Professional Documents

Culture Documents

Computations For Budgeted Figures in The Master Budget-Trading Concern

Computations For Budgeted Figures in The Master Budget-Trading Concern

Uploaded by

Zackie LouisaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Computations For Budgeted Figures in The Master Budget-Trading Concern

Computations For Budgeted Figures in The Master Budget-Trading Concern

Uploaded by

Zackie LouisaCopyright:

Available Formats

COMPUTATIONS FOR BUDGETED FIGURES IN THE MASTER BUDGET-

TRADING CONCERN

In computing for other figures for inclusion in the master budget of a trading

concern the following formulae may be applied:

Budgeted purchases : Budgeted sales + Desired ending inventory

- Beginning inventory

Budgeted operating expenses : Fixed expenses + Variable expenses

Pasig Trading Co., Inc. is making its 21G financial plans based on the following:

Planned level of sales 20,000 units @ P20

Merchandise inventory, Jan 1, 21G 1,500 units @ P 8

Desired inventory, Dec 31, 21G 3,000 units

Unit purchase cost in 21G P 12

Fixed operating expenses per annum

(including depreciation charge, P15,000) P 50,000

Variable operating expenses per unit P 4

Interest expense P 14,500

Income tax rate 35%

Compute the following:

1. Budgeted purchases (in volume & peso amount)

2. Budgeted cost of sales (with breakdown)

3. Budgeted operating expenses (Fixed & Variable)

4. Prepare the following budgeted statements

a. Budgeted income statement

b. Cash budget – Pasig Trading Co., Inc. has budgeted the following cash flows

for 21G

Collection on sales P365,000

Payment for purchases 210,000

Payment for expenses 108,000

Payments for interest expense 10,000

Payments for income tax 10,000

Acquisition of additional equipment 50,000

Loan amortization, excluding interest 22,000

Dividends 10,000

Sale of old pieces of furniture (at book value) 12,000

Issuance of additional shares of stock (80 shares

At P120) 9,600

Cash balance on Jan 1, 21G is P12,000 and desired minimum ending cash

balance is P4,000. The corporation can obtain 15% loans in multiples of

P10,000 should it need additional funds.

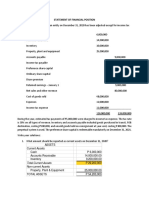

c. Budgeted Balance Sheet

The beginning balance sheet of Pasig Trading Co., Inc. shows the following

account balances:

Cash P12,000

Accounts receivable- net 8,000

Merchandise inventory 12,000

Property and equipment 39,500

Total assets P71,500

Accounts payable P 8,000

Income tax payable 10,000

Loans payable 30,000

Capital stock, par value per share – P100 18,000

Retained earnings 5,500

Total liabilities and equity P71,500

You might also like

- College Accounting A Contemporary Approach 3rd Edition Haddock Solutions ManualDocument36 pagesCollege Accounting A Contemporary Approach 3rd Edition Haddock Solutions Manualsynomocyeducable6pyb8k100% (29)

- MGT530 - Week 1 - Homework Questions From End of Chapter 1Document2 pagesMGT530 - Week 1 - Homework Questions From End of Chapter 1samNo ratings yet

- This Study Resource Was: CASTILLO, Lauren Financial Management Mam Barquez BSA-3 Problem 1 (Pro Forma Statements)Document5 pagesThis Study Resource Was: CASTILLO, Lauren Financial Management Mam Barquez BSA-3 Problem 1 (Pro Forma Statements)KATHRYN CLAUDETTE RESENTE100% (2)

- IR 2 - Mod 6 Bus Combi FinalDocument4 pagesIR 2 - Mod 6 Bus Combi FinalLight Desire0% (1)

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1From EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1No ratings yet

- Cash To Accrual Basis, Single Entry and Error CorrectionDocument7 pagesCash To Accrual Basis, Single Entry and Error CorrectionHasmin Saripada AmpatuaNo ratings yet

- AFAR - 07 - New Version No AnswerDocument7 pagesAFAR - 07 - New Version No AnswerjonasNo ratings yet

- Paid and Not Currently Matched With EarningsDocument46 pagesPaid and Not Currently Matched With EarningsBruce SolanoNo ratings yet

