Professional Documents

Culture Documents

Time Series

Time Series

Uploaded by

Yash Mhatre0 ratings0% found this document useful (0 votes)

8 views18 pagesOriginal Title

Time series

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

8 views18 pagesTime Series

Time Series

Uploaded by

Yash MhatreCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 18

3.2. DEFINITION:

‘Time series is the arrangement of statistical data in chronological order that is in accordanc

with time. i. Time series data is nothing but the data collected over a period of time. Th

quantitative values are recorded over equal time interval like daily, weekly, monthly, quartet

half yearly, yearly, or any other time measure.

For example:

(2) Monthly Industrial Production in India,

(2) Annual birth-rate figures for the’given state,

(3) Yield from particular shares during the month,

(4) Monthly wholesale price of wheat,

(5) Daily records of sales in a departmental stores,

(6) Census data,

(7) Daily records of maximum temperature of a given city.”

A time series represents the relationship between the two variables, one of them being time.

The purpose of time series analysis is to see what changes take place over the time in the event

under observation.

33 USES OF TIME SERIES:

The analysis of time series is of great significance not only to the economists and business man

put also to the scientists, astronomists, geologists, sociologists, biologists, research worker etc. for

the reasons below.

(1) It helps in understanding past behaviour: By observing data over a period of time one can

easily understand what changes have taken place in the past. Such analysis will be extremely

helpful in predicting the future behaviour.

It helps in planning future operations: The major use of time series analysis is in the theory

of forecasting. The analysis of the past behaviour enables to forecast the future. Time series

forecasts are useful in planning, allocating budgets in different sectors of economy.

() Ie helps in evaluating current accomplishments: The actual performance can be compared

with the expected performance obtained from the analysis and the cause of variation can be

analyzed. If expected sale for 2009 was 10000 refrigerators and the actual sale was only 9000.

One can investigate the cause for the shortfall in achievements.

(4) It facilitates comparison: Different time series are often compared and important conclusions

are drawn from there. E.g. By comparing sales of two products produced by company, one

can take the decisions. Or in business administration it is essential to compare the output by

different departments for the allocation of resources.

Analysis of time series shows that the observed time values of the variables are always

fluctuating from time to time, The fluctuations are due to various factors or forces like increase of

population, changes in habits and tastes of people, weather conditions etc. Therefore, the first

task is to break down the data and study each of these influences in isolation. This is known as

decomposition of the time series. It enables us to understand fully the nature of the forces at

work. We can then analyse their combined interactions. Such a study is known as time-series

analysis. The purpose of time series analysis is to isolate and ascertain these forces (i.e. various

components).

34 COMPONENTS OF THE TIME SERIES:

Fluctuations in a time series are mainly due to four basic types of variations known as

components or elements of time series. These are:

(a) Secular Trend (T)

(b) Seasonal Variation (S)

(©) Cyclical variation or periodic variation (C)

(d) Irregular or Random movements (R)

‘These components provide a basis for the explanation of the past behaviour and help us to

predict the future behaviour. A value of time series Yt at any time t is regarded as the function of

the combined impact of above components.

c) 5

3.4.1 Secular Trend (o1) Trend (1): the general tend ney oF population or mS

By secular trend or simply trend we aoe usually see ae ore or less constant for a} fi

i eriod of time. e.g ich are nae aan

cee aa the effect of such factors 7 i not include short es te alee

fine oF wicca very graally and slowiy. Trend ee factors are gradual son

eri t due

but rather the steady movements over a long p' rial outpul : : |

Population, tastes oa habits or the effect on ae ase in production of ink pens, Tadio ae

Increase in production of automobiles and a gradual de

examples of increasing and decreasing secular trend. sti

All basic trends are not of the same nature. eae jah line wi

This type of trend movement takes the form of a str i nt percell { .

on a graph paper. Sometimes the trend will be ca an ee are plotted on a semi-logatitin,

type takes the form of a straight line when the bien #5 curves", ett.

chart. Other types of trend encountered are “logistic”,

: end, constant trend or noy

Generally we observe linear trend -upward trend, downward tr

linear trend.

of the data to incre,

there is tendency of constant groyy

i hen the trend values are Plotteg

tage increase or decrease, This

Upward trend:

(1) Agricultural production.

(2) Yearly population.

(3) Number of graduates.

