Professional Documents

Culture Documents

Shaina Camaganacan BSA-2 Year Cost Accounting

Shaina Camaganacan BSA-2 Year Cost Accounting

Uploaded by

Shaina CamaganacanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Shaina Camaganacan BSA-2 Year Cost Accounting

Shaina Camaganacan BSA-2 Year Cost Accounting

Uploaded by

Shaina CamaganacanCopyright:

Available Formats

Shaina Camaganacan

BSA- 2nd Year

Cost Accounting

1. Cost of good sold is:

Answer: a. An expense

2. For manufacturing company, the cost of goods available for sale is during a given accounting

period is:

Answer: c. The sum of the above

3. Which of the following would not be classified as manufacturing overhead?

Answer: b. Direct materials

4. The wage of a timekeeper in the factory would classified as

Answer: c. Indirect labor

5. As current technology changes manufacturing processes, it is likely that direct

Answer: b. Labor will decrease

Problems:

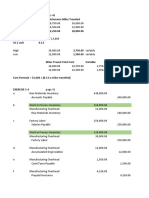

1. For the month of March 2019, prime cost was

Answer: D. 150,000

Solution:

Direct Materials:

Direct Materials, beg. 36,000

Add: Direct Material Purchased 84,000

Less: Direct Mats- end (30,000)

Total Direct Materials 90,000

Direct Labor 60,000

Prime Cost P150,000

2. For the month of March 2019, conversion cost was

Answer: b. 140,000

Solution:

Direct Labor 60,000

Factory Overhead (60,000/7.50)x10) 80,000

Conversion Cost: P140,000

3. For the month of March 2019, cost of goods manufactured was

Answer: d. 236,000

Direct Materials used

Direct Materials, beg 36,000

Add: Direct Materials Purchase 84,000

Goods Available for Sale P120,000

Less: Direct Materials, end 30,000 90,000

Add: Direct Labor

Factory Overhead 80,000

Total Manufacturing Cost P230,000

Add: Work in process, beg 18,000

Cost of goods put into process P248,000

Less: Work in process, end 12,000

Cost of Goods Manufactured P236,000

4. The total amount of direct materials purchased during March was:

Answer: c. 180,000

5. The cost of goods manufactured during March 2019 was:

Answer: b. 388,000

Solution:

Direct materials

Direct Materials, beg 40,000

Purchases 180,000

Less: Direct Materials, end (50,000) 170,000

Add: Direct labor 120,000

Factory overhead 108,000

Manufacturing costs 398,000

Add: Work in process, beg. 25,000

Cost of Goods put into process 423,000

Less: Work in process, end (35,000)

Cost of Goods Manufactured 388,000

Add: Finished goods, beg 60,000

Goods available for sale 448,000

Less: Finished goods, end (70,000)

Cost of Goods Sold P 378,000

Reflection:

Donna Company

Cost of Goods Sold

For the month ended, May 31 2019

Direct Materials

Direct Materials, beg 124,000

Purchased Materials 107,800

Less: Direct Materials, end (115,000) 116,800

Direct Labor 160,000

Factory overhead 240,000

Manufacturing cost 516,800

Add: Work in process, beg 129,200

Cost of goods put into process 646,000

Less: Work in process, end (124,000)

Cost of good manufactured 522,000

Donna Company

Cost of Goods Manufactured

For the month ended, May 31 2019

Cost of goods manufactured 522,000

Add: Finished goods, beg 150,000

Goods available for sale 672,000

Less: Finished goods, end (122,000)

Cost of goods sold P 550,000

You might also like

- Normal CostingDocument3 pagesNormal Costingrose llar67% (3)

- Sample Problems With AnswerDocument7 pagesSample Problems With AnswerCatherine OrdoNo ratings yet

- Assignment 3 Accounting PDFDocument11 pagesAssignment 3 Accounting PDFjgfjhf arwtr100% (1)

- Vicenzo Bernard Leandro Tioriman - 01011182025009Document6 pagesVicenzo Bernard Leandro Tioriman - 01011182025009ImVicNo ratings yet