- Auditing Problems3Document32 pagesAuditing Problems3Kimberly Milante100% (2)

- Final Presentasi MCI by Grup 5Document23 pagesFinal Presentasi MCI by Grup 5Prayogi Purnapandhega0% (1)

- Merchandising Lecture MRFDDocument59 pagesMerchandising Lecture MRFDMaria Louella MagadaNo ratings yet

- Module 1 - Financial Statement Analysis - P2Document4 pagesModule 1 - Financial Statement Analysis - P2Jose Eduardo GumafelixNo ratings yet

- Exercises On Projected Financial StatementsDocument2 pagesExercises On Projected Financial StatementsSharmaine LiasosNo ratings yet

- Budgeted Income Statement and Balance SheetDocument5 pagesBudgeted Income Statement and Balance SheetNeil De LeonNo ratings yet

- Debit Balances Increase (Decrease) Credit Balances Increase (Decrease)Document7 pagesDebit Balances Increase (Decrease) Credit Balances Increase (Decrease)Shane TabunggaoNo ratings yet

- 1 Financial Statements Exercises 2022Document9 pages1 Financial Statements Exercises 2022Alyssa TolcidasNo ratings yet

- Homework On Statement of Cash FlowsDocument2 pagesHomework On Statement of Cash FlowsAmy SpencerNo ratings yet

- Copy 1 ACC 223 Practice Problems For Financial Ratio AnalysisDocument3 pagesCopy 1 ACC 223 Practice Problems For Financial Ratio AnalysisGiane Bernard PunayanNo ratings yet

- Cash Flow Statements Notes and Practical ExercisesDocument9 pagesCash Flow Statements Notes and Practical ExercisesRNo ratings yet

- Chin Figura - Unit IV Learning ActivitiesDocument7 pagesChin Figura - Unit IV Learning ActivitiesChin FiguraNo ratings yet

- Cash FlowDocument15 pagesCash FlowCandy BayonaNo ratings yet

- Chapter 39Document9 pagesChapter 39Mike SerafinoNo ratings yet

- Topic No. 2 - Statement of Cash Flows PDFDocument3 pagesTopic No. 2 - Statement of Cash Flows PDFSARAH ANDREA TORRESNo ratings yet

- 4.2.2 Assignment Statement of Cashflows KarununganDocument1 page4.2.2 Assignment Statement of Cashflows KarununganRenzo KarununganNo ratings yet

- Intermediate Accounting Iii - Final Examination 2 SEMESTER SY 2019-2020Document7 pagesIntermediate Accounting Iii - Final Examination 2 SEMESTER SY 2019-2020ohmyme sungjaeNo ratings yet

- PRACTICEDocument4 pagesPRACTICEGleeson Jay NiedoNo ratings yet

- AFARDocument9 pagesAFARRed Christian PalustreNo ratings yet

- FA2 - SFP and SCI-Answers 1Document5 pagesFA2 - SFP and SCI-Answers 1Angel AtirazanNo ratings yet

- 3 - Cash Flow Statement - Indirect Method - QuestionsDocument3 pages3 - Cash Flow Statement - Indirect Method - Questionsmikheal beyber100% (1)

- Audit of Financial Statement PresentationDocument7 pagesAudit of Financial Statement PresentationHasmin Saripada Ampatua100% (1)

- Pre Finals Manacc 1Document8 pagesPre Finals Manacc 1Gesselle Acebedo0% (1)

- Additional Cash Flow ProblemsDocument3 pagesAdditional Cash Flow ProblemsChelle HullezaNo ratings yet

- Cash To Accrual and Single EntryDocument3 pagesCash To Accrual and Single EntryJerAnneReyesNo ratings yet

- Quiz Installment Sales 2Document1 pageQuiz Installment Sales 2MARJORIE BAMBALANNo ratings yet

- PDF Topic No 2 Statement of Cash Flows PDF - CompressDocument3 pagesPDF Topic No 2 Statement of Cash Flows PDF - CompressMillicent AlmueteNo ratings yet