Downward trend:

) Cost of electronic goods,

(2) Death rates,

(3) Number of illiterates,

Constant trend:

Seer > () Daily temperature in

(2) Atmosphe:

G) Monthly electrical consumption of

family,

a season.

tic pressure,

Non linear trend:

(1) Share price.

(2) Life time of an electronic device, -

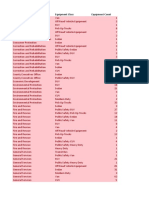

Fig. 1: Types of trend

Properly recognizing and accurately measuring basic trends is one of the most important

problems in time series analysis. Trend values are used as the base from which other three

movements are measured. Therefore, any inaccuracy in its measurement may vitiate/spoil the

entire work, The elements controlling trend growth are relatively stable. Trends do not

commonly change their nature quickly. It is therefore reasonable to assume that a representative

trend, which has characterized the data for a past period, is prevailing at present, and that it may

be projected into the future for a year or so.

3.4.2 Seasonal Variation (S):

Seasonal variation is a short term periodic movement which occurs more or less regularly

within a specified period of one year or shorter. It reoccurs periodically year after year. The major

factors that cause seasonal variations are climatic and weather conditions, customs and habits of

people, religious festivals etc.

Fig. 2: Seasonal Variations

Eg. The sales of the departmental store show sudden rise before Durga pooja, Diwali and

Christmas. The prices of grain vary between the harvest and the non harvest seasons. A business

executive has to study seasonal variations in order to take care of policy decisions regarding,

inventory, purchase, sale schedule etc.

Although the period of seasonal variations refers to a year, in a business and economics it can

also be taken as a month, week, day, or hour depending on the nature of characteristic under

study. E.g. withdrawals in a bank, temperature recorded during 24 hrs,

Note that the amplitude may differ from cycle to cycle.

3.4.3 Cyclical Variations (C):

Apart from seasonal variations, there is another type of fluctuation which usually lasts for

More than a year. Cyclical fluctuations are a long term periodic movement which occurs over a

long period of time usually two or more years. It is oscillatory in nature but not as regular as

Seasonal variation. The cyclic movements in a time series are generally attsDoNES of po ret

Business Cycle’ which may also be referred to as the ‘four phase cycle’ comms IEN Say,

tecession, depression and recovery. Each phase changes gradually into a

bead given above until one business cycle is completed. (Fig 3) ie

business cycle does not recur regulaily like seasonal movement, :

causes which develop intermittently out of complex combinations of economic and i

considerations. When the business of a country or a community is above oF De mal, the

excess deficiency is usually attributed to the business cycle.

Peak Steady Growth Line

Jat moves in response ty

Expansion

Recession Expansion

Prosperity

Line of Cycle Recovery

Trough

Fig. 3: Business cycle

Many people confuse cyclic behaviour with seasonal behaviour,

different. If the fluctuations are not of fixed period then they are cyclic; if the period is

unchanging and associated with some aspect of the calendar, then the pattern is seasonal. In

general, the average length of cycles is longer than the length of a seasonal pattern, and the

magnitude of cycles tends to be inore variable than the magnitude of seasonal patterns, :

3.4.4 Random or Irregular Movements (R): 7

Such variations are caused by the factors of irregular nature.

nature and are unpredictable, regulnr movements are qnores by eae Purely, rondo

wars, earthquakes, strikes etc. These variations do not occur in a definite events like floo oe

excluding trend, seasonal and cyclical variations are irregular, Pattern. All variatiog

but they are really quite

Fig. 4: Random movements

35 ANALYSIS OF TIME SERIES:

Analysis of time series means ~ study of time serics.

The main purpose in a time series analysis is two fold.

(2) To identify the forces or components whose net effect is exhibited in the movement of

time series,

(2) Toisolate, study, analyse and measure them independently.

Models for time series: In the analysis it is essential to know how the components interact

and show the joint effect. This is done with the help of the models. Generally two models are

used to describe a time series.

@ Additive Models:

According to this model a time series can be expressed as

WaT +S + Cr+ Re

That is all components of time series are additive in nature. It assumes that the four

components have no interaction so they act independently. The term & will not appear in a series

of annual data. C; will have positive or negative values depending on whether we are above

normal or below normal phase.

