ1 Here Is The Post-Adjustment Trial Balance of Status Cymbal LTD at 30 June 2019kietNo ratings yet

- Statement of Cash FlowsDocument11 pagesStatement of Cash FlowsanjuNo ratings yet

- 14207Document6 pages14207genenegetachew64No ratings yet

- Accounting Worksheet 2 Answer SheetDocument31 pagesAccounting Worksheet 2 Answer Sheetzeldazitha87No ratings yet

- CRANBERRY PLC Scenario Chapter 12Document3 pagesCRANBERRY PLC Scenario Chapter 12Nguyễn Thanh Thanh HươngNo ratings yet

- Sem I Acc - NEP-UGCF 2022Document8 pagesSem I Acc - NEP-UGCF 2022Raj AbhishekNo ratings yet

- Tutorial QuestionsDocument2 pagesTutorial QuestionsNishika KaranNo ratings yet

- Midterm 5101Document4 pagesMidterm 5101MD Hafizul Islam HafizNo ratings yet

- ACCT10002 Tutorial 9 ExercisesDocument6 pagesACCT10002 Tutorial 9 ExercisesJING NIENo ratings yet

- Acc311 2021Document4 pagesAcc311 2021hoghidan1No ratings yet

- ACC 401-2023 GA 2-EvenDocument3 pagesACC 401-2023 GA 2-EvenOhene Asare PogastyNo ratings yet

- Acc.2023 Practical Exam Sample QN - PaperDocument5 pagesAcc.2023 Practical Exam Sample QN - PaperMidhun PerozhiNo ratings yet

- Solved StatamentsDocument16 pagesSolved StatamentsHaris AhnedNo ratings yet

- QUESTION 6 Financial Reporting May 2021 KOLIDocument6 pagesQUESTION 6 Financial Reporting May 2021 KOLILaud ListowellNo ratings yet

- Assets: Instruction: Write The Solution of The Problems Below (In Good Form)Document5 pagesAssets: Instruction: Write The Solution of The Problems Below (In Good Form)Christine CalimagNo ratings yet

- Capital Reorganization QuestionsDocument20 pagesCapital Reorganization QuestionsProf. OBESENo ratings yet

- Drafting Financial Statements: (International Stream)Document7 pagesDrafting Financial Statements: (International Stream)api-19836745No ratings yet

- Problem SolutionsDocument5 pagesProblem Solutionsmd nayonNo ratings yet

- 4 Tangible Fixed Assets: DR CR 000 000Document7 pages4 Tangible Fixed Assets: DR CR 000 000Fazal Rehman MandokhailNo ratings yet

- The Following List of Accounts For Company Y Ltd. Is Available at The End of 200XDocument2 pagesThe Following List of Accounts For Company Y Ltd. Is Available at The End of 200Xai0412No ratings yet

- Q7 Mguni LimitedDocument2 pagesQ7 Mguni Limitedamosmalusi5No ratings yet

- Mock ExamDocument4 pagesMock ExamAna-Maria GhNo ratings yet

- NOMSA NYANDOWE - ACC136 November 2020 Question PaperDocument8 pagesNOMSA NYANDOWE - ACC136 November 2020 Question Papernomsanyandowe371No ratings yet

- Llagas 01 Laboratory Exercise 1Document5 pagesLlagas 01 Laboratory Exercise 1Angela Fye LlagasNo ratings yet

- Financial Reporting and Analysis Final OSADocument9 pagesFinancial Reporting and Analysis Final OSATracy-lee JacobsNo ratings yet

- KZN 2020 June P1 Memo 2Document7 pagesKZN 2020 June P1 Memo 2shandren19No ratings yet

- What Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Document12 pagesWhat Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Nguyễn HoàngNo ratings yet

- Net Sales Cash Accounts Receivable Merchandise Inventory Preapid Expense Property, Palnt, and EquipmentDocument6 pagesNet Sales Cash Accounts Receivable Merchandise Inventory Preapid Expense Property, Palnt, and EquipmentMadina MamasalievaNo ratings yet

- Capital Asset Investment: Strategy, Tactics and ToolsFrom EverandCapital Asset Investment: Strategy, Tactics and ToolsRating: 1 out of 5 stars1/5 (1)

- D. Factory Overhead Costs Incurred Were Less Than Overhead Costs Charged To ProductionDocument4 pagesD. Factory Overhead Costs Incurred Were Less Than Overhead Costs Charged To ProductionGuinevereNo ratings yet

- Cash Sales Credit Sales: ACCT201B Practice Questions Chapter 8Document9 pagesCash Sales Credit Sales: ACCT201B Practice Questions Chapter 8GuinevereNo ratings yet

- DocxDocument20 pagesDocxGuinevereNo ratings yet

- Partnership Accounting Table of Contents: Partnership Formation, Operation & DissolutionDocument18 pagesPartnership Accounting Table of Contents: Partnership Formation, Operation & DissolutionGuinevereNo ratings yet

- 25781306Document19 pages25781306GuinevereNo ratings yet

- DocxDocument8 pagesDocxGuinevereNo ratings yet

- Questions Problems Pre BQTAP 2018 2019Document12 pagesQuestions Problems Pre BQTAP 2018 2019GuinevereNo ratings yet

- ACC3100 Fall 2017 Mid Term 1 Exam Practice Question From Test BankDocument100 pagesACC3100 Fall 2017 Mid Term 1 Exam Practice Question From Test BankGuinevereNo ratings yet

- Chapter 7Document18 pagesChapter 7Kogilavani Balakrishnan0% (1)

- Iac 11 Probs PDFDocument12 pagesIac 11 Probs PDFGuinevereNo ratings yet

- Cpa Review School of The Philippines Mani LaDocument2 pagesCpa Review School of The Philippines Mani LaGuinevereNo ratings yet