- Activity No 1 Financial Analysis and Reporting 2nd Trimester 2022 2023 Copy 1Document4 pagesActivity No 1 Financial Analysis and Reporting 2nd Trimester 2022 2023 Copy 1devy mar topiaNo ratings yet

- W8 - AS5 - Statement of CashFlowsDocument1 pageW8 - AS5 - Statement of CashFlowsJere Mae MarananNo ratings yet

- Acctg4a 02042017 Exam Quiz1aDocument5 pagesAcctg4a 02042017 Exam Quiz1aPatOcampoNo ratings yet

- Far01 - The Financial Statements PresentationDocument10 pagesFar01 - The Financial Statements PresentationRNo ratings yet

- Afar 104 Installment SalesDocument3 pagesAfar 104 Installment SalesReyn Saplad PeralesNo ratings yet

- Pract 1 - Exam2Document2 pagesPract 1 - Exam2Sharmaine Rivera MiguelNo ratings yet

- Illustrative Example - Cash FlowDocument3 pagesIllustrative Example - Cash FlowJuliaNo ratings yet

- Accounting For Business Combinations Pre 7 - Midterm QuizzesDocument2 pagesAccounting For Business Combinations Pre 7 - Midterm QuizzesJalyn Jalando-onNo ratings yet

- Accounting For Business Combinations Pre 7 - Midterm QuizzesDocument2 pagesAccounting For Business Combinations Pre 7 - Midterm QuizzesJalyn Jalando-onNo ratings yet

- Exercise 2 Statement of Financial PositionDocument8 pagesExercise 2 Statement of Financial Positionjumawaymichaeljeffrey65No ratings yet

- Activity 1 PartnershipDocument4 pagesActivity 1 PartnershipJanet AnotdeNo ratings yet

- Ala in Finacct 3Document4 pagesAla in Finacct 3VIRGIL KIT AUGUSTIN ABANILLANo ratings yet

- FAR - CompreDocument16 pagesFAR - CompreJoana Lyn GalisimNo ratings yet

- DT - FAR, AFAR, MS, RFBT and AuditingDocument30 pagesDT - FAR, AFAR, MS, RFBT and AuditingJoana Lyn GalisimNo ratings yet

- DT - FAR and AFARDocument21 pagesDT - FAR and AFARJoana Lyn GalisimNo ratings yet

- DT FAR AFAR MS and RFBTDocument25 pagesDT FAR AFAR MS and RFBTJames R JunioNo ratings yet

- Classroom Exerisises On Presentation of Financial Statements PDFDocument2 pagesClassroom Exerisises On Presentation of Financial Statements PDFalyssaNo ratings yet

- Financial Accounting and Reporting Final ExaminationDocument13 pagesFinancial Accounting and Reporting Final ExaminationBernardino PacificAce100% (1)

- Joint Arrangement Answer KeyDocument8 pagesJoint Arrangement Answer KeyMonica DespiNo ratings yet

- Audit Practice Accrual Solution PDFDocument19 pagesAudit Practice Accrual Solution PDFEISEN BELWIGANNo ratings yet

- Acc14 Exercise Capital-BudgetingDocument3 pagesAcc14 Exercise Capital-BudgetingyeezzzzNo ratings yet

- Intermediate Accounting Practice Sets 1Document17 pagesIntermediate Accounting Practice Sets 1Mhaydel Garcia67% (3)

- Practical Accounting TwoDocument25 pagesPractical Accounting TwoJoseph SalidoNo ratings yet

- Activity Preparing Journal EntriesDocument5 pagesActivity Preparing Journal EntriesJomir Kimberly DomingoNo ratings yet

- ABM 4 Lesson 5 6 Notes 2Document5 pagesABM 4 Lesson 5 6 Notes 2Angela BonifeNo ratings yet

- Actg 26A - Strategic Cost Management Take Home Quiz: RequirementsDocument2 pagesActg 26A - Strategic Cost Management Take Home Quiz: RequirementsseviNo ratings yet

- MOD2 Statement of Cash FlowsDocument2 pagesMOD2 Statement of Cash FlowsGemma DenolanNo ratings yet

- Pawn Shop Revenues World Summary: Market Values & Financials by CountryFrom EverandPawn Shop Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Crystal Report Viewer 1Document1 pageCrystal Report Viewer 1Arsi LoveNo ratings yet