The assumption in the additive model that the components are non-interactive or they act

independently is not realistic."In order to overcome this drawback multiplicative model is

developed.

(i) Multiplicative Model:

In this model it is assumed that the various components in a time series operate

proportionately to the general level of the series. Accordingly the model can be expressed as

Yee Tex Sex Cr Re

Where S,, C,, R: instead of assuming positive or negative values are indices fluctuating above or

below unity and the geometric means of S; in a year, Cr in a cycle and R; in a long term period are

unity.

Note: multiplicative model can be converted to additive model by using log transformation.

In this chapter we will study the measurement of two components namely-trend and seasonal

variation.

3.6 MEASUREMENT OF TREND:

The reasons for the measurement of Trend, is to study the behaviour of the variable in the

Jong run. .

Trend can be measured by the following four methods.

(1) Graphic Method

(2) Semi-average Method

(3) Moving average Method

(4) Method of Least Square

3.6.1 Graphic Method or Free hand curve method:

Itis the simplest method of studying trend. In this method the values of Y: (a time dependent

variable) aré plotted against t and a smooth curve is drawn through these points. It enables us to

form an idea about the general trend of the series. Smoothing of the curve eliminates other

i does 1

sauPoRents such as regular Auctuations. This. method

joints of this method.

mathematical calculations hence simplicity and flexibility are strong P

Fig. 5: Graphical method

Example 1:

Following data represents Production of Rice( in ‘000 tones) for the years 2000 to 2097

Observe trend by graphical method.

Year Production of Rice in '000 tones

2000 120

2001 135

2002 345

2003 412

2004 720

2005 900

2006 1100

2007 1040

Solution:

Draw the graph.

Y ‘ Production of Rice in ‘000 tones

1400

1200

1000

e00 Given Data

Points

600

] Trend

200

‘ 2

Mig. 6: Graph showing trend -

We observe the upward trend,

Merits:

(i) Itis very simplest method for studying trend values and itis easy to draw trend.

(ii) Sometimes the trend line drawn by the statistician experienced in computing trend may be

considered better than a trend line fitted by the use of a mathematical formula.

Demerits:

() This method is highly

(i) Since the method is subjective, the prediction may not be reliable.

ubjective and curve varies from person to person who draws it.

(ii) The work must be handled by skilled and experienced people.

fiv) Ttdoes not enable us to measure trend.

3.6.2 Semi-Average Method:

In this method given data is first divided into two parts (preferably equal) and an average for

each part is found. Then the two averages are plotted on the graph paper as points against the

mid-point of the time interval covered by the respective two parts. These two points are joined by

astraight line. This line is the required trend line.

If the data contains n-even number of data points then easily data can be divided into two

parts each containing 5 points. In case n is odd then we omit middle value and divide data in to

‘0 equal parts.

Example 2:

Following data represents students strength in the college ABC for the years 2004 to 2009.

Observe trend by Semi-Average method.

[ Year 2004 | 2005 | 2006 | 2007 | 2008 | 2009

|’ Students’ strength in ABC college | 450-| 560 | 580 | 540 | 720 | 850

Solution:

Here data contains observations for six years so we divide it in two parts.

[Year | Students' strength

in ABC college Semi averages

2004 450

2005 560 SOE Se SH = 530

2006 580

2007 540

2008 720 S40 + 720+ 850 = 703.33

2009 850

Students’ strength In ABC college

900 7

800 +

> Given Data

600

Trend fine joining

semi average points

2004 2005 2006 2007 2008 2009

Fig, 7: Trend line by method of semi averages

Merits:

(i) This method is simple to understand as compared to moving average method and method

of least squares.

(ii) This is an objective method of measuring trend.as everyone who applies this method is

bound to get the same result, so it is better than graphical method which is subjective.

Demerits: 7

(i) The method assumes straight line relationship between the plotted points regardless of the

fact whether that relationship exists or not.

(i) The main drawback of this method is if we add some more data to the original data then

whole calculation is to be done again for the new data to get the trend values and the trend

line also changes.

(iii) As the A.M of each half is calculated, an extreme value in any half will greatly affect the

points and hence trend calculated through these points may not be precise enough for

forecasting the future.

3.6.3 Moving Average Method:

Moving average of period m is a series of successive averages of m terms at a time starting

with 1*, 24, 34 term etc. Thus the first average is the mean of 1st m terms, the 24 is mean of terms

from 2r4 to (m+1)t term and so on.