- EconomyDocument3 pagesEconomyKellyTiburcioNo ratings yet

- Problem 1-20: 1 JGG Manufacturing Company Manufacturing CostDocument9 pagesProblem 1-20: 1 JGG Manufacturing Company Manufacturing CostMackenzie Heart Obien0% (1)

- Chapter 3 Cost Accounting Cycle Multiple Choice - TheoriesDocument36 pagesChapter 3 Cost Accounting Cycle Multiple Choice - TheoriesAyra Pelenio100% (2)

- Lecture 3 Job Order CostingDocument20 pagesLecture 3 Job Order CostingTheresa RoqueNo ratings yet

- Cost Accounting 2 Answer To Cost Accoutning - CompressDocument36 pagesCost Accounting 2 Answer To Cost Accoutning - CompressjommaetiNo ratings yet

- Quiz 1 Answers KeyDocument3 pagesQuiz 1 Answers KeyDesiree100% (1)

- Bacolod, Queenie Rose C. BSA2-B Summary of Answers Problem 5-Chapter 3 Requirement 1-Journal EntriesDocument7 pagesBacolod, Queenie Rose C. BSA2-B Summary of Answers Problem 5-Chapter 3 Requirement 1-Journal EntriesQueenie Rose BacolodNo ratings yet

- Cost Accounting Test BankDocument144 pagesCost Accounting Test BankKidd RubioNo ratings yet

- Cost Accounting & Control 1Document8 pagesCost Accounting & Control 1Mary Lace VidalNo ratings yet

- Activity#2 - VILLALOBOS, AngeluDocument8 pagesActivity#2 - VILLALOBOS, AngeluJeluMVNo ratings yet

- 625009eef26fe Cost Accounting and Cost Management 1 Quiz No. 2Document2 pages625009eef26fe Cost Accounting and Cost Management 1 Quiz No. 2El Jehn Grace Babor - Ledesma100% (1)

- Review Material in Cost Accounting: Bachelor of Science in Accountancy (Aliat Universidades)Document79 pagesReview Material in Cost Accounting: Bachelor of Science in Accountancy (Aliat Universidades)Isabel FlonascaNo ratings yet

- Cost Accounting AssignmentDocument6 pagesCost Accounting AssignmentCharles BarcelaNo ratings yet

- Marvin Manufacturing Company: Cost of Goods Sold P 884,000Document8 pagesMarvin Manufacturing Company: Cost of Goods Sold P 884,000Ryze100% (1)

- Cost Acctg Cycle Activity AnswerDocument2 pagesCost Acctg Cycle Activity AnswerElaine Joyce GarciaNo ratings yet

- Cost Accounting. ActivityDocument6 pagesCost Accounting. ActivityReida DelmasNo ratings yet

- Assignment Far1Document1 pageAssignment Far1lain slngNo ratings yet

- Assignment Far1Document1 pageAssignment Far1lain slngNo ratings yet

- Muhammad Kashif Raheem 5212 Cost Accounting Sir Naveed AlamDocument8 pagesMuhammad Kashif Raheem 5212 Cost Accounting Sir Naveed AlamKashif RaheemNo ratings yet

- Accounting For Managers Canadian 1st Edition Collier Solutions ManualDocument17 pagesAccounting For Managers Canadian 1st Edition Collier Solutions Manualnicholassmithyrmkajxiet100% (28)

- Acco 20073 Discussion Sy2122 (Bsma 2-4)Document81 pagesAcco 20073 Discussion Sy2122 (Bsma 2-4)Paul BandolaNo ratings yet

- Ca Quiz1Document4 pagesCa Quiz1Ferlice JusayNo ratings yet

- Drill12 Drill13 Manufacturing BusinesDocument6 pagesDrill12 Drill13 Manufacturing BusinesAngelo FelizardoNo ratings yet

- Chapter 1 Question Review - 102Document5 pagesChapter 1 Question Review - 102Mark Joseph CanoNo ratings yet

- Chapter 2 - 1 - IllustrationDocument6 pagesChapter 2 - 1 - IllustrationYonas BamlakuNo ratings yet

- Answers To Activity 1Document5 pagesAnswers To Activity 1jangjangNo ratings yet