- Definition, Nature, Scope and History of Insurance: Difinition What Is Insurance?Document65 pagesDefinition, Nature, Scope and History of Insurance: Difinition What Is Insurance?Geoffrey MwangiNo ratings yet

- Medip, IJRMS-7730 ODocument6 pagesMedip, IJRMS-7730 OsundarcetNo ratings yet

- Key 3 MarksDocument6 pagesKey 3 MarksNAOMIKA DUTTANo ratings yet

- 213 - F - Hdfc-A Study On Profitability and Operating Efficiency of Banking in India at HDFC BankDocument68 pages213 - F - Hdfc-A Study On Profitability and Operating Efficiency of Banking in India at HDFC BankPeacock Live ProjectsNo ratings yet

- Law of Agency3Document29 pagesLaw of Agency3Senelwa AnayaNo ratings yet

- The Economic Thought of David Hume: A Pioneer in The Field of Law & EconomicsDocument32 pagesThe Economic Thought of David Hume: A Pioneer in The Field of Law & Economicstarun motianiNo ratings yet

- Chameleon Company Requirement1 Debit CreditDocument3 pagesChameleon Company Requirement1 Debit CreditAnonnNo ratings yet

- Demand Estimation & ForecastingDocument15 pagesDemand Estimation & ForecastingSufana UzairNo ratings yet

- Chapter 1 Differing Perspectives On Quality - Revision1Document20 pagesChapter 1 Differing Perspectives On Quality - Revision1Moon2803No ratings yet

- Teaching Planning AAT20603 Sem March 2024Document3 pagesTeaching Planning AAT20603 Sem March 2024chongjiale5597No ratings yet

- Application Instructions For PETRONAS Powering Knowledge Education Sponsorship - Mid Education 2024 2Document16 pagesApplication Instructions For PETRONAS Powering Knowledge Education Sponsorship - Mid Education 2024 2Mohankummar MuniandyNo ratings yet

- Lebanon - Opportunities May.2023Document78 pagesLebanon - Opportunities May.2023Daniel dAzNo ratings yet

- Accounting Question BankDocument217 pagesAccounting Question BankFaiza TahreemNo ratings yet

- FDI Opportunity and Challenges in NepalDocument16 pagesFDI Opportunity and Challenges in NepalsamsonNo ratings yet

- TreasuryDocument17 pagesTreasurySanjay PriyadarshiNo ratings yet

- Commercial Law NoteDocument29 pagesCommercial Law Noteavinash nashNo ratings yet

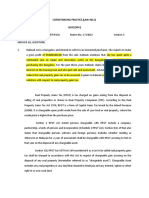

- Conveyancing Practice (Law 4612) QUIZ (30%)Document7 pagesConveyancing Practice (Law 4612) QUIZ (30%)Alia PalilNo ratings yet

- Ruis LK TW Iv 2022Document157 pagesRuis LK TW Iv 2022Ragil ArdianNo ratings yet

- Sheela Foam LTD.: Issue Type: DebtDocument15 pagesSheela Foam LTD.: Issue Type: DebtIshaan DuaNo ratings yet

- DEEEPPDocument6 pagesDEEEPPCHOICE BROKERNo ratings yet

- 6-Surplus Konsumen & ProdusenDocument48 pages6-Surplus Konsumen & ProdusenAgnesNo ratings yet

- Rimsha Chapter 1Document6 pagesRimsha Chapter 1coursehero1218No ratings yet

- OPMAN TOPIC 5 Part 1Document7 pagesOPMAN TOPIC 5 Part 1Ria BryleNo ratings yet

- 12731/tpty SC SF Exp Sleeper Class (SL)Document2 pages12731/tpty SC SF Exp Sleeper Class (SL)Ravi KumarNo ratings yet

- Index NumbersDocument8 pagesIndex NumbersSiddiqullah IhsasNo ratings yet

- 1108 - Addendum - Introduction of HDFC DREAM SIP FacilityDocument3 pages1108 - Addendum - Introduction of HDFC DREAM SIP FacilityIshan AarushNo ratings yet