Suppose we have the following time series.

- Time thy tay tay vee wa ta

Y values Yi, Y2, Ya,» Yn

If we want to calculate moving average of period m. Then series of moving averages §

calculated as follows:

Yat Yor ont Yn

m

Yor Yat... + Yor

m

First moving average =

Second moving average =

Ys+ Yat

+¥ms2

‘Third moving average = =

Merits:

) This me

i) The calculations are simple.

ii) If an appropriate period is chosen that is if the period of the

the period of cyclical fluctuations then these fluctuations are

data by using this method.

(in) The choice of period of moving average is made by observin;

the data and not by personal judgment of the sabofaction.

() The method is quite flexible in the sense that when a few observations are added to the

given data, the trend values already obtained will not be affected, only more trend values

will be included in the series.

Demerits:

@ Some trend values at the beginning and at the end of the series cannot be determined.

(ii) Ttis not easy to determine the period of moving average when the oscillatory movement

does not exhibit any regular periodic cycle. .

(ii) It cannot be used for forecasting or predicting future trend, which is the main objective of

trend analysis.

(iv) This method is used to find only linear trend.

thod is used to measure trend, seasonal, cyclical and irregular fluctuations.

moving average coincide with

automatically eliminated from

g the oscillatory movements in

3.6.4 Method of Least Squares:

This method yields correct 1 of the function to be fitted is obtained ei

by screening of the graphical plot er ee time or by a theoretical understanding of thy

mechanism of the variable change. On examination, the plotted data often provides an adequay,

basis for deciding upon the type of the trend to use. The following are types of fitting of curves, .

(D Fitting of a straight line Yi =a + bt i

_ To estimate the parameters ‘a’ and ‘b’, we solve the following normal equations obtained by

minimising the error sum of squares (SE2).

Let S=SE =r(Y-a- bt)?

=0=-2E(%-a-bt)=0

= E¥r=na+b3t (1)

as:

Gp =0>-2E(-a-bijt=0

=> EY: = alt + bre -(2)

By solving equations (1) and (2) as simultaneous equations we get the values of a and b, with

these values we can write equation of trend line Y; = a + bt for the given data.

(I) Fitting of parabolic curve or second degree equation.

Yi satbt+ct?

To estimate the parameters ‘a’ and ‘b’, we solve the following normal equations obtained by

minimising the error sum of squares.

$?=SE? =Z(¥-a-bt-ct?

ast

Gy 0-2 B(%r-a-bt-c) =0 |

=> EY, =na+bSt+ cht (1)

as?

Gp =O -2E-a-bt-cejt=0

=> Et =abt+bE+cze (2)

ase

— = od -a—bt-ct2fS

Ge =O -2E(Kr-a—bt-et?|F=0

= ERY, salP+bEP+crt 3)

By solving equations (1),(2) and (8) as simultaneous equations we get the values of a, b and

with these values we can write second degree equation of trend Yi = a + bt + ct? for the give

data.

Merits:

(i) This is a mathematical method of measuring trend

(i) Trend values can be obtained for all the given time periods in the series,

Demerits:

() Great care should be exercised in selecting the type of trend curve to be fitted i.e. linear,

parabolic or some other type. Carelessness in this respect may lead to wrong results.

Gi) The method is more tedious and time consuming.

(ii) Predictions are based on only long term variations ie trend and the impact of cyclical,

seasonal and irregular variations is ignored.

x

Gv) This method can not be used to fit the growth curves like Gompertz curve \Y=Ka? ),

fet 1

logistic curve @ = mem) etc.

Example 5:

Following data represents the produétion of sugar in the given factory.

Year 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014

Production in ‘000 quintals | 55. 60 65 67, 70 78 cc 80 82 87 82, 78 85.

() Fita straight line trend and calculate trend values.

i) Piot the data on the graph and show the trend line.