- Manufacturing OperationsDocument14 pagesManufacturing OperationsGet BurnNo ratings yet

- Karen Company Statement of Cost of Goods Manufactured For The Year Ended Dec. 31, 2020Document8 pagesKaren Company Statement of Cost of Goods Manufactured For The Year Ended Dec. 31, 2020Althea Gabrielle PinedaNo ratings yet

- RCA Solutions Mod3 PDFDocument13 pagesRCA Solutions Mod3 PDFdiane camansagNo ratings yet

- MCMCDocument6 pagesMCMCIT GAMINGNo ratings yet

- Test 1 ProblemsDocument48 pagesTest 1 ProblemsKaira Arora50% (2)

- Problem 9.10 SolutionDocument4 pagesProblem 9.10 SolutionPrincess Dhazerene M. ReyesNo ratings yet

- A3. Activity 1 COST CONCEPTS AND COST BEHAVIORDocument8 pagesA3. Activity 1 COST CONCEPTS AND COST BEHAVIORSittie Ainna A. UnteNo ratings yet

- Cost AccountingDocument5 pagesCost AccountingLhaizsa PalmagilNo ratings yet

- Costcon 1Document3 pagesCostcon 1Frances Clayne GonzalvoNo ratings yet

- UntitledDocument13 pagesUntitledPiands FernandsNo ratings yet

- UntitledDocument4 pagesUntitledJomar PenaNo ratings yet

- Chapter 04Document4 pagesChapter 04Nouman BaigNo ratings yet

- Module 3 QuizDocument9 pagesModule 3 QuizjmjsoriaNo ratings yet

- CH 2 - SupplementDocument5 pagesCH 2 - SupplementCa WUNo ratings yet

- Code 4Document8 pagesCode 4Đỗ Hải MyNo ratings yet

- ManAc Quiz 1Document12 pagesManAc Quiz 1random122No ratings yet

- Assignment 3 Managerial Accounting: Submitted By-Ghayoor Zafar Submitted To - DR MohsinDocument11 pagesAssignment 3 Managerial Accounting: Submitted By-Ghayoor Zafar Submitted To - DR Mohsinjgfjhf arwtr100% (1)

- (New Account Titles and Financial Statements) : Module 8: Introduction To Manufacturing OperationDocument4 pages(New Account Titles and Financial Statements) : Module 8: Introduction To Manufacturing OperationAshitero YoNo ratings yet

- Cost AccountingDocument2 pagesCost AccountingMaricar RoqueNo ratings yet

- Problem Lecture - MANUFACTURING 2 With ANSWERSDocument4 pagesProblem Lecture - MANUFACTURING 2 With ANSWERSNia BranzuelaNo ratings yet

- Assignment #1Document5 pagesAssignment #1Crizelda BauyonNo ratings yet

- Cost Activity 1Document12 pagesCost Activity 1Dark Ninja100% (1)

- Cost 1 Sample ProblemsDocument3 pagesCost 1 Sample ProblemsCatherine OrdoNo ratings yet

- Baya - Exercise 4 Job Order Costing, Accounting For MaterialDocument12 pagesBaya - Exercise 4 Job Order Costing, Accounting For MaterialAngelica BayaNo ratings yet

- Cost Acc ReviewerDocument3 pagesCost Acc ReviewerAlyssah Grace EllosoNo ratings yet

- WK 2c Lesson 2 Problem Solving IllustrationDocument2 pagesWK 2c Lesson 2 Problem Solving IllustrationRosethel Grace GallardoNo ratings yet

- Act. 2 Job Order CostingDocument3 pagesAct. 2 Job Order Costing0322-1975No ratings yet

- Product CostDocument10 pagesProduct CostApple BaldemoroNo ratings yet

- Cost AccountingDocument3 pagesCost AccountingRajibNo ratings yet

- Samira Company - Income StatementDocument2 pagesSamira Company - Income StatementTimNo ratings yet

- Production Function - IsO-Quants & ISO - Cost& Expansion Path of A FirmDocument17 pagesProduction Function - IsO-Quants & ISO - Cost& Expansion Path of A Firmcharu KNo ratings yet