- Finacc Quiz 2 PDF FreeDocument11 pagesFinacc Quiz 2 PDF FreeGuinevereNo ratings yet

- Practical Accounting 2 Topic: Long-Term Construction Contracts C. GonzagaDocument10 pagesPractical Accounting 2 Topic: Long-Term Construction Contracts C. GonzagaGuinevereNo ratings yet

- Learning Objective 7-1: Chapter 7 Audit EvidenceDocument33 pagesLearning Objective 7-1: Chapter 7 Audit EvidenceGuinevereNo ratings yet

- Taxation of IndividualsDocument3 pagesTaxation of IndividualsGuinevereNo ratings yet

- PPTXDocument140 pagesPPTXGuinevereNo ratings yet

- Cost-Volume-Profit Analysis: Solutions To Chapter 8 QuestionsDocument15 pagesCost-Volume-Profit Analysis: Solutions To Chapter 8 QuestionsGuinevereNo ratings yet

- UNIT-4 - Income-From-BusinessDocument114 pagesUNIT-4 - Income-From-BusinessGuinevereNo ratings yet

- Module 6 TAXATION OF CORPORATIONS PDFDocument60 pagesModule 6 TAXATION OF CORPORATIONS PDFGuinevereNo ratings yet

- Break-Even Point and Cost-Volume-Profit Analysis: QuestionsDocument34 pagesBreak-Even Point and Cost-Volume-Profit Analysis: QuestionsGuinevereNo ratings yet

- Law QuestionsDocument14 pagesLaw QuestionsAlthea CagakitNo ratings yet

- Jurnal Analisis HBUDocument18 pagesJurnal Analisis HBUAprileo RidwanNo ratings yet

- SSRN-Influência Dos Credores No Governo SocietárioDocument79 pagesSSRN-Influência Dos Credores No Governo SocietáriobarbaramacaricoNo ratings yet

- From The Basel Iii Compliance Professionals Association (Biiicpa)Document4 pagesFrom The Basel Iii Compliance Professionals Association (Biiicpa)Vinay SonkhiyaNo ratings yet

- 12 x10 Financial Statement AnalysisDocument22 pages12 x10 Financial Statement AnalysisaizaNo ratings yet

- HANA230228RDocument7 pagesHANA230228RsozodaaaNo ratings yet

- The Scope For Islamic Banking in Maldives: Annex: 1 - Survey QuestionnaireDocument3 pagesThe Scope For Islamic Banking in Maldives: Annex: 1 - Survey QuestionnaireShirwaan MohamedNo ratings yet

- Assignment - 1-Financial Statement Analysis-Jnu-12th BatchDocument4 pagesAssignment - 1-Financial Statement Analysis-Jnu-12th BatchImran KhanNo ratings yet

- FABM 1 Lesson 7 The Accounting EquationDocument19 pagesFABM 1 Lesson 7 The Accounting EquationTiffany Ceniza100% (1)

- Chapter 8Document4 pagesChapter 8rakibulislammbstu01No ratings yet

- ALCOAnnual RPRT 2012 Consov 2Document100 pagesALCOAnnual RPRT 2012 Consov 2kristinamanalangNo ratings yet

- PartCorp. Exercise June 4Document4 pagesPartCorp. Exercise June 4ginalynNo ratings yet

- Rfbt102 CorpoDocument13 pagesRfbt102 CorpoNathalie GetinoNo ratings yet

- Kraft Heinz's Goodwill Charge Tops Consumer-Staples Record - WSJDocument6 pagesKraft Heinz's Goodwill Charge Tops Consumer-Staples Record - WSJUyen HoangNo ratings yet

- Chapter 1 AbcDocument24 pagesChapter 1 AbcChennie Mae Pionan SorianoNo ratings yet

- Valuation of Bonds and SharesDocument19 pagesValuation of Bonds and SharesSandeep GillNo ratings yet

- Terms Sheet SampleDocument4 pagesTerms Sheet SampleKamil JagieniakNo ratings yet

- Far660 - Special Feb 2020 QuestionDocument5 pagesFar660 - Special Feb 2020 QuestionHanis ZahiraNo ratings yet

- Cgapter 9Document7 pagesCgapter 9Rena Jocelle NalzaroNo ratings yet

- FN281 Financial Management QuestionsDocument10 pagesFN281 Financial Management QuestionsRashid JalalNo ratings yet

- Reading 22 Slides - Understanding Balance SheetsDocument41 pagesReading 22 Slides - Understanding Balance SheetstamannaakterNo ratings yet

- Valuation of SharesDocument11 pagesValuation of Shareslekha1997No ratings yet

- Excel Sheet For LedgerDocument6 pagesExcel Sheet For LedgergggNo ratings yet

- A Study of Corporate Governance Practices in India PDFDocument402 pagesA Study of Corporate Governance Practices in India PDFMohamed RilwanNo ratings yet

- General Banking UBLDocument61 pagesGeneral Banking UBLaslammalg100% (1)

- Corporate Social Responsibility: Learning OutcomesDocument25 pagesCorporate Social Responsibility: Learning OutcomesHitesh KarmurNo ratings yet

- Financial Statement Analysis: Project Report ON "Motherson Sumi Systems LTD"Document17 pagesFinancial Statement Analysis: Project Report ON "Motherson Sumi Systems LTD"writik sahaNo ratings yet

- Shareholders' Equity Problems (Gallery Company)Document19 pagesShareholders' Equity Problems (Gallery Company)Nikki San GabrielNo ratings yet

- Ümmüşnur Özcan - CartwrightlumberworksheetDocument7 pagesÜmmüşnur Özcan - CartwrightlumberworksheetUMMUSNUR OZCANNo ratings yet