Solution:

Year Y= Production in ‘000 quintals. | t= year-2008 ty e trend values

2002 55 -6 -330 | 36 60.17

2003 60 5 300 | 25 625

2004 65 4 260 | .16 64.83

2005 67 3 -201 | 9 67.16

2006 70 2 -140 | 4 69.49

2007 78 -1 at 71.82

2008 75 0 o | o 74.15

2009 80 1 go | 1 76.48

2010 82 2 164 | 4 78.81

2011 87 3 261 | 9 81.14

212 82 4 328 | 16 83.47

m3 78 5 300 | 25 858

2014 85 6 510_| "36 88.13

Tol 964 0 424 | 182

For fitting of a straight line Y; =a + bt, we have to solve the normal equations

ZY, =na + bEt

EtY, = abt + bE‘?

ie, DY; =na + brt = 964 13a+0xb=>a=74.15

i 182b => b = 2.33

ile, DEY; = abt + BEEP = 42 =ax0+

feat pation for the trend line is Yt = 74.15 + 2.33t = 74.15 + 2.33 (year-2008).

Y Production in ‘ooo quintals.

Given Data

Trending

Op} ttt X

2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

X . t)

Fig. 10: Trend line by method of least square

3.7 MEASUREMENT OF SEASONAL VARIATION:

Seasonal variations are measured as a percentage of ,the trend rather than in absolute

quantities. The seasonal index for any month (week, quarter etc.) may be defined as the ratio of

the normally expected value (excluding the business cycle and erratic movements) to the

corresponding trend value. When cyclical movement and erratic fluctuations are absent in a time

series, such a series is called normal. Normal values thus are consisting of trend and seasonal

components. Thus when normal values are divided by the corresponding trend values, we obtain

seasonal component of time series.

Seasonal patterns are exhibited by most of the business and economic phenomena and theit

study is necessary for the following two reasons.

(Q) To isolate the seasonal variation that is to determine the effect of seasons on the size of the

variable.

(2) To eliminate them that is to study as to what would be the value of the variable if there

were no seasonal fluctuations.

To study the seasonal variates the data must be given for parts of the year (month

terly, weekly, daily or hourly). Followi i :

aad rb iy. weekly, daily or hourly). Following are the different Ways of measuring season

(1) Method of simple average

(2) Ratio to trend method

(3) Ratio to moving average method

(4) Link relative method

3.71 Method of Simple Average: :

This is the simplest of computing’ seasonal variation and this method is used when trend and

cyclical fluctuations if any have little effect on the time series.

Let the data be given for n periods (where n can be yearly, monthly, quarterly etc.)

(1) Average the data Periodically

(2) Let Xi, be the average of the ith period (I= 1,2,... n)

Ss -_3

(3) Compute the average X of these n averages that is X ==

(4) If we assume additive model, then seasonal indices for n periods are %1-X , %—K ..-%a—

x,

If we assume multiplicative model, then seasonal indices for n periods are

© x10,

x

Merits: sad

@ Thisis the simplest method of all the methods. 3

Demerits:

@ This method is based on the basic assumption that the data do not contain any trend and

cyclic components and consists in eliminating irregular components by averaging the

monthly (or quarterly) values over the years. Since most of the economic time series has

trends, these assumptions in general are not true and hence this method is not of much

practical utility.

(i) The seasonal indices obtained by this method are rough estimates,

Example 6:

Determine seasonal indices for various quarters by using simple average method,

Year! 008 | 2009 | 2010 | 2011

Quarter

T 152 157 162 135

0 187 | 148 165 150

ir 154 157 153 154

Iv 158 156 148 152

Solution:

We have to evaluate quarterly averages x then the average of averages X,

Then calculate seasonal indices by using formula ~! x 100

Quarter 1 lt iis 1 :

Year

2008 152 157 154 =

2009 187 148 187 156

2010 162 165 153 48

2011 135 150 154 152

Total 606 620 618 614

Quarterly average 151.5 155 154.5 Te 5

Seasonal Index |_151.5 154.5 _ 1

= T53.605% 100 | qm gng 100 | z55q95* 100 | 75.605 * 100

% 100 98.6168 100.895 100.5696 9.9186

x

3.72 Moving Average Method (Ratio to moving average method):

This method is widely used for measuring seasonal variations.

The steps are as follows.

Let the data be given for n periods (ie. quarterly, monthly etc.)

(Calculate n-period moving average. These moving average values give estimate of the

combined effects of trend and cyclic variations.

Express the original data as a percentage of the centred moving average values. Using

multiplicative model, these percentages would then represent the seasonal and

irregular components.