- Unit 7Document22 pagesUnit 7Sandhya ChimmiliNo ratings yet

- Bgteu v2s60Document15 pagesBgteu v2s60maye dataelNo ratings yet

- Cost Accounting and Control Lecture NotesDocument11 pagesCost Accounting and Control Lecture NotesAnalyn LafradezNo ratings yet

- Chapter 8 Profit Maximisation and Competitive SupplyDocument26 pagesChapter 8 Profit Maximisation and Competitive SupplyRitesh RajNo ratings yet

- Cost, Scale of ProductionDocument19 pagesCost, Scale of ProductionAli AshhabNo ratings yet

- Exercise Accounting Management (March 22' 2021)Document3 pagesExercise Accounting Management (March 22' 2021)Hannah SitompulNo ratings yet

- Seminar 4 - Sales Mix and Financial Analysis 1Document8 pagesSeminar 4 - Sales Mix and Financial Analysis 1Benedicta AmanfuNo ratings yet

- Complete Topic 1 - Cost - Cost ClassificationDocument12 pagesComplete Topic 1 - Cost - Cost ClassificationchaiigasperNo ratings yet

- Economics - Profit and RevenueDocument23 pagesEconomics - Profit and Revenuejinnah kayNo ratings yet

- L2 - ABFA1163 FA II (Student)Document4 pagesL2 - ABFA1163 FA II (Student)Xue YikNo ratings yet

- Powerpoint Lectures For Principles of Microeconomics, 9E by Karl E. Case, Ray C. Fair & Sharon M. OsterDocument47 pagesPowerpoint Lectures For Principles of Microeconomics, 9E by Karl E. Case, Ray C. Fair & Sharon M. OsterfredNo ratings yet

- 11 Standard CostingDocument30 pages11 Standard CostingLalan JaiswalNo ratings yet

- Microeconomics CH 6Document9 pagesMicroeconomics CH 6Mohammed Rakeen Akiel CamilNo ratings yet

- Group 2: Wilkins, A Zurn Company: Aggregate Production PlanningDocument10 pagesGroup 2: Wilkins, A Zurn Company: Aggregate Production PlanningSiddhant SinghNo ratings yet

- Cost AccountingDocument128 pagesCost AccountingCarl Adrian Valdez50% (2)

- Cost PDFDocument20 pagesCost PDFUzzalNo ratings yet

- Chapter 6 Theory of Firm and Market Structure - PART 1Document36 pagesChapter 6 Theory of Firm and Market Structure - PART 1hidayatul raihanNo ratings yet

- Chap 13Document66 pagesChap 13Phuong Anh Ta VuNo ratings yet

- COM01P105S23U00Document35 pagesCOM01P105S23U00SHAMPA SINHAROYNo ratings yet

- NO. Perimeter Denah Rumah 6 X 8 H VDocument407 pagesNO. Perimeter Denah Rumah 6 X 8 H VrealtigtigrealNo ratings yet

- Group 7 JUST IN TIME PRACTICES OF SERVICE DELIVERY OF FAST FOOD CHAINS IN BATANGAS CITYDocument4 pagesGroup 7 JUST IN TIME PRACTICES OF SERVICE DELIVERY OF FAST FOOD CHAINS IN BATANGAS CITYMary Grace PanganibanNo ratings yet

- Job Order Activity For Take HomeDocument12 pagesJob Order Activity For Take HomeRg Cyrus SerranoNo ratings yet

- Full Ma PDFDocument9 pagesFull Ma PDFkelvinsab623No ratings yet

- CH 13 Student Handout 8e PDFDocument14 pagesCH 13 Student Handout 8e PDFVidya AsNo ratings yet

- ECON 1000 Exam Review Q41-61Document5 pagesECON 1000 Exam Review Q41-61Slock TruNo ratings yet

- Assignment 1 Audit of inventories-MINGLANADocument4 pagesAssignment 1 Audit of inventories-MINGLANAMitch MinglanaNo ratings yet

- SIA 1 ProblemDocument7 pagesSIA 1 Problemleny prianiNo ratings yet