(ii) The preliminary seasonal indices are now obtained by eliminating the irregular or

random components by averaging these percentages. For averaging either mean ot

median is used.

Gi)

(iv) The sum of these indices = s (say) will not in general be 100n. Hence to get the sum

100n the adjustment is done by multiplying throughout by a constant factor = k= py

Merits:

(i) It is the most flexible and widely used method.

Gi) These indices do not fluctuate as much as the indices by the ratio to trend method.

Demerits:

(i) This method does not completely utilize the data.

Example 7:

Determine seasonal indices for various quarters by using Ratio to moving average method.

Year| 2011 2012 2013

Quarter

1 68 65 68

u 62 58 a

mI 61 66 63

Iv 63 61 a:

solution:

irst we have to

Firs! ne trend values by using 4 quarterly moving averages.

‘able 1: Calculations of ratio to moving averages

Yearand / Original | 4quarterly | 2point | quarterly moving | Ratio to M.A.

quarter values] moving totals | moving average Col(2)

totals _ Coll) = 100% Co1(5)

(oe = Col(8)

2) 8) @ @ ©

2011-1 68

u 62

254

1 or 505 63.125 96.6336

: 251

_ oa 498 62.250 101.2048

247

2012-1 65 499 62.375 104.2084

i 252

0 58 502 62.725 92.43028

250

wm 66 503 62.875 104.9702

253

Vv 61 511 63.875 95.49902

258

2013-1 68 513, 64.125 106.0429

255

63 516 64.500 97.67442

261

m 63

Vv o7

Table 2: Calculations of seasonal Indices:

Ratio to moving averages Seasonal | Seasonal Indices

Year 2011 2012 2013 Indices adjusted = Average

=Average at

Geddes 399.3318

T = 104.2084 | 106.0429 |” 105.1257 105.30

u = 92.43028 | 9767442 | 95.05235 95.21

m 96.63366 | 104.9702 - 100.8019 100.97

Iv 101.2048 95.49902 - 98.35192 98.52

Total 399.3318" 400.00

F since the total is not 400 we have to calculate Seasonal Indices adjusted by multiplying by

factor k= A =

ctor k = 359 3939 = 1.0017

3.7.3 Ratio to Trend Method:

In this method trend values are first determined by the method of jeast square by fitting a

mathematical curve that is a straight line, parabola etc. It is based on the assumption that

seasonal variation for any given period is a constant factor of the trend. The measurement of

seasonal variation by this method consists of following steps.

Let the data be given for n periods (ie. quarterly, monthly etc.).

(i) Obtain the trend values by least square method by fitting a mathematical curve.

(i) Express the original data as a percentage of trend values assuming multiplicative model.

These percentages will contain seasonal, cyclical and irregular components.

(iii) The cyclic and irregular components are wiped out by averaging the percentages fr

different periods, leaving the seasonal indices.

aot

(iv) Finally these values are multiplied by the factor .[ Since the sum of these indices

(say) will not in general be 100n. Hence to get ne aur 100n the adjustment is done by

Lf

multiplying throughout by a constant factor = k= 2

Merits:

(i) The advantages of this method over the moving average method lies in the fact that ratio to

trend can be obtained for each period.

Demerits:

(@ IE the series exhibits significant cyclical swing, the trend values obtained by

uare

can never follow the actual data as moving average method. the least squ

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Montgomery Fleet Equipment Inventory FA PART 2 STARTDocument7 pagesMontgomery Fleet Equipment Inventory FA PART 2 STARTYash MhatreNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Department Equipment Class Equipment CountDocument3 pagesDepartment Equipment Class Equipment CountYash Mhatre100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Rough Notes Sampling Techniques - Part1Document38 pagesRough Notes Sampling Techniques - Part1Yash MhatreNo ratings yet

- LPP 1Document4 pagesLPP 1Yash MhatreNo ratings yet

- FC Question Bank - Descriptive Paper Sem 2Document3 pagesFC Question Bank - Descriptive Paper Sem 2Yash MhatreNo ratings yet

- A Critical Analysis - Caste System in IndiaDocument10 pagesA Critical Analysis - Caste System in IndiaYash MhatreNo ratings yet

- Montgomery Fleet Equipment Inventory FA PART 2 ENDDocument8 pagesMontgomery Fleet Equipment Inventory FA PART 2 ENDYash MhatreNo ratings yet